Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Reasons to accept the Humanforce Offer

(a) The Humanforce Offer Price of $0.24 per intelliHR Share represents a

significant premium to the recent trading price of intelliHR Shares prior to

the announcement of the Humanforce Scheme

The Humanforce Offer Price of $0.24 per intelliHR Share represents a significant

premium of:

(i) 281% to the closing price of intelliHR Shares of $0.063 on the

Undisturbed Share Price Date; and

(ii) 2% to the last offer made by TAG of $0.235 per intelliHR Share under its

proposed off-market takeover bid announced to the ASX on 3 April 2023.

If you do not accept the Humanforce Offer and Humanforce does not achieve a

Voting Power of at least 90% at the end of the Humanforce Offer Period which

would enable it to Compulsorily Acquire any remaining intelliHR Shares, you will

remain a minority shareholder and your intelliHR Shares may trade at a price that

is below the Offer Price

Tax:

(d) The tax implications of the Humanforce Offer may not be suitable to your

financial circumstances or position

If you accept the Humanforce Offer, there may be tax consequences that result

for you as an intelliHR Shareholder, some of which may be adverse.

The tax consequences that will arise for you from your acceptance of the

Humanforce Offer will depend on your specific circumstances.

A general guide to the Australian taxation implications of the Humanforce Offer is

set out in section 8 of the Bidder’s Statement. However, intelliHR Shareholders

should consult with their own independent taxation advisors regarding the taxation

implications for them if the Humanforce Offer is accepted

The two interested parties continue to bid against each other today.

TAG this morning $0.235 a share, with Humanforce increasing their own market bid to $0.24 shortly after lunch.

The board is recommending shareholders do nothing while they invoke the 5-day TAG matching right.

Another day, another development.

Today IHR Board Committee has advised shareholders to reject Humanforce Bid and Accept the TAG Transaction.

TAG wants 100% of the company for up to $0.22 per share via the TAG Scheme. (75% for $0.215, 50% for $0.21 by takeover Bid).

Not long after this announcement, Humanforce upped their on-market offer to match at $0.22. It's hard to not see TAG increase their offer at this point (or give up). Not sure how many people would want to hang onto IHR shares for months for the TAG scheme to run its course - which would only result in the same net outcome by cashing out now.

Disc: Still holding a small holding IRL.

The bidding war continues.

This morning Humanforce upped their ON market offer to $0.195

Not long after (approx an hour) TAG increased their Binding Proposal to $0.22

As Humanforce point out in their offer, they own 19.9% of intelliHR shares and confirm they will vote no to the TAG offer. For the moment I'm happy to hold my small parcel IRL to see how this all plays out. Both parties seem highly motivated to achieve their desired outcomes. I wouldn't be surprised if the price edges up ~$0.30 by the end of next week.

Oh spicy, another counter offer at 0.20 by TAG.

A few more of these and I might get out of the stock whole.

Well, that didn't take long.

$0.165 offer for 339991116 shares.

IHR has entered a "Pause in Trading", I've never noticed a "Pause" (vice "Trading Halt") before. I assume this means it's for a matter of hours not days?

No reason given for the pause.

Also selling out of IHR.

IHR is getting interesting again with a 2nd bidder emerging (The Access Group), with a 14c a share takeover offer. Still lots of caveats in it and is non-binding but they have been granted an expediated 10 day due diligence to confirm the offer.

HumanForce have positined themselves in a strong position and now own 15% of the company after buying heavily on-market after they made their 11c takeover offer. They now have 5 days to respond with a matching bid to avoid giving the other guys a look at the books. I think the odds are pretty good that they will match it as it looks like they want this prize.

In the half year report management also gave broad outlines how they have contingency plans in place if shareholders vote down the takeover and said they will need to refinance, but are still on track to become cashflow positive with an annual run rate of $9m ARR at the end of last year.

Glad I hung on to my own shares as I was thinking of selling them as I didn't think a 2nd bidder was going to emerge. The market always surprises!

The takerover offer has a very high probability of getting over the line, given it has the unanimous support of the BoD and the largest shareholder (Colinton).

A bailout that will leave many shareholders still well underwater, but it is better than a highly dilutive unprofitable company that may eventually cease operations.

Under the proposed Scheme of Arrangement (“Scheme”), IHR shareholders will be entitled to receive $0.11 cash per share (“Scheme Consideration”)

The IHR Board of Directors unanimously recommends that IHR shareholders vote in favour of the Scheme, and each director intends to vote all of the IHR shares held or controlled by them5 in favour of the Scheme in the absence of a superior proposal and subject to the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of IHR shareholders

IHR’s largest shareholder, Colinton Capital6 , which controls (14.6%) of IHR’s ordinary shares on issue as at the date of this announcement, has expressed its intention to vote all of the shares it controls in favour of the Scheme, subject to no superior proposal arising, and has entered into a voting and acceptance deed with Humanforce

Wow, what a disaster for a lot of shareholders - just wow, management backed themselves into a corner and then this.

In my opinion I think IHR has a great product but I think it has been let down by the managment team and now faces significant dilution from a capital raising near the lows. I think another capital raising was inevitable at some point but they way they handled the last one was poor and now they on their their last dollars at an inopportune time. If they can pull it off to reach breakeven now without raising capital I will be impressed. I'm not sure whether some of these choices were due to the founder who has now stepped down but hopefully things improve from here as I'm looking to initiate a position at some point.

IHR released an updated quarterly with some more info around their tax back for R@D. They had earlier said it was material but have clarified that they are expecting it to be around $1.2M, which is much higher than I was expecting. It will be very interesting to see if they can squeak by without needing to raise but at the least it will get them through until next year and hopefully the Cintra channel starts to deliver.

Seems this company has been sold down strongly due to burning cash, particularly when the market wants to see profits from companies.

That said the price now looks reasonable, growth continues and management are looking like they may be prepared to control cost.

Watch for money burn going forward.

Disc. Held s.m. Not in real. But may shortly.

This is the first quarter report since Matt Donovan took over as CEO, from Rob Bromage who is now an executive director and in charge of products and strategic partnerships. I think this is a good move, I like founder led businesses but I have also seen examples where the skillset of the founder isn't necessarily whats needed to drive the buisness from where it is to where it needs to be. I expecially like it when they can stay involved with the buisness in the area they are good at and don't let egos get in the way, so far it looks like this is happening at IHR. I will watch this carefully though as I wouldn't want to see Rob quit.

I like the way Matt Donovan has reported in this quarterly, good clear summary of the quarters highlights/problems, the previous reports did have a tendancy to hide information depending on which metric was the focus that quarter and lots of visuals that looked good but were sometimes hard to interpret.

Rocket6 and Rapster have given a good summary so I wont rehash beycond adding my thoughts.

-I think the customer churn (0.6% or revenue) on the back of the 10-12% price rise is probably more of the small companies which don't really add much to the bottom line. I will be worried if I see any large enterprises dropping the product. So far all good and they added another 3 in the quarter.

-Cintra reseller arrangement is slower than I was expecting, hopefully the numbers start to increase following the UK launch. Lots of good commentary around new partnerships though and the pipeline does look strong.

Cash of 5.5m is getting low but given they are accutely aware of this I am not as worried as I was previously. They should also get their R&D tax concession back by September, last year it was 800K, which if similiar would provide a nice buffer. So between that, the $500K/qr cost savings, and the pathway to10M ARR by H1 23, I think they might just squeak in without needing a cap raise. If they do though it will most likely be a small sophisticated invester raise and will probably be a good time to buy on market.

One thing I am surprised at is the number of subscribers yet to be invoiced - it is always increasing and is now 16K. I am guessing these are customers that are in the process of transitioning to the software so can't be billed yet.

Highlights

- Cash flow negative (-2.23m), an improvement on Q3 (-2.9m). This was mainly due to increased cash receipts – up 29% QoQ – and a small reduction to costs.

- Cash on hand 5.4m.

- Contracted ARR growth for FY22 at 7.9m. It went backwards in Q4 (was 7.75m in Q3).

As @Rapstar indicated a few months ago, management promised a reduction in costs. Advertising almost halved to 366k and staff costs decreased from 2.1m to 1.82m. Despite this, R&D spending increased (from 1.07 to 1.27m) and advertising/business costs increased 200k. In short, costs decreased, but not a great deal.

The business noted that they increased prices for existing customers. 23 customers were ‘added’ in Q4, but reported customer numbers only increased from 304 to 320. Customer churn might be attributed to the business increasing pricing. This is an area to watch though – if IHR don’t lose too many customers over the next 3-6 months it would suggest at least some level of pricing power.

Another concern is ARR, which decreased slightly in Q4. Yes, slow quarters happen, but another one would raise some alarm bells. On a more positive note, Q4 saw contracted subscribers increase from 64k to 71k – one metric very much moving in the right direction.

Holders beware – with 5.4m left in cash the business is staring down the barrel of a capital raise, unless they can secure a loan. They have enough funding to last them 3 quarters, at most (that is being generous).

Disc: not held

Following an internal strategic review, Matt Donovan has confirmed there is a clear pathway to accelerate to $10 M ARR, manage cash reserve more effectively, and bring forward the point at which operating cashflow is achieved. Key takeaways:

1) Increasing focus on partnership channel to drive growth, and presumably reduce sales and marketing costs.

2) Downsizing will reduce cash burn by +$500k per quarter from Q4.

3) More focus on target market of customers with 200-2000 employees.

4) Cintra (UK payroll company) partnership goes live at end of June, with the entire Cintra customer base having the option to access IHR service.

Note: IHR have $8 million in the bank. With the implementation of the above policies, IHR have sufficient cash for 3 more quarters......IMO, they'll need more cash to reach breakeven. I reckon they are about $6 million shy of what they need....

DISC - HELD.

@PinchOfSalt, agreed.

I didn't want to post a straw due to me previously being pretty bearish on IHR, despite liking the company. I don't want to come across like a consistent negative nancy every time they announce results/updates -- but your straw has baited me!

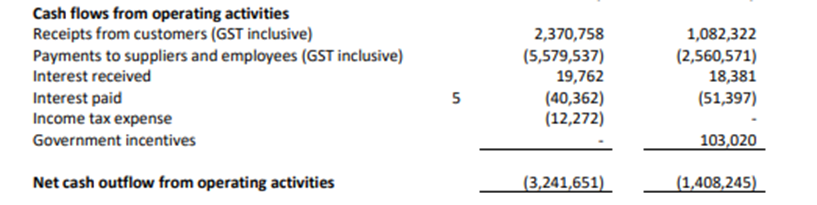

Ignore the noise and pretty graphs for a second - the cash flow statement makes me run for the hills:

When compared to Q2, we have seen a decent increase in receipts from customers of 179k. This is offset by increasing marketing (-174k), increasing R&D costs (-50k - although i dont think this is an issue) and increasing staff costs (-196k). There is no evidence of scaling here -- their continued global expansion is impressive but I want to see improvements to the cash flow statement before even thinking about investing.

Burning 3m a quarter is not sustainable in this environment. At this rate, they have around two quarters left of cash so they a capital raise can't be far away. I wouldn't be surprised if they raise in the next quarter to be completely honest, otherwise they risk causing a declining share price as investors start to smell it coming.

Next capital raise can't be far off now is probably the reason for the sell off (on top of growth selling off). $10 million in the bank with over $2 million cash burn a quarter so about 12 months lead time. Wonder if retail investors will get a look in now.

Highlights/snapshot

- ARR increase to 5.67m, up 90% YoY.

- Customer cash receipts increase to 2.37m, up 119% YoY.

- Three consecutive quarters of record organic growth.

- Two other revenue figures – implementation and global – included in the snapshot. *Red flag number one*

- Operating loss 4.6m, well up on H1 FY21’s 3.03m.

- 10.8m cash on hand

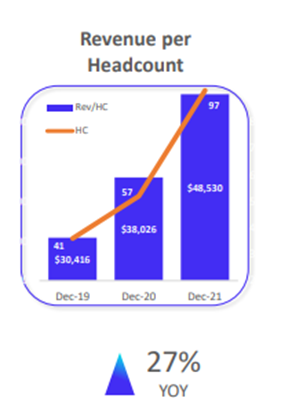

- Revenue per headcount up 27% YoY – see graphic below.

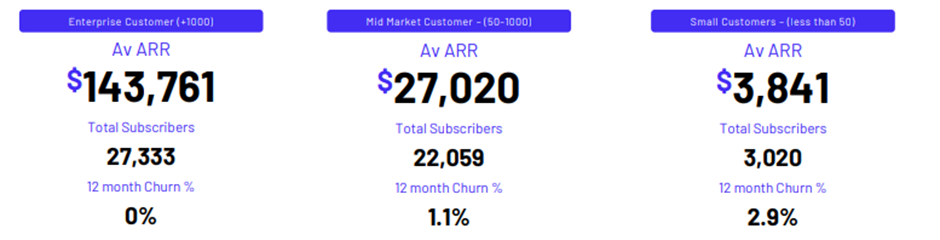

There is no denying that the company is achieving impressive revenue growth, the result of an increase in subscribers on platform and enterprise customer wins. Pleasingly, churn is very low – somewhat validating the company’s offering. The below demonstrates what portion of IHR’s ARR comes from enterprise customers, in comparison to mid-market and small customers:

Interestingly churn was reported at 0% for enterprise. This suggests that, once adopted, IHR is sticky and obviously useful for enterprise. This also supports the view that IHR should really be targeting these big enterprises to best support its growth.

The reason I like IHR is due to their tailwinds post-pandemic. We are already seeing a shift in businesses needing to support more flexible and remote working arrangements, in addition to a more digitalized workforce (systems and people). IHR seeks to optimize HR admin costs, increase engagement and wellbeing, increase productivity through streamline and subsequently reduce turnover as a result. Provided we continue to see steady growth and low churn, this is a business I want to keep a close eye on as they continue to develop and grow.

I have one big issue though: costs. As it stands, the business is throwing cash at achieving this growth. Yes, there is a good case to suggest this is necessary, particularly in the development/growth phase they are in. But current investors will be the ones to pay for that, likely through dilution and a down-trending share price. Revenue increases have come at the expense of higher employee payments/benefits for a year now:

To delve into the loss figure a little, it consists of employee benefits (3.6m), admin expenses (nearly 1m) and marketing (nearly 1m), with D&A at 1m. To achieve a revenue increase of 119%, supplier and employee costs increased by 118%.

This suggests they are not scaling as well as I would have hoped. This is a big problem for a) dilution and b) the short/medium term outlook for these sorts of plays, which remain unfavourable. With 10m in the bank, IHR is staring down the barrel of a capital raise, likely within the next 12 months. They absolutely screwed retail investors with the last one, so many likely wont be too happy with this. I am also concerned that, to continue growing, IHR will have to continue to inject more funds into business operations (staff and marketing) to ensure revenue increases – ie justifying the high growth play that it is. I think this has a lot of similarities with Whispir (WSP) at the moment.

And like WSP, it remains on the watchlist, where I envisage it will remain for the next year. What I will be monitoring going forward is IHR's ability to continue to achieve revenue growth without costs increasing. Even better, if they manage to achieve ongoing growth with costs actually reducing, then we might be onto something.

Disc: not held

IHR released there quarterly and overall it was fairly positive and the story is still on track for me and I will be adding more at this level in both RL and STM. I was thinking they might have been dumped during the recent selloff, they did momentarily get to 15c but have steadied around 17c and I think have held up pretty well given that they are a cash-flow negative tech growth company, they are spending 3.4M per quarter and getting 1.2M in cash in from customers.

The growth curves in ARR, customer numbers on platform and headcount and all definately going in the right direction. I am not 100% sure what their professional services constitute, but the revenue from this source is increasing in-line with the growing customer base which is an unexpected positive. Comparing the last two quarters we are getting steady growth and increased 3-fold from a low base in 2019 and the growth rate is accelerating. Customer churn is low so i am fairly confident the ARR values will translate to reliable revenue. They are pointing to momentum continuing into Q3.

December 2021 quarter

September 2021 quarter

They have increased staff costs by 500k in Q2 (1.9M vs 1.5M in Q1) and marketing costs were up 200K in Q2 (800K for H1 22). I am ok with this as they are operating gloabally and from the chart below we can see that sales force and time on the ground does precede growth in customer numbers so happy for this to keeep playing out.

Nov 2020

Interesting company that have outsourced the HR department to the cloud. Reviews of the software are positive and they are growing customer and ARR numbers quickly. A lot to like and I can see this getting north of 0.75c if the expansion in Canada/US keeps going well. The COVID working from home background gives them a nice tailwind. Bevan Slattery as a cornerstone investor helps as well (although he bought in at 7.5c which caused the first spike in price), the most recent spike in price is based on growth performance and customer numbers increasing.

Jan 2022

This one has been interesting and the growth hasn't played out as quickly as I thought it would in 2021. I find this company hard to value and have reduced to 40c but it is really just a guess until they are cash flow positive. I think IHR will be a binary outcome of either a steady growing revenue, containmnent of expsense and growing share price or it will be revenue growing but so does the bleeding of cash and continual capital raisings. I am confident the revenue will grow and I think 2022 will be a make or break year for my thesis.

What has became apparent is the importance of enterprise customers to drive revenue (see below) and the good news is that 6 of these has been added in H1 22, if this trend continues which I am expecting it will, then revenue should tick up nicely this year. I also like the recent partnership with Cintra to sell IHR software to there existing customer base in the Uk. This will be worth 1-3M for the next few years and up to 8M ARR longer term if it is successful. I think this is a great way for IHR to get market share without having to spend on cost of sales as they have enough of that already.

The company is growing revenue (2.9M FY21 vs 1.45M FY 20) but this rate needs to accelerate as there break even point is around 8M per year. They had a 7.4M loss in 2021. I am happy for them to spend on sales teams as they are chasing sales in Uk, US and Australasia but the flow on to revenue from this investment will need to happen in 2022, so far it is looking good but a long way to go still.

They raised 11.5M (@ 0.23c) in September 21 and have enough to see them through 5-6 quarters at the current rate.

I dislike the way this company reports, they chop and change what they present on each report and whether it is numbers or percentage change, which makes it hard to track the progress through time. I particularly dislike how they present ARR, but the actual revenue they receive in a quarter is always less. They also love to present time series graphs without Y axis lables of magnitudes so its really just a picture not data they are giving you. I don't think this is purposely trying to hide information, but it is a bit of a red flag to me as the appearance of lots of data is an easy way to confuse people.

I am waiting for the december 4C to be released over the next few days and if the trend in revenue growth s still intact and cash costs aren't also expanding too much then I expect I will buy more. I think 2022 could be a good year for IHR

As per @thamno's straw, last week IHR announced that things were tracking ok. There were two things of particular note in that announcement:

- the number of enterprise customers has increased to 6, from 2 the previous quarter

- ARR has doubled since last December to $5.5m

Both very encouraging.

I had another look at their product compared to competitors. Their USP seems to be employee engagement and career satisfaction. There has been a lot of commentary regarding "the great resignation" and 2022 being the "year of the worker". All this points to greater worker mobility, and an unwillingness to put up with substandard employment conditions. (links to relevant articles in the Economist)

Evidence of the balance of power passing from employers to employees seems to be everywhere these days, the rise of unionism, increasing strikes, pay rises and increases in minimum wage levels.

This all plays neatly into IHR's product offering. If you want to have the best staff, it is easier to not loose the good ones you already have, rather than to be constantly chasing new hires in a competitive market. Their software claims to be able to predict, with a degree of accuracy, how likely an employee is to leave, allowing the employer to take action to mitigate this. Apparently, they can reduce attrition rates from 60% to 5% for some clients.

The second feature I believe will be particularly useful, is their module for ensuring remote workers are feeling loved and valued. Most commentators seem to think that wfh is here to stay. Omicron will certainly ensure that is true for the short term, but much of my reading would indicate that a degree of wfh is likely to outlast the pandemic. Ensuring these workers feel engaged, have the correct support and equipment they need and can be productive with their team and goals will be a challenge. IHR provides a module to do just that.

It also does many of the other less fancy things that HR software should also do such as ensure compliance with mandatory training is up to date, appraisals, feedback and all the hiring/CV stuff.

It scores 4.9/5 stars on cap terra, 5/5 on softwareadvice.com.au

A tough business to value. They are yet to hit free cash flow or demonstrate an ability to scale effectively. While ARR is slowly ticking upwards, so are associated business costs.

Q1 FY22 below:

How does this differ from Q3 and Q4 FY21? Both quarters recorded operating losses of 1.5m. Perhaps concerningly sales have increased at a steady enough rate, but at the expense of staff and admin costs continue to increase in turn. They are advertising and spending lots on staff costs to drive top line growth. On their current trajectory, they will continue to increase ARR but high advertising and staff and admin costs will mean cashflow breakeven won't be achieved. Have a look at Nuheara (NUH) and see how this impacts the share price over time. Its not pretty.

Yes, IHR could be a sizeable company one day, but as it currently stands, the business is not scaling as well as I would have liked. I don’t mind seeing high levels of R&D, but IHR are currently bleeding cash with no sign of hitting free cash flow any time soon. The risks here? As the market continues to become a little less friendly to ‘growth’ stocks, its stocks like IHR which are likely to have a really difficult time. Particularly if they struggle to achieve cash flow breakeven and have to keep hitting the market up for money. They recently conducted a capital raising – its fair enough to say this was a poor one, with a steep discount offered. This angered a lot of investors and rightly so. They currently have 11m in the bank. Another few quarters at current levels and further dilution will probably be necessary.

I calculate a CV of 68m based on a four-year FCF forecast. For the purposes of my valuation, I put FY22 FCF number as 0, with an improvement to 1m in FY23. This might be generous – in fact it almost certainly is – I don’t see the business hitting positive cash flow in the next 12 months. Divide this by shares outstanding and I get a valuation of .20c. Again, I think this is generous.

I really like what IHR are trying to achieve; customer retention is good, and they are driving top line growth. That said, the scaling issues and the high rates of cash burn concern me. I have added a tiny position in Strawman to reflect my interest in the company, but I want to see more runs on the board before I enter IRL or with any meaningful position on Strawman. I will be keeping a close eye on the next two quarters. I see too many orange flags to invest as it currently stands.

There are many reasons for me to like IntelliHR:

- I understand its business model as a SaaS provider of ‘human capital management’ software

- It is a founder led company

- It is targeting a global market, with revenue already coming from several countries

- Bevan Slattery is a significant shareholder, and he rarely puts a foot wrong

There is however one overriding reason for me not to like the company, which is the fact that it operates in a very competitive market and I am not convinced that IHR’s software has any uniquely compelling features. IHR doesn’t figure at all in Gartner and Forrestor analyst reports for ‘enterprise HCM’, but perhaps that is understandable given that IHR is primarily addressing the SME market, where 80% of their customers were managing the HR function using spreadsheets and manual processes before they became IHR customers.

Given my concern about competition, I thought I would start my research by trying to establish a possible valuation for IHR shares in 2025, based on a projection of the market share it may be able to claim. If this results in a pitiful value (which is my thesis at the start) then I won’t need to spend further effort researching the company.

Taking a conservative and very rough average of market forecasts, the TAM for HCM software in 2025 is assumed to be $20b USD.

This is the breakdown of the US Market:

- 40% of market is Enterprise (2500+ employees)

- 48% of market is Small Business (1-499)

- 12% of market is Midmarket (500-2499)

If I assume IHR is targeting the Small Business and Midmarket segments, and assuming this is 60% of the TAM, this gives IHR an addressable market of $12b USD. Then, given this is a very competitive market, if I assume IHR can win 5% of the market, this would give them revenues of $600m USD.

Next, looking at the price/sales ratios for the major SaaS companies, these range from 6.8 (Facebook) to 31.7 (Atlassian). Workday sits in the middle with a P/S of 10.3.

So I’ll assume a P/S ratio for IHR of 10 in 2025, and revenue of $800m AUD. That gives a market cap of $8b AUD. Current market cap is $75m AUD. So even with some very dilutive capital raisings, it looks like there is a reasonable growth opportunity here after all.

IHR reported the following progress over Q1:

- $776 k in ARR contracts + $225K implementation revenue over quarter, bringing CARR to $4.66 M.

- subscription revenue up 127% YoY.

- Lead growth up 168% YoY, and 29% on previous quarter.

- Subscriber accounts incrreased to 237, an increase of 29 over the prior quarter.

- 100% subscriber retention in Q1.

DISC - I HOLD

A few comments on the recent unfair capital raising via Morgans and Petra.

- steep discount at 20%, raising more than is needed

- raise is $10m, sell down by CEO is $1.5m

- raise went to Morgans and Petra. For those unaware, these are not the people you generally see conduct tight raises. A tight raise might make sense at a discount, for example to an institution or strategic investor. A raise through broker networks is more likely to be pitched to clients as "stock is at 29c, you buy at 23c, make a quick profit"

- if that's the case, look for some pumpy announcement on Monday next week

- shares issued on Friday 27th, so may see some selling that day or on Monday.

- bit of a downer considering previous capital raising had been made available to retail investors.

- doesn't really change the thesis, though it's not good to see.

One article about the capital raising here... doesn't seem like too many still go into bat for retail shareholders though.

Hyper growth story IntelliHR in a trading halt, pending a capital raise.

With less than $4M in the bank, a top up was inevitable. Really interesting little company though.

Game-Changing Reseller Channel Partnership for UK Enterprise Market

HIGHLIGHTS

- Execution of a significant Reseller Agreement with leading UK-based payroll software provider Payroll Software and Services Group (PSSG) and its subsidiary Cintra to sell the intelliHR SaaS offering to Cintra’s enterprise customer base of over 200 customers, representing over 200,000 potential subscribers. In addition, the PSSG portfolio exceeds 1,250 customers, servicing a payroll of 1.6 million people.

- The agreement accelerates intelliHR’s international expansion and represents its first major large-scale channel partnership deal in its emerging reseller sales channel. The arrangements are expected to dramatically increase intelliHR’s UK market penetration.

- Annual Recurring Revenue (ARR) potential of up to circa $8.0m from the agreement, subject to successful roll out which is expected to gain significant momentum in H2 FY2022\

intelliHR Limited (ASX: IHR) is pleased to announce it has executed a major channel partner agreement with UK-based payroll software provider PSSG and Cintra, to sell intelliHR to Cintra’s enterprise customers. Cintra will package intelliHR as its HR and People Management offering "Powered by intelliHR" targeting their existing customer base and also the broader UK mid-to-enterprise customer marketplace. The partnership significantly extends intelliHR’s potential as a high growth best-of-breed SaaS platform, realising the potential to scale quickly through large channel partnerships. The arrangements complement intelliHR’s fast growing direct global sales channel and its growing HR technology ecosystem marketplace.

...Cintra and intelliHR are also partnering with leading UK Recruitment Software provider Pinpoint as part of a full HR Ecosystem offering.

This is why the trading halt the Matthew advised us of yesterday

DISC: I hold

Edit~Heading

Lockdown does allow some things to get done that would otherwise would not!

Signals that can point to greatness for SaaS companies include:

- T2D3 = from start up tripling ARR every year, then doubling for the next 3. This brings a start up from an ARR of 1-2 million to over 100 million and a MC of 1 billion. IHR has accomplished one T with an increase in ARR of 263%. Tick

- low churn = 0.5%. Tick. Actually less important in early stage SaaS but hey, nice to get another tick.

- high gross margins. Would hope for something in the 70s (like Damstra). Did not answer my request for information on this metric. Assumption is therefore this is a fail. Margins tend to improve with time, so am guessing they will start reporting this only when it looks good. No tick.

- months to recover CAC < 12 months - from personal communication this is less than 12 months for APAC but longer in N America (where they are a newer entity and offering preferential deals). Tick

- a net retention rate > 100% ie each customer uses the product in an increasing fashion over time. From personal communication IHR reports 106%, which they believe was impacted by COVID, and estimate they will return to 112% which was their pre-pandemic normal. Tick.

- LTV:CAC >3 lifetime value of a customer / the cost of acquiring them. I am unable to get the data for this as CAC is not reported. I may be able to derive this from annual report, however, if NRR as >100% (see above). Probable tick.

- the Bessemer Efficiency Score, is a measure of both growth and efficiency use of funds: is the company blowing cash in the pursuit of growth or doing so wisely. It can be calculated by growth rate + FCF margin. I will have a crack at this after the annual report.

- Rule of 40. Defined as the growth rate +/- cash burn or revenue. This probably applies to more established, later stage SaaS companies. A modification for earlier stage companies is the weighted version (revenue growth rate x 1.33 + EBITDA margin x 0.67). Again will update this straw with most current figures after annual report.

Has been sold down this year but is continuing with increased growth. Think as we come out of covid restictions things should continue to improve for this company.

Expansions internationaly provide opportunity if they can continue to exercute well.

Another great 4c. Still some metrics

not being reported in a reliable manner and expenses increasing.

muted SP response likely reflects inevitability of upcoming cap raise and hence dilution. Will no doubt drop lower around this time.

will be looking to add a further small amount when opportunity presents itself.

with such tiny companies DCF is challenging and even a rough EV/S is difficult as a couple of large enterprise customer contract wins blows the "S" up out of all proportion.

25-50% quarterly increases in ARR can be expected in the short term, making the valuation leap spectacularly. The big question is if they can sustain these wins as a percentage of total sales rather than an absolute number ( which will become less and less meaningful as the MC grows)

hopefully they can but super high risk.

30/4/21

Appointment of Cloud Technology Growth Leader to intelliHR Board

After their announcement reporting stellar 1/2 yearly growth as reported by Chagsy yesterday, they have today reported a stellar new member to the board...

intelliHR Limited (ASX: IHR) is pleased to announce the appointment of Belle Lajoie as a Non-Executive Director. Belle brings a wealth of experience in fast-growing cloud-based technology businesses and her appointment provides the Board and management with access to her many learnings from these experiences just as it commences a period of rapid international growth.

Belle has played integral roles in driving the operations and commercial success of a number of Australia’s most successful technology start-ups including NEXTDC (ASX:NXT) and Megaport (ASX:MP1). During her six years with Megaport as Global Chief Commercial Officer, she was a key part of the team that grew the company from start-up to global enterprise with a market cap of over $2Billion.

In 2019, Belle was appointed as Chief Executive Officer at Bevan Slattery-founded data centre and cloud services directory provider, Cloudscene. Belle has led the start-up into its next growth phase and is overseeing the ongoing development of the product roadmap and software development implementation, high-level growth plans for marketing, sales and data teams, the management of HR, and operations, training, and GDPR compliance. She also sits on both the internal and external Cloudscene advisory boards.

intelliHR Chairman, Mr Tony Bellas, welcomed the appointment, stating that Belle is an exciting addition to the intelliHR board at a crucial time in intelliHR’s growth trajectory.

“Her experience scaling teams both in Australia and internationally will be an asset to intelliHR's plans for rapid and global expansion”, Mr Bellas said.

Belle will replace Alan Bignell who is retiring from the intelliHR Board. In thanking Alan for his service, Chairman Mr Tony Bellas paid tribute saying that Alan’s Global SaaS experience had proven to be invaluable to the board as it has navigated the challenges of globalizing and scaling intelliHR.

“Alan has provided counsel to the business over a number of years, and I am very pleased that he will continue to offer this post his retirement”, Mr Bellas said.

Authorised by the Board of intelliHR.

Disc: I hold

International expansion underpins record 1st Half Growth

intelliHR Limited (ASX: IHR) announces record performance for 1H21 with significant improvement across all major metrics, including revenue, cash flows, customer numbers, and customer retention.

- Contracted annual recurring revenue grew by a record $919,000 to $2,874,000, an increase of 82% on 1H20 and 47% on 2H20.

- Contracted subscribers increased by a record 14,639 to a total of 29,170 as at 31 December 2020, an increase of 147% on 1H20 and 101% on 2H20.

- Invoiced revenue growth of 81% over 1H20 and 38% over 2H20, with annualised invoiced revenue as at 31 December of $2,595,855.

- Three successful enterprise contract wins delivered a 288% increase in 1H21 new subscribers per account, with a 58% YOY increase in ARR per account.

- Total new contracted customers in 1H21 increased 60% YOY to 43 new customers added.

- Net Cash used in 1H Operations reduced by 20% YOY, supporting a strong forward cash position of $6.859m as at 31 December 2020.

https://www.asx.com.au/asxpdf/20210219/pdf/44sv01yk5pmjwd.pdf?utm_source=marketo&utm_medium=email&utm_campaign=2021.02.February.Shareholder-Update-01&mkt_tok=eyJpIjoiTWpneVlXVTFOVE0xTURNeSIsInQiOiJ1Sm5udXlQZWxlMFwvdHZ5TDArNGsrWDBsTU5lemJnUjd2RjQ4aEJMXC92VHdzWUFGeVZuS2ZxRmR1YzlTcVwvSFwvNUo1bFNlb3BpWTZsMjhYdVlLNjhNQXFZb2hUa1JMT3ZQclRJZmtPVDNSNnNNY0hpS01vcVJ6Vzc0XC9YNVdNN2EyIn0%3D

DISC: I hold

International Expansion Strategy Underpins Record First-Half Growth

- Contracted annual recurring revenue grew by a record $919,000 to $2,874,000, an increase of 82% on 1H20 and 47% on 2H20.

- Contracted subscribers increased by a record 14,639 to a total of 29,170 as at 31 December 2020, an increase of 147% on 1H20 and 101% on 2H20.

- Invoiced revenue growth of 81% over 1H20 and 38% over 2H20, with annualised invoiced revenue as at 31 December of $2,595,855.

- Three successful enterprise contract wins delivered a 288% increase in 1H21 new subscribers per account, with a 58% YOY increase in ARR per account.

- Total new contracted customers in 1H21 increased 60% YOY to 43 new customers added.

- Net Cash used in 1H Operations reduced by 20% YOY, supporting a strong forward cash position of $6.859m as at 31 December 2020

4D & and Half Year Report

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02343547-2A1281541?access_token=83ff96335c2d45a094df02a206a39ff4

Disc : I Hold

APPOINTMENT OF ILONA CHARLES AS A NON-EXECUTIVE DIRECTOR

INTELLIHR LIMITED (ASX Code: IHR) is pleased to announce that Ilona Charles has joined the Board of intelliHR Limited as a non-executive Director effective today.

Ilona Charles is an experienced executive with an extensive career in human resources, transformation and change across multiple industries. She has been the Chief People officer for Aconex, CSIRO and Medibank and has held senior executive director roles with Telstra and NAB. Ilona is a Non-Executive Director with Goulburn Valley Health and LaunchVic and holds an advisory role to the People Committee and Board of the Burnet Institute. Ilona brings a wealth of experience and a unique combination of skills in HR, SaaS, start-ups and corporates and is passionate about supporting and enabling fast growth companies. She is the co-founder of shilo., a national HR consultancy providing world class on-demand HR talent. Ilona is also the founder of pivotnow, a strategic advisory business with a focus on people.

This announcement has been authorised for release to the ASX by the Chairman, Tony Bellas.

I haven't heard of Ilona before, but its a pretty impressive CV

DISC: I hold

International expansion strategy delivers record new business growth in Q2

Up ~ $522k Record 23% ARR Growth in Q2 FY21

Up 77% ~ Proportion of New Q2 FY21 Subscribers attributed to Nth America

Up 147% ~ YoY Contracted Subscriber Headcount Growth 47% in Q2 FY21

Up 40% ~ YoY Net Cash Outflows Reduced by 40%

intelliHR Limited (ASX: IHR) is pleased to report record New Annual Recurring Revenue growth of $522k in the quarter - a 23% increase in Annual Recurring Revenue and a 24% increase in Invoiced Revenue quarter on quarter (QoQ). Q2 FY21 subscriber growth was 47% QoQ and 147% higher YoY – this accelerating growth was driven by our recent North American and UK market expansion where 7 customer Q2 contracts were converted including a major American cornerstone customer. APAC growth remained steady including the addition of a new NZ enterprise customer. In total the number of new contracts in Q2 was 26% higher than the previous quarter which was itself a record. Contracted subscribers grew during Q2 by 47% and have more than doubled in the first half of FY21. Global Subscribers now account for 41% of total subscribers which validates the potential of our global growth ambitions. The business has continued to see strong customer and revenue retention with less than 0.5% of revenue lost in the last 12 months not withstanding the impact of Covid. Customer receipts remain strong with no bad debts. IntelliHR supports businesses across 18 countries and continues to maintain a customer NPS of 70.

DISC: I hold