Two thirds of the Earth’s surface may be covered in water, but less than 1% is fresh and easily accessible. And of that tiny percentage, the quality of available fresh water is becoming an increasingly thorny problem.

Enter Phoslock Environmental Technologies (ASX:PET), a company that provides innovative water technologies and engineering solutions to manage nutrients and other water pollutants. The leading product, the eponymously named Phoslock, helps remove phosphate from waterways, safely and in a cost effective manner.

Why does this matter? Too much phosphate can lead to algal blooms and other problems that can render water sources unusable. Sadly, increasing agricultural and urban run-offs (think fertilizer and sewage) are creating all manner of problems for a wide array of stakeholders — and demand for reliable solutions is increasing, especially in countries like China that are experiencing rapid development.

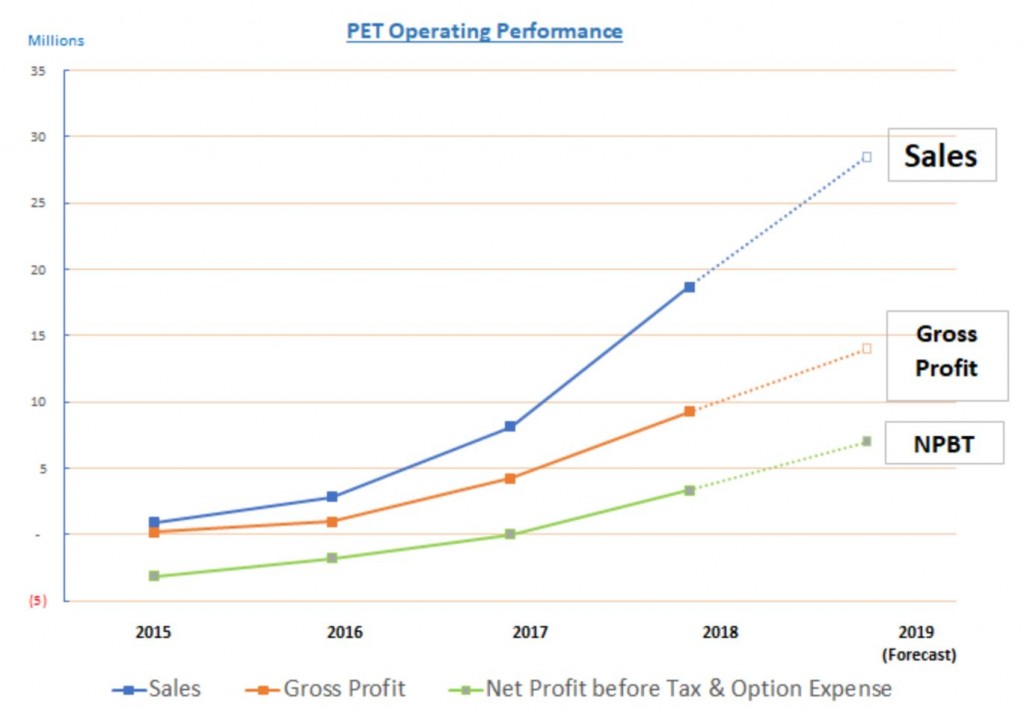

Originally developed within the CSIRO, the technology (like so many) has taken many years to prove and subsequently commercialise. But, after years of stagnant sales and losses, PET is finally gaining some traction — and the market has taken notice.

In the last financial year, ended December 31, 2018, PET posted sales of $18.7 million and a pre-tax profit of $3.5 million. For the current year, the business is expecting top-line growth of at least 44% and to roughly double pre-tax profit to between $6-8 million.

Importantly, PET is generating positive operating cash flow (a record $10.8 million over the previous 6 months) and has close to $18 million worth of cash in the bank. The company remains debt free.

PET enjoys strong gross margins of around 50%, and enjoys a good deal of recurring revenue thanks to maintenance contracts. The business also boasts a high level of repeat business, with 60% of projects leading to further work. The company has recently been awarded recognition by the Chinese Ministry of Water Resources which PET expects to help accelerate growth in this important market.

Are shares good value?

It’s been a cracking year for PET shareholders. Shares in the company have climbed around four-fold since January and sit near recent all-time highs.

Accounting for a few company options, PET has a diluted market capitalisation of approximately of $790 million, or about 27 times forward sales. Accounting for prior tax losses, the business looks to be trading on a P/E of approximately 113 times.

Even for a capital-light and highly scalable software company, those are lofty multiples. For an engineering and manufacturing operation they are, shall we say, bold. A lot of future growth has been priced in by the market and if PET can’t deliver to these expectations investors can expect a sudden and severe correction…

Nevertheless, the company has a truly global and fast growing market, patented technology and impressive reference clients. If it can maintain sales momentum and manage costs, shareholders will likely do well in the fullness of time.

Ranked #62 on Strawman, shares in PET currently sit a fraction below the community’s consensus valuation. Click the button below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223