I've looked at IKE a few times over the years, but I've never gained conviction in it. Spoiler, and after Q1 that hasn't changed.

I last looked at IKE when they have capital raise at 81c in July 2025. It never quite got me across the line then, so thought I'd check in on where they are at after Q1 FY26 results were released (with HY due in November). What put me off IKE in the past was the lumpiness in their revenue and how low quality it was. I dislike how they also refer to the prior corresponding period but are using SaaS metrics.

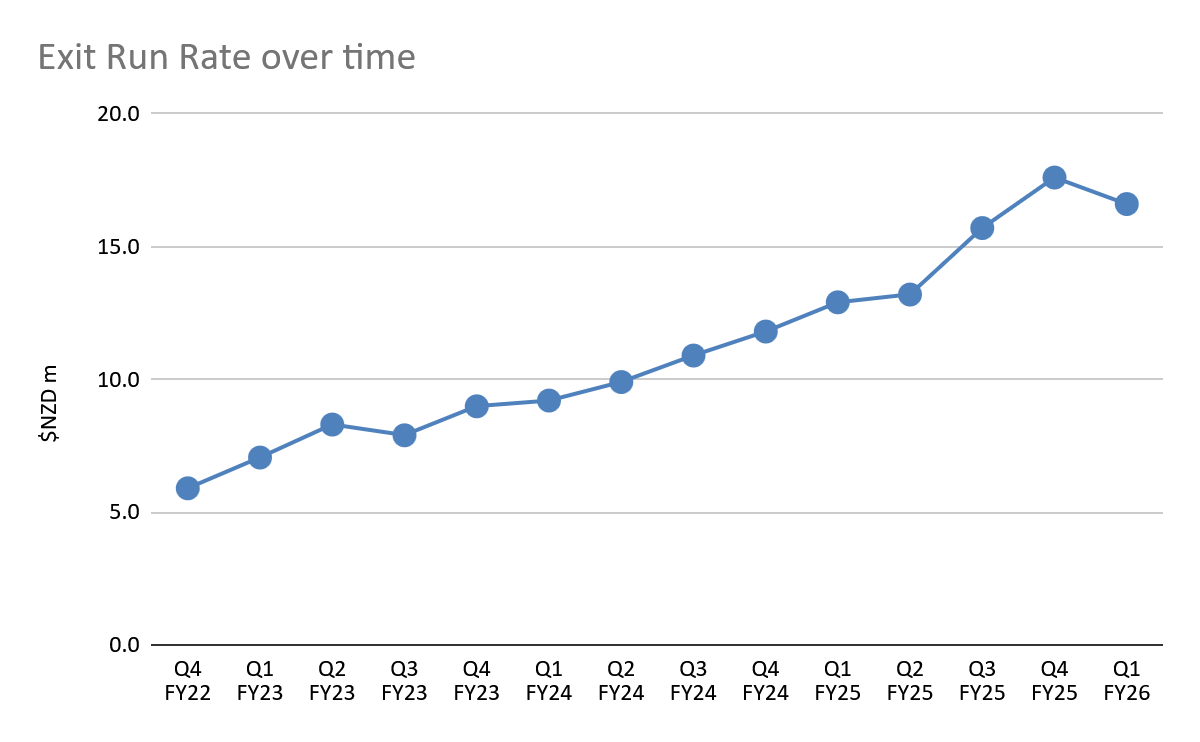

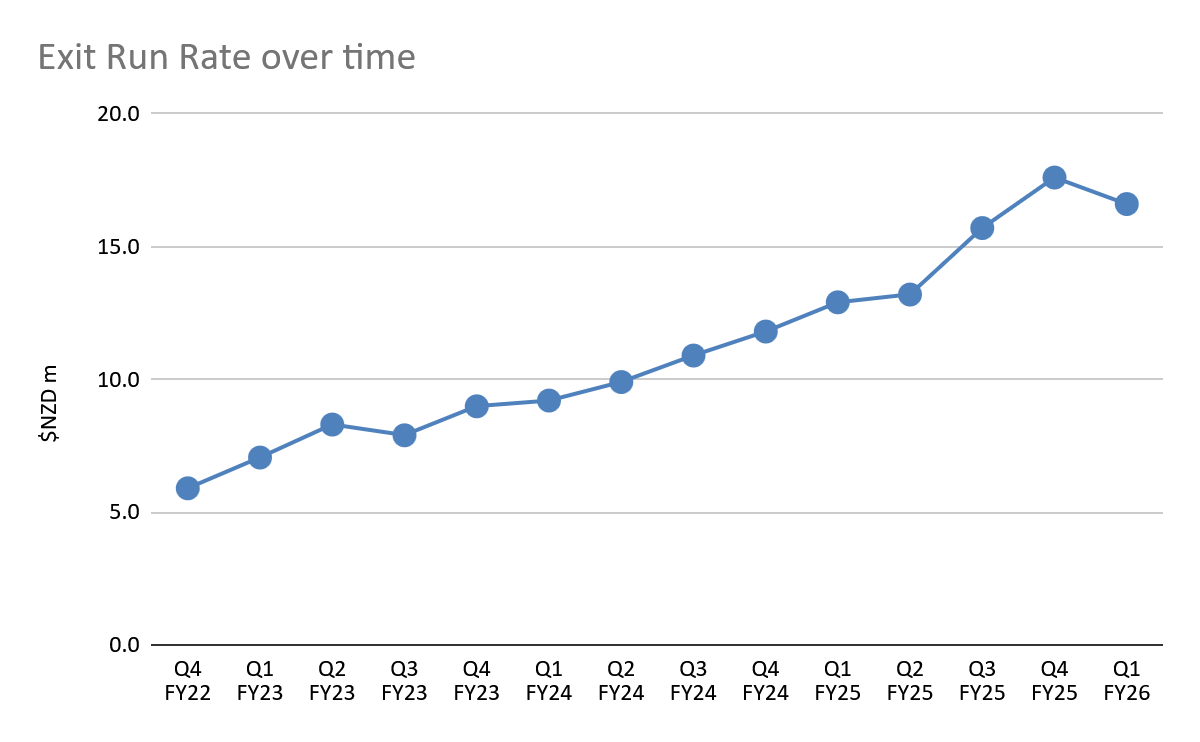

The first place to start is Exit Run Rate. It went down in Q1 FY26. Note they don't release a transparent chart like the below, it's always pcp numbers. After congratulating themselves on the growth on pcp (ancient history) they eventually comment on the decline putting it down to foreign exchange (1.3m) and the change of 2 customers unsubscribing and moving to transaction revenue.

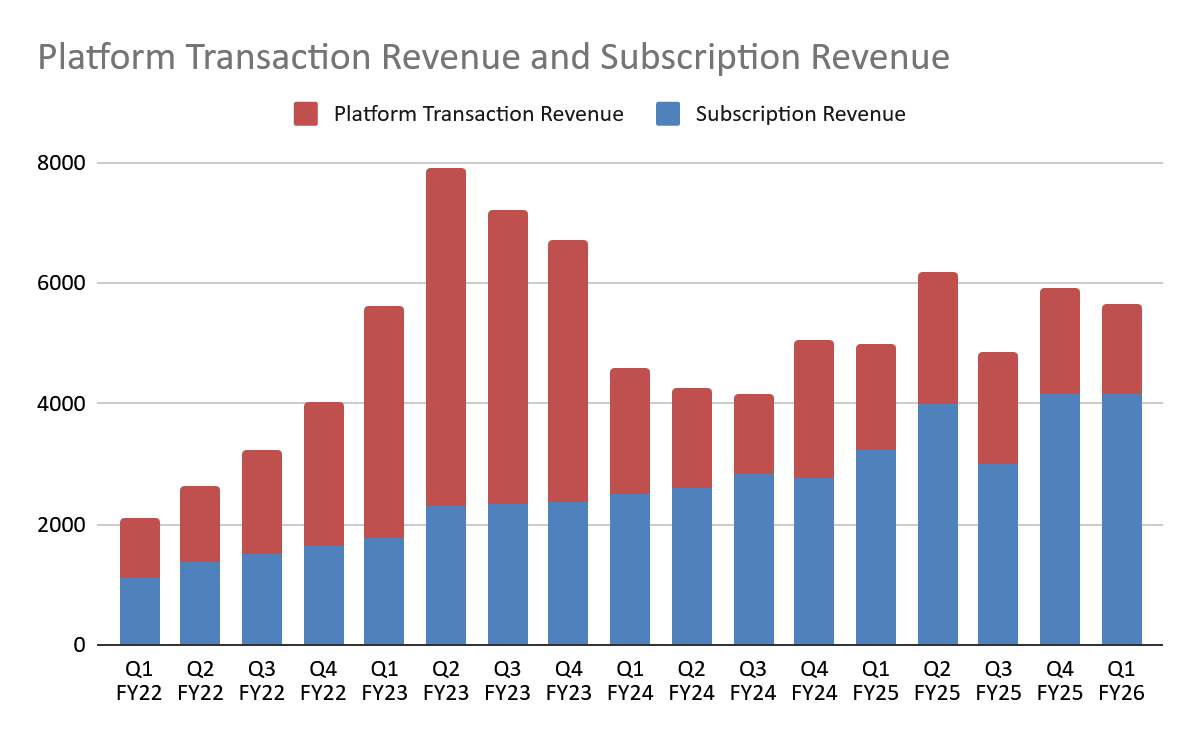

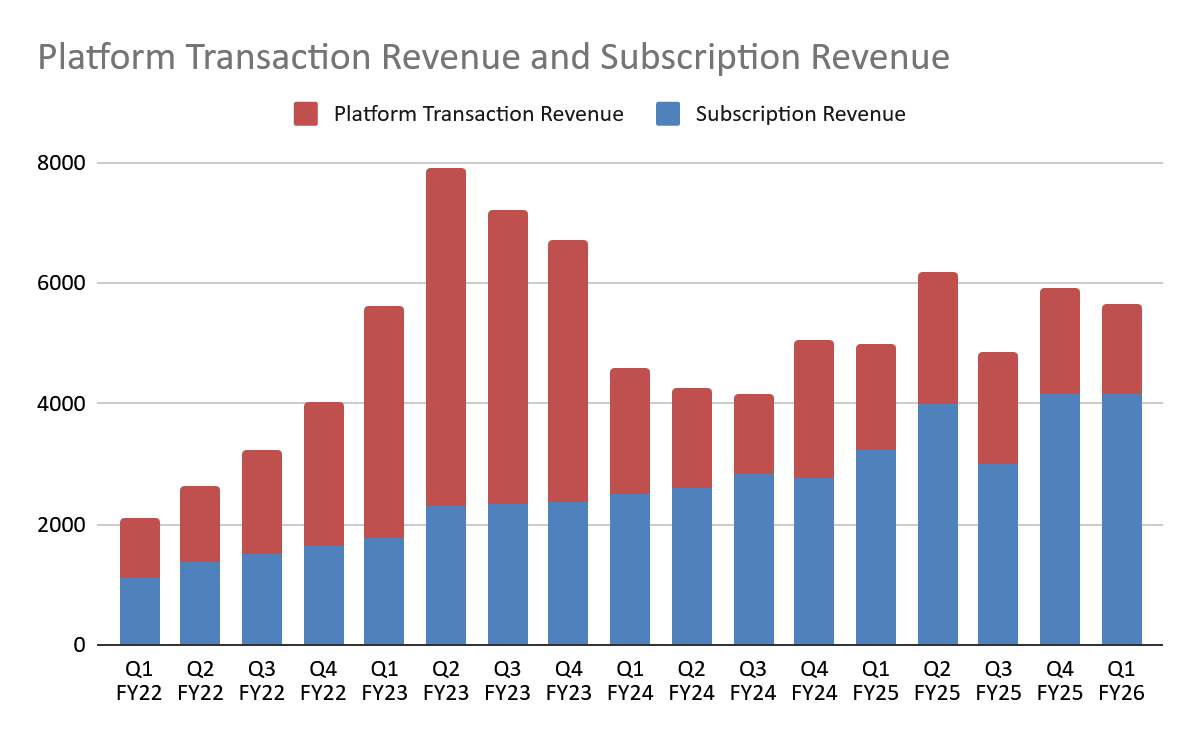

Looking at revenue break-down (ignoring hardware sales) we see the past lumpiness in FY23 (project based) but overall there's a steady growth in subscription revenue. I assume the strategy was to grow subscription revenue, since transaction revenue has been flat over the past 2 years. This makes the switch away from subscription revenue in the most recent quarter from long-term customers concerning.

Guidance for 35% subscription revenue growth was reaffirmed. Historically, next quarter, Q2, looks like a strong quarter and Q3 looks weak, so I expect Q2 and Q4 to do most of the heavy lifting if guidance is to be achieved. If they achieve it, they would be trading around 8x subscription revenue. They are still making large losses but hovering around free cash flow positivity. When I compare with other SaaS like business, it's not that compelling at the moment.

There's a real business here, it's impressive the growth they have achieved in the US against many better funded competitors. In summary, compared to other opportunities I don't find it compelling, but I will keep watching.