Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

FOURTH QUARTER FY25 BUSINESS UPDATE

Q4 FY25 HIGHLIGHTS

• CARR2 of A$30.2M; ARR3 Run Rate of A$23.5M at 30 June 2025

• Q4 FY25 Sales orders of A$7.8M (TCV4); FY25 Sales Orders of A$29.1M5

• Operating cash flow positive in FY25 (A$0.7M) and Q4 FY25 (A$0.6M)

• Cash of A$23.1M at 30 June 2025 and no debt

• On-market share buy-back continued in Q4 FY25 with approximately 6.3M shares (A$2.2M)

bought back between 3 March and 30 June 20256

• FY25 guidance was updated on 10 July 2025.7 Revenue is expected to finalise at A$33M-

$34M, CARR at approximately A$30M-$31M and OPEX growth to be less than revenue

growth

Mach7 Technologies Limited (“Mach7” or the “Company”) (ASX:M7T), a company specialising in

innovative medical imaging software solutions, today provides a business update and quarterly

cashflow report for the quarter ended 30 June 2025 (Appendix 4C).

Mach7 CEO Teri Thomas said: “There is much to be pleased with as we conclude the 2025 financial

year. Mach7 recorded strong revenue growth demonstrating the value of our products and solutions

to our customers. Operating costs were carefully managed and OPEX growth will be less than revenue

growth in line with our FY25 guidance. With closing cash of A$23.1M and no debt, Mach7 is in a strong

financial position, and we delivered on our objective to be operating cash flow positive for the year.

This provides us with a solid foundation to move forward, and I am excited by the opportunities ahead.

“In my first month as CEO, I have acted decisively to position the Company for long-term growth and

sustained customer excellence. I have reshaped the leadership team, streamlined key roles, and

appointed a Chief Innovation Officer to sharpen our focus on delivering compelling customer value.

These changes are part of a deliberate strategy to redirect resources towards customer-facing

functions and build dedicated teams that ensure our solutions remain essential — driving deeper

adoption, expansion of use, and new sales. Together with increased investment in sales and

marketing, this creates a powerful customer–sales and marketing flywheel that will accelerate growth,

strengthen customer loyalty, and drive sustainable, profitable performance.

I view Teri's appointment as a good one, and an outcome similar to the one she achieved at Volpara would be acceptable to most shareholders I suspect.

CEO TRANSITION

Mach7 Technologies Limited (“Mach7” or the “Company”) (ASX:M7T), a company specialising in

innovative medical imaging software solutions, today announces that Mike Lampron will be stepping

down as Managing Director & Chief Executive Officer, effective 30 June 2025. The Board has appointed

Teri Thomas as incoming Managing Director & CEO, commencing on 1 July 2025.

Mach7 Chair Robert Bazzani said: “The Board would like to acknowledge and thank Mike for the

significant contribution he has made to Mach7 since joining the Company in 2017. As CEO since 2019,

he has been instrumental in driving the growth and strategic direction of the business, including the

transformative acquisition of Client Outlook. He leaves Mach7 in a strong financial position and we

wish him well in his future endeavours.

“We are delighted to welcome Teri Thomas to Mach7 as CEO. Her drive and energy, deep operational

and turnaround experience in healthcare technology, and strategic leadership will be invaluable as we

continue to execute our growth strategy and maximise shareholder value. Teri also has extensive

experience across global markets including the United States, Europe, Australia, New Zealand, and

South Korea. Given her proven track record, Teri is well positioned to lead Mach7 in its mission to

revolutionise healthcare imaging through innovation and strategic execution.”

Teri Thomas has a distinguished career in healthcare technology and executive leadership, and in

driving strategic growth. Most recently Ms Thomas was the CEO of Volpara Health Technologies Ltd

(ASX: VHT), a global leader in medical software for breast cancer screening, and Chief Business Officer

of Lunit, a market leader in AI-driven cancer detection and diagnostics.

At Volpara, Ms Thomas led a remarkable corporate turnaround where her strategic focus on

operational efficiencies, disciplined commercial strategies, US sales and strong cultural leadership

stabilised the company and positioned it for the successful acquisition by Lunit in May 2024.

An American citizen, Ms Thomas has extensive experience in healthcare technology, including a 20-

year executive career at leading US electronic medical record company, Epic. Ms Thomas was also an

Executive Vice President with NZ-headquartered healthcare software company, Orion Health, where

she supported their large-scale enterprise sales and corporate strategy.

Incoming Mach7 Managing Director and CEO Teri Thomas said: “I am honoured to join Mach7

Technologies at such a pivotal time in its journey. The Company’s commitment to transforming

medical imaging and data management aligns perfectly with my passion for healthcare innovation. I

look forward to working closely with the team to scale operations, drive sustained profitability, and

deliver cutting-edge solutions that enable exceptional patient care.”

Wilsons maintains its OW on M7T after the latest 4C. PT remains $1.05.

Wilsons continues coverage, maintaining their $1.05 price target.

Patent Infringement Case Dismissed

Mach7 Technologies Limited (“M7T” or “the Company”) (ASX:M7T), a company specialising in

innovative imaging software solutions, today advises that the patent infringement lawsuit brought by

AI Visualize, Inc. has been dismissed on appeal.

On 4 April 2024,1 the United States Court of Appeals for the Federal Circuit affirmed a lower court’s

dismissal of patent infringement claims asserted by AI Visualize, Inc., a Texas Corporation against

Nuance Communications, Inc. and Mach7 Technologies, Inc., a wholly-owned subsidiary of Mach7

Technologies Limited.2

In affirming the decision of the United States District Court for the District of Delaware, the Court of

Appeals held that the subject patent claims “are patent ineligible because they are directed to an

abstract idea and fail to transform that abstract idea into patent-eligible subject matter.”

In doing so, the Court confirmed that Mach7 Technologies, Inc. did not infringe on any patents.

M7T is pleased with the affirmation of this dismissal and the closure of this legal action.

---

Great! Now can the shares respond in kind, please? It's been a long wait!

Inside Ownership Ordinary Shares Net Value at $0.70

Michael Lampron 3,408,590 $2,386,013

Robert Bazzani 414,900 $290,430

Eliot Siegel 346,100 $242,270

Dyan O’Herne 390,000 $273,000

Rebecca Thompson 69,934 $48,954

Total 4,629,524 $3,240,667

*Market Cap ~$168.8m at $0.70 per share

Bio from investor relations

Rob Bazzani -Non-Executive Chairman

Rob has spent the past 20 years with the global consulting firm KPMG, where he rose to the top and served as Chairman of KPMG Victoria, National Managing Partner for KPMG Australia’s Enterprise Division and National Managing Partner for KPMG’s M&A Division. Whilst in these roles, Rob was a member of KPMG’s National Executive Committee (NEC), which oversees and is responsible for the Firm’s turnover, strategic decision making, profitability and operations. Rob has a demonstrated track record of leading and growing large scale and complex businesses. He has played a significant role in advising clients (public, private, and global subsidiaries) on commercial maters, public transitions, corporate governance, M&A and has engaged with Government and Regulators. With extensive experience in corporate advisory, Rob has deep commercial and industry knowledge across financial services, asset and wealth management, property, insurances and consumer & industrial markets.

Mike Lampron - Managing Director

Mike is the Chief Executive Officer of Mach7 Technologies. With over 20 years of experience in business and operational management for Healthcare IT companies, Mike brings a broad experience ranging from private start-up organizations as well as long established companies such as IBM and GE. Mike was previously the Chief Executive Officer for a National Teleradiology Company and has a proven ability to drive results through a combination of astute analysis, innovative execution and cross-functional teamwork. Mike is responsible for our customers’ success while driving excellence throughout Mach7.

Eliot Siegel, MD -Non-Executive Director

Dr. Siegel is a well-known thought leader in the world of radiology and imaging informatics and artificial intelligence applications in medicine. He is currently Professor and Vice Chair of information systems at the University of Maryland School of Medicine, Department of Diagnostic Radiology, and the Chief of Radiology and Nuclear Medicine for the Veterans Affairs Maryland Healthcare System, both in Baltimore, MD as well as adjunct professor of computer science and biomedical engineering at the undergraduate campuses of the University of Maryland. Under his guidance, the VA Maryland Healthcare System became the first filmless healthcare enterprise in the World. He has written over 300 articles and book chapters about PACS (Picture Archiving and Communication Systems) and digital imaging, and has edited six books on the topic, including Filmless Radiology and Security Issues in the Digital Medical Enterprise. He has given more than 1,000 presentations throughout the world on a broad range of topics involving the use of computers in medicine and artificial intelligence. Dr. Siegel was symposium chairman for the Society of Photo-optical and Industrial Engineers (SPIE) Medical Imaging Meeting for three years and has been honored as a fellow in that organization as well as the American College of Radiology. He is also a Board member of Carestream Health, a billion-dollar global company in digital radiography and computed radiography systems and serves on numerous advisory boards in medical imaging.

Rebecca Thompson -Non-Executive Director

Rebecca has deep experience in financial markets with senior roles at global investment banks, most recently at J.P. Morgan, and with listed companies over her 30-year career to date. Since mid-2022 and until her September 2023 appointment as head of investor relations at ASX-listed building materials company CSR Limited, Rebecca was a consultant to Mach7. Rebecca’s professional experience spans the property, resources, fintech and charitable sectors with a strong focus on sustainability and ESG. She holds a Bachelor Degree in Economics from the University of Sydney and has a graduate qualification in finance and investment.

Dyan O'Herne - Chief Financial Officer

Dyan is the Chief Financial Officer of Mach7. Prior to becoming CFO, she spent seven years in various financial controller roles within Mach7. With the benefit of tenure and leadership positions, Dyan has a deep knowledge of the Company’s finances, operations, history and culture.She is a Chartered Accountant with more than 25 years’ experience in senior finance roles including with Aon Insurance Managers and PricewaterhouseCoopers immediately prior to joining Mach7.

Major Contract Timeline

· December 2023 Sentara Healthcare new 5-year subscription agreement The total minimum value of the renewal is A$10.2m and will generate Annual Recurring Revenue (ARR) of approximately A$2.0m. Sentara Healthcare is one of the largest health systems in the Mid-Atlantic and Southeast of the United States. It is among the top 20 largest not-for-profit integrated health systems in the country with 30,000 employees and 12 hospitals in Virginia and North eastern North Carolina. https://announcements.asx.com.au/asxpdf/20231214/pdf/05ykf5sz7n5w6z.pdf

· September 2023 contract extension with Authority of Hong Kong, renews five-year service and support agreement total value of $15.26m. The agreement is for a five-year extension of HAHK VNA and eUnity Support and Maintenance along with professional services that will be delivered and recognized on an as needed basis through the contract extension. The total value of the extension is $15.26m, with a recurring revenue value of $12.36 ($2.47m annually) that will be recognized over the course of the extension. The professional services component is $2.9m which will be delivered and recognized over the course of the extension on an as needed basis. https://announcements.asx.com.au/asxpdf/20230928/pdf/05vdg5vrbkt5t5.pdf

· July 2023 Diagnostic Imaging Associates signs 5 year subscription licence to provide eUnity to Diagnostic Imaging Associates (DIA). As part of the contract, Mach7 will provide its eUnity Diagnostic Viewer solution to DIA for general diagnostic interpretation and mammography diagnostic reading. Based on a subscription licensing model, the contract expands the use of eUnity beyond an original 75,000 annual study agreement for mammography remote reading to a licence covering the full spectrum of eUnity’s diagnostic tools for 1.2 million studies annually, a 16-fold volume increase. The new contract has a TCV of A$3.7 million and will add A$0.64 million to ARR. https://announcements.asx.com.au/asxpdf/20230721/pdf/05rtxp1jd5snrj.pdf

· July 2023 Veterans Health Administration Phase I potential TCV of A$11.7M; potential to increase to A$59.6M with Phase II. The VHA NTP is Veterans Affairs’ in-house teleradiology service which has been providing 24x7 service to VHA facilities for over a decade. The NTP currently supports 125 sites across all 18 Veterans Integrated Services Networks (VISNs) and is projected to interpret between 1.0 and 1.5 million studies annually. https://announcements.asx.com.au/asxpdf/20230703/pdf/05r6ylg3lmgvmd.pdf

· March 2023 Adventist Health System orders Mach& PACS for remaining 15 contracted hospitals. A contract regarding Adventist Health’s PACS replacement program for its 22 hospitals was announced in January 2021. The initial, overarching agreement was valued at over A$7.9 million and included A$2.4 million of sales orders for the first seven hospitals. The remaining order forms for 15 hospitals have now been received and have a value of A$7.1 million including scope expansion. https://announcements.asx.com.au/asxpdf/20230309/pdf/45mh5pv7zws74n.pdf

Previous Contract History Refer to other straw

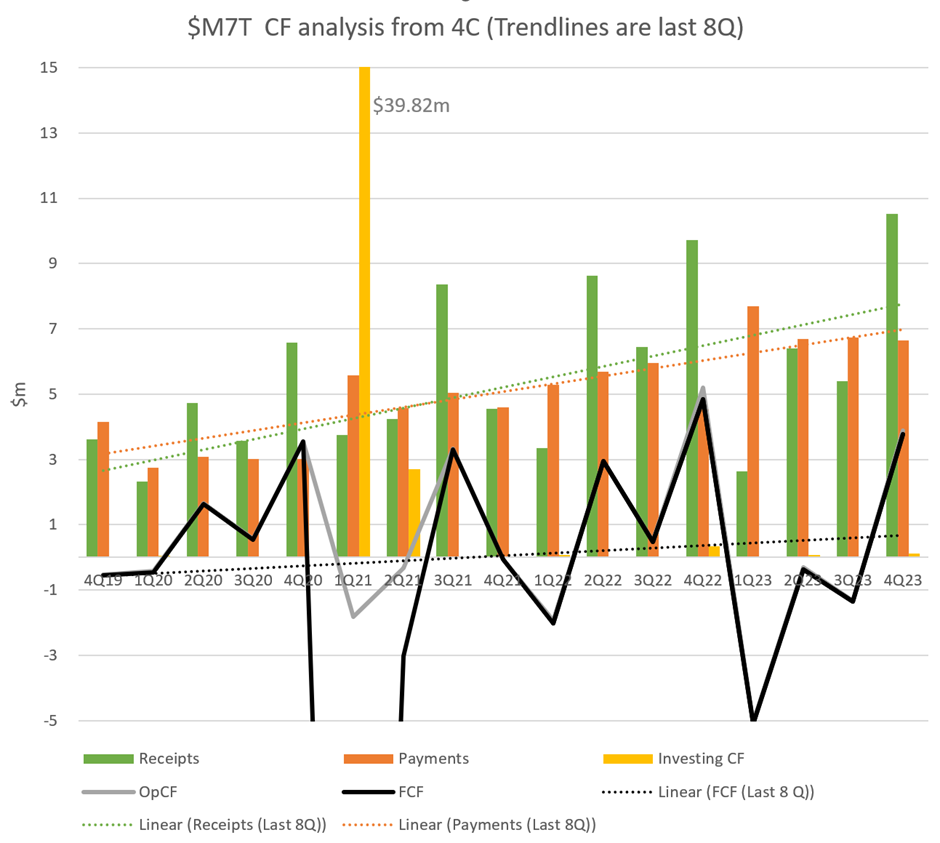

$M7T have released their 4C this morning.

Their Highlights

• Sales orders of A$16.0M (TCV1 ) in Q2 FY24 (A$22.4M in Q2 FY23, A$22.6M in constant currency)

• Contracted Annual Recurring Revenue (CARR) of A$26.8M at 31 December 2023, up 5% on 30 September 2023 (A$25.5M).

• Annual Recurring Revenue (ARR) run rate of A$18.6M at 31 December 2023, up 1% on 30 September 2023 (A$18.4M).

• Cash on hand of A$22.7M at 31 December 2023, up 10% on 31 December 2022 (A$20.6M) and marginally lower on 30 June 2023 (A$23.4M).

• Reaffirm FY24 guidance with sales order outlook supported by strong pipeline of opportunities with new and existing customers.

My Analysis

I have covered the key points in my commentary last week on the Guidance Update, so I'll not repeat here.

The usual CF analysis is included below for completeness. Its another medical software business struggling to generate cash with two softer quarters on receipts, with the unavoidable advance of costs.

I have now exited $M7T in RL and SM.

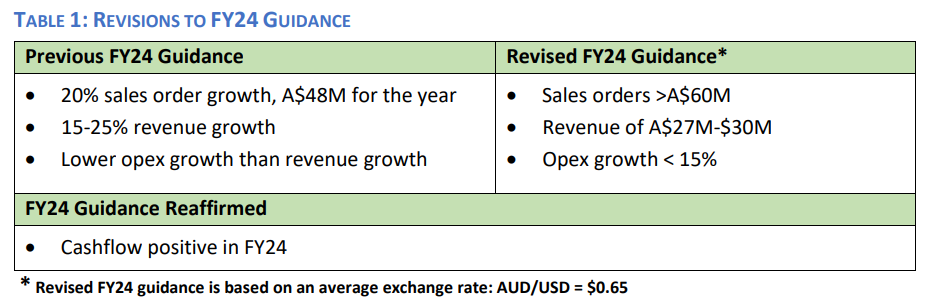

Medical imaging software provider $M7T provided an update on their FY24 guidance today.

I'm a little slower than usual in my analysis due to having a day job today (finishing soon!), however, $M7T was falling towards the bottom of my conviction lsit, despite great progress in renewals, and today's announcement tipped me over the edge.

Their Summary

My Analysis

I'm not going to summarise the entire release. The release is long and detailed and is clearly aimed at preparing investors for the HY result. Rather, I'll get straight to my analysis.

As those following the business will know, FY24 is a huge year for renewals of key contracts - and management has clearly and correctly focused on those renewals. Several have been accounced previously, and I have commented positively on several because they have expanded some key accounts on renewals - a good sign. And don't forget the new huge Veteran's Health deal signed last year, which can be expected to drive revenue for years to come.

However, those of us who invest in SaaS have become conditioned to the idea of a subscription business being one of perpetual renewal, moderated only by hopefully modest or low churn. However, it is wrong to think of $M7T (or other SaaS businesses) in this way. They are fixed term contracts which must be renewed to sustain a flat revenue base. The growth has to be on top, including expansion of customers buying more of the product because it adds value or the pricing structure allows revenue to grow as customers grow.

On renewals, $M7T has outperformed the expectations they set - by some margin. However, sales orders of $60m - largely renewals - have to be understood in the context of $30m revenue in FY23 and sales contract terms of 3 to 5 years.

So there is some significant bad news in the release. They had targeted 15-25% revenue growth, which on $30m revenue for FY23 implies an expectation of $34.5-37.5m (Indeed, the market consensus for FY24 revenue is $35.7m; n=5). So to be guiding now to FY24 revenue of $27-30m isn't just a downgrade, its indicating that revenue is expected to decline. Not good.

There is a narrative about FY24 having lower capital sales, with this being positioned as "subscription transition accelerates". I'm not so sure.

There is further bad news on costs. A key part of the premise of moving to positive operating cashflow, is that opex growth would be lower than revenue growth. Today, we learn that opex growth will be <15%. OK, but renvenue isn't expected to grow. What?

There is an effort to point to $8,2m of contracted ARR which is yet to reach the "first productive use" milestone. True, that is material in the context of the gap between FY23 revenue and forecase FY24 revenue. Further, if much of that revenue is activated in H2 FY24, its revenue impact in FY24 will be modest and it will contribute materially to FY25.

But that's the problem with the growth treadmill. My investment thesis is predicated on $M7T maintaining >20% revenue growth with growing operating leverage. So a year of going backwards, makes the challenge for the next year even harder. As you will see from my threads on this firm over the last 1-2 years, I have been on watch on this factor. Today, the double-whammy of lower revenue and higher costs has pushed me over the edge.

Divestment Decision

Today, I lost my remaining conviction in my thesis for $M7T. I sold my entire RL holding (during my lunch break between classes). While I understand the critical importance of supporting the FY24 renewal program, today $M7T have indicated to me that they might not be able to simultaneously renew AND grow.

I'm disappointed to have to have exited this business. There is still a long way to go for imaging operations to transition to the cloud, particularly outside the US. I like Mike Lampron, as he is a matter-of-fact CEO, who isn't unduly promotional and historically sets targets his team can outperform.

This might well be a bad decision. With a solid year of renewals in FY24, FY25 might turn out to be a stellar year in new business growth as new accounts come back into focus. However, I am not convinced.

To be honest, I've had the feeling for a while that $M7T isn't going to meet MY expectations at the more speculative end of my portfolio. I need to see strong, sustained growth and cost control leading to operating leverage.

Overall, this was a minor capital loss, but today I have called time.

Disc: No longer held in RL; Held in SM

For the record, my SM order didn't clear as I set a price limit of $0.73 which the SP has sunk below by close. I'll have to figure this out in due course - but I no longer hold $M7T in RL, which is unique in my SM portfolio. In future, I think I'll not set price limits in SM for trades executed in RL. Today, I had to go back into class, so I didn't know until 5pm that the RL trade had cleared. However, the SM portfolio isn't real money, and I do try to maintain my SM portfolio as a reasonable reflection of the higher risk part of my RL portfolio.

31-October-2023: M7T-Q1-FY2024-First-Look-Wilsons.pdf

01-November-2023: M7T-Utilising-X-ray-vision-Wilsons.pdf

Page 1 from the "First Look" update:

...and Page 1 from the "Utilising X-ray vision" update (one day later):

Disclosure: I do not hold M7T shares.

Imaging software firm $M7T presented their results today. There were no material new disclosures, given that we get quarterly 4C reports and presentations.

Their Highlights

- Record sales orders of A$40.3M (TCV), up 21% on FY22 and exceeding the A$36M FY23 target

- Record Revenue of A$30.1M, up 11% on FY22; recurring component up 22% on FY22

- NPATA of A$7.2M, up 61% on FY22; NPAT of -A$1.0M, a 75% improvement on FY22

- CARR A$20.6M as of June 2023, up 19% on June 2022; CARR of A$24.8M in July 2023

- ARR run rate A$17.0M as of June 2023, up 18% on June 2022; ARR of A$17.7M in July 2023

- Cash on hand of A$25.9M at 3 July 2023, up on A$25.7M at 30 June 2022

- Management restructure confirms CFO and creates COO; Board renewal process commenced

- Significant contract wins with new customers Akumin, Nuvodia, St Paul’s HK, Veterans Health Administration and Diagnostic Imaging Associates signed in the last 12 months

- Strong start to FY24 with over A$15.4M TCV of sales orders and a large renewal program

Further Details from the Presentation

FY24 Outlook

CEO Mike Lamprom provided a more detailed outlook than I recall previously:

- 20% sales order growth

- 15-25% revenue growth

- Lower opex growth than revenue growth

- Cashflow positive in FY24

An important feature of the outlook is that FY24 is a big year for renewals. $31m in contract renewals are due in FY23, and Mike indicated that this is on a current contract basis, and does not represent the potential for price increases. In Q&A he said he did not consider any of these contracts to be at risk. On churn, he indicated that only two small customers did not renew in FY23.

Given the amount of expected renewing TCV in FY24, $31m vs $5.3m in FY23, there was a Q&A discussion as to whether the 20% sales order growth was a soft target. Mike batted this away by saying that this is what they have expected to achieve on average each year over several years, and stated that of course they hoped to exceed that level of sales. (He couldn't have come any closer in my opinion to saying that he agreed with the question and expects to outperform!)

Revenue

While on the face of it the midpoint of the 15-25% revenue growth outlook range is essentially the same growth rate as the FY23 target, the FY23 target was stated as 20% growth on the FY22 Target. But because actual FY22 revenue exceeded target significantly, they were able to beat the FY23 target with only an 11% growth in revenue.

As stated, this year's target implies 15-25% revenue growth on FY23 revenue. So it is actually a step up. All that said, FY23 revenue of $30.1m was a miss against consensus (n=2) at $31.9m. And the outlook range for FY24 guidance of $34.6-37.6m compares with the current consensus of $38.9m.

There was of course a lot of excitement a few months ago with the VHA deal (especially the prospect of the material Phase 2). However, Mike pointed out that this would not go live until June-24 and therefore will not contribute materially to FY24 (as it is a subscription model). Of course, it follows that it will make a significant and full year contribution in FY25 - so it is good to have that locked in.

EBITDA

EBITDA was another miss vs. expectations and, at $1.7M, was down on FY22 at $2.8m. MIke put this down to some priority "cost investments" late in the year. In Q&A he clarified that these were for cyber security and labour.

Indeed, operating expenses grew at 19%, which is not great when your revenue growth 11%.

NPAT

NPAT was -$1.0m, a significant improvement from -$4.2m in FY22, down to increased income tax benefits.

Cash Flow

Free Cash Flow for the year by my estimation was -$3.2m a reversal of $6.0m positive in the prior year. Of course, given the 4C reporting this was not news, and it reflects the lumpiness in the $M7T business, which is only 60:40 recurring:capital sales.

The outlook was to be cashflow positive in FY24. And with cash on hand of $25,9m at 3 July, actually up on end-FY22, cash is not a concern.

Operating Leverage

Given the modest revenue growth in the year and the cost increases, Q&A inevitably turned to operating leverage. $M7T is wallowing around at the inflection point and not exactly blasting through. Mike made clear that opex would grow slower than revenue in FY24, pointing to progress on EBITDA and NPAT. (Might we see a statutory profit in FY24?)

My Key Take Aways

The result was OK - nothing exceptional. And the guidance is OK, if a little soft on the expected sales side, given that Mike reported that the sales pipeline is strong.

Unlike pure SaaS players in the space, unpicking $M7T results each year is a challenge given the mix of capital and recurring revenue, and therefore it is important not to over-react in either direction in pcp comparisons. Overtime, the model is trending to high subscriptions, but they maintain the strategy of allowing customers to buy in a way that suits the customer. Fair enough.

What is keeping my interest is the progress in FY23 and the first weeks of FY24 to land significant contracts with new customers (Akumin, Nuvodia, St Pauls HK, VHA and DIA). The product is highly ranked in KLAS and customers are, for the most, part renewing.

The SP is undemanding, however, my conviction is not strong enough to increase my position and so I am a hold.

If the strong base of renewals can be delivered, and if news sales outperform, then I still think $M7T can be interesting and am prepared to give it time. It is a slow burn and with Mike I always feel that I am getting a clear and factual account without any gloss.

Disc. Held in RL and SM

After a promising set up, the post-4C price action has not been good.

Shares have now settled back into the range they broke out of, after rallying close to overhead resistance at $1 (the high was around 96c).

So back in the doghouse until there are material fundamental developments again (or the price starts moving ahead of those developments, as often tends to be the case especially in small cap land).

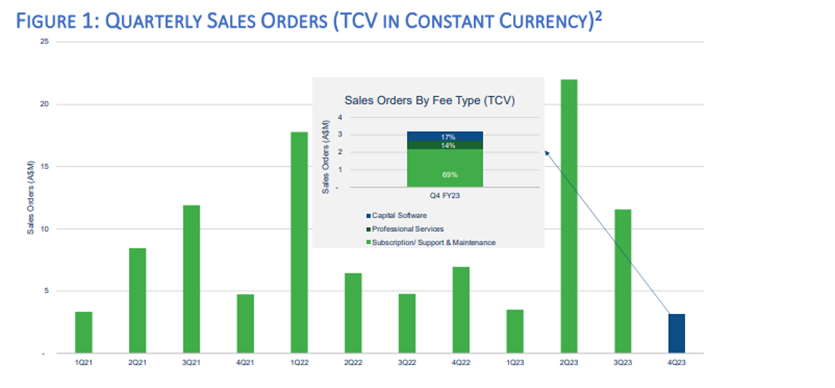

$M7T reported their 4C today and I attended the investor call.

Their Highlights

- Q4 FY23 sales orders of A$3.2M (TCV ) bringing FY23 sales orders to A$40.3M, up 21% on FY22 and exceeding FY23 target of A$36M

- Contracted Annual Recurring Revenue (CARR) steady at A$20.6M as of June 2023

- Annual Recurring Revenue (ARR) run rate largely unchanged at A$17.0M as of June 2023

- A$23.4M cash on hand at Friday, 30 June 2023 plus customer’s A$2.5M electronic payment advice bringing cash on hand to A$25.9M at Monday, 3 July 2023; (A$19.4M at 31 Mar 2023)

- Management restructure elevates David Madaffri to COO; confirms Dyan O’Herne as CFO

- Strong start to Q1 FY24 with over A$15.4M TCV of sales orders secured

My Analysis& Observations from the Investor Call

Contracts

Overall, it was a soft Q for $M7T contract wins but quite strong from a CF perspective. Recent SP advance has been due to announcements made following the close of the reporting period of the Phase 1 of the Veterans Health Administration (VHA) contract (A$11.7m) and the Diagnostic Imaging Associates a$3.7m 5-year contract.

The chart below shows the lumpiness of $M7T’s contract wins and, I suspect, this morning’s 11% SP drop at time of writing is a response to that, after the kicker following the recent contract win announcements.

It is at this moment that I reflect just how funny the market is. On their own, the individual wins, or periods of few wins, say nothing about the fundamental value of this business. You have to zoom out and look at the bigger picture. (Ok, so I admit to maybe feeling a little $3DP-exit regret. We are all human. But perhaps that case illustrates the same point.)

Looking forward, this lumpy story will continue, because one month in to 1Q FY24, they’ve already contracted for $15.4m, making 1QFY24 already their second strongest 1Q and 3rd strongest Q ever. And there are still 60 days to close more contracts, with America now back to work after the summer holidays!

Mike stated that several of the contracts had seen volume-based revisions. The example he gave was that a customer who has a contract for 100,000 studies per year and hits 105,000 within the period, has to purchase a licence for a further 15%, to take their contract up to 115,000. In this way, organic growth within existing customers drives $M7T revenues. He noted, however, that not all customers are winning, and some of the recent contract revisions has been from customers experiencing reducing volumes.

Cash Flow

Once more, they came close to achieving cash flow neutral for the year, citing a late receipt against the payment schedule of A$2.5m (received on 3 July) meaning they just missed the goal. (Our good friend Claude Walker had a go at Mike asking if they’d missed opportunities to report this earlier, which Mike batted back saying that the payment was expected on time, and was just a few days late. Storm in a teacup, I think, Claude.)

Again, zooming out I plot my usual CF trend analysis, with the trends calculated on the last 8Q.

You can see the favourable trend in OpCF by the clearly different slopes of the Receipts and Payments line. The trend on FCF is also positive, and now in cash generation territory. (Note that the acquisition investments in 2021 are now outside the trend window.)

Outlook

Mike has once again set expectations for FY24 of 20% top line growth. He reported that the sales funnel provides 3X coverage of the target. He also commented that more of the pipeline was for two-product sales, whereas two years ago, the majority was for single products.

There was some discussion about prosects in Asia and Middle East, as these have been discussed previously over the last year with no recent newsflow. Mike confirmed that there were multiple prospects in HK, Singapore and Middle East and that he expected to see more of a contribution here in FY24 than in FY23.

On staffing, costs appear well controlled. Headcount has risen to 96 from 87 a year ago. That’s an increase of 13%, with the top line growing at 20%. In terms of further staff growth, Mike indicated that they are focused on delivering an excellent customer experience and will staff up ahead of demand, to ensure that staff working on deployments have the required product and system knowledge. He said the management are about to meet to finalise FY24 plans. My interpretation is this means that the recent contract wins and, in particular, the transformational VHA contract will require additional staffing.

VHA Contract

The discussion yielded some important insights about the recently announced VHA contract, which has a first phase worth A$11.7m, and a second phase with a potential to increase the TCV to $59.6m, which far exceeds any contract won to date.

- $M7T will integrate products from several providers, covering the prime vendor, IT infrastructure, cloud services and AI analytics. $M7T has undertaken integrations with (at least some of) these vendors before, which lowers execution risk.

- Year 1 will focus on the phase 1 deployment

- Once Phase 1 deployment (and presumably performance) milestones are met, the contract can proceed to Phase 2. This is important, in that Phase 2 does not need to wait until the 3-year term of Phase 1 is completed. Indeed, Mike indicated that Phase 2 could start soon after the successful deployment.

- The VHA NTP program can be opted in to by the many service providers and centres within the VHA. These are autonomous organisations which make their own decisions about PACS procurement. Mike commented that many have legacy PACS that will roll off contract in the coming years, and he believes that with M7T being the exclusive provider to the NTP, then M7T is well-positioned to replace existing PACS at the renewal point. He stated that they were very much focused on doing just that.

- Mike also pointed out that this program could potentially lead to analogous programs in other public health services. He cited the Defense Department and Indian Affairs. Clearly, these would be separate, competitive processes, however if M7T can demonstrate success in the VHA contract, then that would be an important calling card.

Competition

In the Q&A Mike indicated that $M7T (eUnity) and $PME (Visage) were starting to compete for contracts. He explained that Visage started out focused on the radiologists’ work flow, whereas eUnity focused on connecting radiologist and other healthcare professionals outside the walls of the centre with a zero-code solution. Over time, he commented, each has developed the functionality of their product to be able to do more and more of the competitor’s offering.

Market Development

Mike re-iterated a comment made on previous calls that he saw tailwinds in the demand for solution in outpatient (ambulatory) imaging services for which $M7T’s products are advantaged. He cited market research which pointed to this moving from 40:60 (ambulatory:inpatient) to 60:40 (and maybe even 65:35). There are two drivers. First, the staff shortages of radiologists in hospitals is driving more hospitals to have images read externally. The second driver is insurers, as it is cheaper to have radiologist read images outside the hospital.

My Key Take Aways

This quarter was a soft result and, over the last two years, although revenue is growing above the 20% p.a. level (Mike would not be drawn on FY23 Revenue, so we’ll have to wait a few weeks), $M7T has been making slower progress on contract wins within FY23.

This explains today’s negative SP response, bringing the SP back to reality after the euphoria following the two recent contract wins at the start of FY24.

To Mike's credit, he focused the results call on the quarter which was unexciting.He didn't do anything to deflect from that. Inevitably, the Q&A focused much more on the recent contracts and the outlook, which is strong.

I am still on the fence regarding $M7T. For me, the thesis is holding together for three reasons:

· Continuing to grow revenue while managing costs;

· Positive benchmarking with other industry solutions (KLASS customer surveys);

· Periodic news flow on larger contracts (>$2.5m), with VHA a gamechanger.

At a multiple of EV/EBITDA (FY25) of 12x, $M7T is very good value within the sector. The lower multiple is a direct consequence of the more lumpy deal flow and cashflows. Over time, as $M7T grows, this should become less and less of a problem, and earnings quality will improve.

However, as the imaging software space becomes more competitive among the market leaders, it remains an open question whether $M7T can continue to win more of the larger deals. With a strong pipeline of 3x what is needed to grow top line at 20%, FY24 should help answer the question. The VHA deal is, however, a gamechanger. If $M7T can will more of these programmatic deals for large services, then it would certainly deserve a closer look (i.e., a bigger position).

For now, I continue to hold.

Disc: Held in RL (2.0%) and SM

Mach7 Technologies Limited (ASX:M7T), today announced it has signed a new five year licence agreement with DIA (Diagnostic Imaging Associates). Mach7 will provide its eUnity Diagnostic Viewer solution to DIA for general diagnostic interpretation and mammography diagnostic reading.

The contract expands the use of eUnity beyond an original 75,000 annual study agreement for mammography remote reading to a licence covering the full spectrum of eUnity’s diagnostic tools for 1.2 million studies annually, a 16-fold volume increase. The new contract has a TCV of A$3.7 million and will add A$0.64 million to ARR.

CEO and Managing Director of Mach7, Mike Lampron said “Market research continues to evidence a dynamic shift in where and how patients want to receive healthcare. This is amplified by the tightening of reimbursement rules by North American payers for non-emergency imaging due to the additional price tag placed on imaging by acute care providers. DIA represents a large, growing practice that is benefiting from the shift in diagnostic imaging from acute care to ambulatory settings and we are delighted to now provide its 70-strong radiologist practice with the full functionality of our zero-footprint eUnity Diagnostic Viewer.”

This is another medtech name that has been a laggard for a while, and is now gaining legs after the VHA contract announcement.

Technically, there has been good follow through, and the price has punched through a couple of resistance levels (which have held in the past couple of attempts) to sit at a new 52w high. Looks promising. Significant overhead resistance does exist around $1, and also at $1.20-25.

MACH7 (ASX:M7T) TO PARTICIPATE IN U.S. VETERANS HEALTH ADMINISTRATION’S NEXTGEN PACS ( Picture Archiving and Communication System) PROGRAM

The possible Total Contract Value of full Phase I implementation is A$11.7M and there is the potential to increase to A$59.6M with Phase II

I see this as an exciting step-up change in the type and size of client contracts being assigned to M7T.

Mach7 Technologies Limited , has today announced its participation in the U.S. Veterans Health Administration’s (VHA’s) National Teleradiology Program (NTP). As part of the contract, Mach7 will provide its VNA and eUnity Enterprise Diagnostic Viewer solutions which will help form the core of the NTP NextGen PACS architecture.

The VHA NTP is Veterans Affairs’ in-house teleradiology service which has been providing 24x7 service to VHA facilities for over a decade. The NTP currently supports 125 sites across all 18 Veterans Integrated Services Networks (VISNs) and is projected to interpret between 1.0 and 1.5 million studies annually.

The NTP seeks a best of breed, next generation PACS (“NextGen PACS”) that is designed, deployed, and optimised for its teleradiology workflow and reading environment. The system will also serve as a replacement PACS for VISNs as they transition off existing contracts.

The NextGen PACS program involves two major phases. Phase I will see Mach7’s VNA and eUnity viewer solutions form the core of NTP’s NextGen PACS. This phase has a potential TCV of A$11.7 million with a 12 month implementation/Professional Service fee period then a fee per study subscription license over a three year term. Phase II, which is contingent upon a number of success factors in Phase I, involves expansion into Veterans Affairs’ hospital network to support up to seven VISNs with migration, integration and software representing additional potential TCV of A$47.9 million over a five year term.

Mach7’s participation in the project is as one of several subcontractors to the prime vendor, Frontier Acquisitions, LLC

$M7T Signed up 22 hospital Adventist in Jan 2021 for a $7.9m contract, with $2.4m of inital order covering 7 hospitals.

Today, further orders totalling $7.1m for remaining 15 hospitals are announced, indicating to me that the contract size has grown.

In any event, this is good news - an existing customer cotninuing to roll-out the full offering after having implemented in a first wave of hospitals.

Full text of announcement follows.

ADVENTIST’S FINAL DEPLOYMENT PHASE BEGINS

♦ Existing customer, Adventist Health System, orders Mach7 PACS1 for remaining 15 contracted hospitals

♦ Latest hospital orders have Total Contract Value (TCV) of A$7.1 million2

♦ Capital contract expected to contribute A$3.0 million to revenue in FY23

Mach7 Technologies Limited (“Mach7” or the “Company”) (ASX:M7T), a company specialising in innovative medical imaging software solutions, is pleased to announce that existing customer, Adventist Health System/West (“Adventist Health”), has signed sales orders for the remaining 15 contracted hospitals that are yet to deploy Mach7’s PACS. A contract regarding Adventist Health’s PACS replacement program for its 22 hospitals was announced in January 2021. The initial, overarching agreement was valued at over A$7.9 million and included A$2.4 million of sales orders for the first seven hospitals. The remaining order forms for 15 hospitals have now been received and have a value of A$7.1 million including scope expansion.

The Adventist Health PACS solution involves the Mach7 Enterprise Imaging Platform, eUnity Diagnostic Viewer, Mach7 Universal Worklist, Mach7 QC Module and Mach7 Clinical Portal. The capital contract covering the 15 Adventist Health hospitals is expected to contribute A$3.0 million to revenue in FY23. Headquartered in Roseville, California, Adventist Health is a faith-based, non-profit integrated health system serving more than 80 communities on the West Coast of the United States and in Hawaii. Founded on Seventh-day Adventist heritage and values, Adventist Health provides care in hospitals as well as in clinics, home care agencies, hospice agencies and joint-venture retirement centers in both rural and urban communities.

Mach7’s Chief Executive Officer, Mike Lampron said: “We have developed a strong and collaborative partnership with Adventist Health over the last few years and we are delighted that its enterprise imaging growth strategy will soon be fully realised. Our implementation and support teams have delivered high quality outcomes for the hospitals in the initial deployment phase, and this positive experience has helped accelerate the rollout program to cover the entire Adventist hospital network.”

Disc: Held RL (1.3%) SM (6.7%)

Major Contract Timeline

· January 2023 Akumin Total Contract Value of ~$16.7m 10 year term. Largest customer contract in Mach7’s history. Entire Enterprise Imaging Platform including its Vendor Neutral Archive (VNA), eUnity Diagnostic Viewer and Workflow Applications to provide a true cloud-based, enterprise-wide imaging and informatics solution. Headquartered in Florida, Akumin is a national leader in comprehensive outpatient radiology and oncology solutions and a partner of choice for U.S. hospitals, health systems and physician groups. Akumin provides fixed-site outpatient radiology and oncology services through a network of 234 owned and/or operated centers; a mobile division with 300 semi-trailers; as well as outpatient radiology and oncology solutions to approximately 1,000 hospitals and health systems across 48 states. https://www.asx.com.au/asxpdf/20230103/pdf/45kbnyvyzqn0p7.pdf

· December 2022 Nuvodia Total contract value of ~$2.5m over five year term. The agreement with Nuvodia involves Mach7’s entire Enterprise Imaging Platform including its Vendor Neutral Archive (VNA), eUnity Diagnostic Viewer and Workflow applications to provide a true enterprise wide PACS solution for healthcare providers. Headquartered in Spokane Washington, Nuvodia is a national IT and radiology service provider that creates, manages, and supports mission-critical IT environments. Nuvodia has a long history of providing enterprise-class technology solutions to independent radiology practices, outpatient imaging centres and community hospitals. https://www.asx.com.au/asxpdf/20221220/pdf/45k0b2820ws5jb.pdf

· November 2022 St Paul’s Hospital Hong Kong, $1.52m one year contract - agreement with St. Paul’s Hospital involves Mach7’s entire Enterprise Imaging Platform including its Vendor Neutral Archive (VNA), eUnity Diagnostic Viewer, Universal Worklist and additional workflow tools together with Support and Professional Services. St. Paul’s sister hospital, St. Teresa’s, is an existing Mach7 customer. https://www.asx.com.au/asxpdf/20221125/pdf/45j1ktvz2pdmx0.pdf

· June 2022 Cabell Huntington A$2.8m five year agreement. Renewal has converted from a five year capital term license to a subscription based volume license with potential upside based on volume expansion. https://www.asx.com.au/asxpdf/20220621/pdf/45b39s59v8888w.pdf

· September 2021 Trinity Health announced it has received purchase orders for its Mach7 Enterprise Imaging Platform, eUnity Diagnostic Viewer, eUnity Enterprise Viewer, and Mach7 Universal Worklist from Trinity Health (“Trinity”). These initial purchase orders have a combined value of $3.6 million for software and services which is expected to be recognised this financial year. Following the software being deployed in the live environment at Trinity, these orders will contribute a further $3.8 million in support fees over the next seven years, taking the total contract value of this initial order to $7.4 million. These orders follow the 7-year contract Mach7 signed with Trinity for the eUnity Enterprise Viewer, announced to ASX on 13 November 2020. https://www.asx.com.au/asxpdf/20210928/pdf/450yv2vghhvwpv.pdf

· August 2021 St. Luke’s, Boise, $443K for first year for eUnity universal viewing solution. The contract has the option for annual renewals of $389,000 per year for an additional five years. St. Luke’s Boise is Idaho’s largest health care provider and the flagship of St. Luke’s Health System. https://www.asx.com.au/asxpdf/20210803/pdf/44yyzmkcg69n54.pdf

· July 2021 Adovocate Aurora Health $4.3m initial five year support term. It has licensed its eUnity universal viewing solution to AAH. AAH now utilizing the full suite of Mach7 solutions. The contract provides for volume expansion pricing and the ability for AAH to extend the initial term at agreed pricing. https://www.asx.com.au/asxpdf/20210719/pdf/44ydzffjb15417.pdf

· May 2021 University of Vermont Medical Centre $730k of subscription fee revenue over five years with potential upside if contractual minimum annual imaging procedure volumes are exceeded. UVM previously purchased a license to the Mach7 Enterprise Imaging Platform (EIP) in 2017. Today its added eUnity Viewer. https://www.asx.com.au/asxpdf/20210506/pdf/44w821tx99w9ts.pdf

· January 2021 Adventist Health A$7.9m Five year contract (support and maintenance). Mach7 initially contracted with Adventist in April 2020 to provide its eUnity Diagnostic Viewer and Mach7 Universal Worklist to Adventist Health Tulare, one of the hospitals in the Adventist Health network. Today, Mach7 (via its subsidiary) has signed a contract amendment with Adventist Health to provide its full PACS solution, including the Mach7 Enterprise Imaging Platform, eUnity Diagnostic Viewer, Mach7 Universal Worklist, Mach7 QC Module, and Mach7 Clinical Portal. The Mach7 PACS solution is part of the Adventist PACS replacement program which is being rolled out across all 22 of its hospitals. https://www.asx.com.au/asxpdf/20210125/pdf/44rzlqq2h0r1xx.pdf

· November 2020 Trinity Health (USA) A$5.26m, 7 year contract for eUnity Enterprise Viewer. Trinity is the fifth largest healthcare Integrated Delivery Network (IDN) in the USA. This contract will see Mach7s eUnity enterprise viewer being installed across 92 hospitals located across 22 states.https://www.asx.com.au/asxpdf/20201113/pdf/44ptt54wljtk24.pdf

· May 2020 Hamad Medical Centre in Qatar, $840k p.a. top provide continued support for its enterprise imaging platform. This renewal contract represents a 25% uplift (per year) to previous annual support agreements. Mach7’s Enterprise Imaging Platform currently manages more than 230 million images for HMC, which constitutes over 90% of Qatar’s clinical imaging requirements. https://www.asx.com.au/asxpdf/20200520/pdf/44hz7kmnwx8lg0.pdf

· May 2020 Hospital Authority Hong Kong A$4.8m for large purchase order for its software includes a license to the Mach7 enterprise imaging platform, licenses to its partner’s “eUnity” enterprise viewer, and additional Mach7 gateways. https://www.asx.com.au/asxpdf/20200514/pdf/44htj06xgqljnc.pdf

· August 2019 St. Teresa’s Hospital in Hong Kong. Estimated contract value of $950 across a 5 year term. St. Teresa’s Hospital, a private hospital located in Kowloon, Hong Kong. Provide Enterprise Imaging Platform, Universal Worklist, QC Workflow and migration engine to consolidate its existing siloed Picture Archiving Communication Systems (PACS) into a single system. https://www.asx.com.au/asxpdf/20190822/pdf/447r02gwbj6k7k.pdf

· July 2019 Advocate Aurora Health minimum contract value of A$5.7m across a 5 year term. An integrated healthcare network headquartered in Milwaukee, Wisconsin. Contracted to provided its Enterprise Imaging Platform to store and manage images across its healthcare network. Also purchased the migration engine to migrate ~3.5 petabytes of data. https://www.asx.com.au/asxpdf/20190709/pdf/446gznkmpbkl9s.pdf

· March 2019 Sentara Healthcare selects Mach7 for PACS Modernisation. With existing annual support fees, Mach7 will earn a minimum of $850K guaranteed annual subscription fees from Sentara. These subscription fees will increase where study volumes exceed the contracted minimums. https://www.asx.com.au/asxpdf/20190328/pdf/443v8tf9b006y0.pdf

· October 2018 Authority of Hong Kong Initial 5 year term with deal value of A$15m Optional further 5 year term. To provide its Enterprise Imaging Solution. The hospital Authority manages 43 public hospitals and institutions. https://www.asx.com.au/asxpdf/20181029/pdf/43zq2w9j8m3l2h.pdf

· August 2018 Hamad Medical Corporation expands business in Qatar. With new orders expects to recognise revenues from Qatar of at least $1.4m in current financial year. https://www.asx.com.au/asxpdf/20180823/pdf/43xlr3x6x22n58.pdf

· June 2018 Raleigh Radiology expected to generate revenues of at least $1m over the next 5 years. A 5-year term license that includes Mach7 VNA, Communication Workflow Engine, Clinical Studio and iModality. https://www.asx.com.au/asxpdf/20180629/pdf/43w4pd4zhvt3fy.pdf

· November 2017 Sentara Healthcare US$1.8m for data migration project. To manage a data migration of over 20 million imaging studies to Mach7’s Vendor Neutral Archive (VNA) storage solution. https://www.asx.com.au/asxpdf/20171117/pdf/43pb4mqwfc657h.pdf

· September 2017 University of Vermont Medical Centre Multiyear agreement, first year deal value US$1.2m with recurring annual support fees beyond. https://www.asx.com.au/asxpdf/20170922/pdf/43mk33wv081gh8.pdf

· June 2017 RAPA Us Based Radiology Associates, contract value minimum A$1.8m minimum 3 year software licence agreement. RAPA serves the Arkansas community supporting 18 hospitals. https://www.asx.com.au/asxpdf/20170626/pdf/43k5qf7fvw1wkq.pdf

· September 2016 Sidra Medical and Research Centre (Sidra) Doha, Qatar minimum contract value of A$2m plus ongoing annual support. https://www.asx.com.au/asxpdf/20160906/pdf/439zd3z4m5rb3c.pdf

· August 2016 MaineHealth minimum value of A$3.8m 7 year software licence. https://www.asx.com.au/asxpdf/20160818/pdf/439dwp51cdhnwk.pdf

· August 2016 Large U.S University Medical Centre US$800,000 5 year contract https://www.asx.com.au/asxpdf/20160802/pdf/4390yw5mck1v21.pdf

· May 2016 Premier US Radiology Group A$650K P.A. – software being rolled out to 25 sites following a successful pilot program. https://www.asx.com.au/asxpdf/20160506/pdf/43725qy154lg06.pdf

Capital Raises – Raised $71.3m since 2015, Market Cap today at $0.74 is $177.3m

· June 2020 Raises $34.8, Institutional $23.4m, $11.4m Retail at $0.68 per share

· December 2019 Raises $20m via an equity placement at $0.62 per share

· November 2018 Raises $3m via a private placement at $0.20 per share.

· November 2017 Raises $2m via an equity placement to Oceanica Capital Partners at an issue price of $0.175 per share.

· November 2016 Raises $9m via Institutional placement at $0.04 per share

· May 2016 Raises $2.5m via Institutional placement at $0.06 per share

· October 2015 Mach 7 enter into binding merger agreement with3D Medical Limited (3D Medical Raised Capital to buy M7T haven’t included numbers for simplicity)

Acquisitions

· June 2020 Client Outlook Group CA$38.5m (~A$40.8) is a leading provider of enterprise image viewing technology “eUnity”. Provides Mach7 with a full departmental clinical diagnostic Picture Archive Communication System (PACS) solution offering. https://www.asx.com.au/asxpdf/20200610/pdf/44jjd0sw17tkzj.pdf

$M7T released their Q2 FY23 4C today.

Their highlights:

- Record quarterly sales orders of $22.4M (TCV) in Q2 FY23; up 280% on $5.9M in Q2 FY22 (or up 240% on $6.6M in constant currency )

- Record revenue of $18.1M in H1 FY23; up 27% on $14.3M in H1 FY22; positive EBITDA

- Contracted Annual Recurring Revenue (CARR) of $20.0M; ($17.9M at 30 Sept 2022)

- Annual Recurring Revenue (ARR) run rate of $16.4M; ($15.5M at 30 Sept 2022)Increased exposure to high growth radiology outpatient market with new customers Nuvodia and Akumin

- Cash on hand $20.6M; ($21.5M at 30 Sept 2022 )

Discussion Points from the Investor Call

M7T is on track to achieve tageted FY23 reveneue of at least $36.0m, with over 70% of revenue achieved in 1H. This was helped by the recognition of a portion of the revenue from their largest ever $16.7m Akumin contract announced in December

There was a question on the call about the large difference between revenue recognised and cash receipts in the half ($18.1m revenue in H1 vs. $9.031m receipts). This was explained in terms of the recognition of a component of the large contract, and the lag between revenue (a portion of which is recognised on deal signing) and receipts which follow invoicing after the delivery of services and beneficial use. The CFO made clear that they would be working in H2 to achieve receipts from this contract so as to achieve an overall cashflow positive outcome for the year. (Watch this space and progress towards this in Q3.)

CEO Mike Lampron discussed the industry trend for an increase in remote viewing of images by radiologists, citing an industry report that the current trend of on-premises to off-premises viewing of 60:40 is expected to shift to 40:60 over the coming years. Mike considers this a positive for M7T due to its positioning as an off-prem solution (cloud-based SaaS meaning no need for on-prem. software and vendor neutral platform).

Our mutual friend (Claude Walker) asked for more info on last year’s CFO departure. Mike wouldn’t be drawn on this beyond saying that it was a mutually-agreed departure, and that there had been a handover of several months to the new CFO, who has been with the firm for 7 years and understands the business “inside out”. “We haven’t missed a beat” said Mike.

In terms of the sales prospect pipeline, Mike indicated that the Akumin deal was unusually large and that they did not have any more of that scale. He described current prospects as being of “medium scale” for $1-3m CV and “large” for “>$3m” CV and indicating there was a large set of opportunities in front of them, most of which are medium-sized.

My Takeaways

M7T continues to grow, albeit the option for capital sales means that there is a lumpiness in revenues from quarter to quarter. They clearly don’t expect a repeat of furthers contracts of the scale of the Akumin deal, so will need a larger number of smaller deals to sustain growth.

I have updated the usual cash flow trend analysis. The firm is yet to demonstrate a positive trend at the operating cash flow level. That said, as receipts from recent larger contracts flow, we may start to see a positive trend emerging. Management sees the prospect of stronger receipts in H2, which will be needed to deliver a positive cashflow result for the year. Provided this is achieved, then current cash on hand of $20m is a strong position.

For me, M7T remains a small, speculative position and a HOLD.

Disc: Held in RL and SM.

@mikebrisy thanks for the information and also the correction to my numbers for FY23 of ~32 not ~36m.

It has been on my watch list for a while and I decided to take a small 0.5% stake in my real life portfolio. I wanted to take a position earlier. However, there was significant noise out there comparing this to PME so I took a step back to look at the opportunity for M7T should they be able to execute without being blinded by the dream of a 100x opportunity.

When reviewing company info and data the sentence below from the Aug results summary caught my eye.

”The ARR run rate now covers approximately 65% of the Company’s annual operating costs”.

I find this an indication of the potential profitability the company can look forward to should they continue to win contracts and an insight into how management are developing the business.

I had a top up order at 55c from a couple of weeks ago. That's been left hanging now.

Good to see a significant contract. Onwards and upwards!

@NewbieHK My view on the macro hasn't changed much in 4 months and I want to reply by starting that I'm not a fan of Revenue multiples for valuation.

In the case of M7T I resorted to a revenue multiple so that I could calculate some sector comparables with $PME and $VHT as two bookends within which the value of $M7T should reasonably lie.

Rationale:

- $PME now has scale and proven, attractive economics

- $VHT has comparable scale to $M7T and evidence to date is that it can't make money

- $M7T is at the inflection point (CF positive) but not yet at scale

As of today, based on FY23 consensus numbers the Revenue to Market Cap multiples are:

- $PME = 48

- $VHT = 4.2

- $M7T = 5.0

Revenue growth FY22 to FC FY23 are:

- $PME = 26%

- $VHT = 34%

- $M7T = 20% albeit today's announcement offering potential for upside surprise.

So, in answer to your question, I am still comfortable holding a valuation of 10x revenue on a comparables basis.

Moving to an FY23 revenue FC valuation basis of $32.5m, the value per share would increase to $1.36.

I'm not updating my valuation because it is flakey as it is and I'd rather see what the results for FY23 reveal, when I will do an update.

$M7T is a speculative holding for me, but contracts like today's are definitely de-risking the proposition. If we say another large contract in the next 6 months, I'll definitely consider increasing my position.

From a macro perspective, M7T it not burning cash and healthcare sector should do relatively well in a recession. so I see only upside risk to the share price if they continue to execute.

Disc: Held in RL and SM

@mikebrisy thanks for the update. I saw your previous valuation 4m ago of 10x revenue $1.14. Do you think this valuation is still realistic based on the changing investment valuation environment? Todays bump to 67c has it priced at around 4.5x revenue (FY23 ~36m).

M7T signs a $16.7m, 10-year deal with a new customer, with $7.5m revenue to be recognised in FY23.

The deal is M7T's largest to date, and underscores its traction to major providers of outpatient imaging services.

https://app.sharelinktechnologies.com/announcement/asx/15fbcaa2097d5fe69796d11223ec7d1a

Disc: Held IRL and SM

Mach7 Technologies Limited (ASX:M7T), specialises in medical imaging software solutions. Today they announced their first sales order from a new partner, Nuvodia. Pleasingly, the agreement with Nuvodia involves Mach7’s entire Enterprise Imaging Platform.The subscription contract has a five-year term and a Total Contract Value (TCV) of $2.5 million.

Nuvodia is an American IT and radiology service provider of technology solutions to independent radiology practices, outpatient imaging centres and community hospitals.

Under this agreement, Nuvodia will expand its products and services by offering Mach7’s Enterprise Imaging Solution to its customers. Nuvodia selected Mach7 as a partner for its ability to deploy a truly vendor agnostic platform to capture, store, and publish medical imaging data.

Mach7’s zero footprint diagnostic viewer can be used by healthcare professionals inside or outside the walls of healthcare facilities to

provide primary or secondary diagnostic readings.

As part of the announcement CEO and Managing Director of Mach7, Mike Lampron predicted that this partnership agreement will enhance sales and service opportunities for Mach7.

M7T's FY23 Q1 Sales Orders were significantly less than the prior corresponding period. They noted that Q1 is typically a softer quarter for net cash in and gave reasons why However, in their Q1 Outlook statement they were confident of acheiving FY23 sales of at least $36 Million.

So, I'm pleased that this subscription contract with their new partner is for the provision of M7T's complete Enterprise Imaging Platform.

Looking forward to chcking the effect this and other recent contracts have had on Cash receipts for Q2 of FY23.

Mike Lampron, CEO presented last week on the Share Cafe Webinar Micro/Small Cap Hidden Gem Webinar.

The Mach7 segment runs from 20:00 mins to 34:00 mins.

Covers ground from recent FY22 presentation (refer to my recent Straw) in case you missed the Investor Call.

Mach7 is growing streadily across 15 countries. CEO Mike indicated that 2023 is looking like 20% sales /revenue growth. It was cash generative last year.

Mach7 appeared for the first time in the Best in KLAS 2022 Awards, ranking as #2 Universal Viewer (Imaging) and #3 Vendor Neutral Archive. The following report on the 2022 KLAS awards is interesting, as it shows how important the equipment makers are in the imaging software space, and also lists some of the other players to follow.

Three institutional shareholders account for 36% of shares, although as noted by other StrawPeople, insider holdings are low.

Disc. Held in RL and SM

Mach7 Technologies reported their annual results today.

A few words of introduction, as M7T is largely below the radar screen in ASX small-cap world. Headquartered in VT, USA, it was one of many small companies listing on the ASX pre-GFC. So, it is not really an Aussie company at all, and it derives no revenue in Australia.

The CEO is Mike Lampron, an experienced medical imaging software industry executive. Chairman David Chambers was Pro Medicus CEO from 2007 to 2010.

Up front, one of my major concerns is lack of insider shareholding, at only 5%. However, Directors have been buying over the last year, so that’s a positive. I dont really understand the share register, and need to do some work on that.

$M7T is a recent addition to my portfolio (RL and SM). Having done my PhD in imaging decades ago, when I had to write much of my own image processing code (!), I have always understood the great potential for software, integration, and SaaS in this space. I could just never bring myself to pay the $PME SP over recent years, and have been in constant regret. So, $M7T has, in a small way, allowed me to scratch that itch.

In this straw, I want to focus on the recent results, having attended the call this morning. I will start a separate forum for discussion as I am keen for any insights from fellow StrawPeople on M7T. (Maybe @Strawman could put it forward for discussion at Baby Giants?)

The first few slides of the presentation give a really good description of the company for those interested.

1. THE HIGHLIGHTS

- Record sales orders of $33.2M (TCV¹) in FY22; up $7.6M or 30% yoy.

- Record revenues of $27.1M for FY22; up $8.1M or 42% yoy

- Annual recurring revenue (ARR) run rate $14.4M; up 7.5%

- Record cash receipts of $28.2M in FY22; up $7.2M or 34% yoy

- Record positive operating cashflows of $6.3M in FY22; up $4.8M or 320% yoy

- Record gross margin of $26.1M or 96%; up $7.7M or 42% yoy

- EBITDA of $2.8M; up $4.6M or 253% yoy

- Cash on hand 30 June 2022 $25.7M; up $7.4M or 40% yoy

It was worth noting that these were the first results that allowed an organic y-o-y comparison, given that the Client Outlook acquisition closed on 14 July 2020, so was almost entirely included in FY21 results.

2. INSIGHTS FROM THE RESULTS CALL

Business model

$M7T are agnostic as to whether customers choose a capital or subscription-based model. The detailed structure of both models was illustrated, as investors had previously requested clarification. They are observing a trend towards subscription, with 58% of FY22 sales orders being subscription, up from 49% in FY21.

Strong Customer Renewals / Churn Low

Existing customer renewals of $8.0m accounted for 24% of total sales showing that customers are sticking with the platform. Importantly, Mike reported that many of these legacy contracts had been signed at historically low rates, and that it was encouraging that customers saw sufficient value that they accepted the higher rates applying today. Churn was reported to be very low, at <1% of revenue and <2% of customer numbers. With a typical 5-year contract cycle, 8-10 renewals are expected in FY23.

Slide 18 also highlighted significant contract wins during the year, including existing cusomters who are expanding their adoption of Mach7’s modular product suite.

Growth Outlook - Targeting $36m FY23 Sales Orders

Mike emphasised that the targeted +20% growth in sales orders from $30m in $36m should be considered a floor to what would be delivered, given that in FY22 sales exceeded the target to stand at $33.2m and that since the end of June 22, the sales pipeline has already expanded by 30%! Even though it is a oft target that should be readily exceeded, it is good for management to have the confidence to speak externally about their short term targets.

Sales growth was put down to the good performance of an experienced sales team, noting that a new VP Global Sales has been in place for a year and has made several changes to staff to build the sales team.

Mike also commented that the pipeline contained a wide distribution of sales sizes from <$2m right up to larger deals of $5m-$10m (Mt note: more akin to what we are seeing $PME signing).

Industry trends driving growth

Mike noted that from $M7T’s perspective, hospital investment programs have returned to pre-COVID19 BAU. He noted that in the USA, hospital chains are on the move again with M&A, and that this would be a growth driver as their larger customers implemented their systems in acquired hospitals.

Capital Management

Now solidly cash generative, closing cash of $26m and no debt, one of the analysts on the call asked if a share buyback was being considered by the Board. Mike responded that the Board wanted to keep a strong balance sheet and that they wanted to maintain the capacity for further bolt-on acquisitions, if the right target was found. In addition, they want to maintain a strong balance sheet to be able to continue to invest in the platform.

3. MY KEY TAKEAWAYS

This was a year of solid progress for $M7T, and it is great to be able to review a clean set of results based on strong organic growth. While costs increased driven by staff churn following the acquisition in 2020 (something to monitor), the company moved significantly forward in FCF generation. If they can achieve the 30% targeted sales growth in FY23, then we should be able to get a good handle on the quality of operating leverage for the company into the future.

I don’t have a sufficient understanding of $PME to understand how $M7Ts offering lines up against it. This is something for the “to do” list. But with over 6,000 hospitals in the USA and 15,000 in Europe, and many, many more specialist imaging centres and clinicians that use imaging software, $M7T estimate the global market to be $2.bn. So, it sounds like there is an opportunity for several quality firms to grow for some time.

Litigation

For almost two years, $M7T has been subject to patent infringement litigation. The litigation was recently dismissed by the District Court of Delaware, but the dismissal has been appealed. There was no reference to this on the call today, and I can’t find any reference to it in the annual report, so they don’t appear to be burning material legal fees on the defence.

Valuation

As with nearly all tech, the SP has taken a beating this year, sitting this morning at $0.67 down from a high of $1.59 in Feb 2021. However, not only does M7T have good positive OpCF at $6.4m, up from $1.5m in FY22, they also generated just under $6m in FCF.

The current value is undemanding at <6 x revenue, particularly given that M7T now appears to be solidly cash generative.

Prior to today, broker estimates are $1.20 and $1.34 (mean of $1.27). At $1.27 this would represent a valuation of 11 x revenue.

(Comparables: Other imaging stocks $PME is 47x at one extreme and $VHT at 4.72x at the other).

There is a world of difference between $VHT (which can’t make money) and $M7T (which can). So , I will put a SM valuation of 10x revenue, as a placeholder.

My Holdings and Future Strategy

Prior to this morning I held a 1.4% holding IRL, which I have now increased to stand at 2%. That is an upper limit for me for a company with this risk profile. I need to do more work to understand the company, its history, management, and the Board. However, it looks to be a good quality, global, medical software.

Disc: Held RL and SM

A pretty handy set of numbers released by M7T today. Considering the bloodbath on the broader market, any form of green next to your price means you're having a good day. The trend towards subscription away for licencing appears to be accelerating too

Mach7 have announced a 5 year renewal of an agreement with Cabell Huntington Hospital for a total value of A$2.8m. It's a small amount, but has changed to a subscription based volume license. As the CEO implied, there is increasing appetite for transition to subscription model which may lead to some short term anomalies but will provider greater consistency over the medium to long term.

Mach7 Technologies released their 3Q22 cashflow and business update.

- Q3 Sales Orders rose $4.4M (TCV) to $26.5M FYTD; on track to deliver Sales Orders of $30M (TCV) for FY22

- Record FYTD Revenue of $21.2M; up $7.8M or 57% on last year

- Record FYTD EBITDA of $3.2M; up $4.7M or 306% on last year

- Net positive operating cash inflow for Q3 of $0.5M

- Cash on hand increased to $20.6M; up from $20.3M on 31 December 2021

- Contracted annual recurring revenue (CARR) of $16.8M; up 6% (or 24% annualised) on 4Q21 ($15.8M)

- ARR of $13.4M, with additional $3.4M of CARR expected to convert to ARR in FY23

The sales order in particular was a highlight for me, with them being on target to deliver 30m for FY22. I also thought the briefing update pained a positive picture on IT spending & how it might lead to future sales. In particular the new relationships with AdvaHealth and Althea was positive. I think it trades on a attractive range of multiples compared to peers, but will update my valuation later.

M7T Q2 FY22

Highlights

- Sales orders rose $5.9m (TCV) or 37% to 22.1m in the quarter

- Record FYTD sales orders $22.1M (206% on year)

- Record FYTD Rev $14.3M (102% on year)

- Contracted ARR of $16.8M (24% annualised)

- $20.2M Cash on hand

I like to keep tabs on M7T due to it's similarities with PME but have always struggled with how lumpy some of the quarterlies are. Current ARR is forecast to come in at $13.5m for the FY and with a market cap of $163m it's not the most demanding given the high margin and growth nature of the business. Operationally the business is cash flow positive which in the current market is beneficial, think I'll do some more work on this.

Mach 7 (ASX Code M7T) has landed several major sales orders this quarter, which total $16.2 million. This has been their strongest quarterly sales order result on record and it is up by 368% on the prior quarter. As a result, their sales have already reached 63% of last year’s full year orders of $25.6 million. A revenue result for the full year FY2022 well above the $19 million reported for FY2021 is looking extremely likely. They are on track to deliver a positive EBITDA result for FY2022.

Trinity Health Purchases License to Mach7's PACS Solution

M7T has received a PO of $3.6m for their software and services (to be recognised this FY)

A further $3.8m in support fees expected to be recognised over the next seven years.

M7T is one I've followed for a while as I searched for the next PME. They're currently trading on a12x Trailing Rev ($19m) multiple which isnt the most demanding in the current market but M7T is still a long way from being the next PME.

This is an important step in the right direction for M7T and deserves a closer look.

Mach7 updated the market with another solid result. Revenue up 95% to ~ $25M with ARR doubling from $6M to $13.4M ($2.4M to recognise in FY22).

Mach7 is transparent in the win rate of FY20 $40M sales pipeline:

- Won 32% ~ $13M.

- Lost 17% ~ $7M

- Expect to win 30% ~ $12M

- Delayed tenders 21% ~ $8M

The main issue with the business is revenue fluctuation by the nature of the capital license business model. Mach7 has a recurring revenue component but it is < 70% of total revenues. Investors hope the Client Outlook integration provides Mach7 leverage to expand the pipeline and improve gross margins.

They have over 150 customers across 15 countries which is really impressive for a small-cap company.

2 sales models - Good thing they broke down the business model.

- "Capital License" or Capex model where fixed revenues are paid upfront and annual support subscription applied for the lifetime of the contract.

- "Subscription License" or SaaS model with no upfront revenues but monthly recurring revenues. Every new customer win added on to the top line.

They are guiding for EBITDA profitability FY22 which is really surprising considering the growing R&D operating expense.

The market size for PACS & radiology is massive at $2.5B which means a lot of healthcare software needs upgrading. Even Promedicus with $50M revenues is a drop in the ocean when compared to the large incumbents (Phillips, GE, Mckesson) with legacy systems. It is good news for both Mach7 and Promedicus as they have time to prove their product to customers and grow. The niche they are occupying will not be disrupted by the large players, as they are too widespread and slow-moving. If anything, we could see them acquire Promedicus and Mach 7.

Mach7 Licenses eUnity Viewer to Advocate Aurora

AAH now utilizing the full suite of Mach7 solutions

Melbourne, Australia; 19 July 2021: Mach7 Technologies Limited (“Mach7” or the “Company”) (ASX:M7T), a company specialising in innovative medical imaging solutions for healthcare providers, today announced it has licensed its eUnity universal viewing solution to Advocate Aurora Health (AAH). The license contract is valued at $4.3 million, which includes a software license fee, professional services, and an initial five-year support term. Of this value, Mach7 expects to recognize $1.5 million - $1.7 million in FY22, with the remainder being recognised evenly from FY23 – FY27. The contract provides for volume expansion pricing and the ability for AAH to extend the initial term at agreed pricing.

AAH currently utilizes the Mach7 Vendor Neutral Archive (VNA) for storage and image data management. This agreement will extend Mach7’s product presence at AAH with the Mach7 eUnity Viewer, which will serve as a universal viewer for multiple departments across the AAH network. The eUnity viewer will also be deployed as a full diagnostic viewer and, in conjunction with Mach7’s Universal Worklist, will serve a back-up PACS solution for downtime occurrences, including planned maintenance and unplanned events.

3 June 2021

From today's presentation:

- Cash on hand $18M, no debt, no capitalized R&D (all expensed as incurred)

- Cash flow positive Q3 YTD $1.2M (FY2020: $4.5M)

- Shares on issue 235.65M, current market capitalization $245M

"... Mach7 competes in all segments of the Radiology IT market, except Standalone RIS & Image Exchange ..."

License fees from:

- Capital License (“Capex”)

- Subscription License (“SAAS”)

Q3FY21 results came yesterday and it did not disappoint

- Cash receipts of $8.2M as most of Client outlook revenues are recognised this quarter compared to previous quarter.

- Positive operating cashflow from operations. In other words capital raises would be for acquisitions not for running the business.

- Cash on hand $18M which is a handy buffer. I believe they still have to complete the acquisition of Client Outlook. Will recheck my notes, it was $40M so it was quite expensive from a balance sheet perspective. To determine whether Client Outlook is a good acquisition is to check how quickly Goodwill decreases every half year. If Goodwill stays the same they have overpaid and my early suspicions would be right.

- They generated $12.84M of new sales this quarter. That is quite astounding as last year (FY20 ~ $10M). One quarter outperformed last financial year.

- They are winning more orders with exisiting customers. Case in point Adventist Health System West:

- Winning Adventist lead to 8 new orders.