Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Austco provided a short update on the first quarter of the year. The update was light on details, with no mention of profit or cashflow numbers.

This could be interpreted negatively, but I’m not certain that’s what this means. I think it's more likely that they are using their privilege to not have to report these.

Whilst microcap Jesus gave them some grief on Twitter for reporting the order book in a very selective way which I agree with, it feels like the market is missing that growth with acquisitions is coming in at 90%.

If we use the same profit margin as last year, which was actually quite high at 13%, my back of the napkin math is that they may end the year on a PE of around 8-10.

If the organic growth can be maintained at 15%, then the fair PE should be somewhere around 15. This implies fair value on the stock somewhere around $0.45.

Good update and broadly in line with the assumptions in my valuation (so don't feel the need to update it for now).

Market seems to like it - up 6% on reasonable volumes (for Austco shares at least).

DISC: Held (SM and IRL) and continuing to add to (IRL)

Austco released its full year results announcing Revenue of 58.2m, NPAT of 7.1m (tax offset by the last of its loses) and an order back log of 50m.

Is a re-rating on the cards?

https://austcohealthcare.com/wp-content/uploads/2024/08/29AUG24_media-release.pdf

Another milestone win Austco Healthcare Ltd Secures $5.0m Contract to Supply New Surrey

Austco Healthcare Ltd Secures $5.0m Contract to Supply New Surrey

Hospital with Industry-Leading Tacera System

• Agreement to supply Austco’s advanced Tacera alarm management and

clinical workflow solution

• Construction commenced, expected completion in 2029

• Contract win boosts Austco Healthcare Group’s contracted orders to a

record $46.2m

Austco Healthcare Limited's (ASX: AHC) subsidiary, Austco Marketing & Service (Canada), has

secured an AUD $5.0M contract to provide its industry-leading Tacera alarm management and clinical

workflow solution for the new Surrey Hospital in Vancouver, British Columbia.

The new Surrey Hospital will feature over 650 beds, including 48 Intensive Care Unit (ICU) beds and

25 Neonatal Intensive Care Unit (NICU) beds. It will also house a new emergency department, the

second largest in Canada, with specialized care areas for children, mental health patients, and those

with less urgent needs. This facility will significantly enhance access to critical healthcare services for

the residents of Surrey and the surrounding areas.

This high-profile project will include Austco Healthcare’s most advanced alarm management and

clinical workflow solution, featuring over 513 full IP patient stations, 559 clinical workflow terminals,

and Webservices interfaces for seamless systems integration. Critical messages, including medical

emergency notifications, will be delivered to application stations installed throughout the facility,

ensuring staff are promptly notified and can act quickly. Two-way audio will connect patients to

healthcare personnel in real-time, improving workflow, driving efficiencies, and reducing risk.

The new Surrey Hospital will become a landmark healthcare facility designed to meet the growing

healthcare needs of Surrey's rapidly expanding population. It will provide state-of-the-art medical

services and enhance access to high-quality care.

"This contract is a significant milestone for Austco Healthcare and underscores the importance of the

Company’s investment in developing advanced clinical healthcare solutions for modern healthcare.

Our Tacera system will enhance patient care by ensuring timely communication and efficient workflow

management. We are excited to collaborate with the New Surrey Hospital to deliver technology that

supports their commitment to exceptional patient care," said Clayton Astles, CEO of Austco

Healthcare.

Construction of the new hospital has commenced, with revenue recognition expected to begin in

FY25.

This announcement has been approved for release by the Board of Austco.

ASX Trading Update – Financial Year ended 30 June 2024

Following Austco Healthcare Limited’s (ASX: AHC) third quarter trading update of 17 April 2024, Austco

Healthcare is pleased to provide a further trading update for the full financial year ended 30 June 2024.

On an unaudited basis Austco Healthcare expects full year FY24:

• Revenue to be approximately $58m which is a 38% increase on FY23 revenue of $42m; and

• EBITDA is expected to be in the range of $7.5m to $8.0m, being an increase of between 108% and

122% on FY23 EBITDA of $3.6m.

The Full Year audited results (Appendix 4E) are expected to be released on or before 29 August 2024.

APPROVED RELEASE BY THE BOARD.

All important for small caps.

Share count @ June 2020: 284 188 951

Share count @ December 2023: 290 790 167

Share count growth: 0.8% pa.

What do they do?

Ausco develop software and hardware relating to healthcare communications systems, primarily nurse call and real time patient tracking systems, as well as re-sell and market complimentary systems.

They are also Systems integrators (nurse call and PTS installation contractors), through acquisitions, giving them sales channels into various geographic markets. It has achieved this primarily through acquisition, and is part of a strategy to enhance their direct sales channels in Australia, where systems integrators tend to have the customer relationships.

Financials

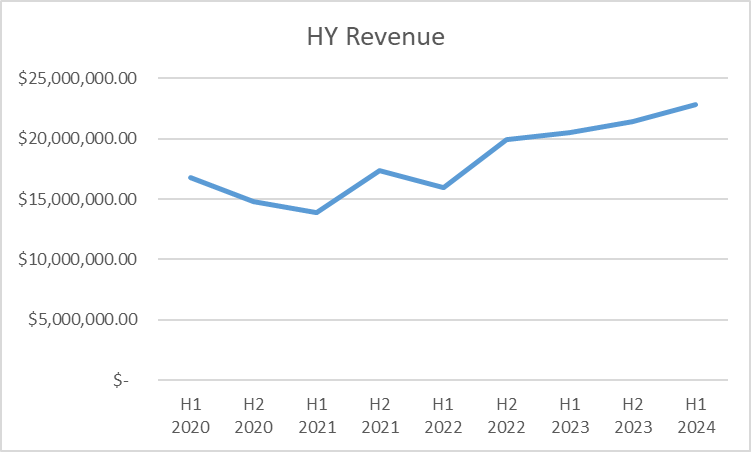

The business experienced significant disruption throughout FY 2021 due to COVID-19. Since then, revenue CAGR is 18%

Gross margins have remained relatively flat over the past 3 years at around 52%.

Profit margins have been in the range of 2-7%, noting the business has been profitable over the past 3 years.

Since H1 2022, software and software services revenue CAGR is 28% over the past 2 years, and is now 21% of total revenue. AHC has been developing its Nurse call and clinical comms platform Tacera,

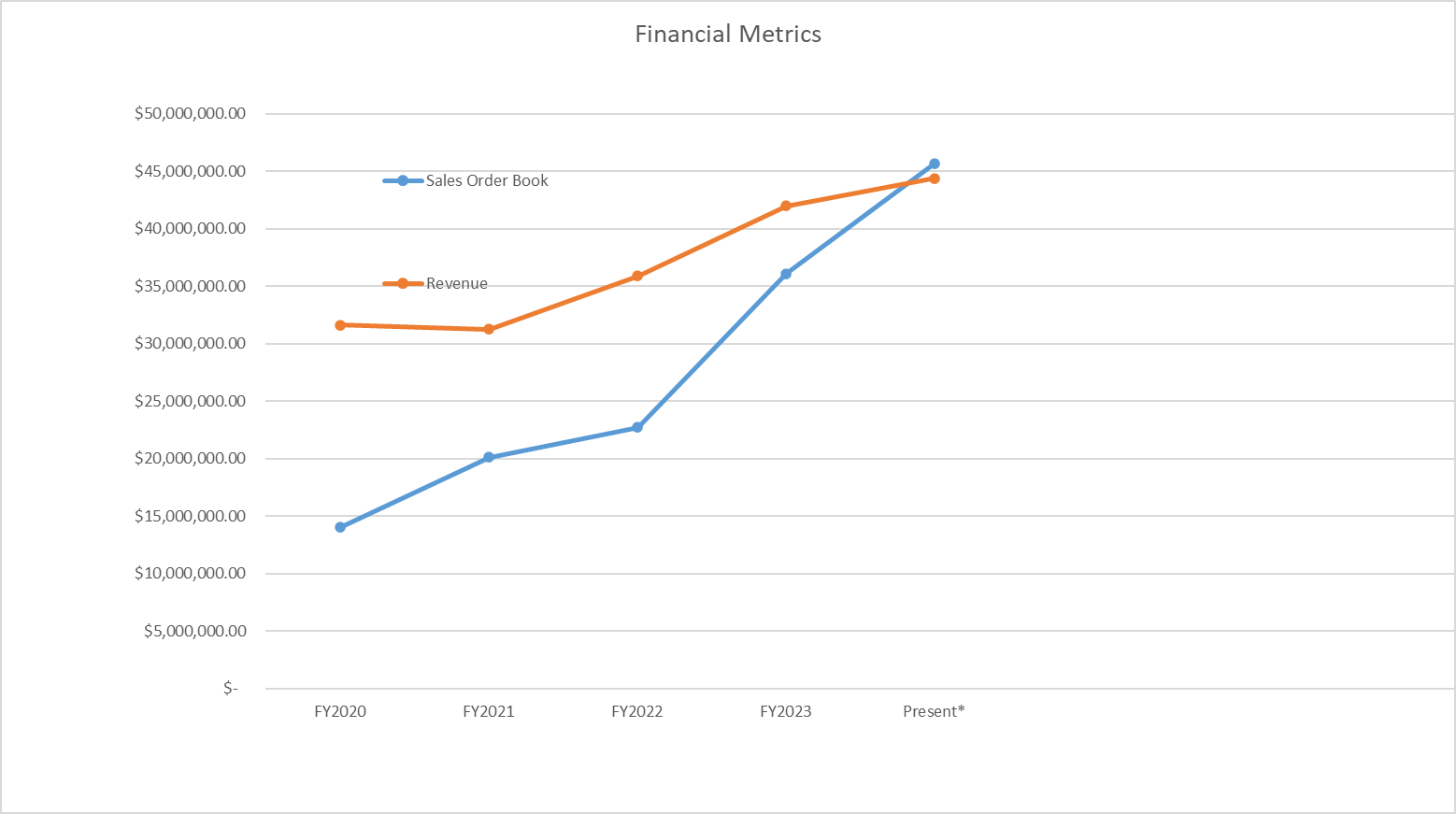

Sales Pipeline: Sales pipeline has more than doubled to $44.4 million over the past 12 months, leading into H2. AHC revenue streams are seasonal, with H2 traditionally being the stronger half. The sales pipeline has benefited from the following recent acquisitions:

- Acquired Amentco (Integrator) for $10.6M (3.5 x 2023 EBITDA) - Feb. 2024

- Acquired Tecknocorp acquisition for $2.6M plus earnout (3.5 x EBITDA) - Sep. 2023.

- Present revenue value is annualising H1 revenue.

Share Price Performance

Share price has been in an upward trend since early 2019.

Valuation

Austco Healthcare Ltd is trading on a trailing PER of 24.5. However, given the strong pipeline into a seasonally stronger H2, I would estimate the forward PER is around 20, which appears to be reasonable value, assuming it can continue to grow at around 10-15% pa.

Ownership

The largest owners are:

- Former CEO / Founder: Robert Grey (19.2%)

- Aust. Ethical Investments (17.8%)

- Asia Pacific Holdings (18.1%)

The board is a lean one, with just 4 members

MD, Clayton Astles owns 1.1% of the company, and Brendan Maher (CFO) 0.85% . Other directors holdings of around $100-200k each.

AHC has some solid institutional investors, with reasonable inside ownership

Management Incentives

Short term incentives are based on pre-defined profitability, gross margins, and revenue financial targets. Non-financial are product development, process improvements, and Leadership and team contribution.

Summary

AHC strategy of rolling up integrators and re-sellers in Australia at about 3.5x EBITDA will juice revenue and hopefully profits over the next few years. The call option is it the re-sellers / integrators enable AHC to get their sticky Tacera platform on sites around the country. Once these systems are in, they are difficult to replace.

Presently, sales orders are exceeding the H1 2024 revenue run rate, indicating a strong H2 is ahead of us.

DISC - HELD

Austco Healthcare Awarded National Purchasing Agreement with Premier

Austco Healthcare Limited's (ASX: AHC) subsidiary, Austco Marketing & Service (USA), has

been awarded a National Group Purchasing Agreement for Nurse Call with Premier, Inc. The

new agreement allows Premier members, at their discretion, to take advantage of special

pricing and terms pre-negotiated by Premier. Premier is a leading healthcare improvement

company, uniting an alliance of approximately 4,400 U.S. hospitals and 250,000 other

healthcare providers.

Whilst this agreement does not guarantee immediate revenue, it is an important step in

promoting the Austco brand as a leading Nurse Call provider in the US and provides

immediate reach to the alliance of hospitals and healthcare providers.

"We are honored to be awarded this National Group Purchasing Agreement with Premier,

Inc. The agreement underpins Austco’s reputation for delivering innovative, high-quality

clinical communication solutions to healthcare providers nationwide. We’re excited to offer

Premier members access to our industry-leading technology designed to enhance patient

care and streamline operational efficiency," said Clayton Astles, CEO of Austco Healthcare

Nice, company continues to deliver.

Further acquistion should add to bottom line if costs can remain low.

Austco puts out out their hand for a capital raise

Bell Potter are the underwriters.

Bell Potter also did the raise for Clarity Pharmaceuticals and only 33% took the offer.

I think this could head the same way. Extra 15m shares for retail OR Bell Potter has to buy up to 10m shares (going by the 33% using Clarity and an example) if retail do not take the offer.

I know comparing Clarity Pharmaceuticals and Austco is not an apples to apples comparison but I'm making the point that that retail right now doesn't have the stomach to tip money into the begging bowl unless there is very clear upside and synergies.

Sold on the pop on the morning

[not held].

Found a bear case while scrolling through my feed

Tauranga Investments - Feb 2024 update

It is a bit old as it was published before the Q3 update but does highlight the challenges faced by AHC one being less cash as a result of acquisitions, revenue growth versus software costs and now the trading halt pending capital raise.

[held]

@LifeCapital and @BendigoInvesto covered this, so I won't back over what they've written. Except to say that I was scratching my head at this result. The numbers just looked too good, and I couldn't get them anywhere near to adding up until I re-read almost to the bottom of their trading update:

Talk about burying the lead - a 5.6% increase in GM is huge! Much higher than anything they've done for at least 10 years. What is that? Is that Technocorp? I'd thought of Technocorp as strategically important, but of lower quality than the existing business. That isn't borne out by the numbers though:

So Teknocorp appears to be holding its own and then some. But the underlying business appears to have had a standout quarter as well. While I thought the 1H numbers were fair-to-good, I had expected a lot more given the growth in order book and commentary around impacts of COVID impacts easing. Q3 appears to have made up for that.

It's just as dangerous to extrapolate a good quarter as it is a bad one, but I'll do it anyway cause I'm a slow learner. Although they disclose NPAT, I'll focus on EBITDA because their tax is all over the shop. They are run-rating at almost $10 million EBITDA, which is an EV/EBITDA ratio under 6. Add a record order book and I'm a happy holder.

I’ve only looked at the results quickly from being tied down with work, but I make it that the TLDR on Austco’s results is that they are mixed with growth that is yet again to come ‘in the near future’.

It’s not like they’re making this up because the continued and impressive growth of the order book supports this (up $5M to $44M total since reported at the AGM). But still, I’m a little surprised given I thought management had hinted they would start to chip away at the order book.

Perhaps someone that’s more properly read could shed a little more light and offer their opinion. Certainly nothing worrying here with top line of 11%, but thought we might get more, especially considering recent acquisitions (although I admit I reckon they would have only just been integrated and barely had time to add).

Austco has announced a $3.8 million contract win across two hospitals in Singapore.

They have also announced this has taken their order book to $40.7 million, up from the $38.7 million announced at the AGM last month. They've been on a bit of tear this year having more than doubled the order book since February this year.

Zooming out a bit the order book has been steadily rising since late 2019, apart from some COVID and supply chain impacts through 2022 and early 2023.

Nice to see at least one of my holdings kicking ass and taking names. I still think it flies under the radar a bit considering its history of profitable, non-dilutive growth. @Strawman have we spoken with Clayton?

Austco has come out with a roadshow presentation today, with lots of funky graphs and "buy me" arguments. Not a lot new, although they did disclose sales orders were up again from last month's record high to $37.2m - so they're filling the funnel faster than they can drain it. (Ignore the 'Revenue from customers' tag - revenue it ain't).

Austco is one of my more comfortable holdings. They disclose often enough to make you feel wanted, without getting all over-promotional. When they make investments in product or people they set realistic expectations about how long it will take to get a payback from the investment. They certainly appear to be in that zone of getting a return of previous investment right now though.

If I were being hyper-critical I'd say the CEO is very well compensated for a company of this size. However, Clayton appears to be getting the job done so I'll not quibble while that remains the case. It's arguably not a screaming bargain but if they keep growing at the rate they are it will look cheap soon enough. Happy to hold.

If I have a pet hate - and I have many! - it's when a company describes an acquisition as earnings per share accretive when they're paying largely cash in the deal. As long as there are earnings how could it be anything but EPS accretive? Anyway, Austco are doing an EPS accretive deal for Melbourne-based Healthcare reseller Teknocorp.

Including likely earnouts they will pay $3.85m to purchase $9m in revenue and $1.1m in EBITDA. The EBITDA multiple of 3.5x seems reasonable even in these austere markets, although they're to some extent cannibalizing their own sales given that a significant but undisclosed proportion of Teknocorp's sales are Austco products. Also a reseller is inevitably going to have a lower quality people-based business model, relative to Austco's proprietary hardware/software model, and so should justify a lower multiple.

In addition to Austco, Teknocorp also partners with Avigalon, Gallagher, inner range and IndigoVision. The rationale would appear to be gaining a greater proportion of the reseller's sales and acquiring a direct sales capacity in Australia. Other regions in which Austco operates already have this capacity.

The deal is expected to complete in early Q1 FY24.

[Held]

Bull Case:

- $7m in cash and no debt

- Strong product offering: They seem to know their market, so have a good level of optionalty while also not trying to be "all things to all people" and as such watering down their core competency.

- Strong sales momentum coming out of Covid and catching up on the backlog of sales orders

- Great gross margins (for software plus hardware business) of 50+%

Things to watch:

- Continued sales momentum - increasing revenue and sales orders

- Software and SMA revenues as a % of revenue - ideally I'd like this to increase, but ultimately as long as the gross margins stay high it is not that important. It would be nice if they started reporting on actual recurring revenue as well.

Pop in share price after AGM update

Would have been good if they had a slide that tracks their progress against competitors. Otherwise lots of content to take away and digest.

Still have watch position

[held]

Maybe I'm a bit picky but biggest concern is the lack of shares traded on AHC. Trading of shares seems very illiquid and is difficult to get a sense of what the market thinks about this company.

Another concern is there are other bigger players competing for the same pie including Phillips.

Despite this, I took a small starter after reading some of the previous straws by Noddy74 and Wini (must have taken weeks to finally get some shares), but then bumped my partial fill back down a bit while I do more research into the competitive landscape. Not keen on making a full position yet.

[held]

Austco snuck in a price sensitive investor presentation this morning, which was an interesting decision given they released results less than two weeks ago (sans presentation). It came two days after a competitor, Hills Limited (HIL.ASX) announced they had been successful in bidding for the New Footscray Hospital tender in Melbourne. I'm not saying it was because of that. I'll leave that to others.

Largely it replicated what they they had already released with some swanky graphics added. It did give a little more detail about the growth investment being made in each region. One nice little new tidbit it shared was an increase in the order book to a record $24.7m. That's $2m higher than they had disclosed at the end of August and is probably what justified it being price sensitive.

[Held]

The latest investor preso (see here) warns shareholders of supply chain issues -- increased raw materials and transport costs, semiconductor shortages -- and says that management expect these pressure to last for the remainder of FY22, and possibly beyond.

This will impact margins, and has prompted the company to build up inventory. The business will also be investing in added sales resources. With $7m in cash, they are also on the lookout for acquisitions, particularly in Europe and the US.

Will be interesting to see how sustained these supply chain issues are, and whether there is much capacity to increases prices (i suspect not)

I think there's good scope for sales growth as they prosecute their record order book, but with ongoing investment and added costs it'll make profit growth more difficult.

Not a great deal of insight provided in terms of FY22 trading or outlook. Main takeaways for me were:

- increase in open order book to $22.9m (from $20.1m at Jun 2021)

- Biggest risk being supply change shortages, particularly semi-conductors

Austco copped a first strike against their remuneration report in FY20 but this was passed comfortably this time around. The re-election of director Brett Burns was the most contentious with 22.69% voting against. Claude Walker chipped in with a question to Brett Burns to detail one opportunity and one risk to the business. To his credit he did answer it, although I wouldn't say I was left any more enlightened about Austco after doing so. Given the stage the business is at and the stated strategic direction of the business I think an acquisition in FY22 is probable.

[Held]

Austco has won a $3.3m contract to supply its Tacera Nurse call platform to Khoo Teck Puat Hospital -- a 795 bed hospital in Singapore (as a side note, Singapore has one of the worlds leading healthcare systems. Certainly in the top 5 globally).

ASX announcement here

The deal is a significant one, representing ~10% of last years total revenue.

Further, the hospital belongs to the Yishun Health Network -- and it is Yishun that the contract is with. This network encompases many other healthcrae institutions in Singapore, so although it wasnt mentioned, I assume there's potential for the contract to be extended to other facilities if all goes well.

Post a valuation or endorse another member's valuation.