Today's business update has not been well received by the market; so far today RedBubble has lost over 1/4 of its market value, and is down roughly 70% in the last year. Ouch!

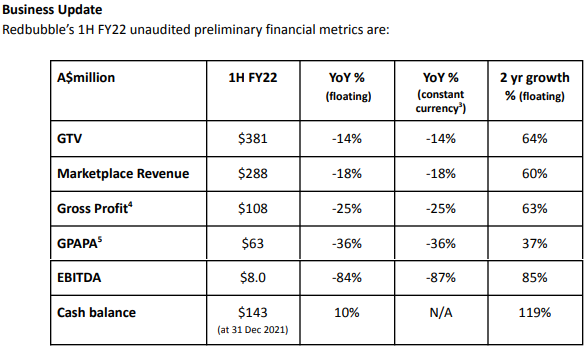

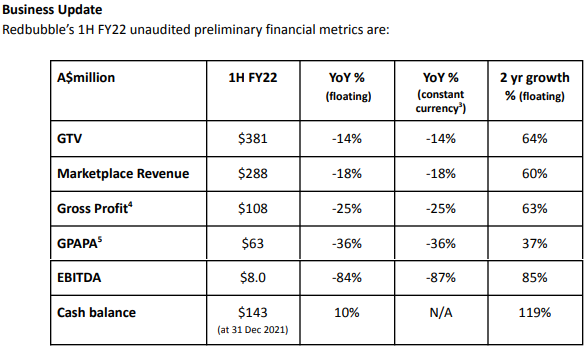

Back in October last year, the business told the market it expected Marketplace Revenue to be "slightly above FY21 underlying Marketplace Revenue" (underlying strips out mask sales). It also said that EBITDA margin (as a % of marketplace revenue) would be in the mid single-digit range.

Today's update says that it now expects Marketplace Revenue to be "slightly below" FY21's underlying result, with EBITDA margins to be "low single-digit negative".

The margin deterioration was a result of increased competition and increased acquisition costs (marketing -- basically paid search). In addition, it suffered from increased shipping costs.

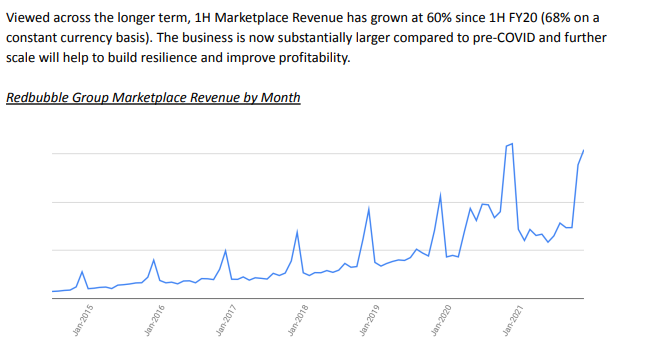

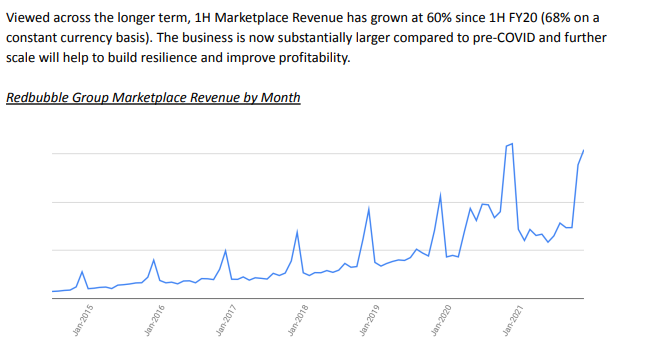

The company was at pains to point out the longer term trajectory of the business:

So, investors can probably expect FY22 Marketplace Revenue of roughly $495m. After today's drop, the business is now on about 1.2x that. That's hardly demanding for a business that is targeting marketplace revenue of $1.25 Billion in the medium term (2.5x current level). However, sales multiples offer little context without some assumptions of what margins look like at maturity.

The issue then, it seems to me, is about the ability of the business to deliver reasonable margins as it grows -- and not have search companies (Google & Facebook etc) capture most of the value. It may well achieve decent long term growth in revenues, but only operate on razor thin margins.

For example, let's say the business is actually doing $1.25b in revenue by FY25 but only gets a 4% net margin (which, according the the bears may even be still too generous). That'd be around $50m in net profit, or about 18cps (with no additional share issuance). A PE of (say) 20 would give a FY25 price target of $3.60, or $2.58 when discounted back by 10%pa for 3.5 years.

In this context, the previous close of $2.99 does indeed look a bit pricey, and today's price action is not entirely unreasonable.

So that's the conundrum I think. If you think RBL can actually sustain better margins, there's likely a decent opportunity at the current price. If not, and assuming they can keep growing the top line, shares are probably described as fair (at best).

For me, I don't have nearly enough conviction that the business can grow without sustained and significant customer acquisition costs. I'm not sure it will generate enough of a genuine network effect to make it a primary destination of choice for consumers, who will continue to simply google for what they are after and find the lowest cost producer.