After steadily climbing the Strawman company rankings, New York based LiveTiles (ASX:LVT) has just qualified for entry into the Strawman index. If history is any guide, that’s a very bullish signal…

Comprised of the most popular recommendations from our community of investors, the Strawman Index has delivered market beating returns since inception:

What does LiveTiles do?

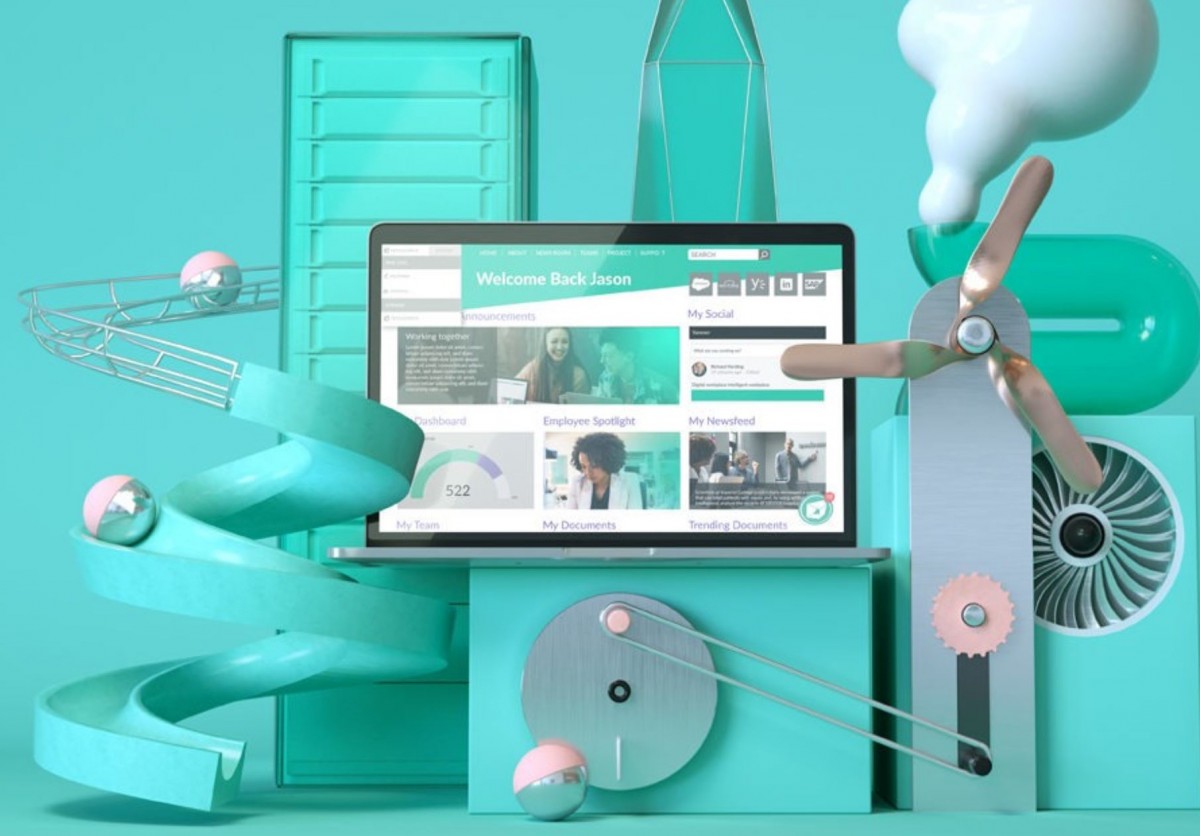

LiveTiles is a software developer that provides an “intelligent workplace platform” for business. It integrates the output from Microsoft Office, Azure and Sharepoint (and others) into customisable user interfaces with the aim of simplifying processes and enhancing productivity.

LiveTiles allows users to create dashboards, employee portals, and corporate intranets from existing resources and technologies. In essence, it’s software that connects and integrates other software, displaying information in a coherent and practical format.

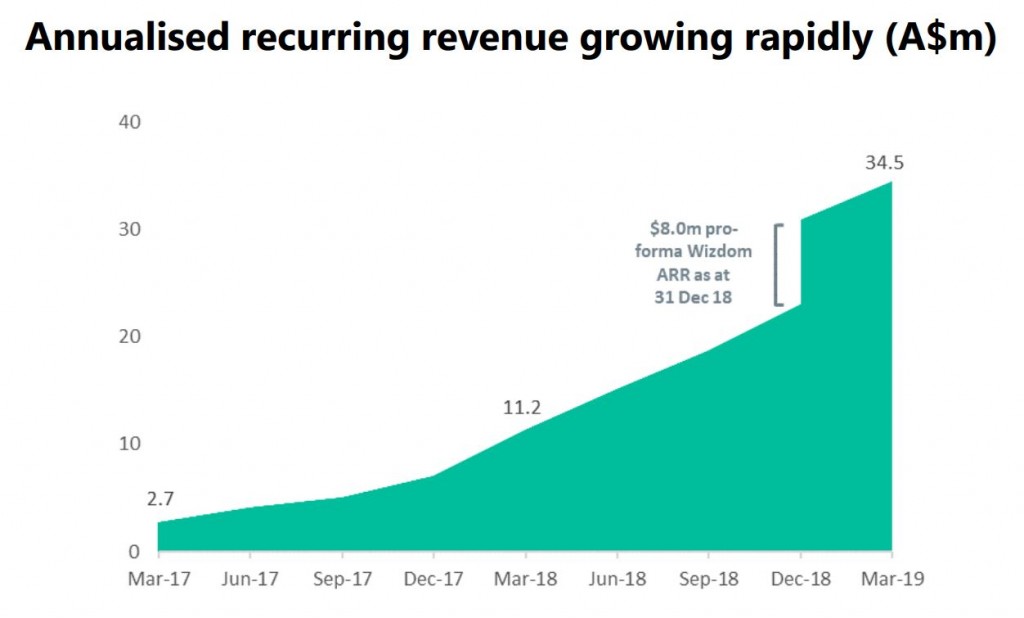

Importantly, it seems the product is resonating with customers. Since launching in 2015, it has grown its customer base to almost 900 and has won several industry awards. Moreover, sales are rising strongly with almost $35 million in annual recurring revenue secured as of the latest report.

Management’s objective is to grow this to $100 million by 2021.

Also of note, the average recurring revenue per customer has been increasingly strongly; up 65% in the last 12-months alone. And with an average customer lifetime of ~6 years, LiveTiles claims a 3.5x lifetime value to acquisition cost multiple (LVT/CAC).

Is it a Buy?

Like a lot of tech-stocks, LiveTles has had a good run so far in 2019 with shares up ~40%. But it’s been a bumpy ride over the past 12 months, with shares trading as low as 27.5c and as high as 75.5c.

The company is still loss making, although the rate of cash-burn has been decreasing. As of the most recent quarter, LiveTiles is losing around $7.8m in operating cash flow per quarter and has around $21 million of cash in the bank.

With a market capitalisation of approximately $287 million, the business is trading on 8.3x annual recurring revenue (ARR). That’s a hefty multiple, but then again, ARR is has been growing at over 200% and is forecast to grow by over 59% per annum over the next few years.

Indeed, it looks downright cheap next to other tech players — Wisetech (ASX:WTC) is trading on a price/ARR of around 30!

According to the consensus valuation on Strawman, shares in LiveTiles are still good value. Click the button below to see the latest research and target price.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223