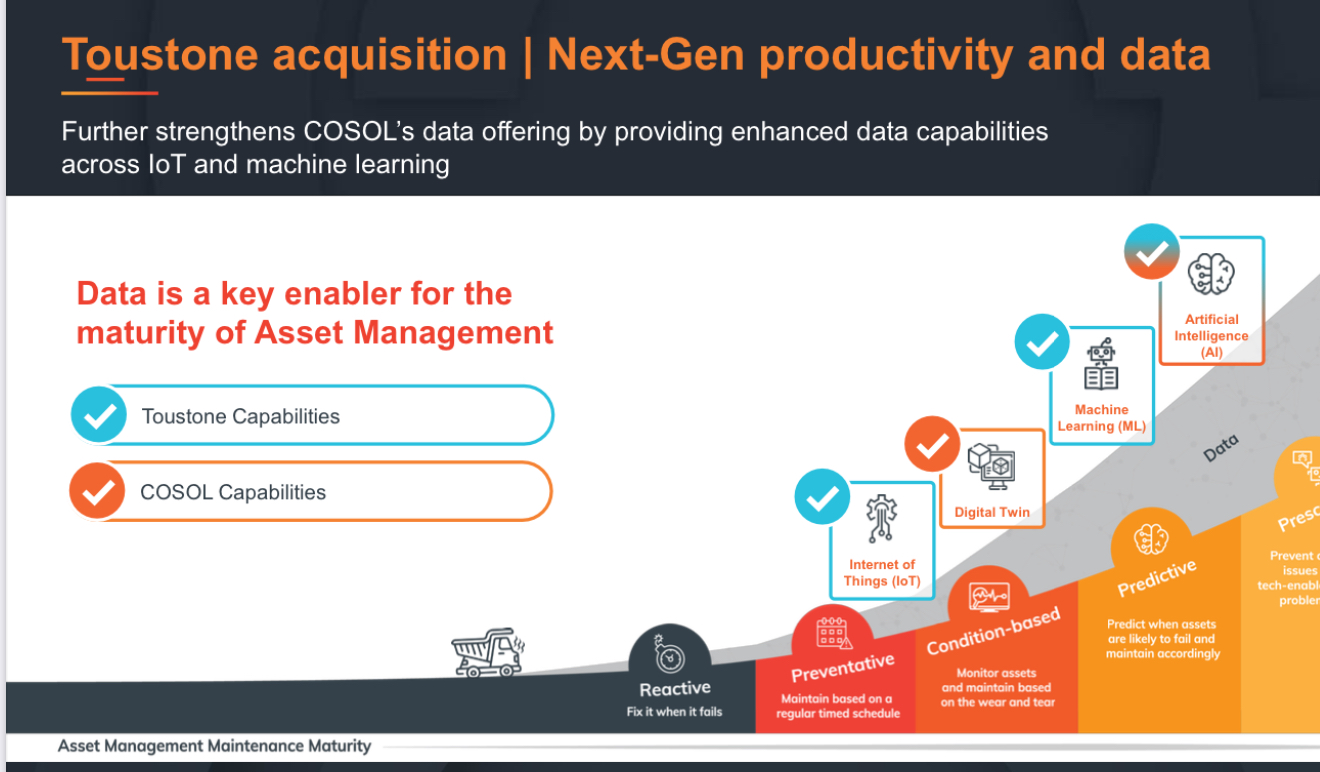

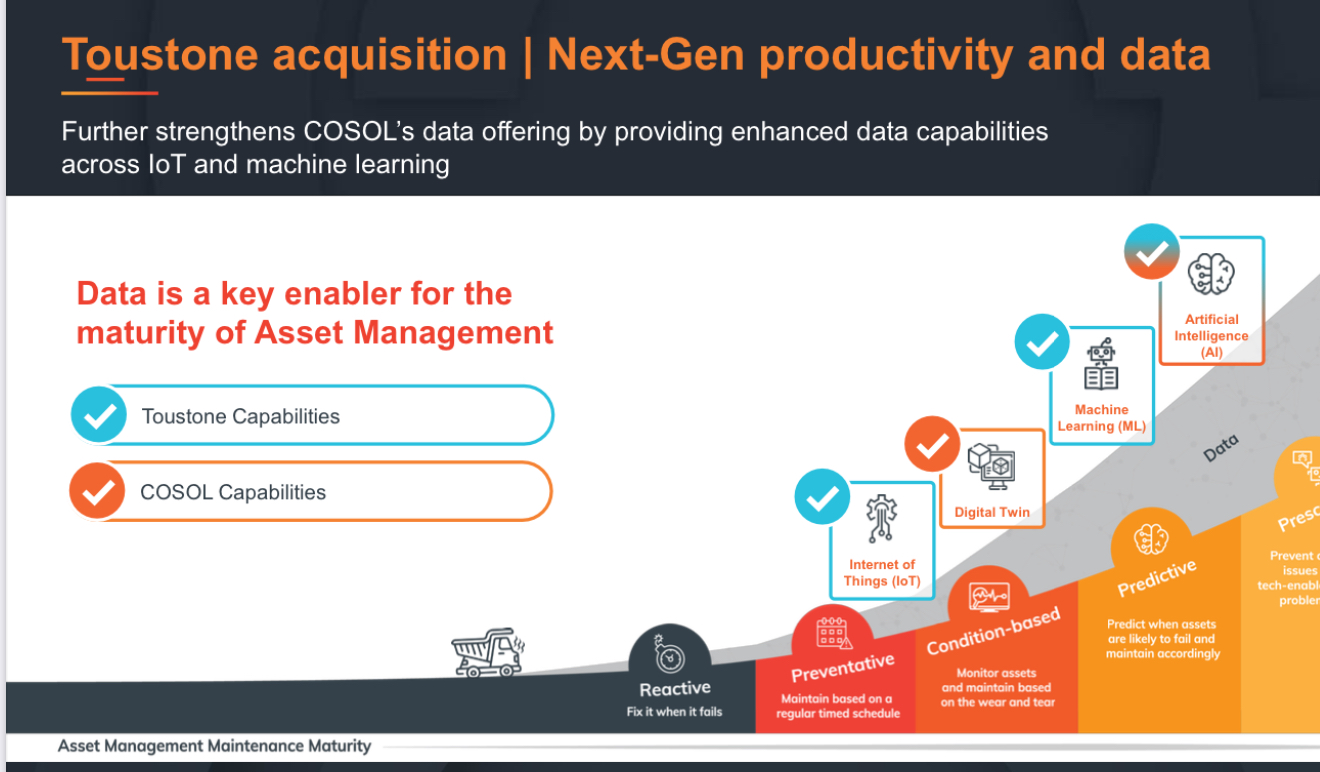

COSOL announced it has acquired Toustone for $22.4 million in cash and script to grow its data analytics capability. It will use part of its new debt facility for the cash component. I don’t know if it is good value at 5.61 times CY26 EBITDA. However, I like the strategic fit for this business. Toustone’s proprietary software is state of the art technology in asset management and can be immediately applied across Cosol’s current and future asset management projects. This should help Cosol to deliver state of the art technology to new and existing clients in a competitive market.

Toustone Chief Executive Officer and co-founder Craig Lefoe said COSOL was the perfect springboard to pursue its growth ambitions.

“We have admired COSOL and the manner in which it has grown its customer offer and market share while maintaining the high levels of service excellence and strong operating margins,” said Mr Lefoe.

“Toustone is equally growth oriented and becoming part of the COSOL ecosystems opens up a new world of opportunity, in Australia and overseas. We are proud that Toustone’s data analytics capability – including our proprietary platforms – can be instantly offered to COSOL’s outstanding blue chip client base.

Held IRL (0.5%)

ASX Announcement

Highlights

• Acquisition of leading data analytics group Toustone

• Proprietary data platform generating ARR software subscription revenue

• Total consideration of up to $22.44m, tied to profit performance

• Total consideration based on targeted multiple of 5.61 times CY26 EBITDA

• Immediately earnings and EPS accretive

Brisbane, 4 December 2024 – COSOL Limited (COSOL, ASX: COS) is pleased to announce the acquisition of

Toustone Pty Ltd, a leading Australian data analytics group.

The acquisition delivers COSOL an unparalleled position in enterprise asset analytics and a special position in the transport sector where Toustone has market-leading reputation and standing.

Toustone delivers a significant boost to COSOL’s intellectual property and proprietary software solutions in an asset management market ever hungry for digital solutions that identify savings and deliver material efficiencies.

Toustone leverages its expertise and proprietary IP in predictive analytics and decision intelligence to give order to clients’ complex data lakes and provide insights into their operations and efficiency opportunities.

Consideration

Total acquisition consideration is up to $22.4 million, subject to Toustone meeting profit hurdles. This is based on a targeted multiple of 5.61 times CY26 normalised EBITDA

A total of $12 million is payable upfront, comprising $8 million cash and 4,531,038 COSOL shares (being $4 million worth at a deemed issue price of $0.8828 per share). The balance of the consideration comprises up to $6.5 million in earnout and up to $3.9 million in outperformance consideration, and is payable subject to the Toustone business achieving profit and margin hurdles in CY25 and CY26. The upfront multiple is 6.3 times normalised EBITDA.

The acquisition is immediately earnings per share accretive and consistent with COSOL’s long-standing strategy of growing into market segments where there’s existing customer demand and abundant growth opportunity. COSOL affirms the earnings guidance released at its 2024 AGM, which is not changed as a result of this acquisition (see ASX announcement dated 14 November 2024).

Toustone

Toustone (www.toustone.com) is a data analytics, predictive analytics and decision intelligence company dedicated to solving complex data problems and providing accurate and reliable reporting. Founded in 2014 by a team of experienced, industry-leading data scientists, Toustone has built an outstanding base of blue-chip clients, with strong penetration in transport, large-scale agriculture and food processing, and in heavy asset infrastructure.

Toustone has developed proprietary data platforms that generate revenues across ARR software subscriptions, managed services contracts and consulting. Existing Toustone clients in transport include major public transport operators in NSW and Victoria, including Australia’s largest metro train operator.

Other major enterprise customers include a number of large agricultural and food processing companies.

Toustone fits seamlessly into the COSOL ecosystem of asset management services, with immediate deployment opportunities across COSOL’s transport, infrastructure and natural resources clients.

Comments

COSOL Managing Director Scott McGowan said Toustone was an important addition to COSOL with the increased customer emphasis on using analytics to extract efficiencies.

“Large organisations have enormous data lakes from which they look for meaning and advantage,” said Mr McGowan.

“Toustone has developed pre-configured proprietary platforms that give customers a single source of truth through synthesising data sets from operations, finance and third-party providers. This delivers outstanding insights and efficiency opportunities to customers, which is precisely what COSOL provides right across the asset management spectrum.

”Mr McGowan said Toustone deepens COSOL’s data management expertise and boosts our next-gen productivity solutions.

Toustone Chief Executive Officer and co-founder Craig Lefoe said COSOL was the perfect springboard to pursue its growth ambitions.

“We have admired COSOL and the manner in which it has grown its customer offer and market share while maintaining the high levels of service excellence and strong operating margins,” said Mr Lefoe.

“Toustone is equally growth oriented and becoming part of the COSOL ecosystems opens up a new world of opportunity, in Australia and overseas. We are proud that Toustone’s data analytics capability – including our proprietary platforms – can be instantly offered to COSOL’s outstanding blue chip client base.

“We know we can bring a lot to COSOL – in economic contribution and intellectual property – and we are excited for the future,” said Mr Lefoe.”

Transaction Details

A summary of the transaction details is set out in the Annexure to this announcement. COSOL completed finance, tax, legal, people and technical due diligence on Toustone prior to executing the acquisition agreement.

The cash component of the consideration will come from the Company’s updated, expanded debt facility with Westpac (see ASX announcement dated 2 December 2024). The issue of COSOL shares for upfront, and potential earn-out and outperformance consideration will consume a portion of COSOL’s existing placement capacity under ASX Listing Rule 7.1. The earnout and outperformance consideration is payable in instalments subject to the Toustone business achieving audited/reviewed normalised EBITDA hurdles in calendar years 2025 and 2026.

Completion of the acquisition is scheduled for early December.