Half Year Results - FY2024 - Laserbond

Laserbond... the first small cap company I dipped my toe into, and as such, I have a soft point for them. As I type away, the market did not like the results, with the SP dropping almost 14% to $0.75.

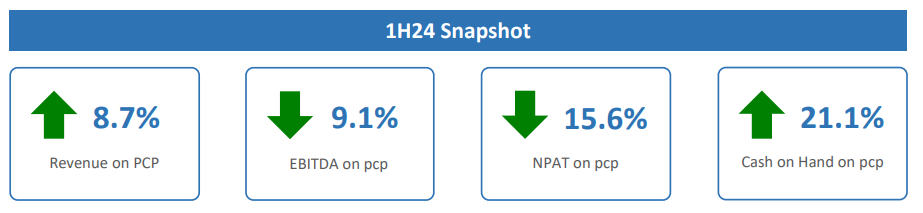

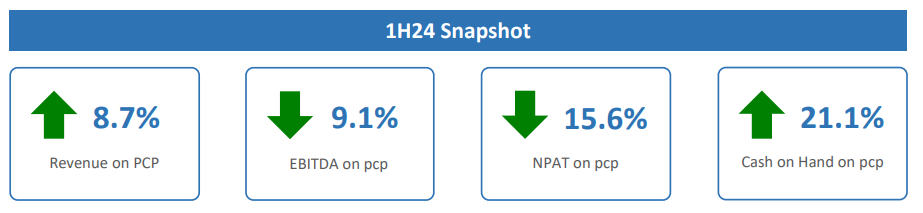

A few key financial updates:

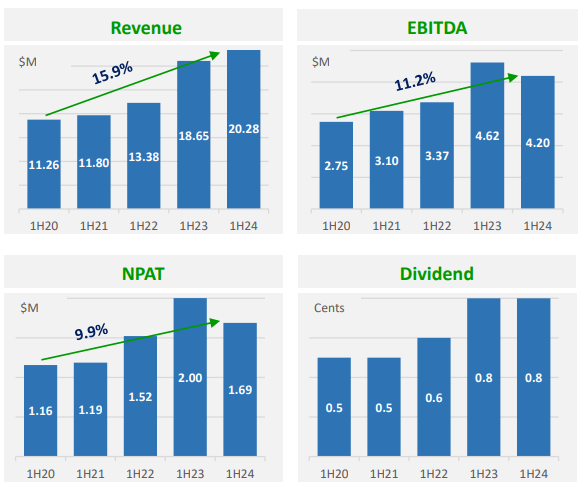

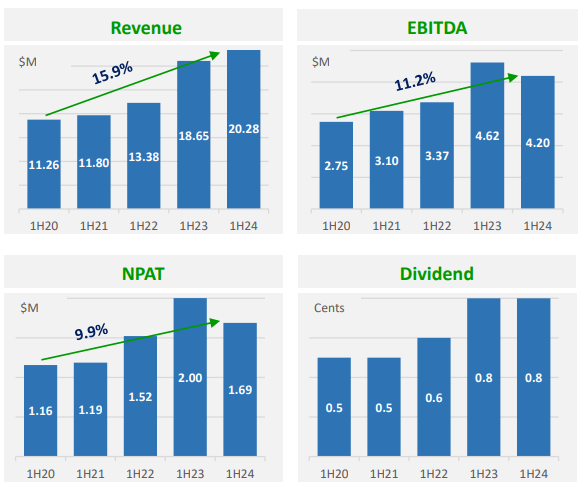

- Revenue: Increased by 8.7% to $20.28 million from $18.65 million from the PCP.

- EBITDA: Decreased by 9.1% from the PCP.

- NPAT: Decreased by 15.6% from the PCP.

- Cash: Increased by 21.1% from the PCP.

For those of you (much like myself) who like pretty pictures...

Division updates:

- Services Division: Revenue of $11.19 million, representing a 15.4% increase over $9.69 million in 1H23. EBITDA decreased slightly due to growth costs, from $3.04 million to $2.98 million. The gross profit was consistent, with margins of 55.8% and 55.6% for 1H24 and 1H23, respectively.

- Products Division: Faced challenges due to an unexpected withdrawal from trading by a supplier of raw materials needed for manufacturing products for a large OEM customer. An alternative supplier was sourced, but the delay in manufacturing componentry and testing led to delays in order fulfillment and revenue recognition. Efforts to expedite the process included air freighting components from overseas.

- Technology Division: Generated revenue of $0.42 million, largely from a technology sale to Swinburne University in Victoria, with additional contributions from licensing fees and the sale of consumables to licensees in the United Kingdom and New Zealand. Other technology sales revenue has been dependent on customer timeframes. A revision to the operational scope in response to redefined customer requirements for the North American cell is progressing, with factory and field testing required before revenue recognition can occur. Revenue from the sale of the Curtin University and Indian cells is expected in late 3Q24.

My view:

The market has looked at the pretty picture on the front page outlining EBITDA down 9.1% and NPAT down 15.6% and decided to hit the sell button - this is an overreaction.

Yes, there were supply chain issues in the products division due to an "unexpected withdrawal from trading by a supplier of raw materials componentry needed to manufacture products for a large OEM customer". Admittedly, this isn't a great look, but these things happen... it's about how the company solves the issue, and Laserbond sourced an alternate supplier. They attempted to get the components air freighted from overseas but were unable to get them over in time to enable the shipment of most order before year-end.

I like Laserbond's move to sign an agreement to purchase an initial 40% of Gateway Group, with an option to move to 51% within three (3) years.

I also like Laserbond committing to their prior outlook with Wayne Hooper stating, “With the inclusion of Gateway Group’s revenue, LaserBond will achieve its FY25 $60 million revenue target". The strategic focus for the next period will be leveraging the strengths of Gateway, incorporating our surface engineering capabilities into Western Australia, and completing research into an acquisition for North America".

My thesis on Laserbond is unchanged at this stage - I think this is a blip for a company that has proven over the last few years that it's making the right steps in the right direction.

Disc: I hold at small size IRL and on Strawman... and I'm thinking about adding...