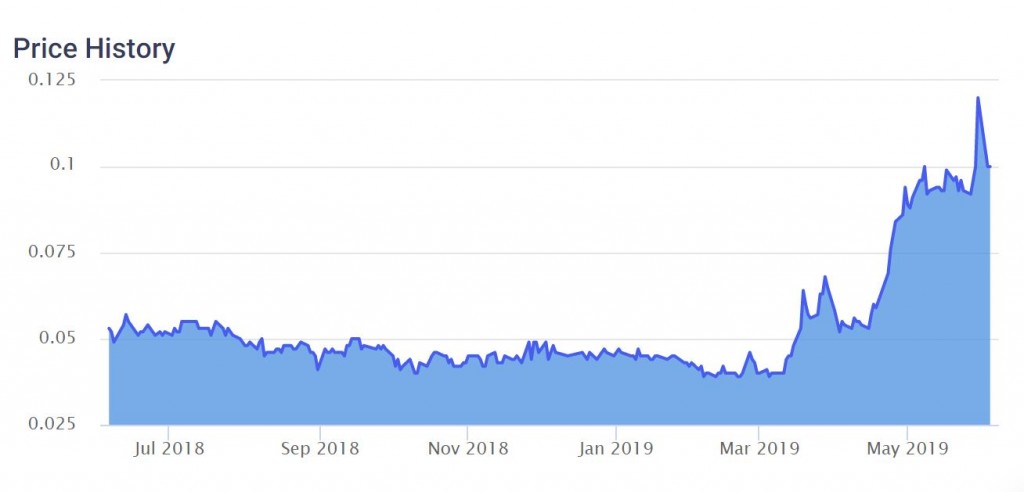

The market’s renewed optimism towards all things tech has seen shares prices for related stocks soar in 2019. But although the big-name stars have captured much of investors’ attention, there’s been some spectacular results from several under-the-radar small-cap tech names.

One such example is Alcidion (ASX:ALC), a developer of an enterprise analytics platform for clinicians and healthcare organisations. Boasting AI and machine learning features, a high proportion of recurring revenue and strong customer growth, it ticks a lot of boxes for tech focused investors. Add to that the delivery of positive operational cash flow in the latest quarter, and it’s little wonder shares have rocketed higher in recent times. Indeed, shares in Alcidion have doubled in the past six weeks alone.

Shares were identified early on Strawman, and have delivered some exceptional returns for its supporters. Having steadily climbed the company rankings, Alcidion is now #35 and shares presently hover close to the community’s consensus valuation.

At the latest quarter, Alcidion said it expected to recognise full year revenue of $15.9m for FY2019, which puts shares on a Price-to-sales ratio of approximately 5.7x. In the current market, that’s not especially demanding — especially for a business whose sales are expected to grow by over 25% on a pro-forma basis.

Although the business is still loss making on an annual basis, positive operating cash flows have strengthened cash reserves to $2.9 million at the end of the 3rd quarter, and Alcidion expect the final quarter to see a further improvement. With over $46 million in contracted revenue locked in through to 2024, and the potential for decent operating leverage, investors could see impressive profit growth in the years ahead — provided the company can continue to secure new contracts and contain costs.

Visit the Strawman company report to see the latest valuation and research from our investors.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223