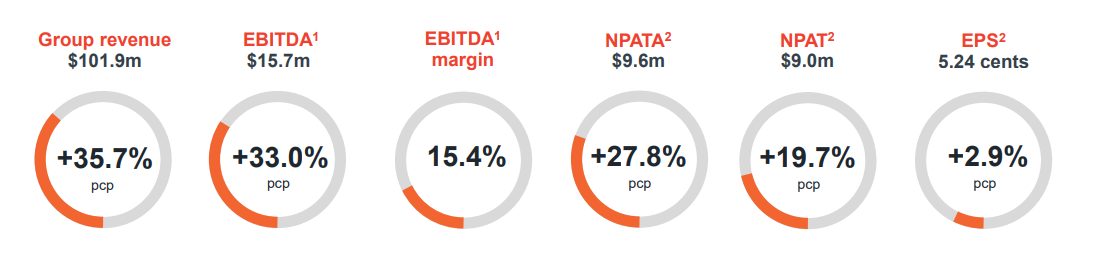

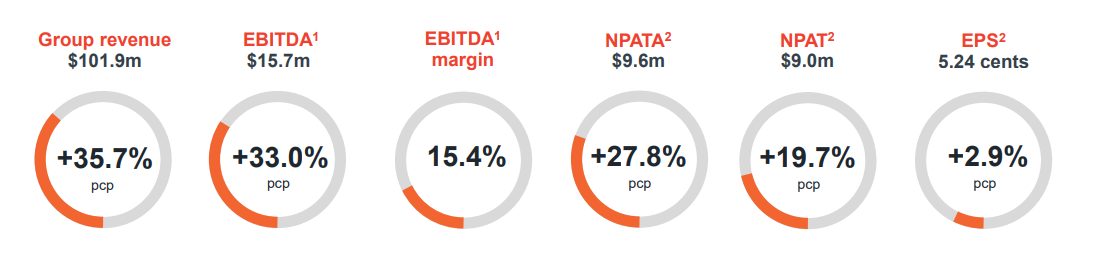

Another strong H1 Revenue announcement following the AGM yesterday. Key Highlights being:

- Long term contracts signed with Department of Transport Victoria, Qbuild and Cleanco

- Revenue growth of 17-20% from previous corresponding period, which does not have any built in revenue from services from 2 customers (one being Qbuild)

- EBITDA growth of 17-25% which shows some improvement in margins.

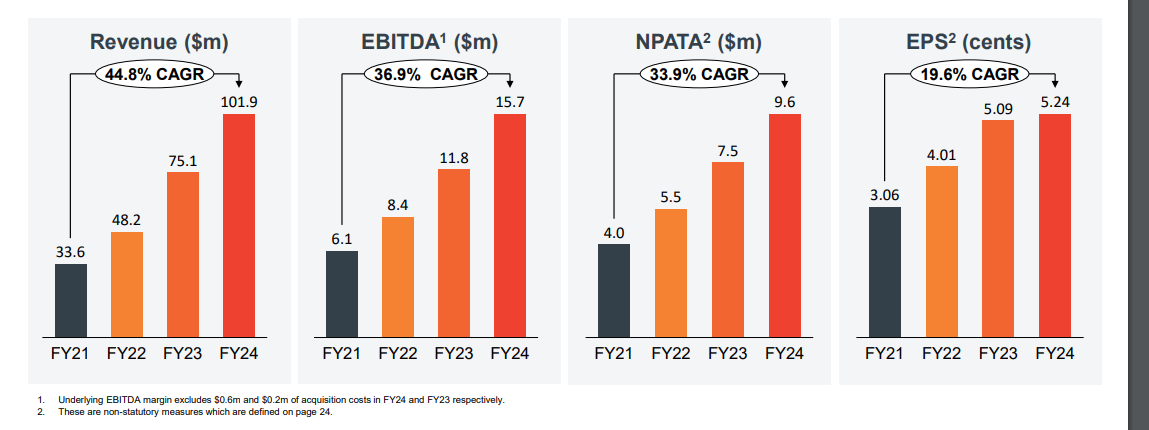

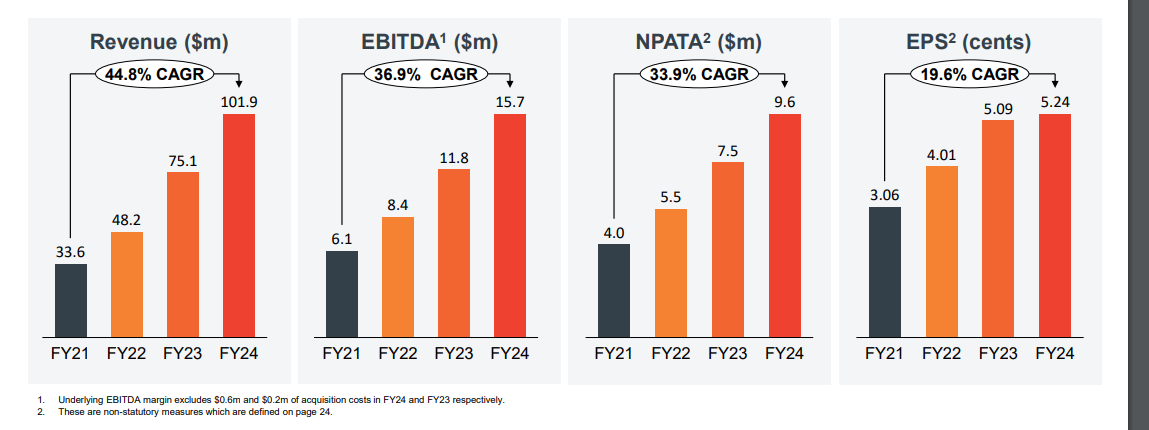

This follows from another year of growth in 2024 and prior years, with the previous acquisitions working well and positively contributing to the numbers as you can see from the preso. EPS for last year not great but mainly from the cap raising later in the year.

Managing Director Ben Buckley resigning, along with Grant Pestell not standing for re-election was something that I was not expecting and definitely got my attention. CEO Scott McGowan will take on the MD role, and substantial changes to the board (including a new independent chair) will be brought in over the coming months. There will be some knowledge gaps in the short term but hopefully they are able to bring in fresh new expertise to help the next phase of growth.

Based on everything above an, I am expecting NPAT to for FY25 be around $10.5m with a price range between $0.95 and $1.1 based on a PE of 17-20.

Where to go from here for me is still a little bit unclear. The stepping down of Ben Buckley might mean that the M&A could be slowing in the future, however they they did pass a resolution for additional 10% placement capacity, and also voted on new proportional takeover provisions so there might be another big purchase or merger (via reverse listing) on the horizon.

Held IRL (1.5%) and continuing to monitor progress.