Online retailer Kogan (ASX:KGN) tends to divide investors more than most. Perhaps, then, it’s little wonder shares tend to be so volatile: in the past year alone they have both halved and doubled. Daily moves of >3% are not uncommon.

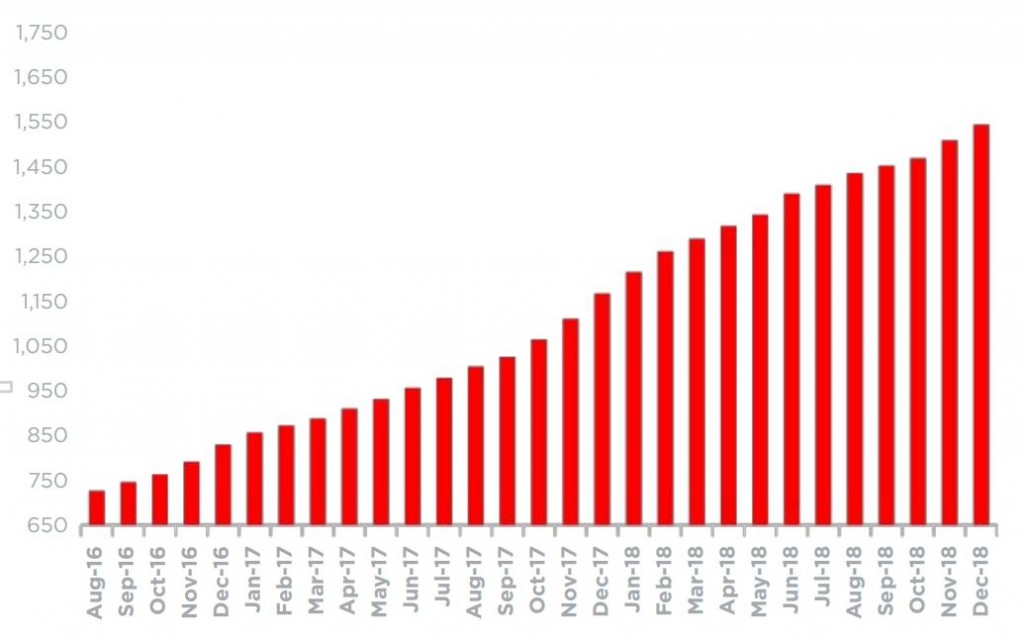

Of course, the short-term gyrations of market prices don’t always reflect the underlying economic reality for a business. In the past few years, sales have doubled and net operating margins have exploded. While most retailers are struggling to make headway, Kogan continues to post double digit growth and expand into new segments.

Nevertheless, it’s the future that is the market’s focus, and it is here the bulls and bears disagree.

Buyers will point to the ongoing growth in Kogan’s customer base — up around 32% at the most recent half. And there’s an increasing array of goods available to these consumers, with Kogan continuing to branch out into new segments such as mobile, internet, insurance and higher-margin own-branded products.

As the business expands, proponents argue, further scale benefits are unlocked, enabling Kogan to compete even more aggressively on price and range. Further, despite the strong growth to date, the online retail industry as a whole is still relatively juvenile and still expanding strongly. Even if Kogan ends up with only a modest market share in the long-run, it’ll likely be a much larger and profitable operation than it is now.

The bears, however, aren’t as enthusiastic.

While growth may have been strong to date, the pace of expansion seems to be slowing. Following a 42% rise in full year sales at the end of FY2018, the first half of the current year saw only a 10.6% gain. Worse, net profit actually went backwards due to a big increase in costs (primarily a big investment in warehousing).

You also have the arrival of Amazon. Although the Australian launch was over-hyped, the US retail juggernaut can out gun Kogan on scale, capital, technology and more. Whatever happens, it’ll be a much mightier competitor than many of the sleepy brick & mortar rivals that Kogan has faced in the past.

Bears will also point to tussles with the ACCC, the sell down of the founder’s shares and concerns for the broader economic backdrop.

The bottom line

Shares in Kogan are trading on a forward price to earnings (P/E) multiple of approximately 25, with analysts expecting ~20% annual earnings growth in the next few years. If these forecasts prove accurate, the current price doesn’t seem too ambitious.

Indeed, with Kogan claiming only a 2% market share in online retail — an area that is expected to grow rapidly in the coming decade — it’s not unreasonable to assume the business could sustain high rates of growth for a while yet.

Then again, margins may face added pressure in the presence of other online retailing specialists, and there’s a very real possibility sales will suffer some set-backs if there’s any broader economic shocks. Retail is hard, retail is cyclical and the industry is evolving faster than it ever has.

Whatever the outcome, one thing is clear: shares will likely remain more volatile than most. If you do side with the bulls, understand that this story is one that will play out over many years, and will require a good deal of emotional fortitude.

Ranked #63 on Strawman, shares are presently undervalued according to the community consensus. Click below to take a closer look…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223