Environmental monitoring technology company Envirosuite (ASX:EVS) has raised $10 million from institutional and sophisticated investors, issuing around 35 million new shares.

The company provides environmental monitoring, management and reporting software. With data fed through a network of sensors, the platform allows clients to monitor environmental outcomes (such as odours, pollutants, emissions, noise etc) and assets (pipes, vents and other plant & equipment) in real time. This enables clients to more effectively manage operations, investigate incidents, predict outcomes, manage complaints and meet regulatory and reporting requirements.

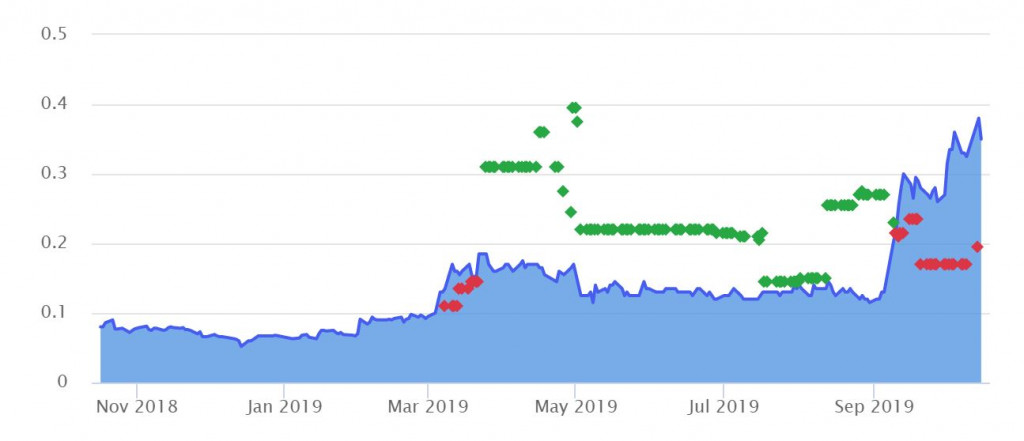

Shares have rallied around 380% in the last twelve months as the company doubled its recurring revenue and, more recently, announced a strategic partnership in China. The later also involved an injection of around $4 million, which means that Envirosuite will have around $20 million in net cash in its coffers.

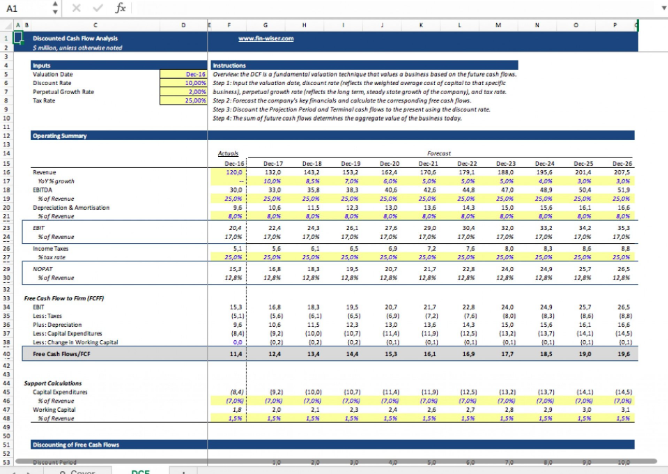

As of the latest report, EVS was burning through ~$5 million in free cash flow per year, but is targeting cash flow breakeven on a monthly basis by the end of current financial year. So hopefully this will be the last time ordinary shareholders (who were not invited to participate in recent raises) will be diluted. Shares on issue (or that could be issued on options conversions) have increased by over 25% in the past year.

That being said, the huge run up in market price perhaps permits Envirosuite to be opportunistic with funding and could well prove to be highly beneficial to shareholders if the funds are invested wisely and it allows the business to accelerate market capture.

The key thing for shareholders is that the pace of revenue growth is largely maintained without a major blow out on costs. Having doubled annual recurring revenue (ARR) last year, and hoping to do it again in FY2020, the business clearly has good momentum and the market opportunity remains vast. The potential in China is especially exciting, though it’s still the earliest of days here, and the examples of failed penetration into this giant market are legion. Investors should watch these areas closely.

A long time favourite amongst Strawman members, Envirosuite has nevertheless dropped down the rankings recently as some members took profits on concerns over valuation. To see the consensus valuation and supporting member research, visit the Envirosuite Company report, below.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223