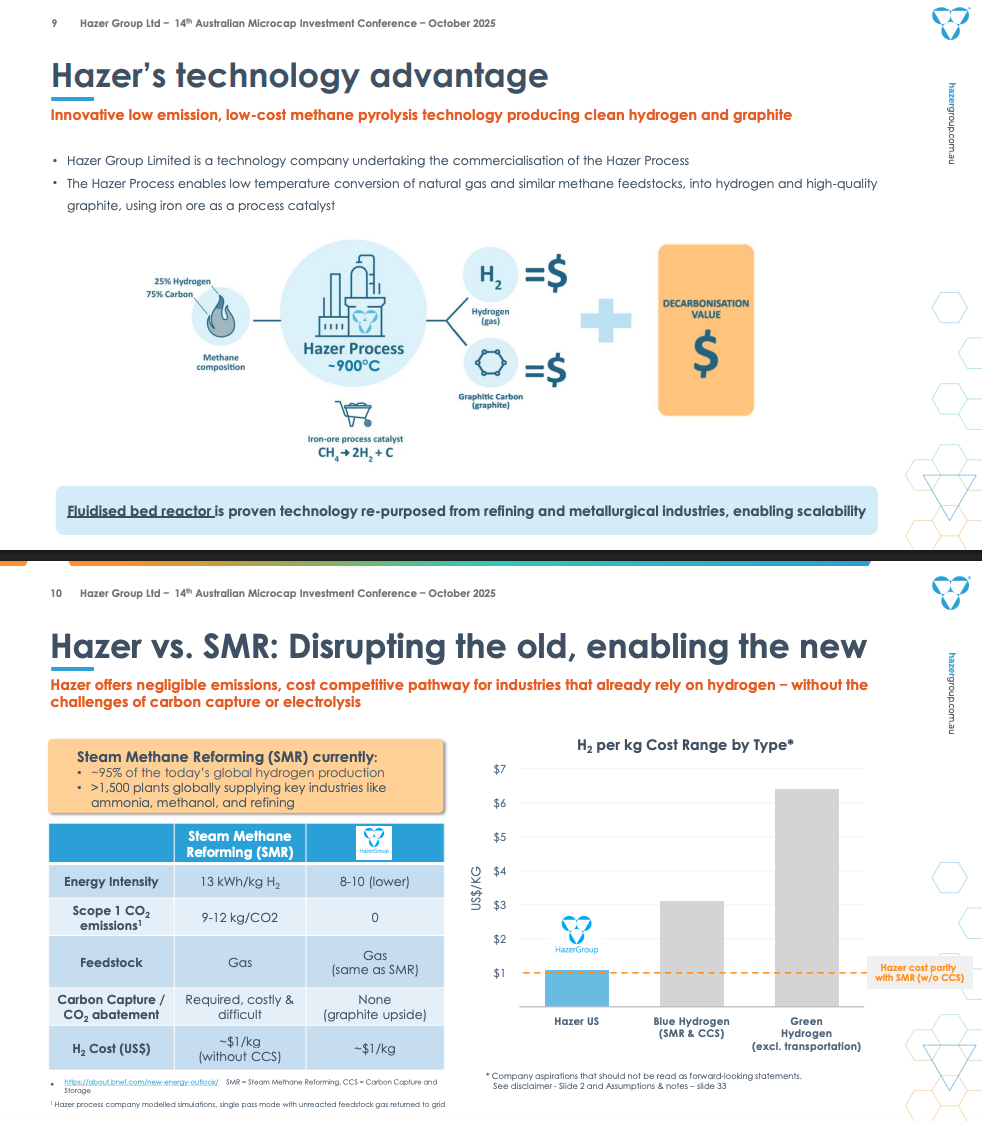

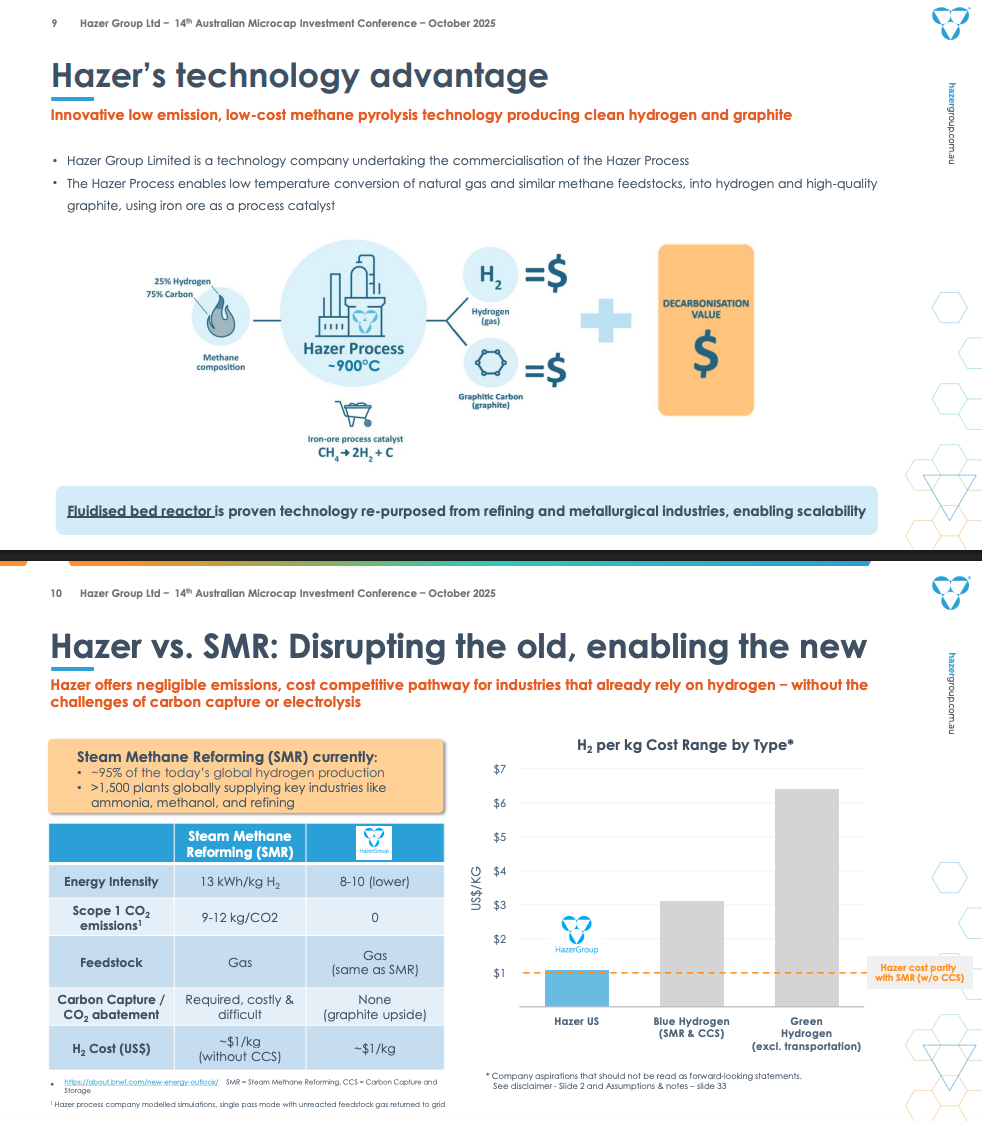

For those new to the stock: HZR is a WA-based technology development company undertaking the commercialisation of the HAZER Process, which enables the low-emission, efficient conversion of natural gas and similar methane feedstocks into hydrogen and graphite using iron ore as a process catalyst.

A potted history: I was attracted to HZR because of the chemistry and the possibility of a future technology. I took a small position in 2021 and sold out in 2023 (at a loss) - very annoyed that the then-board had taken the (highly green) tack of making their first RL project a biomass deal - to convert the methane from a biomass facility that they proposed to build at Busselton, WA. The project was dependent on state government support, which predictably didn’t eventuate. So after lots of commitment into design, etc, the company was left with…nothing. Complete failure.

In hindsight, it's possible that that failure - and ironically, the WA government’s hand in it - will in the end turn HZR into the company it always could’ve/should’ve been.

Enter Glen Corrie as CEO. He refocused the company on generating “turquoise” hydrogen (from methane from LNG - so there’s a small amount of emissions in the sourcing of the gas, but down the track, that could be addressed as well.) Still, he never claims the Hazer product is completely green hydrogen.

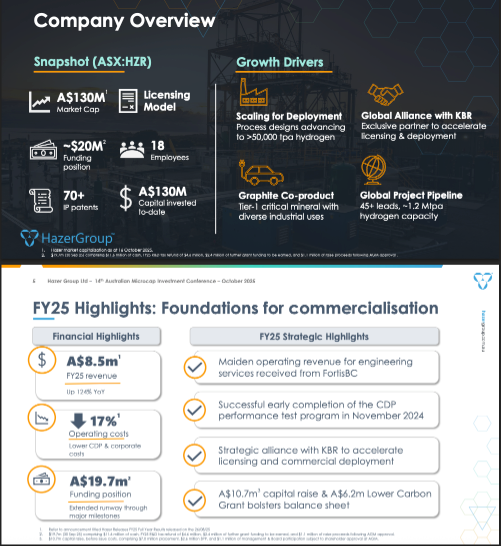

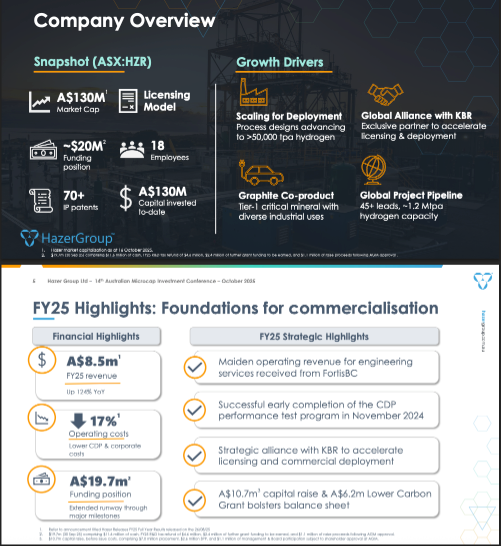

Fast forward three years to now:

In 2024, the Commercial Development Plant passed all trials with flying colors, and FortisBC were an early potential partner to actively engage. FortisBC are a renewable energy, gas, and electricity utility in British Columbia..

This is the Hazer process:

I have to say that Hazer have become heaps better at communicating and explaining what the process is and what advantages it has.

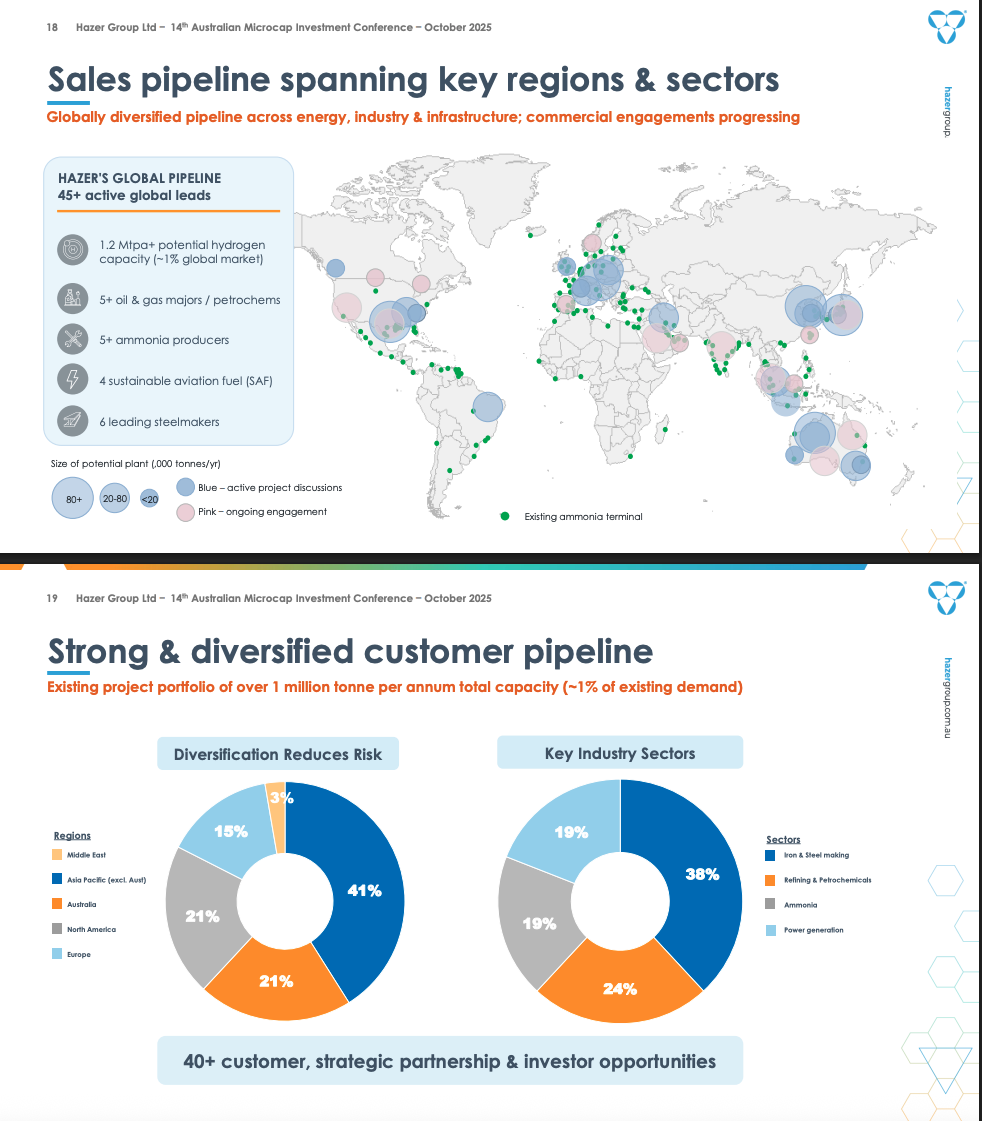

And now, it’s a go on several fronts.

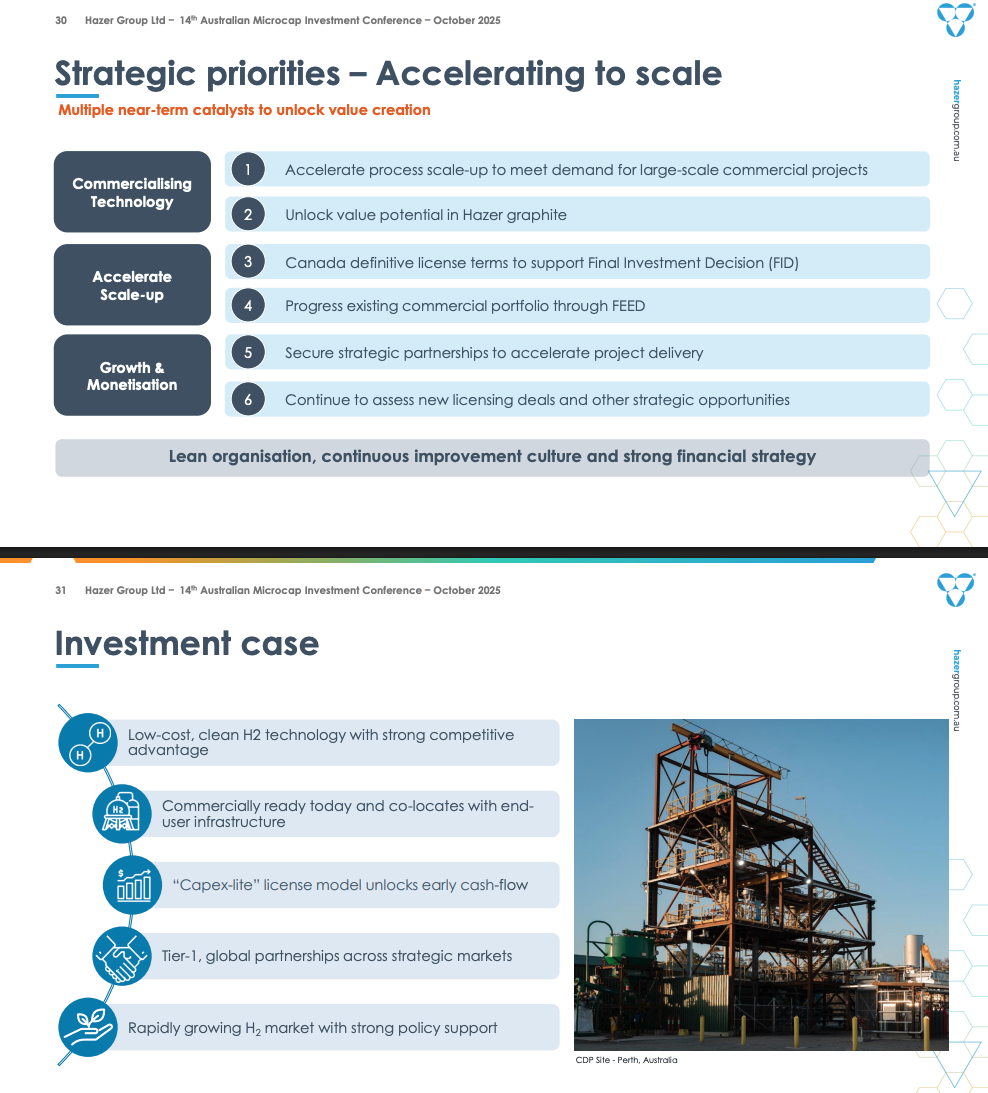

One of the factors that moved me to buy back into HZR last year was that Corrie has set it up as pure licensing. NO building anything, and the patent portfolio is broad and deep.

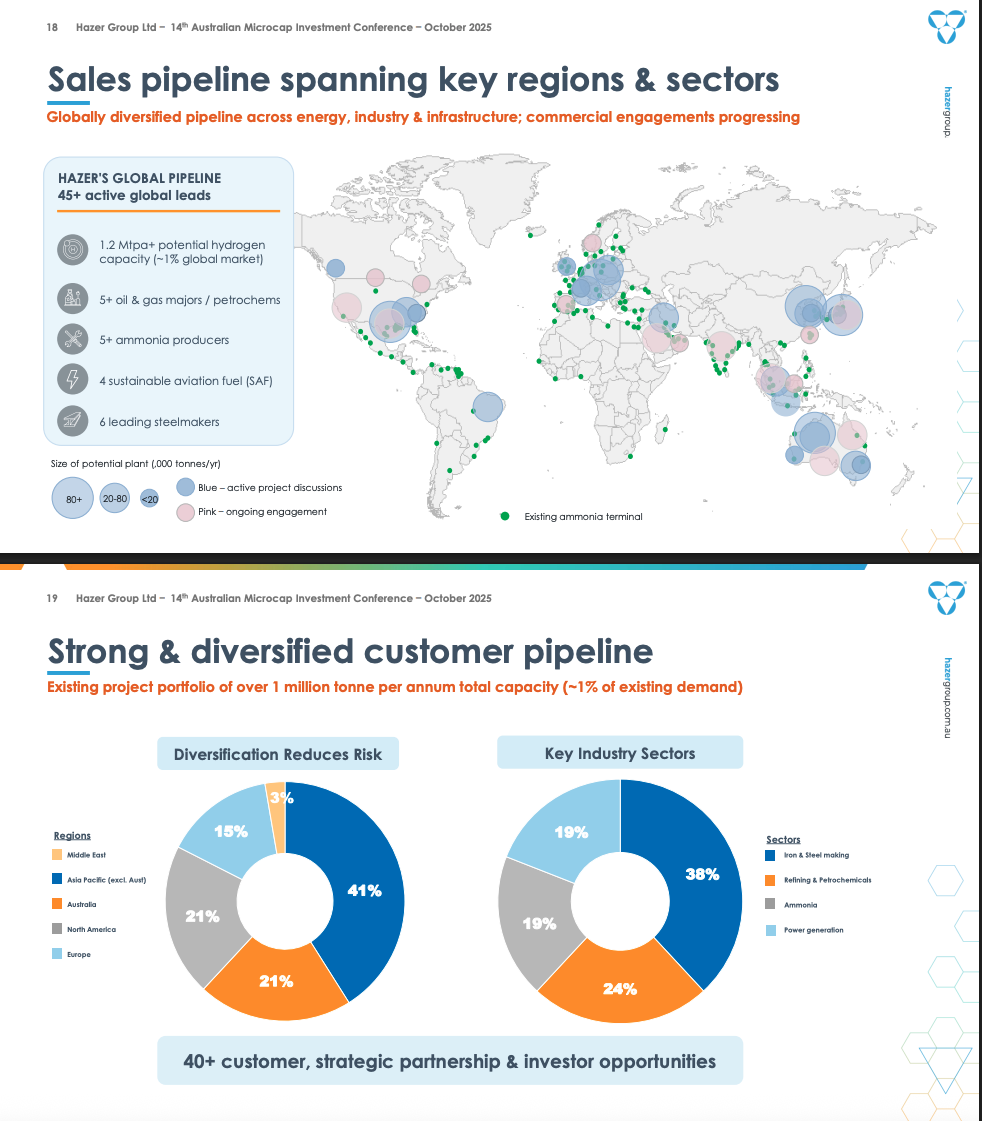

However, as shown in the above, like most similar businesses, HZR faces a lumpiness in income due to the lag between inking an agreement and the partner’s facility coming fully online. They are addressing that by ramping up efforts to draw in more partners/sites - which gets easier the more agreements they sign.

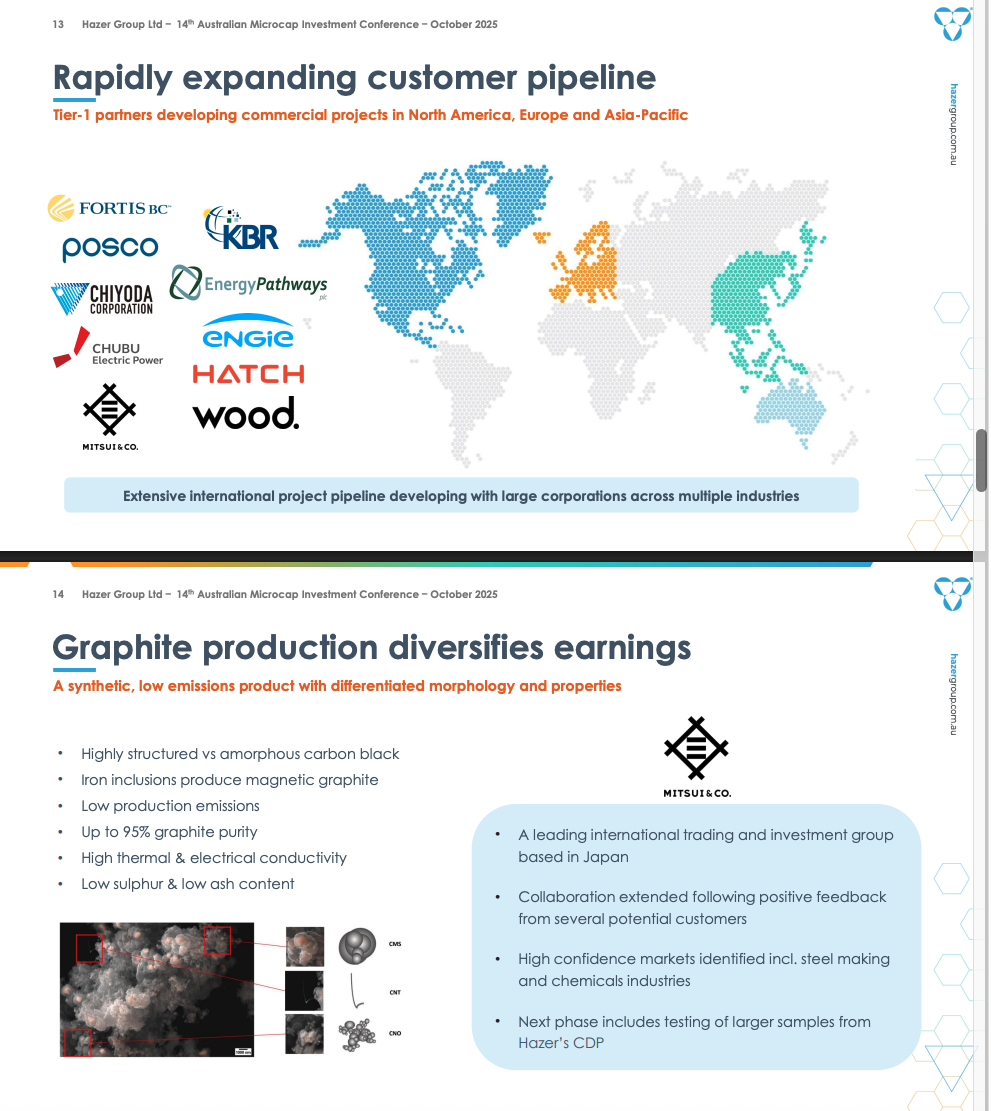

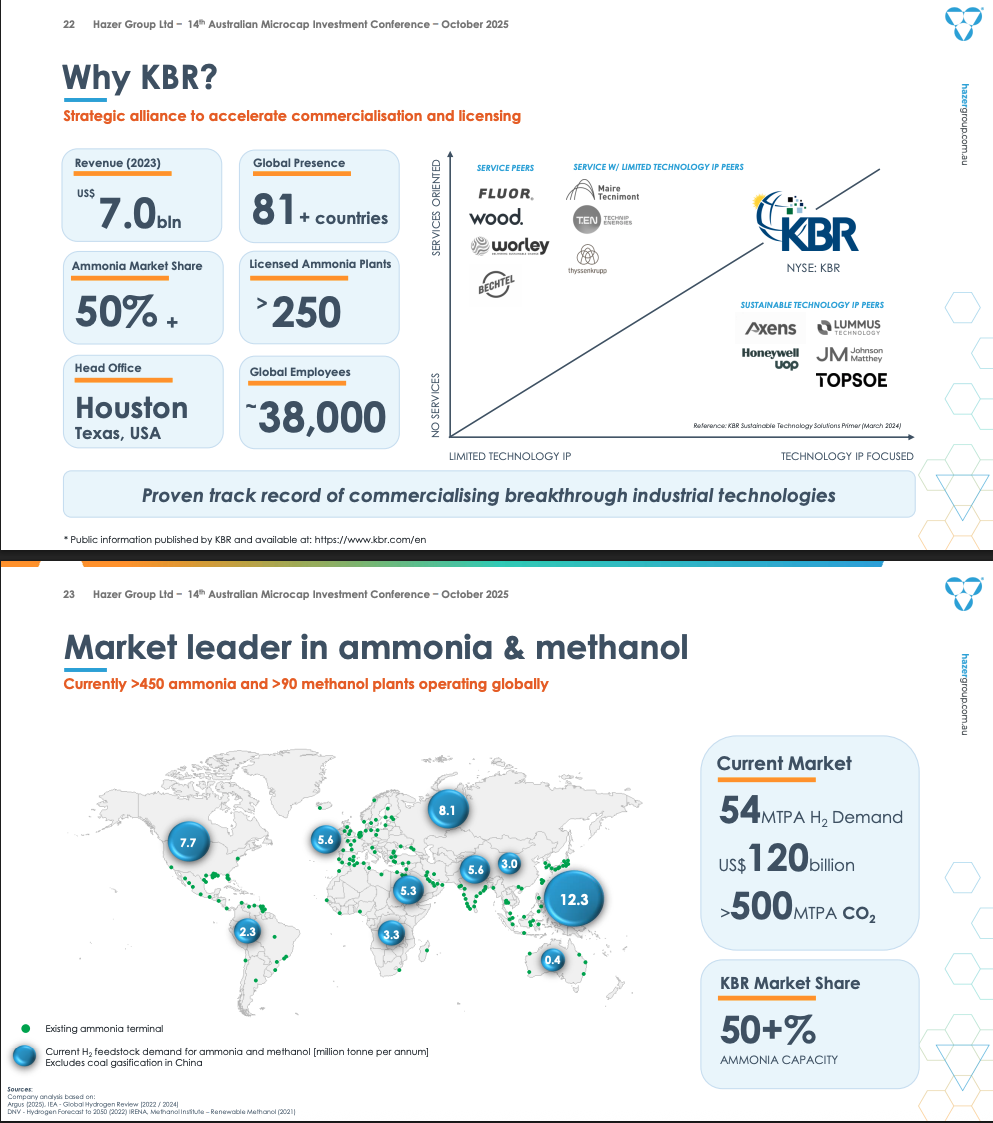

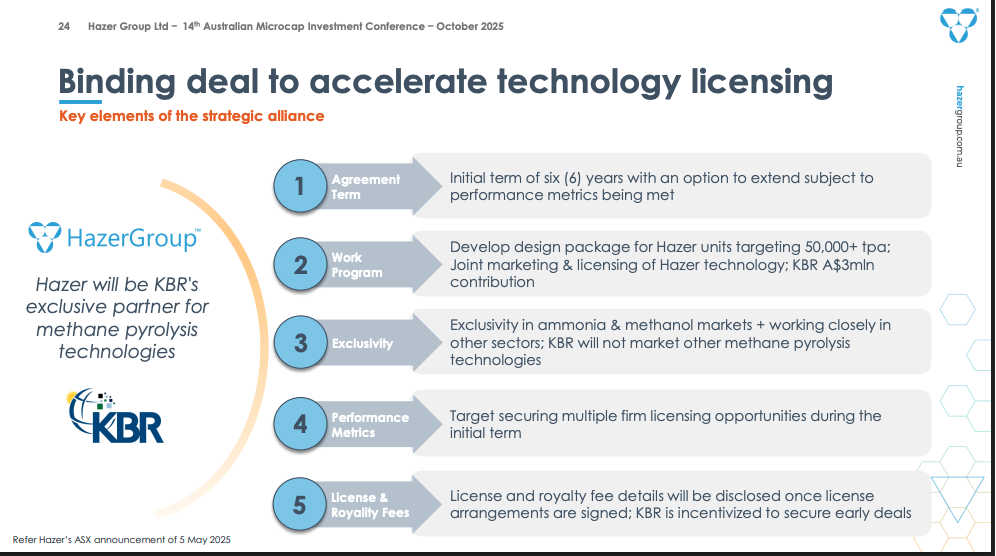

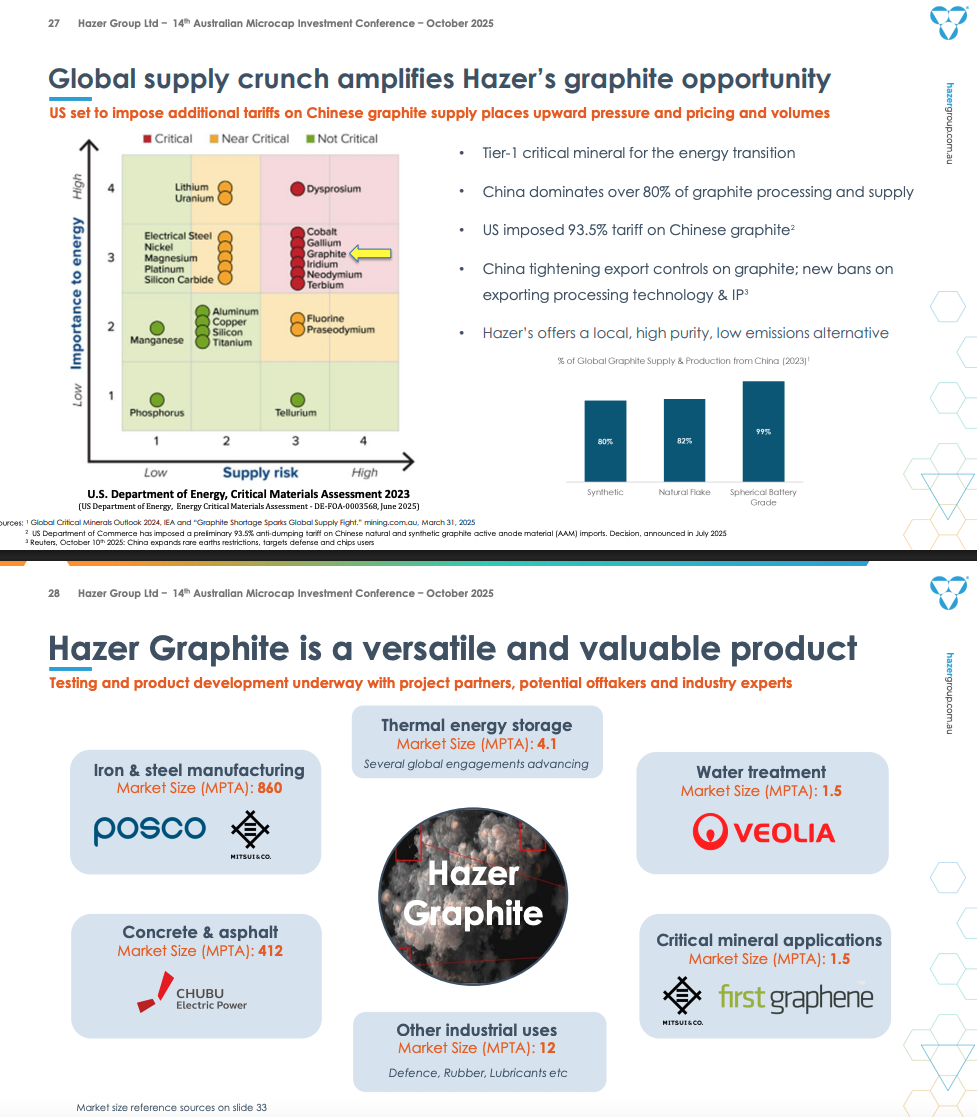

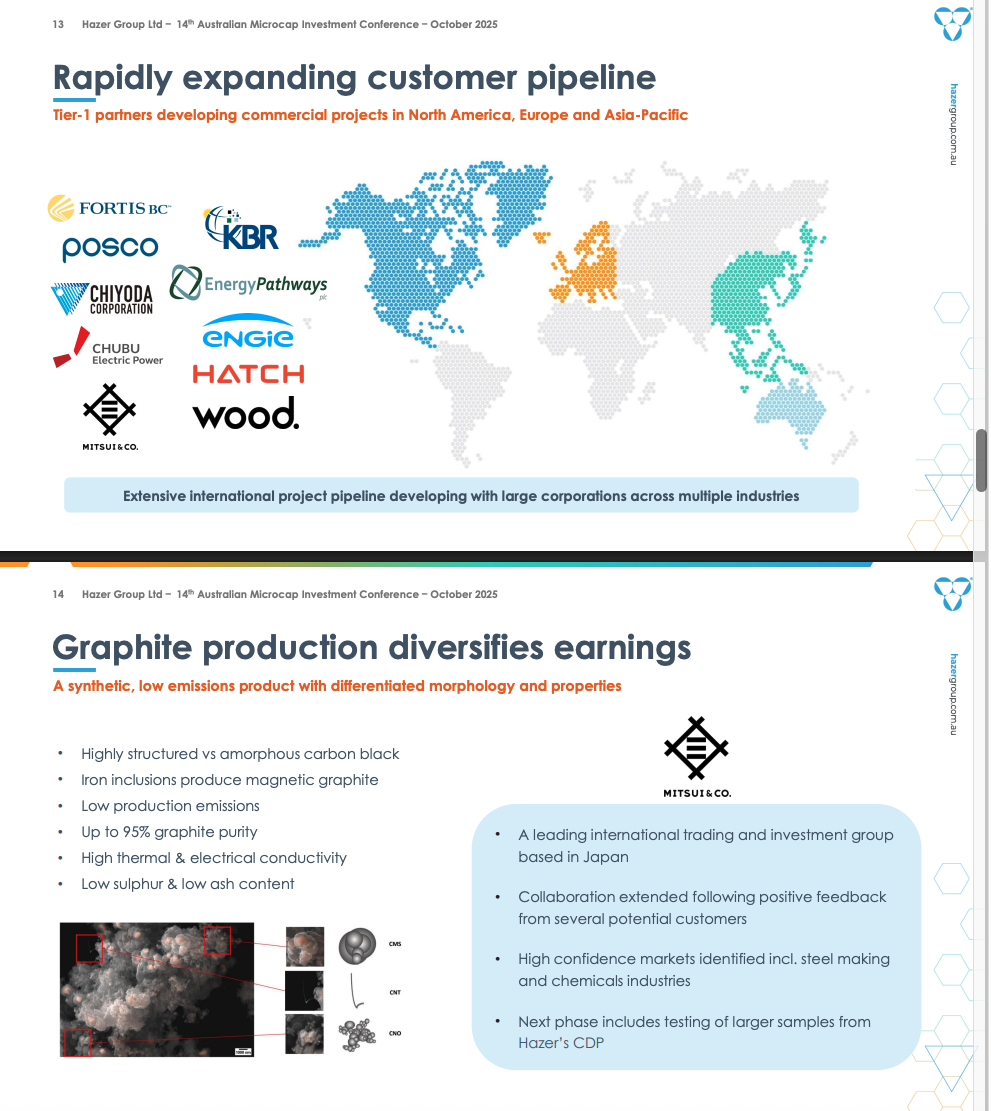

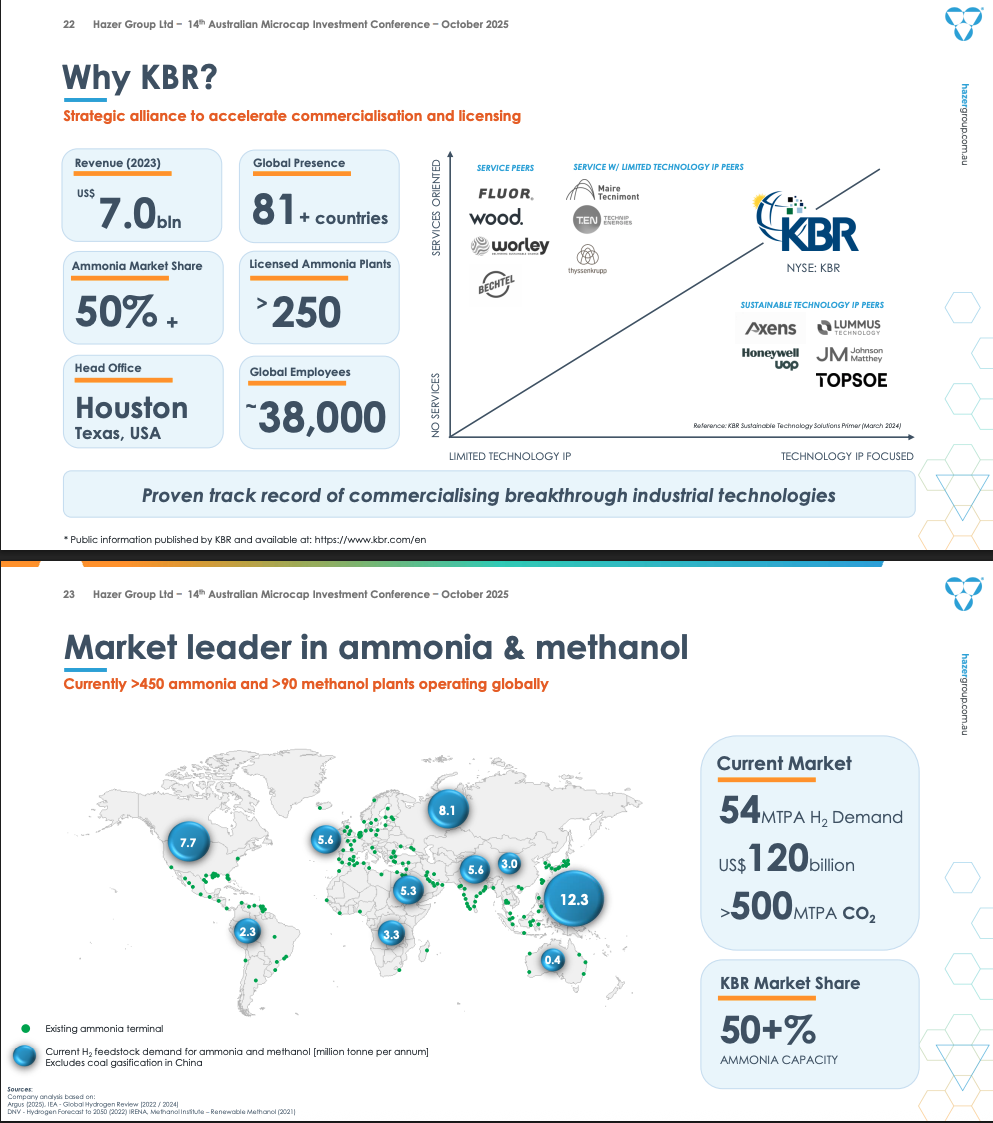

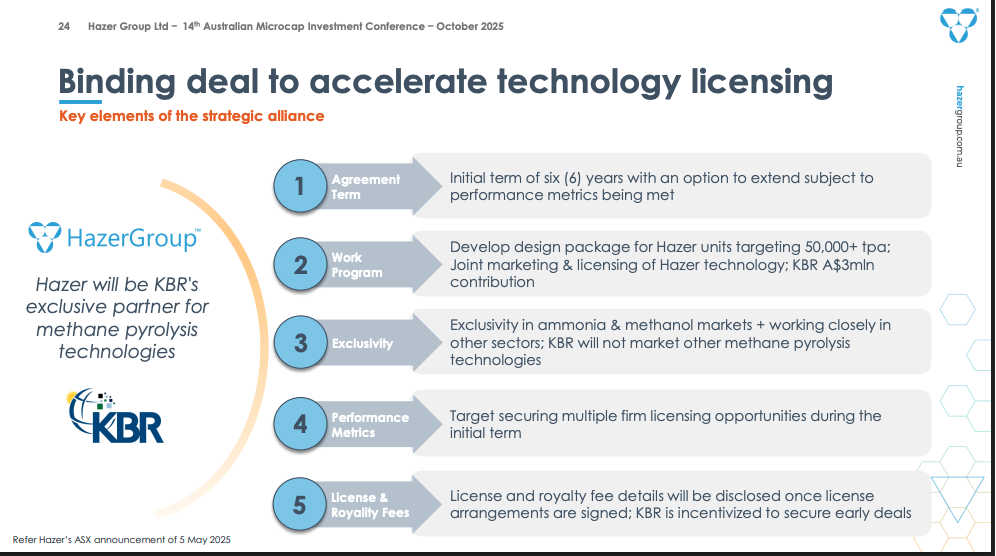

And through a seriously helpful strategic alliance with KBR

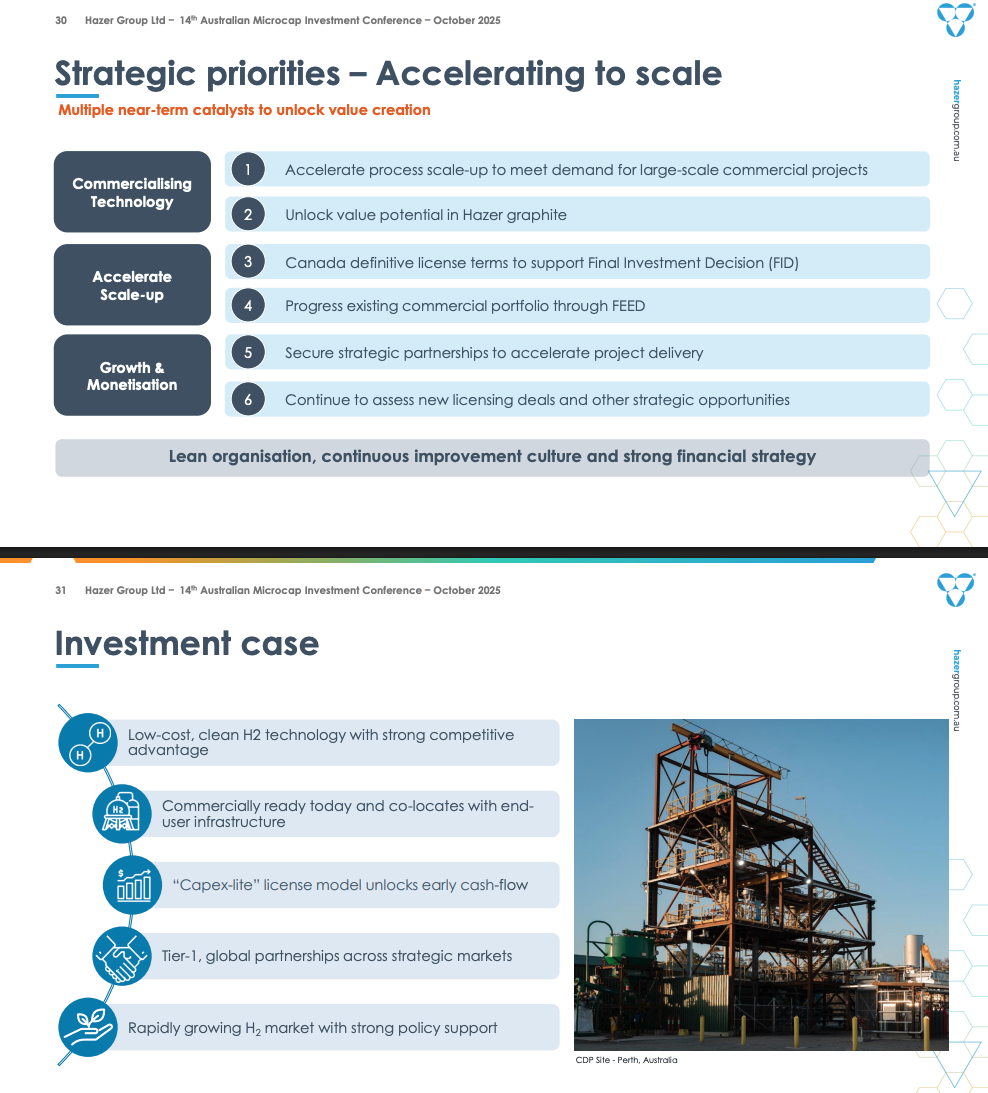

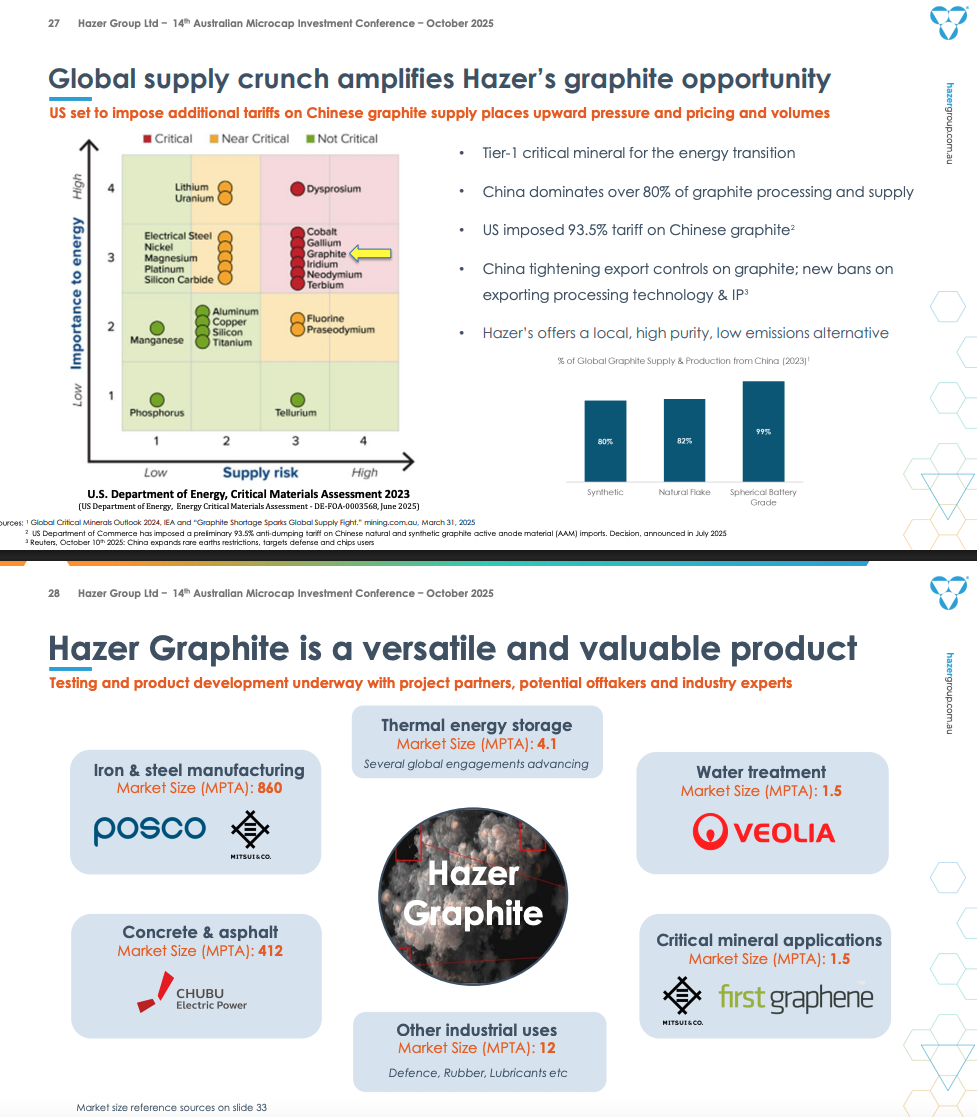

AND…then there’s the graphite.

Putting it all together:

So HZR seems to be hitting its stride (finally). Much kudos has to go to Corrie’s leadership, and thankfully, he’s just signed on for another three years.

Of course, lots can still go pear-shaped, and HZR remains a speculative play, but step by step, month by month, it’s getting closer to take off.

One facet of the HZR story that continues to fascinate me is that at no time has WDS - which is sitting right there next door in WA - ever shown any signs of buying HZR. Just think about it. If WDS has a massive supply of LNG and also has exclusive rights to the HZR process, which turns that LNG into the closest thing to readily transportable liquid “green” fuel...

Discl: Held in RL.