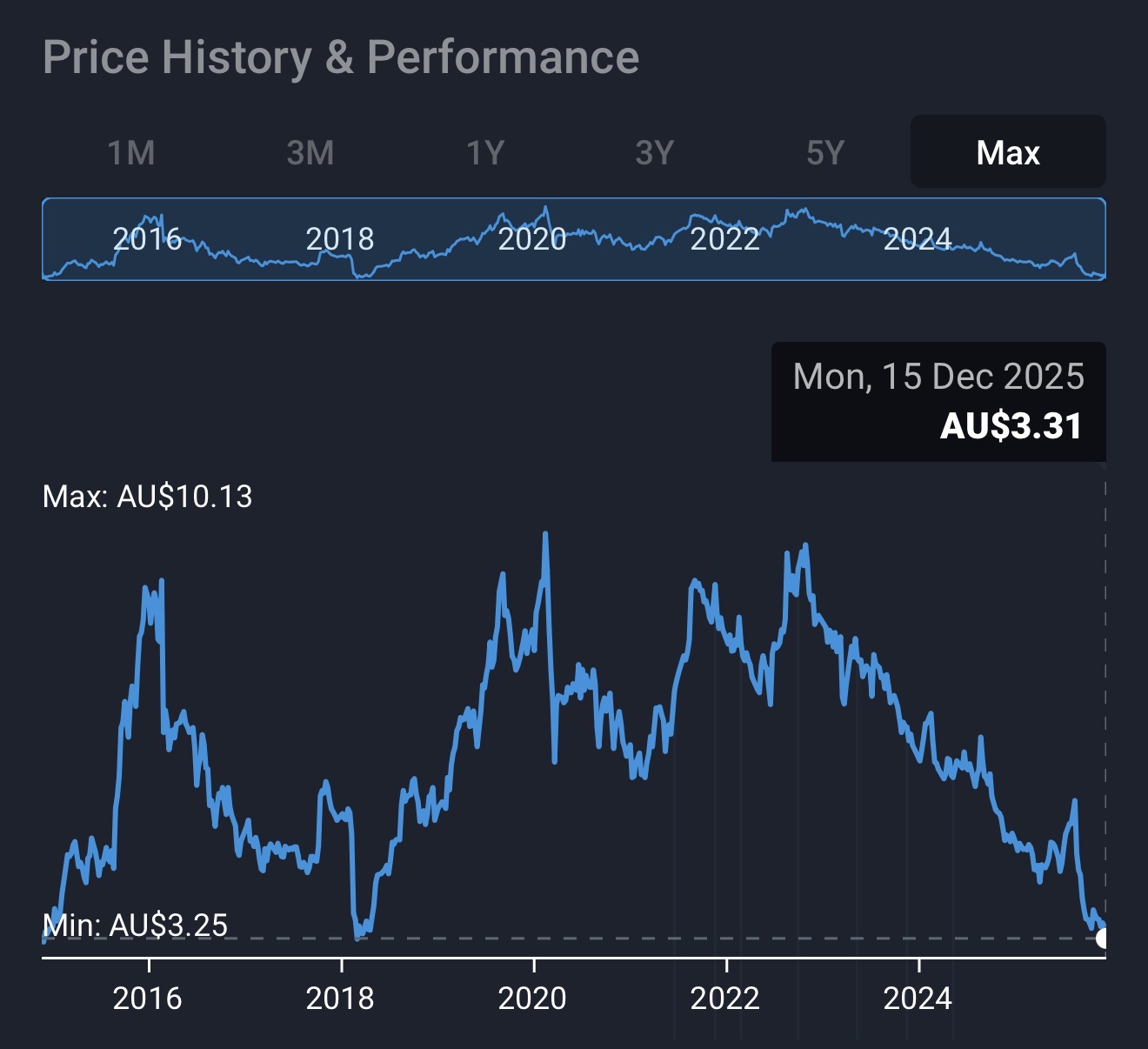

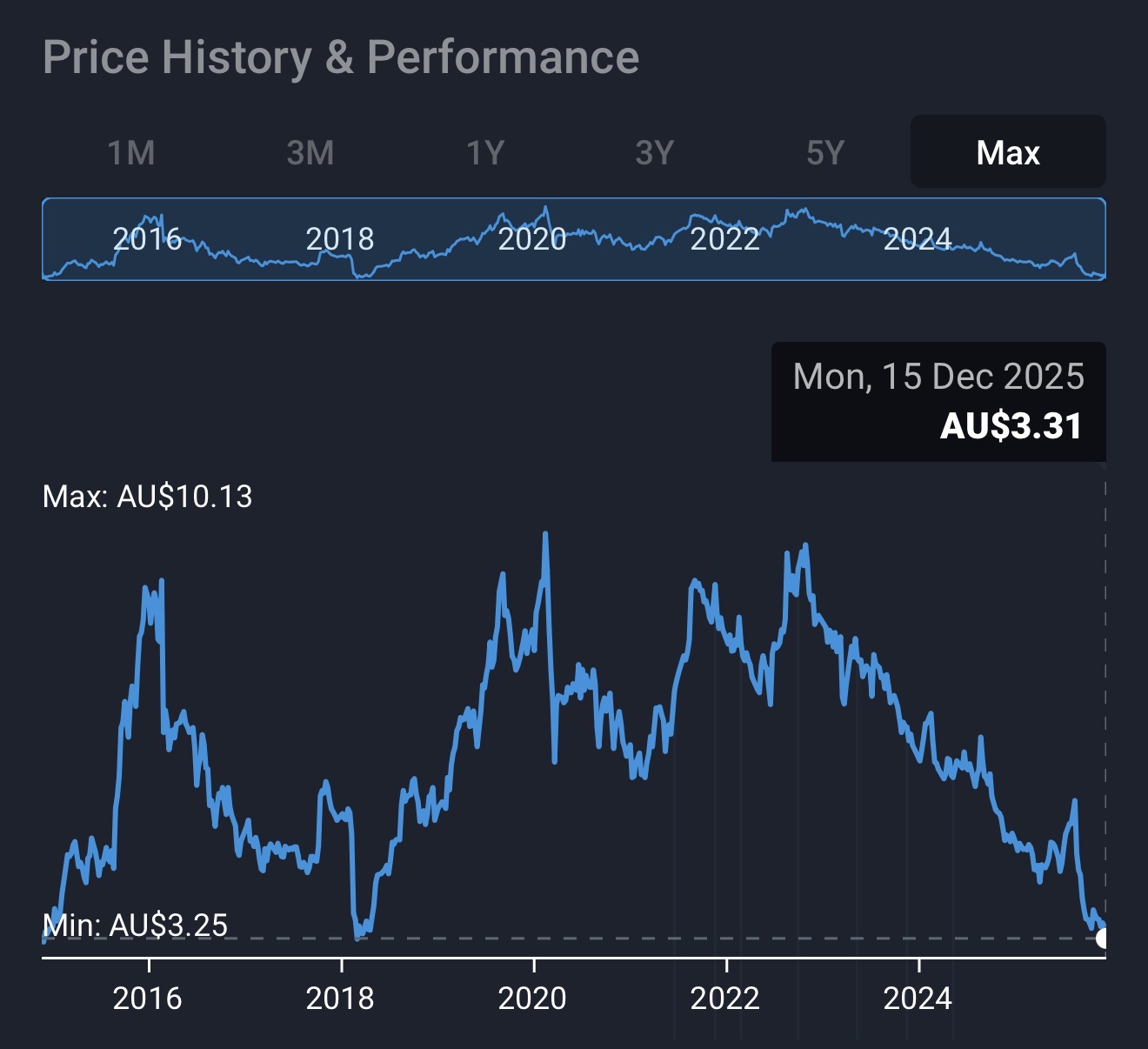

There are a few things having an impact on the IPH share price since my previous straw, resulting in the share price declining 8% from $3.59 to $3.30. Earlier this week the share price hit $3.23, which was an eleven year low!

I think the negative sentiment and a shocking chart is definitely having an impact. This is also being exacerbated by a few other things lately.

In the S&P Dow Jones Index Quarterly Rebalance announced on 5th December, IPH will be booted from the ASX 200 prior to the open on 22nd December 2025. If the passive fund money hasn’t already been withdrawn from the IPH share register, it soon will be. This will put further pressure on the share price.

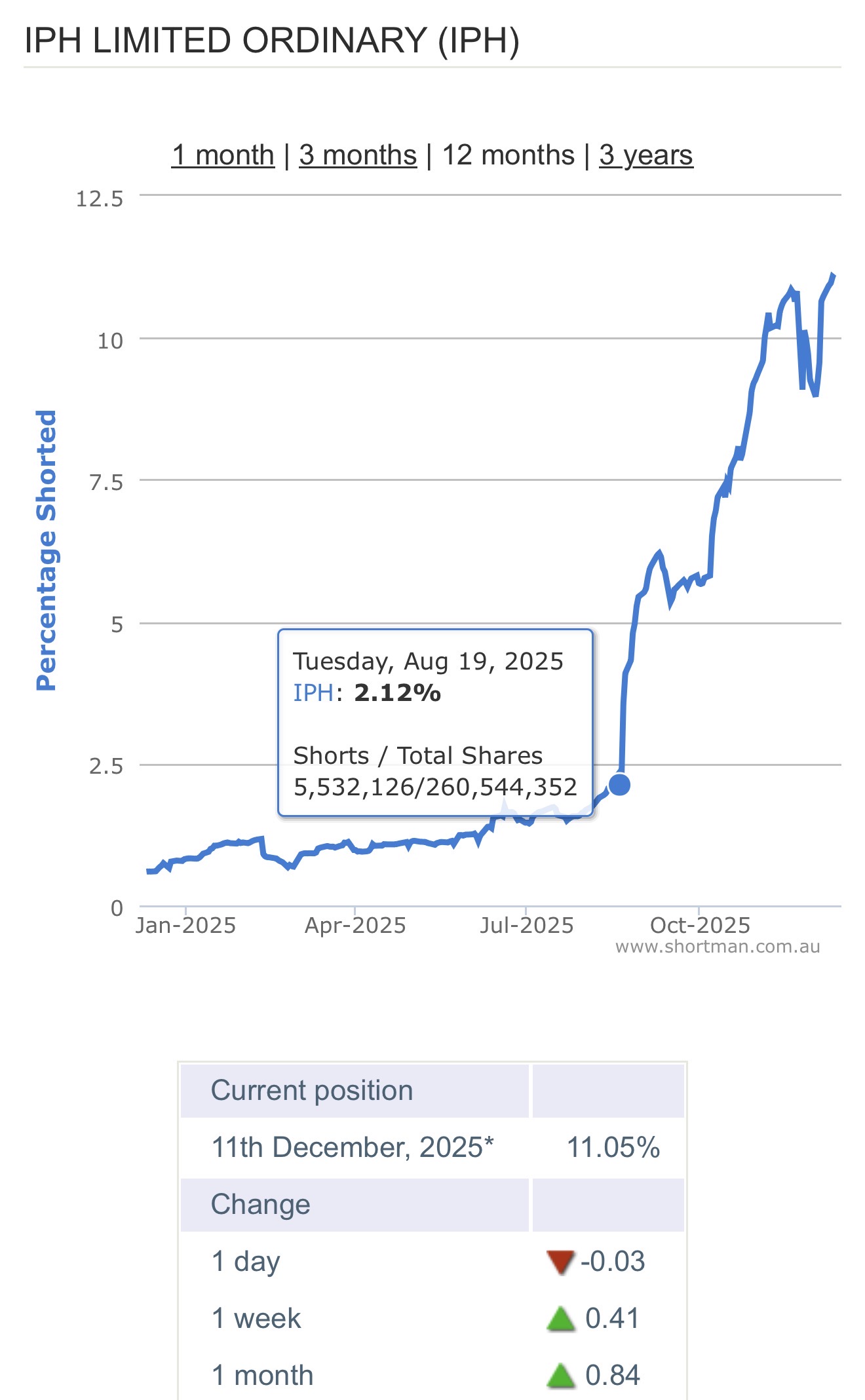

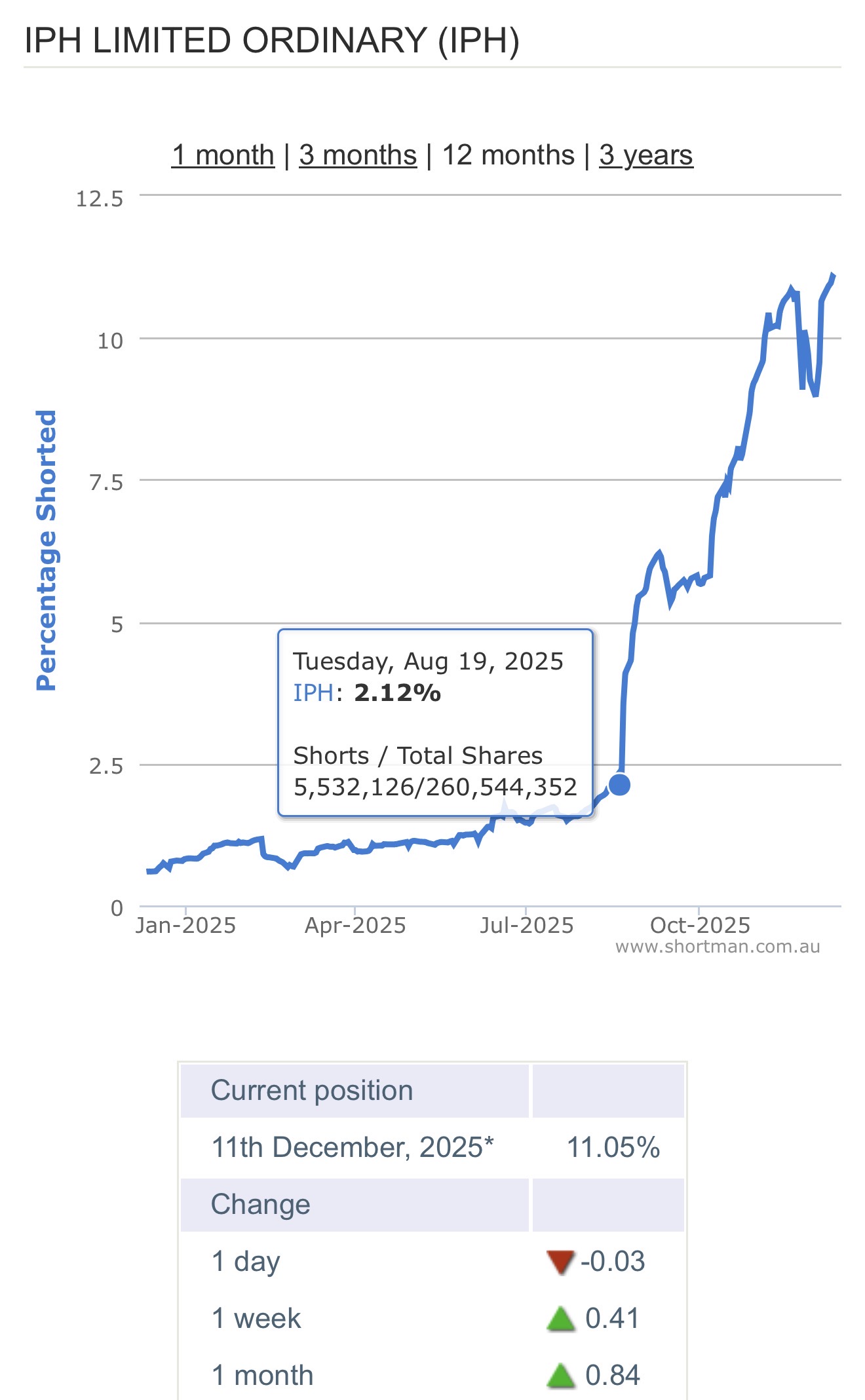

I think short sellers were already anticipating IPH would be booted from the ASX 200 and started shorting IPH during in late August. As of the 11th December there were short positions on 11% of IPH shares (top ten on shortman.com).

The IPH trading update on the 20th November did nothing to prevent further short positions during December.

I thought the trading update for the first 4 months of FY26 was reasonably positive for the overall business:

- Unaudited IPH Group Revenue was $241.7 million, up 7% on the same period last year

- Group Underlying EBITDA of $72.4 million, up 13% on the same period last year.

Positives

Growth was a result of the prior year acquisition of Bereskin & Parr, organic revenue growth in both Asia and Canada as well as a positive movement in foreign exchange rates. The average AU$/US$ exchange rate for the first four months of FY26 was 65.4 cents compared to 67.0 cents for the PCP.

The Group Underlying EBITDA improvement was also assisted by a reduction in corporate costs, which will remain a focus across the rest of the financial year and beyond.

Negatives

Most of the negatives are associated with Australia and NZ which contribute 43% of the group’s earnings.

Earnings decline continues in Australia and NZ, impacted by lower US PCT filings and the economic downturn in NZ (Australia and NZ contribute 43% of earnings).

IPH member firms have a significantly higher exposure to US clients relative to the market, and IPH’s Australia/NZ segment is impacted by the decrease in market filings from US applicants.

The Australian patent market has also included an unusually high number of self-filed provisional applications (i.e. applications which are not attached to a filing agent) which have increased by 222% for the year-to-date period compared to the PCP. At this stage, it is unclear what is driving this somewhat unusual activity.

FY26 Focus

While the macro environment has been challenging, we are focused on driving organic growth and generating operating efficiencies.

Given the ongoing decline of US PCT filings into Australia and NZ, we are re-focusing our business development activities to target second tier associate firms for filings into our member firm jurisdictions.

We have also deliberately re-focused and significantly boosted our business development activities to target Western Europe, Japan, South Korea and Chinese incoming filings.

Our focus in Canada is to leverage our integrated platform and to harness the beginnings of a recovery in patent workflow following the CIPO systems issues to deliver growth.

While in Asia, we are building on the current filing momentum to deliver revenue and earnings growth.

As we detailed at our full year results, we have realigned our cost base to drive operational efficiencies which will deliver annualised cost savings of $8-10 million from FY26.

My Take

Yesterday IPH shares closed at $3.30 per share. I think the risk/reward for this business at $3.30 is attractive and I have added more to our holding. The share price could fall further yet because of the short selling and poor sentiment. The chart doesn’t show much support above $3.30 per share.

Fundamentally, the ROW business is showing signs of growth and the temporary issues in Canada are now resolving. ROW makes up 57% of the groups earnings and this is likely to continue growing slowly. The business also has consistent strong cash flows which are forecast to continue. Earnings per share is forecast to be higher in FY26 at 39 cps, up from 26 cps in FY25 (analyst consensus), putting IPH on a forward PE of 8.5, which seems incredibly cheap! Based on forecasts the FY26 ROE could be 14%. Not amazing, but reasonable.

It is feasible for IPH to continue paying a solid dividend, possibly 37 cps. IPH has a track record of increasing dividends every year for a decade. At the current share price I am anticipating a yield of over 12% (including 25% franking credits for the Australian component). Over the next 15 months (3 dividend payments) it’s feasible IPH will pay shareholders 54 cps in partly franked dividends.

There are a lot of ‘if’s’, ‘but’s’ and ‘maybe's’ with my thesis, and the short sellers could turn out to be right! The analysts and the short sellers seem to be poles apart on their views for the business. I’m working on the 4 month trading update continuing for FY26, with earnings and cash flow both higher than for FY25.

Held IRL and SM