Ralph Wanger, former portfolio manager of the US-based Acorn Fund, may not be familiar to many investors but he was a very successful practitioner of his craft.

Between 1977 and 2003, the Acorn Fund delivered an average annual compound return of over 16%. Or, put another way, he managed to grow his clients’ capital more than 47-fold over that period. Not bad, and a reminder of the awesome power of compounding.

Ralph was also a great communicator, and would regularly pen updates to clients in which he’d outline his thinking and process. One of the best was an analogy he offered to describe the sharemarket:

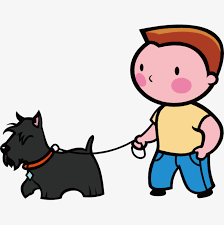

“[There’s] an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch.

But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the [dog watchers], big and small, seem to have their eye on the dog, and not the owner.”

The ‘dog’, of course, refers to the daily movement of a company’s share price, with the ‘owner’ being the underlying business. And we ‘dog watchers’ are, depressingly, guilty as charged.

This is especially true when the dog is particularly flighty — as it was last night in the US where markets suffered their greatest fall since December. The steady plod of underlying businesses will very much take a back seat to the far more gripping drama of watching a mad canine flit wildly about.

There’s no need to lament this state of affairs. It has always and evermore will be thus.

But knowing the true nature of things — which is exactly what Wanger’s parable so eloquently describes — helps us endure with equanimity. Indeed, it enables us to turn the situation to our advantage.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223