Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

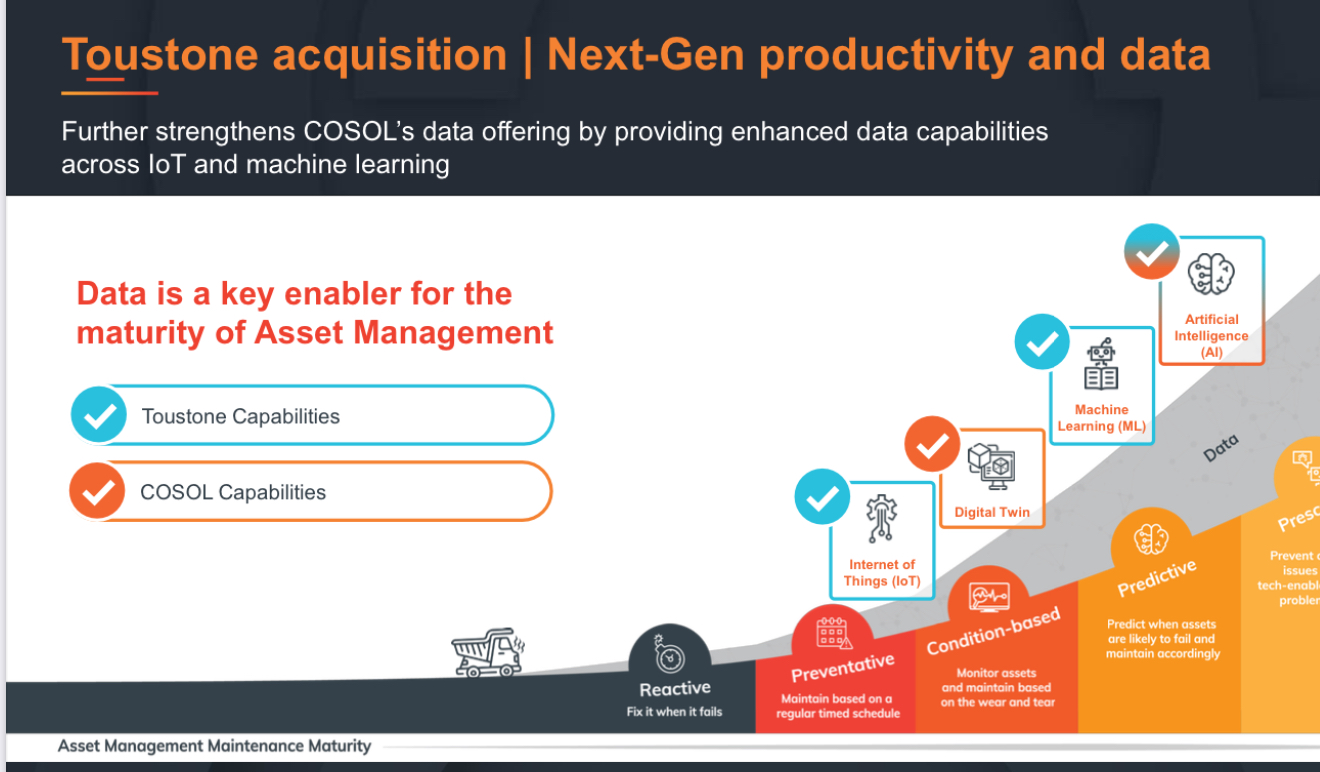

COSOL announced it has acquired Toustone for $22.4 million in cash and script to grow its data analytics capability. It will use part of its new debt facility for the cash component. I don’t know if it is good value at 5.61 times CY26 EBITDA. However, I like the strategic fit for this business. Toustone’s proprietary software is state of the art technology in asset management and can be immediately applied across Cosol’s current and future asset management projects. This should help Cosol to deliver state of the art technology to new and existing clients in a competitive market.

Toustone Chief Executive Officer and co-founder Craig Lefoe said COSOL was the perfect springboard to pursue its growth ambitions.

“We have admired COSOL and the manner in which it has grown its customer offer and market share while maintaining the high levels of service excellence and strong operating margins,” said Mr Lefoe.

“Toustone is equally growth oriented and becoming part of the COSOL ecosystems opens up a new world of opportunity, in Australia and overseas. We are proud that Toustone’s data analytics capability – including our proprietary platforms – can be instantly offered to COSOL’s outstanding blue chip client base.

Held IRL (0.5%)

Highlights

• Acquisition of leading data analytics group Toustone

• Proprietary data platform generating ARR software subscription revenue

• Total consideration of up to $22.44m, tied to profit performance

• Total consideration based on targeted multiple of 5.61 times CY26 EBITDA

• Immediately earnings and EPS accretive

Brisbane, 4 December 2024 – COSOL Limited (COSOL, ASX: COS) is pleased to announce the acquisition of

Toustone Pty Ltd, a leading Australian data analytics group.

The acquisition delivers COSOL an unparalleled position in enterprise asset analytics and a special position in the transport sector where Toustone has market-leading reputation and standing.

Toustone delivers a significant boost to COSOL’s intellectual property and proprietary software solutions in an asset management market ever hungry for digital solutions that identify savings and deliver material efficiencies.

Toustone leverages its expertise and proprietary IP in predictive analytics and decision intelligence to give order to clients’ complex data lakes and provide insights into their operations and efficiency opportunities.

Consideration

Total acquisition consideration is up to $22.4 million, subject to Toustone meeting profit hurdles. This is based on a targeted multiple of 5.61 times CY26 normalised EBITDA

A total of $12 million is payable upfront, comprising $8 million cash and 4,531,038 COSOL shares (being $4 million worth at a deemed issue price of $0.8828 per share). The balance of the consideration comprises up to $6.5 million in earnout and up to $3.9 million in outperformance consideration, and is payable subject to the Toustone business achieving profit and margin hurdles in CY25 and CY26. The upfront multiple is 6.3 times normalised EBITDA.

The acquisition is immediately earnings per share accretive and consistent with COSOL’s long-standing strategy of growing into market segments where there’s existing customer demand and abundant growth opportunity. COSOL affirms the earnings guidance released at its 2024 AGM, which is not changed as a result of this acquisition (see ASX announcement dated 14 November 2024).

Toustone

Toustone (www.toustone.com) is a data analytics, predictive analytics and decision intelligence company dedicated to solving complex data problems and providing accurate and reliable reporting. Founded in 2014 by a team of experienced, industry-leading data scientists, Toustone has built an outstanding base of blue-chip clients, with strong penetration in transport, large-scale agriculture and food processing, and in heavy asset infrastructure.

Toustone has developed proprietary data platforms that generate revenues across ARR software subscriptions, managed services contracts and consulting. Existing Toustone clients in transport include major public transport operators in NSW and Victoria, including Australia’s largest metro train operator.

Other major enterprise customers include a number of large agricultural and food processing companies.

Toustone fits seamlessly into the COSOL ecosystem of asset management services, with immediate deployment opportunities across COSOL’s transport, infrastructure and natural resources clients.

Comments

COSOL Managing Director Scott McGowan said Toustone was an important addition to COSOL with the increased customer emphasis on using analytics to extract efficiencies.

“Large organisations have enormous data lakes from which they look for meaning and advantage,” said Mr McGowan.

“Toustone has developed pre-configured proprietary platforms that give customers a single source of truth through synthesising data sets from operations, finance and third-party providers. This delivers outstanding insights and efficiency opportunities to customers, which is precisely what COSOL provides right across the asset management spectrum.

”Mr McGowan said Toustone deepens COSOL’s data management expertise and boosts our next-gen productivity solutions.

Toustone Chief Executive Officer and co-founder Craig Lefoe said COSOL was the perfect springboard to pursue its growth ambitions.

“We have admired COSOL and the manner in which it has grown its customer offer and market share while maintaining the high levels of service excellence and strong operating margins,” said Mr Lefoe.

“Toustone is equally growth oriented and becoming part of the COSOL ecosystems opens up a new world of opportunity, in Australia and overseas. We are proud that Toustone’s data analytics capability – including our proprietary platforms – can be instantly offered to COSOL’s outstanding blue chip client base.

“We know we can bring a lot to COSOL – in economic contribution and intellectual property – and we are excited for the future,” said Mr Lefoe.”

Transaction Details

A summary of the transaction details is set out in the Annexure to this announcement. COSOL completed finance, tax, legal, people and technical due diligence on Toustone prior to executing the acquisition agreement.

The cash component of the consideration will come from the Company’s updated, expanded debt facility with Westpac (see ASX announcement dated 2 December 2024). The issue of COSOL shares for upfront, and potential earn-out and outperformance consideration will consume a portion of COSOL’s existing placement capacity under ASX Listing Rule 7.1. The earnout and outperformance consideration is payable in instalments subject to the Toustone business achieving audited/reviewed normalised EBITDA hurdles in calendar years 2025 and 2026.

Completion of the acquisition is scheduled for early December.

To add to @SudMav’s results straw a few days ago, Cosol also provided a business update and 1H25 guidance (see announcement below). I thought the guidance looked quite positive. Management are expecting revenue growth of 17% to 20%, and EBITDA growth of 17% to 25% underlying EBITDA margin for the first half to be in the range of 14.1% to 14.7%. Seasonally the first half EBITDA margin is lower than the overall year. The shares are trading at just over 15 times FY25 forecast earnings, which doesn’t look expensive given earnings have been growing at over 20% per year, and this is likely to continue. ROE is likely to be c. 17% going forward.

Someone out there either doubts the guidance or was expecting a lot more from Cosol, because the share price fell over 8% today to a 12 month low of 83 cps. I’ve had COS on my watchlist for over a year now and I took the opportunity today to take a starting position IRL at 85 cps. I will most likely add if the share price weakens further.

Held IRL (0.4%)

Brisbane, 14 November 2024 – COSOL Limited (COSOL, ASX: COS) is pleased to announce it will see strong revenue and profit growth in the first half of FY25 as momentum from the end of FY24 carries through to the current financial year.

Major contract wins and extensions from Q4 FY24 have underpinned strong revenue growth in H1 FY25, locking in a buoyant H1 performance and providing a springboard for continued growth across all key metrics for the full financial year.

COSOL is on track to deliver revenue growth of 17.0% - 20.0% over H1 FY24 and to be in the range of $57.5 to $58.4 million.

First half underlying EBITDA growth is expected to be in the range of 17% to 25%, with underlying EBITDA margin for the first half to be in the range of 14.1% to 14.7%. Seasonally our first half EBITDA margin is lower than the overall year.

COSOL Chairman Geoff Lewis said the Board was pleased that momentum at the end of FY24 had carried through strongly in the 2025 financial year.

“This is testament to COSOL’s investment in deep capability and the manner in which COSOL has been able to demonstrate real benefits for clients in the form of efficiencies and material cost savings,” he said.

“COSOL has consistently delivered 30%+ growth in revenue and EBITDA since listing in 20202. In FY24, we delivered 35% growth in revenue, 33% in underlying EBITDA, and an underlying EBITDA margin of 15.4%.

“This consistent growth means there is a positive predictability to COSOL’s operating performance – and we’ll do it again for the full year FY25.”

First half growth has been driven by key client wins across the Group in Q4 FY24 and early FY25 with organisations such as Horizon Power, Department of Transport in Victoria, QBuild and CleanCo, and extended work with the Department of Defence.

These long-term contracts create further momentum into FY25 and beyond.

In addition, COSOL continued to expand its capabilities in providing end-to-end Asset Management software and solutions with the successful acquisition and integration of AssetOn Group and Core Asset Co.

These strategic acquisitions position COSOL well to deliver a sector-leading Asset Management as a Service offering to our expansive blue chip client base and a platform to win new customers in the asset intensive market.

Another strong H1 Revenue announcement following the AGM yesterday. Key Highlights being:

- Long term contracts signed with Department of Transport Victoria, Qbuild and Cleanco

- Revenue growth of 17-20% from previous corresponding period, which does not have any built in revenue from services from 2 customers (one being Qbuild)

- EBITDA growth of 17-25% which shows some improvement in margins.

This follows from another year of growth in 2024 and prior years, with the previous acquisitions working well and positively contributing to the numbers as you can see from the preso. EPS for last year not great but mainly from the cap raising later in the year.

Managing Director Ben Buckley resigning, along with Grant Pestell not standing for re-election was something that I was not expecting and definitely got my attention. CEO Scott McGowan will take on the MD role, and substantial changes to the board (including a new independent chair) will be brought in over the coming months. There will be some knowledge gaps in the short term but hopefully they are able to bring in fresh new expertise to help the next phase of growth.

Based on everything above an, I am expecting NPAT to for FY25 be around $10.5m with a price range between $0.95 and $1.1 based on a PE of 17-20.

Where to go from here for me is still a little bit unclear. The stepping down of Ben Buckley might mean that the M&A could be slowing in the future, however they they did pass a resolution for additional 10% placement capacity, and also voted on new proportional takeover provisions so there might be another big purchase or merger (via reverse listing) on the horizon.

Held IRL (1.5%) and continuing to monitor progress.

NRX is another company dealing with Asset Management systems

Appear that they have a more global reach than Cosol although don't see them listed in public through the parent HubHead.

Verbrec is a partner for NRX

Something to research for Cosol holders.

Management

Inside Ownership Ordinary Shares %COS Issued Net Value at $1.00

Geoffrey Lewis 24,903,595 14.24% $24,903,595

Ben Buckley 653,329 0.37% $653,329

Stephen Johnston 24,903,595 14.24% $24,903,595

Grant Pestell 2,500,000 1.43% $2,500,000

Gerald Strautins 3,000,000 1.72% $3,000,000

Total 55,960,519 31.99% 55,960,519

Management Bio

Geoffrey Lewis -Chairman

Geoff Lewis has over 20 years’ experience in the global delivery of IT services and outsourcing. He established ASG Group Limited (formerly ASX listed, ASX: ASZ), an IT business solutions provider, in 1996 and was its Managing Director until it was acquired in late 2016 for $350 million by Japanese multinational IT services and consulting business Nomura Research Institute, Ltd. Geoff was appointed as a director on 10 September 2019.

Ben Buckley - Managing Director

Ben Buckley was appointed as Managing Director of COSOL Limited in January 2020. His significant business experience includes over ten years with Nike where he was ultimately appointed as Marketing Director, and roles as Executive Director at Foxtel between 2013 and 2016, Chief Executive Officer and Executive Director at Brava Sports & Entertainment since 2017, and Executive Director at BKD Executive Leaders since 2018.

Stephen Johnston - CA | Non-Executive Director

Stephen Johnston has significant international experience in investment, corporate finance, mergers and acquisitions and commercial management gained over 25 years in Australian industrial and investment organisations. Stephen was the managing director and founder shareholder of Schutz DSL Group, an industrial packaging group with operations in Australia and south east Asia, and was an independent non-executive director of ASG Group Limited (formerly ASX listed, ASX: ASZ), an IT business solutions provider, until it was acquired in late 2016 for $350 million by Japanese multinational IT services and consulting business Nomura Research Institute, Ltd. Stephen was appointed as a director on 10 September 2019.

Grant Pestell -Independent Non-Executive Director

Grant Pestell was a founding director and has been the managing director of Perth-based legal firm Murcia Pestell Hillard since 2000. He has extensive experience advising both listed and private companies, particularly in the ICT, energy and resources and mining services industries. Grant is regularly involved in and advises on complex commercial disputes, strategic contract negotiations, mergers and acquisitions, risk management and large-scale financing. Grant was an independent non-executive director of ASG Group Limited (formerly ASX listed, ASX: ASZ), an IT business solutions provider, until it was acquired in late 2016 for $350 million by Japanese multinational IT services and consulting business Nomura Research Institute, Ltd. Grant was appointed as a director on 7 August 2019.

Gerald Strautins -Independent Non-Executive Director

Gerald Strautins has extensive executive, mergers and acquisitions, consulting, programme and business management experience, with particular strength in formulating, implementing and managing strategic managed service/outsourcing operations and transformation initiatives. Gerald’s strategic business consultancy and corporate management experience was gained through extensive work in Australia, Europe and Asia. He was the Executive – Strategy and M&A of ASG Group Limited (formerly ASX listed, ASX: ASZ), an IT business solutions provider, and was responsible for the strategic direction of the organisation, while also completing in excess of $500 million in mergers and acquisitions transactions. Gerald was appointed as a director on 4 October 2019.

· December 2023 Ok Tedi Mining, engagement to cease. Notice to terminate the contracts. https://announcements.asx.com.au/asxpdf/20231227/pdf/05yyvp7xhl2m0r.pdf

· July 2023 $17m OK Tedi Mining, This contract extends and deepens the existing relationship, which has spanned almost two decades, delivering operational efficiencies and cost savings. Under the contract, COSOL will deliver comprehensive, end-to-end Asset Management Services, leveraging the combination of COSOL’s proprietary software and services. https://announcements.asx.com.au/asxpdf/20230711/pdf/05rjbrdq82jbwq.pdf

· February 2023 $4m Glencore – Koniambo nickel project. As part of the contract, COSOL will establish an Asset Reliability Centre (ARC) in Brisbane where a major focus will be on improving equipment reliability and master data across critical processes to enable effective asset management for the joint venture operation. COSOL will utilise its proprietary software platform and asset optimisation solutions to further add value to Koniambo in delivering this critical capability. https://announcements.asx.com.au/asxpdf/20230223/pdf/45lxs29lzsqpj0.pdf

· December 2022 $8.2m new contract with Australian Department Defence. The contract will see COSOL work in partnership with IBM to deliver services under the Defence Enterprise Resource Planning Program (ERP Program). At the core of COSOL’s service delivery to Defence is the Company’s proprietary RPConnect Software, which is Defence-cleared to deliver data migration services across the Department’s widespread asset portfolio. https://announcements.asx.com.au/asxpdf/20221228/pdf/45k762bv9d05bf.pdf

· December 2022 A$4m worth contracts, Arch Resources: $2.7 million, a three-year contract extension for managed services contract support using COSOL’s Evergreen platform to maximise deployment of Ellipse software. SSR Mining Inc: initial contract value $488k; data migration using COSOL’s proprietary RPConnect software to bring all business units, in a $4.5 billion market cap mining group, into a standard SAP S4 environment. This includes RPConnect licencing fees and the work is expected to be completed in FY23. DeBeers Canada: $585k contract extension for additional De Beers business unit; data migration using RPConnect expected to be completed in FY23. DZSP 21: $258k, the first North American contract for COSOL’s Clarita team for EAMaaS (Enterprise Asset Management as a Service) for a defence services contractor located at US Navy base in Guam with revenue to be generated over 12 months. https://announcements.asx.com.au/asxpdf/20221201/pdf/45jbczkrz8px6p.pdf

· January 2022 signs multi-year contract with De Beers Group, This initial phase of the De Beers contract, for which COSOL has been contracted, is circa AUD $1 million. Further phases will lift the total contract value to AUD $2.4 million over a period of two years. De Beers is the world’s leading diamond company with expertise in diamond exploration, mining, grading, marketing and retail. It employs more than 20,000 people across the global diamond industry, mostly in the diamond source countries of Botswana, Canada, Namibia and South Africa. The first phase of a multi-year, multi-million-dollar data migration assignment for De Beers Group’s (De Beers) global SAP to S/4 HANA digital transformation project. https://announcements.asx.com.au/asxpdf/20220106/pdf/454sbdfs6gv7k0.pdf

· April 2021 new contracts with Transgrid, loner, and Anglo American. Total contract value of A$2.2m. COSOL Australia was awarded a multi-year contract with Transgrid as part of its digital transformation program that will see it replace its existing ERP platform (Hitachi Ellipse) and move to Oracle Financials and Field Service and as well as Maximo EAM. COSOL Australia was also awarded a new contract with Anglo Nickel a division of Anglo American Group. The contract is to provide data migration services as both divisions move from Ellipse and SAP ECC6 to SAP S/4 Hana. COSOL swholly owned subsidiary AddOns Inc, based in Denver Colorado, was also awarded a new contract with Australian owned mining company Ioneer (ASX:INR). The contract is the first of a potential three phased agreement to support the initial growth of Ioneer as it establishes its Rhyolite Ridge Lithium-Boron Project in Nevada, USA. The project will see COSOL become the partner of choice to work on the implementation of the Hitachi Ellipse Finance module. https://announcements.asx.com.au/asxpdf/20210420/pdf/44vpfbhyzrs561.pdf

· April 2021 awarded extension to current agreement on Department of Defence ERP program – total contract value $8.5m. Cosol provide its proprietary IP, RPConnect®, and professional data migration services for the Australian Department of Defence’s ERP transformation programme. The well-publicised Defence ERP programme is replacing Defence’s core enterprise resource planning platform, Hitachi’s Ellipse EAM product suite and SAP ECC6, with SAP S/4 HANA. https://announcements.asx.com.au/asxpdf/20210407/pdf/44vb3vzk5wcnsw.pdf

· August 2020 awarded $2.1m contract with Urban Utilities to provide application and system support services. Urban Utilities is the largest drinking water and wastewater service provider to residential and business customers in south-east Queensland and is a valued past COSOL client. https://announcements.asx.com.au/asxpdf/20200831/pdf/44m3dxq87b18wc.pdf

· August 2020 award $3.2m contract as sole subcontractor for Department of Defence’s major Ellipse maintenance and upgrade project. Sole subcontractor to Hitachi ABB Power Grids (Hitachi) to provide professional services for the Australian Department of Defence’s MILIS Sustainment Programme. The programme is centered on Defence’s core enterprise resource planning platform, based on Hitachi’s Ellipse EAM product suite. https://announcements.asx.com.au/asxpdf/20200821/pdf/44lqy49vjj5s4x.pdf

· April 2020 awarded a comprehensive data migration work engagement with CleanCo Queensland Limited. CleanCo is the Queensland Government’s new publicly owned clean energy generator. The awarding of the contract was based on COSOL’s industry acknowledged reputation, strength, capability and proprietary digital intellectual property, particularly RPConnect. https://announcements.asx.com.au/asxpdf/20200428/pdf/44h97vkr4fsyjr.pdf

· Mar 2020 COSOL awared $2.2m mulit-year work expansion with OK Tedi Mining. OTML is a leading PNG gold and copper producer, and a longstanding client of COSOL. The expanded engagement provides for a continuous improvement approach for OTML, to further enhance and optimise the exploitation and efficiencies of its core SAP ERP business systems. The expanded engagement is valued at approximately $2.2M per annum over 2 years. The expanded engagement builds on the existing support arrangement provided by COSOL for OTML’s SAP, Ariba, SuccessFactors, core HR and payroll systems. In addition to the continued core systems support, COSOL is driving the expanded digital transformation programme focusing on digital workspace collaboration and business intelligence. A key component of the programme will be the sustainment and modernisation of OTML’s underlying IT infrastructure to underpin the move to a hybrid cloud platform. https://announcements.asx.com.au/asxpdf/20200313/pdf/44g0jv2625ky0r.pdf

· April 2023 acqusition of Core Asset Co, Total consideration of up to $6.1m ($5.4m in cash and scrip on acquisition, deferred earn-out payment of up to $0.7m). Core Asset is an asset performance advisory firm that provides data-driven insights and solutions to clients to help improve the performance of their asset networks and their return on investment.https://announcements.asx.com.au/asxpdf/20240419/pdf/062nwgspcx4g30.pdf

· August 2023 acquires AssetOn Group, OSOL will pay up to $29.0 million for AssetOn Group, consisting of, $18.0 million in cash, $4.0 million in scrip ,An earnout component of up to $7.0 million contingent on achieving earnout hurdles. AssetOn Group serves major natural resource companies such as Rio Tinto, Glencore, Anglo American, BHP and BMA (BHP Mitsubishi Alliance). Energy and utility customers include Santos, AGL Energy, Arrow Energy and Sunwater. Like COSOL’s, AssetOn Group’s relationships with customers are long-term, high level and growing. AssetOn Group’s service offering is underpinned by its proprietary software platform OnPlan, which is a Software as a Service (“SaaS”) product that is an end-to-end enterprise-grade digital system for efficiently building, maintaining and deploying asset strategy and work instructions for large industrial assets.

· June 2022 acquires Work Management Solutions, a Perth-based business that delivers business advisory and technical consulting services to the resources and utilities sectors. The total consideration payable for WMS’s shareholders under the SPA is up to $9 million, comprising $7 million on settlement and up to a further $2 million upon the WMS business meeting certain performance hurdles in FY23. The upfront consideration comprises $4 million in cash and $3 million in COSOL shares. https://announcements.asx.com.au/asxpdf/20220623/pdf/45b5kzr68kgrll.pdf

· November 2021 acquire Clarita Solutions, $7M in cash and 7,951,123 COSOL shares, with up to a further $3.75M payable in either cash or an issue of Shares by way of earn-out consideration. an IT and Enterprise Asset Management (EAM) services business based in Brisbane, Australia which specialises in the implementation, management and business exploitation of IBM’s Maximo EAM platform. https://announcements.asx.com.au/asxpdf/20211108/pdf/452pn2dt40bdlz.pdf

· October 2020 acquire Denver, Colorado USA based AddOns Inc – a managed services IT and professional services organisation with a portfolio of proprietary digital IP used to support over 50% of the North American installed base of ABB Ellipse Asset Management clients. Upfront consideration for the acquisition consists of US$1.5M in cash and 4,271,695 fully paid ordinary shares, with up to a further US$1.75M payable in cash and COSOL shares by way of earn-out consideration based on AddOns’ audited EBITDA for FY21 and FY22. https://announcements.asx.com.au/asxpdf/20201006/pdf/44ncqlbgcly38w.pdf

Offers Asset Management Services. What does that mean?

Clients in the natural resources sector contributed approximately 50% of revenue for the year, with the remaining clientele operating across utilities, government, defence, and public infrastructure sectors. From a geographical standpoint, 84% of the entity’s revenue for the year originated from our Australian operations, while the US operations contributed the remaining 16%.

Ended 30 June 2023, 38% of the entity’s revenue was derived from advisory and professional services, 27% from products and product-led services, and 35% from managed services.

I equate this to mean that 27% comes from software the rest from people. Hence the 10% net profit margin. Compare that with Technology One (a pure software company) which has an NPM pf 23%.

Acquisitions are a key plank of their strategy. Perhaps you could so far as to call them a roll-up. The CEO has 25% of his STI based on delivery of acquisitions. Another 25% goes toward outcomes from the Hitachi contract.

Having said that, in November, they provided guidance of 40-45% revenue growth for 1H24 compared to PCP. EBITDA margin of 13.5-14% which is same as 1H23 but down from full year 23 of 15.5%. Organic growth is mid-teens. That is very strong growth.

BUT. 1H23 NPAT was $3.2M. Full year was $8M. ie 2H23 NPAT was $4.8M. Their guidance for 1H24 is $3.2M + 45% = $4.6M which is no growth from 2H23 NPAT. They could also report nice growth numbers for FY24 when in fact they had none for 18 months. ie FY24 they could report $9.2M and say it is 15% above FY23.

So this begs the question as to whether growth has stalled or not.

Management

Chair is Geoff Lewis who was founder of ASG Group (ASZ) that was bought by Nomura Research (NRI - A japense company) ASG was an IT managed services company (servers, desktops, SOE's, etc). It was an WA company so it makes sense that COSOL has 50% mining companies. It has plenty of other high profile companies too.

Geoff has 15% of shares. Another director also has 15%.

Overall view.

It's a profitable company on a modest P/E of 18 promising near term growth of 40% but it's questionable whether that is real or a play with numbers. From a long term perspective. I think it is closer to a roll-up and it will run out of steam. I have no idea when that will be (perhaps already?). I don't know how fragmented the market is. Roll-ups can be attractive investments. Just look at TPG and iinet. Acquisitions are notorious though for providing sugar hits along with a sugar crash.

Not held.

Based on;

A trailing PE of 18

40-45% Revenue growth has been guided for the half year FY24

Assumption of 11mil NPAT in FY24 with a PE expansion to 30

Base Case(Assumes 20% Growth): FY24 NPAT 9.6mil x PE18 = Market Cap 173mil or Share Price $1

Mid Case(Assumes 30% Growth): FY24 NPAT 10.4mil x PE18 = Market Cap 187mil or Share Price $1.07

Bull Case(Assumes 40% Growth): FY24 NPAT 11mil x PE30 = Market Cap 330mil or Share Price $1.90

Cosol (COS) today made a reasonably good announcement.

Cosol is a SAAS company specialising in Asset Management Software.

- Major clients of this company include the likes of Rio Tinto, Glencore & Aurizon

- Revenue has grown from 12mil in FY2020 to 75mil in FY2023

- NPAT has grown from 1.5mil in FY2020 to 8mil in FY2023

- Todays Market Cap is 146mil and as such has a trailing PE of 18.5

Assuming the half yearly guidance can be annualised and reaches the bottom line this company could have an FY24 NPAT 11.1mil and a forward PE of 13.2. I won’t speculate on the probability of that occurring, however in a world where most asx listed SAAS companies carry a PE in the range of 30-60 this company looks like it has value.

I am however finding it difficult to zero in on the TAM, and how sticky if at all this companies software actually is. I’d love to get peoples thoughts.

There is lots to read in the acquisition of AssetOn

Probably only positive is the potential cross selling opps. Also some ARR earned from the assetOn OnPlan offering although it is small.

Negatives I see are:

* Ebitda margins being reduced after acquisition (was already falling in latest update)

* Not much detail on what MDaaS (Master data as a service) actually is. But it looks like a semi automated processing of asset data to more useable format

* Discounted 15m placement of 76.5c (but was oversubscribed)

* Earnouts seem generous

Out for now even though I see Bell potter increasing their target price.

So this is my attempt at trying to work out what the market is pricing into Cosol. From my first pass, it looks like there is quite a high ongoing growth rate that is required to be maintained. I have only just started looking at COS but it may be one that remains on the watchlist at this time.

Another new contract. I think Cosol is a solid business and it’s on my watchlist. I’d like to pick it up a bit cheaper, but I will probably miss out. Good metrics in a good sector: Forecast ROE 21%, 50% reinvested income, PE 20, PB 3.1, PEG 0.9, EPS growth 22%, net debt on equity 22%. Have it returning c.11% returns at the current price and performance.

COSOL signs $17m contract to deliver asset management services to global leader in Copper and Gold mining

Brisbane, 11th July 2023 - COSOL Limited (ASX:COS) is pleased to announce it has signed a major contract to deliver Asset Management Services to OK Tedi Mining Limited, owner of one of the world’s biggest copper-and gold mines, based in Papua New Guinea.

The contract has a value of $17 million and will run for three years.

This contract extends and deepens the existing relationship, which has spanned almost two decades, delivering operational efficiencies and cost savings.

Under the contract, COSOL will deliver comprehensive, end-to-end Asset Management Services, leveraging the combination of COSOL’s proprietary software and services.

COSOL will generate major operational efficiencies, material cost savings, and assist the company in its drive to achieve zero waste in its operations and supply chains.

CEO Scott McGowan said “COSOL is delighted to solidify the long-term relationship and it is pleasing that we have again been entrusted by a leading asset intensive business to continue providing crucial asset management software and services to a global scale mining operation.”

Disc: Not held

Found out that Euroz Hartleys initiated Buy at 1.20 on Nov 22.

Bit old price target but better to put it in for now.

No details on the report.