Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

At the sixth time of asking since the first takeover bid from Soprano came through, Whispir has confirmed that further substantive discussions with other parties have ceased, and the board is now unanimously recommending that shareholders accept the Soprano offer. Mr. Jeromy Wells has also changed his stance and will accept the offer on the table.

Overall, a pretty pedestrian outcome for ordinary shareholders, but it's better than languishing at the bottom I guess.

Happy New Year to all the Straw people, and hope you are enjoying your holidays so far. I'm back to work unfortunately.

There's been a fair bit of activity here during what is supposed to be a quiet period.

Soprano has since tabled multiple revised offers, first at 52c and then at 55c. The latter has actually gotten a recommendation from the Whispir board, so that's interesting because Pendula has also upped its offer price to 60c - the board is clearly not looking at the conditions attached to the Pendula offer favourably.

For any holders or interested watchers, what would you do? The market price is hovering just above the revised Soprano offer (which seems final, finally!), like it did when Soprano initially came in with their 48c offer.

P.S. Founder and major shareholder Jeromy Wells is not recommending the offer as it stands, as he is not part of the IBC which is evaluating the offer.

Weak second hand played by Soprano.

Knowing that there is another bidder who is prepared to pay a premium, they have not changed their $0.48 offer in making it unconditional today. They are also trying to sell it via an early (T+5) settlement for the early bid accepters.

NGMI :D

Quite an eventful day for Whispir.

First up, an announcement was released by the board rejecting Soprano's bid. As part of that, the indepdent valuers have placed the value of the company at $0.4859 to $0.5649 (the precision to the fourth decimal is in itself some sort of "flag"!).

Then, a "letter of intent" was filed indicating that another party, "Pendula" (trading under Zip Cloud Pty Ltd) intends to lob a bit that is at a premium to the current $0.48 bid from Soprano.

Good to see another party emerge out of the woodwork - existing holders can hope for a bidding war to squeeze as much out of this particular lemon as possible.

A takeover offer as come in for Whispir. All cash offer of $0.48 a share. Given the flogging many holders have taken with this company over the past 12 odd months hopefully another bidder comes along to pump the price further

Finally got around to view the playback of the WSP Product Showcase from earlier this week and the related ASX announcement.

WSP launched 4 new service offerings this week. Initially, I was unimpressed - lots of AI-related jargon, but I changed my view after viewing the playback of the Product Showcase session.

https://www.whispir.com/en-au/blog/Whispir-Product-Innovation-Showcase/

Click Watch on Demand.

Whispir Talkbots - impressive demo of the Talkbot capability around 11:25 into the video.

- The Talkbot sounded like a natural person, with the local accent, pitching an upgrade to an existing customer

- Was able to detect, deflect customer pushback and keep the sales pitch going on the offer in what sounded like a normal sales conversation

- Customer ended up agreeing to receive an SMS with the pitched offer, which is an impressive outcome of that one conversation

- Conversations are fed back into the learning engine to improve the effectiveness of future Talkbot calls

The key WSP pitch is conversations like these can be made at scale, giving rise to increase in leads, conversions, productivity gains etc.

Content Assist - demo around 18:34 in the video

- Simple user-entry form to provide basic parameters around the content required for a given communication - communication channel (email, SMS etc) message, audience, tone, formality etc

- The WSP platform then uses Open AI’s ChatGPT platform to draft out the content

- Allows repeated attempts to get the content right, before porting into the WSP platform for actual transmission

- Brings to life the value proposition of allowing the platform to address Content + Purpose of Communication, while the user focused on Channel + Timing, the 4 elements of effective communication

From past experience of having to draft out different communications from operations-related SMS’s to update emails etc, I can see how this capability will help speed up effective communication using the capabilities of ChatGPT, from within the WSP platform.

Compliance Automation and Whispir Verify - more under-the-hood, back-end capabilities. Whispir Verify does not come across as revolutionary but there seems to be added security by the non-storing/deletion of the One-Time-Passwords after verification is completed.

Overall, the demo’s in the Showcase brought the first 2 capabilities to life quite clearly for me. I never liked Bots of any sort (either too dumb or too smart-arsed), but the fact that the Talkbot could engage in what sounded like a normal Sales conversation was impressive for me - the ability to target the audience, then unleash the Talkbots at scale is very exciting.

Also liked the fact that WSP has delivered against the Product Upgrade roadmap in Q1 with the promise of more to come throughout FY24. This reminds me of what Jenni Pilcher said in the early CY2023 chat - the platform base is “sorted”, which then allows for more capabilities like these to be built and pushed out. It was good to see the traction against that comment.

What remains is to see what the rate of uptake is, and what the impact on revenue is during FY24.

Discl: Held IRL and in SM

Extract from the ASX announcement:

My notes in reviewing the WSP FY2023 results.

Discl: Held IRL and on SM

SUMMARY

- FY23 has been a year of business consolidation and rationalisation in terms of (1) re-focused energies on Asia, exited the US (2) organisation structure right-sizing - stripped out $20m of cost per annum (3) washing through of direct Covid-related revenue - revenue hit taken

- FY23 is essentially the re-baselining of WSP going forward in a non-pandemic environment

- FY24 is poised to leverage on the FY23 business consolidation to grow revenue and get to cash flow positive

A disappointing but necessary painful year to reset the business from non-sustainable Covid-related revenue to a non-Covid BAU environment.

I like the bluechip customer list, the sticky nature of the platform, the telco strategy, and the ongoing essential need for businesses to have good communications management. But clearly, the Covid-driven high revenue days are over and a reset for the post-Covid environment has occurred.

Very tempting to give up on WSP and exit based on the promise that never really materialised. But management has taken decisive steps to rightsize and refocus the business and thus, a good platform for growth is now in place. FY24 will be a make-or-break year for management to prove that this is a sustainable growth business.

Will give it 2-3 more quarters to understand what the "new normal” looks like/can be expected in terms of revenue growth, profitability and cash flow, before making a call as to whether to stay invested or exit.

THE GOOD

Financials

- Gross margins 60.3%, up 1.8% on PCP, increasing traction in 2HFY23 where margins was 62.0%, up 3.4% on 1HFY23

- Asia revenue growth accelerates - 19% YoY increase - Telco channel partner go-to-market strategy is delivering growth

- Churn remains low, Revenue retention > 103%

- Good traction in reducing operating expenses of $51.2m, 16% lower than PCP, 2HFY23 reduced 33% on 1HFY23 as full effects of business rightsizing are felt

- FY2023 Exit Cost Base = $36m, as restructuring costs in FY23 fall away

- Free CashFlow $21.6m, was a 3% improvement on FY22, with 2HFY23 improving 66% on 1HFY23 - trending nicely to positive free cash flow

- Cash at Bank $4.3m + $6.5m unused debt facility - no requirement to raise further capital in FY24

Innovation

Continued innovation - 4 new product/revenue streams planned for FY24, 1 product release per Quarter

NOT SO GOOD

- Revenue $53.7m was down 24% from FY22 - cessation of one-off pandemic-related revenues, this is the post-Covid baseline Year 0 revenue

- Cash Flow Positive target moved again from FY23, then 1QFY24, now guided for 2HFY2024

WHAT TO WATCH OUT FOR

- Achievement of Positive Cash Flow

- Sustaining of flat operating cost base around ~$36m

- Gross margin improvements from favourable Telco wholesale pricing

FY24 Strategy

- Ability to deliver the FY24 Strategy in terms of (1) Revenue Growth (2) Sources and sustainability of Revenue Growth (3) Rollout of new Products and impact on revenue

Could they just skate through?

ASX Announcement

17 July 2023

Whispir Limited

(ASX : WSP)

Appendix 4C and Activities Update – Q4FY23

Cash flow break-even clearly in sight as free cash flow up 73% on Q3

Whispir Limited (ASX:WSP, Whispir or the Company) provides its Appendix 4C cash flow and activity report for the quarter ended 30 June 2023 (Q4 FY23, the Quarter). The prior corresponding period is Q4 FY22 (PCP), and the prior quarter is Q4 FY23 (PQ).

Quarterly Summary

● Free cash outflow for the Quarter of $1.33 million is a 72.7% ($3.54 million) improvement on the PQ of $4.87 million

● Expenditure from operating and investing activities has reduced by 21% ($3.89 million) on the PQ evidencing successfully completed cost reduction programs

● Receipts are down slightly by 2.6% ($0.35 million) on the PQ to $13.36 million (PQ $13.71 million)

● Funds received (net of costs) of $0.94 million from RiverFort Capital for working capital following execution of $7.50 million debt facility during the Quarter

● Cash at bank $4.32 million, providing cover for seven quarters (1.75 years) of free cash outflows based on the Quarter

● Positive cash flows expected to be generated during FY24 - supported by current revenue trajectory and sales pipeline, improving gross margins, and current cost base.

Quarterly performance

Free cash flow1

This Quarter is the first quarter to show the full impact of earlier restructures, with free cash outflow improving 72.7% ($3.54 million) over the PQ to $1.33 million. The significant reduction in outflows during the year, as illustrated in the chart, has improved the Company’s financial resilience, positioning it well to achieve positive free cash flow during FY24 as revenue growth and margins continue to improve.

1 Cash flow from operating and investing activities, excluding transfers from restricted cash

Cash receipts

Receipts from customers for the Quarter were $13.36 million, a 2.6% decrease on the PQ. This small decline reflects timing of collections only as underlying revenue was up 1% for the Quarter compared to the PQ. Whilst Q4 FY23 revenue was not as strong a quarter as expected, recent contract wins suggest both revenue and receipts will improve next quarter.

Cash payments

Cash payments from operating and investing activities have reduced by 21% ($3.89 million) on the PQ following the successful execution of cost reduction programs, and continued improvement in margins. More specifically:

• Staffing costs (including capitalised development labour) were down 23% on the PQ, at $6.90 million reflecting the down-sizing of the US operations;

• Corporate administration costs were down 28% on the PQ to $1.14 million;

• Sales & marketing payments saw a similar sized reduction of 21% on the PQ to $1.01

million for the Quarter; and

• Product-related cash payments were $4.89 million, down 16% on the PQ, in part due to timing, but more importantly continued improvement in gross margins.

The Quarter includes payments to related parties of $271k for directors’ fees and CEO remuneration. Following the recent rightsizing of Whispir’s board, non-executive Director remuneration will be significantly lower going forward.

Cash reserves and financing

During the quarter, the Company entered into a funding agreement with RiverFort Capital, which provided the Company with an immediate cash injection (loan) of $0.94 million (net of costs) and access to a further $6.50 million upon approval by RiverFort. Further information on this facility is contained in the ASX announcement dated 23 June 2023.

At the end of the Quarter the Company had $4.32 million cash at bank, $1.01 million of restricted cash, and a further $6.51 million in unused credit facilities (which includes the RiverFort facility), providing cover for seven quarters of free cash flows (based on Q4 FY23).

Business news

Australia/New Zealand (ANZ)

The ANZ region has experienced positive momentum during the Quarter, including further gains in the health sector. Namely, the Company has signed a new contract via its Channel Partner to deliver electronic prescription messaging, an initiative which forms part of Australia’s National Digital Health Strategy. E-prescription messaging is where a unique electronic token (in the form of a QR code) is created and sent to the patient as an SMS or email. The token is a key that unlocks the electronic prescription. Patients can provide the token to the pharmacist to enable dispense and supply of the medicines. E-prescriptions are likely to become an increasingly popular way for patients to access medications, and this contract is expected to deliver at least $1 million revenue in FY24, starting in August.

Whispir continues to have a positive impact in the community. Since the Victorian Police launched its text-notification service “STOPIT” to help combat sexual offending on public

ASX Announcement

transport – more than 1500 notifications have been received by the police leading to 13 arrests. This initiative is the first of its kind in Australia and is powered by the Whispir platform.

Whispir has recently renegotiated a 13% discount to its SMS delivery rates with one of its largest messaging carriers effective from 1 July 2023 which will serve to improve gross margins even further in this region.

Asia

During the Quarter the region signed several new blue-chip customers, all contributing valuable entry point sales which are expected to grow significantly over time.

Recently, a large insurance company has signed a 3-year renewal and will be integrating Whispir with another large software provider to further digitize their customer engagement. Another new customer win in the region will see Whispir powering their big data marketing campaign, uplifting capability from plain SMS to rich message content. In addition, a large bank in the region will be using Whispir to automate workflow with SMS and voice.

The chart below demonstrates the growth trajectory occurring in the region via Channel Partners over the last five months (up more than 7x), showing a noticeable acceleration in the last month of the Quarter.

FY24 outlook

Whispir CEO and founder Jeromy Wells said: “Recent contract wins, improving gross margins, and a reducing cost-base provide us with a clear line of sight to delivering a cash flow positive FY24. Whilst the initial $1 million drawdown from our debt facility provided us with greater flexibility to manage intra-month working capital requirements, we do not intend to make any further drawdowns as the business verges on being self-sustainable.”

“We continue to see demand for digital communications from existing and new customers in ANZ, while the significant growth we are seeing in our Asian business shows no sign of slowing. We have a solid sales pipeline for the year ahead and will continue to innovate our platform to create and seize additional opportunities in our key markets. The e-Prescription support is an example of the crucial role digital communications can play in everyday life, and this is true across all the sectors we work in. With our costs now reined in, and our sales efforts focused on markets offering immediate growth, we are confident about Whispir’s prospects in FY24.”

The Company expects to release its results for the financial year ended 30 June 2023 on 24 August 2023.

ASX Announcement

-ENDS-

Authorised by the Disclosure Committee.

Corporate

Jenni Pilcher, CFO & Company Secretary

+61 424 750737

About Whispir

Investors

Andrew Keys +61 400 400380

Whispir supplies a no code, Communications-as-a-Service (“CaaS”) platform enabling seamless omnichannel interactions between organisations, their systems, and their people to solve common challenges in terms of compliance, deliverability, and engagement.

Whispir operates across three key regions of ANZ, Asia and North America and its platform is used across more than 60 countries. More information www.whispir.com.

Appendix 4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

Name of entity

WHISPIR LIMITED

ABN

89 097 654 656

1. Cash flows from operating activities

1.1 Receipts from customers

1.2 Payments for

(a) research and development

(b) product manufacturing and operating costs

(c) advertising and marketing

(d) leased assets

(e) staff costs

(f) administration and corporate costs

1.3 Dividends received (see note 3)

1.4 Interest received

1.5 Interest and other costs of finance paid

1.6 Income taxes paid

1.7 Government grants and tax incentives

1.8 Other (GST payment to the ATO)

1.9 Net cash from / (used in) operating activities

2. Cash flows from investing activities

2.1 Payments to acquire or for:

(a) entities

(b) businesses

(c) property, plant and equipment

(d) investments

(e) intellectual property

ASX Listing Rules Appendix 4C (17/07/20)

+ See chapter 19 of the ASX Listing Rules for defined terms.

Quarter ended (“current quarter”)

30 June 2023

Rule 4.7B

Consolidated statement of cash flows

Current quarter $A’000

Year to date (12 months) $A’000

13,355

(4,885) (1,014)

(5,982) (1,136)

1 (105)

-

(593)

(88) (915)

56,327

(23,716) (4,725)

(34,326) (7,768)

79 (227)

22 (2,029)

(228) (5,376)

Page 1

(359)

(16,363)

(f) other non-current assets

2.2 Proceeds from disposal of:

(a) entities

(b) businesses

(c) property, plant and equipment

(d) investments

(e) intellectual property

(f) other non-current assets

2.3 Cash flows from loans to other entities

2.4 Dividends received (see note 3)

2.5 Other (term deposits)

2.6 Net cash from / (used in) investing activities

3. Cash flows from financing activities

3.1 Proceeds from issues of equity securities (excluding convertible debt securities)

3.2 Proceeds from issue of convertible debt securities

3.3 Proceeds from exercise of options

3.4 Transaction costs related to issues of equity securities or convertible debt securities

3.5 Proceeds from borrowings

3.6 Repayment of borrowings

3.7 Transaction costs related to loans and borrowings

3.8 Dividends paid

3.9 Other (payment of finance lease liabilities)

3.10 Net cash from / (used in) financing activities

4. Net increase / (decrease) in cash and cash equivalents for the period

4.1 Cash and cash equivalents at beginning of period

4.2 Net cash from / (used in) operating activities (item 1.9 above)

4.3 Net cash from / (used in) investing activities (item 2.6 above)

ASX Listing Rules Appendix 4C (17/07/20)

+ See chapter 19 of the ASX Listing Rules for defined terms.

31 31

- (342) - 617

- 13 1,000 1,000

(60) (60) (242) (1,091)

4,969 26,078 (359) (16,363) (972) (5,298)

Page 2

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B

Consolidated statement of cash flows

Current quarter $A’000

Year to date (12 months) $A’000

(972)

(5,298)

698

(138)

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B

Consolidated statement of cash flows

Current quarter $A’000

Year to date (12 months) $A’000

4.4 4.5 4.6

Net cash from / (used in) financing activities (item 3.10 above)

Effect of movement in exchange rates on cash held

Cash and cash equivalents at end of period

698 (16)

(138) 41

4,320

4,320

5. Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts

Current quarter $A’000

Previous quarter $A’000

5.1 Bank balances

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (Term Deposits < 3 mth maturity)

5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above)

2,809 4,455 1,511 514 - - - -

4,320

4,969

6. Payments to related parties of the entity and their associates

Current quarter $A'000

6.1 Aggregate amount of payments to related parties and their associates included in item 1

6.2 Aggregate amount of payments to related parties and their associates included in item 2

The amount disclosed at item 6.1 is of comprised Directors’ fees and the CEO’s base remuneration for the current quarter.

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

271

-

ASX Listing Rules Appendix 4C (17/07/20)

+ See chapter 19 of the ASX Listing Rules for defined terms.

Page 3

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B

Total facility amount at quarter end $A’000

Amount drawn at quarter end $A’000

7. Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources of finance available to the entity.

7.1 Loan facilities

7.2 Credit standby arrangements

7.3 Other (credit cards)

7.4 Total financing facilities

7.5 Unused financing facilities available at quarter end

7,500 1,000

123 104

7,623 1,104 6,519

7.6 Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well.

Credit card facilities are utilised across two providers:

• NAB AUD 50k, secured at 12.65%.

• Silicon Valley Bank USD 25k (AUD 38k at closing rates), unsecured at 15.60%.

• Amex AUD 35k, unsecured, zero interest rate with 3% late payment fee and $1.2k annual membership fee.

• RiverFort convertible note facility of $7.5M, at a rate of 12% interest per annum plus 6% drawdown fee. Further drawdowns under this facility are subject to RiverFort’s approval. For a summary of the terms and conditions of this facility please refer to the ASX announcement made by the Company on 23 June 2023.

8. Estimated cash available for future operating activities

8.1 Net cash from / (used in) operating activities (item 1.9)

8.2 Cash and cash equivalents at quarter end (item 4.6)

8.3 Unused finance facilities available at quarter end (item 7.5)

8.4 Total available funding (item 8.2 + item 8.3)

8.5 Estimated quarters of funding available (item 8.4 divided by item 8.1)

$A’000

(424) 4,320 6,519

10,415

Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5.

8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions:

8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not?

8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

ASX Listing Rules Appendix 4C (17/07/20) Page 4 + See chapter 19 of the ASX Listing Rules for defined terms.

25

Answer: N/A

Answer: N/A

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B

8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis?

Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered.

Compliance statement

Answer: N/A

1

This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

This statement gives a true and fair view of the matters disclosed. 17 July 2023

2

Date:

Authorised by: By the Disclosure Committee

(Name of body or officer authorising release – see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

ASX Listing Rules Appendix 4C (17/07/20) Page 5 + See chapter 19 of the ASX Listing Rules for defined terms.

Hi @jcmleng

I agree with your general sentiment, however would not be the first time a company's management have suggested they don't need to raise but then taken an "opportunity" when it arises. I actually though Jenni was generally very open, but careful on her language around a raise, ie. "We don't want to", or "would really like to avoid". Either way I came away from that meeting without your level of confidence.

There's a good summary here from Claude Walker that may have been posted already:

https://arichlife.com.au/why-whispir-asx-wsp-will-probably-raise-capital-again/

I also thought the announcement out a few weeks ago had that dangerous promotional smell about it. Call me paranoid but if I'd just closed the books on the quarter and knew I hadn't yet got costs where they need to be, I'd be tempted to try and pump the share price prior to releasing a quarterly that showed maybe only 1 or so quarters of cash left. Best they can do to provide some headroom if a raise is needed.

All is to say, while I have recently bought a small parcel of shares and am confident about the long term, I'm still more sceptical that you about the requirement to raise, but would plan to participate in an SPP if it came along. The forager purchase moves the needle more positively too.

Here's hoping you are right and in a year I'll be kicking myself for not having taken a larger position! Cheers

Announcement today:

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02648279-3A615595?access_token=83ff96335c2d45a094df02a206a39ff4

Rather interesting to see this summary in the context of the call with the CFO last week. Perhaps Jenny took a learning out of the SM question "what is the most frustrating thing that the market simply does not get about WSP", updated Jerome and got him to send this comms. For me, the "what don't you idiots get about where we are at and the opportunity ahead", with gritted teeth, comes through in the comms particularly after the chat with Jenny last week. But I am admittedly biased!

I still think that WSP is now at a positive inflection point post the heavy lifting technical work, org restructure and pivot towards Asia.

Will be topping up IRL and in SM to further average down my IRL holdings.

My notes from the VC with Jenny Pilcher, CFO WSP (this is not a transcript). Wish I knew how to do a quick valuation ... bought the Damodran book, which is now in the mail, to learn ...

Discl: Hold 0.5% IRL, topped up 0.3% today IRL and in SM after the call. Good insights which really helped crystallise and put it together for me.

PLATFORM

- Low-code, no-code day-to-day use/operations - software is designed to be deployable “the next day after deal is done” - no need for much customer IT and IT development effort at all

- Entire platform is internally developed and organically grown - no acquisitions, hence no goodwill on balance sheet

SALES EXECUTION STRATEGY

- Land and Expand Use strategy - sell 1 or 2 use cases, then push to (1) add use cases (2) broaden communication scope/groups across the enterprise

- Customers are not only staying in, but are using/spending more - $20-30k revenue initially but can scale up quickly thereafter - platform is very sticky - good slide from the 1HFY23 results preso

NATURE OF REVENUE

- Per User license - 100% gross margin on this as there is no 3rd party involved

- Per message/transaction fee thereafter

- In normal years, expect revenue split to be 65% Transaction Fees: 35% Platform Fees - during Covid, the mix was 80%:20%

- Covid demonstrated the ability for the platform to be scaled quickly and was heavily tested for robustness

PIVOT TOWARDS CASH FLOW AND EBITDA, US PULLOUT

- 2021 capital raising was intended to invest in growth

- Hired a lot of product developers, improved security posture of the platform - this is now paying off as deals are being won based on strong security posture

- Responded to market concerns on losses, pivoted to being cash flow and EBITDA positive - expecting this to materialise in Q4 FY23

- Reflected on US Strategy and the lack of traction, bleeding of marketing costs - Asia starting to fire made the pullout decision an easy one - focus finite resources on growth areas

- Park US for now - may come back later

- The Nov 2022 restructure is a key step against this pivot in direction - 30% roles cut in 1H, 2H is now operating on the leaner structure

- HR costs have settled down from 6M ago

CASH POSITION

- $9m cash

- Heavy cost spend on the technology stack has already occurred in the last 2 years - WSP will start leveraging this as customers scale from hereon

- Q3, expecting the cash to dip below $9m, but that will bounce back above $9m in Q4

- Have debt options which have not been pulled yet

- No Silicon Valley Bank impact - already have access to funds

COMPETITORS

- Twillio - a competitor but also a partner as it is used as a platform for specific WSP use cases, and hence, also gains transaction revenue for messages sent through the Twillio platform

- Main competitor is be-spoke in house solutions or companies that have no existing communications platform

- Do not see Microsoft or Google competing in this space

- CRM systems are inadvertently a “competitor”, by virtue of it being a tool which businesses communicate to its customers, but it not a direct competitor

- The ability to personalise the communications is a key feature and selling point, especially in the post Covid environment

- WSP believes it has only tapped 5% of the TAM, which in itself, is hard to define

IMPORTANCE OF RESELLERS

- Telco’s eg. Telstra, Singtel are a key customer channel as they help WSP get in front of the Customer

- Telco’s directly benefit from this from the subsequent carrier and messaging charges - this is a good barrier to entry for competitors as they are unable to get to the customer after WSP is locked in, in partnership with the Telco

- This explains why marketing spend was heavily focused on the US as there are no similar US Telco resellers

AI

- Have AI capabilities eg. Chat bots, Talk bots, back-end system AI for load balancing etc

- Have scaled by investment in AI

- Exploring ChatGPT - fits well with the platform and is a real opportunity

KEY RISKS TODAY

- In the short term, focus is on getting to Positive Cash Flow Target - this does require revenue growth, over and above cost management

- Management view of the share price - stay the course against stated Free Cash Flow and EBITDA positive objectives as a lot of the internal housekeeping/hard yards on cost management, org restructure and technology stack improvements have already been executed - time is needed to deliver the revenue growth results which leverage off these efforts

- Not in the market for a capital raising

- Not sure that there is much that the market is misunderstanding of WSP other than the fact that retail investors might not truly understand the product/platform and what it does for enterprises

- WSP as a target for acquisition given current share price:

- “Jerome does not want to sell” - passionate founder

- Lots more organic value to be delivered

- Shareholder register “well structured”

INVESTMENT THESIS

- WSP feels like it is on the cusp of robust revenue growth:

- Pullout from US allows focus on growing and scaling ANZ and Asia regions - makes good sense to divert finite resources to areas that have greatest potential and return

- Hard work and large capital spend is completed - org restructure, cost optimisation, technology stack improvements

- Revenue growth is being delivered via the reseller channels - showing good signs of delivery, particularly in Asia

- Need time to leverage the investments to deliver the customer and revenue growth

- Requirements for big cash investments in the next 12-24 months does not appear high given the housekeeping done and the pullout of the US

- Robust, scalable platform, sticky customers, low spend Telco reseller marketing channel, more focused organisation, pivot towards EBITDA and Cash Flow Positive in Q4

- $9m (25%) of today’s market cap of ~$35m is in cash

- Almost at 52-week low

RISKS

- Do not meet Q4 targets of either EBITDA or Cash Flow - unlikely given current confidence, trajectory and focus

- Founder sells out or WSP is acquired - little incentive to do so given low share price vs possible organic growth and huge available TAM

- Cyber security incident - risks appear mitigated from 2021 product focus, but requires ongoing spend and focus to upkeep

- Customer churn stays above 5% target - another red flag

TLDR - Muted operating performance, but the decision to fold up in the US will accelerate the push towards profitability - also a good move given their track record there and the inherent difficulties breaking into that market.

If management can hit their longer-term targets (>20% revenue growth, gross margins > 65% and EBITDA margins > 20%), there is value here - but that comes with a large degree of uncertainty.

Im putting up some interesting charts (ggod and not good). My usual 6 month rev (LHS), pbt and CFO in orange and grey. the company aimed to cut costs, but rev now falling off and profitability under pressure. i dont think i have missed any one offs etc. looks like deteriorating. trades at under 1X sales so cheap if recovers, numbers show a concerning trend imo--whispir to become a whispir? cash $9m...not held

A disappointing quarter for Whispir all things considered. In particular the cash burn of around $9 million leaves it with less than two quarters of cash left. Without a loan facility it looks likely a capital raise at a depressed price is likely. Despite this they state they have enough capital to reach positive EBITDA in 2H FY23. This excludes share-based payments. EBITDA is not an audited number and it's notable they haven't set a set a cash flow target.

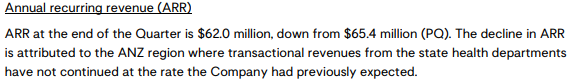

It seems even less likely when you consider they disclosed a decline in ARR.

This highlights a couple of things. First, when you add it to the fact they expect expenses to stay flat, they're heading in the wrong direction. Second, what does it say about the quality of your ARR if the 'Recurring' bit relied on COVID to continue at the same rate as last year.

[Not held]

Highlights

- Receipts from customers 16.9m – a decrease since Q3's reported 19.8m and Q2's 25m.

- Staff and admin costs have narrowed slightly QoQ. There has also been 2.5m reduction in manufacturing and operating costs, but this is probably due to less demand/output.

- The business continues to bleed cash – net cash used in operating activities -2.3m in Q4.

- Another 5m burnt throughout the quarter, with 26m cash remaining. This should be enough for operations to continue for at least another year unless we see a serious increase in spending, which is unlikely in this environment.

This business continues to highlight their promises for a reduction in costs – and to be fair this has occurred – but receipts from customers continues to decline QoQ.

Management is forecasting positive EBITDA during the second half of FY23, but also suggest that this forecast EXCLUDES share-based payments. Que? This is a significant cost for the business, so excluding this is meaningless – at least to me.

I still can’t see the evidence of scaling that I want to see. The continued decline in receipts is concerning and suggests WSP might not be able to grow its revenue without spending a heap of cash.

Disc: not held

1.50 based on a simple DCF which is naturally full of uncertainty with a company growing like this and no proof as to whether it can scale effectively.

Summary

I like Whispir to keep growing. They are building a strong history of revenue growth, proving demand and relevance of their offering. I'm planning to wait a little longer to buy given market sentiment. I would like to see at least the next quarterly, with an eye to costs and how the COVID Vax work is cycling out of the numbers

Its a punt on future profitability while they continue to absorb losses for the next few years to deliver on growth. So far management have delivered and general industry tailwind is real IMO.

What I like

Strong, compounding revenue growth going back to 2016 (as far as I've looked). Last 2yrs CAGR of ARR 28% (COVID assisted).

Capital light software, high margins, should be high retention

Founder CEO, although <10% ownership, Wells and Chesson sold last year, Chesson exited completely.

General market sentiment has been applied to the stock price, seeing it trading on ~2x ARR

At least 12-18 months of cash in the bank, probably more like 18 months at current scaling

What I don't like

Cost growth. Not showing clear scale benefits as yet with the main culprit being staff and admin costs. Not sure what's better, if the marketing and R&D was very high I'd also be concerned. My instinct is this will improve but I don't have a clear and reasonable argument at this point.

This was pointed out by Rocket, I've included my 4C historicals below (pardon the formatting)

DCF Model Assumptions

Continued growth at 25% next year, slowing across the rest of 2020s

Terminal Revenue A$160m by 2031

10% dilution in 2023, continuing to make losses until 2026.

Eventual 25% NPAT margin once ex-growth through 2030s

10% discount rate.

FY22 Q3 - highlights

- Cash receipts of 19.8m, a -22% decrease since Q2’s 25.4m.

- Cash from operating activities came in at (3.4m), a slight increase vs Q2’s (3.1m). Despite the increase in low, Q3’s loss also includes a 735k payment to ATO due to admin and corporate costs occurred in Q2 – exclude these and costs have narrowed.

- ARR increase of 2.4m since Q2 (24% vs pcp).

- 82 new customers during the quarter; 26 coming in North America, 18 in Asia and 38 in ANZ.

- 31.2m in cash holdings, following another 7m burnt in Q3

WSP are careful in making most comparisons vs pcp, as the quarter-on-quarter comparison is pretty ordinary. That said, for costs they elect to use quarter-on-quarter comparison -- in an attempt to demonstrate narrowing costs.

Despite the business reporting reductions to cash outflows due to ‘cost efficiencies’ and ‘savings’ being realised, cash receipts came in much lower than Q2 -- which they suggest was due to large Covid-19 vaccine roll out programs in Q2. In this environment, reductions in loss is important, but WSP need to be careful not to chop their right arm off in doing so.

I still want to see more evidence of scaling and operating leverage here, and I am not buying the business touting a reduction in costs when we continue to see 7m being burnt, coincided by a sharp reduction in cash receipts.

Disc - not held

Quarterly Report

https://www.asx.com.au/asxpdf/20220427/pdf/458bmfwk32jy2k.pdf

Highlights

- ARR of 60m, up 5% on Q1 figures and 26% on pcp.

- Cash receipts for Q2 recorded at 25.4m, 56% higher than Q1 and a 124% increase on pcp.

- New customers acquired during Q2 increased by 119% on pcp

- 38m in cash holdings

They are scaling a little better than in Q1, but losses still increased slightly as top line growth expanded. They burnt 2.8m in Q1, and another 3.1m this quarter. On this trajectory they are burning around 12m a year – and that's without accounting for investment costs (IP etc - which has come in at 2m + in both Q1 and Q2). With all costs accounted for, it wouldn’t be unfair to suggest WSP will need to burn through around 20m a year.

With that in mind, I think a cap raising is likely to occur in late FY22 calendar year or some time in FY23 CY. While the latter is obviously more likely, I think they will want to avoid the 'cap raise incoming' alarm bells, which we know can really harm the share price, so I don't think a cap raise towards the end of this CY is out of the question.

I really want to like WSP. But I can’t get my head around current losses, nor do I think it is scaling well enough at this time. And with the environment we are entering, I don’t want to be holding too many companies that are dependent on investor capital.

This one continues to be a no for me, but watching closely.

Disc: not held

Whispir (WSP)

Discount rate: 10%

Market cap: 335m

Revenue FY21: 47m

Revenue FY22 projection: 64m

Revenue FY23 projection: 74m

Income FY21: -9.6m

Income FY20: -9.8m

Shares outstanding: 117,711,354

I posted an overview/thesis relating to WSP last week. This elaborated on some key points associated with the business, my potential investment thesis and what I am monitoring in the coming months/years. In short, I really like WSP. Their last quarterly (Q1 FY22) shows strong demand for their services, in addition to their recent material contract with Singtel. There is lots to like. That said, I think Q1 also shows the very risk associated with a possible investment case in WSP. They aren’t scaling particularly well – operating costs and staff costs remain high (without even mentioning marketing and other admin-related costs). They burnt through another 3m in operating costs in Q1, with a further 2m in investment activities – 5m in total. It helps that they are armed with a healthy 43m in cash holdings, but I would like to see that loss rate (and mainly their ability to scale) improve before I invest.

That said, I still think they are undervalued. Applying a 10% discount rate – which I have increased from my standard 8.4% to account for execution risk in the North American region – I reach a company value of 426m. Divide this by shares outstanding and I reach a valuation of $3.60.

Founded in 2001, Whispir is a global SaaS company that helps its customers interact and engage with an audience. It does this by offering a low-code/no-code software platform that simplifies the automation and management of communications at scale, without the need for IT expertise.

So why use it? Glad you asked! To solve a broad range of business challenges, from operational coordination through to enhanced customer engagement and crisis management. Think widespread messaging, internal incident notifications, click and collect, in-store pick up notifications etc etc.

It is used by insurance companies, telecommunications companies, banks, governments – any business or agency that needs to facilitate cost-effective digital communications.

Some key points:

- 801 customers across three regions (Asia, North America and ANZ) increasing by 171 during FY21.

- ANZ accounts for 83% of total revenue.

- ARR increased to 53.6m in FY21, a 28.5% increase on FY20 – largely driven by existing customers expanding use cases. This suggests to me that Whispir is onselling effectively and implementing new innovative solutions for its customers (reminds me a little of 3DP and how they look to produce/innovate on demand).

- Losses remain high - around the 9m mark. Yes, the business is investing significant amounts into marketing and R&D, but this remains the big risk/question mark for Whispir going forward – dilution should be expected.

- The business wants to achieve strategic growth in three areas: its product roadmap, customer growth in ANZ and Asia; and expansion in the North American market – the latter is said to represent the largest opportunity for the company.

Thesis

- The company’s platform is designed to be used without IT expertise. The same open architecture enables Whispir to easily integrate with existing IT systems making it simple to use, adopt and implement. Strength is often found in simplicity - I think this is an example of that.

- They appear to be efficient at offering additional value-add to existing customers (their 'story' with Chemist Warehouse, outlined within their FY21 report, is indicative of this). This should drive platform utilisation over the coming years.

- The need for Whispir’s platform is universal – it isn’t restricted to any one industry or thematic. If they can continue to execute, Whispir can theoretically target customers in almost every vertical. I don’t want to discuss the dreaded ‘TAM’, but I would argue that Whispir can evolve into something much bigger.

- The company's solid customer base – consisting of blue-chip customers, government agencies and more – provides endorsement and legitimises Whispir’s offering.

What I want to see in the coming months/years

- Losses narrowing.

- R&D costs converting to additional value-add for existing customers over the long term.

- Steady growth in North America given its investment in the region, where there is lots of competition.

- Whispir continuing to demonstrate strength and ongoing growth in the years to come. There is a possible bear case that Whispir partly benefited from Covid-19 – yes, the business suffered too – but I can’t recall a period in my lifetime where there has been a requirement to quickly reach and disseminate information to diverse audiences. Will the requirement to do this fade over time post-pandemic, and with that interest in Whispir? To counter this view though, it is entirely possible the pandemic has accelerated the need for digital transformation – and with that the need for a contactless and digitalised way for business to reach customers, for whatever reason. I think the latter is primarily the case, but something to watch going forward.

I will post a valuation later in the week.

Disc: not held yet, but certainly high on the watchlist. I would like to see losses narrow before investing. Their expansion into North America is also something to watch closely.

Assuming they can achieve there upgraded guidance given at AGM $64-$68m (Assumed Mid $66). Assumed they can continue strong growth for next 5 years forecasting ~$160m in FY26.

Discounted back to today gives me $4.25

Held in RL and Strawman

Evening All

Not a quarterly, not an interim result and not a Full Year Result.

The messaging from today's AGM provided some confidence which should counter months of low sentiment. I bought WSP as a Company which should rebound as the impact of Covid restrictions eased. Stayed the course, but a lovely example of how a sustained decline in the share price can gett you overthinking an investment. I had periods of doubt, despite all the analysis of their financials. Whispir have endured headwinds, then seized some opportunities allied to Covid management and now look to re-instate the sales momentum achieved prior to March 2020.

Only difference, the product offering and value propsition is significantly improved ( never sat on their hands during the pandemic). Add to this the fact that the roadmap to renewed success now carries a further whopping R&D spend of $17 + m in FY2022. The trajectory of Revenue excl any R& D grants and the Expenses excluding any R& D spend present a very different picture of this Company's future and likely profitability. Compliment this with the super impressive cohort analysis graph ( see their FY or AGM presentation) and you can start to see the future value. I love the 'land & expand' models as, provided the value prposition is in tact, it becomes the hidden growth engine.

The Company's slogan of ... "Developing a product led growth engine, solving real world problems" has to be tested over time. Their aspirations in North America will be a key indicator going forward. Right now, only doing $1.3 m across 49 customers. The acid test over the next 12 to 18 months.

Even with a slight re-rate today, incredably cheap at anything below $2.80 IMO. I will confidently hold Whispir for 3 to 5 years, only subject to them getting traction in the North American market. This Company is in better shape than many believe. Look forward to the interim results for FY2022.

RobW

Long suffering shareholders will be enjoying Whispir's guidance upgrade today at their AGM with a strong start to FY22.

Their strategic reset in 2H21 targeting an expansion into the US looks to be gaining a bit of traction - time will tell.

FY22 Guidance Update Whispir Limited (Whispir) advises that the full year revenue for the year ending 30 June 2022 (FY22) is now forecast to be in the range of $64m to $68m. This reflects an improvement on revenue for FY21 of between 34% and 42%, and an improvement on prior guidance of between 11.9% and 13.0%. Whispir had previously advised, on 20 October 2021, that FY22 revenue was expected to be in the range of $57.2m to $60.2m.

Furthermore, guidance for EBITDA excluding non-cash share-based payments for FY22is forecast to be in the range of $(13.2)m to $(11.2)m - an improvement on previous guidance of between 13.8% and 14.8%. Whispir had previously advised, on 20 October 2021, that FY22 EBITDA excluding noncash share-based payments for FY22 was expected to be in the range of $(15.5)m to $(13.0)m.

Whispir is well positioned for growth in FY22, predicated by its book of long-term, bluechip clients. Several new business wins, including a sizeable customer in North America, provides confidence that the sales pipeline is strong, and the product is delivering to meet the changing needs of customers across our core regions of ANZ, Asia, and North America.

Commenting on the upgraded revenue and EBITDA guidance, Founder and CEO, Jeromy Wells said: “This improved forecast performance, in revenue and EBITDA, validates that our strategy is working. Our updated guidance also highlights the valuable role we’re playing in the delivery of COVID specific communications across our install base. Our ‘return to work’ and ‘vaccine roll-out’ campaigns are clearly benefiting our top-line and they also provide an increased opportunity, for up-sell and cross-sell, introducing our platform, and our products, to an expanding customer base.”

I hold in RL and SM

Appendix 4C – Q1 FY22 Whispir Limited (ASX:WSP, Whispir or Company) provides its Appendix 4C cash flow and activity report for the quarter ending 30 September 2021 (Q1 FY22, the Quarter).

Highlights

Q1 FY22 Annualised Recurring Revenue (ARR) of $56.8 million, up 31.8% on Q1 FY21

Continued customer growth with 33 net new customers onboarded in Q1 FY22 taking total customers to 834; growth of 25.4% on Q1 FY21

12-month customer revenue retention of 117.2%

Q1 FY22 cash receipts of $16.3 million; 55.7% higher than Q1 FY21

Whispir reaffirms FY22 guidance and remains well-funded to accelerate its growth strategy with a cash and equivalents balance of $43.9 million

Quarterly performance

The global megatrends of digitisation and digital transformation provide strong tailwinds as Whispir meets the increasing demand for communications intelligence; resulting in continued growth in ARR, new customers and cash receipts during Q1 FY22. Whispir’s ARR was $56.8 million for Q1 FY22, representing an increase of 31.8% on the prior corresponding period (pcp). Gross revenue churn year to date was just 2.1%, an improvement on the pcp as Whispir continues to support customers in solving their complex communications challenges. Whispir onboarded 33 net new customers during the Quarter – which were diverse in both regional and industry attributes – taking total customers to 834 as at 30 September 2021, 25.4% growth on pcp. Whispir’s customers grow stickier over time as reflected by the 12-month revenue retention of 117.2%, also highlighting strong levels of product satisfaction and underpinning Whispir’s future revenue. Customer cash receipts in Q1 FY22 were $16.3 million, up 55.7% on pcp and reflects strong underlying business growth. Operating cash outflows increased by $2.4 million on Q4 FY21 to a total of $2.9 million in Q1 FY21, which is 45.1% above pcp. This is broadly in line with the execution of the Company’s growth strategy as it scales globally. The rate of customer cash receipt growth exceeds the rate of increased expenditure. Payments to related parties and their associates totalled $0.5 million, comprising Directors’ fees and expenses, and the CEO’s base remuneration, short term incentive and expenses for Q1 FY22. Whispir ended the Quarter with a strong cash and equivalents balance of $43.9 million at 30 September 2021. ASX Announcement Whispir CEO Jeromy Wells said, “Strategic investments across our product roadmap, sales, marketing and customer service continued during the Quarter as we onboard our new customers across ANZ, Asia and North America, while delivering better value for existing customers on the platform. “This is a strong Quarter of growth for Whispir and we’re seeing quality sales momentum across each of our regions. As COVID-related restrictions continue to ease, we’re anticipating a return of demand from customers in suppressed industries including transport and aviation. We are ramping up investment in the capability of our global team – which increased by more than 30 people over the quarter – to widen our competitive moat, improve speed to market, and over time, reduce the cost of customer acquisition.”

Regional Dynamics and Product Roadmap

Whispir’s go-to-market strategy leveraged channel partners and digital direct methods to cost effectively acquire new customers across all three regions during Q1 FY22. In ANZ, Whispir acquired 7 net new customers including the NDIS Quality and Safeguards Commission, and National Rugby League, while Queensland Health grew its contract to support multiple state-based services. In Asia, Whispir acquired 13 net new customers including Suzuki, Emapta, and Keppel FELS. In addition to diversifying the go-to-market approach with channel partners, Whispir is focused on expanding in-country resources to increase sales coverage across Singapore, Indonesia, and the Philippines. In North America, where the majority of customers are self-discovering Whispir’s offering online, 13 net new customers were acquired during Q1 including AgVocacy, Ridgefield, and Richland County. Whispir continues to invest in strategic digital marketing to increase brand awareness and build a quality sales pipeline. A total of $4.1 million was spent on R&D during the Quarter as the Company continues to evolve platform functionality with prediction, detection and automation capabilities. Whispir’s Artificial Intelligence and Product Intelligence teams remain focused on market leading innovation and increasing the lifetime value of customers through positive product experiences. During the Quarter, Facebook Messenger was incorporated into Whispir’s Conversations product, which will soon be offered to customers as another channel for audience engagement.

Outlook

The Company remains focused on increasing customer numbers, platform usage and revenue performance across ANZ, Asia and North America in line with its long-term growth strategy. Mr Wells concluded, “As our customer growth continues, delivering stronger recurring revenues for Whispir, we’re pleased to reaffirm our outlook for FY22. ANZ continues to deliver impressive results and we’re building momentum in North America and Asia. We anticipate continued growth in our pipeline across all markets where Whispir is well placed to support businesses with their digitisation and digital transformation agendas.”

Renewal of Telstra Business Partner Agreement

Whispir Limited (WSP, Whispir or Company), a leading software-as-a-service (SaaS) communications workflow platform that automates interactions between organisations and people, is pleased to confirm that its wholly owned subsidiary, Whispir Australia Pty Ltd, has renewed its business partner agreement (Telstra BPA) with Telstra Corporation Limited (Telstra) for a further period of three (3) years, on the same terms and conditions.

The Telstra BPA provides for Telstra entering into contracts with its customers for the re-sale of the Whispir platform and other services. It also provides the terms under which Telstra uses the Whispir platform and services for its own internal purposes.

DISC: I hold

WSP Straw (18/2/21) 1H FY21 Results

Half year results for WSP are disappointing principally for the fact that US sales growth continue to stall when the current share price (and my valuation at $3.80 – unchanged) requires that they grow rapidly in the US market (300% this year from a low base). Also, gross margins are going the wrong way, down to 60.7% (from 62.0% 1H FY20), they need to go up, not a lot, but up all the same.

The bottom line & EBITDA figures are reasonable due to ANZ top line growth and cost controls in Admin expenses which are good. Customer growth was solid but not enough for its current size, up to 707 or 38.9% on PCP, of the 77 added only 7 were in the US.

As it stands my Bear case valuation of $2.17 (75% weight) is looking significantly more likely than my Bull case $8.68 (25% weight).

WHISPIR DELIVERS STRONG FY21 HALF-YEAR, WITH INCREASED PLATFORM USUAGE AND RECORD NEW CUSTOMERS

1H FY21 Highlights:

- Annualised Recurring Revenue (ARR) at $47.4 million, up from $36.7 million for the same period last year - a 29.2% increase

- Half-yearly revenues increased 27.3% over the prior corresponding period (PCP) to $23.1 million

- Customer numbers now total 707, up 38.9% on PCP with a record 77 net new customers onboarded in 1H FY21

- EBITDA of $(1.8) million, significant improvement on PCP

- Upgraded EBITDA guidance and updated guidance for ARR and revenue

Disc; I hold

WSP~Appendix 4C – Q2 FY21

Highlights

• Annualised Recurring Revenue (ARR) of $47.4 million at end of Q2 FY21; 29.2% higher than the prior corresponding period (PCP) and up 8.5% on the quarter ended 30 September 2020 (Q1 FY21).

• Quarterly cash receipts increased 8.2% over Q1 FY21 to $11.3 million.

• Acquired 42 net new customers during the Quarter, bringing total customers to 707 by the end of Q2 FY21.

• First quarter operating cashflow positive, at $0.4 million.

DISC : I hold