Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Interesting that the bros on Baby Giants mentioned Articore (formerly RedBubble) in the latest episode. It's one I took a look at recently. I was interested because the EV is now less than 1x GPAPA (gross profit after acquisition costs) and it's now running around breakeven. Any improvement in reducing costs, any incremental growth, or any improvement in paid marketing efficiency (Google ads mainly), will see a marked turnaround.

But the trend in GPAPA margins is ugly.

The Gross margins have been improving over the years - likely from scale, better pricing with manufacturers, clawing more margin back from artists, some better efficiencies with routing, etc. But they've given it all back and more with increasing paid acquisition spend.

The good news is that management seem to be finally shifting their focus towards paid acquisition efficiency and cost reduction - rather than chasing growth, fly-wheels and brand-building. Will be interesting to see if they can make a dent.

Undifferentiated E-commerce - your margin is Google and Facebook's opportunity.

Redbubble received shareholder approval to change its name to "Articore" with the new ASX code ATG.

Not held in RL, or planning too.

Redbubble released the following announcement on Thursday with an update to the market. Briefly working through the numbers, I think the company will continue to operate on negative cash flow basis until revenues increase or they can cut costs even harder but how do they do that and grow at the same time? Of interest was a new tiered system for artists, three levels: standard, premium and pro. I never believed the story that the "artists" were core to the business, I saw the "artists" more as content creators trying to make something to match the current trending items of the week. The different tiers may allow Redbubble to discourage the use of copyright infringing material through lower financial incentives and incentivise original work, in the same way YouTube incentivises their best channels.

At the moment still firmly on the sidelines...

Not sure if anyone is still following the RBL story but looks like Etsy is having similar issues re counterfeit issues.

Recently the subject of a short report "$ETSY has become one of the largest platforms in the world for counterfeit goods, and it is indisputable. They risk running afoul with the DOJ, FTC, and Customs Border Protection.'

Source - Citron Research | Executive Editor Andrew Left | Publishing Since 2001

The trading update for 1HFY23 didn't look good for Redbubble. As a previous shareholder I was surprised how far backwards the business has gone in such a brief time. Revenue is flat for YoY and "operating EBITDA" moved from $10.5m to $-18m for 1HFY23.

When I sold out, I highly doubted the $1.25bn sales target they had for "CY24+". Flicking through the announcements of the past year or so, this blow out to FY26/27 in the presentations and now isn't even mentioned. One of the things I liked about Redbubble is the consistent format of data they provided quickly at the end of each quarter. I note this half end there is no presentation and the financial information provided is not a complete set. Management don't want to be loud about the current condition of the business.

Just a reminder to me how as an investor I should be "reading between the lines" when looking at company announcements and noticing the subtle changes period to period in what the company is saying. Additionally, don't take management's goals as forecasts but as aspirations....

The last six halves with revenues (blue), PBT and CFO (gray)—both on RHS. Its been a wild ride for RBL through C19. Revenues falling again this half but costs not--cash crunch. Only trading at about 0.6x sales, but the lack of control over the operating lines is disconcerting to me. Plenty of cash, but where is it going? One for the thrill seekers imo. sorry not sure about the empty box

Why are labour costs so high/increasing?

Never been a fan but harder to be negative when the price has fallen as far as it has.

Looking at the medium term targets (have assumed they get there by FY28) - I cant see how they can get to 13-18% EBITDA margins unless the cost base stays static from here onwards?

Revs $1.25bn

Gross margins 40%

marketing costs - 16% of sales in line with current levels

EBITDA $130m / 10% margins at best

OR....

Revs $1.25bn, GM 37%, marketing costs increase to 20% of sales to stay relevant... EBITDA $65m / 5% margins

General Comments: I really wasn't expecting such a hit to margins for RBL. The margins are important to profitability for RBL with a few percent making a significant difference to profitability. I still don't believe management will get anywhere near their revenue target unless there are significant further decreases in margins, which would make the goal of increasing revenue pointless from a shareholder point of view.

I have formed the view management overemphasises the need for high quality artists. In my own opinion, RBL is more of a fun gift site, when you search RBL there is so much content that I wouldn't know who is a great "artist" compared to a bad one. I think most of the "artists" on the site are just there to make a few extra bucks from design work they enjoy doing. Whenever, there is a trend, a bunch of "artists" will create a similar copy just to be in the running to pick up more sales. Basically, I am saying you don't need to pay artists more because there is already so much competition between them.

Valuation assumptions (with recent changes in italics): MP Revenue for FY22 = $518 million Revenue growth = 20%, from 25% previously.% to artist = 20% from 17% previously.GP = 38 , from 40% previously.Paid acquisition as a % of marketplace revenue = 11%, from 10% previouslyDepreciation and amortization increase per quarter = 8% FY24 Net earnings = $54 million FY24 PE assumption = 25 (previously FY23 used an PE of 30, reduced due to margin contraction).Discounted back at 15%.

Trading update released today, Redbubble has posted a 16 percent slip in its marketplace revenue of $384M and a 22 percent decrease in its gross profit of $144M. This results in an EBITDA loss of $2.3M on the back of FX losses.

They say this is in line with expectations and they reiterated its previous FY2022 full year outlook statements.

The statement adds they are committed to a medium term strategy of investing for sustainable growth which almost sounds like an afterthought.

On open the shares are up over 4% - results must be better than the market expected. Not held.

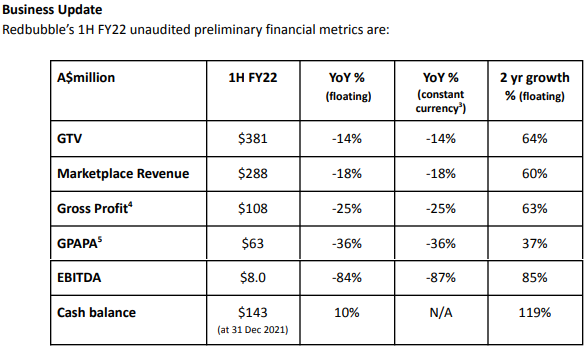

Today's business update has not been well received by the market; so far today RedBubble has lost over 1/4 of its market value, and is down roughly 70% in the last year. Ouch!

Back in October last year, the business told the market it expected Marketplace Revenue to be "slightly above FY21 underlying Marketplace Revenue" (underlying strips out mask sales). It also said that EBITDA margin (as a % of marketplace revenue) would be in the mid single-digit range.

Today's update says that it now expects Marketplace Revenue to be "slightly below" FY21's underlying result, with EBITDA margins to be "low single-digit negative".

The margin deterioration was a result of increased competition and increased acquisition costs (marketing -- basically paid search). In addition, it suffered from increased shipping costs.

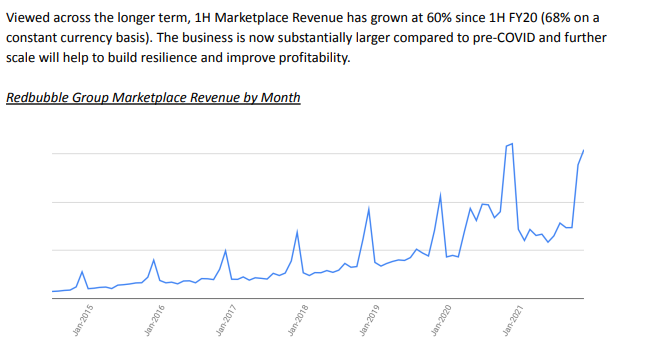

The company was at pains to point out the longer term trajectory of the business:

So, investors can probably expect FY22 Marketplace Revenue of roughly $495m. After today's drop, the business is now on about 1.2x that. That's hardly demanding for a business that is targeting marketplace revenue of $1.25 Billion in the medium term (2.5x current level). However, sales multiples offer little context without some assumptions of what margins look like at maturity.

The issue then, it seems to me, is about the ability of the business to deliver reasonable margins as it grows -- and not have search companies (Google & Facebook etc) capture most of the value. It may well achieve decent long term growth in revenues, but only operate on razor thin margins.

For example, let's say the business is actually doing $1.25b in revenue by FY25 but only gets a 4% net margin (which, according the the bears may even be still too generous). That'd be around $50m in net profit, or about 18cps (with no additional share issuance). A PE of (say) 20 would give a FY25 price target of $3.60, or $2.58 when discounted back by 10%pa for 3.5 years.

In this context, the previous close of $2.99 does indeed look a bit pricey, and today's price action is not entirely unreasonable.

So that's the conundrum I think. If you think RBL can actually sustain better margins, there's likely a decent opportunity at the current price. If not, and assuming they can keep growing the top line, shares are probably described as fair (at best).

For me, I don't have nearly enough conviction that the business can grow without sustained and significant customer acquisition costs. I'm not sure it will generate enough of a genuine network effect to make it a primary destination of choice for consumers, who will continue to simply google for what they are after and find the lowest cost producer.

I don’t want to be the web traffic guy but it’s a quick free and easy method of research and I haven’t thought about DCF since uni.

RBL seems to be steadily increasing web traffic, is already profitable, has cash with no debt. Unless the traffic is only seasonal (and I don’t have a 1-2 yr chart) this seems interesting to me.

WOW! Yesterday was a great example of momentum and following the crowd!

Sold down in the AM only to see it settle by the evening $1+ up from its lows and up again further today!

In my mind I pictured that scene when a merry-go-round has stopped and there is that transition point where the kids who have finished rush off quickly to get to the next ride (sellers) whilst, at the same time the new riders are released when the gate opens and they race to occupy one of the ponies to ensure they get a seat (buyers) for the next ride!

You know when you watch a good court room drama, the defence lawyer is speaking, and at the time he/she seems to make perfect sense and you find yourself agreeing wholeheartedly with them? And then the prosecution lawyer has a go, and you find yourself agreeing wholeheartedly with them too?

Well, I'm getting that with RBL.

I completely understand all the negatives people had raised, but I use RBL and find their products are not overly expensive and of good quality. The only negative as been the kids photographic posters which were not of good resolution. T-shirts and masks were great.

I can see why people are unimpressed about the near term revenue forecasts, but the reasoning behind them seems sensible. There has been an exceptional event which has caused a not-to-be-repeated bump in sales. Firstly the lock down induced online shopping phenomenon, but also the number of masks sold, which is unlikely to be repeated at the same level. I would anticipate many of those customers will continue to use RBL in the future but how many masks do you need? In the presentation, they clearly stripped out this "bump" to estimate "normal sales" increasing at the previous CAGR., not the COVID rate. Should the "underlying" increase in revenue/sales etc not show evidence of improvement over 24 months, then clearly that would be of concern. Flagging the probability of a slow-down in the short term sounds like good managment to me.

Regarding the "network effect". I can see reasonable arguments for both sides. If they can invest in growth to become the dominant place to buy this sort of gear, then there is an argument to say that this will become a flywheel. Sure an artist can go off to some other platform but who is going to go looking for them? I know I can log on and find a huge range of work to choose from at reasonable price. Why would I look anywhere else.

The copying and copyright issues are definitely of concern. The example picked by Claude was unfortunate, given Banksy cannot claim a copyright . But the point could be applied to other areas, and other artists, as has previously noted. I will be watching closely how they cope with this issue.

Overall, I'm happy to hold for the time being.

Good luck to anyone who bought Redbubble at the open today. After closing yesterday at $3.06 it opened down as much as 14% after releasing its annual result on the market. I can't remember seeing the market change it's mind so comprehensively on a company of this size. It's gradually been improving all day and is now up 22% on yesterday's close. If you bought at today's low you would be up more than 42% on the day - on effectively no new news! Efficient markets...pfftt.

I have reviewed my thesis due to a rethink of growth trajectory and poor showing on website traffic pages. Some general points with regards to buy/hold/sell are below.

Reasons to buy:

- PE is around 23-25. Therefore, not expensive for what think is fairly called a growth company with potential.

- Management has a good plan and clear strategy. New CEO has delivered in the past.

Reasons to hold:

- Would you be doing this review if the share price was $5/6? Probably not...

Reasons to sell:

- Website traffic websites all show a significant decline in popularity for YTD. This is hard to judge exactly how this relates to sales but large growth in search popularity generally matches the sales. See Google trends screenshot.

- Loss of mask sales and COVID lockdown customers. Which were a big boost to sales (this risk was known when investing).

- Questions over whether the same profitability will continue. There were one off bumps from covid that didn't match the normal seasonality of similar results for Q1,3 and 4 with Q2 being significantly larger. I think I underestimated the COVID boost.

- Litigation due to copyright likely to continue. There is quite a bit of copyright material on the platform.

Today's price pop was interesting. Not a lot of volume so if I had to bet on what the cause was it would be amateur traders playing the Australian lockdown or some TA bowl shape I have seen mentioned. RBL makes its money overseas so I see no material change due to the Australian lockdowns/outbreak.

I have reduced my valuation down to $4.19 as a result of my revenue expectations. There is still some margin to play with but not a large margin of safety.

The thesis is close to being broken based on revised revenue expectations and google trend data. However, these are just guesses/estimates of the future financial results. I will be awaiting FY end numbers to make the final call. My conviction is lowered going forward with a strong potential of a sell occurring.

Expanding on Rapstar's seasonality of earnings straw. In my opinion the only way to compare the quarterly result is with the corresponding quarter. I have created a column graph of marketplace revenue by quarter. The general trends and seasonality are quite clear..

Holders need to be aware, this is a very seasonal business. Attached is the quarterly revenue numbers, which shows the slowdown, is all part of the seasonal cycle, although the slowdown is about 20% more severre than usual.

If that continues, Redbubble holders can expect a relatively flat FY2022, as the economy tranititions to a post-COVID reality.

General Notes

- Q3 is normally a bad quarter for RBL compared to other quarters results. I believe the way to compare the results is with the corresponding quarter.

- Presentation appeared to be the new CEOs vision for the company. The CEOs strategy background from time at Seek is obvious.

Positives

- Revenue numbers for quarter we better than thesis required.

- Focus on customer loyalty. I think this is somewhere that can improve so acknowledgement of this is positive.

Negatives

- Market didn't like the announcement around $1 taken off the share price (around 20% drop in one day).

- Companies target is approximately my baseline thesis. Are they under or over promising?

- I felt like they were trying to hid the quarter numbers which wont strong compared to other quarters. Still provided the quarter number results table as per usual.

- Is this a negative inflection point as previous quarters YOY was much stronger? Is company just being realistic about growth from here. My thesis was based on 25% corresponding quarter revenue growth, result was 55%.

Has the thesis been broken?

- No, thesis was based on 25% revenue increases over previous corresponding quarter moving forward with margins the same as historical. On a negative, this is now the baseline of expectations set by the company, they do need to execute. Substantial growth has occurred over the previous year, moving forward I had no expectation that those numbers would continue.

- Need to monitor future quarterly results to ensure growth continues at the expected rate.

Valuation

- Based on companies new projections adjusting the end FY2023 PE to 30 rather than 40 for valuation. Valuation based on 25% increase in revenue with previous corresponding quarter and historical metrics being maintained not improved as predicted by management. Valuation at $6.39 based on this. See Strawman valuation for assumption numbers.

Personal Sediment:

- Hold - Monitor progress for potential buy. Don't understand why the market dropped this heavily. Only hold because I am being conservative that I have missed something. If price drops further there is definitely a buying opportunity but I will wait for positive sediment in the share price.

Coca-Cola Amatil Limited to be removed from the S&P/ASX 200 Index

SYDNEY, APRIL 16, 2021: S&P Dow Jones Indices announced today that it will remove Coca-Cola Amatil Limited (XASX: CCL) from the S&P/ASX 200, subject to final court approval of the scheme of arrangement whereby the company will be acquired by Coca-Cola European Partners Plc (XNYS: CCEP).

S&P Dow Jones will remove Coca-Cola Amatil Limited from the S&P/ASX 200 effective prior to the open of trading on April 22, 2021. Coca-Cola Amatil Limited will be replaced by Redbubble Limited (XASX: RBL) in the S&P/ASX 200 effective prior to the open of trading on April 22, 2021.

In reply to El Paso and other recent posters about their offering.

my understanding of RBL's model is a little different

RBL do not hold inventory. They receive payment for an order. They then place an order from third party suppliers. So they hold the money before paying both the supplier and the designer. So have the use of "free cash" to use in promoting and expanding their business.

Etsy act as a marketplace. The designer/seller holds the inventory and Etsy clips the ticket of any purchase.

both benefit from flywheel network effects.

but agree that there is an awful lot of sh*te on the RBL and the site is a bit chaotic and bloated.

Redbubble reported strong H1 results, with marketplace revenue of 353m, which is greater than the total FY20 revenue (349m). Total net cash balance at 130m. YoY customer growth @ 69%, and strong growth across key geographies, mainly UK/EU/US.

20-Nov-2020: Ausbiz: "The Call" - Stock of the day - Redbubble (RBL)

RBL closed at $4.97 +0.43c (+9.47%) on Friday (20-Nov-2020) on their "New CEO" announcement.

From Ausbiz (on Friday): Global print-on-demand online marketplace, Redbubble (RBL), has had a change in the big chair with former Seek exec, Michael Ilczynski who will replace Founder, Martin Hosking, who will now focus on the company's philanthropic efforts. RBL's sales have surged during he pandemic, with gross profit for Q1 surging 149% on Q1 FY20.

Today on The Call, Kochie asked his guests, Jun Bei Liu from Tribeca Investment Partners and Adam Dawes from Shaw and Partners for their views on RBL. Jun Bei likes the company although she thinks it is something of a speculative stock.

"It's expensive and it's been growing really fast and it's absolutely been the COVID beneficiary, given people are buying masks and doing e-commerce related things.

"But I like it because the company has done very well in terms of broadening out its product range... they make a very good margin out of the products that they do. The company is trading on a free cash flow yield of 4%. This is very rare for [stocks in] the tech space."

Adam also likes RBL as a speculative prospect and the fact that it has had a recent pullback.

"It hit some highs and it's come back to $4.85. It jumped today on the announcement of that new CEO. It looks interesting.

"Most of the sectors that are contributing to [market] growth have grown over 100% year-on-year. Despite [the sales of] face mask slightly pulling back over July and through to September... their margins are fantastic."

--- click on the link at the top to view and listen to the entire conversation (this is just a sample from it) ---

--- the other 10 stocks covered on this episode of Ausbiz' "The Call" were WHC, TLT, AGH, FXL, DOU, SLC, COL, ELO, URW & OML ---

[I do not hold shares in any of those 11 companies.]

[Edit: I do hold IFT (Infratil Ltd) and IFT holds 65.6% of TLT, so I do have indirect exposure to TLT. Jun Bei and Adam were not keen on TLT, however they were more positive on IFT - which was added to "The Call Portfolio" in October.]

Redbubble has seen an incredible change of fortune.

Late last year, shares lost their shine after the company reported slower than expected growth due to increased price competition. The price continued to sink lower following a surprise resignation of the CEO and an underwhelming first half result in February this year.

In March, at the height of the Covid panic, shares at one point touched 40c.

Since then, shares have gained an amazing 1200%, with shares up a further 10% today to an all time record high.

Today Redbubble reported a 116% rise in maretplace revenue for the first quarter of FY2021, with Gross profit up 149%. Operating cash flow came in at $27.1m, compared with $10.2m for the same period last year (the company now has over $85m in cash).

Growth was seen across all geographies and segments, although the US (Gross transaction volume up 102%) and accessories (which i presume is things like masks, was up 562%)

You can view today's investor presentation here