Highlights/snapshot

- ARR increase to 5.67m, up 90% YoY.

- Customer cash receipts increase to 2.37m, up 119% YoY.

- Three consecutive quarters of record organic growth.

- Two other revenue figures – implementation and global – included in the snapshot. *Red flag number one*

- Operating loss 4.6m, well up on H1 FY21’s 3.03m.

- 10.8m cash on hand

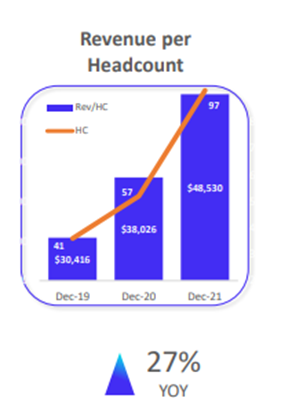

- Revenue per headcount up 27% YoY – see graphic below.

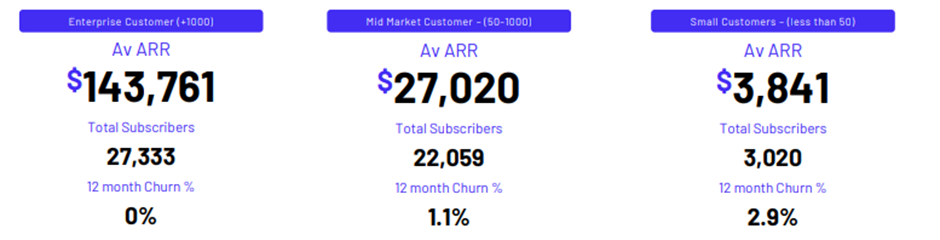

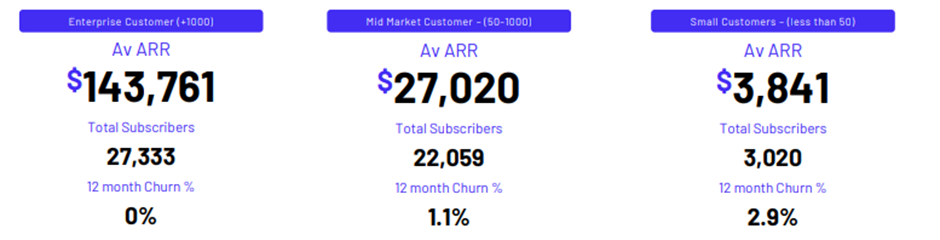

There is no denying that the company is achieving impressive revenue growth, the result of an increase in subscribers on platform and enterprise customer wins. Pleasingly, churn is very low – somewhat validating the company’s offering. The below demonstrates what portion of IHR’s ARR comes from enterprise customers, in comparison to mid-market and small customers:

Interestingly churn was reported at 0% for enterprise. This suggests that, once adopted, IHR is sticky and obviously useful for enterprise. This also supports the view that IHR should really be targeting these big enterprises to best support its growth.

The reason I like IHR is due to their tailwinds post-pandemic. We are already seeing a shift in businesses needing to support more flexible and remote working arrangements, in addition to a more digitalized workforce (systems and people). IHR seeks to optimize HR admin costs, increase engagement and wellbeing, increase productivity through streamline and subsequently reduce turnover as a result. Provided we continue to see steady growth and low churn, this is a business I want to keep a close eye on as they continue to develop and grow.

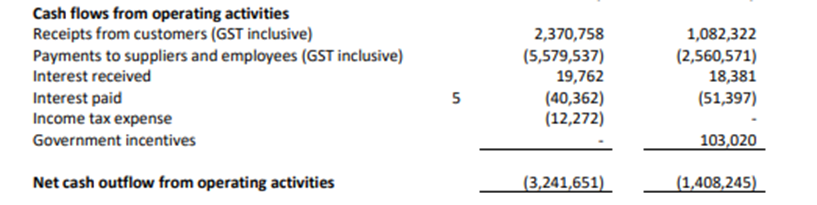

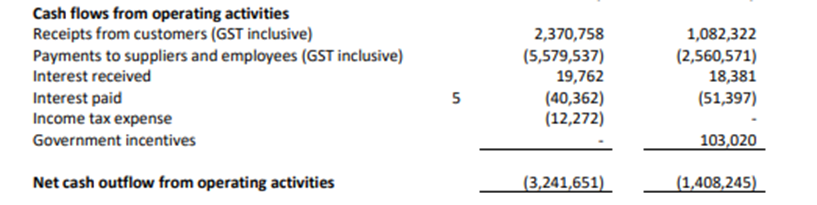

I have one big issue though: costs. As it stands, the business is throwing cash at achieving this growth. Yes, there is a good case to suggest this is necessary, particularly in the development/growth phase they are in. But current investors will be the ones to pay for that, likely through dilution and a down-trending share price. Revenue increases have come at the expense of higher employee payments/benefits for a year now:

To delve into the loss figure a little, it consists of employee benefits (3.6m), admin expenses (nearly 1m) and marketing (nearly 1m), with D&A at 1m. To achieve a revenue increase of 119%, supplier and employee costs increased by 118%.

This suggests they are not scaling as well as I would have hoped. This is a big problem for a) dilution and b) the short/medium term outlook for these sorts of plays, which remain unfavourable. With 10m in the bank, IHR is staring down the barrel of a capital raise, likely within the next 12 months. They absolutely screwed retail investors with the last one, so many likely wont be too happy with this. I am also concerned that, to continue growing, IHR will have to continue to inject more funds into business operations (staff and marketing) to ensure revenue increases – ie justifying the high growth play that it is. I think this has a lot of similarities with Whispir (WSP) at the moment.

And like WSP, it remains on the watchlist, where I envisage it will remain for the next year. What I will be monitoring going forward is IHR's ability to continue to achieve revenue growth without costs increasing. Even better, if they manage to achieve ongoing growth with costs actually reducing, then we might be onto something.

Disc: not held