I am having mixed thoughts on the financial performance of FDV.

Announcement 6 October 2022.

FDV announced that a portion of the future cash earn-out payments to the owner founders of Encuentra24 and Infocasas would be exchanged for equity in FDV Latam.

This is encouraging in that the ‘insiders’ being founding owners of Encuentra24 and Infocasas believe there is better value in receiving shares in FDV Latam rather than cash earn-outs. Big positive tick.

Looking back at the structure of the E24 buyout – FDV owned 26.3%, FDV paid OLX Group A$13.1M for their 36.2% stake. The amount for the remaining 32.6% owner/founder stake was not disclosed (ie subject to undisclosed earn-out provisions). Referring back to the CY21 accounts there is an amount of A$15,397,684 for Contingent Consideration which would value E24 at A$42.5M approximately. This represents 5 x revenue.

I mentioned at the time that growth would need to be spectacular.

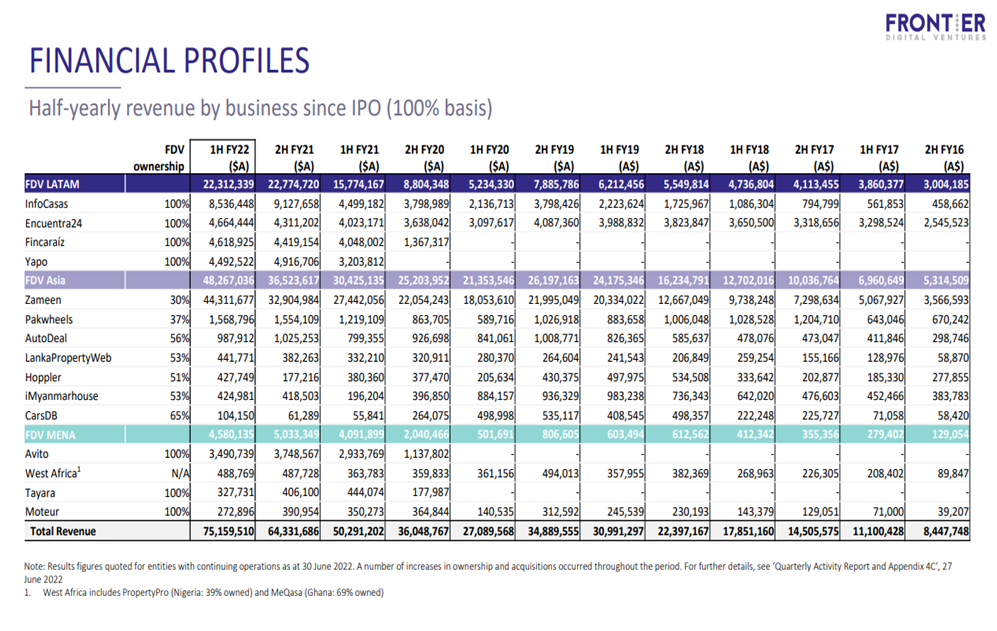

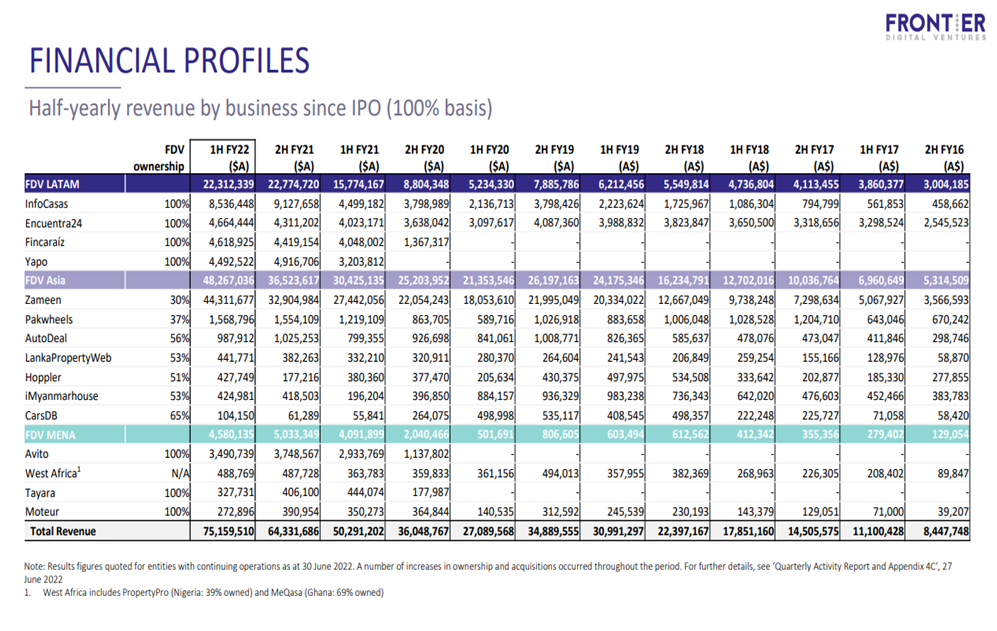

The chart below for the 1st half CY22 results indicates E24 half on half growth of only 8%.

In my mind the growth does not justify the amount being paid for E24.

Similarly, Infocasas with declining revenue half on half has a Contingent Consideration of A$38,577,959 in the December 2021 accounts.

All of the revenue growth in the FDV business is coming from Zameen (Pakastan) which is only 30% held. This is concerning given the recent flooding and global economic conditions.

FDV have previously guided for the CY22 revenue to be double (+) the half year result. The 3rd QTR CY22 results are due shortly and if they start talking down previous guidance this would be a red flag.