Have done a more detailed review of the EOS FY2023 Annual Report, the 1QFY2024 Appendix 4C and the recent Investor Day Presentation. The slides below is how I have internalised the good turnaround story and the very positive trajectory of the business since new management came onboard in late 2022, amidst of a lot of business/Covid turmoil.

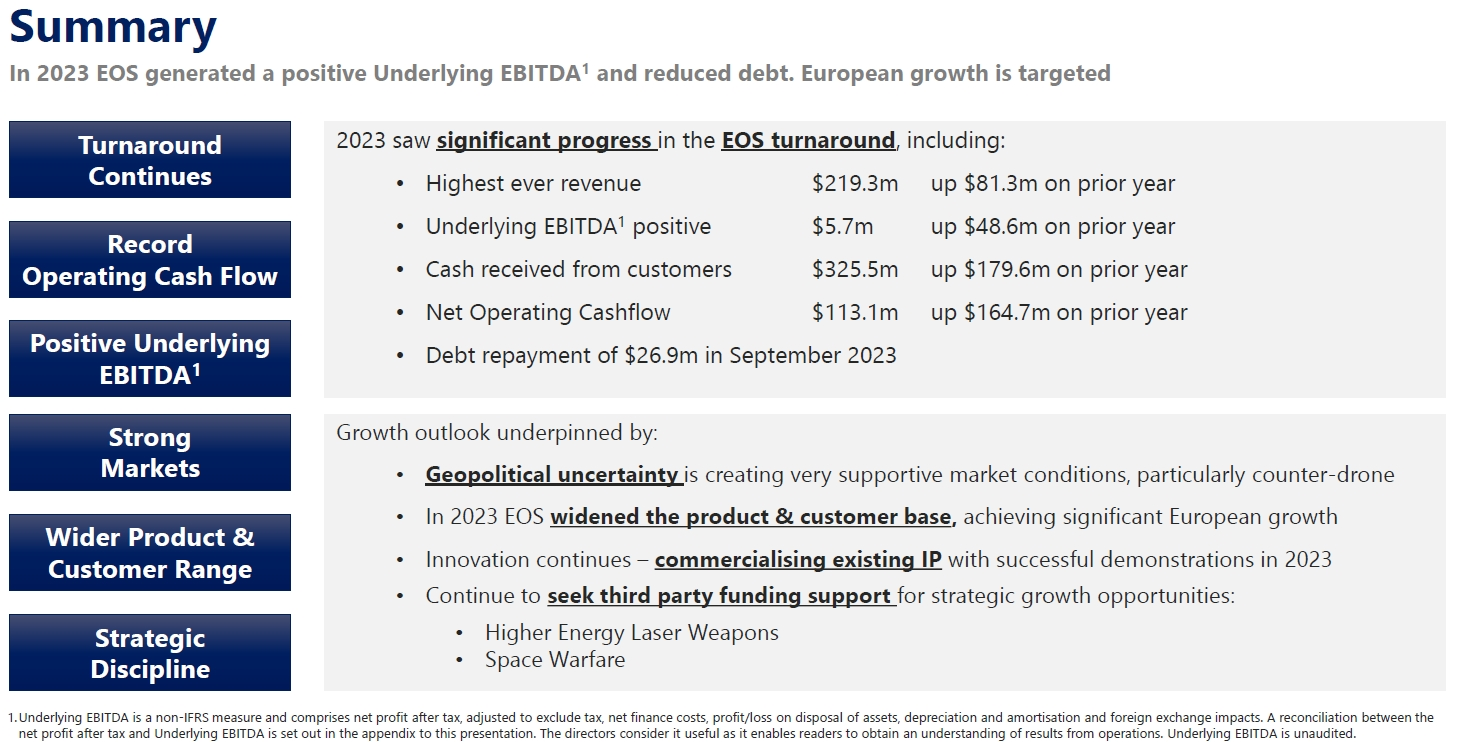

Have been seeing a very steady flow of positive news in the last year and knew that things were going well, but have got a much better appreciation of how well through these slides and the financial summary.

Have remained invested since Mar 2020 when initially opened the position from around ~6.60, after falling from the peak of ~$10, (thinking I got in at a good price ...). Have topped up from about ~1.13 earlier this year as more evidence emerged of the positive turnaround outcomes.

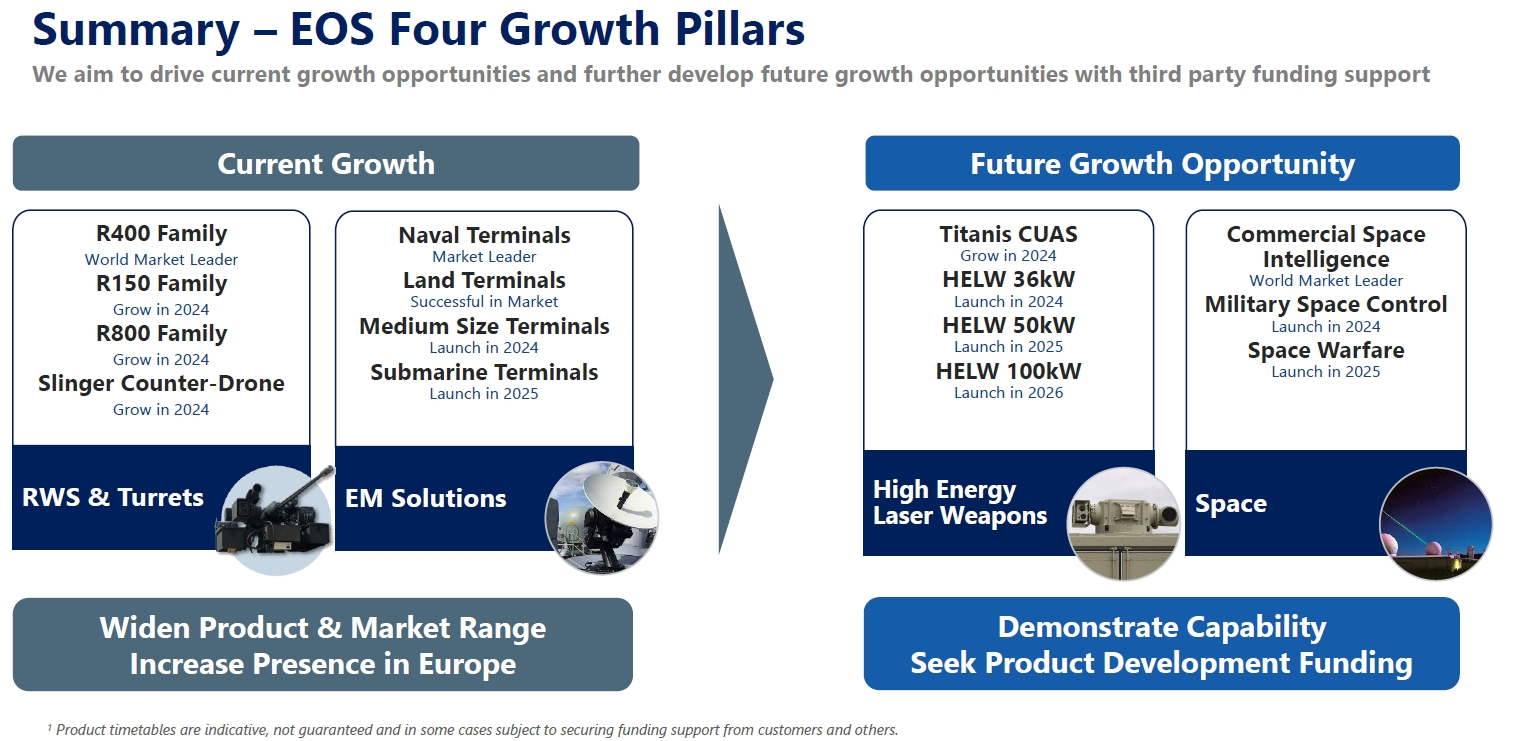

EOS is now on a much firmer footing with clearer direction, amidst buoyant global demand for its products, as governments respond to the changing nature of warfare towards counter-drone, electronic warfare, autonomy/unmanned and space - EOS is very well positioned to meet demands in these areas.

Really liking what management has done to fix the business issues and the evidence of those fixes steadily emerging. Will stay invested and average up as more positive evidence emerges with the expectation that EOS is one best positioned for the medium instead of short term, given the very long selling and product development cycles amidst inherent government/military/was conflict uncertainty.

Discl: Held IRL

FY2023 Results

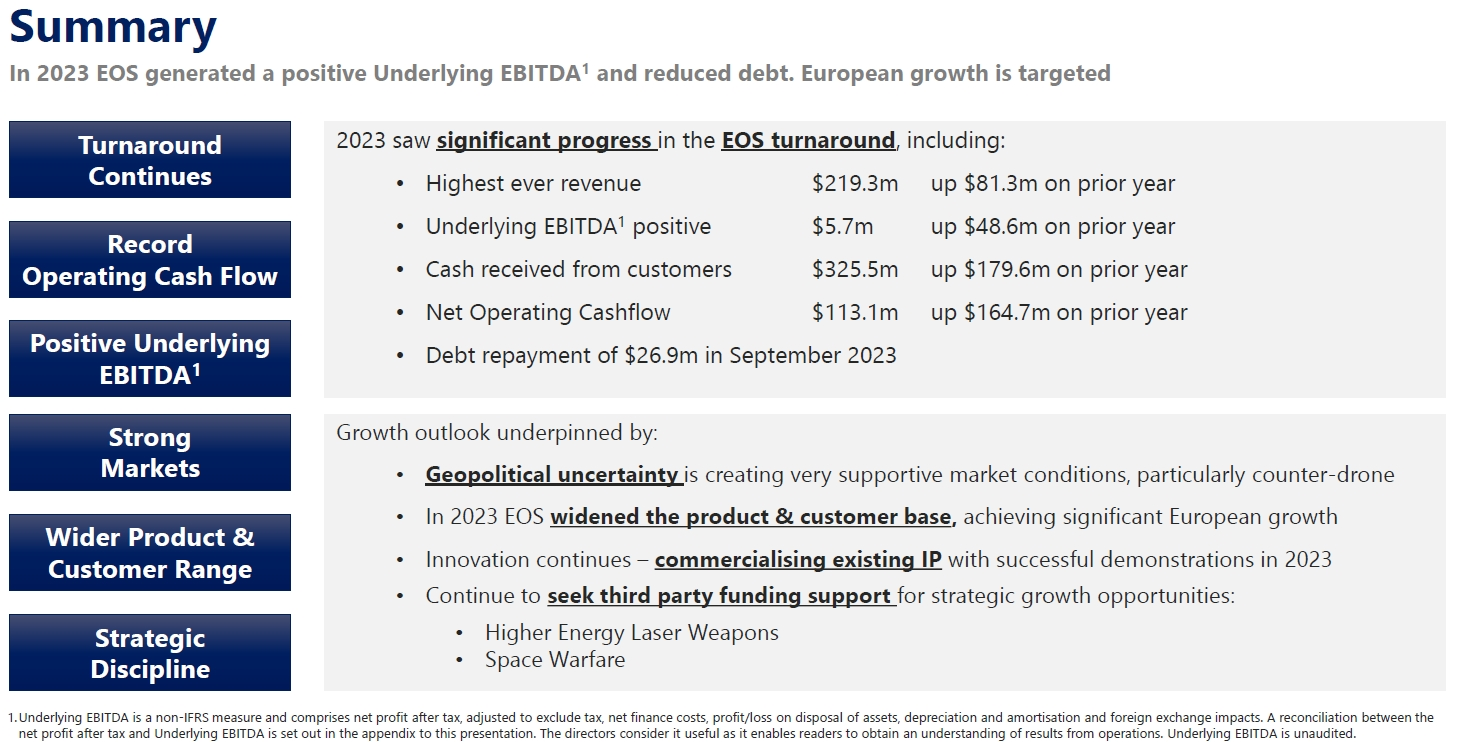

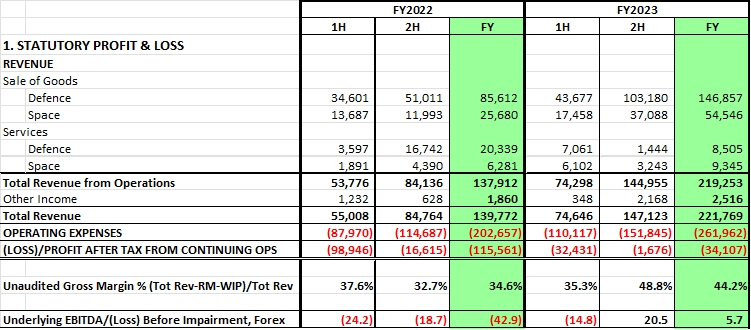

Slides summarises nicely, the FY2023 full year results ending 31 Dec 2023.

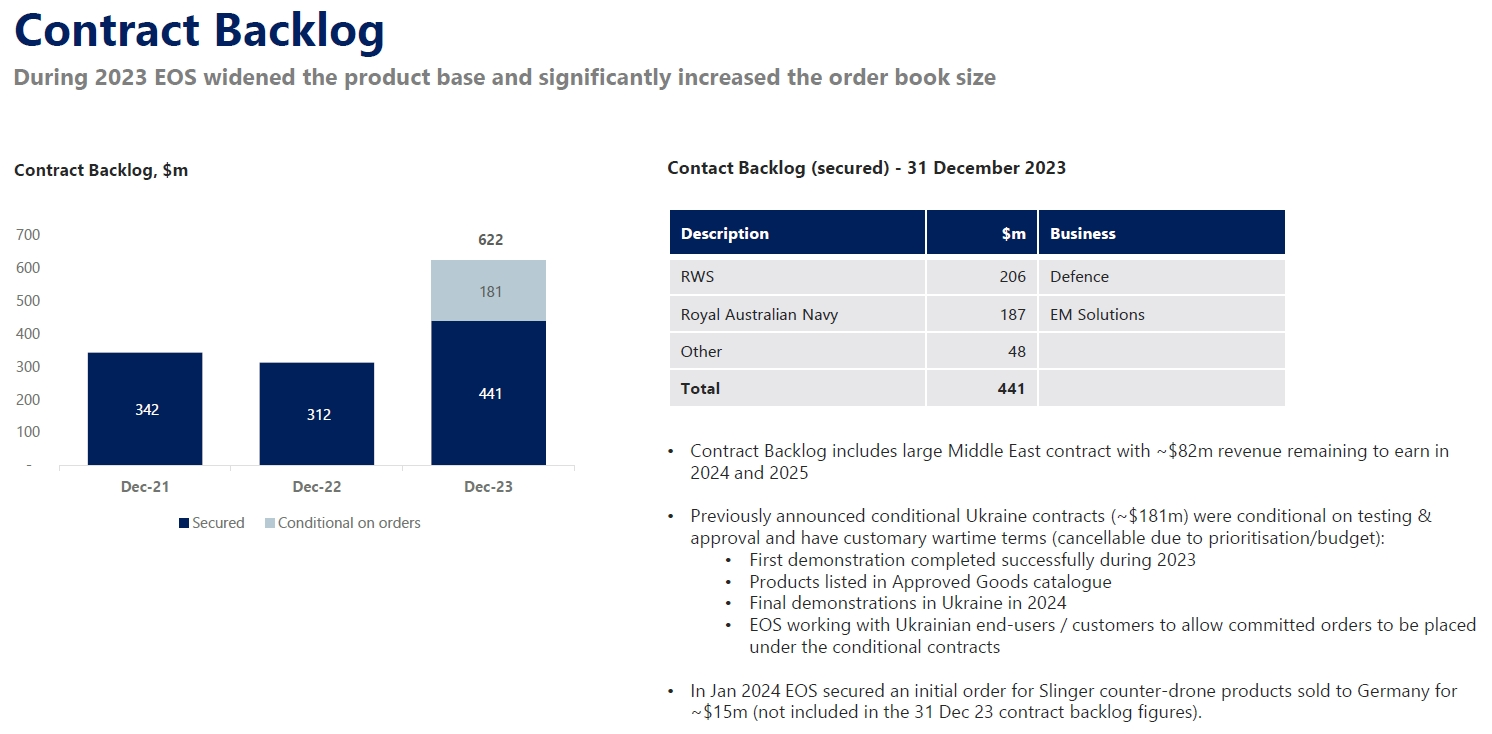

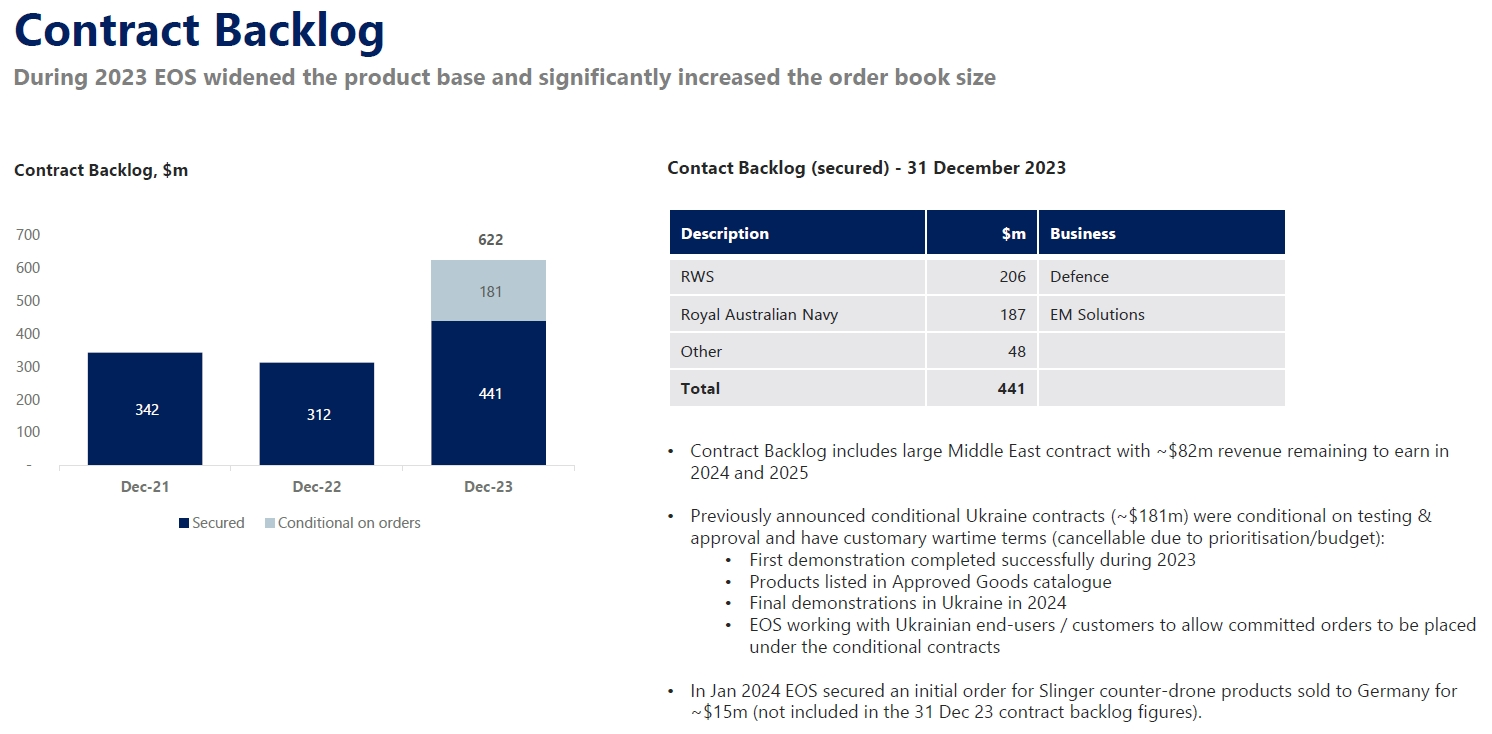

Contract backlog of $622m at 31 Dec 2023

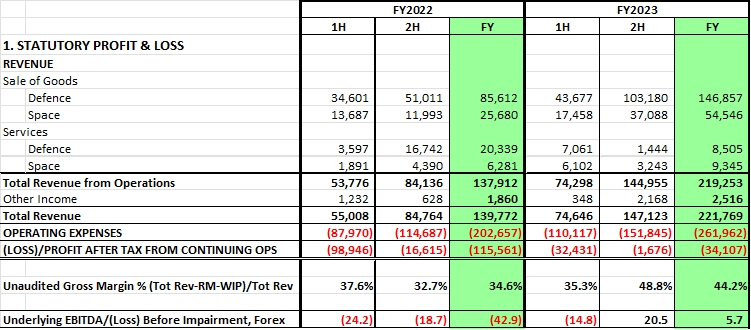

While FY2023 results were strong, summary below of the last 4 HY’s shows more clearly, the significant positive moment in (1) revenue (2) rapidly reducing Loss After Tax (3) improving Gross margin and (4) steady march to positive underlying EBITDA

1QFY2024

- 1QFY2024 continues the 1H revenue momentum since FY2022 - appears that 1H has consistently been the weaker half.

- Cash balance of $72.4m as at 31 Mar 2024 with record cash flows at the end of FY2023

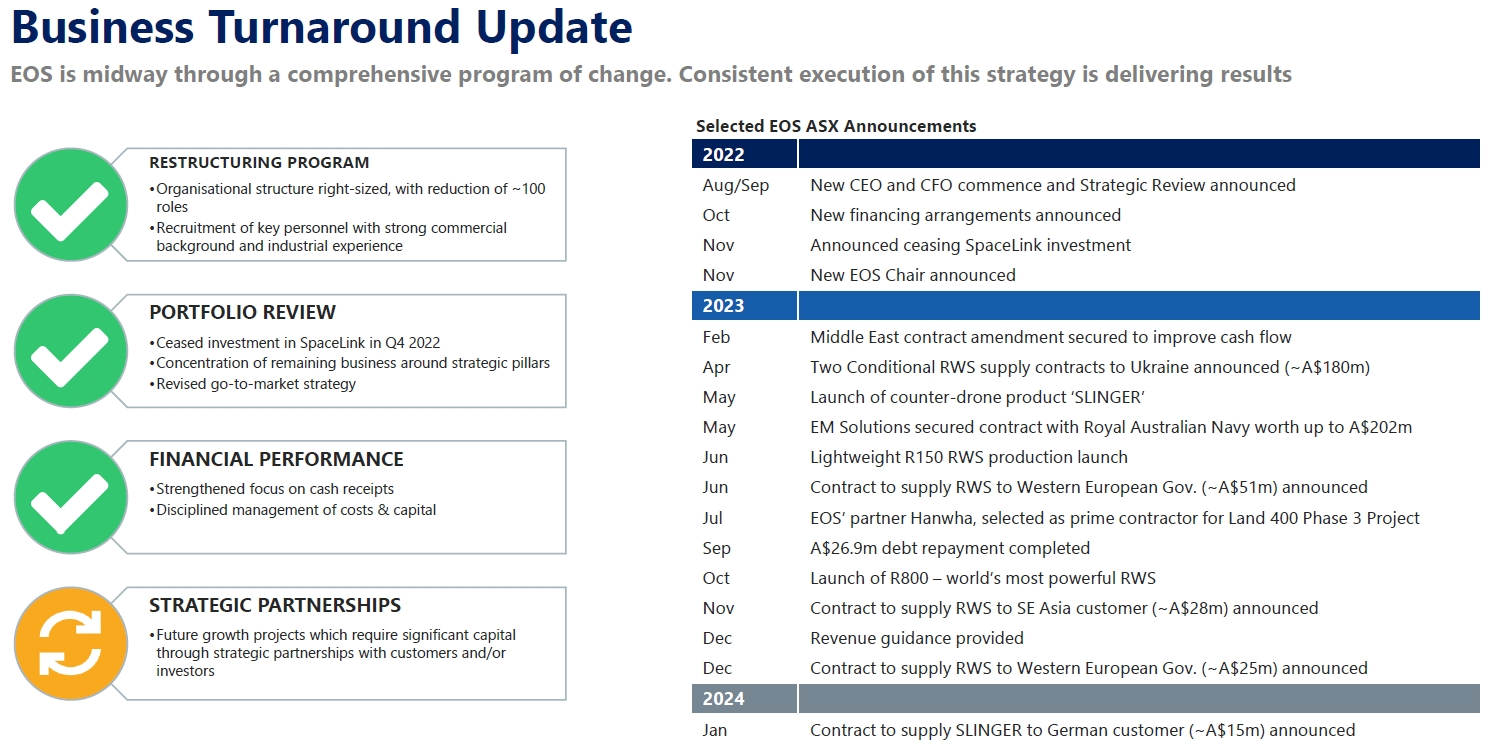

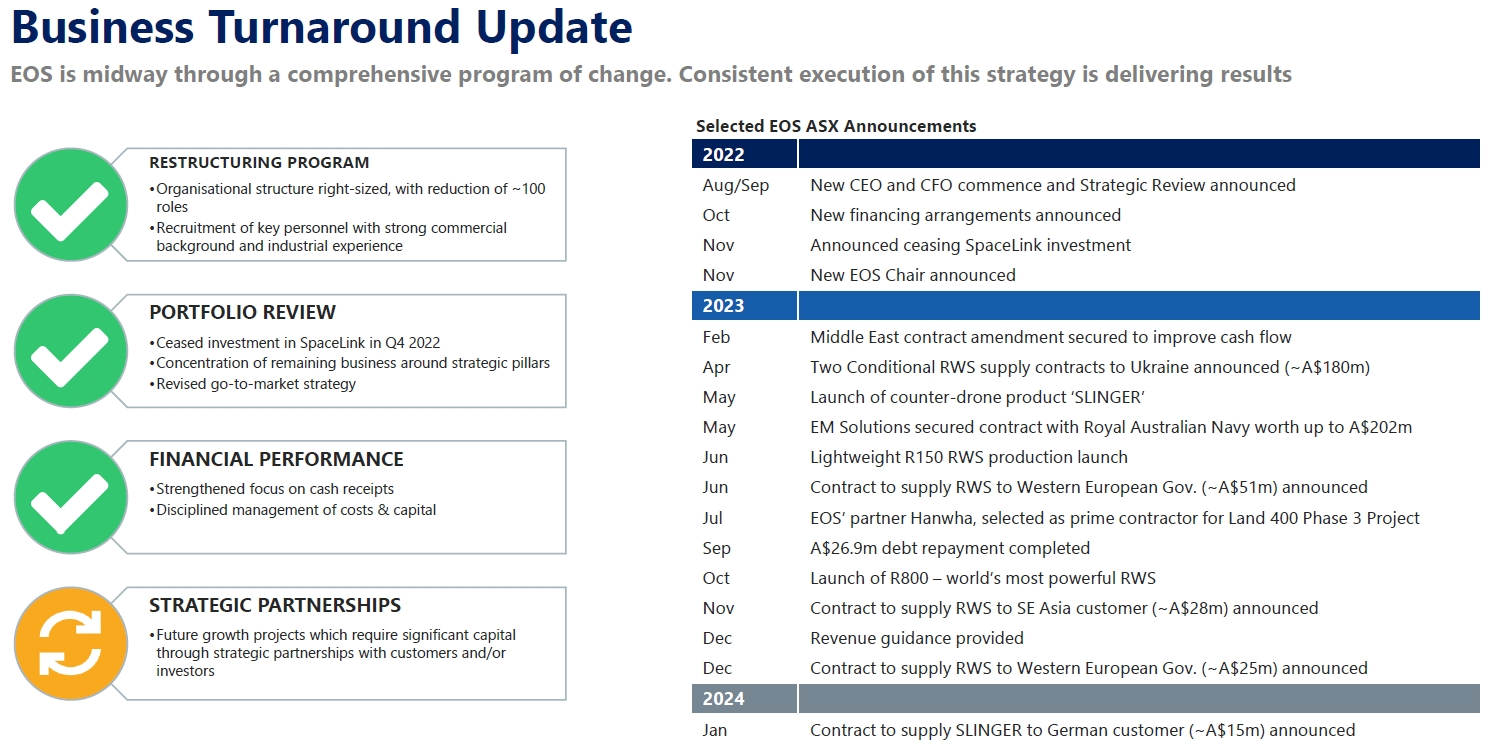

Business Turnaround

- Previous issues with cash collections, liquidity very much under control - significantly improved revenue, revision of contract terms, cash collected + capital raising has allowed the consistent on-time repayment of high-cost working capital loans from Washington SOL Pattison, a major shareholder, and meeting of debt covenants.

- Business Turnaround under new management after the turmoil of 2022 has delivered results and is well advanced - leaner organisation, sale of loss making SpaceLink, disciplined cost and capital management

Market Conditions

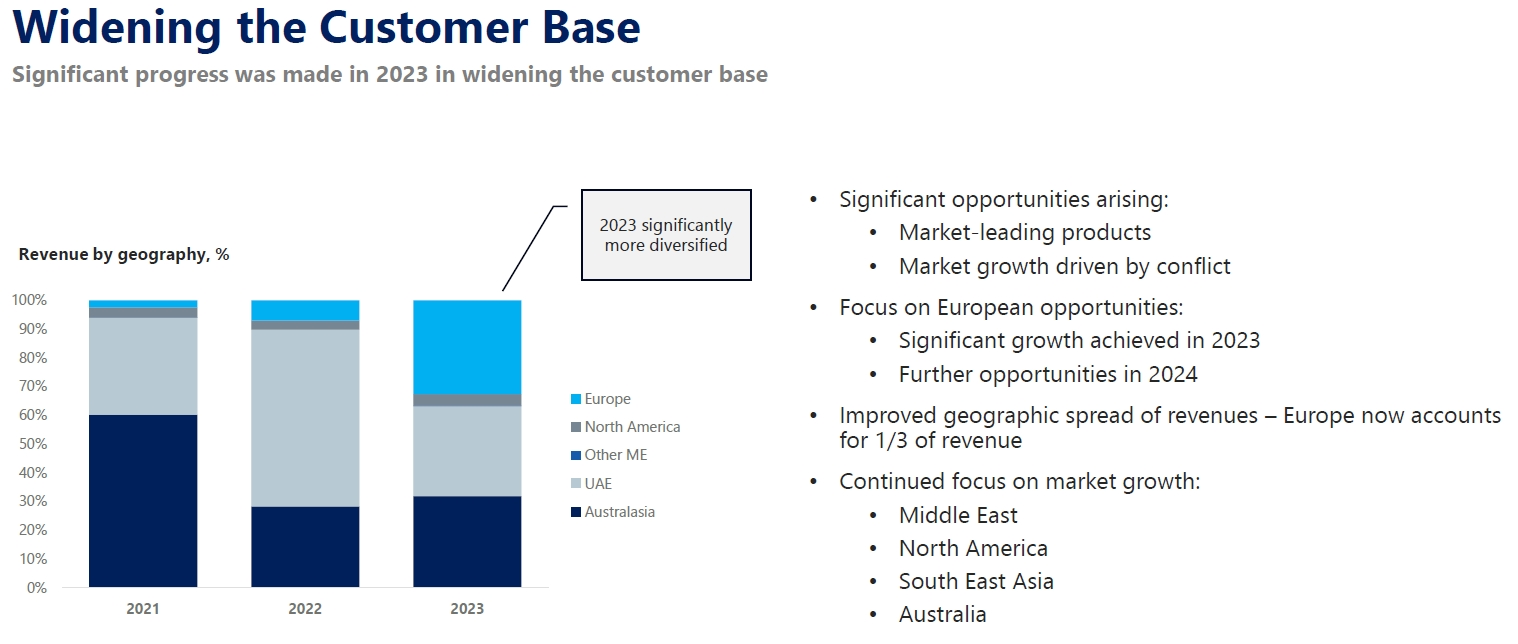

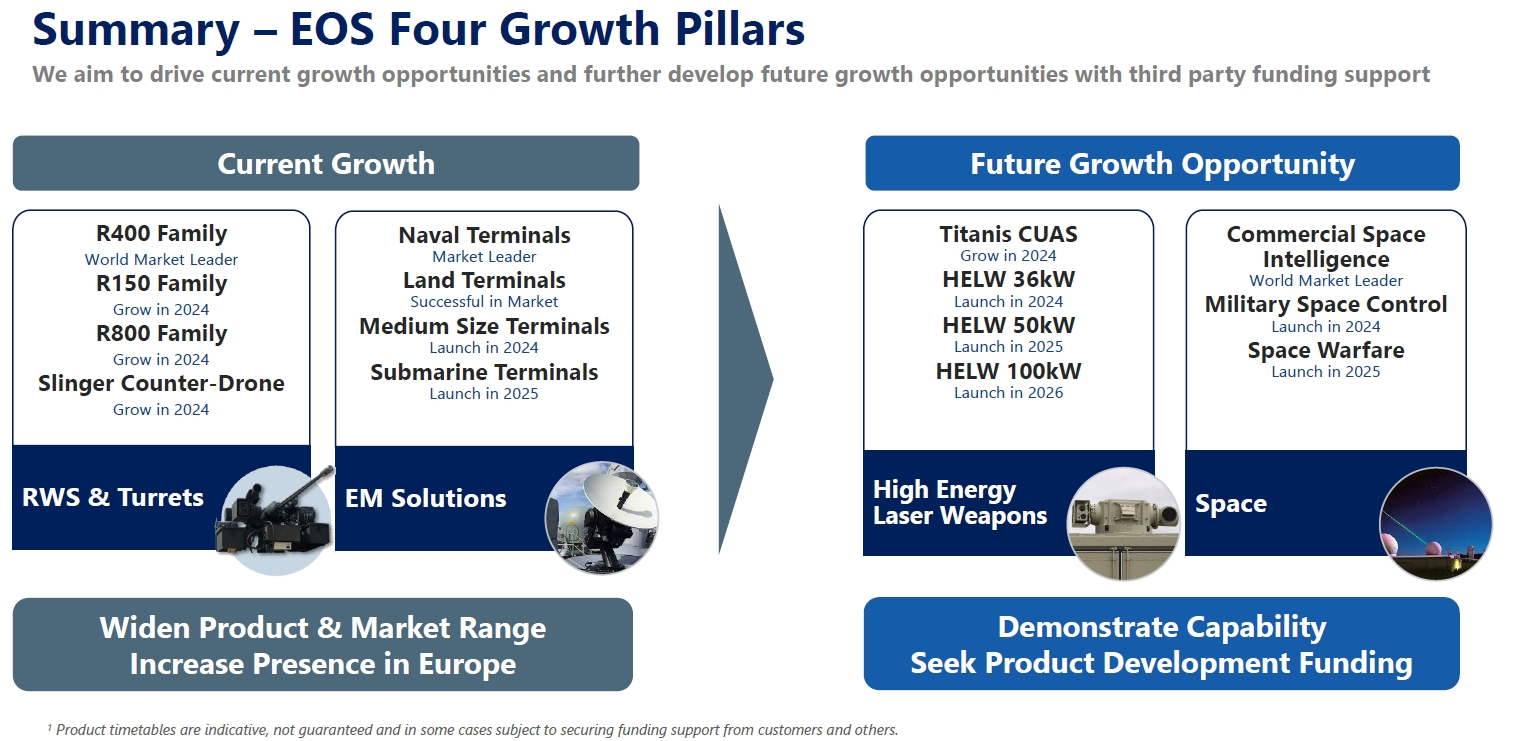

Market conditions and demand are very favourable - current conflicts have highlighted the changing nature of warfare - EOS has products and IP to directly address this changing nature of warfare and is positioned very nicely to capitalise on this demand with recent product launches in the back end of 2023/early 2024.

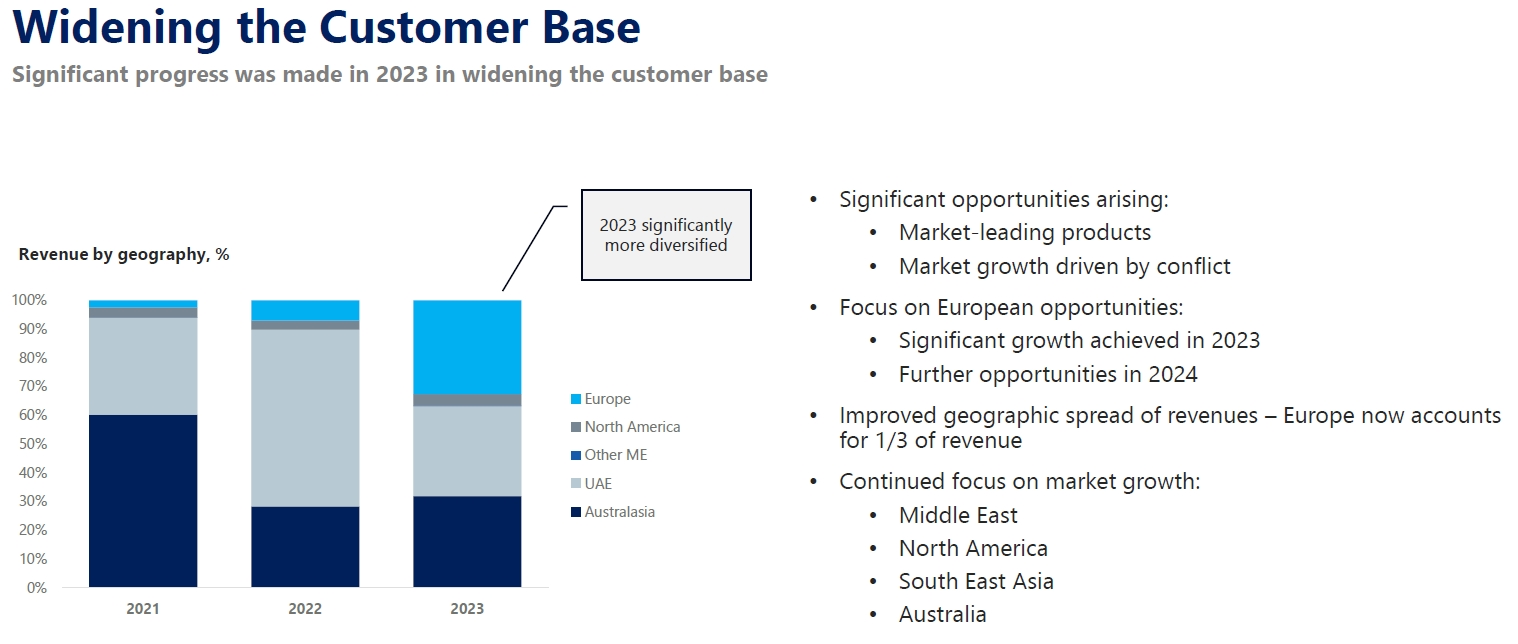

Customer base has significantly widened to Europe, reducing previous heavy dependence on the UAE market

Growth Plans

EOS has IP and innovations in High Energy Laser Weapons and Space Warfare - focus now is on finding customer partners to fund the development of these innovations - this will drive the next wave of EOS growth in 3-5 years and beyond.