Jumbo results solid with a few call outs to monitor moving forward

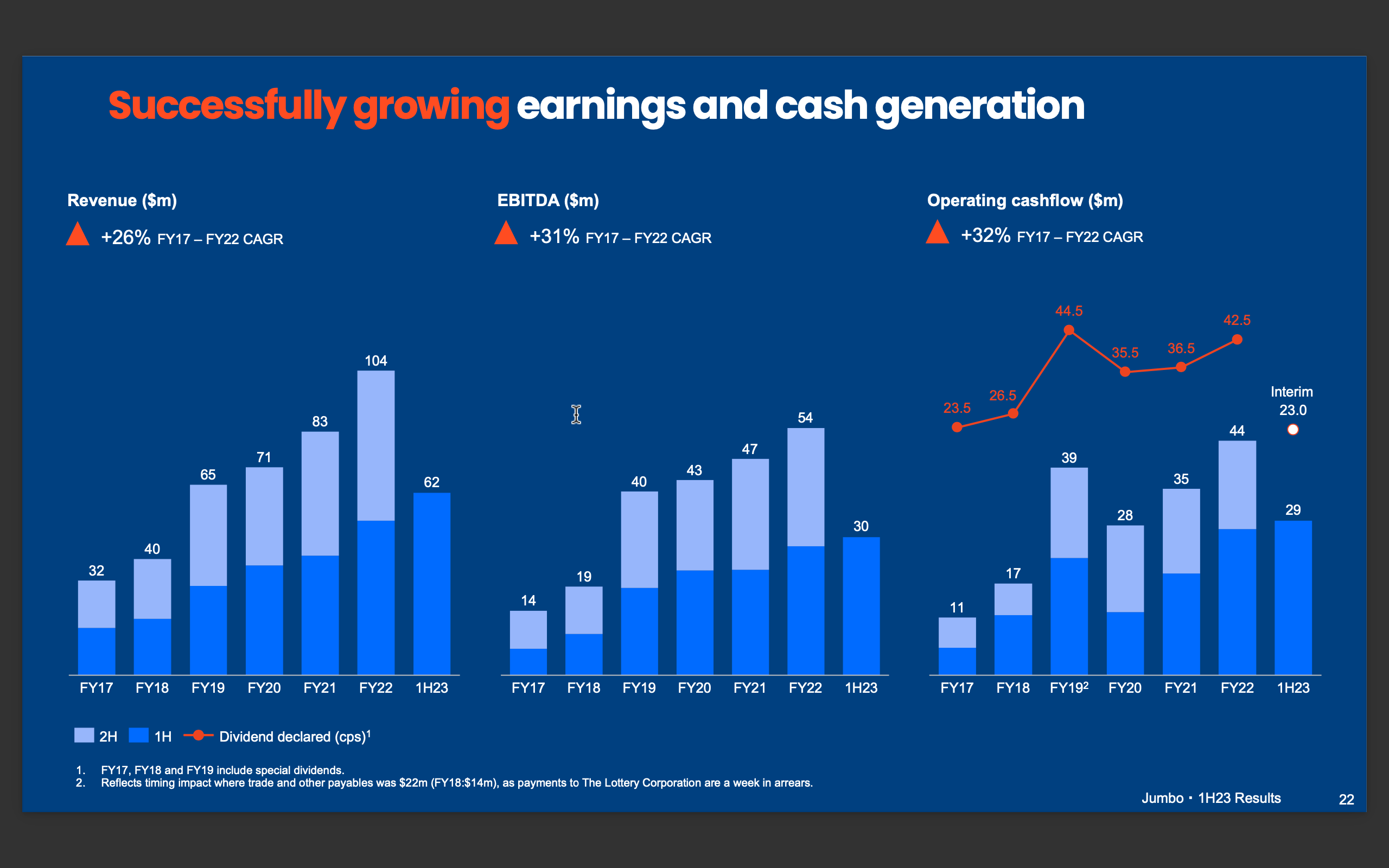

- Revenue growth overall of 18.1% to 62,389 million.

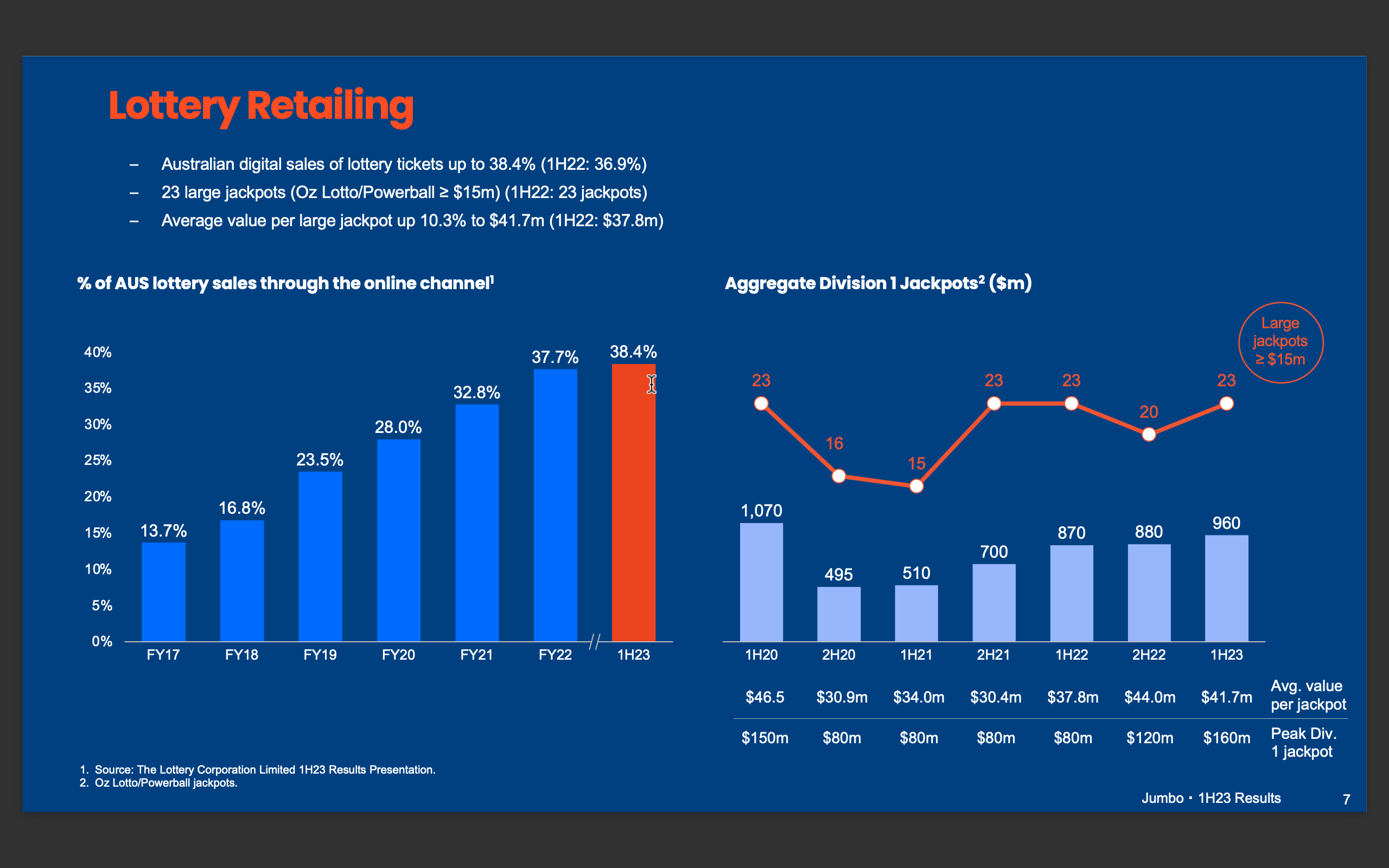

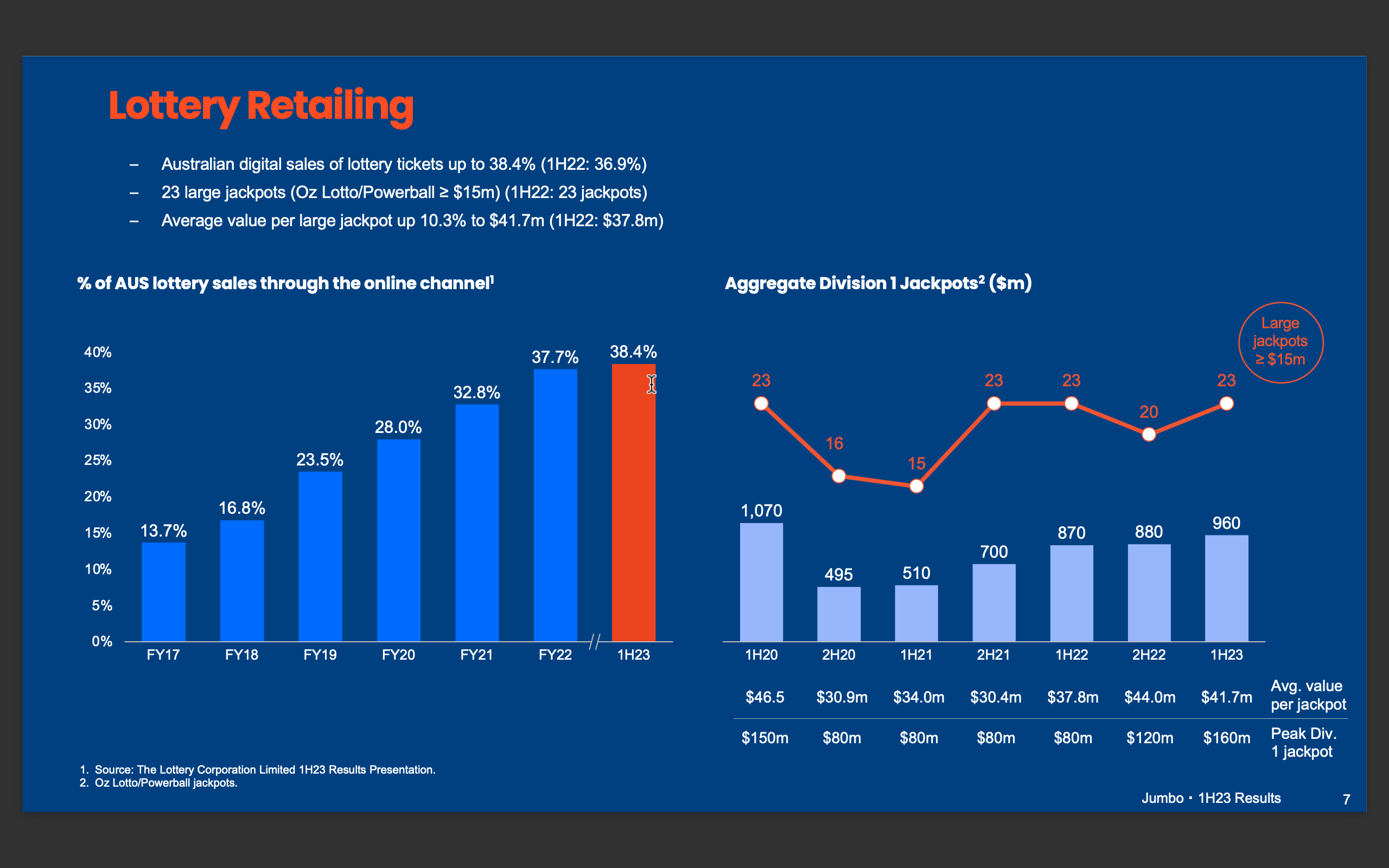

- Jackpots in Q2 helped drive this growth with number of jackpots for the half being 23 but the value of each of them up 10.3%, driven predominantly by 160m powerball. These jackpots are key to driving the growth in the lottery TTV and revenue.

- Number of active players up to 4million in the half, up from 333k in 2015 . Online ticket purchases are now at 38.4% of total tickets.

- Oz Lotto price increase of 15c or 10% on a ticket made no impact to sales . RPPU has risen 17%

- Comments on this acceptance by Mike and David on the call were all around reasonable increases in this inflationary environment with consumers understanding and willing to pay.

- Mike (CEO) and David (CFO) outlined Jumbo are looking to do this with powerball in second half 2023

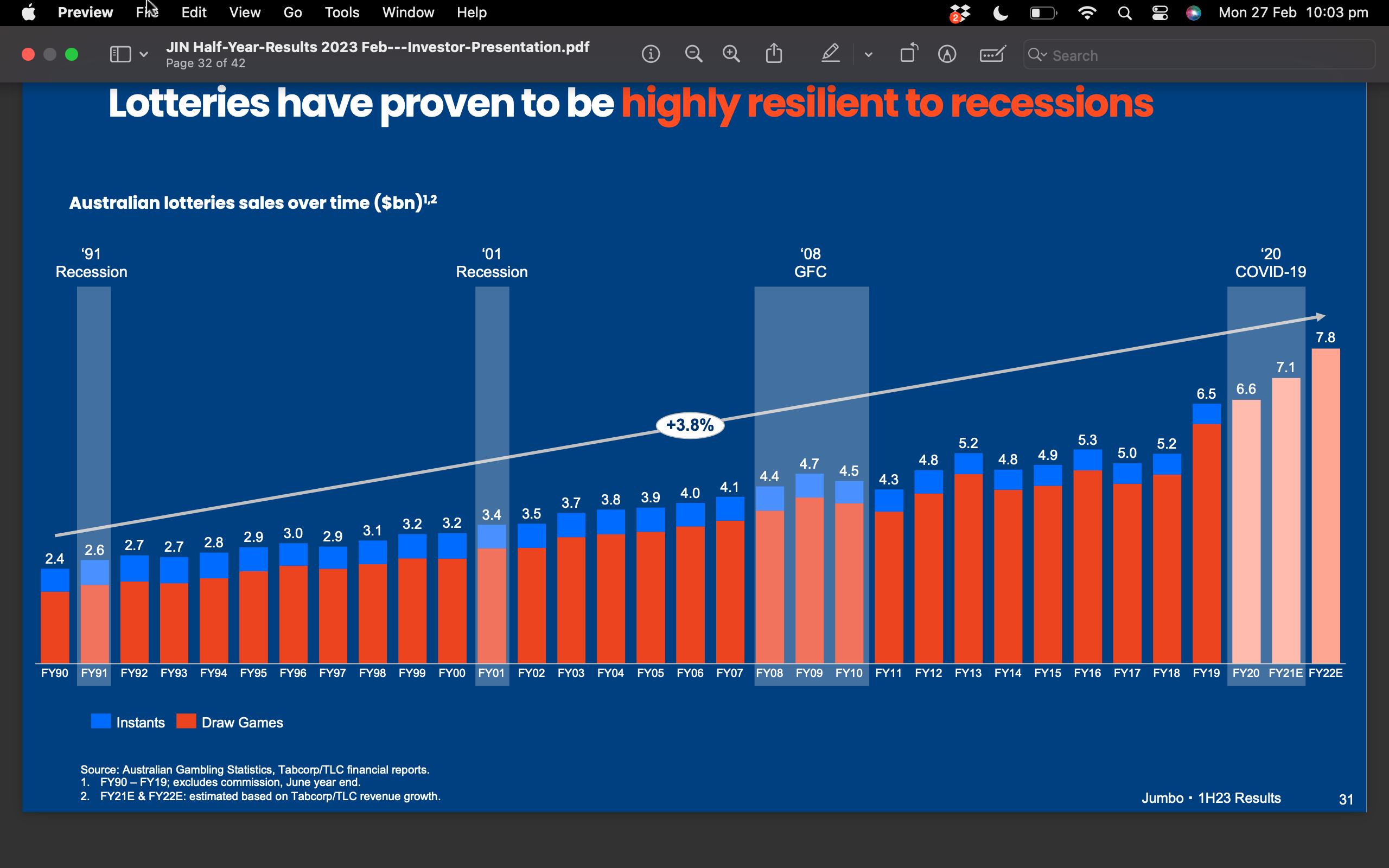

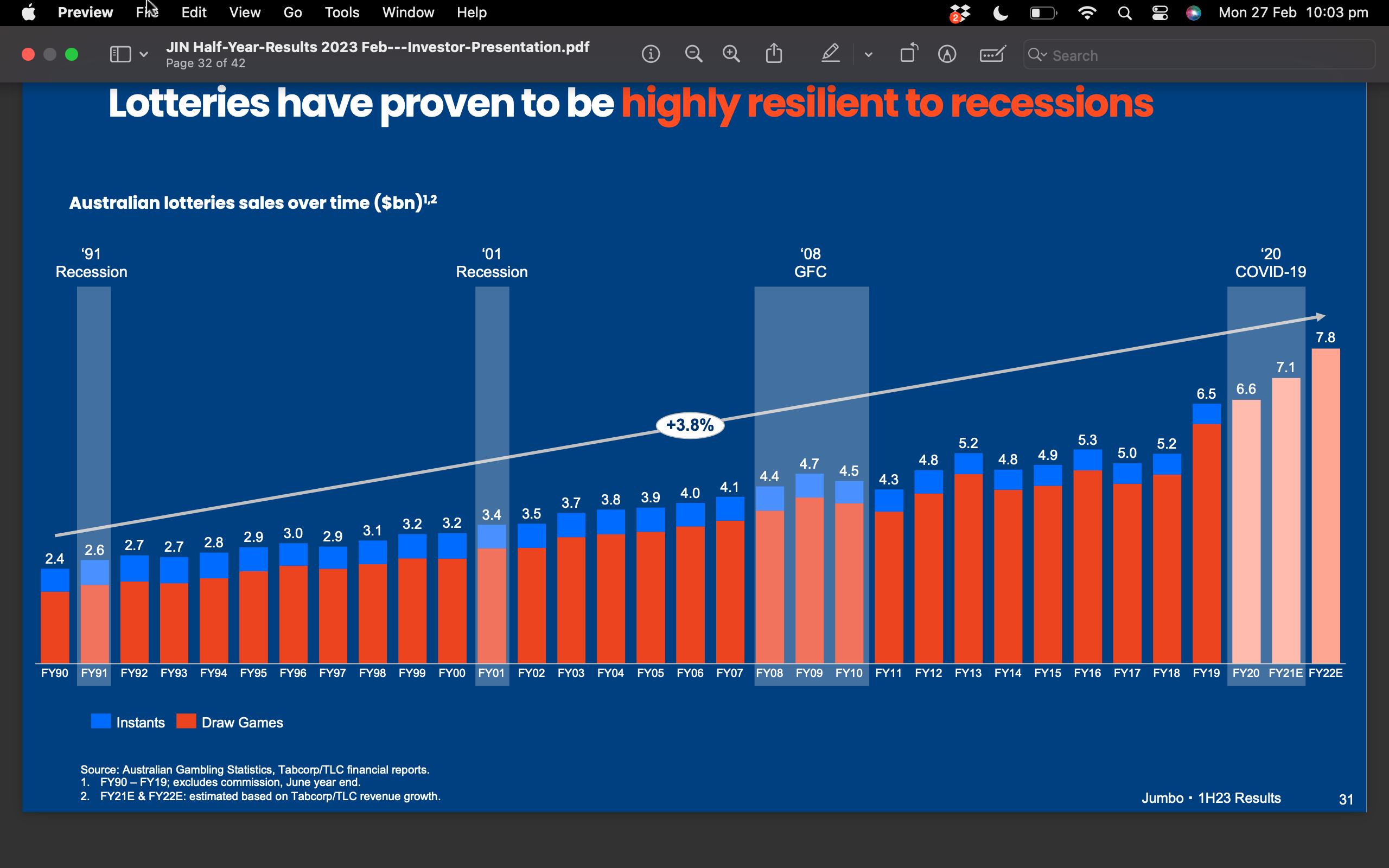

Not sure if one can call this defensive but management were quick to highlight the resilient nature of the lottery business (see graph below).

NPATA, CF and dividends all saw increases in the half by 8%, 6% and 5% respectively

Watch

- Underlying EBITDA margins compressed to 48.8% from 53.7% in 2022. This was expected predominantly due to fee increase from lottery devision 2.5% to 3.5% which will rise again in 2024 to 4.65%.

- Gatherwell in UK saw turnover (TTV) fall by 9.6% in the half to 10,428m from 11,367m. EBITDA was impacted consequently due to rising cost which came in at 423k or 22.3% down from 545k. One segment of the business to monitor moving forward.

- Costs were up 28.1% to $22,544m driven by employee and other admin costs which each rose by $3,074m and $1,960m respectively

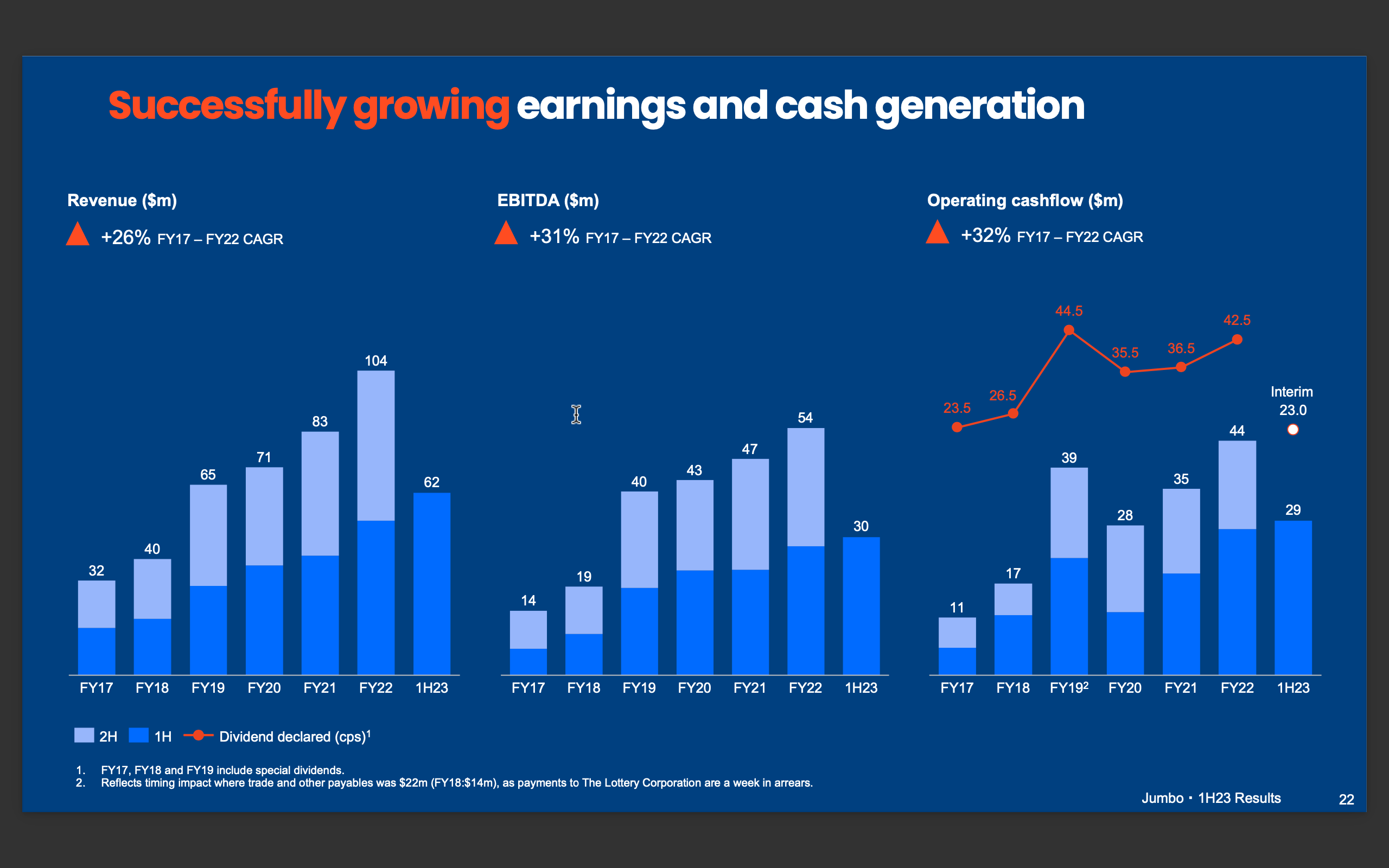

Overall need to admire the ability of Mike and the team to continue to execute over a long period in terms of CAGR, EBITDA and cashflow generation.

Disc Top 5 position in RL not on SM