Been doing some more thinking

I have invested a small-moderate amount in ART (see previous posts for my investment case)

The thing that is stopping me putting more in is simple:

FEES

ART charges fees to both sides of the transaction. The "tasker" (ie person doing the job) gets charged a "service fee" of 20% (although this can reduce for taskers who do a LOT of jobs and have good feedback, see below). There is also a "connection fee" paid by the customer of 15.95%, minimum $4.95, maximum $49.45.

So for a typical $250 job, the tasker will pay a $50 fee and the customer will also pay a connection fee of $40. The customer pays $290, the tasker gets $200 and ART gets $90.

To be fair, there are tiers for the service fee. But the requirements are pretty onerous. To get Silver tier you need to have earned over $880 on the platform in the past 30 days, PLUS have "okay" completion in your past 20 tasks. For that, you get to pay "only" 18.5%, instead of 20%. To qualify for the best "Platinum tier" with a 12.5% service fee, you need to have earned at least $5300 on the platform in the past 30 days, PLUS have "excellent" completion.

Even if the tasker is "Platinum", the breakdown for a $250 job would look like this: customer pays $290, tasker gets $218.75, ART gets $71.25

Things are slightly better (but still too high IMO) for a $500 job. The customer pays $549.45, the tasker gets between $400 and $437.50, depending on tier, and ART makes between $111.95 and $149.45.

TOO EXPENSIVE ?

I would love to get other opinions on this. For me these fees just seem too expensive. Am I being a tight arse? Does anyone want to make the case that fees like that are reasonable?

OR DOESN'T MATTER?

To make the counter-argument, the fees do include 3rd party liability insurance. Plus I suppose if you phone up a company to get someone to come and do a job at your house, they probably take a higher percentage than ART. And you will be paying that fee again for any repeat business. Perhaps the argument can be made that ART is expensive because it is essentially just an introduction service. You pay a high fee for the first job, but if you are happy with the work, you just contact the person directly for sebsequent jobs (and pay no fees).

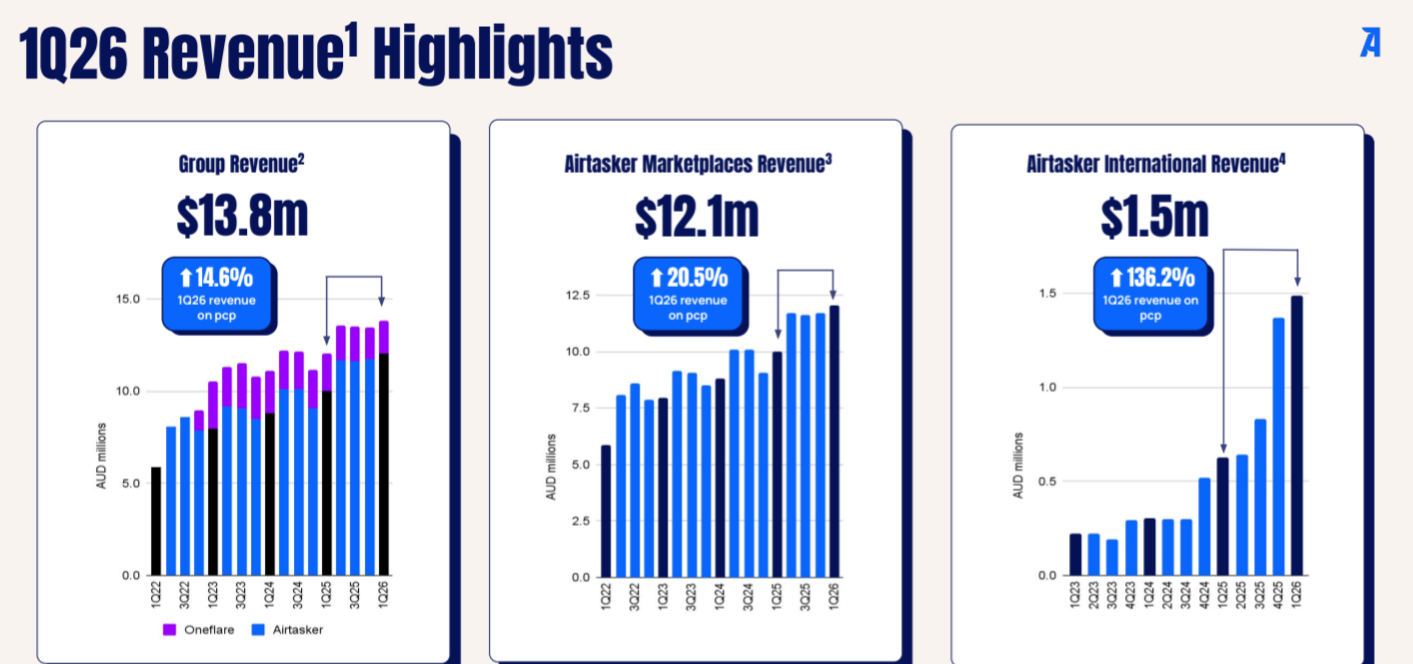

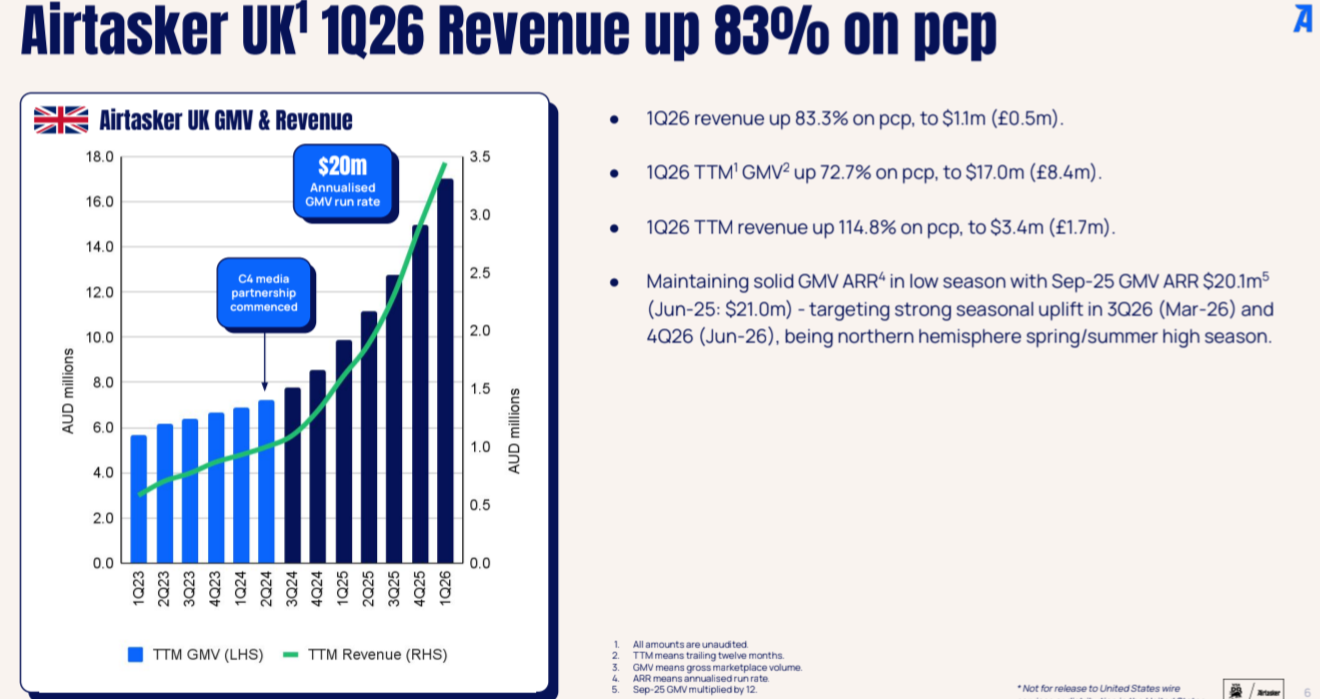

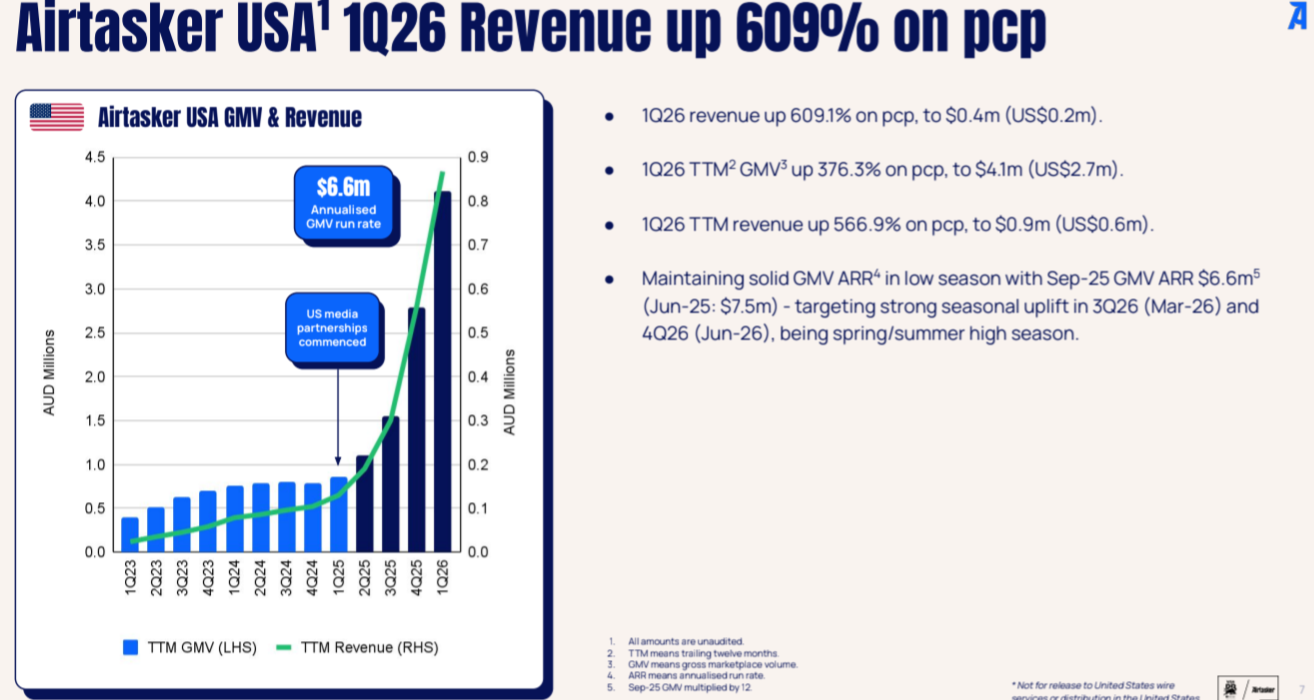

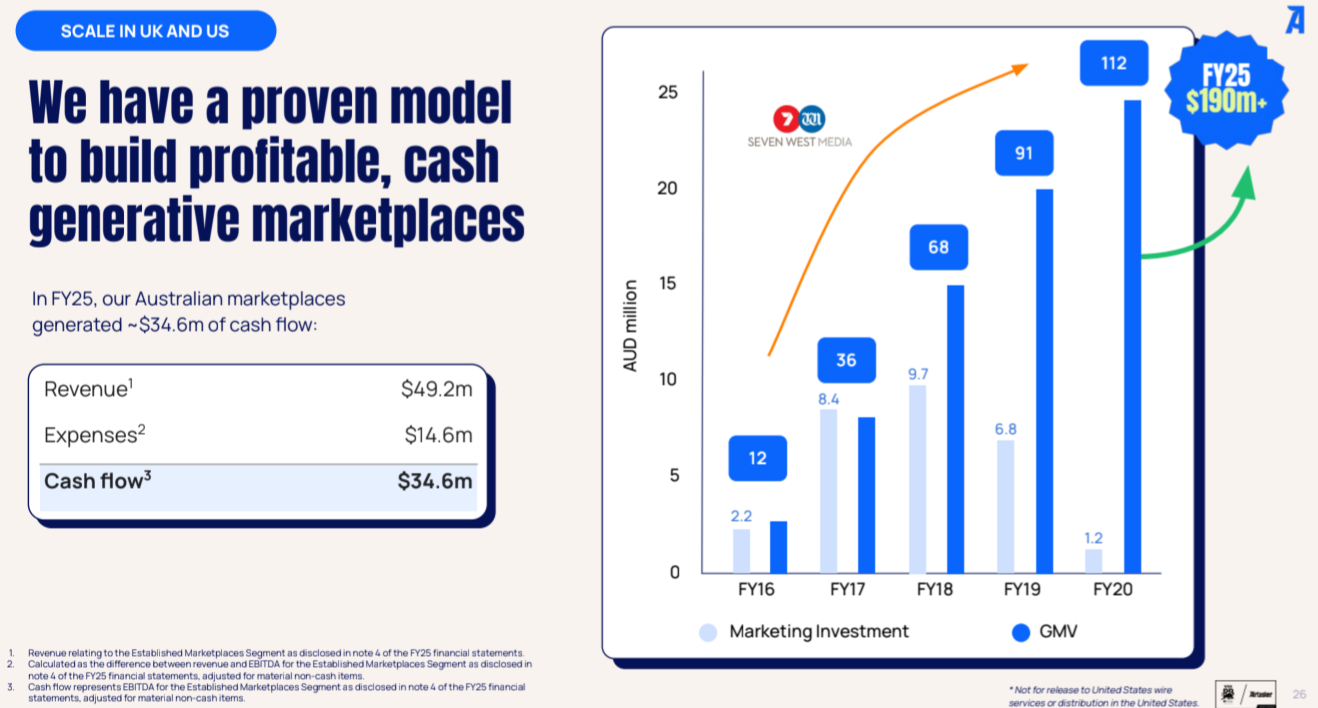

The other major argument against fees being too high, is that the business has been performing. Despite these fees, the Australian business has been growing and profitable, and the overseas businesses are showing promise. The proof is in the pudding, and recently the pudding has been pretty good.

CONCLUSION

I still can't help thinking that ART could do so much better with a different (lower) fee structure. The marginal costs of running the website are pretty low. If fees were lower, I really believe that the platform would get a LOT more use. Less advertising would be required and I wouldn't be surprised if profits ended up higher.

I really hope that Tim (the founder/CEO) agrees to an interview. I would love to hear his response.

Also it would be great to get some other opinions from SM. I am genuinely conflicted about this one.

It is hard to go all in on something that feels like a bit of a rip-off.