You don’t need us to tell you that it’s been a tough run for small caps over the past year or so. And the harsh truth is that much of the pain was well deserved.

Things always look clearer with the benefit of hindsight, but there was never any good justification for a bunch of sub-scale, cash-burning, undifferentiated wannabees to trade at double-digit sales multiples. Frankly, many companies with legitimate potential were probably being valued above what was reasonable.

As we know, significant and rapid increases in interest rates, along with other ‘macro’ factors, eventually called time on the party.

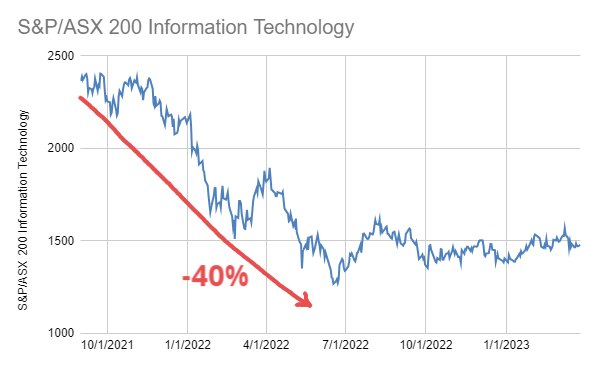

Tech stocks were hit especially hard; the S&P/ASX 200 IT index dropped over 40% from the highs of mid-2021 through to the start of this year. And that’s pretty much where things stayed…until recently.

In the last 3 months, the same index has climbed over 20% higher.

But this rising tide has not lifted all boats. Indeed, the nascent bull market among tech stocks seems much more discerning.

The companies that are finding favour are those that have demonstrated real progress; something the latest batch of quarterly results is highlighting. We’ve pointed to some examples in our ‘trending stocks’ section below, but there are plenty of others among the top-ranked stocks on Strawman.

But here’s what’s interesting: there are still a good number of businesses on the community’s radar that have yet to enjoy a re-rate, despite recent evidence that operations continue to track in the right direction.

Shares in Ava Risk Group (ASX:AVA) remain near 12 month lows despite reporting increased sales traction and reiterating an ambitious 3-year revenue target.

8common (ASX:8CO) is likewise failing to catch much of a bid even though the top line has grown 65% over the last year and the business has shifted to positive operating cash flow.

Envirosuite (ASX:EVS) shares remain below 10c even after reporting a record quarter for new sales and 20% normalised growth in recurring revenue.

Scroll through the newsfeed on Strawman and you’ll see loads of other good examples that members have highlighted.

To be fair, the market may have good reason to remain wary with a few of these. For some, it’ll take more than one good quarter to convince the market that things are on a sustainable growth path. But it’s hard to deny that there are more than a few interesting candidates whose share prices seem disconnected from genuine improvements in the underlying fundamentals.

That can be frustrating for existing shareholders, but it’s also the kind of set-up we should relish — decent businesses that are not being properly priced by the market.

What are we all here for if not that?

As we’ve seen, when things do change, they can change swiftly — just look at what Pointerra (ASX:3DP) did on Friday. And while we can’t hope to accurately time such things, we can ensure we are well positioned for them.

Remember, bear markets are for building. And if this latest rally in small caps continues, the best opportunities may not be around for long…

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2023 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211