Paradigm-shifting innovation always has its skeptics. It’s almost a rite of passage.

Virtually all of our modern technological marvels — the things we today take for granted — were initially met with plenty of Fear, Uncertainty & Doubt (FUD). Steam power, electricity, radio, the internet are all great examples, but one less discussed tech revolution deserves special mention — simply because it seems so laughable in hindsight.

Bicycles: A Revolution on Two Wheels

Though it’s hard to conceive of today, in the late 1800s the bicycle was at the cutting-edge of engineering. It was a revolutionary mode of transport that threatened to disrupt a good portion of horse-powered travel.

It’s difficult to imagine how anyone could have an objection to the humble bike, but plenty did. Unsurprisingly, the most vocal critics were those with vested interests in the status quo; buggy manufacturers being among the most ardent critics.

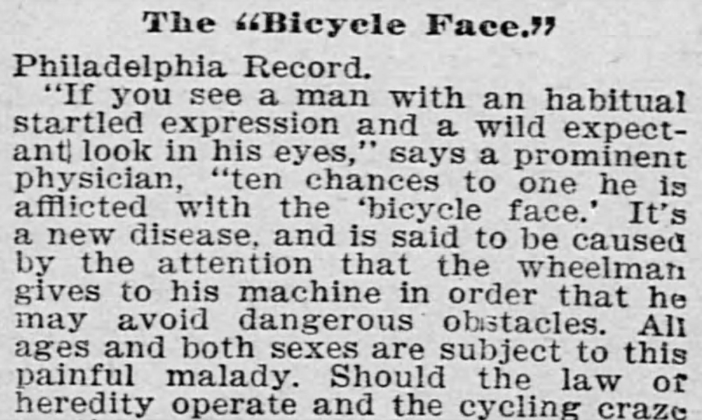

Widespread adoption of the bicycle would, they claimed, lead to a spike in health issues. The most hilarious example being “bicycle face” which allegedly imbued sufferers with flushed faces and strained expressions:

Women were said to be especially susceptible to these claimed health issues. Indeed, bicycles were said to be an agent of moral decay, offering women too much independence and, frankly, affording them a most ungainly appearance.

Nevertheless, in spite of the risks — both physical and moral — the tech soon became widely adopted. The benefits were simply too great to ignore. And a good number of fortunes were made along the way.

The Wright Bothers, in fact, ran a very successful bicycle sales and repair operation before their foray into aviation. Indeed, much of their innovation was underpinned by what they learned from the engineering of bicycles, and it was their business success in that industry that afforded them the means to develop their famed prototype.

(This is another common feature of many technological revolutions: they serve as the foundation for the next level of innovation.)

At the same time, it is also true that technological breakthroughs are also responsible for a lot of investor loss, usually as a consequence of over-inflated expectations, grift or both.

In 1896 British bicycle mania led to a speculative bubble, and the stock market was quickly flooded with start-ups promising huge returns. The end result was the same as it always is, even though the underlying technology was legitimate and went on to experiences significant and lasting growth.

The Ones That Got Away

Not every promising innovation succeeds. LaserDisc, for example, which was a precursor to DVDs, failed miserably as a technology. So did the Segway, the Concorde, Google Glass and a whole lot more besides.

Each of these technologies failed for a variety of reasons, but in the early stages their ultimate demise was not obvious. As a matter of fact, you could have made compelling cases as to why they would all change the world — and many intelligent people did just that.

This is the conundrum for investors; investing early in technological revolutions can yield mind-blowing returns, but how do you distinguish a true revolution from a flash in the pan? And if it really is a genuine revolution, how can you avoid the hype and scam that so often befalls early investors?

Crossing the Chasm

In trying to work out if a new tech has lasting potential, an investor could consider things like market need, switching costs, scalability, user experience, regulatory hurdles and a myriad of other things.

Or, more simply — and more reliably — you could just observe what people are actually doing. That is, you just wait until there is a clear and accelerating adoption. When you observe that, find the dominant players, invest aggressively and strap in.

Yes, you’ll miss the early upside, which is often substantial, but the risk will be orders of magnitude lower. Besides, if the technology’s promise is genuine, there’ll still be immense upside to be had.

Remember, Buffett didn’t invest into Apple (NASDAQ:AAPL) until 2016. At that stage, the company had already delivered an 11-fold increase in revenues over the previous decade (and even more if you go further back).

Buffett started selling down its stake in the tech giant earlier this year, but the point is it generated massive returns for Berkshire over the preceding eight years; something in the order of a 900% gain.

Likewise, returning to our initial example, an investor in the early 1900’s would have seen that bicycle adoption was rapidly growing (despite all the FUD), and was beyond a short-lived fad. Had they invested into more established companies that had developed a good lead — like Dunlop, Michelin or Raleigh — they could have done insanely well, even though they missed all the early gains.

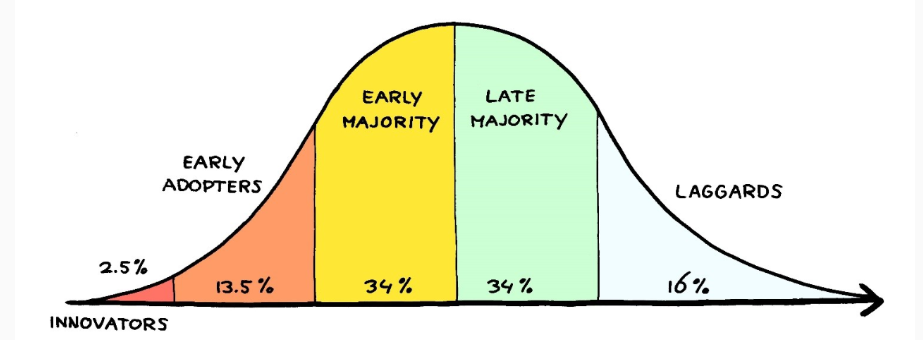

An appreciation of the technology adoption life cycle will serve you well here.

It categorizes users of new technology into five groups based on their readiness to adopt: Innovators (first 2.5%) are the risk-takers who try new technologies first, followed by Early Adopters (13.5%) who are visionaries that influence broader adoption. The Early Majority (34%) are pragmatic users who wait for proven benefits, while the Late Majority (34%) are more skeptical and adopt after the technology becomes widespread. Finally, Laggards (16%) are the last to adopt, usually only when the technology is unavoidable (the Japanese eventual and begrudging adoption of gun powder being a powerful example).

A key point in the curve is Crossing the Chasm, a term coined by Geoffrey Moore, which highlights the challenging transition between early adopters and the early majority, where many technologies struggle to gain mass market traction.

Once that chasm is crossed, there’s a very good chance the technology revolution is real, and still has a long way to run. As stated, you want to be rather aggressive with your allocations at this stage.

Embracing the Future

The stories of past innovations teach us that skepticism is natural, perhaps even necessary. It forces us to question, to probe, and to refine. But history also reminds us that those willing to look beyond the immediate fears, to see the potential for long-term change, are the ones who stand to gain the most.

As investors, the challenge is to navigate the line between healthy skepticism and visionary insight. And a focus on adoption is something that will serve as a valuable guide.

Things like artificial intelligence, synthetic biology, quantum computing, AR/VR, robotics and bitcoin are all, in my humble opinion, potential candidates for genuine, paradigm shifting technologies. Not all will live up to the initial hype, but I believe they all deserve your attention.

If they cross the chasm, or look like they may be on the cusp of doing so, you do not want to be caught flat-footed.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.