Interesting that the bros on Baby Giants mentioned Articore (formerly RedBubble) in the latest episode. It's one I took a look at recently. I was interested because the EV is now less than 1x GPAPA (gross profit after acquisition costs) and it's now running around breakeven. Any improvement in reducing costs, any incremental growth, or any improvement in paid marketing efficiency (Google ads mainly), will see a marked turnaround.

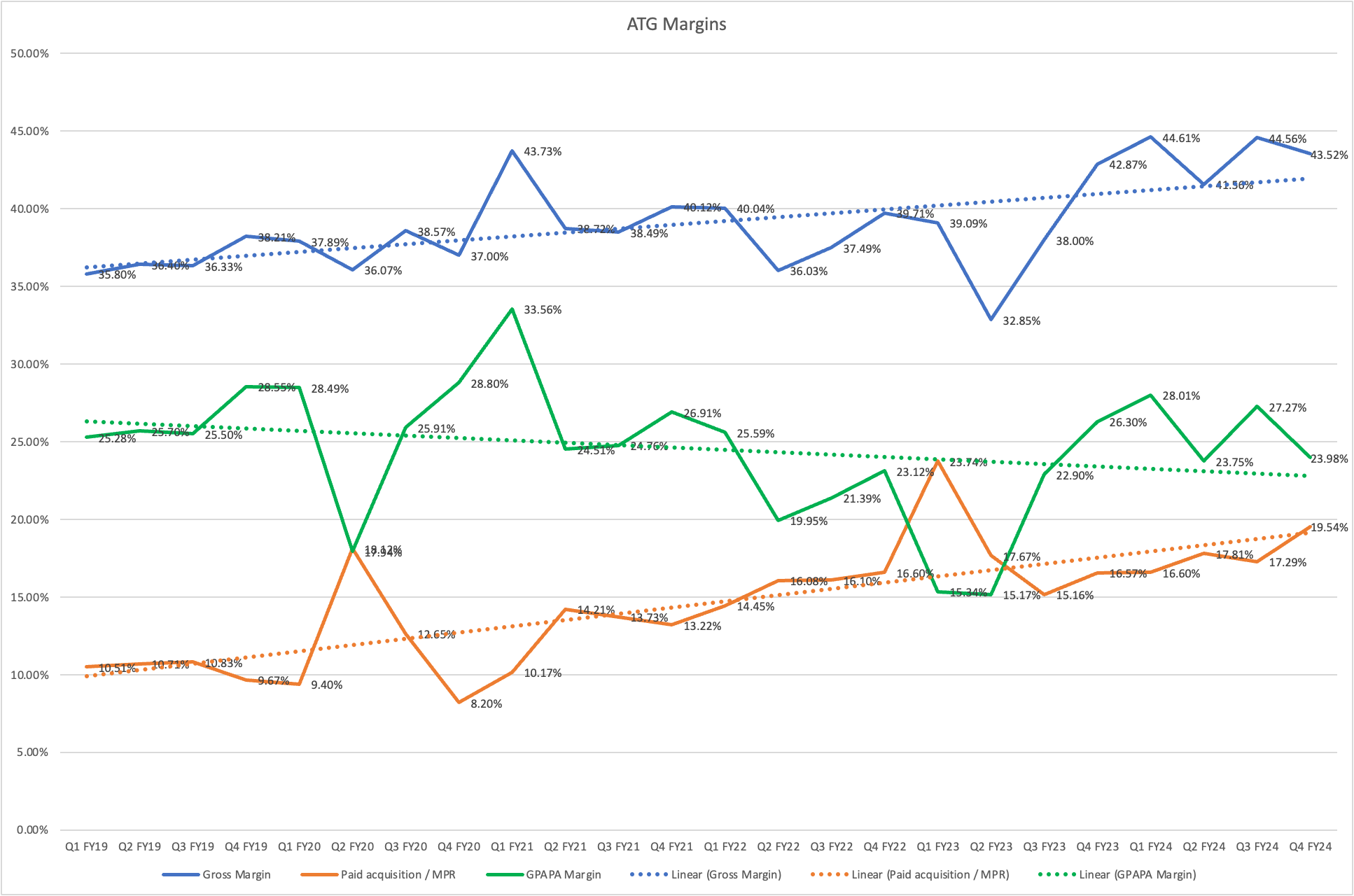

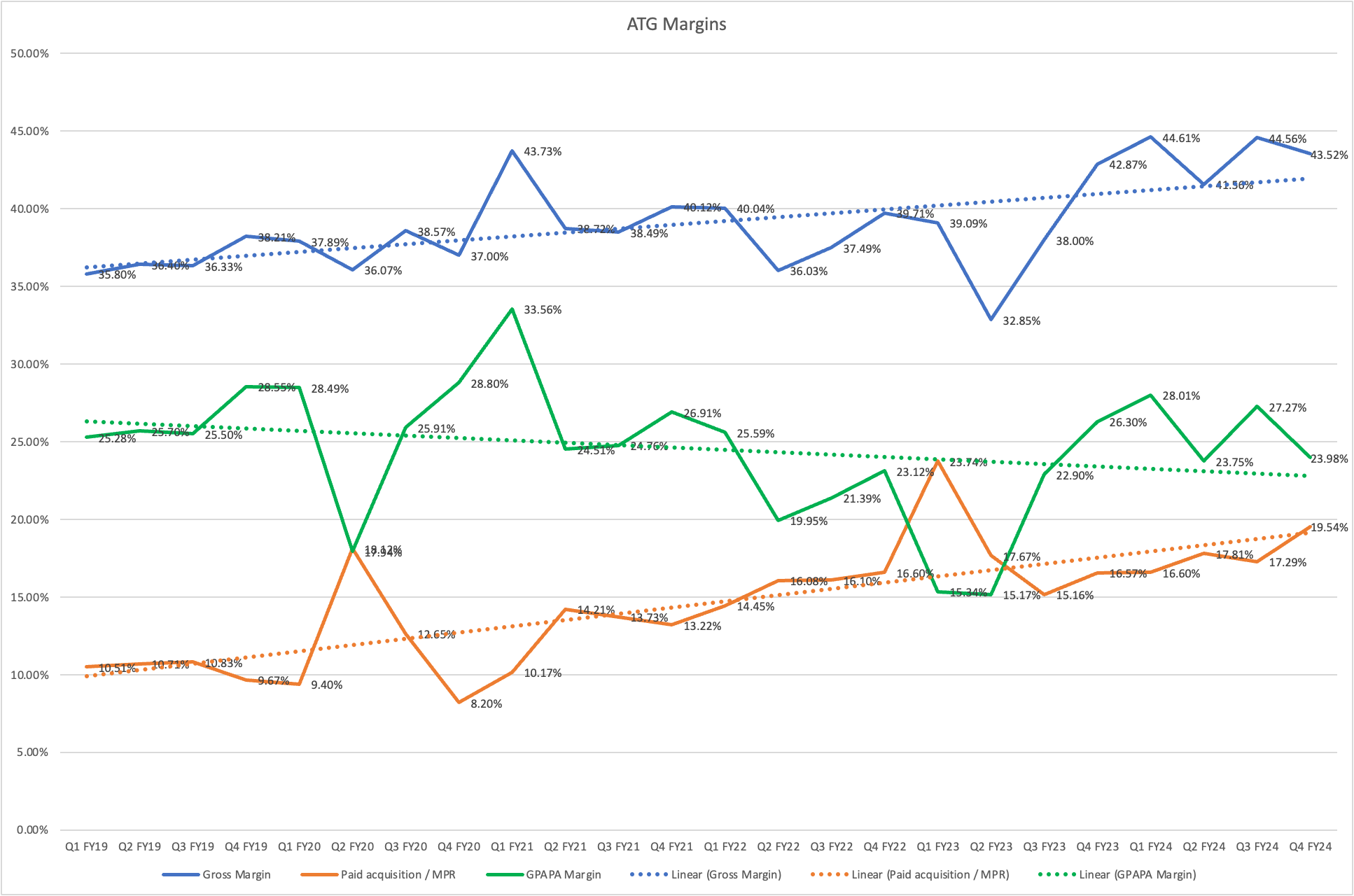

But the trend in GPAPA margins is ugly.

The Gross margins have been improving over the years - likely from scale, better pricing with manufacturers, clawing more margin back from artists, some better efficiencies with routing, etc. But they've given it all back and more with increasing paid acquisition spend.

The good news is that management seem to be finally shifting their focus towards paid acquisition efficiency and cost reduction - rather than chasing growth, fly-wheels and brand-building. Will be interesting to see if they can make a dent.

Undifferentiated E-commerce - your margin is Google and Facebook's opportunity.