What’s happening with the Kogan share price after the AGM presentation yesterday. Gleaning the the report there wasn’t one chart that didn’t show a strong upwards trend! Maybe that’s because they didn’t include a chart for operating expenses.

James Mickleboro from the Motley Fool has done a little digging into the adjusted EBITDA so far for FY22 and it’s not sounding promising:

”There appear to have been a few catalysts for the volatility in the Kogan share price on Thursday.

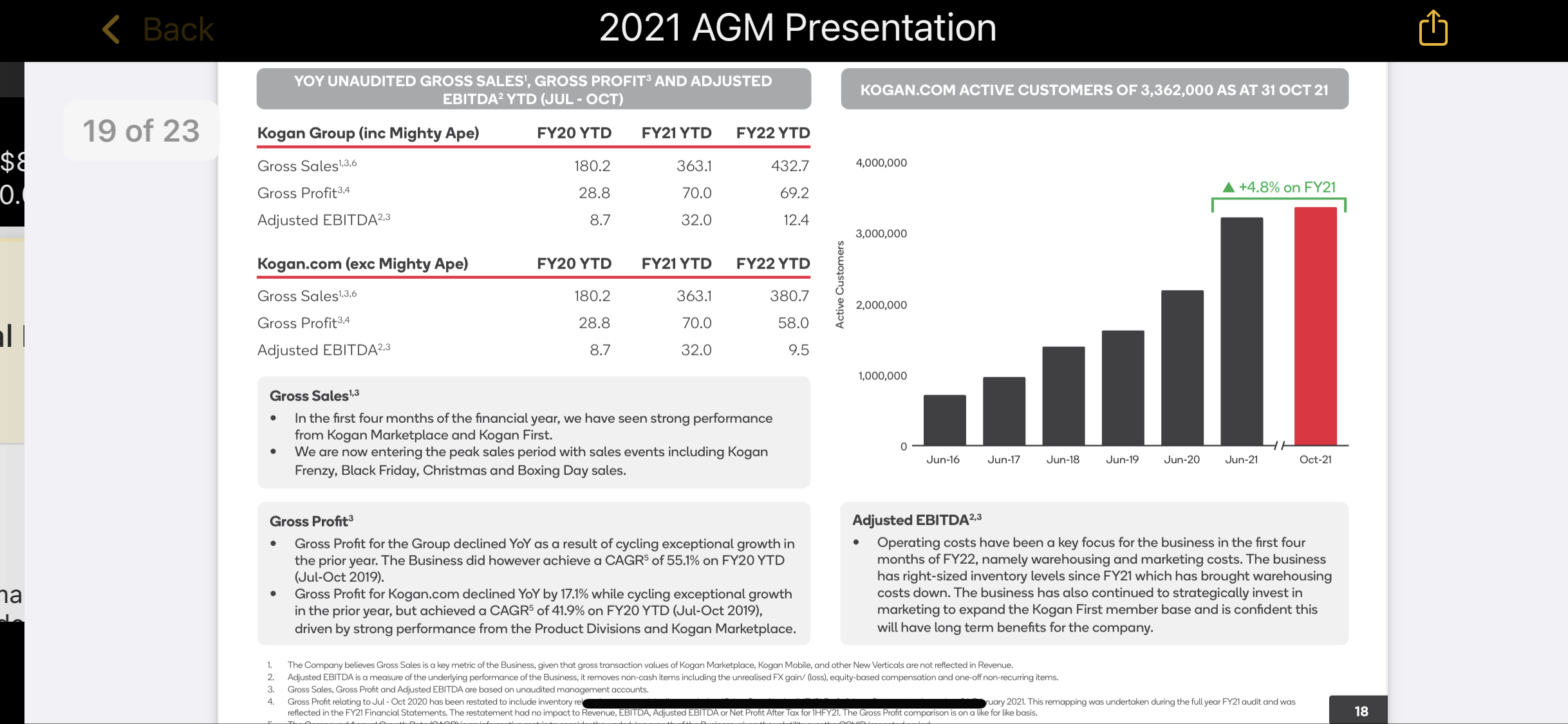

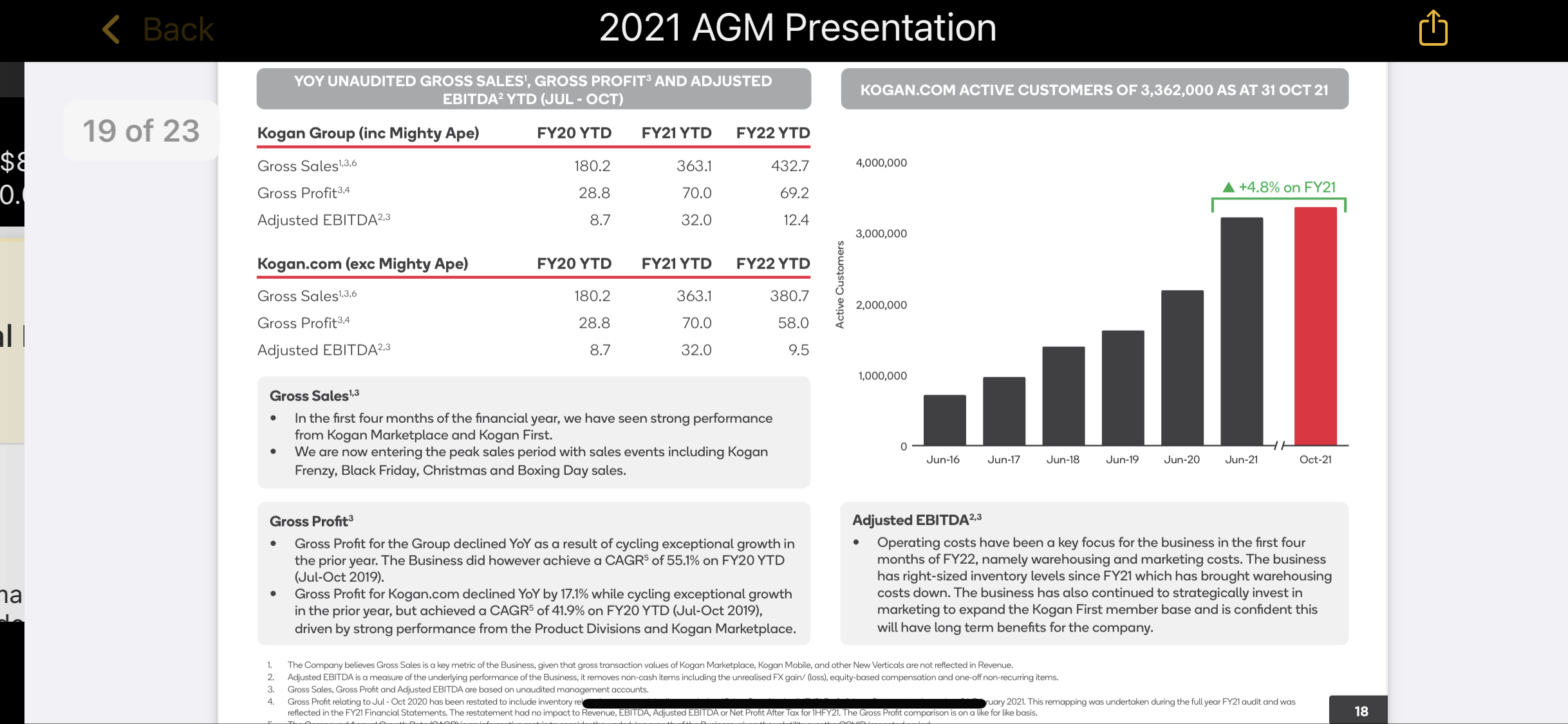

One was its trading update. Although Kogan spoke about further revenue growth during the first four months of FY 2022, this hasn’t translated into profit growth.

Kogan revealed that its adjusted EBITDA (including Mighty Ape) was down 61% year to date to $12.4 million. Excluding Mighty Ape, adjusted EBITDA was down 70.3% to $9.5 million over the prior corresponding period.

Given that Kogan reported adjusted EBITDA (including Mighty Ape) of $10.8 million for the first quarter, this means it only added $1.6 million of EBITDA in October. That compares to a first quarter average of $3.6 million per month. And this is despite the company advising that it had resolved previous inventory pressures during the first quarter, reducing warehousing costs.”

So what do we make of this? Are profit margins getting squeezed? Something to watch out for in the 2H22 report.

Disc: Shares held IRL and SM