Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Interested in @PabloEskyBruh's take on today's announcement of a study by $AVR on performance of DurAVR in a particular patient segment. Note this is outside of the current all-comers, head-to-head PARADIGM pivotal registration trial.

TLDR: a further positive signal of superior performance compared to that typically seen for commercial devices on the specific metric of rate of PPM (defined below).

Analysis of the Study results and Relevance

The newly published 100-patient analysis of the DurAVR transcatheter heart valve provides important early insight into how the device performs in small aortic annuli, a subgroup known to be particularly challenging for today’s commercial valves. Small-annulus patients represent a minority of all people undergoing transcatheter aortic valve replacement, but they experience a disproportionately high rate of prosthesis–patient mismatch (PPM) because their anatomy limits how wide the valve can open.

In current commercial valves, moderate or severe PPM occurs in roughly 11–35% of such patients. In this pooled DurAVR analysis, however, the valve produced an average effective orifice area of 2.2 cm² (reflecting how well the valve opens) and a mean pressure gradient of 8 mmHg (indicating the resistance the heart must pump against), both pointing to excellent blood flow.

Most notably, 97% of patients were free from moderate or severe PPM, far lower than the mismatch rates historically seen with existing devices. This early signal is directly relevant to the company’s recently commenced PARADIGM pivotal trial, which will randomise more than 1,600 patients, including a large predefined subgroup of small-annulus patients, to determine whether DurAVR can consistently outperform standard valves such as Sapien and Evolut.

Limitations

That said, the scope of the current dataset is limited compared with PARADIGM’s broad, all-comers population. The 100-patient cohort is drawn from early-feasibility and prospective multicentre studies, not the controlled, head-to-head randomised setting of the pivotal trial. It represents only a fraction of the anatomical diversity, risk profiles, and comorbidities that PARADIGM will capture across its multinational enrolment. Follow-up in this dataset is only 30 days, whereas PARADIGM will evaluate long-term durability, structural valve performance, safety outcomes (such as death and stroke), and quality-of-life measures out to one year and beyond, with all imaging and hemodynamic data adjudicated by independent core laboratories. Thus, while the early low-PPM signal is encouraging (especially in a subgroup where current valves struggle)definitive conclusions will depend on the much larger and more rigorous PARADIGM trial.

Implications

I am still getting up to speed with this company, and the therapy area. However, I have recently conducted a "deep dive" that indicates that on all key metrics, DurAVR appears to be either superior or in some cases at least not inferior to existing commercial devices.

Today's announcement is not marked price sensitive. And that appears consistent with other clinical updates on studies not directly related to the clinical development program. However, I consider it significant, as it does provide another positive signal on a metric that is relevant to PARADIGM. With a 100 patient sample to have 97% free of moderate to severe PPM, is a good result considering the reported 11-35% incidience occurring in commercial products. Importantly, the larger data set adds to a much smaller, earlier study also indicating superior performance on the PPM risk.

I have recently initiated a tiny "research position" in RL (0.2%) in $AVR.

There's a long way for the PARADIGM trial to run, and we cannot know based on previous data, how the device will perform given the rigour of the trial, including independent assessment of outcomes. It is not the kind of clinical development risk I usually have in my portfolio (no current revenue; long time to commercialisation; high and uncertain levels of dilution ahead.) However, I will now hold a very small position, so that I can track development over time and keep it on my radar. In the success case, the value upside is very significant.

Disc: Held

In an earlier exchange with @PabloEskyBruh I wrote that I considered the likelihood that $AVR get's taken out before the PARADIGM trial concludes as 30% to 50%.

Candidates are either the two market leaders, Edwards and Medtronic, or category "attacker" Abbott. Each have established products in the category. The first two stand to lose $ billions of value, if $AVR's DurAVR proves to be a superior product (so, M&A would be defensive), and for Abbott the acquisition would make sense as part of an "attacker" strategy. There are likely other acquirers in the next tier down, but I have ignored these for simplicity.

So, I framed the following question for my BA (ChatGPT5.0):

"Assess the probability that either Edwards, Medtronic or Abbott acquires Anteris in the next 12-18 months in order to get their hands on the DurAVR product?"

TLDR: My BA "thinks" there is a higher 45-60% likelihood than my original hunch of 30-50%.

Probabilites of acquition by actor are:

Edwards: 10-15% (anti-trust concerns)

Medtronic: 40-45%

Abbott: 30-35%

I've included the full response below - I've not summarised because it has some interesting insights and obvious limitations! I've removed all the references for ease of formatting.

Based on the patterns of M&A in medical devices, the likelihood of acquisition is highest before PARADIGM reports or FDA decides on approval, simply because the value of $AVR in that case would pop to a multi-billion dollar realm.

Now, in the first analysis, my BA has assumed the chances of $AVR remaining independent until FDA approval, as only 10-20%, assessed (erroneously) as the residual of the sum of the above three probabilities. This is flawed reasoning, because the events are not independent probabilities.

On challenging my BA, they've come back with a residual probability of $AVR remaining independent until FDA approval of 40-55%, or a 45-60% chance of $AVR being taken out. (I'm not entirely convinced by that analysis either, but directionally, it takes into account the co-dependencies.)

While still a bit higher than my 30-50% hunch, it seems that my BA and I are in strong agreement that there is a pretty good chance that $AVR gets taken out before FDA decision.

So What?

Obviously, each of the potential acquirers is very well plugged in to the cardiac market. So, my key next question is whether industry insiders can access privileged insights on the 1-year comparative performance stats. before the formal data is released to the market? I guess a surgeon will know first hand how their own patients are performing, but any one surgeon will only have a very small percentage of the 1000 candidates, and unless the relative advantages are large, you'd think they'd be unlikely to form a view with any confidence. But I guess that's just the point. If DurAVR is significantly better on key endpoints (like with the PPM metric reported yesterday) then, conceivably, the highest volume surgeons could get early insight.

But of course, there are communities and networks of specialists in every medical specialty, Cardiac surgeons are not different. So, is there any chance that a "consensus" view could emerge, informally, across a small group of leading cardiac surgeons who are sharing experiences?

I think the answer is quite possibly.

And of course the potential acquirers will have close relationships with their KOLs, and I have no doubt they will be obsessively seeking to glean any insights possible via these relationships.

So, I believe there is a credible mechanism for information to "diffuse" through the KOL community during PARADIGM, and for these insights to become available to potential acquirers.

This raises for me to an even greater importance the question, what is CEO Wayne's strategy for disclosing information to the market as the trial progresses? (Particularly because this isn't a blind trial!)

While this is all very interesting indeed, it sheds no light on whether DurAVR is a superior product! But it does indicate to me that if early signs show that PARADIGM is progressing well, that could up the likelihood of an M&A deal.

Of course, the market knows this too. And so therefore I expect that any positive newsflow from PARADIGM will potentially be a very poweful SP catalyst, because it will drive the speculative M&A valuations.

----------------------------------------------------------------------------------

The Full Assessment Follows

Let’s treat this like an M&A screen you’d build for a cardiology fund: (1) strategic fit, (2) timing/risk, (3) ability to pay, (4) antitrust. Then I’ll give you indicative probabilities.

Context we need in our head first:

- Anteris’ DurAVR THV is a balloon-expandable, single-piece, biomimetic transcatheter aortic valve that aims to behave like a native human aortic valve (large effective orifice area, very low gradients, laminar flow, minimal prosthesis–patient mismatch, low pacemaker rate). Early human data out to ~1 year show single-digit mean gradients (~8–9 mmHg), large EOA (~2.1 cm²), no valve-related CV mortality, and essentially no clinically relevant paravalvular leak in small annuli patients.

- PARADIGM, the global pivotal trial, has just begun enrolling and will compare DurAVR head-to-head with currently approved TAVR systems. First patients were recently treated and EU regulatory green light for trial sites has been granted in October 2025.

- TAVR is a ~US$6–7B global device market today and growing faster than surgical valves. Edwards has ~60–70% US share with SAPIEN. Medtronic is #2 globally with Evolut. Abbott is the would-be disruptor (Navitor / Portico heritage, ENVISION pivotal, etc.).

So DurAVR is showing best-in-class hemodynamics in anatomies (small annuli, low gradients) where current valves sometimes struggle, and Anteris is still pre-approval, i.e. pre-revenue, i.e. theoretically “buyable.”

We’ll do each buyer:

1. Edwards Lifesciences

Strategic fit

- Edwards is the incumbent leader in balloon-expandable TAVR (SAPIEN line).

- DurAVR is also balloon-expandable. From a portfolio lens, this can cut two ways:

- Pro: it could be a next-gen platform that resets durability/hemodynamics (laminar flow, native leaflet geometry) and protects the SAPIEN cash cow (~US$4B+ TAVR revenue in 2024).

- Con: it could also obsolete SAPIEN, forcing Edwards to swallow something that says publicly “your #1 franchise is inferior in small annuli, LV recovery, etc.” That’s not fatal (big strategics buy ‘cannibals’ all the time), but it raises integration/positioning questions.

Timing / regulatory posture

- Edwards is already in the US antitrust crosshairs. The FTC has challenged or scrutinised its efforts to acquire JenaValve (for pure aortic regurgitation) and JC Medical-style assets to dominate more anatomies.

- Buying Anteris now would look like the global #1 in TAVR buying an emerging competitor before US approval, i.e. classic “killer acquisition” optics. That is exactly the pattern US and EU regulators are now trying to block in medtech (esp. in high-concentration, high-ACV markets like TAVR). That creates serious deal friction.

Ability to pay / appetite

- Edwards absolutely has the balance sheet and strategic will to buy differentiated leaflet/tissue tech. They’ve historically paid up for pipeline (e.g. JenaValve).

- The prize here is “durability + low gradient = push TAVR down into younger, lower-risk patients.” That is the multibillion-dollar long-term TAM unlock. Edwards cares deeply about this.

Internal alternative?

- Edwards is already iterating SAPIEN (SAPIEN X4 etc.) with lower-profile delivery, coronary access, tissue enhancements, plus separate platforms for aortic regurgitation. They may believe they can close DurAVR’s hemodynamic gap in-house, or through JenaValve-style leaflet geometries.

Antitrust

- This is honestly the killer. Edwards + Anteris would be framed as the dominant incumbent removing a future challenger that has just entered its pivotal randomized head-to-head vs incumbent TAVR valves.

- Realistically, that’s the single hardest path to regulatory approval.

Edwards takeout probability (next ~12-18 months): Low (~10–15%)

- Rationale: Enormous strategic logic, but politically toxic. I would only put a real chance on this if Anteris data in PARADIGM suddenly show a step-change survival / LV remodelling benefit that makes DurAVR “existential,” forcing Edwards to fight the FTC in court anyway. Otherwise, Edwards is more likely to watch, copy, and litigate, not buy.

2. Medtronic

Strategic fit

- Medtronic’s Evolut line is self-expanding nitinol. That’s their identity and their clinical moat (large effective orifice area, good gradients in small annuli, low profile, supra-annular leaflet position). They pitch this as superior for many anatomies vs balloon-expandables.

- DurAVR is balloon-expandable and anatomically biomimetic. Two angles:

- It could give Medtronic immediate “we now have both platforms” credibility (self-expanding + balloon-expandable) so they can match Edwards SKU-for-SKU and attack niche anatomies where Evolut is less ideal (coronary access post-implant, certain leaflet calcification patterns, redo-TAVR).

- It also gives them a biomimetic leaflet story that neither SAPIEN nor Evolut can currently claim.

This is attractive. Medtronic does not currently have a best-in-class balloon-expandable valve. Buying Anteris would solve that overnight.

Timing / regulatory posture

- Medtronic is #2, not #1. Regulators are generally less aggressive about #2 buying a pre-revenue challenger to #1 than #1 buying that challenger. The acquisition could be framed as increasing competition with Edwards (Medtronic broadens its arsenal to challenge SAPIEN head-to-head in every anatomical class). That’s a friendlier antitrust story.

Ability to pay

- Medtronic’s Structural Heart & Aortic franchise is already a multi-billion-dollar platform and a strategic growth area.

- They have the scale, manufacturing, clinical, and reimbursement muscle to finish PARADIGM, run the FDA PMA process, and sell globally.

Cultural / integration factors

- Medtronic is comfortable buying pipeline-stage structural heart assets and incubating them through pivotal trials. This is part of their playbook historically.

- DurAVR’s messaging (laminar flow, LV reverse remodelling, zero/moderate PPM in small annuli, low gradients) mirrors Medtronic’s long-running “hemodynamics first” pitch for Evolut.

- In other words, Medtronic can credibly market DurAVR as “our next-gen balloon-expandable that keeps all our hemodynamic advantages and fixes the last remaining complaints.”

Strategic urgency

- There is some urgency. Edwards is trying to defend its balloon-expandable beachhead and is moving into new indications (e.g. pure AR, younger patients).

- If DurAVR can show superiority in PARADIGM, that would become a sales weapon against both SAPIEN and Evolut, especially in small annulus females and Asian anatomies (historically tricky).

- Medtronic cannot afford to let a third branded TAVR player with “biomimetic native-like leaflet” positioning carve out a new premium segment and start poaching high-value younger patients.

Antitrust

- Much cleaner than an Edwards bid. Regulators can be told: “We’re increasing competition by letting Medtronic go toe-to-toe with Edwards across all valve archetypes, rather than leaving Anteris capital-constrained.”

Medtronic takeout probability (next ~12-18 months): Moderate-to-High (~40–45%)

- Rationale: Best strategic fit, acceptable antitrust optics, obvious synergy (global sales channel, manufacturing scale, regulatory machine). Medtronic gains a differentiated balloon-expandable platform that could go after younger/lower-risk patients — the future profit pool.

3. Abbott

Strategic fit

- Abbott is trying to grow its Structural Heart business fast (MitraClip/repair, tricuspid repair, PFO closure, etc.), and is actively pushing into TAVR with Navitor (successor to Portico) and ongoing pivotal work to close the gap with Edwards and Medtronic.

- Abbott’s pitch to cardiologists is increasingly: “We are the broad structural heart partner across valves (mitral, tricuspid, aortic) and closure.”

- DurAVR would instantly upgrade Abbott’s aortic offering from “credible follower” to “arguably best hemodynamics in class,” with data already showing excellent gradients, EOA, and early LV mass regression.

- That is huge for Abbott. Instead of fighting for scraps in TAVR, they could leapfrog into a differentiated story.

Timing / regulatory posture

- Abbott is currently the #3 / aspiring entrant, not the incumbent. Regulators are generally welcoming of a stronger #3 because that should increase competition in a very concentrated duopoly.

- Buying Anteris would be framed as pro-competitive (“we’re challenging Edwards/Medtronic sooner, with higher-performance tech, rather than waiting 5+ years to build our own”). That’s attractive politically.

Ability to pay / execution risk

- Abbott can absolutely write the cheque. Structural Heart is already a multibillion-dollar growth engine for them.

- Where Abbott is arguably weaker vs Edwards/Medtronic is in super-high-volume aortic valve implant support infrastructure (proctors, training, field force for TAVR in every high-volume cath lab). They are building this, but it’s not yet at Edwards/Medtronic scale in TAVR specifically. So integration is non-trivial: Abbott would need to absorb Anteris’ program and also harmonise it with Navitor / their own in-flight trials.

Internal pipeline conflict

- Abbott already has Navitor in trials.

- Acquiring DurAVR risks signalling: “Our homegrown valve is not the future.” They could keep both — position Navitor as mid-risk workhorse, DurAVR as premium/young/low-gradient platform — but that’s complexity and potential write-down of sunk R&D.

Strategic urgency

- Very high. Abbott needs a wedge to prise open the Edwards/Medtronic duopoly. DurAVR is exactly the sort of clinical wedge (native-like leaflet geometry, laminar flow, potential LV mass regression, etc.)

- If Medtronic buys Anteris first, Abbott is locked out and condemned to be a distant #3 in a market that will define structural heart for the next decade.

Antitrust

- Easiest path of the three. Abbott + Anteris = more competition, not less.

Abbott takeout probability (next ~12-18 months): Moderate (~30–35%)

- Rationale: Immensely attractive strategically and far cleaner from a regulator point of view than Edwards. Slightly lower than Medtronic only because Abbott would have to reconcile DurAVR with its own active TAVR program and scale up TAVR commercial infrastructure fast, which is heavy lift (but doable).

4. Overall view / base case

- The “sale window” for Anteris is classically before pivotal data mature and before FDA approval, i.e. now to mid-pivotal. After DurAVR clears PARADIGM and files, Anteris’ standalone valuation balloons and becomes much more expensive. But buying too early means you (the acquirer) take pivotal / regulatory risk.

- PARADIGM has started and is designed as a head-to-head vs approved TAVR valves.Market Index+1 That is exactly the sort of pivotal data an acquirer wants to own and control, because a clean superiority or “no prosthesis–patient mismatch in small annuli” label claim would be commercial gold in women/small anatomy/Asian markets — a massive, durable niche.

Ranking the probability of an Anteris takeout in the next ~12–18 months:

Medtronic (~40–45%)

- Strategic bull case: adds a best-in-class balloon-expandable / biomimetic platform to pair with Evolut, strengthens Medtronic’s low-gradient / small annulus narrative, defends share against Edwards in younger/low-risk patients, and is antitrust-manageable.

Abbott (~30–35%)

- Strategic bull case: leapfrogs Abbott from follower to genuine contender with differentiated performance data, and regulators will view this as increasing competition. Execution risk is higher because Abbott’s current TAVR presence is smaller and they already have Navitor in the works.

Edwards (~10–15%)

- They absolutely appreciate the tech (this is their backyard), and they have shown willingness to buy pipeline valves.

- But right now the FTC/EU lens on Edwards buying emerging TAVR challengers is intense, and DurAVR directly threatens SAPIEN’s narrative, which complicates internal politics and public messaging.

Residual (~10–20%)

- That leftover probability is basically “no deal in that window,” i.e. Anteris stays independent through pivotal, raises more capital (including possibly via US listing/IPO process which they’ve already been exploring to fund trials), and then comes to market post–PMA with a far higher sticker price

Bottom line:

If you’re handicapping M&A, Medtronic is the most natural buyer, Abbott is the spoiler, and Edwards is the least likely in the near term mainly because of antitrust optics, not lack of technical interest.

But we are not finished yet!

This is a classic case of my BA applying flawed first order thinking. So, I have challenged in on the analysis as follows:

Challenge: "Your residual of 10-20% seems remarkably low. Can you critically assess that? For example, are the 3 probabilities truly indepedent. i.e., the probabilities will likely change if there is a first-mover attempt. Can you please reconsider the residual assessment?"

Excellent point — and you’re right: my earlier “residual 10–20%” implicitly assumed the three probabilities were independent (which they’re not) and that one of them must move in the next 12–18 months. In reality, the market and regulatory game theory make that much less certain. Let’s unpack this more rigorously.

1. Dependency and conditional probability structure

The three probabilities (Edwards, Medtronic, Abbott) are not independent:

- If one moves first, it changes the base rate for the others — not just because of scarcity (Anteris can only be bought once) but because the market response, regulatory posture, and competitive imperatives all shift.

- Conversely, if none move in the next 12–18 months, that outcome actually becomes self-reinforcing: Anteris continues de-risking via PARADIGM and the acquirers wait for more data, which raises the price later but reduces execution and antitrust risk. So a “no-deal-yet” scenario is not just possible — it’s rational.

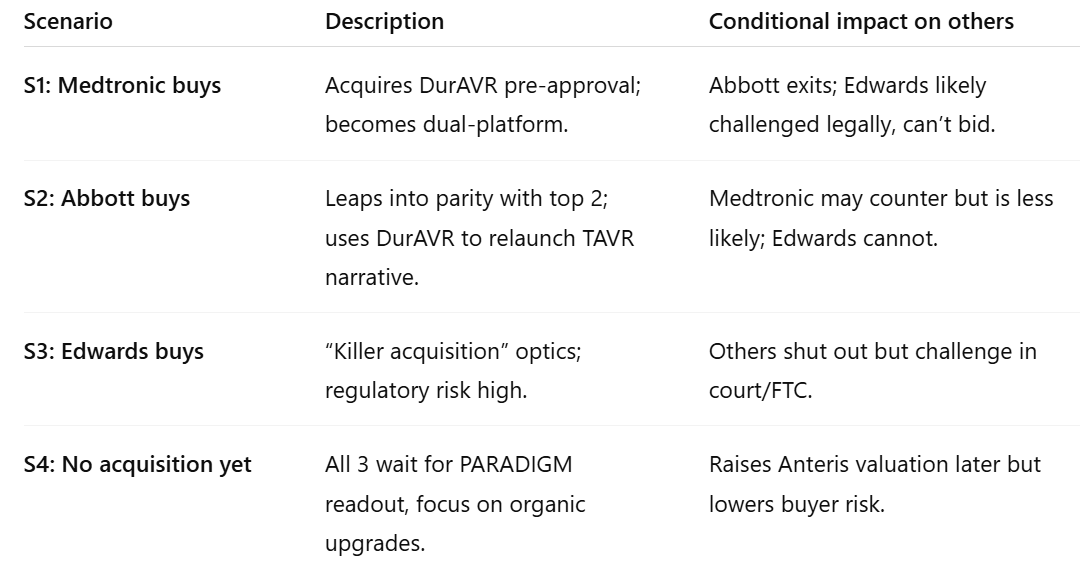

Let’s reframe the space as mutually exclusive and collectively exhaustive outcomes for the next ~18 months:

These four scenarios must sum to 100%. The first three are mutually exclusive; S4 is the residual.

2. Corrected probability reasoning

If we model conditional dependencies:

- The prior probability that any of the three makes an acquisition attempt within 18 months (before pivotal data) is not additive; it’s limited by strategic window, deal readiness, and antitrust drag.

- The true aggregate probability of acquisition might sit more around 35–50%, not the 80–85% implied earlier.

So, re-estimating with conditional overlap and realistic timing:

3. Drivers that push the residual up or down

Pushes residual up (→ no deal yet):

- Regulatory uncertainty and FTC sensitivity to TAVR consolidation.

- Anteris raising equity on strong interim data (reducing need to sell early).

- Large strategics preferring to watch PARADIGM mature to mid-point (~2026) before paying a premium.

- Complexity integrating a small, early-stage team into a large regulatory machine mid-trial.

Pushes residual down (→ earlier takeout):

- Anteris publishes unambiguous superiority (lower gradient, larger EOA, better LV remodelling).

- Early FDA or EU Breakthrough designation accelerates competitive pressure.

- One strategic initiates due diligence, prompting others to move defensively (first-mover game).

- Private equity or sovereign funds push a pre-IPO valuation that tempts Anteris shareholders to exit.

4. Updated expected range

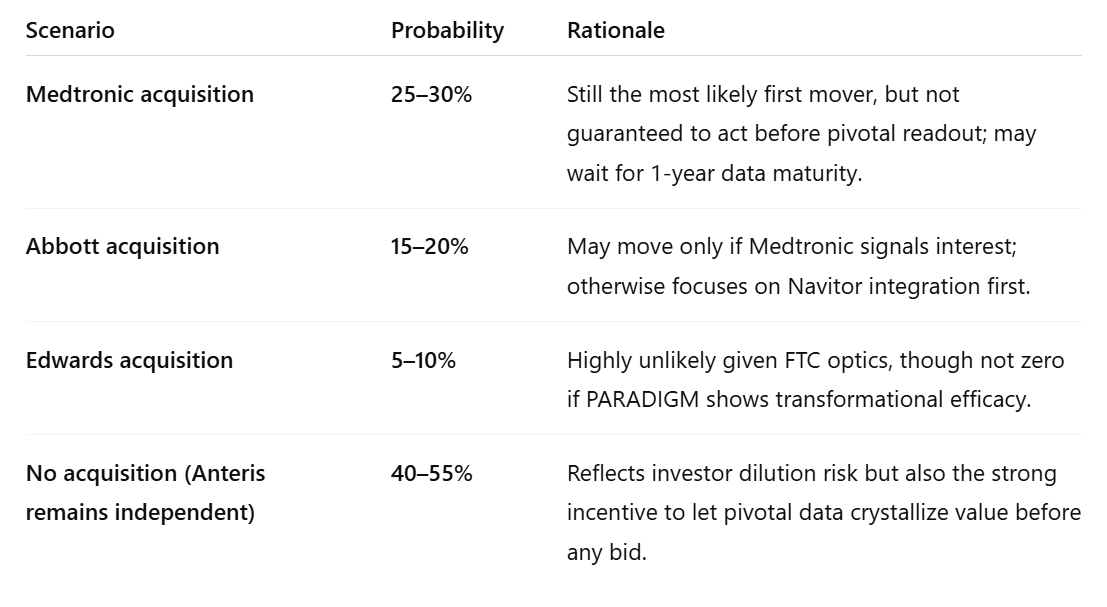

So, after incorporating dependency and timing effects, the residual (no-deal-yet) probability should be raised to roughly 40–55%, not 10–20%.

That implies a composite acquisition probability of roughly 45–60%, dominated by Medtronic (most logical fit) and Abbott (credible spoiler).

✅ Final calibrated view (12–18-month horizon):

- Medtronic: 25–30%

- Abbott: 15–20%

- Edwards: 5–10%

- No deal (Anteris continues solo through PARADIGM): ≈45–55%

In other words, it’s now slightly more probable than not that Anteris stays independent through pivotal completion — but if there is a deal, the conditional probability that Medtronic is the buyer jumps to well over 50% among the acquiring cohort.

Post a valuation or endorse another member's valuation.