Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Record half including record breaking Black Friday week and Active Customers surging past three million

1HFY21 Highlights across the Kogan Group (including Kogan.com and Mighty Ape ) 1

? Gross Sales grew by more than 96%

? Gross Profit grew by more than 120%

? Adjusted EBITDA 2 grew by more than 175%

? EBITDA grew by more than 140%

? Cash at period end was A$78.9M with A$1.4M of the Group’s debt facility 3 drawn within Mighty Ape

? Active Customers was 3,003,000 for Kogan.com and 719,000 for Mighty Ape

DISC: I hold in both Strawman and TRW

Attempt #2 of posting my conservative DCF for Kogan attached. Fair value $16.22.

Let me know your thoughts!

Valuation details from my Feb valuation in response to CHill's great valuation model. Discount rate and terminal growth rate variances are the only significant points of difference.

I maintain my view on valuation at $39.04, based on the attached.

KGN is now number 3 most shorted stock on the ASX with 10.1% shorted on Shortman. What does this mean for long term value? Absolutely nothing in my experience. JBHIFi was highly shorted when it was under $20. Today JBH is trading at over $47. This could be another opportunity on offer by Mr Market!

A summary of Kogan's announcement below. It appears Kogan's growing pains have turned out to be a fully blown case of COVID. While KGN it is likely to survive and prosper in the long term, the short term outlook is grim. With Updated EBIDTA lower than analysts forecast, and a suttle warning that things could get worse, I don't see any rush to buy shares at the moment. I think it's a hold for now. I think the shorters had it right this time.

- KGN doubled in size over first half of FY21

- operational challenges as a result of growth

- KGN significantly expanded its inventory holding, and also expanded its logistics footprint to 31 facilities

- rapid expansion has resulted in a number of near-term chain inefficiencies and inventory planning challenges

- During the month of April, the demurrage issue that the Company was experiencing was resolved.

- imposed significant abnormal costs on the business over the past five months.

- KGN built up its inventory levels from late 2020, which has caused high warehousing costs that are continuing.

- KGN progressively working towards optimising the inventory position to reflect current market conditions

- increasing promotional activity has led to lower near-term gross margin and higher near-term marketing costs.

- Kogan.com is expected to return to normal inventory levels (relative to the size of the business) and marketing spend as the current inventory is progressively reduced over the coming few months.

- cost price inflation of many consumer products is being observed in respect of products that are currently being planned for reorder in advance of the peak Christmas trading period.

- price inflation is being driven by COVID-19 market dislocations, together with inflation in international shipping costs.

Short-term Outlook

- KGN expects underlying operating performance to continue to be challenged in the near-term, and Adjusted EBITDA for FY21 is likely to be lower than analyst forecasts

- FY21 Adjusted EBITDA1 expected in range of $58 million to $63 million (based on unaudited management accounts to April 2021) but warns of a highly dynamic trading environment with trading conditions subject to continual change.

Long-term Outlook

- fundamentals for Kogan.com remain very attractive given the Company’s position in the Australian and New Zealand online retail markets, and with online retail sales currently only accounting for a small percentage of total retail sales in Australia and New Zealand.

- KGN has invested in key strategic initiatives and has a strong level of in-demand inventory heading into the first half of FY22

- The initiatives put in place to address the rapid scaling of a large eCommerce company are expected to drive continuous customer experience improvements in FY22

- KGN has learnt valuable lessons over the last few months, including many key strategies on how to better scale operations of a large fast-growing eCommerce company.

Disc: hold shares (Ouch!)

Kogan short activity peaked at 12.85% on 26 May and has declined to 11.4% on 21 June. Kogan shares shot up 6% today. Is this a sign that shorters are scrambling to cover short positions? If this is the case it will be interesting to watch the Kogan share price over coming weeks.

The Kogan share price has climbed 9.2% over 5 trading days. While I'm pleased to see the uplift I'm not sure what is driving it. It could be due to short sellers closing out on positions.

Short positions have dropped from 12.85% (26 May) to 8.73% (30 July), a 32% drop in 2 months. The move to close out on shorts could in itself be self-perpetuating, and could drive the Kogan prices even higher, at least until we see the 2021 FY results!

With the eastern seaboard locked down I have been interested in the web traffic for Kogan. Up 6.5% from June to July 2021. Similar for temple and Webster up 8.4% over the same period

Absolutely Bear,

Looking at the announcement the move of inventory held from $227m last year to $161m as of June 30th 2022 is a key driver especially considering the build up inventory of major US retailers such as Walmart and Target etc.

Could be that Kogan was ahead of the curve in this regard and takes 12months to cycle through

Time will tell

Smoke and mirrors from Kogan today on the business update (attached), in promoting a good year (+56% Revenue, +60% Gross Profit, +23% “Adjusted” EBITDA) it hides a not so good second half.

What the announcement didn’t highlight:

· Revenue down 32% Half on Half (HoH) for Kogan brand, Mighty Ape was only added in December so HoH not comparable, but it added 60m in H2 Vs 20m for one month of H1 all be it the high sales month of December, I would expect better.

· Active Customers: up 7% HoH for Kogan and 6% for Mighty Ape, which is solid, but Kogan customer growth rate for FY21 is 47%, so a significant slow down on the rate of growth from H1, but that rate of growth was very Covid impacted and not long term sustainable.

· Gross Profit for Kogan down 37% HoH which is worse than sales, resulting in GM% dropping from 27.3% in H1 to 24.7% in H2. FY is a solid 26.2% but supply chain and the need to discount to clear excess stock is clearly impacting margins.

· Adjusted EBITDA: Firstly note this excludes equity based compensation (which is normal), material logistic demurrage charges (which is part of business for a import wholesaler as far as I am concerned) and inventory write-downs (also part of business). Overall growth of 23% YoY is highlighted but take out Mightly Ape (which wasn’t in last year) and you are left with 5% growth, because Adjusted EBITDA for the Kogan brand was down 95% HoH from 51.7m to 2.5m in the second half.

· Inventory – “Following the end of the second half, the Company can now say that the efforts to bring down levels of inventory have come a very long way, and inventory is approaching the right level for the business.” The figures tell a different story, at the end of H1 Inventory was 225.3m and was a blow out, it is now “approaching the right level” and is 228.1m yet revenue has dropped 32% HoH… What the Kogan!

· Cash – They started the half with $76.2m in net cash and finished with $12.8m… No comment on that in the statement. The only hope is that this is a result a reduction in the blow out in Accounts Payable reported at the end of H1 and that we will see high inventory levels convert to cash in the next half.

I continue to hold KGN, but will need to update my valuation as soon as FY21 figures are released in full. Indications from this announcement are that it is most likely a downward valuation revision. The real concern is the cash position and a possible need to raise capital, but I suspect that if Kogan was going to do that they would have done it prior to releasing these figures…

Nice to see them actually put some figures in their update this time following the ASX rebuke of their last business update – blood from a stone

Links not available to post yet - but I am looking forward to the explanation of why logistics charges are being delt with as a one-off.

I don't think it is right to trumpet exceptional Sales and Revenue, and then hide what it took to achieve that.

- Gross Sales2 up 52.7% to $1.179 billion (FY20: $772.3 million3), and a CAGR4 of 46.2% since FY19

- Revenue up 56.8% to $780.7 million (FY20: $497.9 million), and a CAGR4 of 33.4% since FY19

- Gross Profit up 61.0% to $203.7 million (FY20: $126.5 million), and a CAGR4 of 49.9% since FY19

- Adjusted NPAT5 up 43.2% to $42.9 million (FY20: $30.0 million), and a CAGR4 of 51.8% since FY19

- NPAT down 86.8% to $3.5 million (FY20: $26.8 million), reflecting one-off inventory, logistics and

- Mighty Ape acquisition costs

- Adjusted EPS5 up 27.2% to $0.41 per Share (FY20: $0.32 per Share), and a CAGR4 of 42.8% since

- FY19

- EPS of $0.03 per Share, down 88.3% on prior year (FY20: $0.29 per Share), impacted by a

- number of items detailed below

- Kogan.com Active Customer base up 46.9% (excluding Mighty Ape) to 3,207,000. Mighty Ape

- Active Customers grew to 764,000 at 30 June 2021

- Net cash at financial year end (total cash less drawn debt) of $12.8 million

I think Kogan -- the company and the founder -- are both very impressive. Founded only 15 years ago, it now does over $1 billion in annual gross sales. Moreover, since listing, that growth has been largely self-funded, while still delivering a decent profit (and dividend!) along the way.

Despite this growth, Kogan reckons it has around 2.7% share of online retail. Indeed, online retail as a category is only 13% of total retail trade is Australia -- and growing fast.

In the latest year it suffered from some stock provisions, and increased logistics costs due to covid, and there were some one off costs with stock compensation and associated payments, but on a 'normalised' basis this is a business that has grown NPAT 3-fold in 3 years.

And on adjusted EPS numbers the business is trading on a PE of ~30. That doesn't sound too bad, given the growth and market opportunity. It's surely a lot better than the PE of 60 it was last year.

But i worry if it may be less of a bargain than it seems.

First off, if we're going to 'adjust' some costs due to covid, we should surely adjust for some of the benefit too. Covid has helped accelerate online sales growth and no doubt brought some spending forward too. Revenue in FY21 was up 56%! It's hard to know what growth would have been like in the absense of covid, but it's something to keep in mind when looking at the PE.

But the real question for me is to what extent Kogan can keep growing. At maturity -- which is doubtless still a ways off -- this is a low margin, volume sensitive retailer. It'd likely trade on a PE multiple of much closer to 15 (more mature retailers like JBH and HVN are both ~12 at present).

And it's facing off against one of the most powerful businesses on the planet.

Amazon, which entered Australia in 2017 (10 years ofter kogan), and already has around $1b in annual revenue -- roughly 20% more than Kogan -- and Morningstar have them reaching $9b in revenue in Australia by 2025. That would be about 20% of all online trade.

There's no guarantee in that forecast, and I definitely think there's room for both players. Even if Kogan doesnt increase it's market share, and instead only manages to hold steady at 2.7% market share -- the market itself is growing pretty fast.

But Amazon will certainly cap Kogan's prcing power. History has shown that Amazon will happily cede margin if it means gaining market share. And huge logistics investments from Amazon will require kogan to keep up if it hopes to match Amazon on delivery times.

It's all very hard to predict, and i'd want a pretty big margin of safety before I bought. See my valuation.

Not held.

Lots of good coverage on the numbers already.

I don't hold KGN on Strawman but have in my real world portfolio for a while. I've decided to sell out after these numbers after there is a bit of a bottom feeding bump.

Why? Retail is a tough hunting ground, and Kogan has had lots of promise and growth so far. As it matures the experience of the customer becomes far more important to keep people coming back. As a customer, I have to compare it to the Gorilla in the room, Amazon.

Kogan has always had a reputation as a bit cheap and nasty, but I always put up with it because it's too cheap to ignore. Customer service has always been a bit hit and miss, and to be frank, the few times I've had to call or email them, I've given up.

Contrast to Amazon AU, who I've joined as a Prime subscriber recently after buying on and off from Amazon US since the early 2000's, and the customer service experience has been orders of magnitude better than the local competitor. Had a parcel go missing after arrival in Australia from the USA and being lost by the courier, and after a quick phone call, it was refunded no questions asked. Contrast that to the well documented experience of Kogan being hit and miss, and I am pretty set on where my consumer dollars are going.

The Gorilla has far deeper pockets than Kogan does, and more than likely will be the dominant player. Even if there is upside in the share price, my capital is better deployed elsewhere.

It has been interesting to watch the flurry of valuations and the differences between those valuations. This is what makes a market.

Kogan has been compared to Amazon, indeed Strawman's own straw and valuation mentioned Amazon keeping the screws on. I wrote about Amazon in a JB HiFi straw couple of weeks ago, it is worth repeating here. They are still loss making and have not dented the Australian market to nearly the extent their thesis (and analysts) anticipated. That said, on line sales continue to increase the wallet share.

On to Kogan. What I am about to recite I believe is from Maister book True Professionalism – just because your customers know and trust you for one product/ solution, does not mean that they will for another product/ solution.

And Kogan is attempting to be a one stop shop. I understand it. Where there is a dollar on the table, don’t leave it there. TV’s to insurance to NBN.

Ruslin seems to be everywhere. I’m sure I have heard him on at least three recent podcasts. He appears to be articulate, passionate, and driven.

He started bringing in TV’s – there are only a couple of panel manufacturers – drawing a long bow that means the quality is all the same. The big difference is this is not accurate, and the surrounding componentry plus the brand backing to provide after sales service does matter.

On after sales service, just search to see disparaging reviews, again acknowledging reviews can be biased.

Retail is hard. Retail is low margin. Is Kogan going to still be here in another 5 years. I vote yes. Is Kogan going to be larger and serving a greater market share. I also suspect yes. Are there better risk v reward propositions? This one also gets a yes.

Update release today (attached), some highlights and notes:

· Gross Sales $330.5m (+21.1% YoY, +23.2% QoQ)

· Gross Profit $52.5m (-1.7% YoY, +31.6% QoQ). Gross margin of 15.9% is up on last quarter 14.9% but down on last year 19.6%

· Adj EBITDA $10.8m – probably worth ignoring as there is a note in the fine print that there was a significant increase in share based compensation for the quarter which is excluded. The good news is there is some improvements in inventory levels and warehouse costs ($0.8m savings), seems like they still have problems but are getting on top of it. EBITDA margin of 3.3% is up on last quarter of 1.2% but down on last year of 9.2%

· Active Customers 3,351k for Kogan (+144k or 4.5% QoQ which is solid) 748k for Mighty Ape (-16k or -2.1% QoQ, a variance not highlighted).

· Marketplace gross sales of $110.4m, up from 65.4m in Q4 FY21 and 73.7m in Q1 FY21 is a good sign, as is the increase in Kogan First with sales up to $5.9m from $2.5m last quarter and membership up to 197k which is 64.4% up on last quarter.

As usual we get a clear focus on anything good, but even reading between the lines it was a solid result and showing a recovery from a bad H2 last FY.

I have trimmed my KGN position but still see opportunity if they can get the execution right. The current turmoil in supply chain and buying patters is an issue for everyone so I am prepared to cut them some slack in dealing with it.

The Kogan spin continues…more of the same “excuses” being rolled out. At what point does management acknowledge they may need some new people at the top to right this ship?

Why i bought in at $4.71 today

ps- i have fixed mt colour coding to be more obvious

gree now = yes

orange = neutral

red = no

https://www.canva.com/design/DAF43uKr40k/WjlKcCj3opgfsbSMM5u8kA/edit

Kogan.com’s two most senior executives made $17.6 million selling options back to the company just three weeks before a profit downgrade pushed the share price so low that the transaction would not have been possible.

Afr article

https://www.afr.com//markets/equity-markets/kogan-executives-handed-17-6m-payday-three-weeks-before-stock-crash-20240424-p5fmb5?btis

What’s happening with the Kogan share price after the AGM presentation yesterday. Gleaning the the report there wasn’t one chart that didn’t show a strong upwards trend! Maybe that’s because they didn’t include a chart for operating expenses.

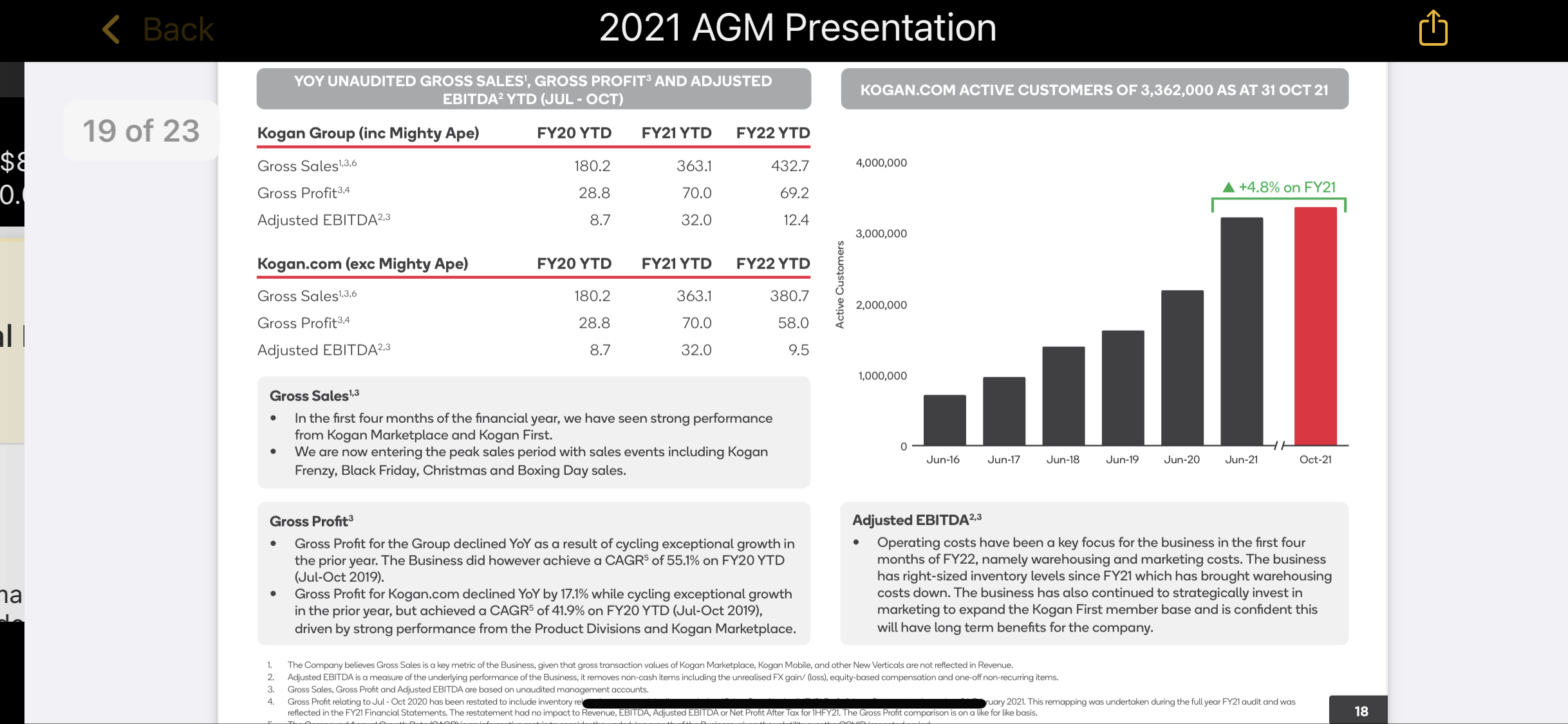

James Mickleboro from the Motley Fool has done a little digging into the adjusted EBITDA so far for FY22 and it’s not sounding promising:

”There appear to have been a few catalysts for the volatility in the Kogan share price on Thursday.

One was its trading update. Although Kogan spoke about further revenue growth during the first four months of FY 2022, this hasn’t translated into profit growth.

Kogan revealed that its adjusted EBITDA (including Mighty Ape) was down 61% year to date to $12.4 million. Excluding Mighty Ape, adjusted EBITDA was down 70.3% to $9.5 million over the prior corresponding period.

Given that Kogan reported adjusted EBITDA (including Mighty Ape) of $10.8 million for the first quarter, this means it only added $1.6 million of EBITDA in October. That compares to a first quarter average of $3.6 million per month. And this is despite the company advising that it had resolved previous inventory pressures during the first quarter, reducing warehousing costs.”

So what do we make of this? Are profit margins getting squeezed? Something to watch out for in the 2H22 report.

Disc: Shares held IRL and SM

DISC: Held IRL and SM

Will continue to hold, mostly for the reason I can best describe as "I have made my bed now I must lie in it".

While it is tempting to assume that their meteoric revenue growth has stalled permanently and their margins won't get back to what they were previously. I'm prepared to give them the benefit of the doubt due to:

- The (even now, still) unprecedented times they operate in.

- The staggering growth they went through in 2020 - which affords the the time to "take a breather" and re-adjust, I think.

- A solid track record of online retail dominance in Australia

- Ruslan Kogan's 15% stake in the company (where we go, he goes)

So, I am prepared to give them 2 years from here to get revenue growth back above 15% and net profit margins above 3% and only then will I sell.

Now I could easily be wrong, and the best course of action could be to sell now and put the money in something in which I have higher conviction (which is very tempting - my spidey senses tell me that Amazon might just wipe the floor with them). But I feel I need to draw a line with myself - I can't be flip-floping just because they have hit a hurdle and market sentiment has gone against them. So I hold.

However, even if they fail I still win, I win because of the lessons I have learned:

- Consumer Retail is hard - you can't just double your sales without thinking about logistics and associated costs.

- If I buy a stock and it triples in 6 months - I should reassess it's value, be very critical if it can be justified, and consider trimming or selling (as opposed thinking I'm such a smart boy, patting myself on the back, and just assuming it will continue to moon).

I've never looked seriously at the financials for Kogan because I've been turned off by their quality, my own negative purchase experiences, and their poor customer satisfaction. It's a sad experience searching for Kogan and its products on ProductReview. 3.6/5 overall for Kogan, 3.2 for Kogan mobile, 3.7 for Kogan internet, 1.5 for Kogan credit card, 2.9 for Kogan tv, 3.3 for Kogan airconditioner. And (disclosure: patronising moralising about to occur) I also whiff questionable ethics in their marketing which is extremely heavy and has at times been illegal. Then there's the executive remuneration . . . Just has never been a company I'd be proud to own.

28-July-2022: KGN-July-2022-Business-Update.PDF

Now, have a read through that and tell me if it justifies a +43.77% share price lift. [so far today]

Sure it's clear that the market was [previously] pricing in worse than the actual reality and there has been some sort of relief rally, AND they're clearly coming off a very low base now, so big percentage movements don't take them back up too far compared to where they have come from... but... surely there's something else going on?

Disc: I do not hold KGN shares.

The hard thing about something like Kogan is that every time you get some disappointing news, and the price plunges lower, you can rationalise it by saying that the news, while negative, is NOW more than reflected in the price, and that none of the issues are structural in nature. ie. they are short term issues that distract from a much more positive longer-term trend.

That might be true, and maybe this latest decline will prove to be a wonderful buying opportunity for longer term investors.

After all, revenues have more or less doubled in the last few years and despite the recent dip in quarterly gross sales, the business has grown sales by almost 20% per annum since Q3 FY20 (and maybe that's a fair period to benchmark things given the covid bump that was experienced in the prior year).

On the other hand, a lot of categories are going backwards -- even over a 2 year annualised basis (eg Advertising, mobile and third party brands). And if you strip out the Mighty Ape acquisition, gross sales have only grown at an annualised rate of 11% since Q3FY20.

On top of that, costs have increased substantially, such that the business is now loss making on an adjusted EBITDA basis. To be fair, a lot of these investments may not have yet had time to bear fruit, but it does underscore concerns over what operating margins look like at scale -- especially in the face of intense competition (Amazon), rising costs pressures and stagnating wages.

Let's annualise the latest quarterly gross sales numbers and apply an *underlying* net margin of 2%. That gives us NPAT of $21m, which puts shares on a PE of roughly 21. I'm not sure that's necessarily cheap for a business that is struggling to find growth (active customers were up only 3.6% yoy), especially in a rising interest rate environment.

Of course, perhaps they can resume sales growth and return to much healthier net margins. For example, we could assume FY gross sales of $1280m if we pro-rata the first 9 months of the year, and apply a 3.6% net margin (what they got on an underlying basis FY21). That'd give a FY *normalised* NPAT of $46m, and that would put shares on a forward PE of less than 10. Cheap!

I'm just not convinced they can deliver solid organic growth and achieve decent margins. Even if you assume 10% top line growth for the next few years, a 2% net margin and a PE of 16 -- you get a target price of just over $5, and that's an annual return of less than 10% from current prices.

This is not a business that is going to zero, far from it. I just find it hard to gain any real conviction and think the best days of growth are over. I think shares are, at best, around fair value.

I could well be wrong, and it's worth remembering that profit assumptions change a LOT if you apply a higher margin (eg if you assume a 3% net margin instead of a 2% one in my example above, you have a FY25 target price of $7.64! -- all else being equal)

So i get the Bull case, but it's just in the too hard basket for me.

You can read the recent quarterly update here

Kogan share price pops 9% on promises of return to previous margins once sell through is complete.

However, the data at this stage is heading in the other direction but let’s wait and see.

Based on todays data and share response it’s still a fan favourite and the first sign of position data and the share price could go crazy.

Our cash balance increased to $65.4 million. In the prior period we had a net balance (after loans & borrowings) of $31.2 million.

● We corrected our inventory down to $68.2 million as at 30 June 2023, a reduction of over 57%. We now enter FY24 with inventory levels aligned to the current levels of demand.

No Dividend yet. Last Divi paid June 2021.

The CEO is Taming the Inventory problem.

Debt vs Equity needs to be contained.

Return (inc div) 1yr: 41.88% 3yr: -36.77% pa 5yr: -1.94% pa

Kogan Management

In 2006, Ruslan Kogan founded Kogan.com, an Australian online retailer that offers a wide range of consumer electronics products at affordable prices. Kogan's business model involved sourcing products directly from international manufacturers and selling them online, bypassing traditional middlemen and reducing costs. David Shafer has worked with Kogan since 2006 moving to full time role as Chief Operating Officer and Executive Director in 2010. Below is the complete history of the two selling history.

Russel Kogan Selling History – Total Sold 31,582,114 shares ($272.3m)

· 19 August 2020

Indirect 5,284,441 shares price $21.60 per share ($114,143,926)

· 23 August 2019

Indirect 3,771,929 shares price $5.75 per share ($21,688,591.80)

· 3 September 2018

Indirect 4,501,465 shares price $6.41 per share ($28,854,390.60)

· 12 June 2018

Indirect 4,467,460 shares price $7.00 per share ($31,272,220)

· 27 February 2018

Indirect 5,681,819 shares price $8.80 per share ($50,000,007.20)

· 24 October 2017

Indirect 3,000,000 shares price $4.25 per share ($12,750,000)

· 24 August 2017

Indirect 4,875,000 shares price $3.00 per share ($14,625,000)

Buying (*indirect Walsh St Management)

· 10 July 2020 (*From Capital Raise June 2020)

Indirect 5240 shares price $11.45 per share ($59,998)

· 5 December – 8 December 2016

Indirect 112,013 shares price $1.4115 per share ($158,111.85)

· 30 November – 2 December 2016

Indirect 222,987 shares price $1.3678 per share ($305,015.34)

David Shafer Selling History – Total Sold 12,729,683 shares ($103.09m)

· 31 August – 2 September 2021

Indirect 1,000,000 shares average price $11.223 ($11,223,000)

· 19 August 2020

Indirect 2,025,214 shares price $21.60 per share ($43,744,622.40)

· 23 August 2019

Indirect 1,445,452 shares price $5.75 per share ($8,311,349)

· 3 September 2018

Indirect 1,748,535 shares price $6.41 per share ($11,208,109.40)

· 12 June 2018

Indirect 1,532,540 shares price $7.00 per share ($10,727,780)

· 24 October 2017

Indirect 2,352,942 shares price $4.25 per share ($10,000,003.50)

· 24 August 2017

Indirect 2,625,000 shares price $3.00 per share ($7,875,000)

David Shafer Buying

· 10 July 2020 (*From Capital Raise June 2020)

Indirect 2620 shares price $11.45 per share ($29,999)

Acquisitions Since Listing

· December 2022 Brosa $1.5m plus logistics support for thousands of customers with undelivered orders. One of Australia’s largest online luxury furniture retailers, out of administration. The deal will see the popular furniture brand stay alive and relaunched stronger than ever with the backing of the Kogan Group. https://www.asx.com.au/asxpdf/20221222/pdf/45k2xp45sy872m.pdf

· December 2020 Mighty Ape $122.4m a leading online retailer in New Zealand. https://www.asx.com.au/asxpdf/20201203/pdf/44ql0zkf2kf3b7.pdf

· May 2020 Matt Blatt $4.4m one of Australia’s premier furniture and homewares retailers, and a pioneer of the online furniture industry in Australia. https://www.asx.com.au/asxpdf/20200515/pdf/44hvdztrqjbkzm.pdf

History Capital Raises

· June 2020 Raised $120m, $100m Institutional, $20m Retail at $11.45 per Share

· IPO Raised $50m at $1.80 Share

Inside Ownership Ordinary Shares % KGN Issued Net Value at $3.69

Ruslan Kogan 15,853,321 14.81% $58.5m

David Shafer 5,225,642 4.88% $19.2m

Greg Ridder 158,000 0.14% 583K

Harry Debney 98,099 0.09% 362K

Janine Allis 14,761 0 54.5K

James Spenceley 0 0% 0

Total 21,349,823 19.94% $78.8m

Recent Management Buying

Janine Allis

5 December 2022 – Buy 4,761 Shares at $3.33 ($15,854.13)

Kogan.com April 2024 Business Update

Continues strong profitability

Kogan.com Ltd (the Company; the Business; Kogan.com; ASX:KGN) is pleased to announce continued strong profitability through 3QFY24, maintenance of a healthy Balance Sheet, and continued growth in its loyalty program, Kogan FIRST.

Kogan FIRST grew to over 472,000 Subscribers at 31 March 2024. This represents growth of over 16% YoY. The Business has continued to deliver incredible value through the program to its most loyal customers, and expects the strong growth to continue.

Founder and CEO of Kogan.com, Ruslan Kogan, said:

“Kogan FIRST has become the north star for the business, creating immense value for our loyal customers. We deliver remarkable value to our loyal members, and in so doing ensure that members come to Kogan first!

“Kogan FIRST is the best way to take advantage of our remarkable value on the most in demand products and essential services. Almost half a million smart shoppers recognise this!

“I’m excited to announce today that we continue to grow the benefits through the program, launching Kogan Travel hotel deals. As of today, Kogan Travel now offers the best value domestic and international hotel stays and packages with exclusive pricing for Kogan FIRST Subscribers. If you have some travel coming up, we encourage you to compare our prices and start saving.

“Our team is committed to delivering remarkable value to millions of customers and help them combat the cost-of-living, so they can live their best lives.”

The Company provides the following update which, where applicable, is based on unaudited management accounts as at 31 March 2024. The update compares the 3QFY24 to 3QFY23:

- Gross Sales of $178.3 million reflects a decline of 6.2% PCP following a recalibration to our quality of Revenue and focus on Platform-based Sales, which resulted in a significant reduction in inventories YoY. The reduction in inventories has been discussed at length in recent announcements made by the Company, and follows the Company’s plan to reposition itself into a more capital-light business.

- Revenue of $105.9 million reflects a decline of 2.4% PCP, and is a result of the recalibration of Revenue quality and inventories right-sizing outlined above.

- Gross Profit of $39.0 million increased 13.8% PCP, driven by an improved Gross Margin.

- Gross Margin of 36.8% improved by 5.2pp PCP, underpinned by a larger contribution from Platform-based Sales and improved profitability of in-warehouse inventory sales after the prior sell-through of excess inventory.

- Platform-Based Sales contributed 61.6% of Gross Sales in 3QFY24.

- The new Advertising Platform is continuing to scale, generating $0.8 million in Revenue during the period.

- Group Active Customers were 2,660,000 as at 31 March 2024, consisting of 1,950,000 for Kogan.com and 710,000 for Mighty Ape.

- Kogan FIRST Subscribers totalled over 472,000 as at 31 March 2024, compared to over 407,000 as at 31 March 2023. Kogan FIRST membership cost was increased from $99 to $129 on 8 April 2024.

- The Group’s return to strong profitability continued:

- Adjusted EBITDA was $9.0 million (3QFY23: $4.4 million).

- Adjusted EBIT was $5.3 million (3QFY23: $0.2 million).

- The Company’s Balance Sheet remains strong, underpinned by:

- Cash totalling $34.1 million, with no external debt, as at 31 March 2024, compared to net cash (after loans & borrowings) of $49.1 million as at 31 March 2023. This result was achieved after completing the Mighty Ape Tranche 4 payment (being the final tranche) of $10.9 million and investing $33.8 million into the Company’s Share Buy-Back program over the past 12 months.

- Inventories totalling $71.1 million as at 31 March 2024, comprising $61.1 million in-warehouse and $10.0 million in-transit. The inventory balance represents a YoY reduction of 9.2%.

Valuation $9.05

Assumptions they can reach $3 Billion Gross Sales in FY26.

Assume Net Margins of 4% (Amazon ~5% as a group)

Earning per Share in FY26 of 0.58 cents

PE 25 Discount 10% back to today gives me $9.05