Legend Corporation (ASX:LGD) is an engineering solutions provider to the electrical, infrastructure, plumbing and gas sectors. It provides all manner of components, consumables and tools, such as cables, connectors, circuit boards and much, much more.

It’s fair to say that Legend is a fairly un-sexy business, and with a market value of less than $70 million it tends to fly under the radar of most investors. But the company has a long history of profitability, delivers reliable dividends to shareholders and is well placed to benefit from increased infrastructure spending in the coming years.

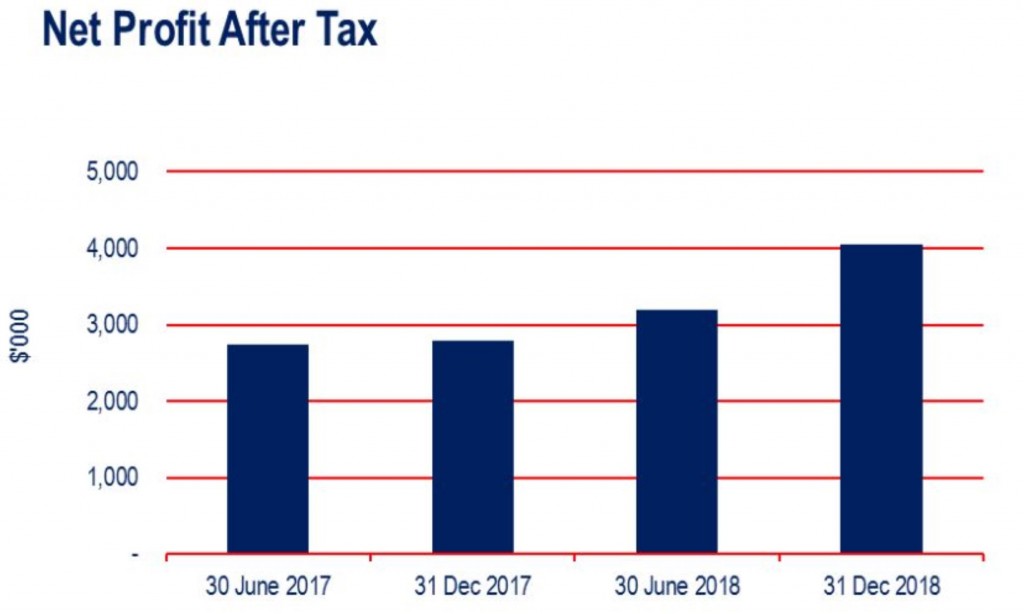

Indeed, at the most recent half net profit surged a massive 46% and management reiterated a “positive” outlook with further profit improvement to come. But this seemed to go unnoticed by the market, with shares recently trading at an undemanding price to earnings (P/E) ratio of 10x, and offering a 6.5% fully franked yield.

Well, it seems someone has taken notice…

According to the Australian Financial Review, private equity group Adamantem Capital is looking to launch a bid for legend that values the company at around $100m. On a per share basis that’s equal to 46c — a full 48% above the last traded price of 31c.

Legend has not confirmed nor denied the report, but was quick to place shares in a trading halt “to enable Legend to respond to the article“. It expects to update the market on or before the 27th of May.

Legend was identified by the Strawman community late last year as an attractive investment candidate. Click here to see the consensus valuation and member research reports.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223