story by switzer

Investors cannot predict all things ..hehe - enjoy - just navigate - 'do yah best'

The offshore ETF flood keeps pushing it higher

:Conclusion

Can the CBA share price keep going higher?

This is where things start to get interesting. Because while everyone agrees there’s plenty of money chasing CBA, there’s also no denying that it’s looking pretty stretched right now.

As Liu puts it:

“The best thing it will do is probably just grind higher. It might underperform a bit compared to the rest of the market, but I think the share market overall will go higher. CBA might just grind a bit higher—it is expensive—but I don’t think it’ll have a substantial fall.”

So she’s not calling the top, but also not expecting fireworks.

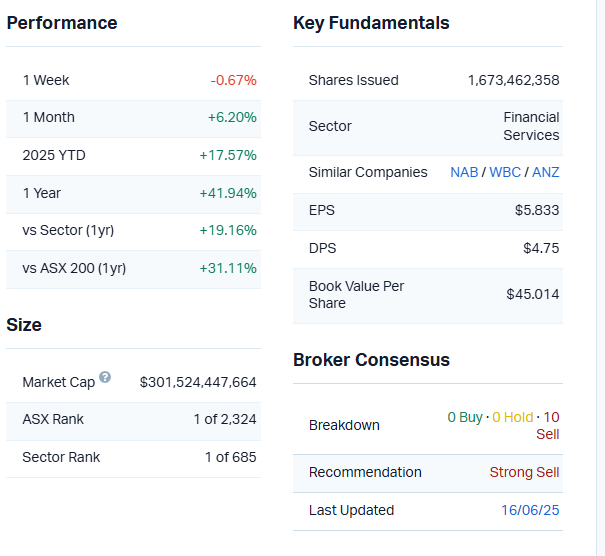

The valuation tells the story. Right now, CBA is trading on a price-to-earnings (P/E) ratio of 31.77. At that kind of premium, you’re basically paying for perfection. Either earnings need to grow a lot faster than anyone expects, or you need even more capital flooding in to push the price higher. And that’s where things get tougher.

Wayne doesn’t sugar-coat it:

“It does beggar belief in many ways, just looking at the valuation it trades on: relative to its earnings growth and dividend per-share growth, which have been fairly anaemic. There’s no doubt that, relative to other banks globally, CBA is expensive.”

He’s not wrong. While CBA’s business is incredibly solid with dominant market share, strong capital position and reliable dividends, none of that easily justifies 32 times earnings forever. At some point, something has to give: either earnings growth accelerates, or the multiple contracts.

For now though, the flows keep coming. And as long as the rest of the world sees CBA as Australia’s proxy blue-chip, the index-following money keeps piling in.

Hey @Bear77 quoted - 19-June-2022: CBA is Australia's second largest company (behind BHP)

$87 looks a good buy then ..hehehe.

19 - June - 2025 Now CBA in ranked 1st Largest Company.

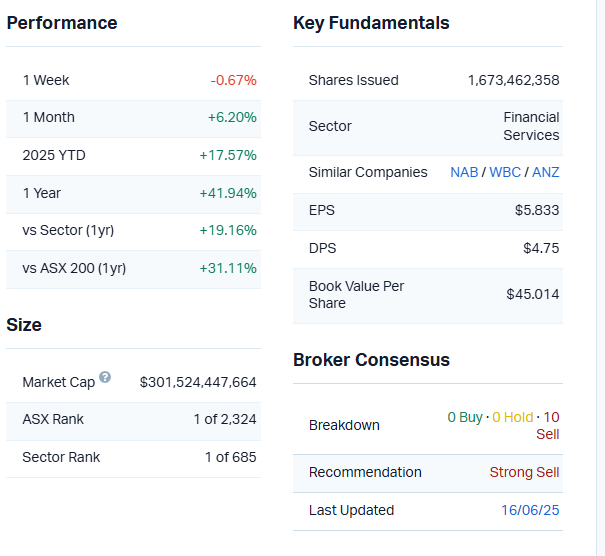

Below - some CBA stats - borrowed from Market Index.