John Philip Coghlan Chairman

2023 Performance Life360 met or exceeded all of the guidance metrics we provided to the market for CY23.

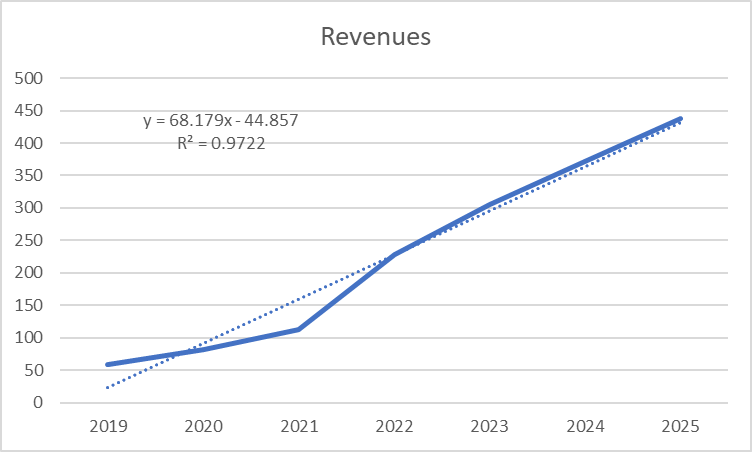

Revenue growth of 33% to $304.5 million benefited from continued strong momentum in the core Life360 subscription business, which increased 52% year-on-year.

At the same time, GAAP operating expenses increased just 4% YoY, and reduced 1% excluding variable commissions, reflecting a disciplined approach to cost.

The strong revenue growth combined with cost restraint underpinned a greater than $60 million year-on-year improvement in each of net loss, EBITDA and Adjusted EBITDA to $(28.2) million1 , $(20.8) million and $20.6 million respectively. A similar $60 million improvement in operating cash flow delivered the first full year of positive cash flow of $7.5 million.

Life360’s balance sheet is strong, finishing CY23 with cash, restricted cash and cash equivalents of $70.7 million.

LIFE360 INC. (ASX:360) - Ann: Annual Report to shareholders, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

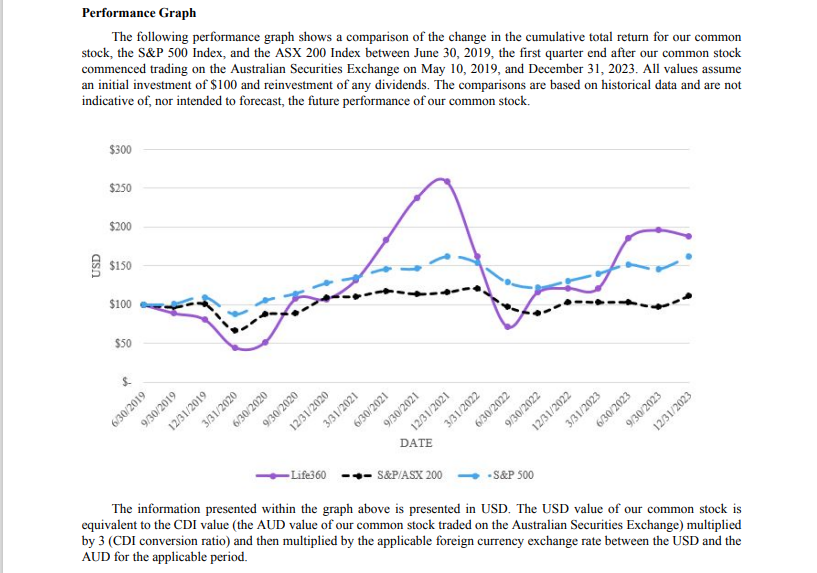

Rerview Life360 is a leading technology platform used to locate the people, pets and things that matter most to families. Life360 is creating a new category at the intersection of family, technology, and safety to help keep families connected and safe. The Company’s core offering, the Life360 mobile application, includes features that range from communications to driving safety and location sharing. The Life360 mobile application operates under a “freemium” model where its core offering is available to users at no charge, with three membership subscription options that are available but not required. Our platform recently entered a new era of location tracking services with the successful acquisitions of Jiobit and Tile. By offering devices and integrated software to members, we have expanded our addressable market to provide members of all ages with a vertically integrated, cross-platform solution of scale. For the years ended December 31, 2023 and 2022, Life360 generated: • Total revenues of $304.5 million and $228.3 million, respectively, representing year-over-year growth of 33%; • Subscription revenues of $220.8 million and $153.3 million, respectively, representing year-over-year growth of 44%; • Hardware revenues of $58.2 million and $47.9 million, respectively, representing year-over-year growth of 21%; • Other revenues of $25.5 million and $27.1 million, respectively, representing year-over-year decline of 6%; • Gross profit of $222.6 million and $148.6 million, respectively, representing year-over-year growth of 50%; and • Net loss of $28.2 million and $91.6 million, respectively. Key Factors Affecting Our Performance As we focus on growing our customers and revenue, and achieving profitability while investing for the future and managing risk, expenses and capital, the following factors and others identified in the section of this Annual Report on Form 10-K titled “Item 1A. Risk Factors” have been important to our business and we expect them to impact our operations in future periods: Ability to Retain Trusted Brand. We strongly believe in our vision to become the indispensable safety membership for families, with a suite of safety services that span every life stage of the family. Our business model and future success are dependent on the value and reputation of the Life360, Jiobit and Tile brands. Our brand is trusted by approximately 61 million members as of December 31, 2023, and because we know the value of trust is immeasurable, we will continue to work tirelessly to ensure that we provide useful, reliable, trustworthy and innovative products and services. Attract, Retain and Convert Members. Our business model is based on attracting new members to our platform, converting free members to subscribers, and retaining and expanding subscriptions over time. Our continued success depends in part on our ability to offer compelling new products and features to our members, and to continue providing a quality user experience to convert and retain paying subscribers. We will also seek to increase brand awareness and customer adoption of our platform through various programs and digital and broad-scale advertising. Maintaining Efficient Member Acquisition. Our investment in developing effective services and devices creates an efficient member acquisition model which drives strong unit economics. Our member acquisition model is complemented by our word-of-mouth and freemium models. We accelerate our organic member acquisition with strategic and targeted paid marketing spend. We expect to continue to invest in product and marketing, while balancing growth with strong unit economics. As we continue to expand internationally, we may increase our targeted marketing investments.

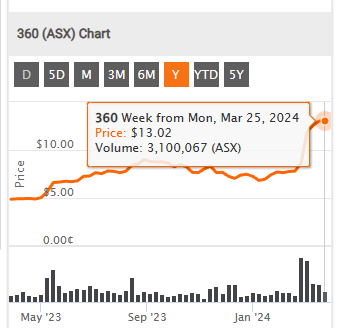

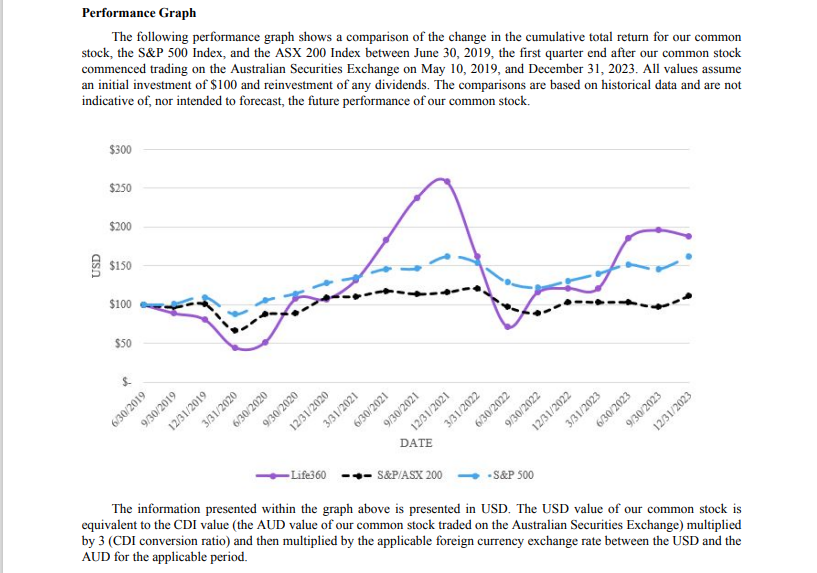

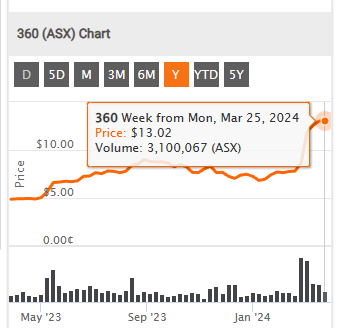

Return (inc div) 1yr: 168.03% 3yr: 40.48% pa 5yr: N/A