Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

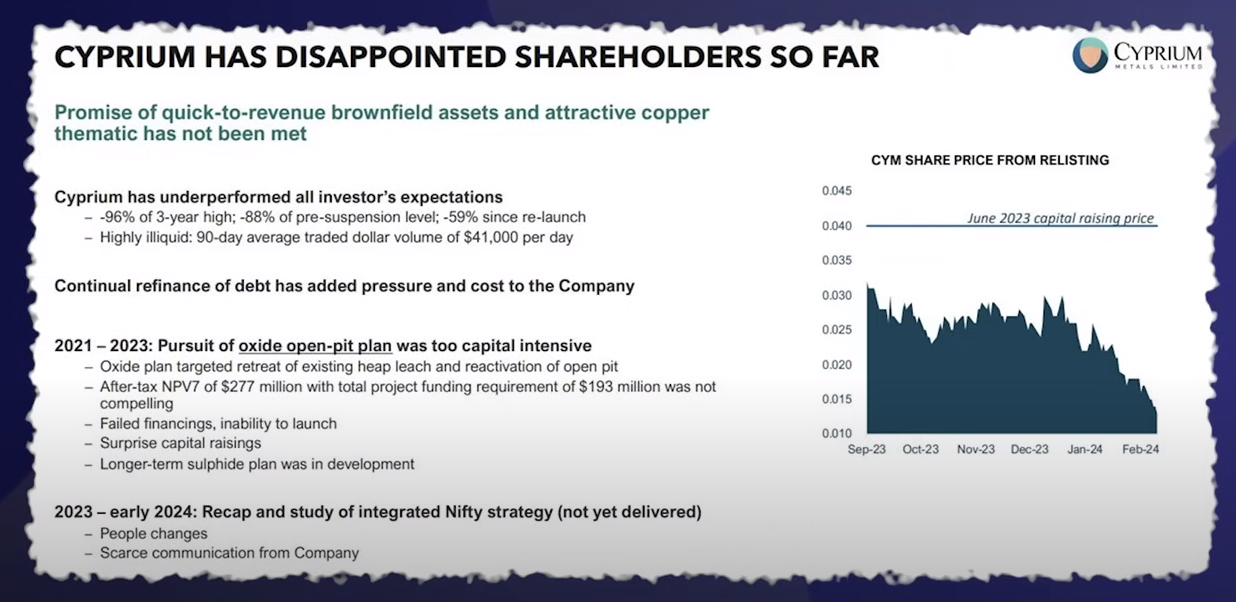

07-March-2024: Cyprium-Metals-Shareholder-Update-and-Presentation.PDF, slide 4:

Source: Money of Mine podcast, 07-March-2024: The boys discuss the CYM update and this slide in particular.

Some Background:

- During 2016, Metals X Limited (MLX.asx) acquired the Nifty copper mine through the acquisition of Aditya Birla Minerals Limited.

- In late 2016, Metals X (MLX) demerged (or "spun out") its gold exploration business from its metals and mining businesses, and issued shareholders with shares in the new entity; Westgold Resources Limited (WGX.asx). Eligible MLX shareholders received 1 WGX share for every 2 MLX shares they owned. (details here).

- In early 2021, MLX sold their Nifty copper mine and two other copper projects for a combined A$60 million, A$24 million of it in cash, to Cyprium Metals (CYM.asx). From commencement of production in 1993 to the placing of the mine into care and maintenance in 2019, Nifty had produced in excess of 700,000 tonnes of copper metal. It was closed down in 2021 when they sold it, and it remains closed down today, although CYM still plan to restart it.

- The sale of Nifty and the other MLX copper assets to CYM was announced on 10-Feb-2021 and completed on 30-Mar-2021. MLX said at the time that the sale of their Copper Assets underpinned the Company’s strategy to focus on the development of their Tin Portfolio. The funds received were put towards MLX's working capital and to reduce their debt at the time.

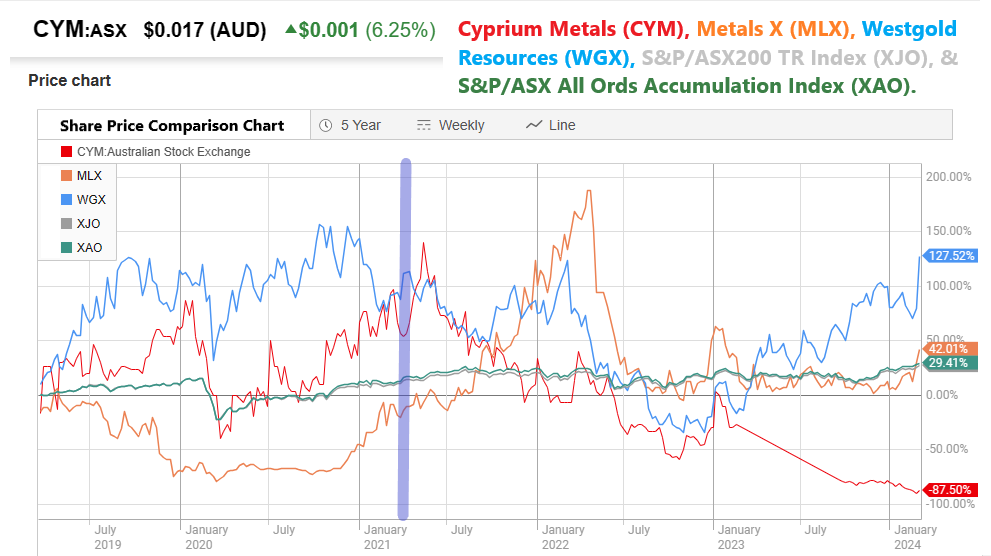

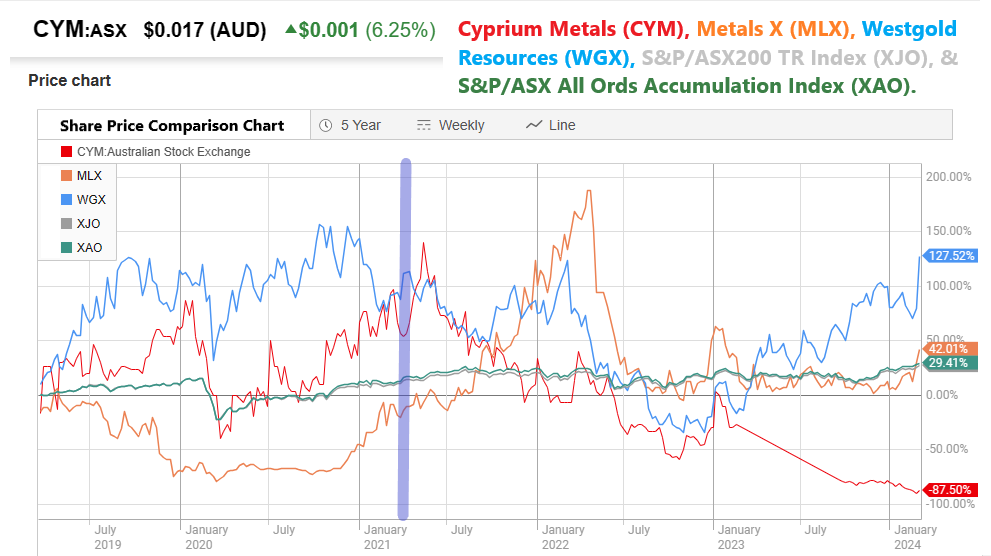

- On the following share price comparison chart, the date of that copper asset divestment - out of MLX - and into CYM - is shown by that vertical purple line in March 2021:

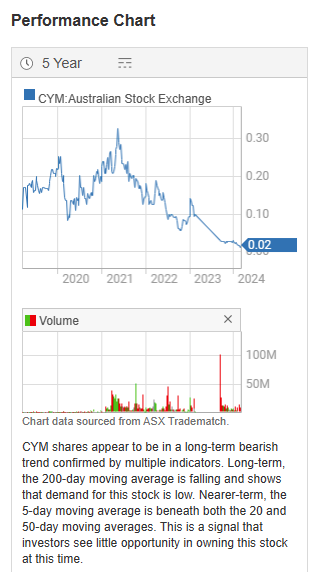

- What we can see from March 2021 onwards is that CYM had an initial pop and then went into a long and sustained downtrend, and they're now trading at less than 2 cents/share (cps) - they were over 20 cps in March 2021 when this deal was announced and spiked up to 32.7 cps on 17-May-2021; MLX had a great run, putting on about +190% by April 2022, but are now just ahead of the All Ords (XAO, +29.41%) and the ASX200 TR Index (XJO, +27.07%) over the full five year period - with MLX doing a little better than those indices since March 2021.

- Westgold is a little ahead now of where they were in March 2021, however they've put on +127.5% over the full five years (since March 2019) vs MLX @ +42% and CYM being down -87.5%.

- It's probably fair then to assume that gold has done reasonably well over the period, and tin hasn't done too badly, although it's been a bit of a boom & bust scenario with MLX, their SP now being back to not too far ahead of where they started both 5 years ago and also 3 years ago when they went 100% into tin, so they haven't lost money - unless you piled in during the "boom" phase in mid-to-late '21 through to April/May '22.

- There are a few more things that happened with Cyprium Metals (CYM) in the past year and a bit; starting with a trading halt on 21-Feb-2023, which rolled into a trading suspension on 23-Feb-2023 with the news that their debt funding package for the Nifty copper mine restart had fallen over: Nifty-Copper-Project-Restart-Financing-Update-23Feb2023.PDF

- That trading suspension lasted for 7 months, until 21-Sep-2023. During that 7 months there were a number of updates, board and management changes and funding attempts, including some successful capital raises, with the following ones probably being the most significant:

- Cyprium-Metals-Update-24Mar2023.PDF

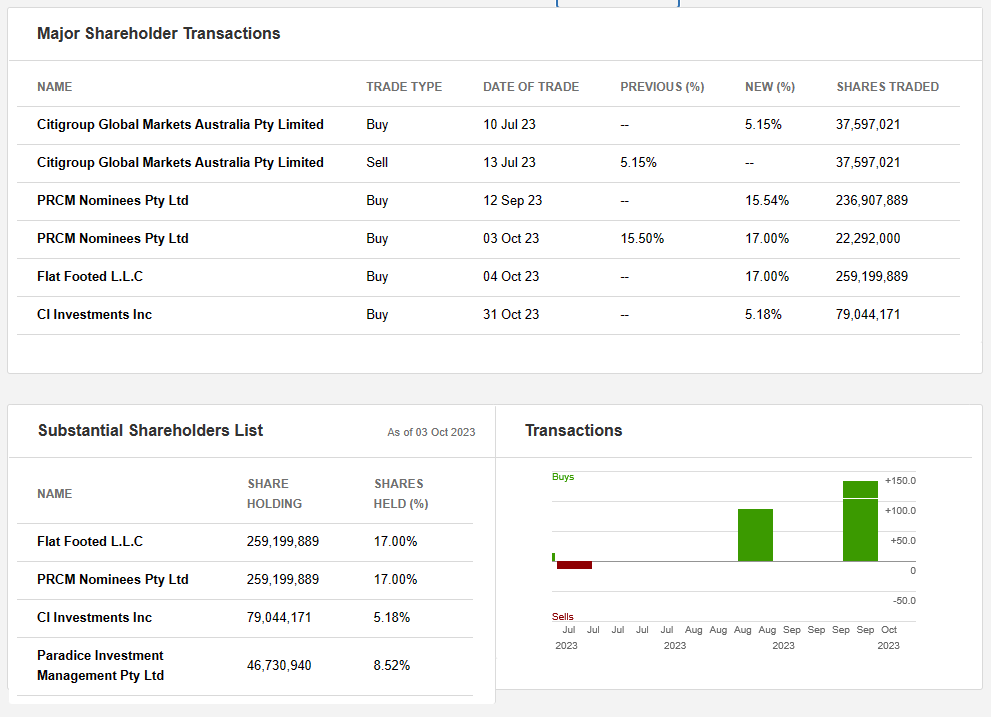

- CYM-$24M-Placement-and-$5-Entitlement-Issue-12July2023.PDF - this one was the one that brought in private equity firm Pacific Road Capital Management (PRCM) who subscribed for $4.05 million in the Placement to hold a 9.9% interest in the Company post Placement; CYM also noted at the time that PRCM would have the right to appoint a nominee to the Company’s board of directors.

- CYM-$316M-Equity-Raising-Completed-18Sep2023.PDF - that was the final CR that allowed the reinstatement to official quotation (CYM trading again after 7 months of being in a trading suspension). Details of this CR included a $24M Placement to Sophisticated and Institutional Investors, a $5M Entitlement Offer that closed oversubscribed raising $7.6M from book build and shareholder demand, a $21M (US$14.5M) Bridging Facility Completed in the prior quarter, Clive Donner, an experienced mining industry executive, appointed as Managing Director, private equity firm Pacific Road Capital Management (PRCM) stumped up $8.3M in the Equity Raising to hold a 15.5% interest in the Company, and Matt Fifield, Managing Director of PRCM, was appointed to the CYM Board as their Interim Chairman.

- On Feb 16th this year (around 3 weeks ago), CYM (Cyprium Metals) accepted the immediate resignation of their Managing Director, Clive Donner (see here: CYM-Board-and-Management-Update.PDF), and announced that Matt Fifield, their Non-Executive Chairman, had agreed to assume the role of Executive Chairman, effective immediately, while they searched for an appropriate successor to Clive to take on the MD role. I note that Cyprium do not have a CEO, only a COO, and their CFO is also acting in an interim capacity only - see here: https://cypriummetals.com/about-us/key-management-team/. Their previous CFO, Wayne Apted resigned as their Chief Financial Officer and their Company Secretary, effective immediately, on 12-Oct-2023, having performed those roles since 2019.

- And that brings us up to Thursday's Cyprium-Metals-Shareholder-Update-and-Presentation.PDF and that extraordinary slide 4 - reproduced at the top of this straw.

Looks very much like they are laying the blame on departed management and marking a new starting point in the sand, however I would point out that their lean 3-person Board - which is appropriately small for a tiny $24 million nanocap wanna-be miner, still has Gary Comb in it, who has been a NED of CYM since June 2019, so has been there throughout the Nifty debarkle. All of the other CYM board members and senior management appear to have been purged during the past year.

Also, Matt Fifield, who has only been with CYM since the capital raisings in the latter half of 2023, is now their Executive Chairman, and is also the MD of private equity (PE) firm PRCM (Pacific Road Capital Management) who own or control 17% of CYM's SOI (shares on issue) and are CYM's largest shareholder. PRCM is a PE group who have a few associate companies, including FF Hybrid, L.P and GP Recovery Fund LLC (together referred to as “Flat Footed LLC”) and that 17% of CYM's SOI may be technically held by "Flat Footed" but PRCM has an arrangements that grants them the voting rights over that 17% regardless of beneficial ownership, so PRCM are therefore jointly recorded as having a 17% interest in CYM along with Flat Footed, but it's the same 17%, NOT a different 17%). See here: Change-of-Director's-Interest-Notice-29Dec2023.PDF - and here:

So - while that slide (top of this straw) is refreshingly honest in their acknowledgement of CYM's many failings with regard to ordinary retail shareholders, I'm not sure if they're going for a rallying call or instead trying to bring on a capitulation where ordinary retail shareholders are faced with the shocking facts around what a basket of steaming dogsh!t this company has become and decide to sell out finally. An even lower share price might actually suit a PE company like Pacific Road Capital, who could take this company private and then repackage it, put some lipstick on the pig, and sell it off at a good profit to what they've paid.

If you need any reminders of what private equity is capable of, see here: https://foragerfunds.com/news/dick-smith-is-the-greatest-private-equity-heist-of-all-time/

If you need any reality checks in relation to how large shareholders can bully smaller ones, drive down a share price and then take a company private to benefit themselves - look no further than Advance ZincTek, formerly known as Advance NanoTek, and also formerly known as Advanced Nano Technologies Limited - ANO - ANO - Takeover (strawman.com) and earlier when people were thinking that Lev hoovering up shares could only ever end well: ANO - Advanced Nano Technologies Ltd General Discussion (strawman.com) (last post was over two years ago in that second forum thread at this point in time)

It will not end well for ordinary retail shareholders, IMHO.

Further Reading:

Nifty Copper Mine history:

Copper – Nifty Copper Operation – Metals X Limited

https://cypriummetals.com/wp-content/uploads/SamsoInsightsTheNiftyCopperMineAForgottenGemInThePattersonRange13Mar21.pdf [March 2021] This was a well researched bull-case report, but the assumptions made didn't play out as expected.

Nifty Copper Mine – Cyprium Metals Limited

CYM:

CYM-Quarterly-Activities-and-Appendix-5B-Cash-Flow-Report-Dec-2023-Qtr.PDF $4.79m/qtr cash burn. $22.59m of cash and cash equivalents as at 31-Dec-2023.

ANO:

Intention-to-Make-Takeover-Bid-ANO-October-2023.PDF

ANO-Response-to-ASX-Aware-Letter-02Feb2024.PDF

ANO-Ankla-Takeover-Offer-Closes-07Feb2024.PDF

CYM is a copper hopeful I hold a small position IRL. On the 11th of March 2022 they announced their Restart Study for the Nifty Copper Project in WA.

Highlights from the restart study:

- Current copper price USD$4.60/lb

- C1 Costs USD$1.91/lb

- C3 Costs USD$2.82/lb

- Average production of 25,000 tpa copper cathode

- Pre-production capital of AUD149M

- NPV of AUD277m

- IRR 37% (Post Tax)

- FCF of AUD544M

- Payback in 3 years

This all looks great on paper, the biggest issue for me is with the current market cap under $100m how are they going to finance this project. Without some seriously favorable debt terms there will be significant dilution to get the project off the ground.

Currently planned to be producing copper cathode onsite in the second half of 2023. I have full faith in the management teams capabilities given their history (See previous straws) but capital is the biggest issue for me.

Great overview of the opportunity here

AISC from Metal’s X’s Scoping Study = $5,400-$5,800 per ton

Current copper price = A$12,625/t

Given 20ktpa copper cathode produced onsite at Nifty

Rev = $252,500,000

AISC = $116,000,000

Gross Profit = $136,500,000 = $136.5M

Current Market Cap = $110.14M

Assume an additional 25% of other operating expenses -> EBITDA= $102.3M

Given $40m cash on hand but financing not finalised I’ll compare MC to EBITDA.

OZL for reference trades on a 5-year average of 6x EV to EBITDA

Given the quality of OZL I’ve given CYM half that multiple of 3x.

Price target for CY23 = 3 x 102.3M = $307M

Although they currently have $40m cash on hand I suspect they will need another $30m before production starts. I'd like to see the restart study provide a positive catalyst before a cap raise is announced. Assume cap raise at $0.30 to bring total shares on issue to 665,000,000.

Share price = 307/665 = $0.46 in Q1 CY23

Discounting at 20% gives me fair value of $0.38

Note: This ignores Nandie & Maroochydore which will come online in later years. Nifty has a 7 year life of heap leachable resource ready. Not including the remaining resource which needs further processing (5x the size of the heap leach ready resource).

Really did enjoy learning about the copper space & CYM in particular. Took a position IRL today.

Before I start I'll preface this with a warning. This isn't a space I usually play in but the youtube algorithm fed me something that really sparked my interest. Why CYM is a different copper producer

CYM is an Australian copper developer & explorer with a number of near term development projects focused in WA. What differentiates them from most other explorers is their highly credentialed team who have successfully developed previous sulphide heap leach copper projects to produce copper cathode onsite, I'll touch more on this later.

Projects currently held include - Nifty copper mine, Maroochydore copper project, Patterson copper project, Cue copper project, Nanadine well copper-gold project.

The Nifty copper project acquired in March of 2021 was first operational in 1993 as an open pit - heap leach project. In 2006 Nifty transition to an underground min and used flotation to produce copper concentrate until 2019 the mine was placed on care and maintenance.

CYM acquired this asset along with key critical infrastructure significantly reducing the restart costs. 2.8Mtpa sulphide concentrator, 25ktpa copper cathode heap leach, 21MW gas turnine power station, heavy vehicle workshop, onsite accommodation & a sealed airstrip.

CYM recently updated the market with the Nifty copper mineral resource update:

- Heap leachable resource increased to 11.9Mt @ 1.1% Cu = 135kt Cu

- Total measured resource increased to 45.9Mt @ 1.6% for 732kt Cu

- This places Nifty within the top 20 Australian copper resources

CYM have a goal of producing copper cathode onsite. Why should we believe what they say? The CYM management team have done exactly this when they operated Finders resources. Finders operated a heap lech copper sulphide plant @1.5% Cu on the Wetar Copper project in Indonesia. This mine produced 25,000t of Copper cathode pa. Finders were taken over by Eastern Field Developments Ltd in 2019, this is when management moved to positions at CYM. Although the grade of copper was higher on this project the copper price was significantly lower in 2019 compared to today.

Barry Cahill & Gary Comb (Ex Finders) hold 2.2% of shares on issue but of note company insiders have been buying on market at higher prices this year & own a total of 4% of SOI.

The current near term catalysts for share price movements include the Restart Study & Finance Process for the Nifty Project (Expected H2 2021). The restart study will provide much more clarity around the economics of the mine but I believe there's enough to take an educated guess of the value in the company.

The company currently has $40m cash on hand and are burning $10m per quarter in exploration and refurbishment of the Nifty plant and equipment. The company have outlined that it will be faster and involve 50% less capital to refurbish the current heap leach equipment onsite.

H1 22 Nifty Timeline: Purchase long lead items, commence construction, finalise approvals, earthworks & pre strip.

H2 22: Complete construction, commissioning, re-treatment heap leach stacking, open pit ore stacking.

H1 23 Production of copper plate onsite & ramp up.

I enjoyed looking into this company & learning about a space I don't usually bother with. The management team is a huge plus for this "explorer" who have a clear path to producing copper onsite.