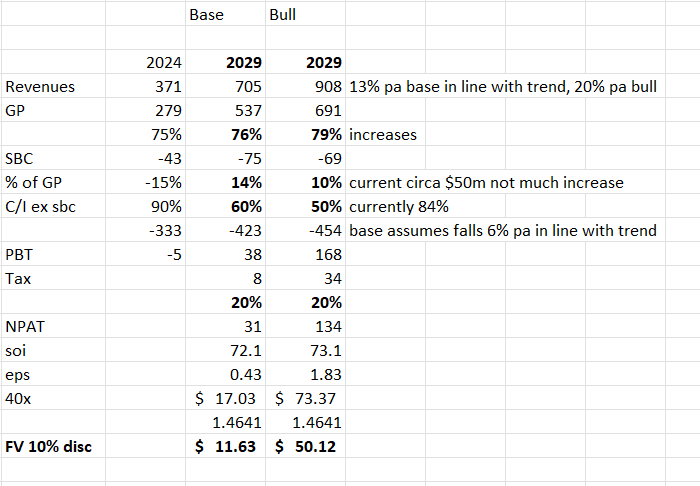

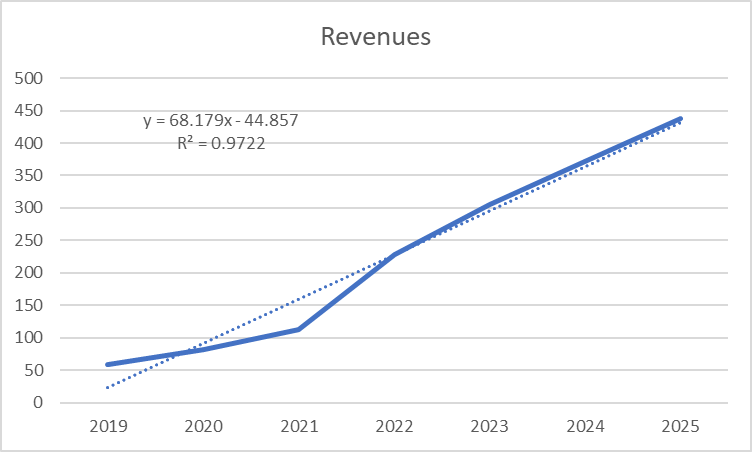

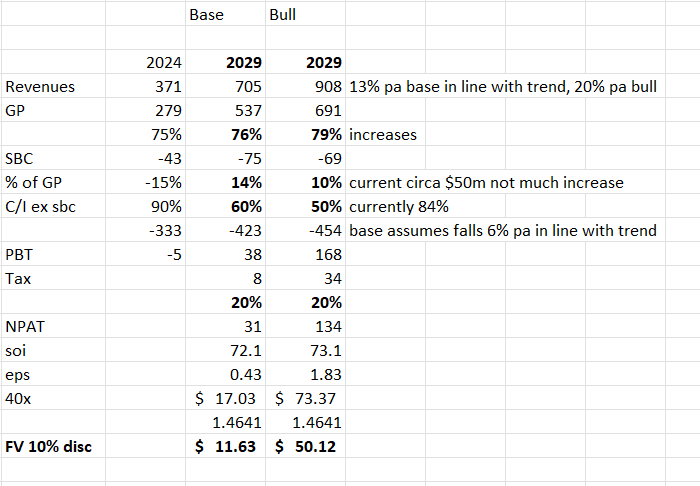

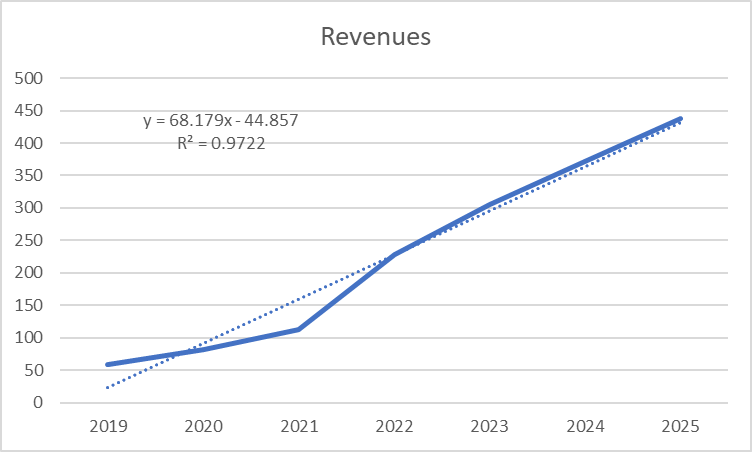

I haven't looked at this one for a few years. It was around $ 4 per share then, and my conclusion was that it had potential. However, knowing my luck, I felt that two weeks after I invested in it, AAPL or GOOG would decide to end 360's life. Maybe that's wrong; maybe the TAM here is just too small for the big boys to bother with, and it ends up as a small, growing, profitable niche or sells out. Whatever, so i decided to do a valuation based on a forward estimate of the 2029 P&L under a base case and bull case scenarios. main assumptions, and there are a few in bold. the most sensitive is the cost ratio on a mature basis or operating leverage, in other words. The conclusion is a very wide range of outcomes.

I'm interested in any Bulls' views on what they see differently.

if anything in the post-GFC investing world, we see winning biz models keep winning and valuations lag, so I'm following this one, its likely to be volatile given the sensitivities.