Although the market may be at record highs, there’s plenty of stocks that continue to languish. Of course, that’s to be expected for companies whose underlying fundamentals have stalled or worse, are going backwards. But there remain some truly impressive names that just can’t find favour with the market, despite going from strength to strength.

Take auto-parts distributor and retailer Bapcor (ASX:BAP) for example.

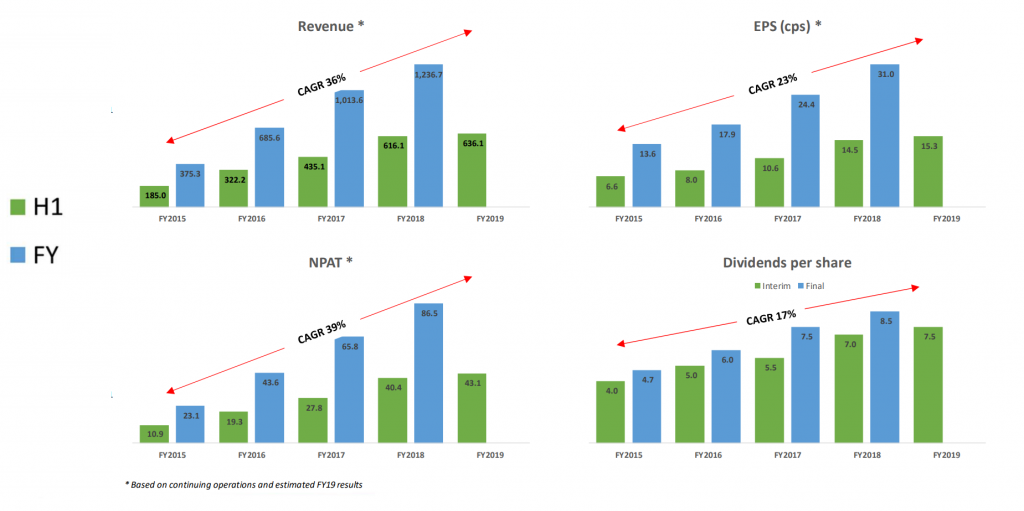

Here’s a business that has grown sales and earnings by an average annual rate of 36% and 39%, respectively, over the last few years. Since 2013, shareholders have seen their shares grow three-fold and have had almost a quarter of their purchase price repaid in dividends.

Sure, as the business has matured, earnings growth has slowed, but Burson is on track to deliver a 9% increase in pro-forma net profit for the full year. If achieved, it will be another record result. More importantly, it continues to have some significant long-term growth opportunities.

Having recently launched in Thailand — a market almost as big as Australia’s in terms of vehicle numbers (but growing more than twice as fast), and with no dominant competitor — there’s a decent amount of growth potential. Here at home, on top of a targeted 2-3% growth from existing locations, Bapcor is looking to establish around 10 trade and 10 retail store locations per year. The business is also looking to expand margins through increased own-brand products and improved supply chain efficiencies.

The business also tends to enjoy certain defensive characteristics, as vehicle owners prefer to maintain existing vehicles instead of buying new ones when the economy gets tough. And, given our collective dependence on cars, this tends to be a relatively non-discretionary spend.

But, despite all of this, shares in Bapcor have essentially tracked sideways so far in 2019, and remain over 20% below the all time high set in October last year. Shares are presently trading on a forward price-to-earnings (P/E) ratio of just 18.1, less than the current market average. The dividend yield, when grossed up to include franking credits, sits at 3.8% — which, given the level of official interest rates, isn’t half bad.

So what’s the problem?

One concern seems to be the potential structural impact of electric vehicles (EVs). These tend to have fewer parts that are longer lasting, so at a given penetration would no doubt have a negative impact to Bapcor’s business. Nevertheless, with EVs representing just 0.03% of the Australian fleet, and representing just 0.2% of new car sales in 2018, it seems this threat is a long ways off. Indeed, according to Bapcor, it will take another 22 years before EVs represent even half of the total fleet.

Another concern seems to be the general malaise being experienced by many retailers, including Bapcor which operates Autobarn, Autopro and Midas stores (among others). At the most recent half, profit for the retail division was flat, despite an 8.8% lift in sales. CEO Darryl Abotomey described the period as “challenging” but also reinforced his longer term confidence in the segment and highlighted the fact that retail comprises just 20% of group revenue and earnings.

The bottom line

As investors we can’t ever hope to anticipate the mood and predilections of Mr Market. All we can do is identify quality business trading at attractive prices, and trust in the wider market to (eventually) recognise value. As Benjamin Graham so eloquently put it:

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

Ranked #3 on Strawman, Bapcor continues to enjoy broad-based support from our community of investors. Visit the company page to see the latest valuation and research.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223