Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Quality Business

Jumbo Interactive is a quality business. This is what I like about it:

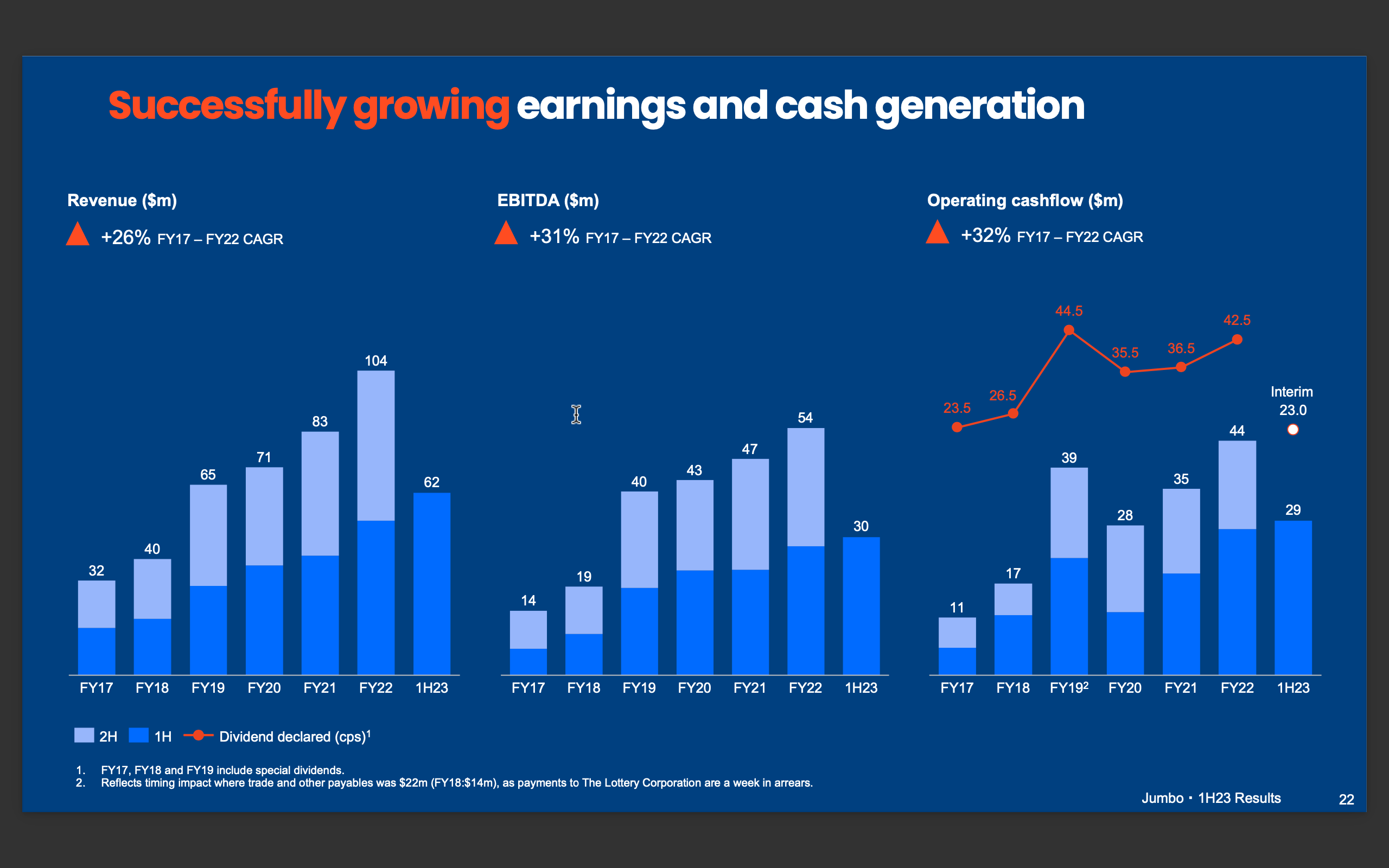

- Solid earnings growth over 10 years. EPS has quadrupled. Analysts are forecasting 11% earnings growth going forward with FY26 EPS expected to be $0.73 per share.

- High Margins: Gross margin over 80%, NPAT margin 27%

- Consistently high ROE. Seven years with ROE over 30%. Based on current forecasts ROE could be over 35% for FY26

- Debt free and $80 million of cash and equivalents

- Good dividends. Forecast FY26 dividend of 3.8% fully franked (5.4% gross yield)

- Buy-back in progress. Jumbo Intends to buy-back up to $25 million of fully paid ordinary shares

- 17% of earnings reinvested

- Strong insider buying over the last 3 months

Analyst Consensus

Analyst Consensus Price Target on Simply Wall Street is $13.58 (10 analysts).

Macquarie is bullish on Jumbo Interactive, giving its shares an outperform rating and $14.60 price target (https://www.fool.com.au/2026/01/15/why-telstra-and-these-asx-dividend-shares-could-be-top-buys/)

Valuation

On an historical PE valuation Jumbo looks like great value. Over the last 5 years PE has ranged from 15 to 40 times earnings, mid-point 27 times. Jumbo is currently trading on 17 times FY25 EPS and 15 times forecast FY26 earnings. At 20 times FY26 forecast EPS Jumbo would be worth $14.60. At 15 times FY26 earnings (lowest PE in 5 years) it would be worth $11.00. Working on a PE of 17 times the valuation Jumbo would be $12.40. I think that’s quite reasonable for a quality business like this.

Using McNiven’s formula assuming equity of $1.95 per share, ROE of 35%, 17% of earnings reinvested, fully franked dividends, and required return of 12%, I get a valuation of approx $10.00 per share.

I think Jumbo is worth somewhere between $10.00 and $14.00 per share. I think the midpoint of $12.00 is fair value.

I would be keen to hear what others see are the vulnerabilities and risks for the business going forward, eg interest rates, household budgets, exchange rate, gov regulation etc.

Held IRL and SM (accumulating under $10.50 per share)

Oct Valuation

Refer https://strawman.com/forums/topic/12014 for my brief valuation update.

Per my post, reducing the overall valuation to the lower end of my forecasted range to consider the increased debt, delivery risk and reduced dividend payment now that the full $120m is drawn.

August 2025 valuation

Positives from the recent update:

- Average spend per player is up by $30 per annum, which is partially offsetting the reduction in active players.

- NPATA went from 18.6 in H1 to $42.3m for the full year, showing the importance of jackpots

- SAAS maintaining strong growth in TTV and active players

- Price increases for Saturday Lotto in May 2025 have materially improved weekly turnover figures, with further increases coming from Powerball in November 2025.

- Took advantage of the low share price to buy back $7.8m worth of shares, and can still purchase another $17.2m in the future under the approved buyback scheme, or put towards a future M&A opportunity.

- Employee costs remained the same as the previous year

- Reliance on TLC income and Lottery retailing is slowly reducing (+$30m SAAS & Managed Services)

- Canada is on the improve since last year.

Negatives from the previous update:

- JIN moving to a brand new office building (which looks to have significantly increased lease liabilities)

- The number of active users for lottery retailing is trending down significantly, dropping 17% (178k users) since the half year announcement, which is concerning given that 110k new players were added to the platform in the same time period. This could potentially be a symptom of the increasing margin added per ticket. This is an orange flag for me, and any further significant reductions next half will likely bust my thesis.

- Lottercorp expiry in 2030 (although sooner in Vic if they don't win the tender)

The revenue and NPAT appears to be back at a more reasonable level this year without the 200m jackpot that significantly skewed results from the prior year.

Valuation:

I am not expecting a huge change in the share price, as i am forecasting that the P/E range normalises and gets closer to the long term average. An estimated NPAT circa $45m next year if growth aligns with the long term average provided in their update. Im still expecting a P/E between 16 & 19 on this one, which is slightly before the long term average.

In absence of any M&A activity, I believe that the valuation range is between $11.5 to $14 per share and have left my overall valuation unchanged.

------------------------------------------------------------------------------------

Feb 2025

Updating my pricing on this one following the recent FY update.

Key updates from the slide deck and investor call.

- TTV $453.4m down 6.4% YOY which is mainly from a 15% reduction in lottery retailing.

- NPAT of $19.1m down 9.3%

- Slight decrease in active players to 1036 (down 5% on H2) but still 100 more than 2024.

- SAAS TTV up but revenue down 5.3% to 13.3m, however the newer agreements signed are starting to show an upwards trend in the % rate applied.

- Free cash flow down 63.6% to 11.6m due to subdued lottery and trade payable timings.

- Managed services TTV down 3.8% with EBITDA down 16% (in line with expectations)

- Canadian business revenue down 19% following contract losses and updates from the previous quarter.

- Dividend of 24c announced (high end of their distribution range).

- H2 numbers looking much higher with the high volume of jackpots this year.

- Diluted EPS of 28.35c (down from 31.88 last FY) based on 340k less shares than the previous year.

The call on this one was quite informative as Jumbo have provided some good information. Learning from their recent acquisitions and market growth, they are looking to focus more on B2Customer space as this allows them to better scale with the solutions they have.

Saturday lotto price increases will be coming in May 2025, and JIN are looking to increase their price over and above by 5c, which is expected to deliver contribute an additional revenue of $300k per annum. This is likely to be the same when Powerball changes in 2026.

Once the pricing is updated, the premium above the regular TLC page is now moving to approximately 20%, which is partially offset by the daily winners giveaways. Will be monitoring the active user count, especially with the current cost of living crunch.

Marketing is being targeted to bigger jackpots, and focussed the new cost per lead of 29.49 also incorporates the cost of returning customers coming back to buy tickets which aren't classified as a new lead, and the significant reduction in new players (down to 81,200)

Overall

The sell down of this one hurts but I'm confident with the mean reversion nature of lottery retailing + price increases will get the NPAT fairly close to where things were last year.

Hoping that they can find some good acquisition opportunities in the B2C space, which will help them to increase geographical reach.

They are continuing to stand up new customers in the SAAS space, and with the renewals of Endeavour and Deaf lottery my thesis of growth opportunities in this space has not yet been busted.

Will continue to monitor the free cash flow situation as the continued trend could ultimately lead to more dilution/debt for any future acquisitions.

If the continued jackpots continue, I think this one sits somewhere between the $12 and $13.5 range. The expected PE is between 17- 19 for now which is well below the historic average of mid-high 20s and reflects the current growth opportunities.

Disc: Held IRL and SM

Slides

Updated valuation in Aug 2025

Based on EPS of 64c, 9% average growth rate for next 5 years and PE of 20 (which is in the bottom quartile of last 5 year history)

FY25 was down on FY24 which was an exceptional year due to lots of jackpots that as expected, didn't repeat in FY25. Looking through the 5 year CAGR though, FY25 is in line with their historical growth trend. Continuing to take market share from newsagents, UK business improved significantly and the charity lottery SaaS business progressed nicely again. Plus, a sensible US acquisition remains on the table which would probably improve sentiment around the business and isn't priced in to my valuation.

Updated valuation in Aug 2024

Based on EPS of 69c, 10% average growth rate for next 5 years and PE of 25 which is in the bottom quartile of last 5 year history.

(Expecting a flat year in FY25 which is why Mr Market seems to be offering up a fatter pitch when announced in Aug 2024)

Why do I own it?

# Mid cap that has been growing consistently for many years in a sector that has been very resilient over the economic cycle.

# Founder/Owner CEO who holds 14% of shares and who hopefully stays on for some time

# Consistently high ROE/ROC of over 30% p.a. and EPS growth of 14% p.a. over past decade, albeit lumpy at times based on annual jackpot numbers.

# Have diversified business recently with international acquisitions In UK and Canada - seems to have gone well and they are now 10% of business

# Certified Great Place to Work and has employee engagement of 83% which is well above the norm and usually leads to financial outperformance

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed our 15%p.a. + target

# The MOS is excellent in Aug 2024 given the relative PE and PS to 5 year history.

What to watch

# Lotterycorp agreement that will need to be renewed around 2030 and the fee charged which can impact margins

# Whether they can diversify further with INTL and charities

# How Board progression plays out - need more Directors and skills

# Increase in SaaS (currently 8%) and Charities (currently 5%) of mix over time

# Price/multiple paid for buybacks or further acquisitions

I was at an Investor event this week where Founder CEO Mike Verveka presented an overview of the business and answered Investor questions. As usual he was humble and transparent. There were a few takeaways that have added to my conviction and with a 5 year view, I believe Jumbo is now one of my least risky and most reliable holdings.

- Mike explained the UK and Canada businesses in Stride, Starvale and Gatherwell are performing OK but because they help other lotteries, rather than running them themselves, the growth is likely to be single rather than double digit going forward.

- He is off to the U.S. next week for follow up work on a possible acquisition (he also mentioned this at the AGM in Oct). And he is looking for a B2C business where Jumbo is more in control of the player experience and marketing, which they are really good at. In turn we should be expecting double digit EPS growth from this, if he can do a deal that is a fair price.

- The balance sheet is very strong and they could survive the Armageddon outcome of losing the TLC contract in 2030 to sell Powerball tickets etc. While he says this is an incredibly low probability and they would be a much smaller company if it happened, they would still survive and be profitable. Marketing and people are their two biggest costs and these can be scaled up or down fairly quickly.

- The SaaS business continues to do well, with recent additions including RSPCA.

- He is very comfortable with the succession planning work thats been done. While he has no plans to go anywhere, he believes Jumbo will be a much bigger business in 10 years time and there are 4 Managers under him that are all capable and a couple that have been with him for 20 years.

- The buybacks at the current price, are "a very easy capital allocation decision".

I will be adding to my holding IRL and on SM given these developments...

JIN appears overvalued under conservative growth assumptions but approaches fair value in high-growth scenarios. Based on my DCF, with a current share price of $11.34, the valuation is only justified if the company can sustain annual growth above 15%. If growth falls below 10%, there is downside risk, as my intrinsic value estimate (median $8.7 quartiles $5.6-11.3) indicate the stock is overpriced in both bear and base cases.

Recent results reinforce this, as they suggest slowing momentum. Valuation ratios also highlight JIN's premium pricing, with a P/E of 27.9x, P/S of 7.54x, and EV/EBITDA of 16.04x. FCF growth varied widely in my sims (4.5%-22.9%), and JIN’s high WACC (13%) and weak ROIC (2.7%-7.0%) indicate that sustained high growth is critical to justify its valuation.

Given recent revenue declines, execution risks, and dependency on jackpot cycles, I remain sceptical of an imminent turnaround. While the recent price drop seems attractive, IMO the risk-reward profile suggests a wait-and-see approach before I will considering entry.

I attended the Jumbo AGM yesterday and was very, very happy with what I saw and heard. Putting aside the short term noise about jackpots right now and what that might do to short term earnings, the culture and approach from Mike and his team was first class.

Unlike some other founder led businesses in the news of late, Mike seems to be very humble and very aligned with his team and shareholders. The staff and customer engagement and satisfaction numbers are excellent. He has allowed the governance of the company to improve significantly in the last few years, with an upgraded Board plus a better and more aligned remuneration structure.

While they are still looking to expand globally with earnings accretive acquisitions on the table, he turned down a recent opportunity as the price wasn't right.

It was also a shareholder friendly AGM, with all questions asked and answered in the room and online, with Directors speaking to their elections and staying around after the meeting to chat with shareholders.

Like all businesses there are people and market risks however unlike most, Jumbo seems to have the management, staff, customers and shareholders all rowing in the same direction at present.

Chart update Wed 9th Oct 24 Im seeing a drop to 13.04 to12.50 region.

Chart Update 26th Sep

I have been waiting patiently for an entry on JIN however the 3 Day chart looks ugly. Note the green circle on the Stochastic indicator. The white line (current action) is way ahead of the longer term (yellow line) indicator. Also the 1day stochastic indicator will be nearing its top in the next day or 2 (if not there already) which may mean it still rises to around the $12.50 however Im not hopefull. Im expecting to see a drop down to the 12.15 - 13.06 in the coming weeks.

Noted the earnings trend staggering about also.

Difficult for buy full conviction here:

TNE: The Earnings trend could be better

Strong results as expected given the favorable jackpot run:

Finally step up in TLC fee now in the results, UK growing well, Canada a bit soft but appears to be a focus.

Hard to fault the results in any way and FCF of just under $53M. $68M in cash and about a billion-market cap. Accelerating buyback when sensible.

Not overly cheap but still results given results and execution - issue would be a slowing jackpot outlook. Interesting to see if digital penetration continues in Australian lotteries and how SAAS and managed service growth looks in a year or 2.

Chart Update Mon 29th July24

Jin had broker updates over last couple of days (Jefferies & Morgans) re affirming my wave 3 target to come. After this drop completes at my adjusted target box (14.90 - 15.08).

Macquarie also came in with the target up the top of the chart. I dont take much note of targets that far away, anything could happen between then and now. I like to work on the closer targets to see it play out the way we want, not hope for way down the line, even if it is possible. Small steps will confirm the longer term PT's.

Overall zoomed out

Zoomed In

Chart Update 11th July 24

Once this C wave down has completed, Jin should have some decent dollars to be made up to my W3 target box and also 2x brokers targets

Well this South Aussie is back to work this morning.

No $150 Million for me.

Jumbo is giving a presentation at a Macquarie event today.

Included is a trading update for the first 10 months of the financial year:

Good growth is continuing, with increased service fees being somewhat offset by price increases.

If you pro-rata ytd performance, you get a FY24 TTV of $534m. They told us to expect a better revenue margin (last year was 20.3%, but based on the 2nd half to date that's more like 22.5%), so FY revenue should be around $120m, giving an EBITDA estimate of ~$59m (based on 49% EBITDA margin) -- both of which are only marginally ahead of FY23 results. Still, as we saw last year, volatile jackpot results can really move things around.

In FY23, they went from $72m in revenues for the first 10 months and then added $45m in the last 2 months!

So it's hard to know, but my best guess is that shares are on a forward PE of something like 22x, which isn't excessive given the nature of earnings and their momentum.

Not sure it's a level where a buy back is really warranted (they have the capacity to buy back another $25m if they choose). To be fair, for the first half they only bought back $3.2m at an average price of $12.74, so as long as they are disciplined and opportunistic, it's not a worry for me.

Held.

I always wonder about Morningstar analysts (broad brush). Maybe it is just a value tilt that hasn't worked for years or some other reason they always seem so far off on value - or how share prices perform - XRO etc as well.

JIN they're still at $13.10. Get a bit overheated at the moment but still.

Recent Acquisition

· January 2022 Jumbo Interactive acquires StarVale to expand UK Business. StarVale is a leading UK External Lottery Manager (ELM) and digital payments company, and the acquisition aligns with Jumbo’s strategy to build scale in its Managed Services and Software-as-a- Service (SaaS) business segments. Jumbo will conditionally acquire StarVale for ~A$32.1 million4 (~£17.0 million), and up to ~A$7.5 million (£4.0 million) to ~A$8.5 million (£4.5 million) of deferred consideration, payable following 30 June 2023 and subject to achieving certain earnings hurdles. https://announcements.asx.com.au/asxpdf/20220127/pdf/455b5rf0k4lyrg.pdf

· August 2021 Jumbo enters Canadian charity lottery market with acquisition of Stride. A$11.7m. Calgary-based Stride provides services to over 750,000 active lottery players in the Alberta and Saskatchewan provinces. https://announcements.asx.com.au/asxpdf/20210826/pdf/44zr50z8w859ch.pdf

· November 2019 Jumbo to enter UK market with acquisition of Gatherwell Ltd. a private limited liability company founded in 2013 and located in Oxford, UK for ₤5.0 million cash (~A$9.1 million). https://announcements.asx.com.au/asxpdf/20191112/pdf/44bh7smh00t2bm.pdf

Three scenarios Growth from 25% to 10%. Share on issue raising to 76.9m. Assume Net margins dropping to 25%. Discounted 10% for each year. And assigned probability to 3 scenarios which one more likely to occur. Come up with Valuation 17.89.

Inside Ownership Ordinary Shares % JIN Issued Net Value at $14.90

Directors

Mike Veverka 8,992,226 14.28% 133,984,167

Susan Forrester 35,098 0.06% 522,960

Sharon Christensen 7,282 0.01% 108,502

Giovanni Rizzo 6,000 0.01% 89,400

Other key management personnel

David Todd 62,470 0.10% 930,803

Xavier Bergade 312,470 0.50% 4,655,803

Brad Board 40,288 0.06% 600,291

Abby Perry - 0.00% -

Total 9,455,834 15.01% 140,891,927

*David Todd Resign CFO unseen health issue Oct 23

Recent Management Buying

Buy 17 Nov 23 Giovanni Rizzo 2000 Shares at $14.02 ($28,040)

Management Bios from Investor Relations

Mike Veverka - Founder, CEO and Executive Director

Mike Veverka is CEO and founder of Jumbo Interactive. He has a proven track record in business and computing, establishing several successful startups to meet new consumer demands for online products. His entrepreneurial flair and ambition for innovation were displayed at the age of fifteen when he created and sold his first software package to Hewlett Packard. Mike worked as a design engineer and computer programmer before founding Squirrel Software Technologies, a company that provided some of Australia’s first internet services and e-commerce software. As founder and leader, Mike plays a pivotal role in the growth strategy, innovation and promotion of Jumbo.

Susan Forrester AM - Chair & Non-Executive Director

Sue has served as chair and non-executive director on multiple ASX-listed companies over the past 10 years. Sue has broad experience in setting strategic direction, and has also held roles with specific responsibility for corporate governance and compliance. A qualified lawyer, Sue has an EMBA from the Melbourne Business School, and is a Fellow and Councillor of the Australian Institute of Company Directors. She is a Member (AM) in the General Division of the Order of Australia for significant service to business through governance and strategic roles and as an advocate for women. Her strengths lie in strategy and governance within industries that are undergoing rapid change.

Sharon Christensen -Non-Executive Director

Professor Sharon Christensen has 29 years of commercial, legal and regulatory experience and is a research leader in regulatory responses to digital innovation and disruption. Most recently, Sharon was a Non-Executive Director of Property Exchange Australia Ltd, the operator of the national online property exchange network. Sharon holds a Bachelor of Laws (Honours) and Master of Laws and is a member of the Australian Institute of Company Directors.

Giovanni Rizzo - Non-Executive Director

Giovanni Rizzo is a specialist in the gaming industry with over 20 years’ experience in various management roles of large listed lottery, casino and electronic gaming machine businesses in South Africa, Canada and Australia. Giovanni was Head of Investor Relations at Tatts Group Limited prior to the merger with Tabcorp Holdings Limited in 2017. He is currently the General Manager of Corporate Advisory at Tyro Payments Limited overseeing the Legal, Company Secretarial, Financial Advisory and Investor Relations divisions.

Brad Board - Chief Operations Officer

Having joined Jumbo in 2001 Brad has been actively involved in Jumbo’s evolution and growth into the leading digital lottery business it is today. Brad has significant lottery and ecommerce experience and is responsible for ensuring that the Jumbo brand, digital experiences and service offerings engage and satisfy its 2,000,000+ customers in Australia and internationally. In addition to responsibility for Jumbo’s marketing and product strategy, Brad ensures various departments and subsidiaries are interacting efficiently with each other and in accordance with Jumbo’s overall strategic goals.

Abby Perry - Chief People Officer

Prior to joining Jumbo in 2016, Abby spent several years as a Human Resources professional working for international IT and Media companies in London. As Chief People Officer, Abby partners with the business in all aspects of HR including strategy, recruitment, learning and development, performance management and organisational effectiveness. With extensive HR experience and a passion for people, Abby seeks to ensure the success of Jumbo’s biggest asset – our people.

Is the 7% bump today just on the back of a big jackpot? No announcements…fascinating

After an unusually low number of jackpots last 6 months - a $150M Powerball next week should give a kick along. Same for TLC.

Not that Morningstar Australian analysts have seen to be very good analysts over the years they have initiated with a fair value of $12.90 for JIN.

I don't think I'll ever get a job hosting 7:30.. Some of these CEO interviews are like Sean Hannity interviewing Trump..

So apologies for being a bit like a gushing groupie sometimes. But Mike represents so much of what I like in a CEO:

Plain speaking, humble, clear focus and vision, lots of skin in the game, founder, engineering background.

At this point, the guy is worth at least $134m (only counting his Jumbo shares) and he's still in there chasing a bigger vision. Last time he sold shares was April 2022, from what i can tell, and that was only about 5% of his total holding.

Mike stressed a couple times that it was their in-house developed tech that was their moat, saying it'd take (from memory) $100m and 3years+ for someone else to emulate their tech stack.(not that we should take that at face value)

fwiw, they only carry around $16m of capitalised development spend on their balance sheet (most has been amortised away) and last year they spent $6.5m on software development, and $5.5m the year before that.

I think his read on the regulatory landscape made sense -- why would government kill off a big source of revenue, especially when this form of gambling, er I mean "gaming", doesn't tend to have negative social impacts (unlike pokies).

Counterparty risk with ASX:TLC is not a thing until 2030, and at this point Jumbo have a much better negotiating position (although again, we may need to push back on that a bit for the sake of intellectual honesty). At any rate, Mike is clearly a long term thinker, and is looking to continue to diversify away from that single source of revenue, targeting 50% revenue from SaaS and Managed services by then.

In the meantime, they have wonderful cash flows to fund their expansion and it looks like they are being very conservative in their plans.

Anyway, capital light, founder led, economically acyclical, strong balance sheet and cash flows -- what's not to like?

I still think shares are reasonable value (see my valuation). Maybe I've been too kind on some assumptions, but even if you pull things back a bit I think you have a current price that is far from expensive.

Another way to look at it is that you have analyst's forecasting a FY24 dividend of 58c. Well, let's call that 50c which represents a forward yield of 4.7% (grossed up for franking), which aint bad for a company that has delivered such strong growth over the years, and that has plenty of runway left.

Anyway -- as always, keen for a different perspective.

Well overdue. Last valuation I had was for $18.91 which I did in 2021

At the time I said that Jumbo was "well on track to achieve $1b in TTV in the next year or so -- especially with the addition of Stride and an improved large jackpot rate. I'm going to assume they'll hit that target by FY24 at the latest."

Well, it seems $1b in TTV will be FY24 at the earliest (I was assuming acquisitions would have added more, although in hindsight that was pretty optimistic). But it does seem almost certain they will cross that threshold in the next 12 months.

In fact, extrapolating past growth, it should come in around $1.05b to $1.1b.

Holding FY24 margins steady, and using 62.5m shares on issue, I get a FY24 EPS of roughly 70c. And based on the targeted payout ratio that'd be a dividend of at least 46cps.

So on a forward basis, at the current market price of $15.43, that's a PE of 22 and a yield of 3%+.

Given the defensive nature of earnings, strong balance sheet and likely M&A activity, I think they can support EPS growth of at least 15%pa over the coming few years.

As such, I'll guestimate 95cps in EPS by FY26. Applying a PE of 25 and discounting back by 10%pa, I get a valuation of $17.84

I'm short on time today, but quickly, the Jumbo results look decent.

Management have reigned in cost growth (not that that was ever a problem), and reduced marketing spend (due to lack of large jackpots), which has helped deliver a 51% EBITDA margin, ahead of guidance for 48%, but down a bit on FY22 (52.9%).

TTV growth was strong, up 18%, which helped grow revenue by 14% and NPAT by 9% (ex amortisation of acquired assets). Active players up 39% thanks to acquisitions, but a good sign of future growth.

Free Cash Flow was the standout, up 21% (cash conversion was 146% -- basically, there's a good chunk of non-cash amortisation which is reasonable to strip out)

All debt has been repaid and the company has $53m in cash. Expecting 100% cash conversion in current year, so can easily fund growth and maintain a dividend payout of 65-85%.

So you have a business on a PE of 27 and a yield of 2.8% (fully franked), which should growth at a very decent rate when you consider the StarVale, Gatherwell and Stride acquisitions.

I dont think shares are 'cheap' per se. But not unreasonable given the quality and reliability of cash flows, as well as the ongoing growth potential.

[Held]

Jumbo's latest slide deck shows that there have been only 11 large jackpots (>$15m) so far in the second half (through to the end of April), and with a lower aggregate size. If you pro-rata the current half, the total aggregate jackpot size comes in at around half the previous second half.

We could see some bigger jackpots in the remaining couple of months (and statistically you'd probably expect that), but given where we are, and how highly ticket sales correlate with jackpot size, it'll be hard to get a good comp for the current half revenue wise.

Of course, this is just the nature of the industry and doesn't hold much relevance to business execution, but it is something to be mindful of.

Cost growth is expected to be in the range of 16-18% as the company continues to invest, but this is down from the previous year's 33% lift, and the underlying operating margin is now expected to come in at the higher end of the original guidance range of 48-50%.

Powerball (which accounts for over half their TTV) is increasing the ticket price by 10c, the first price increase in 5 years. But Jumbo is adding a further 10c to ticket prices. Given the price rise should also lead to more frequent large jackpots, it *should* be a net positive for Jumbo. In fact, on a pro-forma basis, this is expected to drive operating margins from 44% to around 50% from Fy22 to FY23

One small point, the company still has a buy back allotment of $25m, which only 10% or so has been used at an average price of $12.58 (current price $12.71, so maybe that's an area you could see at least some support.

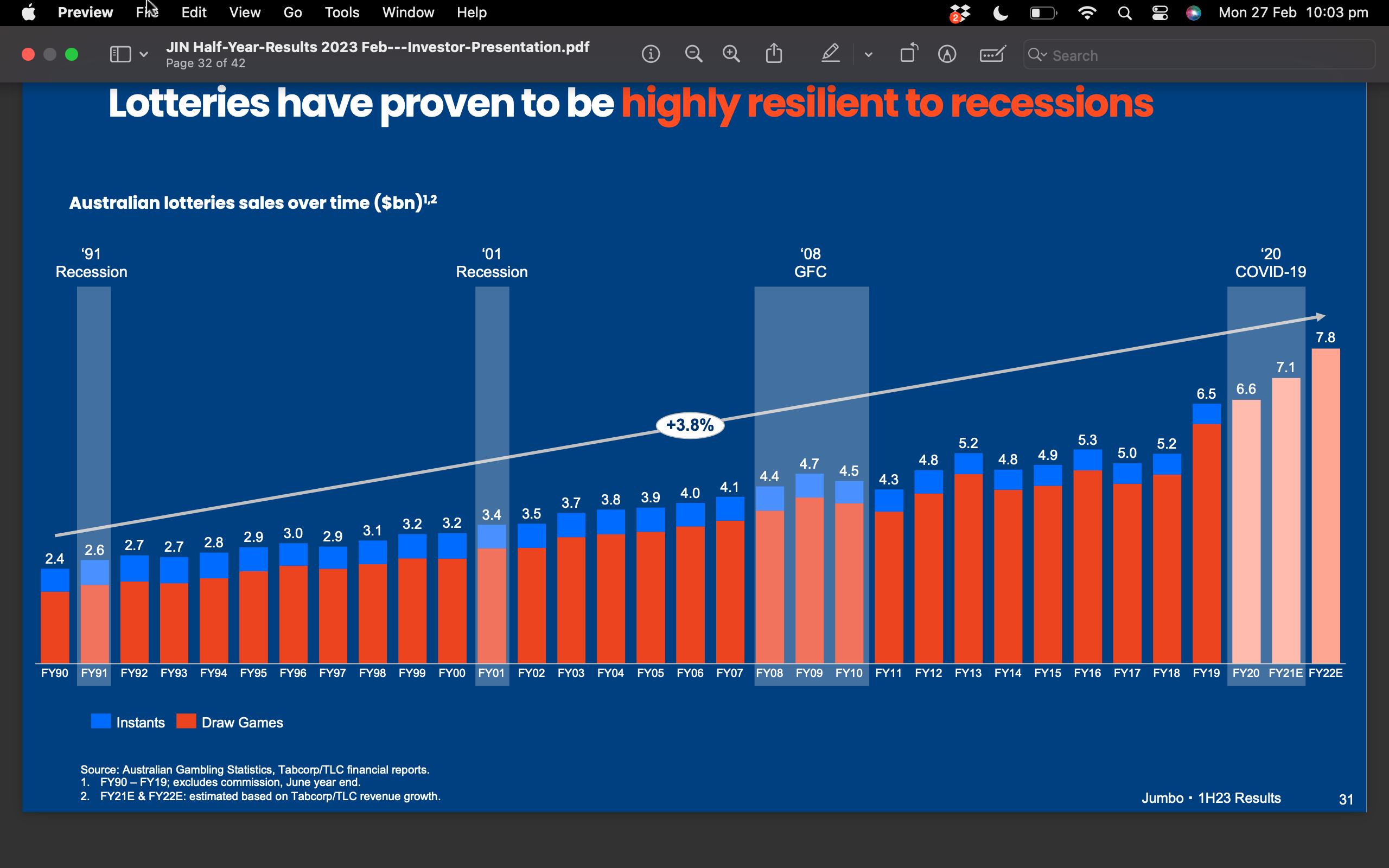

All told, this business is a bit of a cash cow with good secular tailwinds and one that (at least historically) has proven to be very recession proof.

Disc. Held

Jumbo results solid with a few call outs to monitor moving forward

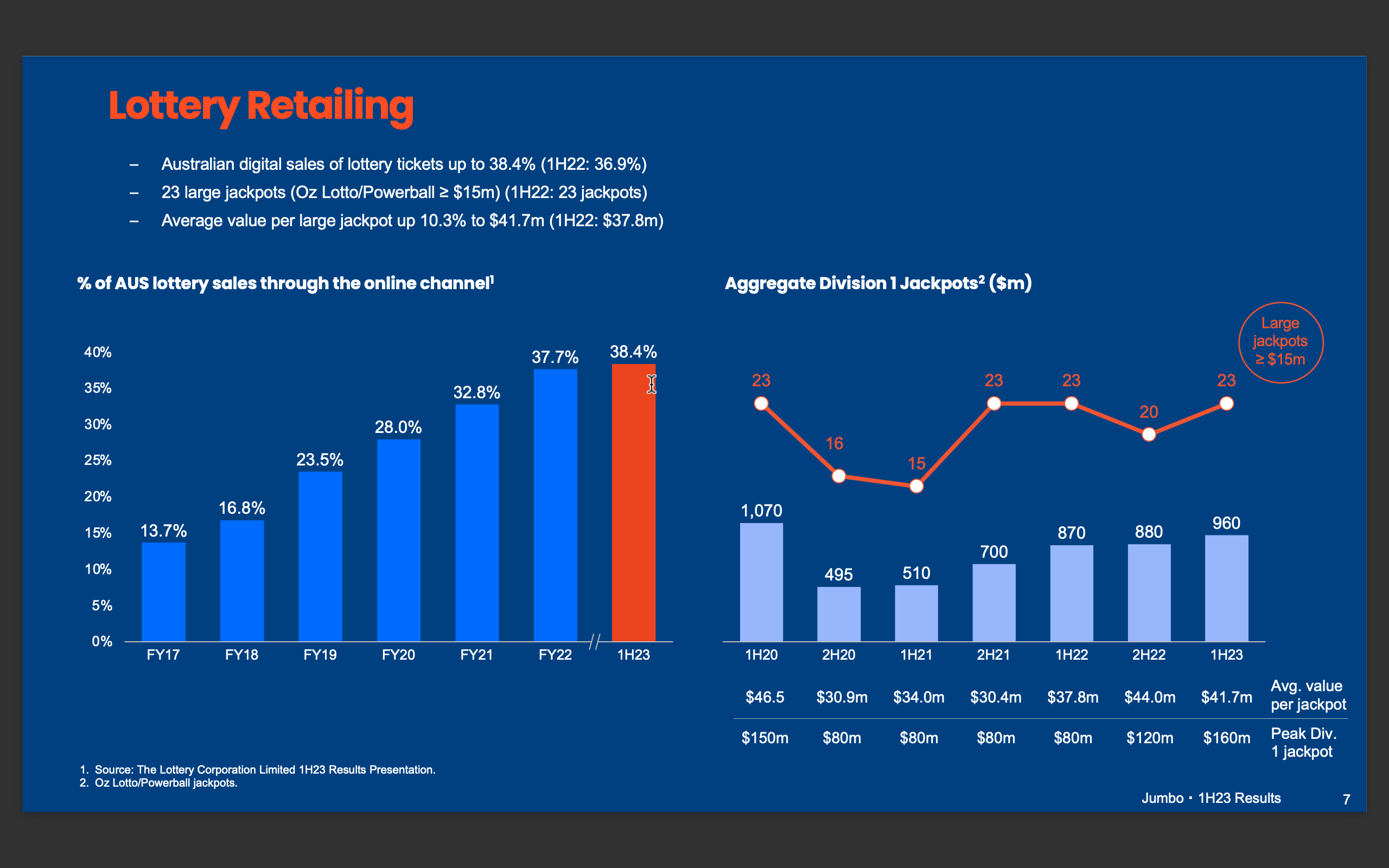

- Revenue growth overall of 18.1% to 62,389 million.

- Jackpots in Q2 helped drive this growth with number of jackpots for the half being 23 but the value of each of them up 10.3%, driven predominantly by 160m powerball. These jackpots are key to driving the growth in the lottery TTV and revenue.

- Number of active players up to 4million in the half, up from 333k in 2015 . Online ticket purchases are now at 38.4% of total tickets.

- Oz Lotto price increase of 15c or 10% on a ticket made no impact to sales . RPPU has risen 17%

- Comments on this acceptance by Mike and David on the call were all around reasonable increases in this inflationary environment with consumers understanding and willing to pay.

- Mike (CEO) and David (CFO) outlined Jumbo are looking to do this with powerball in second half 2023

Not sure if one can call this defensive but management were quick to highlight the resilient nature of the lottery business (see graph below).

NPATA, CF and dividends all saw increases in the half by 8%, 6% and 5% respectively

Watch

- Underlying EBITDA margins compressed to 48.8% from 53.7% in 2022. This was expected predominantly due to fee increase from lottery devision 2.5% to 3.5% which will rise again in 2024 to 4.65%.

- Gatherwell in UK saw turnover (TTV) fall by 9.6% in the half to 10,428m from 11,367m. EBITDA was impacted consequently due to rising cost which came in at 423k or 22.3% down from 545k. One segment of the business to monitor moving forward.

- Costs were up 28.1% to $22,544m driven by employee and other admin costs which each rose by $3,074m and $1,960m respectively

Overall need to admire the ability of Mike and the team to continue to execute over a long period in terms of CAGR, EBITDA and cashflow generation.

Disc Top 5 position in RL not on SM

$JIN announces that Mater Foundation has struck a six year extension of their SaaS agreement out to 2028.

It is good news that such an important customer has the confidence in the product to extend for such a term.

Disc: Held in RL and SM

Looks to be another $100M jackpot next thursday, a string after months of nothing. Not sure it'll get the same attention given Christmas and New Years.

Looking at Semrush for ozlotteries.com.au and looks like steady traffic but not great.

Obviously the Lott dominates. Hopefully we get some good news on JIN partnering further with lotterywest.com

Following on from @Strawman some notes from the transcript for those that can't access it. I left a few out like most of the questions from the Australian Shareholders Association were repetitive and already answered...

Quesiton on change in payout ratio - prioritising acquisitons so payout ratio and dividend may be cut but no lower than 65% of NPATA.

Jumbo not available in Queensland, hard with the State Government 'brick wall' so will prioritise rest of Australian and international given the opportunity.

Quenstion on buyback given acquisitions - only $2M complete of $25M, assessed daily and if an acquisition comes up funds will be directed to that but currently very 'cash-rich.' They did the buyback mainly due to the 'marker turned quite dramatically'

Question on metrics of active players instead of dollar per active player - they could use man metrics cost per player acquisition, average spend but 'We really don't get that many players who come in active and then really don't do much. They're active or they're not.'..... 'the fact that it takes like in Australia only 5 months to get our money back on our advertising is probably one of the best in the industry, demonstrates that we've got quite a tight grip on our marketing expenses, which is one area that things can get away from you very quickly certain with other businesses.'

Follow up on above - '... when we get these big jackpots like $160 million come in, we get a flood of new players come in. We had almost 60,000 come in just in the last month alone. And then we go into the activation. We really want those players to keep on playing. We don't necessarily want them to spend large amounts of money in 1 hit, but we do want them to become regular players. And that's where our software and our teams are very good at giving them every reason to do that.'

Question on growth and international expansion 'as a very small shareholder, more important thing to me is my returns. So -- and why are you focusing on getting bigger, but not necessarily better for the shareholder, better for the Board and better for the executives, always, in pays and returns. But how are you rewarding the shareholders.' - Rewarding shareholders is very key.... If we just stayed as an Australian-only business, it introduces a lot of risks. There's -- we take all our money from just one area, and we kind of like have all our eggs in 1 basket. And so long-term thinking that, that could be quite a risk for shareholders. Going international is not easy. There's a lot more jurisdictions, laws to think about. So we don't do it just for the heck of it. We do it because there's growth opportunities. And I keep on coming back to this one important stat that if you look at the global lottery industry, the percentage of lottery tickets that are sold online is still probably only around about 9% or 10%, very, very low. Here in Australia, we're at 38%, 39%. So we're lucky to be in a country where we're quite advanced, and we can take our advanced knowledge internationally. So most of the world out there is not yet on the Internet. So if I really want to plot a course for Jumbo over the next 20, 30 years for sustained growth, we really have to look internationally. And rather than rush at it like a bull at a gate and buy everything inside I think we've taken a very measured approach, learned things along the way. And every time we learn things, we improve it, we evolve. We put in teams so that we can manage these businesses at different regions, different time zones. Yes, it's not easy. But if we do want to get this long-term growth, it's very much what we have to do.

Question on problem gambling - But your point is a good one in that in the lottery side of the industry, if you've got casinos over on this end, you've got sports betting in the center, that's very risky. Lotteries is very much on this side, which is low risk. And that's a good place to be.... Exactly. Lotteries are well known in Australia and around the world as very low, low, low levels of problem gambling because of the nature of the game because of the regulations in place. And as I travel around the world and I visit other countries, it's the same sort of thing. It's all about maintaining that there is no player harm, but yet allowing the industry to grow at a slower rate but a much more sustained rate. I mean most people when they look at our graphs and they see that graph just ticking up each time year after year, they're very envious of that. We don't have the big ups and downs. We have a few little ones. But that's just specific to lotteries. And in my view, that's a great place to be.

Quesiton on where there is 'data' insurance meaning cyber - ... it was actually a topic on the agenda of our Board meeting this morning, we held before the AGM and CFO provided us an update in relation to our cyber insurance. You can imagine it's a very hot topic for all boards. But yes, we do, and we are reviewing the nature of it, the extent of it and other practices around that.... It's only going to get more expensive as the downside of that review..

Question on increasing board as 'does not seem enough for a growign business' - As we elaborated in the resolution where we requested an increased aggregate fee, we are looking around for another nonexecutive director who will probably be an international -- with international lottery experience and M&A experience. We appreciate the 3 nonexecutive directors plus Mike is a bit skinny, and to be honest, there's actually quite a bit of heavy lifting goes on with Sharon chairing the People and Culture Committee. Giovanni, chairing the Audit and Risk Committee and myself chairing the Board. There's not many meetings, we don't all attend. So we appreciate there's quite a bit of heavy lifting there. And to answer your question specifically, yes, we are on the lookout for another NED.

Some notes from the Chair and CEO addresses:

- Competition for talent resulted in increased turnover & cost pressures, albeit to a lesser extent than peers

- Long term incentive structures in regard to share allocations to be measured against total shareholder return and per share earnings (good!)

- Healthy cash position and available debt facility provide "capacity for further strategic growth" -- i.e. expect more acquisitions

- Machine learning showing good results with a 3-fold increase in purchases of recommended products.

- Stride has significant opportunity to expand into other Canadian provinces

- As we all know, big jackpots are a strong driver of ticket sales and sign-ups. You can't predict when the big ones will come, but it's a mathematical certainty that they will.

- The recent $160m powerball saw 60k new player sign-ups

- Lottery TTV and revenue up 11% and 10%, respectively, from pcp

- Underlying SaaS TTV up 18% with all 5 clients fully operational

- Gatherwell TTV declined 7%, but revenue up 12% due to focus on higher margin services

- Maintain EBITDA margin target of 48-50% for FY23, excluding Stride and Starvale (FY22 was 52.9%)

- Recent acquisition will mean a significant higher rate of amortisation due to acquired intangibles. Non-cash of course, and things like customer lists really can be largely ignored imo. Software less so.

I remain a happy shareholder and think the business should be able to deliver annual EPS growth of at least 10-15%pa for the next 5 years or so at least, but possibly as much as 15%-20%pa.

Lots of cash on hand, and good free cash flow generation. An economically resilient industry. An aligned and capable CEO (who I have reached out to again -- fingers crossed he'll come chat to us soon).

Aside from the growth, shareholders should get a grossed up yield of close to 4.5% too.

I'm thumb-sucking a forward PE of 24 or so, which feels very decent.

Held.

Should be a relativley good read through into JIN - benefit from the $160M powerball. Hopefully JIN captured a fair share of that 2% increase in digital share.

ASX announcement

2 November 2022

Completion of StarVale Acquisition

Jumbo Interactive Limited (Jumbo) is pleased to confirm that the acquisition of StarVale Group (StarVale), as announced to the ASX on 27 January 2022, completed on 1 November 2022 (GMT), following the satisfaction of all closing conditions under the terms of the Sale and Purchase Agreement, and the receipt of regulatory approval from the UK Gambling Commission on 12 October 2022.

The total consideration of £23.0 million (A$40.5 million1) was settled 63% from Jumbo’s available cash reserves and 37% using existing debt facilities and comprises:

• A £12.0 million (A$21.1 million1) upfront payment made on 1 November 2022 (GMT);

• StarVale surplus cash funds of £6.5 million (A$11.5 million1) acquired on completion;

• Deferred consideration of up to £4.5 million (A$7.9 million1) to be held in escrow and payable

in 1H24, subject to the achievement of the earnings target for the 12-month period ended 30 June 2023.

The Jumbo Group remains in a net cash position following completion of the acquisition.

- Ends -

Authorised for release by the Board of Directors.

For further information contact: Investor Relations – Jatin Khosla +61 428 346 792 [email protected]

About Jumbo Interactive

Media – Mike Veverka (CEO & Founder) +61 7 3831 3705 [email protected]

Jumbo is Australia’s leading dedicated digital lottery company, making lotteries easier by offering its proprietary lottery software platform and lottery management expertise to the government and charity lottery sectors in Australia and globally, and by retailing lottery tickets in Australia and the South Pacific via ozlotteries.com.

Jumbo was founded in Brisbane in 1995, listed on the ASX in 1999, and has ~190 employees creating engaging and entertaining lottery experiences for its global player base.

About StarVale

StarVale is a leading UK External Lottery Manager and digital payments company. StarVale provides services to over 850,0002 active lottery players across over 45 charities and not-for-profit

1 GBP0.5675 = AUD1.00

2 Estimated number of players who bought a ticket within the last 12 months (as at 31 December 2021)

Jumbo Interactive Ltd | ABN 66 009 189 128 | Level 1, 601 Coronation Drive, Toowong Qld 4066 1

www.jumbointeractive.com

ASX announcement

2 November 2022

organisations, with many of these being major UK charities. StarVale also comprises of DDPay Ltd, a wholly owned subsidiary and digital payments company that facilitates Direct Debit payments and provides cost effective Direct Credit payment solutions to StarVale’s weekly lottery clients. StarVale generated £67 million (~A$118 million1) in Total Transaction Value, £5.4 million (~A$9.5 million) in Revenue and £2.1 million (~A$3.7 million) in Net Profit Before Tax for the year ended 31 December 2021.

1 GBP0.5675 = AUD1.00

Jumbo Interactive Ltd | ABN 66 009 189 128 | Level 1, 601 Coronation Drive, Toowong Qld 4066 2

www.jumbointeractive.com

Following on from @mikebrisy comments re Jumbo at current valuations i added to my position in RL this week .

At sub $12 Jumbo presents as an attractive log term play.

Revenues

15% rev growth in next 3 years reverting to a 12% in 2026 and 2027 to $198m

Margins to hold @ 50%

EBITDA grow from 57.6m in 2023 to 99m in 2027

Shares on issue to grow at 4% from 2024 to 2027 to 73.5mil. Buy backs in play in 2023 seeing share count neutral.

Net profit after tax to hold steady at 30% rising to 59.4mill in 2027

EPS growing to 81c in 2027.

Discounted back @ 10% per year = EPS land at 49c in 2027

At a 30 PE in 2027 = $14.7

High quality business with strong balance sheet for the long term.

$JIN have just announced that UK approval for Starvale acquisition has come through.

Others here have commented that, with a lower level of current year large prize jackpot wins, we're likely to see broker downgrades over the coming months and a weaker FY23. So with the international growth strategy on track, random local weakness, and the lower margin Tabcorp re-negotiated deal continuing to wash through, we may well see further short-term price weakness offering an opportunity to accumulate. Its certainly on my watchlist, at <3% of my RL portfolio, it is a quality growth company that I'd be willing to hold more of.

Disc: Held IRL and SM.

I like the business but no idea how Jumbo makes it to Mogan Stanly's list of a wide moat business - think you need to put The Lottery Corp on it if either of them.

Capital light, lottery retailer and lottery software provider. The big risk remains the renewal of the Tabcorp licence in another 8 years. It appears there is a strong relationship with Lottery West in WA which could provide an increased opportunity near term. I do struggle to understand the appeal given the surcharge JIN's ozlotteries charges over the Lott but it appears customers are happy with the product.

There are a number of recent acquistions that need to be bedded down and not knowing coding, this always makes me wary when different base codes are being intergrated. I'm not sure if they replace the acquired software with their own or their is more integration. Something I will look into.

All said cash flow easily covers the dividend which is around 3% or gross 4.3%. The decline in the proposed payout ratio to a 65-85% range makes me think this might not grow in fast in future as they look for new acquisitions and to pay down some debt from the latest acquisition. They do generate significant cash and don't have much debt so this might not be the case.

Margins are expected to move down to around 48-50% as a result of the Tabcorp fee scale up in FY23. There has been a lack of jackpots recently which should normalise. With the acqusitions I think 25% growth in revenue is doable - to $131M, using the lower end of the 48% EBITDA range $62.5M in EBITDA. Move down to about a 28% after tax margin as differnce has historically been about 20% gives about $37M in NPAT. 63.2 million shares on issue so EPS around $0.585. 30x multiple seems reasonable given the growth of $17.55.

Seems to be roughly in line with brokers as it happens.

Good results from $JIN today and steady progress on acquistions: past, presents and to come.

Their FY22 performance highlights

Strong double-digit growth reported across key performance metrics:

− TTV up 36% to $659.9 million

− Revenue up 25% to $104.3 million

− Underlying EBITDA1 up 13% to $55.1 million

− Underlying NPAT1 up 14% to $32.2 million

− Underlying EPS1 up 13% to 51.5 cents per share.

The Board has declared a fully franked final dividend of 20.5 cents per share, taking the total FY22 dividend to 42.5 cents per share, up 16% on FY21. In addition, the Board has approved an onmarket share buy-back of up to $25 million.

A few of my notes from the call:

Share buy-back: there was some discussion on the call about why a $20m buyback, when they are continuing to screen bolt-on acquisition opportunities as part of the strategy of accelerating the leverage of their lotteries SaaS platform internationally. But I think it makes perfect sense. 2022 was a standout year driven by higher than normal large lottery prizes. From a capital management perspectives, buy-backs are a good way of managing windfalls, as they allow the dividend progression to reflect the overall prgress of the business. It also signals capital discipline: $JIN are not hoarding all the cash to splurge on future acquisition. So a solid "A" on the report card from me on capital management.

Operating Expense/Margin: Some pressure here, due to the higher fees in the Lottery Corporation Service Fee, which is well-understood by the market and which will max-out in FY24. But there were also other increases in staff expense, staff turnover, expanded management team and marketing expense. This undermined the operating leverage I'd expect to see, Not a major concern at this stage, but something to watch. CEO Mike Veverka made it clear that this is a priority for the management team as well. On marketing expense, customer acquisition metrics still look very favourable, so there is headroom here and it makes sense for them to be spending more.

Outlook

Finally, one interesting chart to address questions investors might have about potential impact of a recession. Key message: don't worry! However, given greater discretionary capacity during COVID period (for all the reasons covered before), might there be a negative post-COVID effect? This was not discussed on the call.

We are barely two months into FY23, however, it was noted that there have been fewer >$20m jackpots so far - indicating FY23 might not be a bumper year. This might lead to SP weakness as the year unfolds, with H1FY22-H1FY23 comparison providing even better buying opportunities. If so, I will consider increasing my position at that time. Happy to hold for now.

Disc: Held on SM and IRL (3%)

I agree @wtsimis -- Jumbo is an impressive company (i also hold here and in real life).

In the last 5 years:

- TTV has gone from $145m to $660m (CAGR of 35%)

- Revenue has grown from $32m to $104m (CAGR of 26%)

- NPAT has grown from $5m to $31m (a 6x improvement!)

Importantly, it's done this without too much dilution (share count is up 5%pa on average over the same time frame, and flat for the last 3 years), and it's consistently paid a dividend.

Solid structural tailwind in the switch to digital ticket sales, and they've built some impressive tech which now serves as its own white labelled SaaS product. Acquisitions have been sensible and with a clear strategic advantage.

As @Mujo reported, the company is looking to post improvements across all the key metrics for FY22, with TTV, revenue and NPAT up 35.5%, 27.1 and 15.8%

And yet, the market is (as I write) down more than 11% on the news. Why?

Well, margins are down across the board. EBIT margin has gone from 58% to 52% and the company expects this to further moderate to 48-50% in FY23.

I wont pretend that is good news, but a part of that is to be expected. Under the 10 year agreement with Tabcorp – signed in August 2020 – a service fee was introduced, and is based on the cost of ticket purchases from Tabcorp. It was 1.5% in FY21, 2.5% for FY22, and will be 3.5% in FY23, after which it levels off at 4.65% for the remainder of the agreement.

They are pretty sizeable steps, but none of it should be a surprise to the market

Jumbo did say it expected Marketing costs to be in the range of 1.5-2% of lotto retailing TTV. But here too, that's about in line with what they reported for the half year, which was at 1.8%. They've also said they tend to see a 5 month payback on marketing spend, so given the stickiness of players, i say have at it!

Perhaps the bigger factor is the jump in operating costs, which were 32% higher in FY22 and are expected to rise a further 20-22% in FY23. At the half they also pointed to this and attributed it to the appointment of a senior leadership group and a tighter labour market (in other words, increased salaries). This is something a lot of companies have reported, and only yesterday we saw just how tight the labour market is. I expect this to remain a feature for a while yet.

So not what you like to see. But to me it's not something that should undermine their ability to deliver attractive growth in operating cash flows. Less than would otherwise be the case, sure. But it's far from a deal breaker for me.

So, looking ahead, while no specific guidance was given, i'd expect continued organic growth and also a nice kicker from recent acquisitions. Starvale should add a further $10m in revenue with a full year of contributions, and Stride generates around $6-7m in annual sales. Also the SaaS and Managed services business seem to have good traction, and they are going after a $10b serviceable addressable market which is presently underserved and with high barriers to entry.

At present, you can buy shares in Jumbo for about 26x earnings and a 3.5% fully franked yield.

I've emailed CEO and founder Mike Veverka to see if he'd like to chat with us.

ASX announcement is here

Love the consistency of Jumbo and runway it still has.

Management continue the disciplined manner in capital management .

Very hard to fault especially business performance in terms revenue growth and profitability, especially when you consider the challenges they faced over the past 2years with Tabcorp.

Rising dividend which should see FY 22 be 43c .

One stock which sits at the core of my real life portfolio.

Trading Update

Looks like a miss on analyst consensus from TIKR - though higher margin.

There was some postive broker commentary yesterday.

Share price has come off a bit (with everything) so will be interesting to see the SP reaciton - pointing to a decent rally on CommSec.

Last night I randomly purchased an OZ Lotto ticket via the website (rarity for me to play)

What I did was place my CVC number in the deposit amount section rather than the required $10.

I immediately call the helpdesk on a public holiday, and spoke to an incredibly nice man, who immediately recredited my bank account with the three figure amount that I stupidly deposited.

We are quick to highlight faults and poor customer service, I wanted to say that if they treat, customers, employees, shareholders etc half as good as they treated me, then this should be mentioned.

Disc hold IRL and SM.

The JIN share price fell following the release of their H1FY22 report, which resulted in a decrease in margins. This also followed a full FY21 report which resulted in a 37% increase in D&A.

With respect to the former, Jumbo blamed the deterioration on the product mix sold as the cost of selling goods rose.

The company indicated the latter was due to:

- 1.3m amortisation of the 15m capitalised Tabcorp extension fee – being amortised over the 10-year term of the agreements.

- 414k amortisation for 12 months of the Gatherwell intangible assets that arose in the business combination on acquisition.

- 805k increased amortisation of capitalised website development costs relating to the proprietary software.

FY22 H1 shows D&A came in at 4.2m for the reporting period – another 5% increase. Nothing major, but something to keep an eye on in upcoming reporting periods.

Despite margin deterioration in H1, Jumbo’s SaaS segment reported a narrow increase in margins which helped partly offset loss elsewhere. I think this is also why management – and investors like myself – want to see Jumbo expand their SaaS offering. The blue sky here also represents the bulk of my investment thesis.

What else do I like? Lots! I am a fan of management, who are tidy capital managers and have plenty of skin in the game themselves. In the last 12 months there has been lots of insider buying, including by the founder/CEO. Jumbo also pay a reasonable dividend – who doesn’t love a dividend?! Add to that a warchest of funds (75m), no debt, growing revenues and favourable tailwinds – with a focus on digitalising what is very much an ‘old school’ industry (only a very small portion of lottery tickets are sold online). There is lots of blue sky.

Despite being lumpy, the business has consistently produced millions in FCF since FY18 – see below (FY18 starts left, moving right to FY21).

When you consider management’s excellent ROE, which exceeds 30%, I become increasingly confident that management will continue to use FCF to grow the business and subsequently reward shareholders. I think this will continue into the future.

I will estimate FY22 revenue of 110m and a conservative NPAT of 33m. That gives me EPS of around 0.53c. Noting the business strengths I have just mentioned, I think a PE of 35 is reasonable. This gives me a current price around $18.50.

Jumbo has acquired StarVale -- a UK based External Lottery Manager that provides services to around 850,000 lottery players across 45 charities and non-profits -- for $32.1m, plus up to an additional $8.5m of deferred consideration based on performance measures.

That represents a 7.3x multiple on StarVale's expected pre-tax profit for FY23 and should be mid-single digit EPS accretive in the first 12 months. (forecast NPBT for FY23 is only 10% above FY21 -- so it doesn't appear they are trying to make the acquisition multiple lower by assuming high growth)

The acquisition will be debt funded with a new $50m debt facility, of which $30m will be used for the acquisition, and the remainder for future possible acquisitions. With no prior debt, $80m in equity and $14m in free cash flow (as of last annual report), this doesn't seem too onerous and ensures no dilution for existing shareholders. The company is also reducing its dividend payout ratio (from 85% of NPAT to 65-85%) which will help ensure they can repay the debt faster -- a good call in my opinion.

This latest acquisition follows the Stride purchase last year, and Gatherwell in 2019, both of which (so far) look to have been good moves, and will help accelerate international growth and provide added scale.

StarVale also owns a Direct Debit solutions business, which can be used for Gatherwell and other UK operations, providing some cost efficiencies. It's also worth noting that StarVale generates a pre-tax margin of close to 40%.

Overall, a good move at an attractive price that should enable the group to further leverage their Powered by Jumbo platform. It's also entirely consistent with their stated strategy.

Announcement here

Disc. held

This was another strong result for Jumbo.

Revenue growth of 17% to $83m represents a doubling since 2018. That's despite a transfer of customers to Lotterwest, on which they now get a lower margin of the transaction value (9.5% vs 20%).

Within retail, excluding this shift, revenue was up 17%

There was a change in the reporting structure too, with retail paying a 7.5% usage fee to the SaaS part of the business, and the commencement of the Tabcorp service fee -- all of which meant gross profit in Retail (selling lotto tickets on ozlotteries.com.au) was down 36%.

But when you factor in the Saas segment -- where there was more than a doubling in TTV and which operates at a near 100% gross profit margin (even though the TTV margin is lower), overall EBITDA was up 13%.

Operating cashflow was up 24% and there was $28m in free cash flow excluding the $15m Tabcorp extension fee. Jumbo even paid an 18.5c final dividend, giving shareholders a record year of dividends (excluding special dividends). The company has a cash balance of $50m and no debt.

For the company to pay out 85% of profits as dividends and still fund double digit growth is impressive, and testament to the strong cash generative ability of the business.

On one hand they are benefiting from the ongoing transition of lottery retailing to online and the associated available TTV growth. Market and market share growth have seen their TTV compound at 20% overthe past 5 years. No wonder they were keen to secure a long term agreement with Tabcorp here, it's a cash cow with them essentially making 10% on all tickets sold on Ozlotteries.com.au. The ratcheting up of the tabcorp fee will drag on margins, but overall it's an extremely reliable and attractive cash generator.

But the SaaS and Managed services segments are really the ones to watch. There's a lot of opportunity -- especially in places like North America and UK. They basically provide full lottery solutions out of the box, and though they get a much lower clip of the TTV, the TTV pie is potentially much, much larger and the unit economics of these segments are incredibly attractive.

This has been touted for a while, but i think there's some good evidence the company is executing well. 4 new clients have been onboarded, and the Gatherwell acquisition appears to be working out very well, where TTV has compounded at 26% per year over the last 3 years.

In fact, the $11m acquisition of Stride looks to be on point. Acquired on a 5x earnings multiple and EPS accretive from day one, it gives them a solid footing into the Canadian market. I also like how 70% is paid upfront in cash, with the remainder based on performance of the business (smart) and that the existing management team are staying on.

Shares are on a PE of 36, (based on underlying EPS of 45c) which just doesnt seem too much of a stretch for a company that has delivered attractive growth and is better placed than ever to capture more TTV. It seems a very defensive type of business too with a very strong balance sheet.

Disc: i own

Attached to this straw is the valuation detail and below a walk through of the reasoning. The main valuation has general information on the company as it currently stands.

Disclosure: I have held JIN since mid-2020 at an average cost of $10.75 and am continuing to hold at current prices.

Bull IV = $43.42 ($686m FY30 Revenue)

Base IV = $15.29 (Valuation)

Bear IV = $6.51 ($33m FY30 Revenue, due to non-renewal of Tabcorp agreement in 2030)

Valuation Assumption (Base):

· Sales Growth (12.3% CAGR): Driven by new SaaS and Managed Services business growth from low to nil base in FY20, with modest (6.5% CAGR) Lottery Retail business growth. FY30 revenue breakdown is 134m/54m/38m for Lottery/Saas/Managed Services.

· Margins: Maintained in line with H1 FY21 for each business unit except for Lottery which has the impact of the increased Tabcorp fee which tops out at 4.65% in FY24. Because this is calculated on TTV, the margins impact is -22.8% Vs pre fee margins. Note that margins for the SaaS and Managed Services business are currently not clear, so margins may need to be reviewed when clearer details are available on these.

· EBITDA%: As with margins I have retained these % by business unit (adjusted for the Tabcorp fee), so the overall impact is the result of a change in the ratio each contributes. Note that I would expect that as sales scale up, operating leverage would improve EBITDA%, but I have left this out at this time due to the lack of margin clarity.

· Capex: This is almost entirely intangibles and I assume investment continues to grow at 10% a year to maintain competitive advantage.

· Share Count: Assumed a 1% growth from ESOP’s which seem reasonable.

· Discount & Terminal value: Taken market risk of 10% (long term average), terminal value is calculated as a multiple of EV/EBITDA of 10, which is around a P/E of 16 and perpetual growth rate of 3%.

· Risks/Options: No discount for risk due to high cash balance and solid underlying FCF positive business to 2030. Options premium of 20% based on the benefit of potential acquisitions (US), cross selling of SaaS and Management services opportunities and new product optionality.

Comment on Valuation:

· The base valuation is around current prices and gives some insights into what has been priced in by the market, this is deliberate and acts a bit like a reverse DCF.

· My preference is for the Bull case, the very large TAM offered by the new SaaS and Management Services businesses offers much higher growth opportunities and ones which the market is yet to accept.

· The elephant in the room is the Tabcorp agreement which finishes in 2030. If it is not renewed and the growth rates are below Base assumptions, then you are left with the Bear case. The value of the Tabcorp agreement alone being renewed is worth around $5 to the current valuation to provide some context.

· JIN needs to continue to innovate and adapt to remain relevant, the new SaaS approach is central to it’s future market beating value and having the founder in place to lead it is going to be an important part. The investment thesis rests heavily on this.

Jumbo reported a 9% lift in revenue for the half year FY21, which came in at $40.9m. Not great, but there's a lot context needed here.

The demand for lotto tickets is very much tied to the size of the jackpot on offer. The large jackpots (eg $100m Powerball) draw in a lot of extra volume, whereas the saturday $2m is far less popular. TTV and revenues for Jumbo can be lumpy as big Jackpots arent consistent in their timing.

So the result wanst too bad when you consider large jackpots were down 35% in the 6 months period. Despite this, revenue for the reselling business was up 2.3%.

And this is by far the largest segment -- it captures over 90% of revenue for the business.

So this hides the really encouraging result, which was a 25% lift in Total Transaction Value (TTV) and a 200% increase in external SaaS revenues (albeit off a very small base).

Importantly, the run rate for TTV at the end of December was $120m pa, compared to the $39m they reported for this half. This will grow as already signed customers are onboarded.

So expect even more growth in this segment in the current half.

The new Managed Services division is also seeing some good early growth, and there seems some good potential there. I think it's a very neat offering that levereges off the company's know-how.

Moving further down the income statement, Jumbo reported only a 3.7% rise in underlying EBITDA and a 5.8% drop in NPAT.

The reduced margins were to do with the new Service Fee to Tabcorp (that added over $2m in cash and non-cash costs), and also establishing expenses for the Managed Lottery Services business.

In regards to the former, although less ideal than the previous agreement, it's still a very good source of revenue for the business and one that now has a lot more certainty for the long term.

Overall, i think the dynamics of the industry are very supportive, and Jumbo is well placed to capture an increasing stake in it.

32% of all lottery tickets are now sold online, up from 28% last year. You have to assume that figure has a lot further to rise.

But the key thing to watch is for the growth in new SaaS business. That's the real growth engine.

Disc: held

Financial highlights

- TTV up 26% to $233m • Revenue up 9% to $41m

- Underlying EBITDA1 up 3.7% to $24.1m

- NPATA2 up 0.5% to $16.3m

- Interim dividend declared, 18.0 cents per share, fully-franked

DISC: Previously held

Launch of Managed Services business in Australia

Jumbo Interactive Limited (ASX:JIN) is pleased to announce the launch of a Managed Services business in Australia with the signing of agreements with two foundation partners - Paralympics Australia and St John Ambulance Australia (VIC) Inc.

The operating segment – Managed Services - provides a complete lottery management service to not-for-profit organisations including prize procurement, game design, campaign marketing, customer relationship and draw management. This segment compliments Jumbo’s existing lottery SaaS and Lottery Retail (OzLotteries.com) solutions.

“We are excited to launch the Managed Services business in Australia with our foundation partners Paralympics Australia and St John Ambulance Australia (VIC)”, said Mr Mike Veverka, CEO of Jumbo. “The addition of managed services in Australia is aligned with our vision of “making lotteries easier” and will assist many not-for-profits meet the challenges of COVID-19 and continue their fundraising efforts via a digital lottery program”, he added.

Jumbo has signed a term sheet with the WA Govt. owned Lotterywest to negotiate an agreement to supply it with its Powered By Jumbo lotteries platform.

The details will be worked out in the coming momths, but key terms include:

- Jumbo will receive a service fee for each transaction on the platform

- A 3 year initial term, with options to extend for a further 3 and 4 years.

- Customers on the white labelled platform will be owned by lotterywest

Exisiting Jumbo clients in WA contributed $33m in totall transaction volume (TTV) last year. Exactly how the margins will differ with the service fee as compared with the current arrangement, and how players may transition to the new platform is not really clear.

But it seems likely it will mean a net increase in the TTV Jumbo is exposed to in WA, and gain some contractual certainty for a good number of years.

The software integration is planned to be completed by the end of 2020.

Announcement here.

Jumbo has signed a new 10 year reseller agreement with Tabcorp for the sale of their lottery products.

This will cost $15m in an upfront extension fee, and a higher service fee per ticket sold, which will be 4.65% phased in over the next three years.

Full details here

It represents a higher cost, but is the longest reseller agreement ever signed and provides a lot of certainty (removes a good deal of counterparty risk) and still leaves Jumbo with very high net margins. The move should be seen as a temporary step down in earnings, rather than a sustained loss of growth in my opinion.

Jumbo also reaffirmed guidance for the full year, which is expected to see ~6% rise in revenue. It is hoping to roughly triple ticket sales by the end of FY22.

Shares are presently on ~9x sales for FY20.