Strawman member Edgescape kicked off a good conversion on Friday, suggesting Occam’s Razor — the idea that we should favour simplicity over unnecessary complexity — was very much relevant to the field of investing. And clearly, other members agreed.

It reminded me of a book by Ben Carlson: A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan. It’s well worth a read, but if you want the short version Ben provides the following summary:

It’s easier to be fooled by randomness with complexity. If you torture the data long enough it’s bound to tell you exactly what you want to hear. Complexity invites data-mining, over-optimization and seeing correlation where there is no causation. Right or wrong, simplifying makes it harder to game your own system.

Intelligent people are drawn to complex solutions. There are plenty of intelligent people in the world of finance. But that intelligence often comes at a cost because smart people can more easily fool themselves into believing they have all the answers. Intelligent people tend to overthink things and that can get you into trouble. Simple is not stimulating enough for most people.

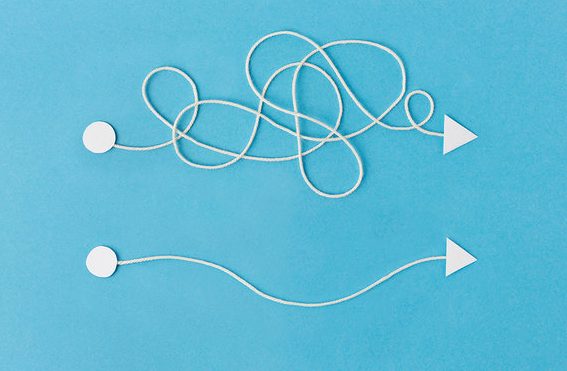

Complexity is about tactics; simplicity is about systems. Tactics come and go but an overarching philosophy about the way the world works can help you make better decisions in multiple scenarios. Simple doesn’t go out of style but complex does.

Simple is harder. You have to fight to keep things simple because our natural human impulses make us susceptible to stories and narratives. Simplicity is more of a psychological exercise while complexity is more about trying to outsmart the competition.

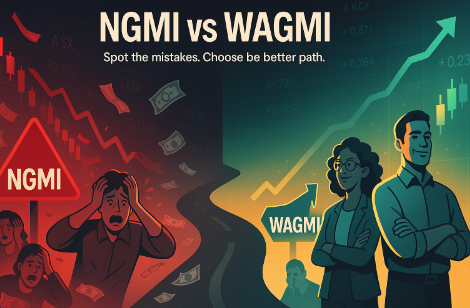

Trying harder does not guarantee better results. Outsmarting the competition is easier said than done because putting in more time and effort doesn’t automatically make you a better investor. It’s not easy getting people to come around to the idea that doing less and making fewer choices is actually better for you in the long haul.

Complexity can lead to unanticipated consequences. Simplicity was once described to me as the art of thoughtful reduction. Sherlock Holmes once said, “If you eliminate the impossible, whatever remains, however improbable, must be the truth.” Complexity, on the other hand, opens you up to far more possibilities and surprises, and not in a good way.

Complexity can give you an illusion of control. As a coping mechanism, people look to avoid stress by giving themselves the illusion of control. Certainty makes us feel more comfortable but really it’s an illusion. Investors seek out a feeling of certainty and control, even if it means being wrong. Simplifying is about focusing on what you can control and understanding what you cannot.

Simple does not mean easy or thoughtless. Simple actually requires more thought up front because it forces you to filter out the endless noise in the markets ahead of time. Simplifying helps you make better decisions by breaking down complex problems into component parts to better understand it.

Sophistication is used as a status symbol. Complexity works as a much better sales tactic than simplicity. I know plenty of “sophisticated” institutional investors who invest a certain way in an attempt to impress others. The markets don’t care about the degree of difficulty involved in your strategy but people with egos do.

Complex problems don’t require complex solutions. It’s difficult to get people to buy into simplicity because it’s hard to believe that complex problems don’t require complex solutions. We all want to believe that the Holy Grail of investment sophistication exists and if we can only find the secret sauce all of our problems will be solved.

Simple is easier to understand. It’s hard to put a value on the ability to understand exactly what you’re doing and why. Simplicity allows for more transparency. It’s easier to set reasonable expectations. Charlie Munger once said, “Simplicity has a way of improving performance through enabling us to better understand what we are doing.”

Advice doesn’t have to be complicated to be good. One anecdote on simplicity comes from the Charley Ellis book Winning the Loser’s Game where he tells the story of his two best friends who both work in the medical field. These distinguished medical professionals both agreed that the two most important discoveries in the field of medicine for enhancing people’s health were penicillin and forcing doctors and nurses to wash their hands. Ellis concludes the story by telling the reader that advice doesn’t have to be complicated to be good.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211