New Zealand based Gentrack (ASX:GTK) provides billing and customer management software for utilities and airports. Formed over 25 years ago, the company services over 220 sites across more than 30 countries.

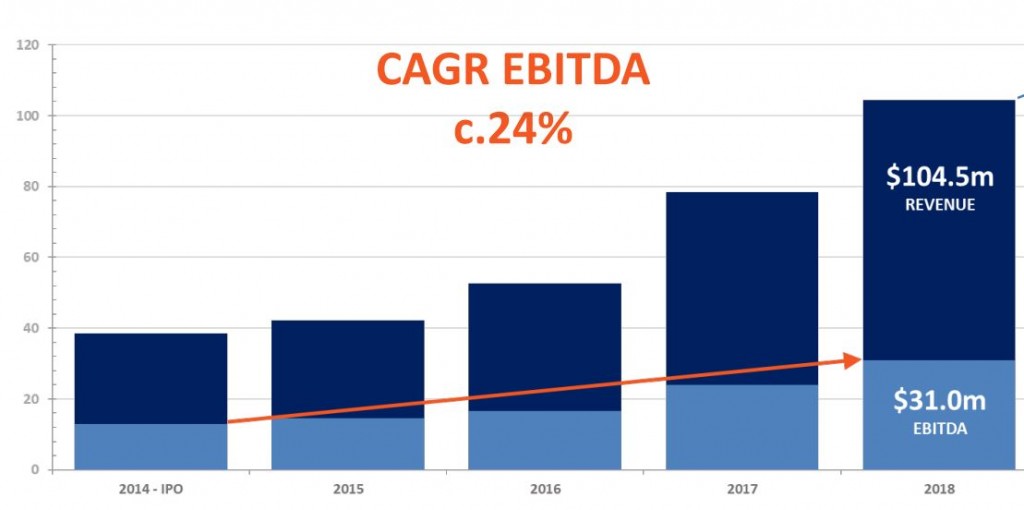

Unlike many ASX-listed software companies, Gentrack is profitable, and even pays a dividend. Since its listing in 2014, shareholders have more than doubled their money, with revenue and earnings growing strongly over the period.

Gentrack is, however, expected to take a backwards step in the current financial year (ending September 30, 2019), with the company telling shareholders that earnings before interest, tax, depreciation & amortisation (EBITDA) is now likely to come in between NZ$25-26 million. That’s a near 18% decline on FY18.

This is the second time this year that Gentrack has lowered guidance. Originally forecasting EBITDA to be “marginally ahead of FY18”, management downgraded this in July to between NZ$27-28 million due to delays in customer projects and bad debt risks in the UK. In today’s update, Gentrack said that an increase in provisions for bad and doubtful debts in the UK was adding further pressure.

While disappointing, it’s worth noting that these issues do not appear to be related to the company’s offering. The UK utilities market is experiencing a high degree of uncertainty at present due to regulatory changes, which have resulted in the failure of nine retailers and ongoing market restructuring. And then there’s the issue of Brexit. That’s not the kind of environment in which companies typically undertake new technology integrations.

Added to this, Gentrack has ramped up its investment in people and is also transitioning to a software as a service (SaaS) model — where customers pay a regular subscription instead of an upfront license fee.

Over the long-term, the SaaS model is expected to bring in a significantly higher level of revenue (about 1.5x over a seven year period), and provides a greater degree of cash flow visibility. Typically, it also reduces the barrier to new sales, allowing customers to replace significant upfront capital expenditure (CAPEX) with lower ongoing operating expenses (OPEX).

At the AGM earlier this year, Gentrack said it remained confident of its long term target of 15% EBITDA growth.

With shares down almost 10% following the guidance downgrade (at the time of writing), Gentrack is now on a enterprise value to EBITDA ratio (EV/EBITDA) of 19, and a yield of 2.7%, partially franked. The forward P/E is likely to be around 40 times.

These are very much growth company multiples. If the business can indeed achieve its stated growth target, the share price actually seems quite reasonable — especially in relation to current averages in the tech space.

Of course, if the issues in the UK continue to drag on, and growth remains elusive, shares could still be considered expensive; despite the 25%-odd fall in the past year.

With only a handful of supporters on Strawman, Gentrack has yet to gain much of a following. However contrarian investors with a longer-term outlook could see this as a buying opportunity.

Click below to take a closer look.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223