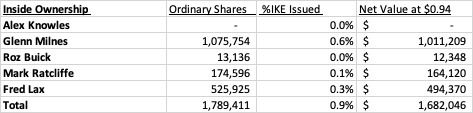

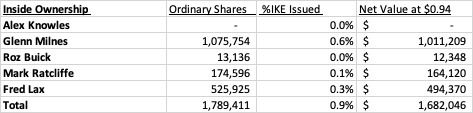

Market Cap Today $182.4m (NZ$211.45m) at share price $0.94

Board Bios

Alex Knowles - Chair and Director

Alex has investing and operating experience with international companies in the information technology and transportation industries. Based in Los Angeles, he was formerly Chief Operating Officer of the largest international freight forwarder and small parcel consolidator in the U.S.

Glenn Milnes - CEO & Managing Director

Glenn Milnes is the CEO and Managing Director at ikeGPS, where he is accountable for the company's overall strategy, performance, and growth. Prior to leading ikeGPS, Glenn previously held senior executive, strategy and corporate development positions in the Communications industry with Cable & Wireless International, and No 8 Ventures.

Roz Buick - Independent Director

Roz brings more than 25 years’ experience from executive leadership positions across global utility, engineering, construction, real estate and agriculture markets with companies including Oracle Inc. and Trimble Inc. Roz is an industry leader who has led businesses through new growth strategies that are market differentiating and innovative, both with product and go to market strategies.

Mark Ratcliffe - Independent Director

Mark was the founding CEO of Chorus New Zealand from 2007 to 2017 where he led the deployment of New Zealand’s national fiber network. Prior to Chorus Mark was CIO and COO of Spark (formerly Telecom NZ). Prior governance roles include Director of 2 Degrees from 2017 to 2020. The majority of his current portfolio is in the Infrastructure Sector and he is currently the Chair of First Gas, Tuatahi Fast Fibre, and a number of other private and public sector boards.

Fred Lax - Independent Director

Fred Lax is an executive leader with extensive global experience in the telecommunications industry and related technologies. Based in California, he is a former director of NASDAQ listed Ikanos Communications Inc. (acquired by Qualcomm Atheros), and former Chief Executive Officer and President of NASDAQ listed Tekelec, Inc.