Good results from $JIN today and steady progress on acquistions: past, presents and to come.

Their FY22 performance highlights

Strong double-digit growth reported across key performance metrics:

− TTV up 36% to $659.9 million

− Revenue up 25% to $104.3 million

− Underlying EBITDA1 up 13% to $55.1 million

− Underlying NPAT1 up 14% to $32.2 million

− Underlying EPS1 up 13% to 51.5 cents per share.

The Board has declared a fully franked final dividend of 20.5 cents per share, taking the total FY22 dividend to 42.5 cents per share, up 16% on FY21. In addition, the Board has approved an onmarket share buy-back of up to $25 million.

A few of my notes from the call:

Share buy-back: there was some discussion on the call about why a $20m buyback, when they are continuing to screen bolt-on acquisition opportunities as part of the strategy of accelerating the leverage of their lotteries SaaS platform internationally. But I think it makes perfect sense. 2022 was a standout year driven by higher than normal large lottery prizes. From a capital management perspectives, buy-backs are a good way of managing windfalls, as they allow the dividend progression to reflect the overall prgress of the business. It also signals capital discipline: $JIN are not hoarding all the cash to splurge on future acquisition. So a solid "A" on the report card from me on capital management.

Operating Expense/Margin: Some pressure here, due to the higher fees in the Lottery Corporation Service Fee, which is well-understood by the market and which will max-out in FY24. But there were also other increases in staff expense, staff turnover, expanded management team and marketing expense. This undermined the operating leverage I'd expect to see, Not a major concern at this stage, but something to watch. CEO Mike Veverka made it clear that this is a priority for the management team as well. On marketing expense, customer acquisition metrics still look very favourable, so there is headroom here and it makes sense for them to be spending more.

Outlook

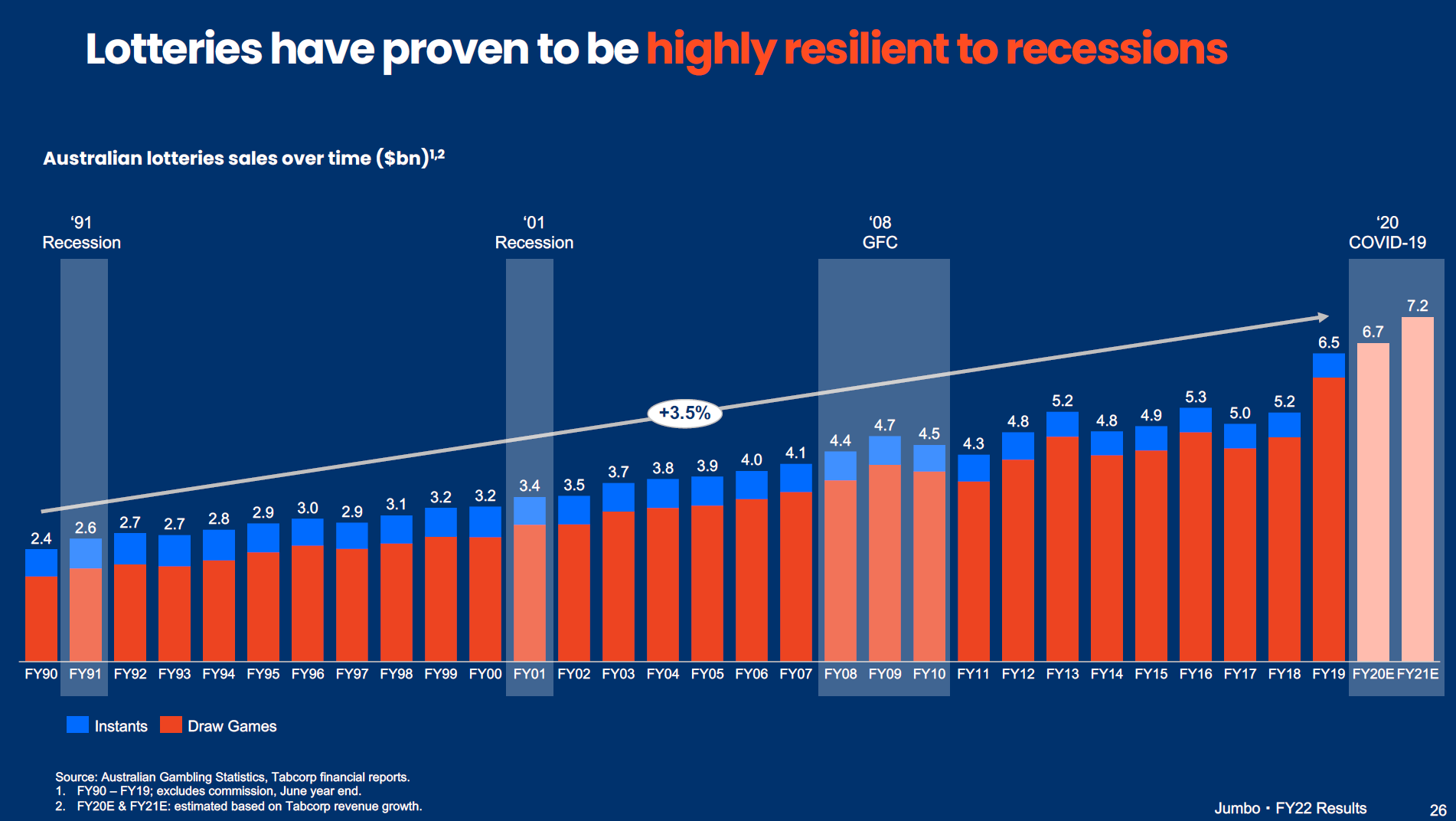

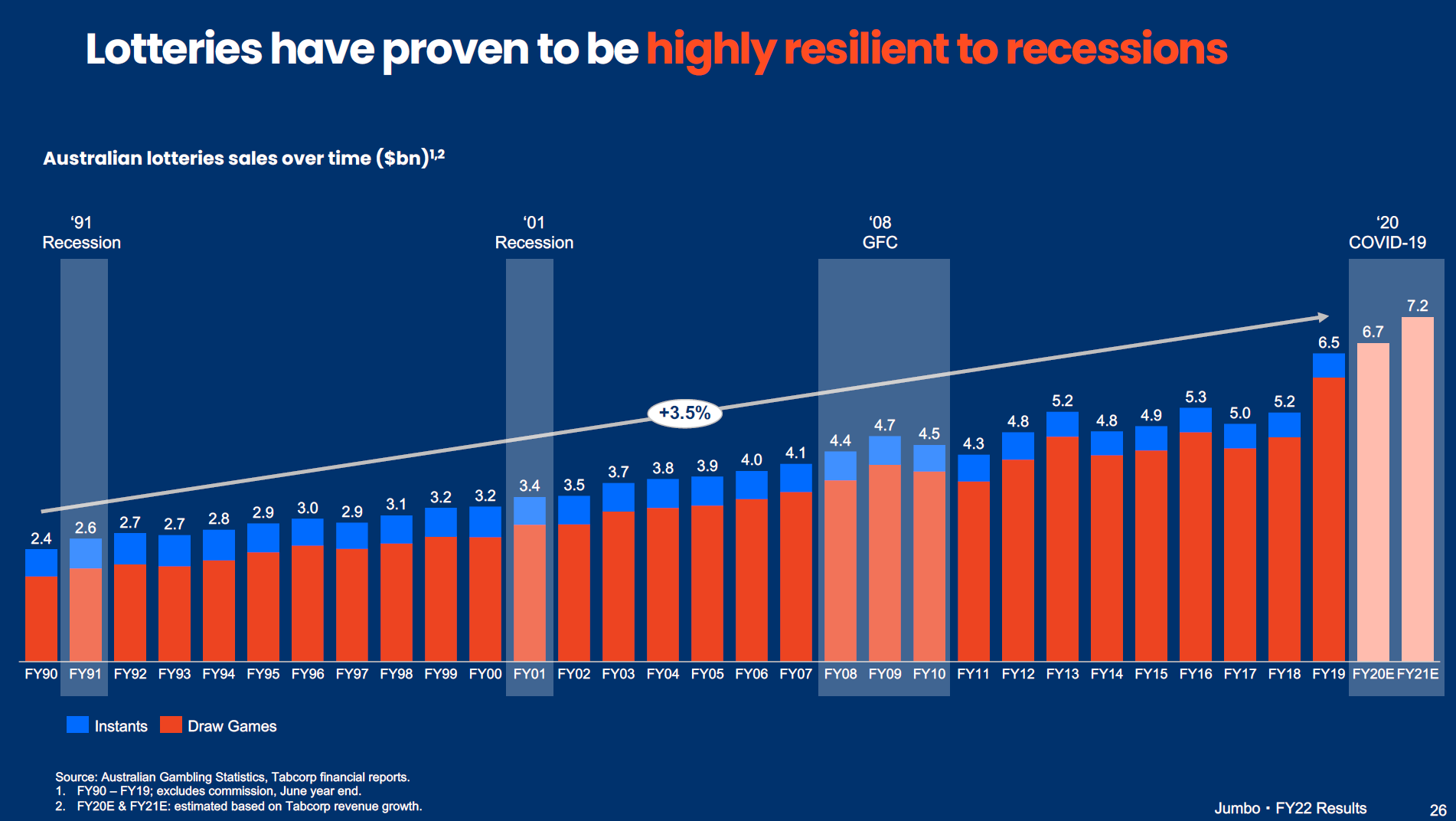

Finally, one interesting chart to address questions investors might have about potential impact of a recession. Key message: don't worry! However, given greater discretionary capacity during COVID period (for all the reasons covered before), might there be a negative post-COVID effect? This was not discussed on the call.

We are barely two months into FY23, however, it was noted that there have been fewer >$20m jackpots so far - indicating FY23 might not be a bumper year. This might lead to SP weakness as the year unfolds, with H1FY22-H1FY23 comparison providing even better buying opportunities. If so, I will consider increasing my position at that time. Happy to hold for now.

Disc: Held on SM and IRL (3%)