To me FDV is a bet on the strong management of Shaun Di Gregorio and team. I think he is a very quality operator and I like the way they tell investors what they are doing, and why and then importantly deliver on their milestones. To me this is a 2-5 year minimum story but I am confident that FDV will be a bigger and better business into the future. This company has the perception of risky as it operates in developing countries but I think the way they have their buisness risk spread across the globe and the quality of management makes me consider this to be one of my lowest risk holdings and expect this will have a share price of more than $2.50 when all buisnesses are operating in positive EBITDA.

A copy of the analyst call is available from the FDV website and is worth a listen. Shaun does a very good job of explaining what they are doing - below are my takeouts.

New geographical structuring of the business segments into three defined regions.

-Latin America (Colombia, Bolivia, Chile, Paraguay- 4 businesses)

-1.1m + EBITDA

-Asia (Pakistan, phillippens, Myanmar, Sri lanka- 7 businesses)

-2.8m EBITDA (5/7 companies + EDITDA)

-Majority ownership of Hoppler (51%)

-MENA (middle east, North Africa + west Africa- 4 businesses)

-2.0m EBITDA loss

-Transformation on track, bought AVITO in full just over a year ago – 4th quarter only 0.2m EDITDA loss vs 2.0m a year ago.

Target the uncrowded market regions (have avoided China, India, Mexico etc) and aim to buy/develop best in region marketplaces

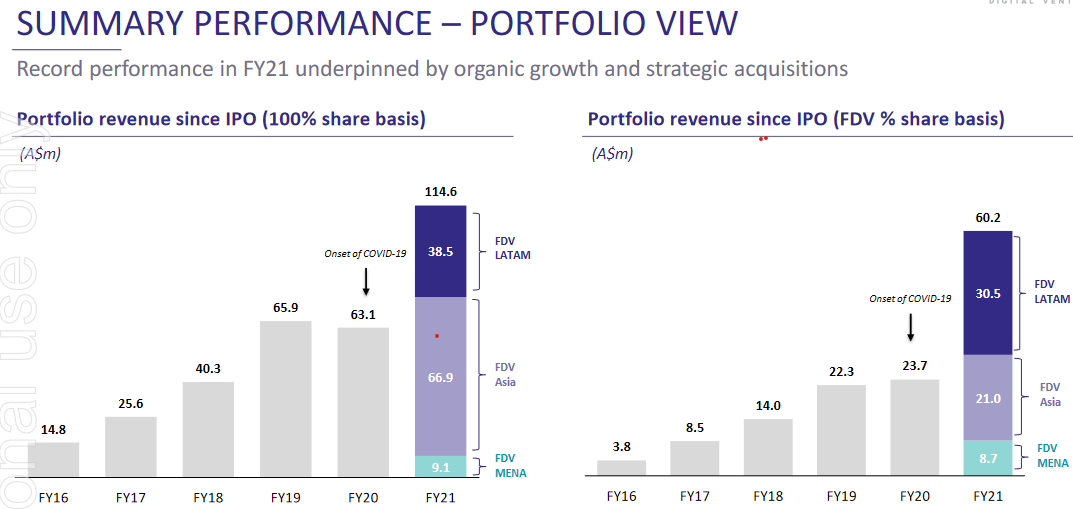

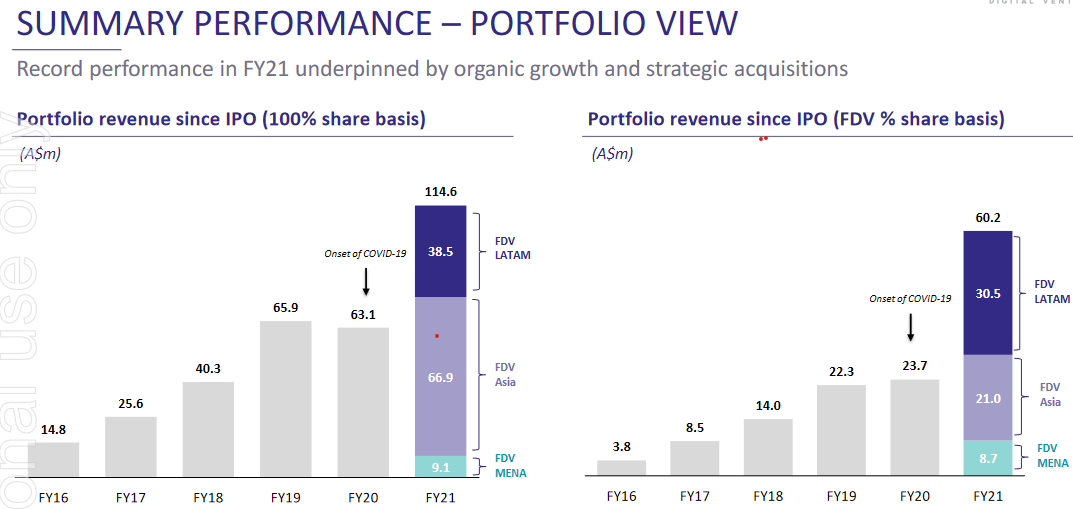

Revenue of 60.2M à next milestone target of 100M/yr, exit runrate is currently 78M

- Used Covid to increase the quality of overall portfolio, growing at rapid rate. FY22 aim for breakeven across the group and maintain and increase positive EBITDA over the next 12-24 months.

- Strong balance sheet (>54m) and no requirement to raise any more capital. Last raise in December (53.9m @ $1.50 - Good timing and they have a history of raising necessary capital when share prices are high).

- Thinks they are in a sweet spot coming into 2022, revenue performing well, intact strategy to grow each business.

Transition to a transaction focused marketplaces from a more traditional market classified business on track and accelerating – gives them the opportunity to collect more of the total value of the transaction and facilitate required services (e.g home loans, pre-purchase inspections etc) and collect a fee.

They think about transaction revenue as the opportunity to fully facilitate the transaction in house within their platforms. To be successful the business needs to be market leaders and have the trust reputation àstrong brands + strong marketplaces = ability to improve the experience for the buyer and seller which facilitate transactions. Using technology to facilitate high quality matching to produce quality leads. Keeping the consumer in your environment and making them feel safe using you to process the transaction. Targeting 10-15% of transactions to be captured by the business will generate 15-20 times the revenue of the traditional classifieds buisness that gets revenue form only advertising.

Economics of the transaction business gets better over time à is expensive and time consuming to start up from scratch. Much easier to facilitate transactions when you a captive audience of sellers which is why they target and develop good market leading classifieds business and then transition to transactions.

Zameen (30% owned by FDV) continues to perform very well – 60m revenue à 51m is generated from transaction revenue. Commentary on Zameen is that they consider this will be a billion dollar standalone business in time.

Lot of excitement about Infocasis (owned for just over 12 months) and its successful transition to transactional revenue – Facilitated 1400 property sales in 2021 vs 185 in 2020. They consider Infocasis has cracked the code on how to do transactional revenue and they are moving this technology and know-how to the other businesses within the Latin America group.

Talked about how the transaction revenue is still cutting edge and many other groups haven’t done it well but they are confident of how it is unfolding in Latin America. Transaction revenue is still a bit earlier in the Asian business. Commentary was this this has gone from nothing to something really quickly and they expect this trend will continue over the next 24 months.