Offers Asset Management Services. What does that mean?

Clients in the natural resources sector contributed approximately 50% of revenue for the year, with the remaining clientele operating across utilities, government, defence, and public infrastructure sectors. From a geographical standpoint, 84% of the entity’s revenue for the year originated from our Australian operations, while the US operations contributed the remaining 16%.

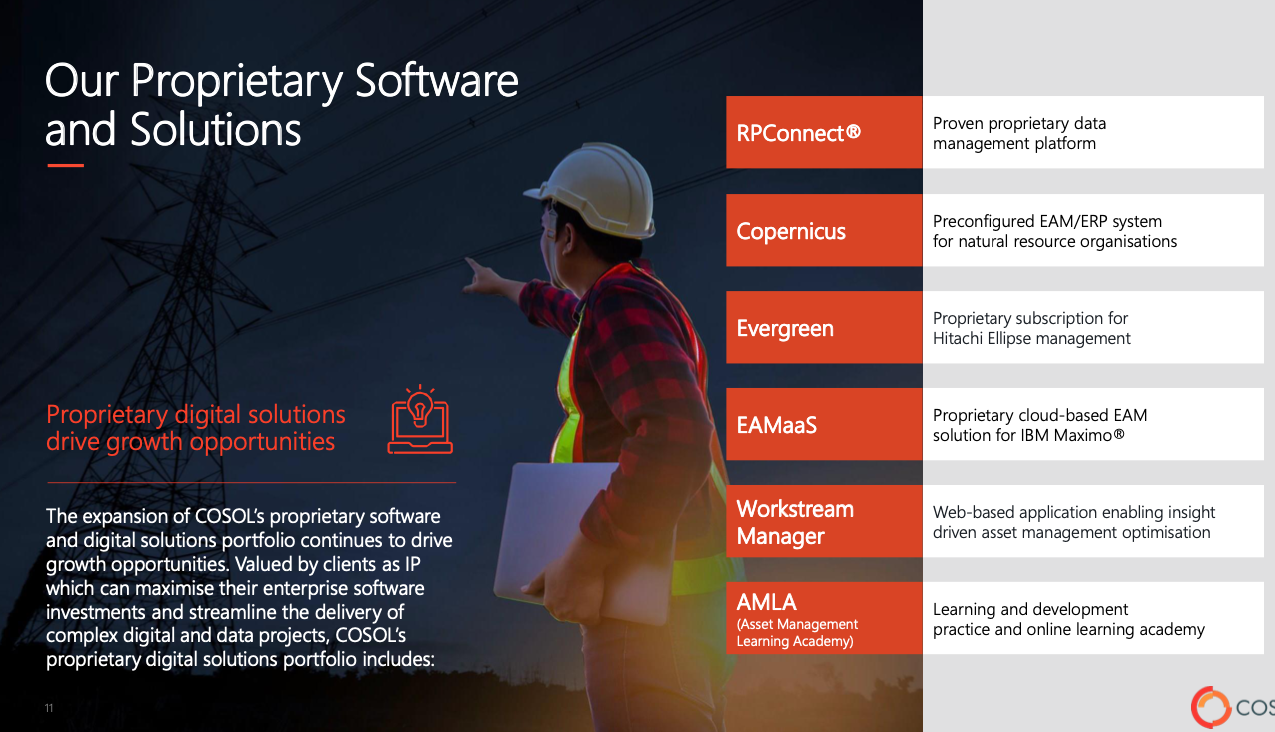

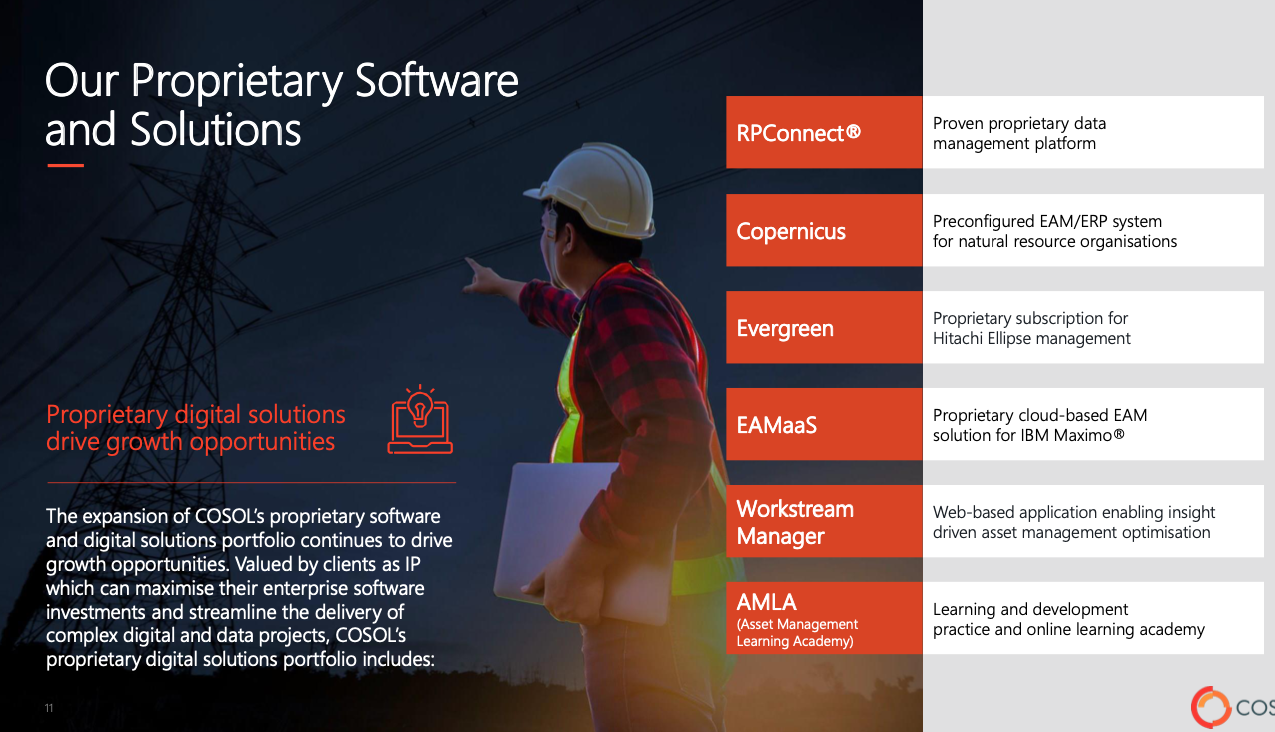

Ended 30 June 2023, 38% of the entity’s revenue was derived from advisory and professional services, 27% from products and product-led services, and 35% from managed services.

I equate this to mean that 27% comes from software the rest from people. Hence the 10% net profit margin. Compare that with Technology One (a pure software company) which has an NPM pf 23%.

Acquisitions are a key plank of their strategy. Perhaps you could so far as to call them a roll-up. The CEO has 25% of his STI based on delivery of acquisitions. Another 25% goes toward outcomes from the Hitachi contract.

Having said that, in November, they provided guidance of 40-45% revenue growth for 1H24 compared to PCP. EBITDA margin of 13.5-14% which is same as 1H23 but down from full year 23 of 15.5%. Organic growth is mid-teens. That is very strong growth.

BUT. 1H23 NPAT was $3.2M. Full year was $8M. ie 2H23 NPAT was $4.8M. Their guidance for 1H24 is $3.2M + 45% = $4.6M which is no growth from 2H23 NPAT. They could also report nice growth numbers for FY24 when in fact they had none for 18 months. ie FY24 they could report $9.2M and say it is 15% above FY23.

So this begs the question as to whether growth has stalled or not.

Management

Chair is Geoff Lewis who was founder of ASG Group (ASZ) that was bought by Nomura Research (NRI - A japense company) ASG was an IT managed services company (servers, desktops, SOE's, etc). It was an WA company so it makes sense that COSOL has 50% mining companies. It has plenty of other high profile companies too.

Geoff has 15% of shares. Another director also has 15%.

Overall view.

It's a profitable company on a modest P/E of 18 promising near term growth of 40% but it's questionable whether that is real or a play with numbers. From a long term perspective. I think it is closer to a roll-up and it will run out of steam. I have no idea when that will be (perhaps already?). I don't know how fragmented the market is. Roll-ups can be attractive investments. Just look at TPG and iinet. Acquisitions are notorious though for providing sugar hits along with a sugar crash.

Not held.