A recent article in the AFR proclaimed “Small caps are ripe for a comeback“, citing the relative underperformance of this space in recent years, and the potential for easier credit conditions later in 2024.

It’d certainly be welcomed by those of us that play in this space. As discussed below, the Strawman Index has kept pace with the broader market over the last 12 months, but it nevertheless remains a good distance from the heady highs of late 2021; a period where we enjoyed rather robust — and perhaps in hindsight, excessive — multiples.

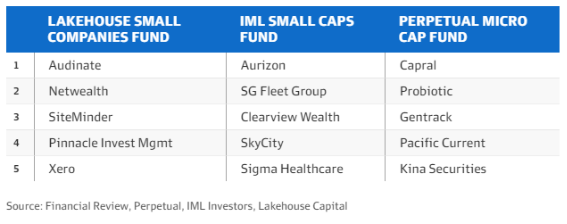

The article features the current top 5 holdings from some small cap fund managers. We’ll leave it to you to judge the merits of these expert’s picks, but many of the stocks mentioned do show some common themes with some of the better performing stocks on our scorecard.

Specifically, despite the recent resurgence in share price, plenty remain below previous highs despite having delivered demonstrable progress in the underlying financials.

The inference being that although the market may have been a tad exuberant a few years back, the value proposition is looking a lot better as earnings have ‘back-filled’ some of that earlier optimism. Moreover, a strengthening (or at least resilient) growth outlook could help move earnings multiples in the right direction — or at least limit any further contraction.

This is definitely NOT the case for those companies that have failed to deliver anywhere near what investors may have expected at the height of the post-covid bull market. In fact, from a valuation perspective, many of these are likely even more expensive today even though they are now at a lower share price.

As we said at the time, a legitimate souring of sentiment towards this group of companies unfairly tainted the entire small-cap space. And while that’s annoying for existing holders, it was a good opportunity to load up some quality stocks.

For example, Audinate (ASX:AD8), the current top-ranked stock in Strawman, could have been picked up at a ~40% discount to its previous highs as the market sold off in early 2022.

What the fundies featured in the article seem to suggest is that although we’ve seen a good recovery among the better quality small-cap stocks, valuations still look attractive — especially on a relative basis when compared to the big end of town.

Hopefully they’re right.

But regardless of whether or not we see improving sentiment towards small caps in the coming year or two, the game plan remains essentially unchanged. Good companies held at a reasonable price will tend to reward shareholders across the cycle, even if Mr Market’s mood will move things around in the interim.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211