Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

*** Edited 23/01/2026 ***

Back of a morning beer coaster calculations based on the latest cap raise including the Medtronic deal. Consume with all the caveats that implies.

Assumptions by 2032 (all in USD until the end)

- Approximately 45,000 DurAVR valves sold per year (about a 30% capture of a conservative estimate of the USA TAVR market).

- Approximately $30,000 in sales per unit with a profit margin of 50%.

- Cash burn of $100 million USD per year until 2032 (6 x $100m = $600m).

- No further cap raises until 2028. Cash obtained from issue of new capital (or acquisition) at fairly non-dilutive prices post 2028.

- About 150 million shares on issue (up from approximately 100 million today — so about 50% further dilution).

- P/E of 15 (again conservative based on growth and runway assumed).

- Gravy not included: Europe; Valve-in-Valve; and any premium unit pricing due to clinical superiority.

45,000 x 15,000 = 675,000,000 earnings

675,000,000 x 15 = $10,125,000,000

10,125/150 = $67.50 per share price

Discounted back by 10% per year to today = $38.10 USD or about $55.70 AUD.

You’ll notice the biggest change to my valuation is the assumption of higher market capture. By 2032 I suspect Anteris will have been acquired fully by Medtronic — but for the equivalent / relevant valuation along at whichever point along the development continuum that ultimately took place. Essentially, Medtronic knows that by 2032 — assuming clinical success — DurAVR is at least a $10 billion USD product to them.

***Edited 09/11/2025***

There has been some good news and milestones achieved since May 2025, which I think are ultimately de-risking for Anteris. However, I was perhaps too optimistic about potential dilution. It appears the market is also concerned about this. I’m redoing my valuation to account for it. I’m assuming average capital to be raised at $7.50 USD (which is where the bulk of outstanding options have their strike price).

Assumptions by 2032 (all in USD until the end)

- Approximately 15,000 DurAVR valves sold per year (about a 10% capture of a conservative estimate of the USA TAVR market).

- Approximately $30,000 in sales per unit with a profit margin of 50%.

- Cash burn of $100 million USD per year until 2032 (6 x $100m = $600m).

- Cash obtained from issue of new capital at average of $7.50 USD per share ($600/$7.50 =80 million new shares.).

- About 120 million shares on issue (up from approximately 40 million today — so about 200% dilution).

- P/E of 15 (again conservative based on growth and runway assumed).

- Gravy not included: Europe; Valve-in-Valve; and any premium unit pricing due to clinical superiority.

15,000 x 15,000 = 225,000,000 earnings

225,000,000 x 15 = $3,375,000,000

3,375/120 = $28.125 per share price

Discounted back by 10% per year to today = $15.87 USD or about $24.45 AUD.

Again, same caveats about the large number of variables — which I maintain are all very conservative. For the record also I don’t actually expect dilution to be this bad. Rather, I’m more making the point that even if it is, there is still value at today’s prices.

*** Edited 08/05/025 ***

Assumptions by 2032 (all in USD until the end)

- Approximately 15,000 DurAVR valves sold per year (about a 10% capture of a conservative estimate of the USA TAVR market).

- Approximately $30,000 in sales per unit with a profit margin of 50%.

- About 60 million shares on issue (up from approximately 38 million today — to factor in remaining options and any further dilutive capital).

- P/E of 15 (again conservative based on growth and runway assumed).

- Gravy not included: Europe; Valve-in-Valve; and any premium unit pricing due to clinical superiority.

15,000 x 15,000 = 225,000,000 earnings

225,000,000 x 15 = $3,375,000,000

3,375/60 =$56.25 per share price

Discounted back by 10% per year to today = $28.86 USD or about $44.00 AUD.

It’s my lowest valuation for a while, but that isn’t a reflection of any wavering conviction. I just wanted to state the case for value very simply this time. My actual investment thesis involves much loftier assumptions, whereas this is just my starting point. You can see how it doesn’t take much optimistic tweaking of any of the variables to generate some pretty staggering potential outcomes.

Done Deal

Price sensitive ASX announcements for Anteris are coming at me thick and fast this morning — faster than I can run all the PDFs through ChatGPT almost.

The gist of them is that the: public offering has closed; Medtronic is now confirmed as a cornerstone investor and will be the preferred partner for any later acquisition; and Anteris has raised $320 million USD for dilution of about just over 50%.

It still boggles my mind just how much can be done — and just how quickly it gets done — in the United States. The Paradigm trial is now fully funded. And the world’s second biggest TAVR player have been outed as DurAVR fanboys.

Links to ASX announcements for those interested:

CEO Paterson on Medtronic Deal

Concise interview with CEO Wayne Paterson discussing the most recent cap raise and Anteris’ future trajectory:

Struck Oil

A cheeky $200 million USD placement by massive competitor Medtronic wasn’t on my bingo card this morning — but I’ll take it.

Sit back and watch time.

Possible Omen of News

Something is brewing in the Nasdaq Anteris price tonight. At least a 20% jump on over 4X the average volume — all on no news.

Could be news leakage of first US Paradigm implantation? Who knows.

There might be an ASX spending ticket if we follow suit in trading today and no updates to the market.

Interested in @PabloEskyBruh's take on today's announcement of a study by $AVR on performance of DurAVR in a particular patient segment. Note this is outside of the current all-comers, head-to-head PARADIGM pivotal registration trial.

TLDR: a further positive signal of superior performance compared to that typically seen for commercial devices on the specific metric of rate of PPM (defined below).

Analysis of the Study results and Relevance

The newly published 100-patient analysis of the DurAVR transcatheter heart valve provides important early insight into how the device performs in small aortic annuli, a subgroup known to be particularly challenging for today’s commercial valves. Small-annulus patients represent a minority of all people undergoing transcatheter aortic valve replacement, but they experience a disproportionately high rate of prosthesis–patient mismatch (PPM) because their anatomy limits how wide the valve can open.

In current commercial valves, moderate or severe PPM occurs in roughly 11–35% of such patients. In this pooled DurAVR analysis, however, the valve produced an average effective orifice area of 2.2 cm² (reflecting how well the valve opens) and a mean pressure gradient of 8 mmHg (indicating the resistance the heart must pump against), both pointing to excellent blood flow.

Most notably, 97% of patients were free from moderate or severe PPM, far lower than the mismatch rates historically seen with existing devices. This early signal is directly relevant to the company’s recently commenced PARADIGM pivotal trial, which will randomise more than 1,600 patients, including a large predefined subgroup of small-annulus patients, to determine whether DurAVR can consistently outperform standard valves such as Sapien and Evolut.

Limitations

That said, the scope of the current dataset is limited compared with PARADIGM’s broad, all-comers population. The 100-patient cohort is drawn from early-feasibility and prospective multicentre studies, not the controlled, head-to-head randomised setting of the pivotal trial. It represents only a fraction of the anatomical diversity, risk profiles, and comorbidities that PARADIGM will capture across its multinational enrolment. Follow-up in this dataset is only 30 days, whereas PARADIGM will evaluate long-term durability, structural valve performance, safety outcomes (such as death and stroke), and quality-of-life measures out to one year and beyond, with all imaging and hemodynamic data adjudicated by independent core laboratories. Thus, while the early low-PPM signal is encouraging (especially in a subgroup where current valves struggle)definitive conclusions will depend on the much larger and more rigorous PARADIGM trial.

Implications

I am still getting up to speed with this company, and the therapy area. However, I have recently conducted a "deep dive" that indicates that on all key metrics, DurAVR appears to be either superior or in some cases at least not inferior to existing commercial devices.

Today's announcement is not marked price sensitive. And that appears consistent with other clinical updates on studies not directly related to the clinical development program. However, I consider it significant, as it does provide another positive signal on a metric that is relevant to PARADIGM. With a 100 patient sample to have 97% free of moderate to severe PPM, is a good result considering the reported 11-35% incidience occurring in commercial products. Importantly, the larger data set adds to a much smaller, earlier study also indicating superior performance on the PPM risk.

I have recently initiated a tiny "research position" in RL (0.2%) in $AVR.

There's a long way for the PARADIGM trial to run, and we cannot know based on previous data, how the device will perform given the rigour of the trial, including independent assessment of outcomes. It is not the kind of clinical development risk I usually have in my portfolio (no current revenue; long time to commercialisation; high and uncertain levels of dilution ahead.) However, I will now hold a very small position, so that I can track development over time and keep it on my radar. In the success case, the value upside is very significant.

Disc: Held

In an earlier exchange with @PabloEskyBruh I wrote that I considered the likelihood that $AVR get's taken out before the PARADIGM trial concludes as 30% to 50%.

Candidates are either the two market leaders, Edwards and Medtronic, or category "attacker" Abbott. Each have established products in the category. The first two stand to lose $ billions of value, if $AVR's DurAVR proves to be a superior product (so, M&A would be defensive), and for Abbott the acquisition would make sense as part of an "attacker" strategy. There are likely other acquirers in the next tier down, but I have ignored these for simplicity.

So, I framed the following question for my BA (ChatGPT5.0):

"Assess the probability that either Edwards, Medtronic or Abbott acquires Anteris in the next 12-18 months in order to get their hands on the DurAVR product?"

TLDR: My BA "thinks" there is a higher 45-60% likelihood than my original hunch of 30-50%.

Probabilites of acquition by actor are:

Edwards: 10-15% (anti-trust concerns)

Medtronic: 40-45%

Abbott: 30-35%

I've included the full response below - I've not summarised because it has some interesting insights and obvious limitations! I've removed all the references for ease of formatting.

Based on the patterns of M&A in medical devices, the likelihood of acquisition is highest before PARADIGM reports or FDA decides on approval, simply because the value of $AVR in that case would pop to a multi-billion dollar realm.

Now, in the first analysis, my BA has assumed the chances of $AVR remaining independent until FDA approval, as only 10-20%, assessed (erroneously) as the residual of the sum of the above three probabilities. This is flawed reasoning, because the events are not independent probabilities.

On challenging my BA, they've come back with a residual probability of $AVR remaining independent until FDA approval of 40-55%, or a 45-60% chance of $AVR being taken out. (I'm not entirely convinced by that analysis either, but directionally, it takes into account the co-dependencies.)

While still a bit higher than my 30-50% hunch, it seems that my BA and I are in strong agreement that there is a pretty good chance that $AVR gets taken out before FDA decision.

So What?

Obviously, each of the potential acquirers is very well plugged in to the cardiac market. So, my key next question is whether industry insiders can access privileged insights on the 1-year comparative performance stats. before the formal data is released to the market? I guess a surgeon will know first hand how their own patients are performing, but any one surgeon will only have a very small percentage of the 1000 candidates, and unless the relative advantages are large, you'd think they'd be unlikely to form a view with any confidence. But I guess that's just the point. If DurAVR is significantly better on key endpoints (like with the PPM metric reported yesterday) then, conceivably, the highest volume surgeons could get early insight.

But of course, there are communities and networks of specialists in every medical specialty, Cardiac surgeons are not different. So, is there any chance that a "consensus" view could emerge, informally, across a small group of leading cardiac surgeons who are sharing experiences?

I think the answer is quite possibly.

And of course the potential acquirers will have close relationships with their KOLs, and I have no doubt they will be obsessively seeking to glean any insights possible via these relationships.

So, I believe there is a credible mechanism for information to "diffuse" through the KOL community during PARADIGM, and for these insights to become available to potential acquirers.

This raises for me to an even greater importance the question, what is CEO Wayne's strategy for disclosing information to the market as the trial progresses? (Particularly because this isn't a blind trial!)

While this is all very interesting indeed, it sheds no light on whether DurAVR is a superior product! But it does indicate to me that if early signs show that PARADIGM is progressing well, that could up the likelihood of an M&A deal.

Of course, the market knows this too. And so therefore I expect that any positive newsflow from PARADIGM will potentially be a very poweful SP catalyst, because it will drive the speculative M&A valuations.

----------------------------------------------------------------------------------

The Full Assessment Follows

Let’s treat this like an M&A screen you’d build for a cardiology fund: (1) strategic fit, (2) timing/risk, (3) ability to pay, (4) antitrust. Then I’ll give you indicative probabilities.

Context we need in our head first:

- Anteris’ DurAVR THV is a balloon-expandable, single-piece, biomimetic transcatheter aortic valve that aims to behave like a native human aortic valve (large effective orifice area, very low gradients, laminar flow, minimal prosthesis–patient mismatch, low pacemaker rate). Early human data out to ~1 year show single-digit mean gradients (~8–9 mmHg), large EOA (~2.1 cm²), no valve-related CV mortality, and essentially no clinically relevant paravalvular leak in small annuli patients.

- PARADIGM, the global pivotal trial, has just begun enrolling and will compare DurAVR head-to-head with currently approved TAVR systems. First patients were recently treated and EU regulatory green light for trial sites has been granted in October 2025.

- TAVR is a ~US$6–7B global device market today and growing faster than surgical valves. Edwards has ~60–70% US share with SAPIEN. Medtronic is #2 globally with Evolut. Abbott is the would-be disruptor (Navitor / Portico heritage, ENVISION pivotal, etc.).

So DurAVR is showing best-in-class hemodynamics in anatomies (small annuli, low gradients) where current valves sometimes struggle, and Anteris is still pre-approval, i.e. pre-revenue, i.e. theoretically “buyable.”

We’ll do each buyer:

1. Edwards Lifesciences

Strategic fit

- Edwards is the incumbent leader in balloon-expandable TAVR (SAPIEN line).

- DurAVR is also balloon-expandable. From a portfolio lens, this can cut two ways:

- Pro: it could be a next-gen platform that resets durability/hemodynamics (laminar flow, native leaflet geometry) and protects the SAPIEN cash cow (~US$4B+ TAVR revenue in 2024).

- Con: it could also obsolete SAPIEN, forcing Edwards to swallow something that says publicly “your #1 franchise is inferior in small annuli, LV recovery, etc.” That’s not fatal (big strategics buy ‘cannibals’ all the time), but it raises integration/positioning questions.

Timing / regulatory posture

- Edwards is already in the US antitrust crosshairs. The FTC has challenged or scrutinised its efforts to acquire JenaValve (for pure aortic regurgitation) and JC Medical-style assets to dominate more anatomies.

- Buying Anteris now would look like the global #1 in TAVR buying an emerging competitor before US approval, i.e. classic “killer acquisition” optics. That is exactly the pattern US and EU regulators are now trying to block in medtech (esp. in high-concentration, high-ACV markets like TAVR). That creates serious deal friction.

Ability to pay / appetite

- Edwards absolutely has the balance sheet and strategic will to buy differentiated leaflet/tissue tech. They’ve historically paid up for pipeline (e.g. JenaValve).

- The prize here is “durability + low gradient = push TAVR down into younger, lower-risk patients.” That is the multibillion-dollar long-term TAM unlock. Edwards cares deeply about this.

Internal alternative?

- Edwards is already iterating SAPIEN (SAPIEN X4 etc.) with lower-profile delivery, coronary access, tissue enhancements, plus separate platforms for aortic regurgitation. They may believe they can close DurAVR’s hemodynamic gap in-house, or through JenaValve-style leaflet geometries.

Antitrust

- This is honestly the killer. Edwards + Anteris would be framed as the dominant incumbent removing a future challenger that has just entered its pivotal randomized head-to-head vs incumbent TAVR valves.

- Realistically, that’s the single hardest path to regulatory approval.

Edwards takeout probability (next ~12-18 months): Low (~10–15%)

- Rationale: Enormous strategic logic, but politically toxic. I would only put a real chance on this if Anteris data in PARADIGM suddenly show a step-change survival / LV remodelling benefit that makes DurAVR “existential,” forcing Edwards to fight the FTC in court anyway. Otherwise, Edwards is more likely to watch, copy, and litigate, not buy.

2. Medtronic

Strategic fit

- Medtronic’s Evolut line is self-expanding nitinol. That’s their identity and their clinical moat (large effective orifice area, good gradients in small annuli, low profile, supra-annular leaflet position). They pitch this as superior for many anatomies vs balloon-expandables.

- DurAVR is balloon-expandable and anatomically biomimetic. Two angles:

- It could give Medtronic immediate “we now have both platforms” credibility (self-expanding + balloon-expandable) so they can match Edwards SKU-for-SKU and attack niche anatomies where Evolut is less ideal (coronary access post-implant, certain leaflet calcification patterns, redo-TAVR).

- It also gives them a biomimetic leaflet story that neither SAPIEN nor Evolut can currently claim.

This is attractive. Medtronic does not currently have a best-in-class balloon-expandable valve. Buying Anteris would solve that overnight.

Timing / regulatory posture

- Medtronic is #2, not #1. Regulators are generally less aggressive about #2 buying a pre-revenue challenger to #1 than #1 buying that challenger. The acquisition could be framed as increasing competition with Edwards (Medtronic broadens its arsenal to challenge SAPIEN head-to-head in every anatomical class). That’s a friendlier antitrust story.

Ability to pay

- Medtronic’s Structural Heart & Aortic franchise is already a multi-billion-dollar platform and a strategic growth area.

- They have the scale, manufacturing, clinical, and reimbursement muscle to finish PARADIGM, run the FDA PMA process, and sell globally.

Cultural / integration factors

- Medtronic is comfortable buying pipeline-stage structural heart assets and incubating them through pivotal trials. This is part of their playbook historically.

- DurAVR’s messaging (laminar flow, LV reverse remodelling, zero/moderate PPM in small annuli, low gradients) mirrors Medtronic’s long-running “hemodynamics first” pitch for Evolut.

- In other words, Medtronic can credibly market DurAVR as “our next-gen balloon-expandable that keeps all our hemodynamic advantages and fixes the last remaining complaints.”

Strategic urgency

- There is some urgency. Edwards is trying to defend its balloon-expandable beachhead and is moving into new indications (e.g. pure AR, younger patients).

- If DurAVR can show superiority in PARADIGM, that would become a sales weapon against both SAPIEN and Evolut, especially in small annulus females and Asian anatomies (historically tricky).

- Medtronic cannot afford to let a third branded TAVR player with “biomimetic native-like leaflet” positioning carve out a new premium segment and start poaching high-value younger patients.

Antitrust

- Much cleaner than an Edwards bid. Regulators can be told: “We’re increasing competition by letting Medtronic go toe-to-toe with Edwards across all valve archetypes, rather than leaving Anteris capital-constrained.”

Medtronic takeout probability (next ~12-18 months): Moderate-to-High (~40–45%)

- Rationale: Best strategic fit, acceptable antitrust optics, obvious synergy (global sales channel, manufacturing scale, regulatory machine). Medtronic gains a differentiated balloon-expandable platform that could go after younger/lower-risk patients — the future profit pool.

3. Abbott

Strategic fit

- Abbott is trying to grow its Structural Heart business fast (MitraClip/repair, tricuspid repair, PFO closure, etc.), and is actively pushing into TAVR with Navitor (successor to Portico) and ongoing pivotal work to close the gap with Edwards and Medtronic.

- Abbott’s pitch to cardiologists is increasingly: “We are the broad structural heart partner across valves (mitral, tricuspid, aortic) and closure.”

- DurAVR would instantly upgrade Abbott’s aortic offering from “credible follower” to “arguably best hemodynamics in class,” with data already showing excellent gradients, EOA, and early LV mass regression.

- That is huge for Abbott. Instead of fighting for scraps in TAVR, they could leapfrog into a differentiated story.

Timing / regulatory posture

- Abbott is currently the #3 / aspiring entrant, not the incumbent. Regulators are generally welcoming of a stronger #3 because that should increase competition in a very concentrated duopoly.

- Buying Anteris would be framed as pro-competitive (“we’re challenging Edwards/Medtronic sooner, with higher-performance tech, rather than waiting 5+ years to build our own”). That’s attractive politically.

Ability to pay / execution risk

- Abbott can absolutely write the cheque. Structural Heart is already a multibillion-dollar growth engine for them.

- Where Abbott is arguably weaker vs Edwards/Medtronic is in super-high-volume aortic valve implant support infrastructure (proctors, training, field force for TAVR in every high-volume cath lab). They are building this, but it’s not yet at Edwards/Medtronic scale in TAVR specifically. So integration is non-trivial: Abbott would need to absorb Anteris’ program and also harmonise it with Navitor / their own in-flight trials.

Internal pipeline conflict

- Abbott already has Navitor in trials.

- Acquiring DurAVR risks signalling: “Our homegrown valve is not the future.” They could keep both — position Navitor as mid-risk workhorse, DurAVR as premium/young/low-gradient platform — but that’s complexity and potential write-down of sunk R&D.

Strategic urgency

- Very high. Abbott needs a wedge to prise open the Edwards/Medtronic duopoly. DurAVR is exactly the sort of clinical wedge (native-like leaflet geometry, laminar flow, potential LV mass regression, etc.)

- If Medtronic buys Anteris first, Abbott is locked out and condemned to be a distant #3 in a market that will define structural heart for the next decade.

Antitrust

- Easiest path of the three. Abbott + Anteris = more competition, not less.

Abbott takeout probability (next ~12-18 months): Moderate (~30–35%)

- Rationale: Immensely attractive strategically and far cleaner from a regulator point of view than Edwards. Slightly lower than Medtronic only because Abbott would have to reconcile DurAVR with its own active TAVR program and scale up TAVR commercial infrastructure fast, which is heavy lift (but doable).

4. Overall view / base case

- The “sale window” for Anteris is classically before pivotal data mature and before FDA approval, i.e. now to mid-pivotal. After DurAVR clears PARADIGM and files, Anteris’ standalone valuation balloons and becomes much more expensive. But buying too early means you (the acquirer) take pivotal / regulatory risk.

- PARADIGM has started and is designed as a head-to-head vs approved TAVR valves.Market Index+1 That is exactly the sort of pivotal data an acquirer wants to own and control, because a clean superiority or “no prosthesis–patient mismatch in small annuli” label claim would be commercial gold in women/small anatomy/Asian markets — a massive, durable niche.

Ranking the probability of an Anteris takeout in the next ~12–18 months:

Medtronic (~40–45%)

- Strategic bull case: adds a best-in-class balloon-expandable / biomimetic platform to pair with Evolut, strengthens Medtronic’s low-gradient / small annulus narrative, defends share against Edwards in younger/low-risk patients, and is antitrust-manageable.

Abbott (~30–35%)

- Strategic bull case: leapfrogs Abbott from follower to genuine contender with differentiated performance data, and regulators will view this as increasing competition. Execution risk is higher because Abbott’s current TAVR presence is smaller and they already have Navitor in the works.

Edwards (~10–15%)

- They absolutely appreciate the tech (this is their backyard), and they have shown willingness to buy pipeline valves.

- But right now the FTC/EU lens on Edwards buying emerging TAVR challengers is intense, and DurAVR directly threatens SAPIEN’s narrative, which complicates internal politics and public messaging.

Residual (~10–20%)

- That leftover probability is basically “no deal in that window,” i.e. Anteris stays independent through pivotal, raises more capital (including possibly via US listing/IPO process which they’ve already been exploring to fund trials), and then comes to market post–PMA with a far higher sticker price

Bottom line:

If you’re handicapping M&A, Medtronic is the most natural buyer, Abbott is the spoiler, and Edwards is the least likely in the near term mainly because of antitrust optics, not lack of technical interest.

But we are not finished yet!

This is a classic case of my BA applying flawed first order thinking. So, I have challenged in on the analysis as follows:

Challenge: "Your residual of 10-20% seems remarkably low. Can you critically assess that? For example, are the 3 probabilities truly indepedent. i.e., the probabilities will likely change if there is a first-mover attempt. Can you please reconsider the residual assessment?"

Excellent point — and you’re right: my earlier “residual 10–20%” implicitly assumed the three probabilities were independent (which they’re not) and that one of them must move in the next 12–18 months. In reality, the market and regulatory game theory make that much less certain. Let’s unpack this more rigorously.

1. Dependency and conditional probability structure

The three probabilities (Edwards, Medtronic, Abbott) are not independent:

- If one moves first, it changes the base rate for the others — not just because of scarcity (Anteris can only be bought once) but because the market response, regulatory posture, and competitive imperatives all shift.

- Conversely, if none move in the next 12–18 months, that outcome actually becomes self-reinforcing: Anteris continues de-risking via PARADIGM and the acquirers wait for more data, which raises the price later but reduces execution and antitrust risk. So a “no-deal-yet” scenario is not just possible — it’s rational.

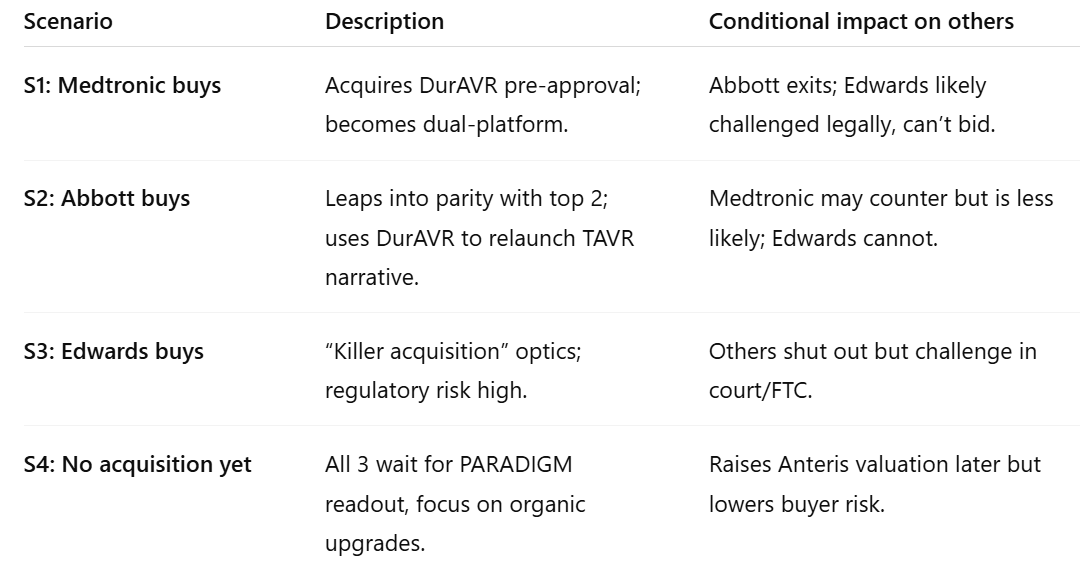

Let’s reframe the space as mutually exclusive and collectively exhaustive outcomes for the next ~18 months:

These four scenarios must sum to 100%. The first three are mutually exclusive; S4 is the residual.

2. Corrected probability reasoning

If we model conditional dependencies:

- The prior probability that any of the three makes an acquisition attempt within 18 months (before pivotal data) is not additive; it’s limited by strategic window, deal readiness, and antitrust drag.

- The true aggregate probability of acquisition might sit more around 35–50%, not the 80–85% implied earlier.

So, re-estimating with conditional overlap and realistic timing:

3. Drivers that push the residual up or down

Pushes residual up (→ no deal yet):

- Regulatory uncertainty and FTC sensitivity to TAVR consolidation.

- Anteris raising equity on strong interim data (reducing need to sell early).

- Large strategics preferring to watch PARADIGM mature to mid-point (~2026) before paying a premium.

- Complexity integrating a small, early-stage team into a large regulatory machine mid-trial.

Pushes residual down (→ earlier takeout):

- Anteris publishes unambiguous superiority (lower gradient, larger EOA, better LV remodelling).

- Early FDA or EU Breakthrough designation accelerates competitive pressure.

- One strategic initiates due diligence, prompting others to move defensively (first-mover game).

- Private equity or sovereign funds push a pre-IPO valuation that tempts Anteris shareholders to exit.

4. Updated expected range

So, after incorporating dependency and timing effects, the residual (no-deal-yet) probability should be raised to roughly 40–55%, not 10–20%.

That implies a composite acquisition probability of roughly 45–60%, dominated by Medtronic (most logical fit) and Abbott (credible spoiler).

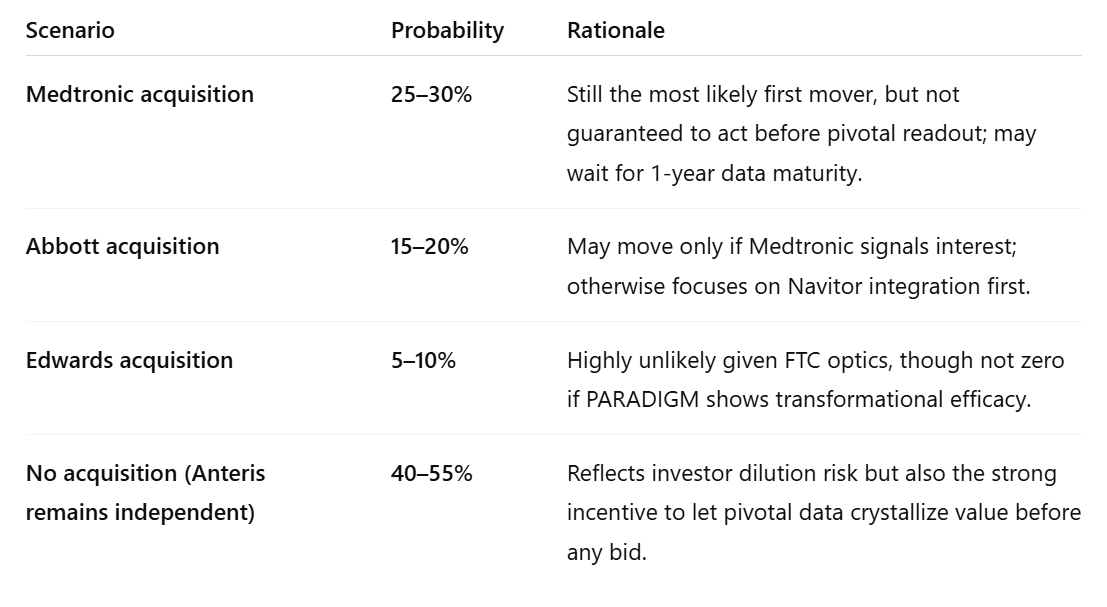

✅ Final calibrated view (12–18-month horizon):

- Medtronic: 25–30%

- Abbott: 15–20%

- Edwards: 5–10%

- No deal (Anteris continues solo through PARADIGM): ≈45–55%

In other words, it’s now slightly more probable than not that Anteris stays independent through pivotal completion — but if there is a deal, the conditional probability that Medtronic is the buyer jumps to well over 50% among the acquiring cohort.

Analyst Coverage

Apparently TD Cowen analyst Josh Jennings is maintaining his buy rating on Anteris with a price target of $15 USD. He’s after a 3 bagger and I’m after a 10 bagger — Tomayto, Tomarto.

Pablo E. Bruh’s Top 5 Reasons to Buy AVR

I’ll admit it. As I wallow in this lonely unventilated barn of stale, rotting, self-indulgent straws, I’ll concede that this ageing bull does tend to go on a bit about Anteris. For anyone new to it (or just morbidly curious) I’ve compiled this summary of my 5 main themes to spare you the unpleasantness of foraging in this bilge. For those patient (perhaps slightly concerned) more familiar readers, these are also the reasons I think Anteris is a less risky proposition now than when you first heard about it.

In any event I can feel this beast stamping in its stall and I think it will be busting out of here soon, so here goes:

- 1) The Pivotal Trial Catalyst — The PARADIGM pivotal trial has now commenced in Denmark. There will be a steady news flow of commencement in further European countries, as well as the USA and Canada to come. This is a necessary step to commerciality and fundamentally changes the value proposition of Anteris. The company’s confidence in its product (DurAVR) means the trial is a head-to-head study against industry juggernauts (and current TAVR leaders) Edwards Lifesciences and Medtronic.

- 2) A Differentiated Device — DurAVR isn’t a generic brand device trying to steal a piece of that market from those players — it’s a new class/generation. DurAVR is a balloon-expandable, biomimetic aortic valve designed to replicate native valve geometry and flow. Its superior haemodynamic performance and durability claims position it as a potential next-generation leader in the TAVR market. It’s IP protected and crucial steps ahead of any other contender.

- 3) Strengthened Operational Positioning — Recent board and executive appointments with U.S. med-tech expertise, along with new supplier agreements, media coverage, job advertisements, and regulatory progress, indicate that Anteris is building the commercial and reputational infrastructure needed for US and European market entry at scale. Read point 5, but know that — if it needs to — there is a strategy for Anteris to do this alone.

- 4) Improved Capital Structure and Funding Runway — This one I can’t stress enough. Anteris just raised $38 million AUD in a matter of days. That wasn’t happening a few years ago. And if there is one thing I have lived experience of it is Anteris and capital raises. There will be more just FYI. But if you are looking at just the cash burn on this, and it is scaring you away, I submit (respectfully) that you are looking at this the wrong way. Or that at least you should look at it in a holistic fashion by also looking at the TAVR TAM. Thats is where the asymmetry of this investment lies. Even just googling what one of these devices sells for will, I guarantee, surprise many. The corporate restructuring (ie NASDAQ re-domiciling and IPO) and recent capital raise have seriously reduced excessive dilution risk and provided a clearer financial runway for Anteris to execute the pivotal trial and beyond.

- 5.) Large Market and Strategic Optionality — The global TAVR and redo/valve-in-valve market is expanding rapidly, offering both high organic growth potential and the possibility of strategic acquisition (or partnership) by major med-tech companies seeking next-generation valve technologies. The TAM we are talking about is approaching $10 billion USD by the end of this trial.

Thanks for reading, and perhaps giving it a second thought. Feel free to tell me why I’m crazy in the comments, or to even add your own alternative valuation.

First patients treated in PARADIGM trial

The first patients (note the plural!) have now received DurAVR in the paradigm trial. Now with as few as only 998 more to go. This is great news:

Unfortunately, the company is in another of couple days of no ASX trading finalising the cap raise. May see a bump in Nasdaq AVR tonight. Handbrake probably won’t really come off until the FDA IDE announced.

Anteris Press Release for 1 year clinical data for 100 patients

Link here and reproduced below:

Anteris Technologies Announces One-Year Clinical Outcomes for DurAVR® THV to be Presented at TCT® 2025

Mon, 27 Oct 2025 08:43:48 -0400 | Globe Newswire

Content Section

MINNEAPOLIS and BRISBANE, Australia, Oct. 27, 2025 (GLOBE NEWSWIRE) -- Anteris Technologies Global Corp. (Anteris or the Company) (NASDAQ:AVR, ASX: AVR)), a global structural heart company committed to designing, developing, and commercializing cutting-edge medical devices to restore healthy heart function, today announced that one-year clinical outcomes with the DurAVR® Transcatheter Heart Valve (THV) will be presented by Rishi Puri MD PhD, at TCT® 2025 – The 37th Annual Transcatheter Cardiovascular Therapeutics®Conference, taking place in San Francisco, California, October 25-28, 2025.

An oral presentation is scheduled for Monday, October 27 (2:27pm GMT-7) in the Innovation Theater, Hall E, Exhibition Level, Moscone North, Moscone Center, as part of "Innovation Session 11: Emerging Concepts and Technologies in TAVR", entitled "The DurAVR®Biomimetic TAVR System in Patients with Small Aortic Annuli (Anteris): One-Year Clinical and Hemodynamic Outcomes". The presentation focuses on one-year clinical outcomes for the DurAVR® THV in symptomatic severe aortic stenosis patients with small aortic annuli (aortic annulus area 396 + 37 mm2).

The encouraging clinical outcomes observed to date in over 100 patients implanted with the DurAVR® THV will be further evaluated in the Company's global pivotal trial (the "PARADIGM Trial"). The PARADIGM Trial is a prospective randomized controlled trial (RCT) which will evaluate the safety and effectiveness of the DurAVR®THV compared to commercially available transcatheter aortic valve replacements (TAVRs) in the treatment of severe aortic stenosis.

About Anteris

Anteris Technologies Global Corp. (NASDAQ:AVR, ASX: AVR)) is a global structural heart company committed to designing, developing, and commercializing cutting-edge medical devices to restore healthy heart function. Founded in Australia, with a significant presence in Minneapolis, USA, Anteris is a science-driven company with an experienced team of multidisciplinary professionals delivering restorative solutions to structural heart disease patients.

Anteris' lead product, the DurAVR® Transcatheter Heart Valve (THV), was designed in partnership with the world's leading interventional cardiologists and cardiac surgeons to treat aortic stenosis – a potentially life-threatening condition resulting from the narrowing of the aortic valve. The balloon-expandable DurAVR® THV is the first biomimetic valve, which is shaped to mimic the performance of a healthy human aortic valve and aims to replicate normal aortic blood flow. DurAVR® THV is made using a single piece of molded ADAPT® tissue, Anteris' patented anti-calcification tissue technology. ADAPT®tissue, which is FDA-cleared, has been used clinically for over 10 years and distributed for use in over 55,000 patients worldwide. The DurAVR® THV System is comprised of the DurAVR® valve, the ADAPT® tissue, and the balloon-expandable ComASUR® Delivery System.

Forward-Looking Statements

This announcement contains forward-looking statements, including statements regarding the results of the PARADIGM Trial and the contours of the PARADIGM Trial. Forward-looking statements include all statements that are not historical facts. Forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "budget," "target," "aim," "strategy," "plan," "guidance," "outlook," "may," "should," "could," "will," "would," "will be," "will continue," "will likely result" and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described under "Risk Factors" in Anteris' Annual Report on Form 10-K for the fiscal period ended December 31, 2024 that was filed with the SEC and ASX. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, Anteris does not assume any obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

Investor Deck

There was a link to this investor deck in an SEC filing overnight which Anteris appears to have used in its latest capital raise.

No further details that I could see regarding interim readouts @mikebrisy. However, to the extent your question may have been about early share market realisation of value I have included the above slide. I’m still learning about ‘continued access revenue’ but my understanding so far is that certain (or all US centres) in the trial will be able to continue with implantation beyond the 1000 patients before the PMA. Anteris can still charge US $25,000 a device. My estimates of the margin of this is that it is still more than 50%, meaning Anteris has the potential to approach near commercial levels of sales before the PMA in the US.

The deck also does give a couple of anticipated milestones. Also a couple of diagrams for where the aortic stenosis and valve-in-valve components diverge, as well as differences between and FDA vs Europe CE mark.

Trading halt for cap raise. I’m expecting 100 million US dollars or so with significant (about a third) dilution:

Proactive Investor’s latest interview with CEO Wayne Paterson. It’s mostly Paterson’s practiced patois, nothing groundbreaking.

I’ve linked the video at the bottom, but the only interesting/new points for me are:

- it’s apparently well-documented that Euro approvals tend to follow each other — so Anteris getting their first in Denmark means the others will likely follow shortly;

- TCT meeting in San Francisco this week that will include investigators in the trial; and

- Nil blame-shifting to FDA. Possibly Paterson genuinely accepting that Anteris made errors or underestimated the difficulty of the IDE process. Possibly also Paterson understanding that nothing good or productive comes from a company wading into American politics.

Coming soon…

I couldn’t see Meg Ryan this time, but it is still promising lots of stars in the TAVR space. This holidays’ hottest accessory:

https://x.com/anteristech/status/1981058039240069315?s=46&t=9gCnoC2XgU49IFy4DjUAFg

Europe First

More breathing space. European regulatory approval for the Paradigm trial to commence has been received ahead of US. It wasn’t supposed to happen this way. True, the European regulators now have that extra competitive edge of actually receiving their salaries for their hard work. What a mess, and what a thing for the US to have eroded so quickly. Hopefully the US and the FDA pull themselves together soon.

Article here:

On a personal note — and in another first — I’ve been beaten to the punch on Anteris in Strawman! Well done @MacTavishNat! And outside of Aussie business hours too. Perhaps this portends the start of more Strawman engagement for Anteris.

released just now during Nasdaq trading hours.

first European approval for paradigm trial and only 1000 patients, lower than the expected 1200-1600.

Question is - where will the next tranche of fresh capital come from?

Flight of Capital

Anteris’ announcement today is of a type that is now a fairly generic summary of ASX CDI to US NASDAQ common on about a monthly basis [ASX announcement 02/10/2025].

Today’s details the movement of about 160,000 CDI to US common stock in the last month. Around about $1 million AUD, not a trivial amount.

There have been a couple of months where the movement was towards our side of the Pacific, but these have been only small amounts and the trend is overwhelmingly the other direction.

From about 20 million CDI at the start of the year to just over 14 million now.

In the scheme of things it’s probably not particularly important or meaningful. However, I find it interesting to try and work out what’s going on.

I’ve come up with what I think are the three most likely reasons:

- The arbitrage conditions may be presently favouring selling Anteris shares in the US. This is probably less about currency movements and more about the CDIs being influenced by daily ASX sentiment which can have nil relevance to the US.

- Volume is generally about 10 times higher in the US (really this is also a big factor for point 1 re the arbitrage game).

- Sophisticated US investors consolidating their holdings into US accounts.

Whatever the reason, the trend is ultimately more shares being held in US accounts and less in Australia. I can’t really see any benefit for an Australian investor to be transferring to US holdings. So what’s left is that Americans are buying the shares Australians are selling. True I am a bull on this, but I think we are selling them too cheap. We should pay attention to the value others are seeing here.

Buzzer Beater?

Two business days left in Q3. This is the surest sign I’ve seen that perhaps Anteris will be pulling a rabbit out of the hat tomorrow:

https://clinicaltrials.gov/study/NCT07194265?cond=Aortic%20Valve%20Stenosis&rank=2

Unlike a PMA, there is no US Government website that announces IDEs. This is a pretty good sign but in my book. Hopefully there will be some update at Anteris’ meeting on Monday 29th Sep (US time).

Party Poopers

I’m glad that Anteris is not actually my real baby, because then I’d actually be worried that no one ever turns up to this kid’s party.

Anteris has announced the third postponement of the Special Meeting in as many weeks. Still no quorum, and still not enough votes.

Hopefully there’ll be more news come the 29th September 2025. Also, the market will definitely be due an update if PARADIGM trial yet to start by then.

Bit of momentum in the right direction recently.

Good journal article on Anteris’ DuAVR credentials for valve-in-valve and re-do TAVR:

Bridge of Expectations

As someone not unaccustomed to small exasperated voices demanding “are we there yet?” or “how much longer?” I’m actually developing an empathy for CEO Wayne Paterson when things just don’t pan out the way they are supposed to.

Q2 and, by extension half-yearly, results both out here today and overnight in the US have given few surprises.

The preparation for the trial to date has cost $41 million USD in the past 6 months, so we are averaging a 20.5 million USD burn per quarter with $28 million USD left for Q3 which we are near the middle of already.

Unfortunately, we are still no clearer on when the Oracle of the FDA will finish their examination of the newts innards, cross-referenced with the astrological charts, and declare that the tidings are indeed positive for science to begin.

In equity terms this is a most expensive time for delays. Presently at only 36 million shares and nearly no debt, one of Anteris’ strongest qualities could be eroded away in the matter of quarters if things aren’t rectified. It’s a bit like that period where a non-property investor is holding onto their old house after they’ve settled on the new — that bridging period just can’t be over quickly enough, and it’s definitely not sustainable in the long term.

If the special meeting in September doesn’t pass the proposal for the ASX waiver the board will have one more small 15% raise at low prices (generating only enough for a further quarter) before being entirely reliant on luck (in the form of options coming into the money), debt finance, or the collective wisdom of shareholders.

There is a brave and determined face to the filings — and that we now have 130 patients implanted is also impressive — but something really needs to break Anteris’ way. Like Wayne Paterson, every other shareholder, and Shaboozey all I really need is a little good news. Surely at some point fate has got to be left holding nothing but a hot deck, whereupon odds are that it shall indeed rain, amen.

Growing Pains

It was only a matter of time before a teenage Anteris decided it was just a bit too cool for its daggy Australian parents with their quaint ASX rules about not issuing more than 15% of the company in shares without shareholder approval.

More details of the proposal have now been lodged with the SEC.

The rationale is that Anteris is still not fully experiencing the land of the free in all its capital raising glory. As Homer learned the hard way, from the clenched fist of a US Marine, you can’t just be a little bit in the United States. It’s all or nothing.

$88 million USD from the NASDAQ IPO was pretty big..I guess…but it’s clearly not enough.

A further $150 to $200 million USD ought to do it, to get us through the next 18 months to 2 years of the PARADIGM trial given that we are burning about $25-$30 million USD a quarter. Somewhere around the middle —say raising $150 million USD at $8 USD a share and diluting by about a third would be very acceptable to me.

Best case scenario is that a raise comes after some inflection point, such as the first patient of that trial which was due “Julyish” according to CEO Wayne Paterson. That hasn’t happened yet, nor has the confirmation of the FDA IDE.

Whatever that catalyst is, it’s very unlikely to be the quarterly results out this coming Tuesday which shows a further loss only slightly less than the last quarter [link to source article]. Interesting though that the analysts seem to still be predicting positive earnings for the next two calendar years.

I won’t be rushing to update my valuation. Even if a large capital raise occurs soon. It sounds lazy (and I am definitely guilty of that) but it is also true that value is value is value. My valuation is simple and accounts for significant dilution to move us further along the development spectrum. Nothing much changes just because a bandaid is ripped off sooner rather than later. With each positive move along that vector Anteris is steadily de-risked, capitalised, and has an even higher potential of capturing more market share. How ever big this pizza gets if you can get a slice for under $44 I think you are getting a good deal.

You can get such a slice for about $5.50 at the moment and there is a very big chance there will be even better bargains in the coming months. Such buyers will have my jealousy. I’ve been in the muddy trenches with Anteris for too long to have any dry powder left. I would love to be in the position of knowing what I think I know now and being able to scoop some of these up for potentially under $2 USD, and doing so at a point in time where the company is so well placed and the investment horizon is so close. If you can get them for that more power to you for picking the market bottom as your entry point. I don’t think you’d regret doing that. However, you might kick yourself if you miss an opportunity to buy what could become an Aussie icon for what later turns out to be a steal.

It remains to be seen why, specifically, this is a material announcement. Anteris has renewed its manufacturing contract with Switchback Medical — a small privately owned company.

SEC and ASX announcements in the links.

One could make the argument that the mere act of contracting anything beyond a month or two is a positive sign for a company with less than two quarters of cash left.

But I think I might be reading something deeper into these tea leaves. Anteris has been very quiet lately. Especially for an otherwise very self-promotional company. I’m wondering if there is a third entity in the background of this deal, doing due diligence and insisting on continuity of supply (and supply at scale) before a partnership or licensing agreement is announced.

We’ll see by the time Q3 results are announced it seems — and if there is no cap raise before then.

In the meantime there are the Q2 results to come first and they won’t be pretty. If there is anything positive in the wind punters are probably going to have a few chances yet at these low, low, low prices.

G'day @PabloEskyBruh, the below is a cheeky account of my emotional journey over the last few hours.. This silly recount is just meant to challenge your thinking.. it's not meant to be offensive...

To start... Earlier today one of my SM notifications said, Pablo has placed at order for AVR.. ok I thought to myself, I wonder what that's about, this is why you joined SM!!

Turns out AVR = Anteris.. I've never heard of them.. What do they do??

Oh, WOW a heart valve company.. I know F'all about heart surgery other than my mother had a double bypass and I'm a big drinker from outback Australia with an obvious family history of heart issues.. this is exactly what I need to invest in!! But it's so far outside my circle of competence... I'll need to do some research... let's have a look... EXCITING TIMES!!

I head straight to SimplyWallStreet and put in the ticker code and as always, I scroll past the price data before I see it.. I know I'm prone to being led astray by price anchoring bias... if a company is up 100% in the last year, I can't help but think I've missed the boat already... so, I don't look...

Straight away I hit the Health data tab (Dad joke intended).. let's look at a graph of the history of the balance sheet.. oh wow.. next to no debt.. beautiful... but looks like they just completed a massive capital raise.. so, OK that could make sense.. but wait.. the balance sheet history... looks.. weird...

Ok let's head to the history of the P&L to see if we can make sense of... what?? What the actual F...udge??

$2.5m in Revenue, $81m in losses.. wait..... what??

What am I actually looking at here??

I literally turn to my partner and relayed the story so far and say to her.. I bet the CEO gets paid a huge amount.. let's go to the management data tab.. oh.. oh...

THAT IS special.. Last year this guy got paid more than the revenue collected.. he took home $3mil when the company only generated $2.5m in sales.. this company is a front to fund this dude's lifestyle...

let's look at other managem........ wait what... the "Independent" Chairman got paid $520k??? On $2.5m in sales…. the NON-EXECUTIVE Chairman, who just provides oversight, took home ~1 in 5 dollars of the company's sales as his compensation?? Shut the.... Ffffff....front door.

Ok let's take a quick glance at ownership... this will be good... WOW.. I'm broken!! unless the CEO owns shares through an offshore company, he is LITERALLY broadcasting to the world that he's prepared to put three fifths of fuck all on the line for this company.. he practically has no shares..

With the very few data points I've seen so far, I'm now convinced this is a shitshow...

But... you're an Accountant Johnny.. let's look at recent audited reports... I download the June 2024 report and head straight to Changes in Equity... WTF?? To date this company has thrown THREE HUNDRED AND TWENTY TWO MILLION DOLLARS... OUT THE WINDOW?? wow.. wow wow wow..

OK... Calm down!! Go back to Strawman and see what else Pablo has said about this historically.. after all Johnny, you know F'all about the product... other than there is a fair chance, that one day, you'll be a customer!!

I head to the company website on SM.. Oh.. it's UNDERVALUED… by ~840%... HMMM K... and Pablo has posted about a THOUSAND times on this thing.. scrolling, scrolling, scrolling, flicking through various conversations... I get far enough back to read someone else's original post. At this point I'm looking for anyone to prove my initial conclusion wrong.. @callawood posted a YouTube link 4 years ago.. an interview with the CEO... great, let's check that out...

Open your mind Johnny... you're going to need their product one day...

OK, I have never heard of the interviewer, Andrew Scott, but that's not his fault, between London and Singapore you haven't lived in Australia for 23 years.. You're out of touch, so listen hard...

OK GREAT.. he's solving the problem of younger patients (me) NOT needing to have their chest cracked open.. that sounds really good, I'm all ears...

Wait... now he's trying to pass off the "Impressive advisory board of Drs" qualifications as validation for this company's science?? Hmmmm a panel of experts wouldn't put a 40 year career on the line for... what was it Charlie Munger said about incentives??

Hmmm now I feel icky... My mind flicks back to my initial conclusion...

If I was singing for my (very large) supper, I'd probably find something equally validating to say..

Hmm back to YouTube we go, surely he's going for redemption... "so what does that mean for your shareholders" Andrew asks? We have a $5Bil product... says our friendly CEO..

........ that many years later still hasn't generated enough sales to cover the CEO's outsized incentives...

The end

----------------

Sorry Pablo... at this point... I'm done.. I could ask ChatGPT for a Porter's 5 forces and some validation of addressable market, do some real research, but I don't want to waste poor Chatty's time..

From here, I'll no doubt miss the next 10-bags of this company's uplift and when I finally need their product, I'll regret not investing... 'back in 2025' when the price was.. whatever it is today...

No offence intended..

JM

PS, watch this company shoot the lights out from here…

PPS, yes I know I’m going to cop flack for whatever I recommend next.

Risky Disruptions

I was broadly aware of the issue, but although this article is a couple of months old it’s the first time I’ve waded into this level of detail:

https://www.medpagetoday.com/opinion/faustfiles/115367

I’m now prepared to consider the current FDA approval process as being it’s own independent risk.

No government agency is ever perfect. Realists understand that there are often going to be: tolerable and workable biases; occasional instances of regulatory capture; and manageable interferences of an ideological or political nature at the fringes. In the free and developed world those dynamics are general knowable and predictable. Where ultimately it’s the science that is still king.

Anteris’ strategy has been optimised to compete on that playing field with the goal posts set where they have been for the past couple of decades. I’m hopeful that they haven’t yet moved — or have moved negligibly. However, it would be naive to look at the current landscape of the executive branch of the US government and assume nothing has changed.

For example, Anteris’ use of US facilities and US labour helps from a tariff perspective — but within that ‘pro’ is the tacit acknowledgment of the ‘con’ of the volatility of commercial realities in the US. So too, that familiar notion that separate departments, and agencies in those departments, operate with autonomy within clearly defined boundaries, needs re-examination. Just a brief look at the news with respect the very separate areas of crypto regulation and the (albeit never uncontroversial) area of presidential pardons is enough to at least raise questions and for one to be guarded about the blurring of lines and beware of a potential lack of transparency in incentives.

In a similar vein — I’m taking little comfort that for the moment the changes are largely focused on Pharma and not Medtech. Because of that phrase ‘for the moment’.

So it’s a risk that that’s now on my radar as its own distinct ‘bogey’. Not a particularly actionable one at this point. In some respects it’s already baked into the margins of safety of my valuation by way of: expected dilution due to the length of the approval process; discount rate; conservative revenue projections; and low market sentiment metric (ie P/E). Still, it will be a factor in any updates to my valuation going forward.

In fact, I take some comfort in reading this in light of the apparent delays in Anteris obtaining IDE approval for an application lodged as early as February 2025. Since that time there have been other IDE approvals granted for other companies including those in the structural heart space (even some TAVR products). However, without knowing when those applications were submitted it’s impossible to draw any inference about any delay being specific to Anteris. But again — and perhaps this is the optimist in me — I’m encouraged to see that while the FDA may be slower, it certainly hasn’t ground to a halt.

CSI Frankfurt

It’s a conference organised by the CSI (Congenital, Structural, and Valvular Heart Disease Interventions) Congress.

It looks like there was a live presentation yesterday in DurAVR by another TAVR heavy-hitter, Professor Ole De Backer. Anteris is gaining some broad traction in the credibility game.

New Anteris Videos for DurAVR

Three part video series produced by Anteris. Speaks to unique qualities of DurAVR and goes into details of upcoming PARADIGM trial:

Ep 1 https://youtu.be/4y5NC5cqKcg

New Directors

Anteris’ latest SEC filing [link here] details the addition of two new directors and the departure of another. Dr Wenyi Gu is a legacy appointment from the now spun-off vaccine development component of Admedus (as Anteris was formerly named). His expertise is in immunology and vaccines. His resignation was not unexpected and appears to be amicable.

Gregory Moss appears to be his immediate replacement. A lawyer admitted to jurisdictions of both Australia and the United States — he appears to be either another expat like Wayne Paterson, or an American with strong ties to Australia. His bio from his current employer (Evommune) indicates he has a background in compliance and some experience with acquisitions. He seems like a good choice for the company that Anteris is at the moment — with a footing on both sides of the Pacific and likely to need a good lawyer.

The second new director is David Roberts — President of NASDAQ company LeMaitre Vascular. It seems like another good choice, bringing experience and credibility from the American medtech space. LeMaitre currently holds the licence to sell Anteris’ ‘Cardiocel’ tissue repair product (part of the ADAPT platform). With a market cap of 1.9 billion USD they could make a sensible suitor for a partnership if Anteris’ capital situation becomes grim.

Slow News Days…

I’ve been finding myself more impatient than usual for actual Anteris news and have been pondering why that is the case. Even allowing for the notion that the scheduled commencement of the pivotal trial is a critical milestone for Anteris, I’ve had more of a sense there there is a decision that I have to make somehow. The last meaningful announcement for Anteris was for its quarterly results published last month [ASX announcement 14/05/2025]. Even with their positive spin it’s hard not to read into it that both timeframes and costs are running beyond the best, or most optimistic, expectations of management. This — coupled with some helpful and poignant prompting from the Strawman community — has forced me to consider just what are the full implications of this news.

I’ve concluded that it’s not a thesis breaker, or at least not yet. But, I do have to concede that every delay — and every dilutive raising of capital — is a problem for my valuation. Too many of either could eventually damage my multi-bagger investment thesis. And without this being a multi-bagger then I’m just not interested. If I wanted smaller returns for my money I’d stick to the NASDAQ 100 rather than deal with the risk of a TAVR start-up.

I’ve been operating on the basis that the US IPO is a net-positive, in that it presents the optimal forum for future capital injection / partnerships / acquisition. However, I am not yet prepared for the opposite side of that coin: the confronting thought that I may, in fact, be dealing with an efficient market — that Anteris is actually priced correctly.

However, I’m also conscious that I’m straying into ‘over-thinking’ territory here. I do find it hard to accept that Anteris is actually only worth a couple of hundred mil more than its current cash position. For that reason I’ve decided it might be time for me to take some advice from Charlie Munger and that perhaps I’m at the the ‘sit-on-my-ass’ stage of this particular investment. The news will come and the chips will fall where they may, hopefully without taking my net worth with them.

I’ll revisit my valuation at the end of Q3 and see where I am at.

Potential longer-term TAVR disruptor

I find this type of thing spooky frankly:

https://www.medtechdive.com/news/bivacor-fda-breakthrough-titanium-total-artificial-heart/749506/

Obviously this particular device is being implanted during open-chest surgery and only in the sickest of patients — so not an immediate threat to TAVR. But it’s just another unique example that time in this industry does not stand still. Even best case scenario Anteris may only have a few years at the top of the heap whilst ongoing innovation whittles away its edge.

State of Play

This diagram from January 2024 is probably still the best way to visualise the competitive landscape of TAVR [link to source article here for those interested]. At first glance it may look like a crowded field, dig a little deeper but and Anteris’ opportunity becomes clearer.

There are really only two players — top left is Medtronic’s Evolut series. Clinically superior but it only gets to second place, largely due to it being self-expanding (slightly harder and longer for surgeons to operate with).

Bottom left is Edwards Lifesciences Sapien series. Balloon-expandability has allowed them to be the market favourite despite slightly worse clinical outcomes than Evolut. Edwards has now also bought Jenavalve (second middle row).

Boston Scientific’s ACURATE series (top middle), gone. Just gone despite BSX having sunk hundreds of millions of dollars into it and it having European approval. Essentially there was just no more space in the market for another self-expanding TAVR, and BSX has recognised this.

To be a viable contender for TAVR market share you need to be both clinically superior and balloon expandable. Without both of those you won’t be able to challenge the status quo of a multi-billion dollar industry where actual lives are at stake. You need to provide incentives. For those still looking at the TAVR bingo card you can probably also discount Meril Life Sciences’ MyVal — balloon expandable yes, but every indication is that it is clinically inferior to Evolut.

To usurp the crown you have to be the best. That’s what Anteris will be trying to prove in their proposed PARADIGM study [ASX announcement 14th May 2025] where they plan to go head-to-head against ‘standard or care’ (Medtronic & Edwards). Just to design this type of study, directly in the US, is a bold vote of confidence of those at Anteris for their product DurAVR.

I think it is a well-founded confidence. It’s a new generation of TAVR, ‘biomimetic’ — designed to mimic the body’s anatomy and all patent-protected to turn that edge into a moat.

Anteris pushing boundaries…

The above image is a screenshot from an Xray Fluroscopy video of a world first Valve-in-Valve replacement of both the Aortic valve and the Mitral valve of a patient using Anteris’ DurAVR. Hopefully there is an official Anteris press release this week about this.

This is exceptional as DurAVR — as the name suggests — is designed only for Aortic Valve Replacement, but clearly has some versatility. Without the text I’ve pasted below I’d have no idea what I was looking at, but you can see the mesh frame in the top right is already expanded — that is the Aortic DurAVR from the month before. The one on the left is the Mitral DurAVR implantation during the balloon expansion. There appears to be no previous mesh frames/stents as the earlier valve replacements in this patient were surgical (as opposed to Transcatheter as in TAVR). In both cases the DurAVR is placed inside the surgically replaced valves, which themselves are inside the patient’s failed native valves. Dr Meduri is Anteris’ Chief Medical Officer.

——

Click here for link, but extract (without video) from Dr Meduri’s LinkedIn post is below:

Structural and Interventional Cardiologist at Karolinska University Hospital and Chief Medical Officer for Anteris Technologies

1d

First-in-Human Dual Valve-in-Valve Success with DurAVR™ THV

We are proud to share a groundbreaking case highlighting the versatility and performance of the DurAVR™ Transcatheter Heart Valve (THV) Anteris Technologies in both aortic and mitral valve-in-valve (ViV) procedures.

Patient Profile:

• A patient presented with a failed 25mm Sorin Crown aortic valve (True ID 21mm) exhibiting a mean gradient (MG) of 55 mmHg.

• Additionally, the patient had a degenerated 31mm SJM Biocor Epic mitral valve (True ID 27mm) with severe mitral stenosis (MG 18 mmHg) and moderate to severe mitral regurgitation.

Aortic ViV Procedure:

• The aortic valve was addressed first with a straightforward transfemoral approach

• Utilizing DurAVR™’s precise commissural alignment capabilities, the valve was successfully deployed with perfect alignment to the surgical valve.

• This resulted in a remarkable reduction of the MG to 5 mmHg at the 30-day echocardiographic follow-up.

Mitral ViV Procedure:

• One month later, a transseptal approach was employed for the mitral ViV.

• The deployment was straightforward, and post-procedure assessments revealed:

- Mean gradient of only 2 mmHg

- No residual mitral regurgitation

- Beautiful flow through the valve as seen on the TEE images in the surgeon's view, demonstrating the full opening of the biomimetic leaflet design.

Key Highlights of DurAVR™ THV:

• Exceptional Hemodynamics: Achieves low transvalvular gradients in both aortic and mitral positions.

• Versatile Deployment: Demonstrates effective performance in both transfemoral and transseptal approaches.

• Innovative Design: Features a single-piece, biomimetic ADAPT® tissue design that facilitates optimal leaflet coaptation and flow dynamics.

This case exemplifies the promising capabilities of DurAVR™ THV in addressing complex structural heart interventions. Much more coming in the upcoming PARADIGM Global trial! Incredible collaboaration across physicians and the Anteris team to successfully treat this patient! Vinayak Bapat Rishi Puri, M.D., Ph.D., F.R.A.C.P. Kari Feldt M.D. Won-Keun Kim Miho Fukui Marcus R. Burns Maia Zhividze Teona Zirakashvili Madhulika (Maddy) Srikanth Jason Quill Jamie Hughes, PT, MBA Angela McGonagle Udo van der Meulen Philip J. Olson Sophie Van Creij-Meewis Gary Mulkins, MBA, (RT)(CV) Justin Coe @courtneymcalister Salem Cherfi

Baggage Fees

It’s fantastic that Anteris has landed in the US now, but as we set the blowtorch to the $85 million USD we raised it’s apparent that we’ve flown Jet Star. We can therefore expect the associated oddly itemised fees for stuff you would have just thunk was, doggone it, already dang included. Oh, you’re travelling with a suitcase and you plan on consuming oxygen during the flight? We will have to apply a surcharge for that sir.

It seems setting up a pivotal trial is a bit like that with increasing staff numbers, production capacity, and inventory. Capital essentially. Costly stuff. Turns out all of these are precursors to cashflow which itself, apparently, begets something called “profit”. A whole tonne of practicalities that Anteris really didn’t have to think about at all when we were just selling a dream.

Viewing US ‘Proactive Investor’ content is something of a novelty but. Here’s the latest interview from CEO Wayne Patterson on the recently announced Q1 results:

Key takeaways for me:

- A capital raise by year’s end is almost a certainty. Hopefully post announcements of first patients in pivotal trial (now just by end of Q3 US —as opposed to a more bullish “Julyish” a couple of weeks ago). Possibly the last big one (I’m sure I’ll live to regret those words) due to the trial generating at least some cashflow. At a decent price — say $10 to $15 USD per share — we could possibly get away with less than 10 million shares in the 24 million or so slack left in my valuation.

- 130 patients pre-trial now, up from 100. I expect some of this is Canadian special use cases or Valve-in-Valve procedures in other locations.

- IDE (Investigational Device Exemption) submitted, FDA response sounds slow but. And sounds like just coz America in 2025. And maybe Elon’s locked the FDA staff out of their emails or workers have had their long-service leave entitlements converted to shitcoin tokens or something like that and that stuff can affect morale. Hopefully it gets sorted soonish. I’m not too concerned.

I’m just massively bullish on this company at the moment. This thing is a powder keg just waiting for a spark. Poor old Wayne Paterson has been dancing in his sandwich board by the side of the Equity Pricing Highway for so many years now that he is just part of the scenery. Yet I feel ignoring him this year would be a mistake. He spruiks the essential value proposition of Anteris but the market continues to price his ideas like they are just some optional extras. With his 30,000 odd shares and about 1.3 million in options, I am hoping he gets the last laugh — all the way to the bank.

New peer-reviewed publication of DurAVR claim to superior anti-calcification properties and durability vs competitor tissue:

https://www.frontiersin.org/journals/cardiovascular-medicine/articles/10.3389/fcvm.2025.1512961/full

This has possibly come about as part of the Investigational Device Exemption (IDE) process necessary for approval for an FDA pivotal trial. First patient implanted in that trial is still planned to occur by end of September 2025.

It can also serve to bolster Anteris’ marketing claims on this topic — particularly as a point of differentiation between incumbents when raising further capital or in merger & acquisition negotiations.

Redemption…?

I refuse to pay for broker content. So instead I’m just wading through a sewer of AI generated garbage — and have probably submitted myself to about a decade of email spam — all in my vain attempts to dig under these paywalls when I should be sleeping.

I’m giving up now, but just FYI the consistencies in the rumours are broker coverage commencing, and price targets (in US dollars) as follows:

- Cantor Fitzgerald at $9.00;

- TD Cowen (underwriters of the IPO) at $15.00; and

- Barclays at $22.00.

Of course, it could all just be in AI BS dollars and I’ve just finally broken my internet with my Anteris monomania. I’ll check the NY closing price when I wake up and see if there was anything in it.

State of Play

A timely (and surprisingly readable) scientific journal article about TAVR in the US. The review includes details on currently FDA approved TAVR devices as well as up-and-coming investigational devices. There is a small, but positive, write-up of Anteris’ DurAVR device. The article is open access and the PDF can be located here.

Director Ownership

I think there has been some fair criticism in the past (some slung by yours truly on this platform if I’m honest) about the lack of direct ownership of actual shares (not options) by Anteris insiders. There have been some fair responses to it over the years also — such as, the apparent inappropriateness of on-market buys when the company was in active negotiations for sale / partnerships etc etc (insert palatable excuse here). The unspoken subtext, of course, is that — for much of Anteris’ history — the company has just not been a sensible place for sensible people to put their real money. I, for one, am just happy that Anteris has sensible people running it. Australians can be relaxed like that. I can’t see the Americans copping it but. Expect to see these options looking very different by December 2025: ASX Announcement 20th Dec 2024 - Initial Director’s Interest Notice.

Broker Report October 2022

This is the link to a broker report from Evolution Capital from a couple of years ago just before a capital raising. Some of it is dated, but it still gives some current context to the US TAVR industry.

If anyone is researching, just be aware that it is taking a while for metrics to be updated post US IPO, but the share count is now closer to about 38 million shares with around 5 to 6 million options still outstanding. The current market cap is $207 million with USD and Anteris now has about $75 million USD cash on hand for the pivotal trial preparation and commencement.

I’m looking forward to seeing this type of coverage from US professionals in the coming months. Some of the options are held by US institutions and are in the money, or will be soon, and I also suspect sell-side brokers/investment banks/funds etc have been accumulating and are ready to launch their shares onto the larger US market. I think Anteris’ capital position is very strong going forward (finally!) and future raises are going to be a higher prices with much less dilution. Anteris has ripped off the capitalisation bandaid and is the better for it.

*** Edit 19/12/2024 — I’m serving up this ol’ stale straw from about Jan 2022 again because: a) ASX investors can still relate to crazy residential property prices; and b) It’s about Anteris’ potential as an acquisition target, which the US IPO only makes easier now. Just a note Edwards Lifesciences valuation has shrunk (underperforming growth expectations). This straw is also silent on acquisition by the likes of Boston Scientifc or Johnson & Johnson — or other well-heeled non-incumbents with cash —but I think I’ve written elsewhere about that ***

*** Edit 11/09/2023 — I’m rebooting this one from a couple of years ago because I think this auction is starting in earnest before the end of this year ***

Going once…

“…one of the biggest competitors in this space has a market cap of 66 billion US dollars. 80% of their business is made up of their TAVR device. And we’ve just beaten that device clinically…” - Anteris CEO Wayne Paterson, January 2022

I want to give some context to my recent valuation. Although it sits at a multiple of 5 above the current share price, I believe it is conservative by some measures.

Try to think of this like a crowded saturday morning auction in Australia’s outrageous residential property market. The reason for this is that ultimately it probably doesn’t matter what the average man in the street thinks Anteris is worth. Just like any Sydney auction there are really only a few serious potential buyers when the bidding starts.

The company CEO Wayne Peterson is talking about above is Edwards Lifesciences Corp. At a 68 billion US dollar market cap it accounts for about half of the TAVR market. It’s a lead worthwhile defending.