Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 2.10% and in SM

A bit of Shares On Issue and Share Options movement, over 3 separate ASX announcements, in Hazer Group yesterday, which needed a bit of unpacking.

In summary:

- These are follow up actions from the resolutions passed at the AGM

- They ensure Glenn Corie is sufficiently incentivised to continue the good things he is doing for the next 3 years

- Both Glenn and the Board are backing the company with very decent chunks of their own coin, immediately, and over the next 3 years - this injects cash into HZR, increases their personal skin in the game and demonstrates their confidence in where HZR is going in a very tangible way

Issue of Glenn Corrie Short Term Incentive Bonus

Glenn Corrie, the MD&CEO received 120,853 free shares as part of his short term incentive bonus - at $0.41, that nets him $49,550, a fair amount I think given the progress he has steered since he joined.

Issue of Tranche 2 Placement Shares to CEO and Directors

3,445,160 shares were issued at $0.31 to Directors and Management.

4 of the 5 directors took up the placement, presumbly with their own coin, including Glenn Corrie, stumping up between $50k and $453k, each - see table. This is some serious coin and demonstrates good confidence in the company’s future prospects. Raises about $1m of capital - very handy indeed.

Issue of 5 Year Director Share Options

Different Directors and the MD/CEO have different vesting conditions.

Glenn Corrie’s vesting lines up with his new 3-year extension tenure.

Discl: Held IRL 1.29% and in SM

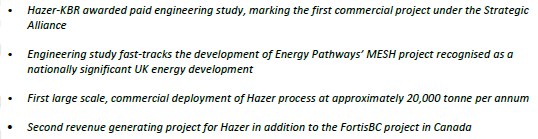

A very nice thesis reaffirming announcement from HZR for me this morning.

3 positive things:

1. The contractual position for EEP moves from MOU to Binding Agreement for a paid engineering study, adding to commercial revenue generation.

2. The commitment comes really quickly, in relative terms, from the MOU signed with EEP on 15 July 2025. EEP moving at pace on the back of FortisBC is really positive for momentum.

3. It is the first commercial project from the KBR-HZR alliance - I thought the alliance was a huge step in increasing the potential of HZR's journey in the ammonia market. This win helps reaffirm that thinking.

Discl: Held IRL 0.72% and in SM

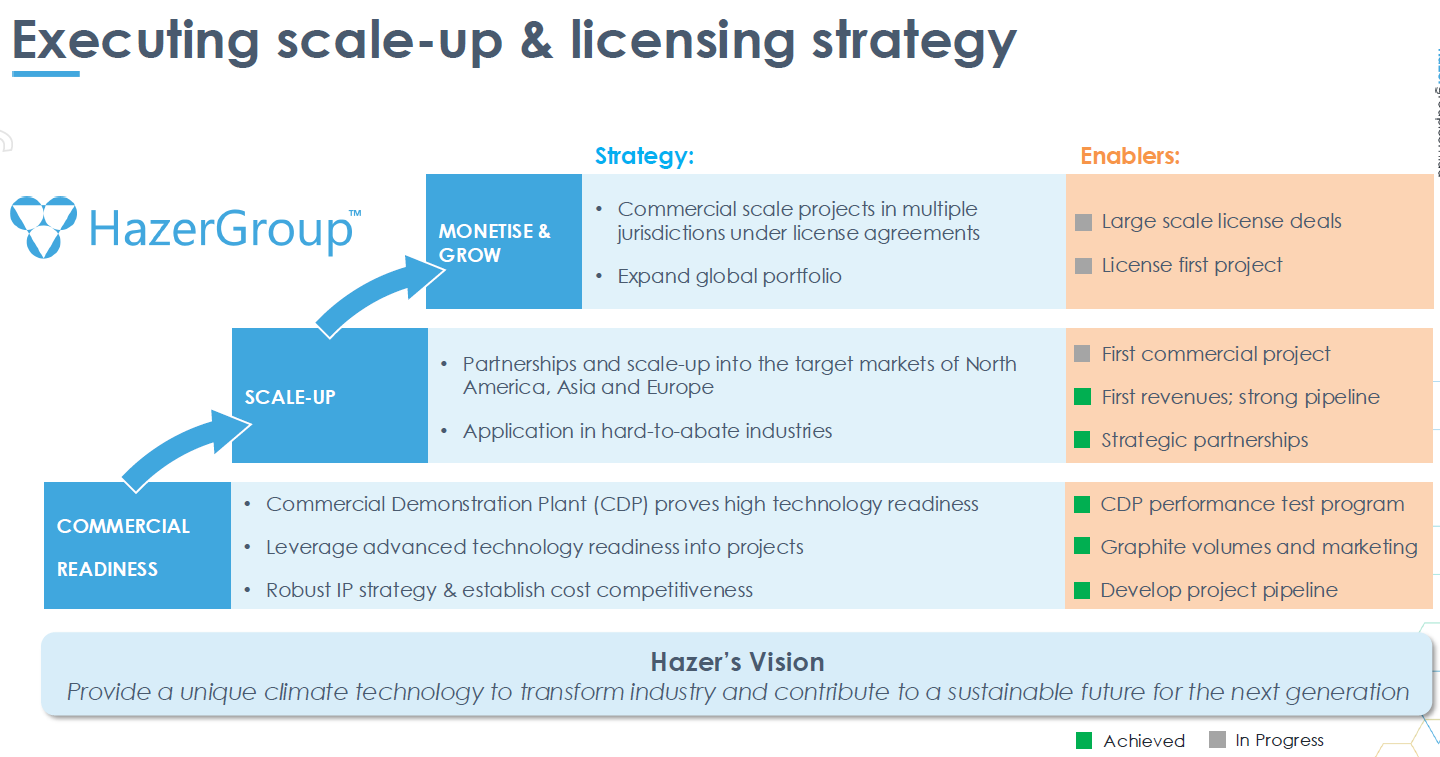

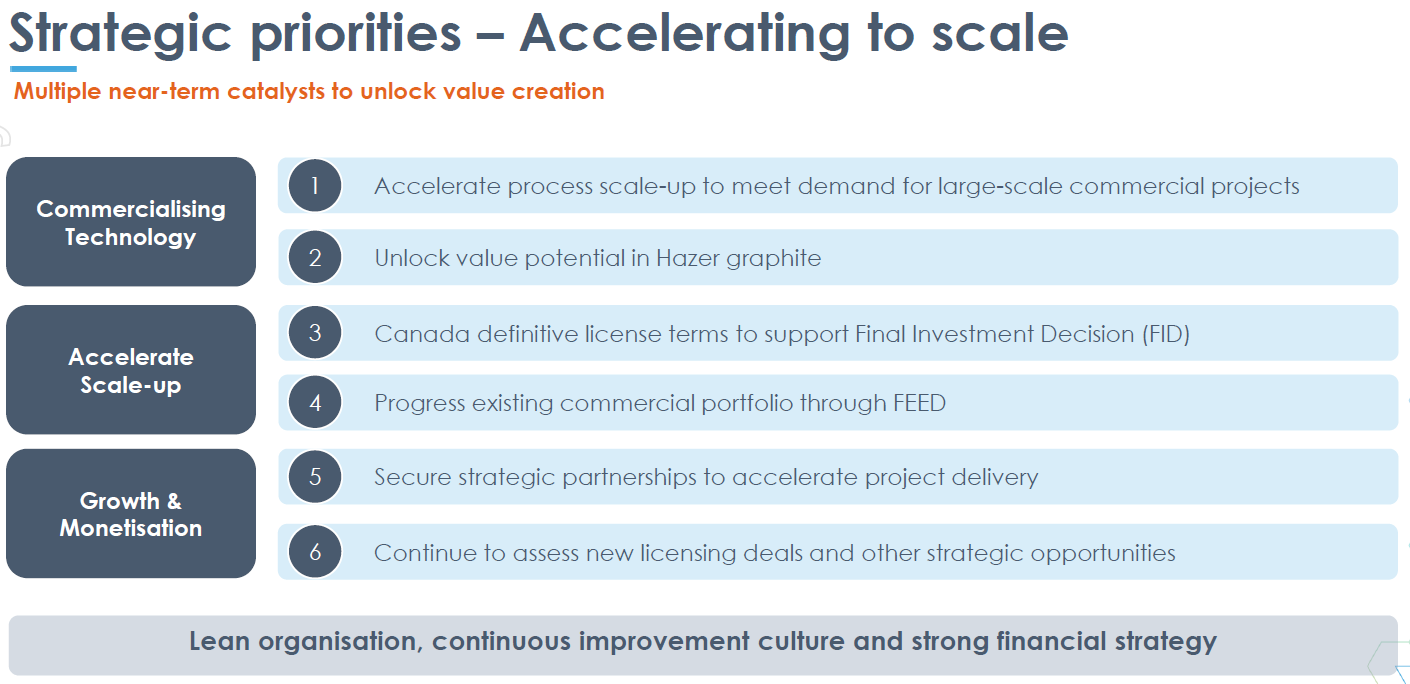

This is how the various pieces of the HZR story comes together for me - the Scale Up, Commercialisation and Licensing Strategy.

SUMMARY

1. Technology is proven and de-risked via the Commercial Demonstration Plant - the hard yards and cost investment to prove the technology is now behind HZR

2. The KBR Alliance locks in KBR, with its ~50% market share of ammonia and methanol plants, exclusively on the Hazer technology, the key ammonia and methanol markets, its plant engineering expertise and its sales and marketing expertise/salesforce in these markets

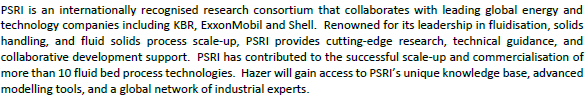

3. The PSRI partnership enables HZR to leverage PSRI’s expertise in fluidisation fundamentals as it realtes to Hazer’s use of fluid bed reactors as a core part of the Hazer process and its primary competitive advantage

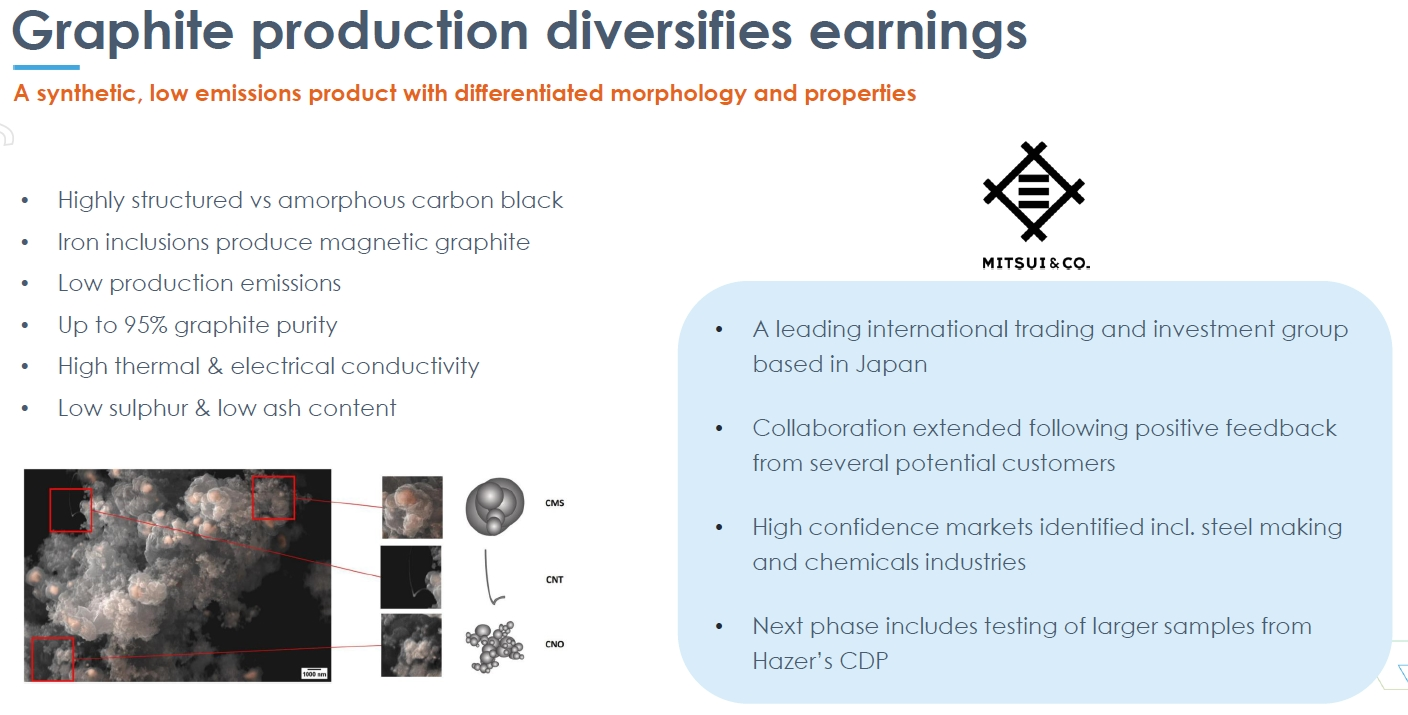

4. Ongoing marketing partnership with Mitsui to unlock potential, find and lock in offtakers for Hazel Graphite

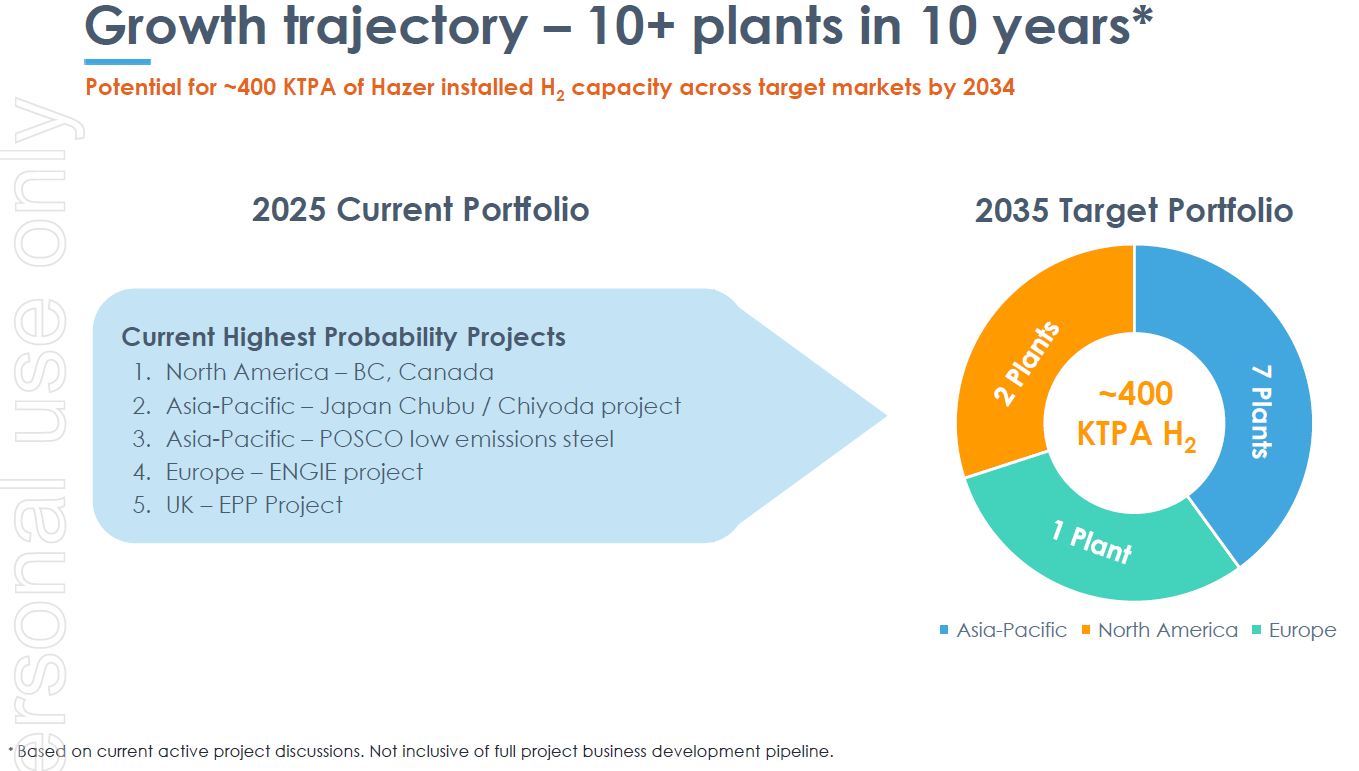

5. Progress the Current 2025 Portfolio of Hazer Technology customers Fortis BC (Power Gen), Chubu (Power Gen), POSCO (Steel), ENGIE , Energy Pathways (Ammonia) - a very nice mix of geography and industry

6. In parallel, progress discussions on the sales pipeline, particularly with KBR

Having looked at each aspect of the HZR business at some level of detail, it feels like now is a really good investment entry point. It feels like all the pieces of the puzzle for scale-up and commercial acceleration have really come together in the last 24 months. Real opportunities are progressing with the 5 current projects, the sales pipeline is being progressed in parallel and the major cost investments are behind HZR.

Discl: Held IRL 0.72% and in SM

Aside from agreements with Customers and Hazer Graphite Marketers, HZR has entered into 2 key technology partner alliances on the technology expertise and delivery end.

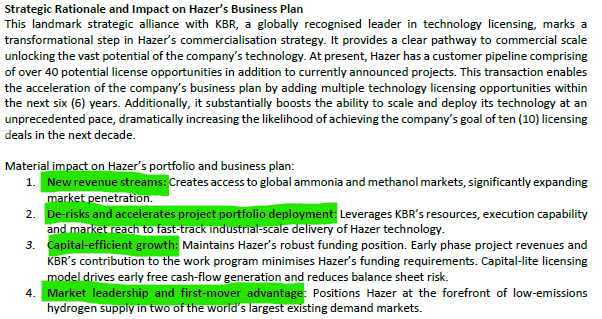

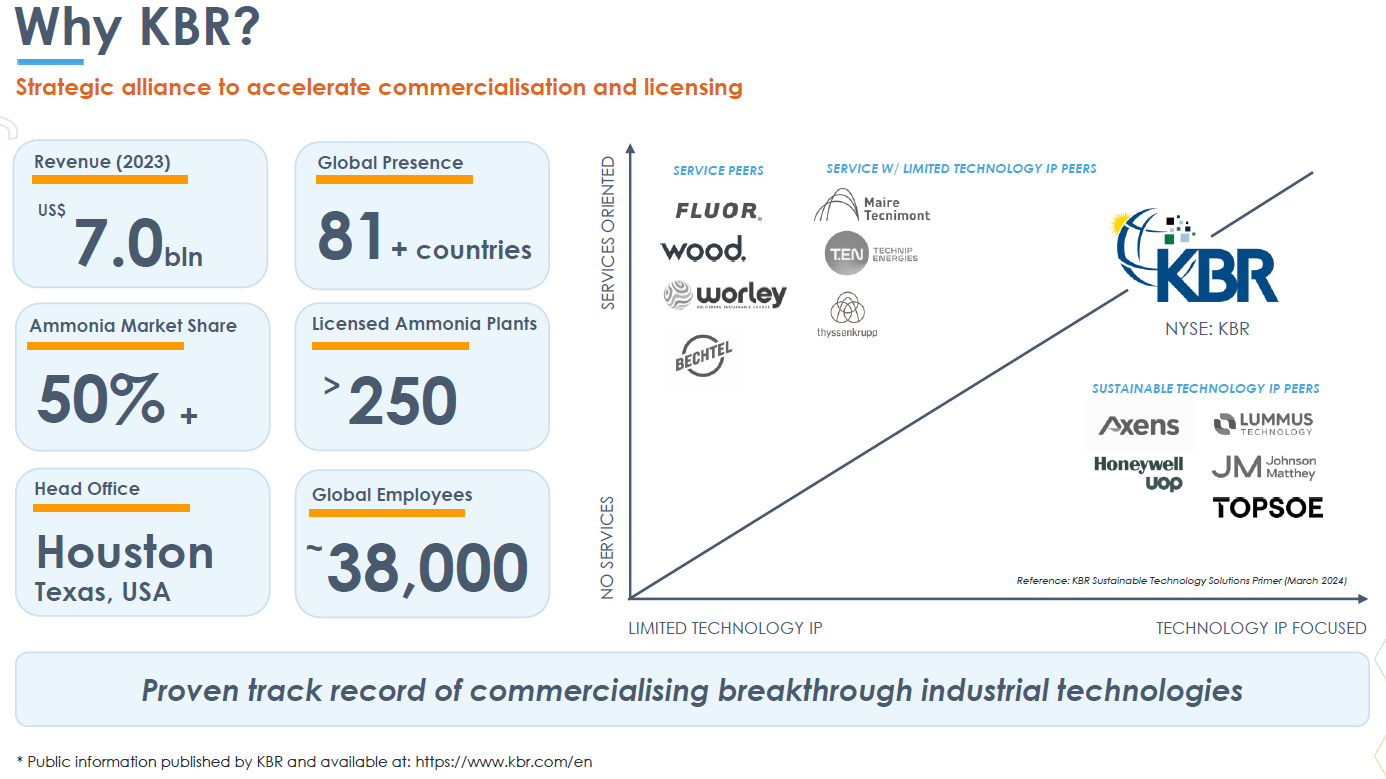

5 MAY 2025: KELLOGG BROWN and ROOT - Binding Alliance Agreement

This KBR agreement was a major tick in the box for my thesis as:

- Huge Engineering name with a solid track record in petrochemical plants

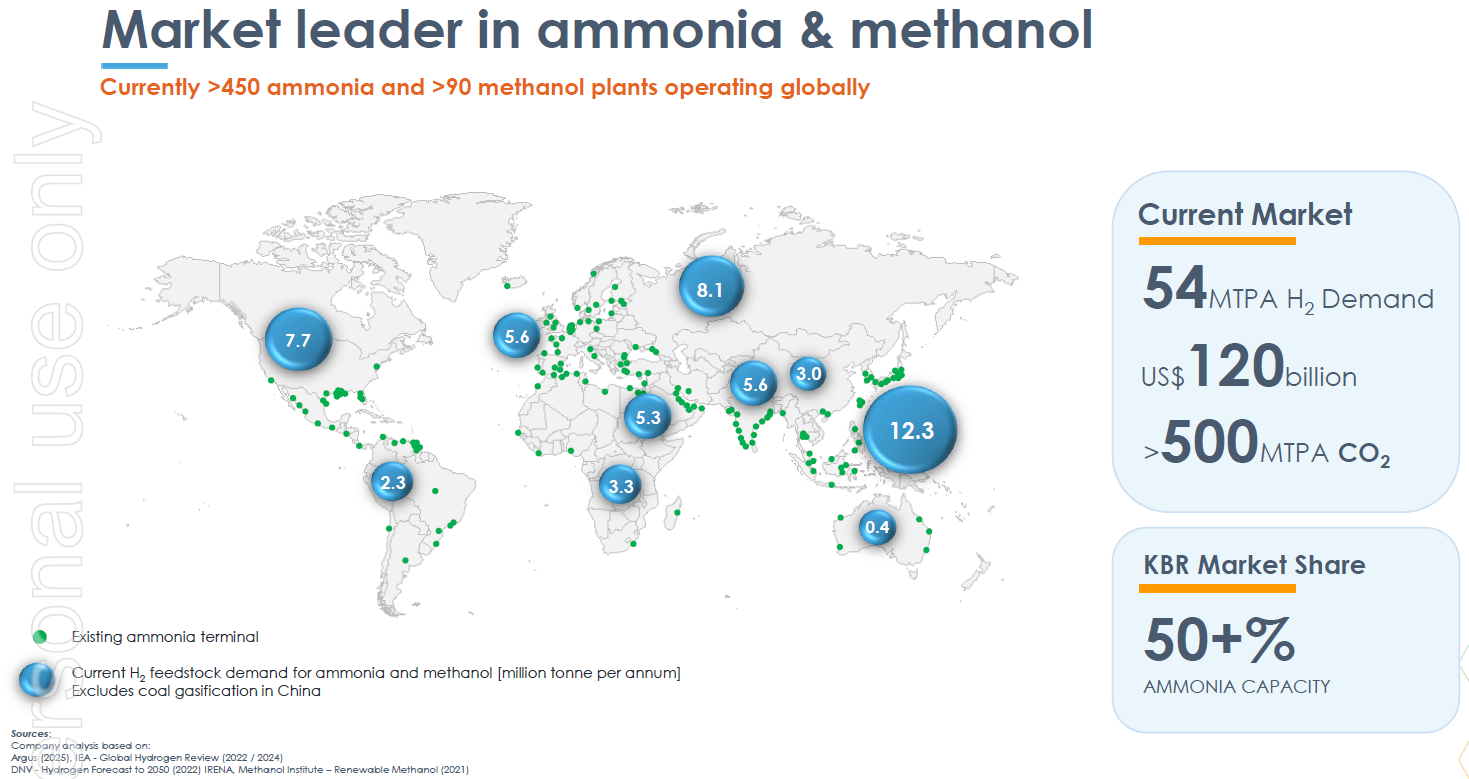

- Ammonia & Methanol plants are HZR’s biggest TAM segment given its very dirty CO2 emissions

- Locks KBR, with its 50% Ammonia/Methanol market share, exclusively within Ammonia and Methanol, to the hip with HZR, for a long 6 years duration - this, I think, is a huge step forward, from a technology confidence perspective as well as commercially

- This is another dimension of “things coming together” on the technology/engineering-end - it gives HZR the best shot at accelerating the uptake of the Hazer Process

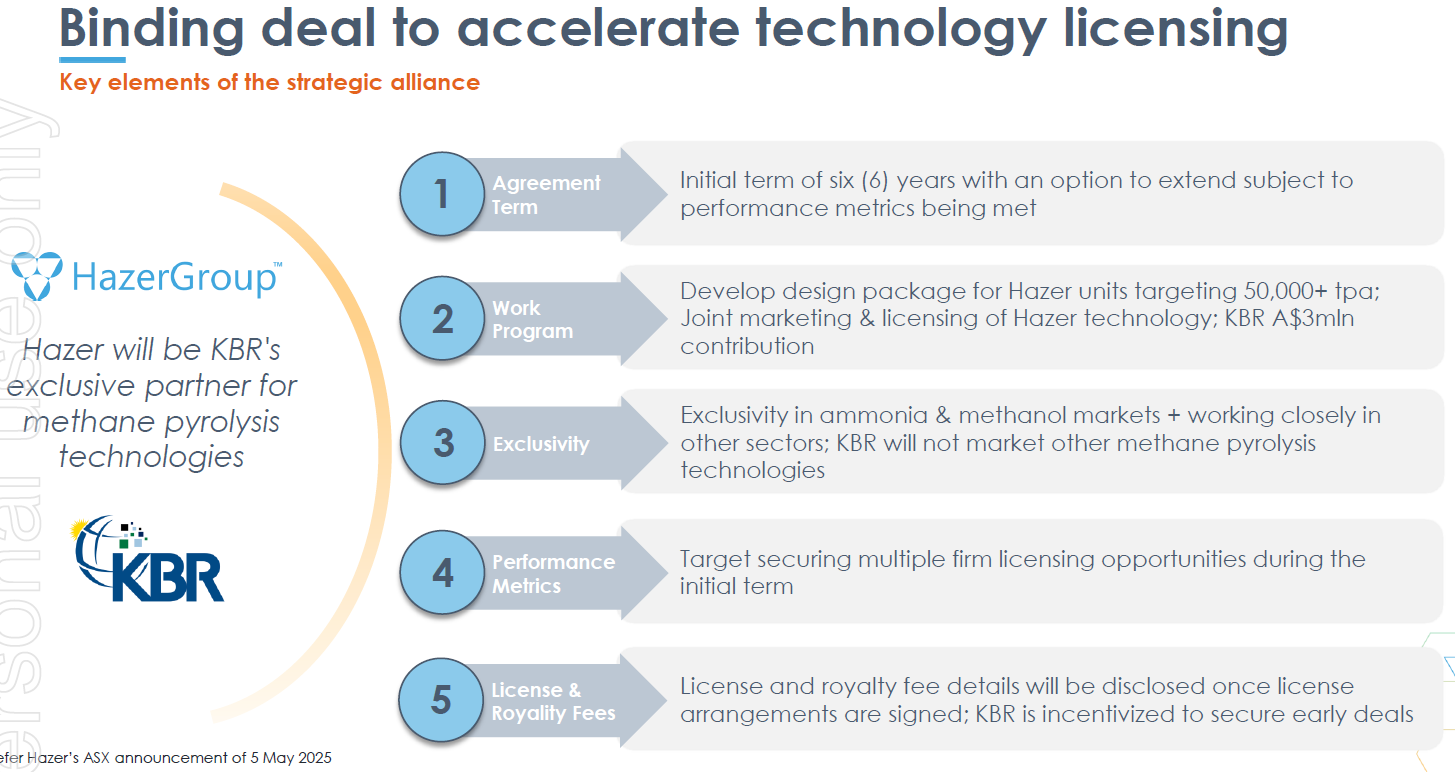

Details of Alliance Agreement

- Binding Alliance Agreement for the commercial deployment and licensing of Hazer’s proprietary methane pyrolysis technology

- KBR will be Hazer’s exclusive global partner for the marketing, licensing and deployment of Hazer technology to customers in the ammonia and methanol markets. KBR and Hazer will also work closely to pursue licensing opportunities in decarbonizing hydrogen markets beyond these exclusive markets

- The initial term of the Alliance is six (6) years with an option to extend subject to the achievement of performance metrics

- Agreed to collaborate on the development of a design package for Hazer facilities targeting hydrogen capacities of 50,000+ tonne per annum as well as the global sales, marketing and licensing of Hazer’s technology. Hazer will be KBR’s exclusive methane pyrolysis technology provider.

- The total cost of the Alliance work program is anticipated to be in the range A$3.0-5.0 million of which KBR will contribute approximately A$3.0 million over the work program period. The Alliance is underpinned by performance objectives with a target of securing multiple firm licensing opportunities during the initial term

- An incentive structure applies in the event KBR secures a license for the first commercial unit secured within three years

- Hazer retains full ownership of its existing intellectual property

The Disruption Opportunity with KBR

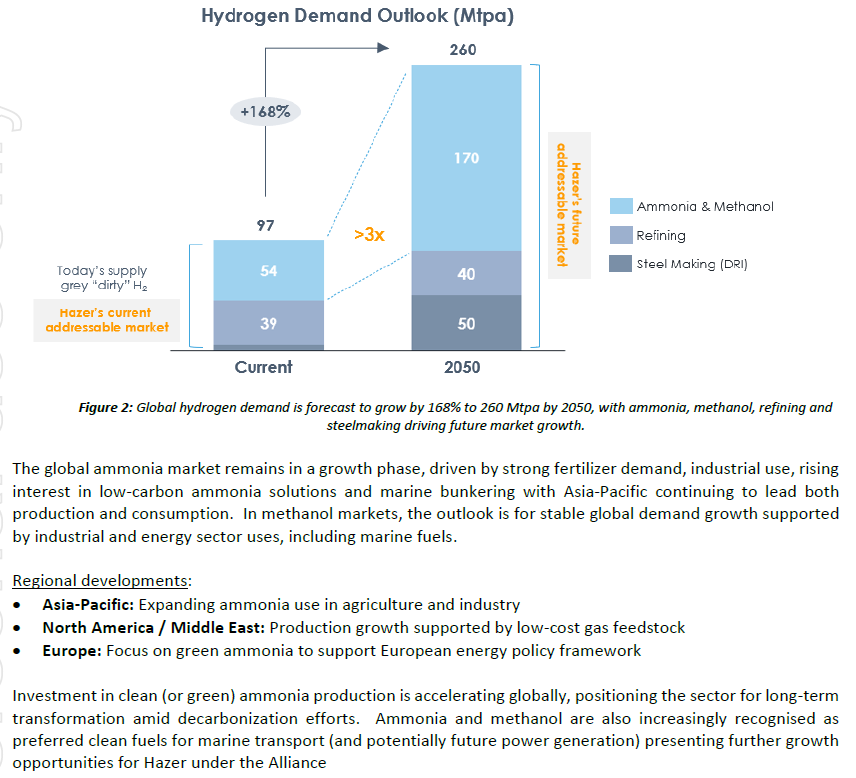

- Hydrogen is critical to ammonia and methanol production, representing over 50% of global hydrogen demand (~54 million tonnes per annum) with the two markets having a combined value of US$120 billion. Current production process used to supply hydrogen to these markets is extremely CO2 intensive, responsible for over 500 million tonnes of CO2 emissions per annum globally

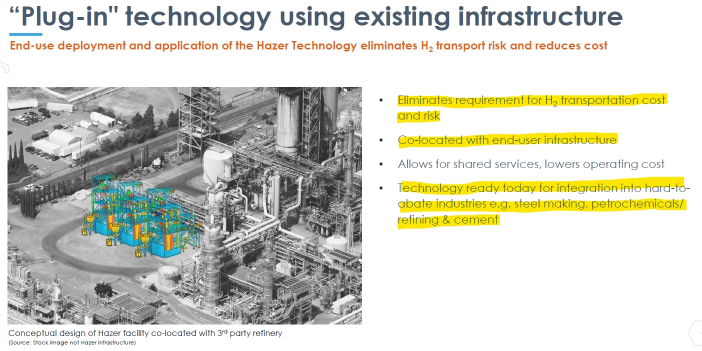

- Under the Alliance, Hazer’s technology will deliver clean and affordable hydrogen supply as the critical feedstock for the ammonia and methanol industries.With KBR’s market leaderhip, the Alliance enables the Hazer process to be positioned as a “bolt-on” low emmissions alternative for both existing brownfields and new greenfield deployments across a large global market.

- Ammonia and methanol are also increasingly recognised as preferred clean fuels for marine transport (and potentially future power generation) presenting further growth opportunities for Hazer under the Alliance

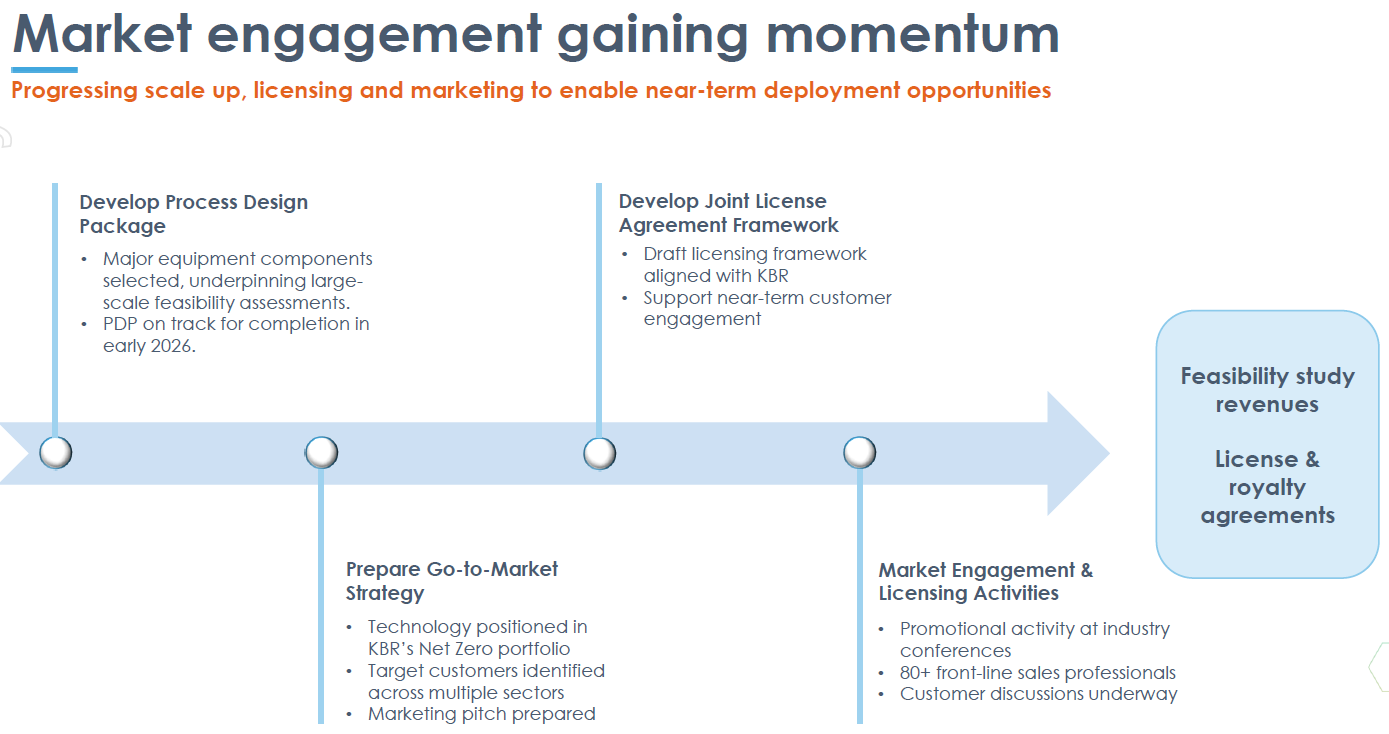

Extract from 15 Oct 2025 Update

KBR Slides from 22 Oct 2025 Microcap Investment Conference

Summary of Progress Update 15 October 2025

10 JUNE 2025: PARTNERSHIP WITH PARTICULATE SOLID REASEARCH INC (PSRI)

- Collaboration accelerate the scale-up of Hazer’s commercial reactor technology.This partnership enables Hazer to leverage PSRI’s world-class expertise in fluidisation fundamentals and process scale-up, further strengthening the pathway to large- scale commercial deployment of its breakthrough technology.

- Hazer’s use of fluid bed reactors is one of its primary competitive advantages

- This partnership with PSRI complements Hazer’s strategic alliance with KBR and enables Hazer to fast-track the development and optimisation of reactor design and integration into these commercial scale applciations.

Discl: Held IRL 0.73% and in SM

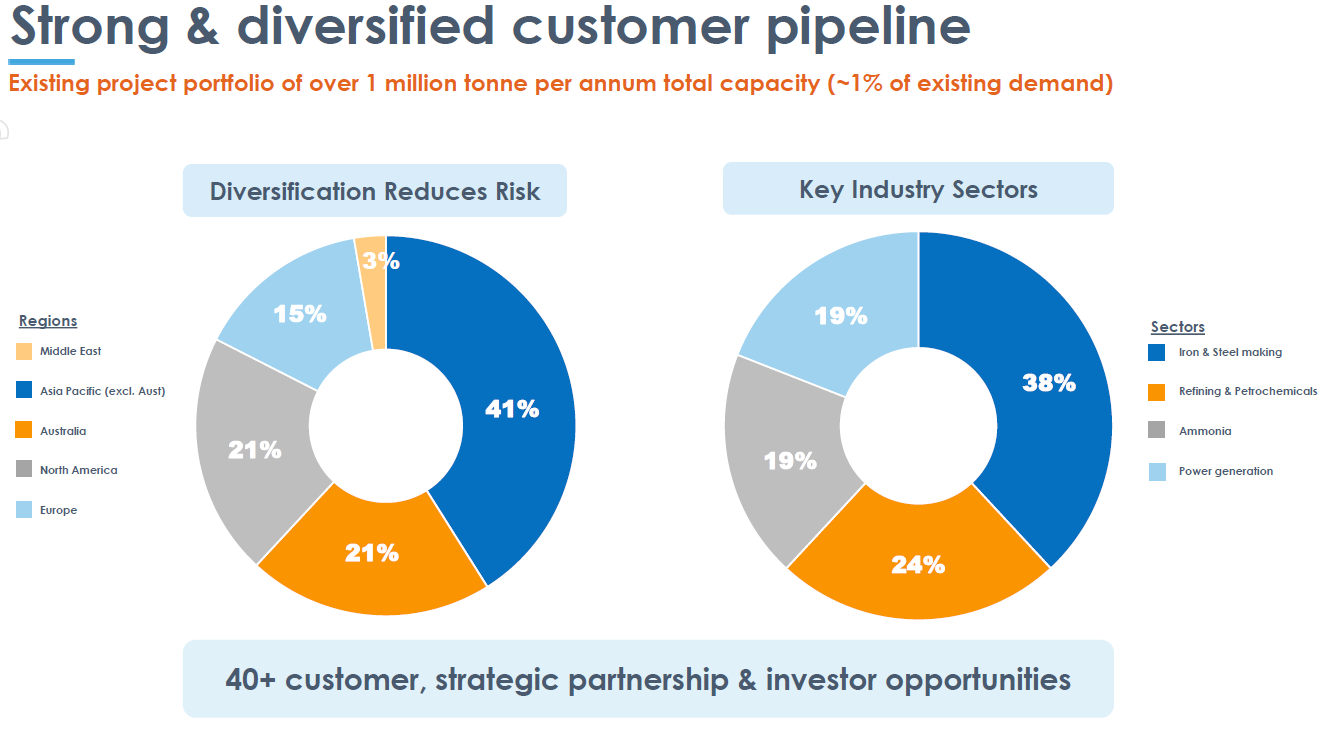

Worked through each of the customer-related Memorandum of Understandings as far back as I could to get a more detailed feel of how it all comes together. There is a lot of detail in each announcement - have summarised the customer projects/MOU’s in the table below.

I am gaining increasing conviction of (1) the technology - it is here and real (2) the opportunities currently on the go and how they are progressing and (3) how the various pieces come together - technology, business model, expertise, graphite.

Will peel HZR’s technology partner agreements next - Kellog Brown Root is a big one, and then PSRI.

HZR'S MARKETS

1. Hydrogen Production Market

2. Graphite Market

Improves the economics of the HZR technology amidst (1) critical Tier-1 need for energy transition (2) China dominates supply and tightening export processing technology and IP (3) HZR is a local, high purity, low emissions alternative.

Graphite is a key component in lithium-ion batteries, electric vehicles, renewable energy storage systems and numerous industrial applications

The Hazer process produces high-purity graphite with unique product characteristics well suited to advanced applications, steel making, cement and asphalt, PFAS remediation and thermal energy storage

3. Sales Pipeline

Very strong global pipeline, with large amounts of potential hydrogen production capacities.

Asia is one of the world’s largest hydrogen markets with regional demand in 2024 of approximately 40M tonnes per annum - almost 40% of the global hydrogen market and growing steadily at around 4$ annually

CUSTOMERS AND PROJECTS CURRENTLY ON THE GO

Worked through each of the customer-related Memorandum of Understandings as far back as I could to get a more detailed feel of how it all comes together. There is a lot of detail in each announcement - have summarised the customer projects/MOU’s in the table below.

I am gaining increasing conviction of (1) the technology - it is here and real (2) the opportunities currently on the go and how they are progressing and (3) how the various pieces come together - technology, business model, expertise, graphite.

Will peel HZR’s technology partner agreements next - Kellog Brown Root is a big one, and then PSRI.

KEY TAKEAWAYS

- Very insightful to see the sorts of hydrogen and graphite production collaborations/MOU’s that HZR has signed up to and are working on

- There is good, steady and positive progress across all projects other than Engie - need to check why that seems to have fallen off the radar.

- The Fortis BC project is particularly exciting in terms of (1) size, 25x that of HZR’s Commercial Demonstration Plant in WA (2) where it is at - successful completion of Commercial Reactor Test Program (3) The British Columbia government support (4) receipt of first revenues and (5) the potential licensing commercial terms during production which could be on a sliding scale model based on size of the facility, production of hydrogen and graphite and other relevant factors

- Each commercial agreement executed in a producing Hydrogen facility is likely to be a step up in long-term recurring revenue - this is very exciting in terms of future revenue stream possibilities - this revenue will grow as the producing plant scales eg. Chubu Electric

- Good to see how the various pieces have come together in the MOU’s/Projects - (1) the role of the Commercial Demonstration Plant in proving the concept (2) the application of the Hazer technology in a real-life site/environment (3) the role of Hazer Graphite in significantly improving the production economics (4) the various MOU’s to commercialise Hazer Graphite, offtake opportunities etc

- Sales Pipeline looks extensive and makes sense in terms of where HZR is targeting the use of the Hazer technology

KEY RISKS THUS FAR

- Very long gestation period from start of concept/feasibility to a producing plant

- There is no deal until there is a deal - this is an ongoing risk, but appears to be well mitigated with steady progress, robust technology and economics, and good technical capability partnerships, but this is still the biggest risk

Customer Projects/MOU's Signed

May not be complete but gives a good idea of the sort of MOUs and capacities being investigated. This was what I could find in the announcements.

Discl: Held IRL 0.67% and in SM

Part 1 of a few parts as I deep dived on HZR.

SUMMARY

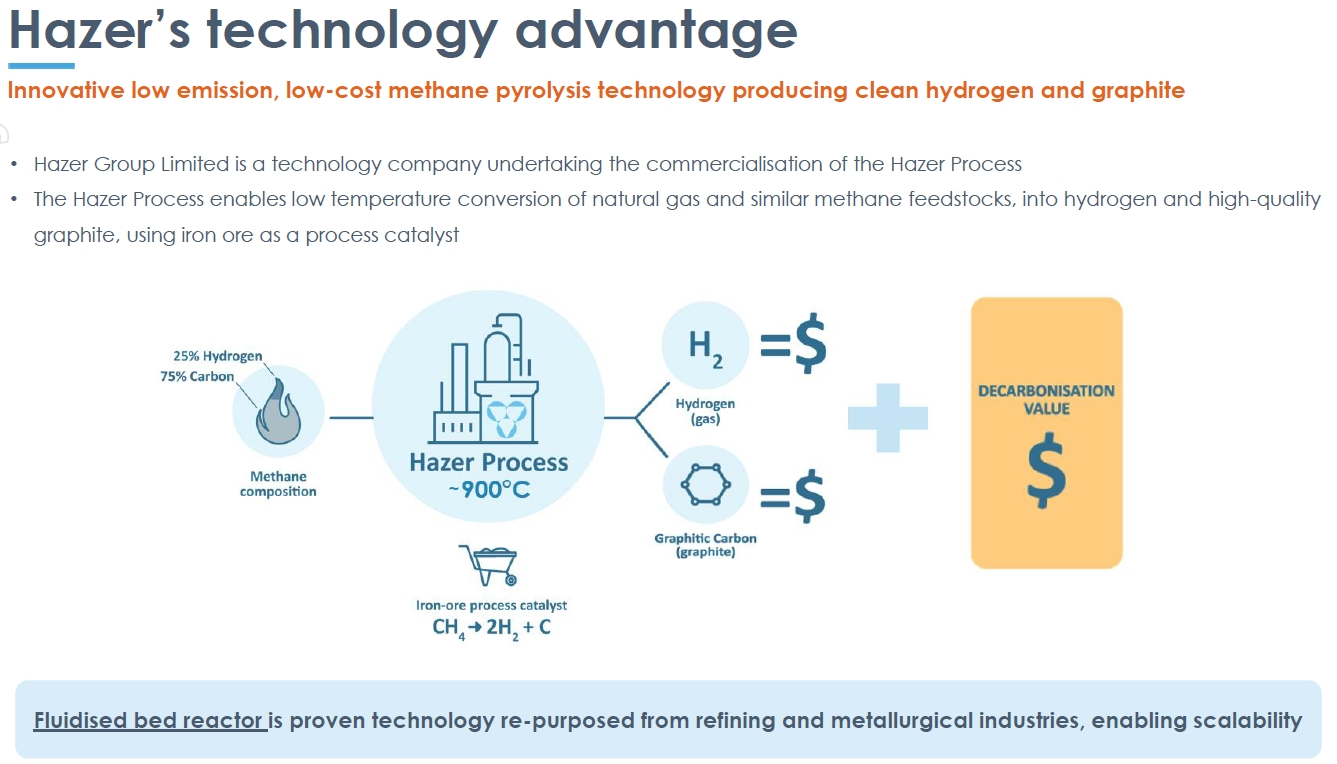

HZR owns the IP to the Hazer Process and is developing and commercialising this technology

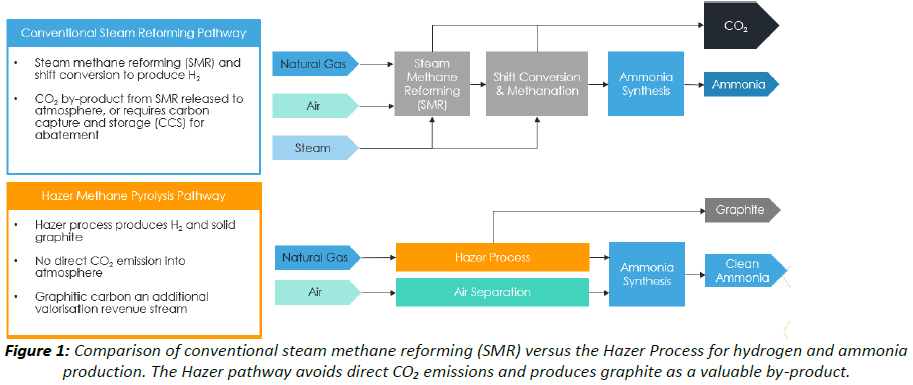

The Hazer process is a low-emission method for producing hydrogen and graphite from natural gas or biogas. It uses a low-cost iron ore catalyst to crack methane into hydrogen gas and solid, high-quality graphite. This process offers a cleaner alternative to traditional hydrogen production by capturing the carbon as a valuable solid product instead of releasing it as carbon dioxide.

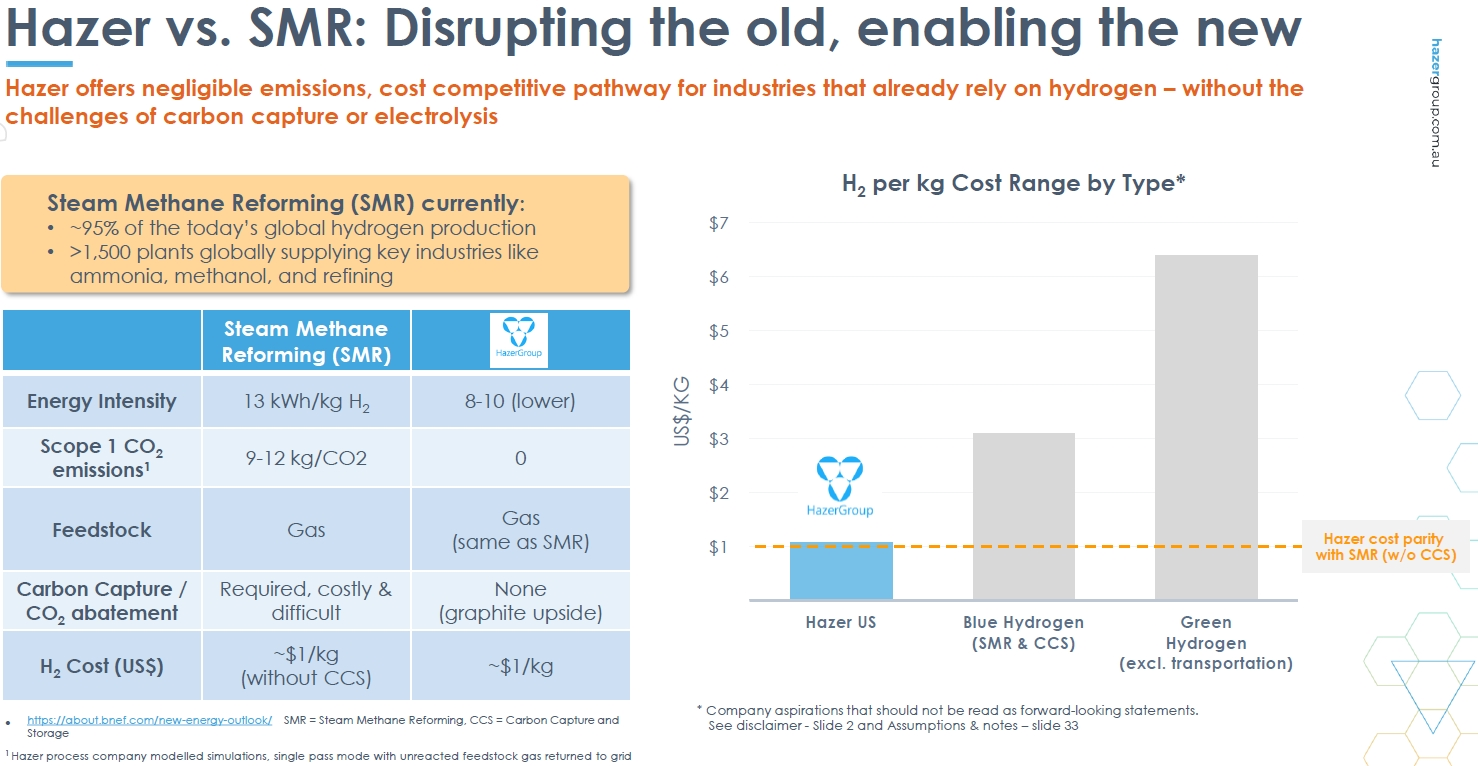

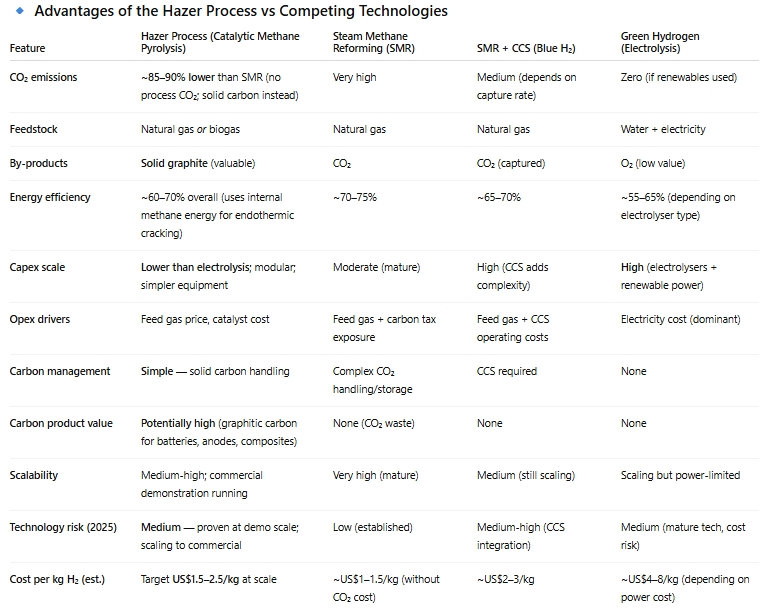

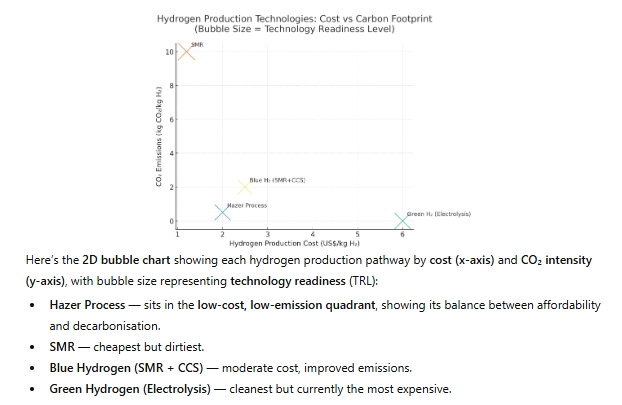

There are significant benefits to the Hazer Process vs the current dominant Steam Methane Reforming (SMR) method of producing hydrogen - zero carbon emission, low energy requirement, no requirement for carbon capture storage, valuable carbon graphite co-product which can be monetised

The Hazer Process is categorised as a “methane pyrolysis” method of producing hydrogen

Other companies have developed variations of the methane pyrolysis method, but the Hazer process is differentiated by the following advantages: (1) the use of Iron Ore as a catalyst (2) creates high quality Graphite Carbon as a co-product (3) avoids need for carbon capture storage (4) low electricity cost

The choice of which methane pyrolysis methods for a given plant/site will depend on several factors, including (1) energy source & footprint (2) scale & deployment model (3) carbon product quality

The focus in the past few years has been to build the Commercial Demonstration Plant (CDP) in Munster, WA, which has been fully operational since Nov 2024 - this was a key milestone to demonstrate the commercial readiness of the Hazer Process technology

WHAT IS ATTRACTIVE

The Hazer process has huge technology advantages over current methods of producing hydrogen, including other alternative methane-pyrolysis approaches

Hard yards to scale up and prove the Hazer process has already been done - the technology appears to be ready for scale-up and commercialisation

This is feeling very much like C79, minus the Capex spend on the Photon Assay machines - the Hazer technology is set to disrupt the current dirty method of producing hydrogen by offering a more efficient and clean approach, with the economic benefit of high quality carbon graphite as a co-product which can be monetised

A. BUSINESS MODEL

Has IP rights to a technology developed a The University of Western Australia which allows the production of hydrogen gas from methane (natural gas) with negligible carbon dioxide emissions and the co-production of a high purity graphite product (the “Hazer Process”)

Business model is focused on scaling-up and commercialising the Hazer Process so as to supply hydrogen gas and high purity bulk graphite to the significant global hydrogen and graphite markets.

B. HAZER’S MISSION

Our mission is to play a significant role across three multi-billion dollar global markets. Hazer Group’s technology can potentially provide an innovative solution for the global industrial hydrogen market, by producing hydrogen at lower cost than alternative options, while also reducing users’ CO2 footprint.

The low-emissions associated with the HAZER Process also potentially provides a gateway for hydrogen to more effectively penetrate the sustainable energy market for both vehicle fuel and stationary power applications. Hazer is also looking to provide high quality synthetic graphite for energy storage and other large global graphite applications.

C. THE HAZER PROCESS

The Hazer process is a low-emission method for producing hydrogen and graphite from natural gas or biogas.

It uses a low-cost iron ore catalyst to crack methane into hydrogen gas and solid, high-quality graphite.

This process offers a cleaner alternative to traditional hydrogen production by capturing the carbon as a valuable solid product instead of releasing it as carbon dioxide.

HAZER’S DISRUPTIVE ADVANTAGE - METHANE PYROLYSIS METHOD vs INCUMBENT SMR TECHNOLOGY

The Methane Pyrolysis technology method has very clear economic benefits over the current Steam Methane Reforming (SMR) method BUT HZR is not the only company with technology in the Methane Pyrolysis space.

Discl: Held IRL 0.67% and in SM.

Continuing with Part 2, focusing on the competitive landscape and Tech Readiness for Commercialisation

COMPETITORS WITH METHANE PYROLYSIS TECHNOLOGY

Methane pyrolysis requires approximately half the amount of energy required by steam reforming to produce the same amount of hydrogen. Finally, the solid carbon byproduct can be sold as carbon black, offsetting the cost of hydrogen produced. Together, these factors make methane pyrolysis a promising technology option to produce low-carbon hydrogen.

Methane pyrolysis takes different forms, and they can be categorized as plasma, catalytic, and thermal

In methane pyrolysis, all the carbon content in the methane is captured in solid form rather than emitted as carbon dioxide

About 44% of methane pyrolysis technology developers are based in the U.S. or Canada, where the feedstock price is cheaper than in Europe and Asia. The attitude toward repurposing existing assets in North America is also more favorable than in other regions, considering that the only operational commercial methane pyrolysis facility is located in the U.S., and the second one is being planned in Canada.

Practical implications — why the methods matter to buyers / project owners

Carbon product quality drives value: Hazer emphasises graphitic carbon (battery anodes / high-value applications). If a competitor produces amorphous carbon black, the co-product value and markets differ. That affects project economics.

Energy source & footprint: Plasma approaches are electricity-intensive (cost + grid emissions matter); microwave and molten-media concepts claim efficiency advantages — Hazer claims lower electricity intensity by leveraging catalytic chemistry and heat integration. Buyers compare energy cost per kg H₂ and grid carbon intensity.

Scale & deployment model: Some firms aim distributed, point-of-use hydrogen (microwave, Aurora), others aim industrial replacement markets (Monolith carbon black), and Hazer targets licensable commercial modules with graphite offtake economics. Choice depends on the customer (industrial vs mobility vs battery material players).

PATENT PROTECTION

- HZR has 70+ IP patents in its IP portfolio in different countries to protect its ownership of the IP

- Full list is maintained at Patents List

TECHNOLOGY READINESS FOR COMMERCIALISATION

Extract from: https://research.csiro.au/hyresource/hazer-commercial-demonstration-plant/

- Focus in the past 3-4 years has been to build and develop the Commercial Demonstration Plant (CDP) to demonstrate the readiness of the technology in a real-life plant environment - located in Munster, WA

- The CDP has been operational since Nov 2024

- Virtual Tour of the Commercial Demonstration Plant:

Discl: Held IRL and Pending in SM

I like it when I gain immediate conviction on analysing a new company. And so it is with HZR this morning.

I will deep dive in the next 1-2 days, but I read the Q1FY26 Preso released this morning, had a look at what the Hazer technology is and does, and pulled the position open trigger 10 minutes into the webinar at $0.52. More detail to follow.

High-Level Position Opening Thesis

- Technology is affordable, scalable and available now - ready to disrupt, after 17 years of developing the technology into an advanced state - $130m development capex cost is now in the past

- IP Owner, licensing model, so capital light

- Global alliance with KBR - big engineering tick to advance commercial scale-up and go-to-market strategy

- End Products of the Hazer Process - Clean Hydrogen and Graphite - huge market demand for both products. Market is aligning to the Hazer technology benefits and technology availability

- Graphite Market dominated by China (80% of processing and supply) - tightened export controls - HZR offers a local, high purity, low emmissions altenative - this is a significant differentiator from other clean hydrogen processes, geo-political developments mean planets are aligning for Graphite

- Global sales pipeline looks impressive - management is focused on "quality over quantity"

- Financials are growing nicely - $20m of funding available, low operating cost base with a focus on continued cost discipline

CHART

The HZR price is in a nice support resistance zone of $0.51 to $0.555. It feels like this is a fair price and entry point given the technology de-risking that has occurred in the past year, and the potential commercial scale up that occurs from here.

Immediate downside support is $0.45 - if my deep dive confirms this initial feel, will be topping up, up to these levels. Given where the company is at the moment, the technology de-risking, the opportunities, this feels like a very defendable floor.

Post a valuation or endorse another member's valuation.