Macquarie Technology Group (MAQ) reported last week. I know @raymon68 has already posted the results so this is more for me to journal down my thoughts on the result.

From their presentation:

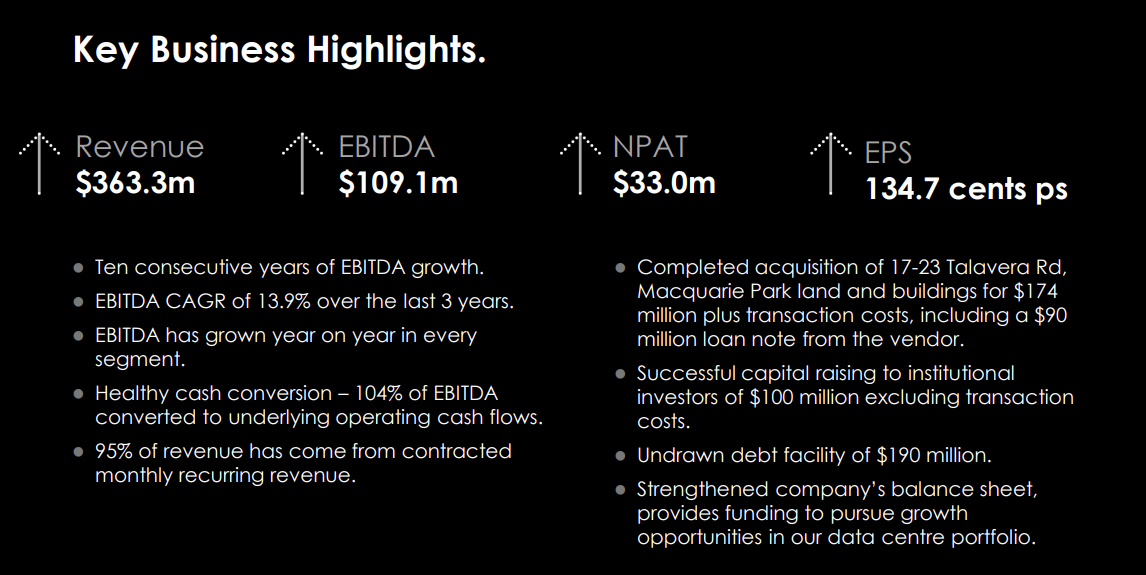

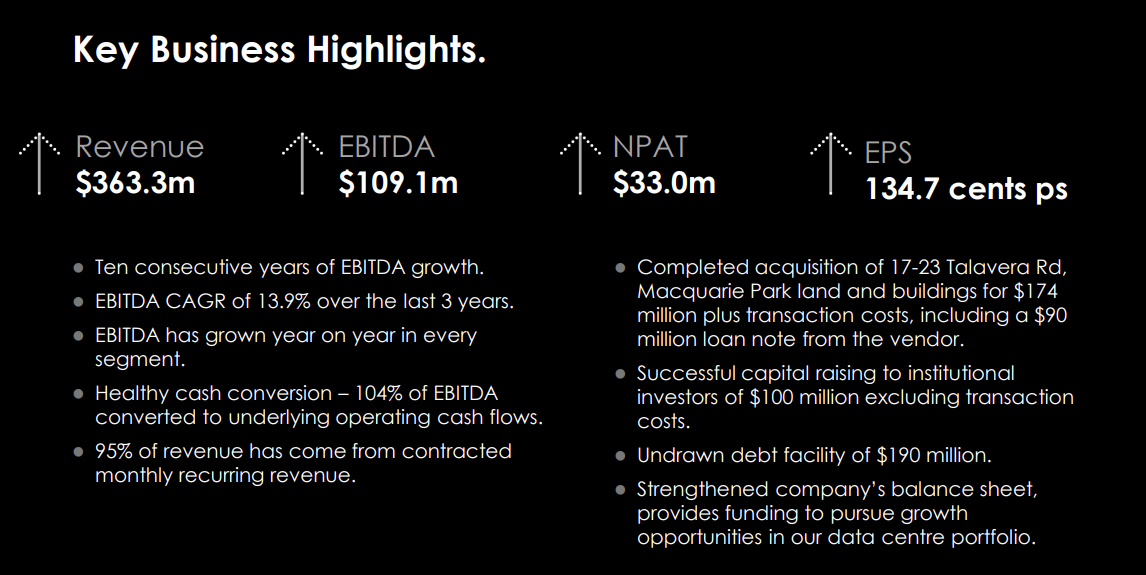

Overall I thought it was a solid result albeit EBITDA was more on the lower end of guidance.

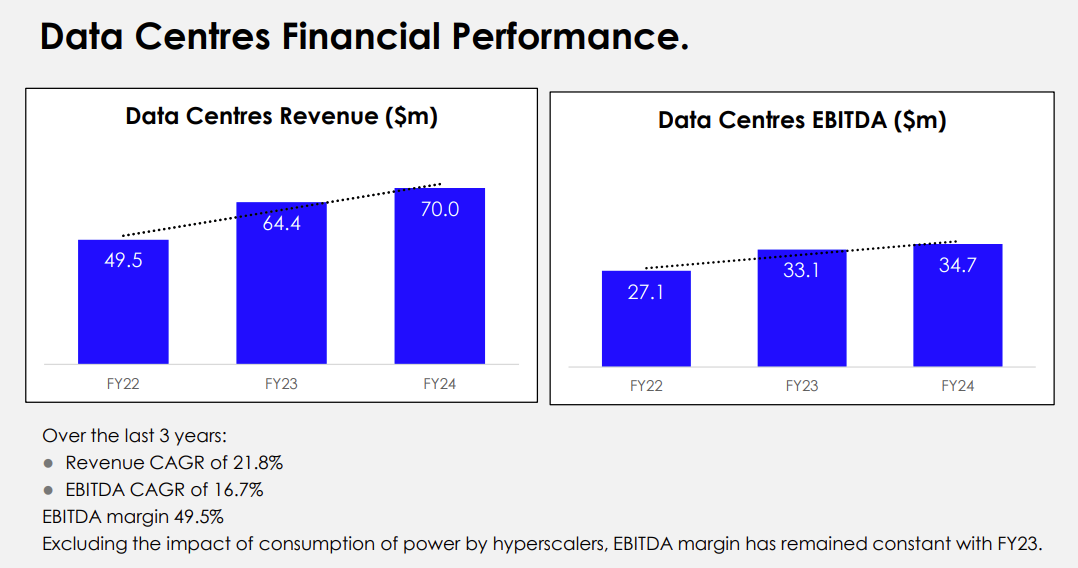

Not much changed from last report. Data Centre EBITDA percentage slightly down on last half.

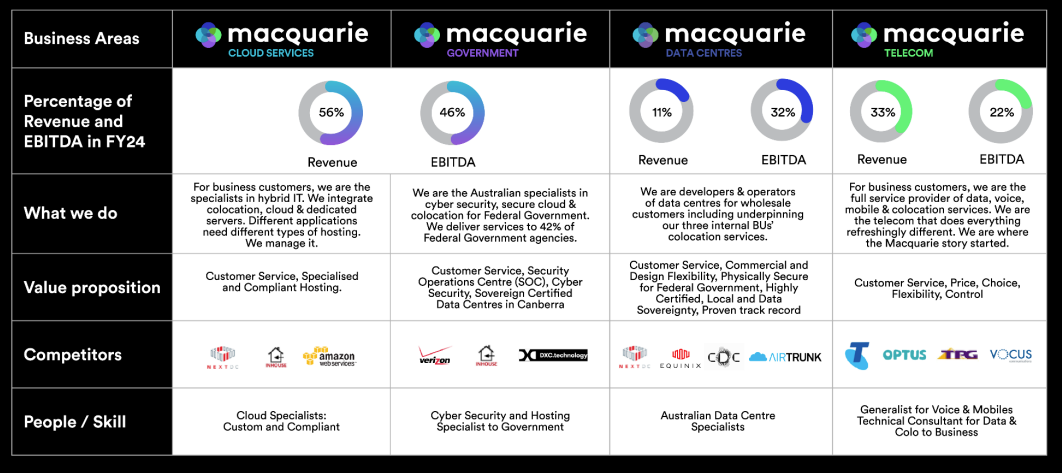

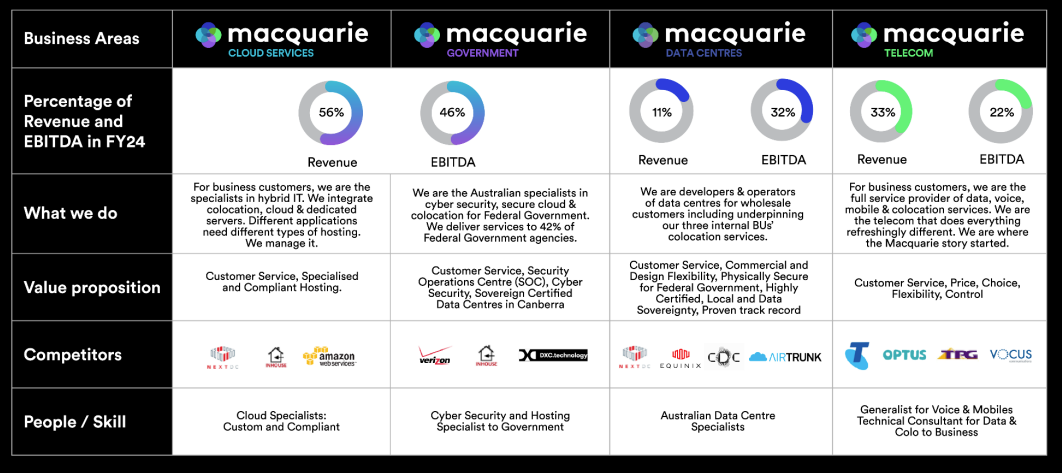

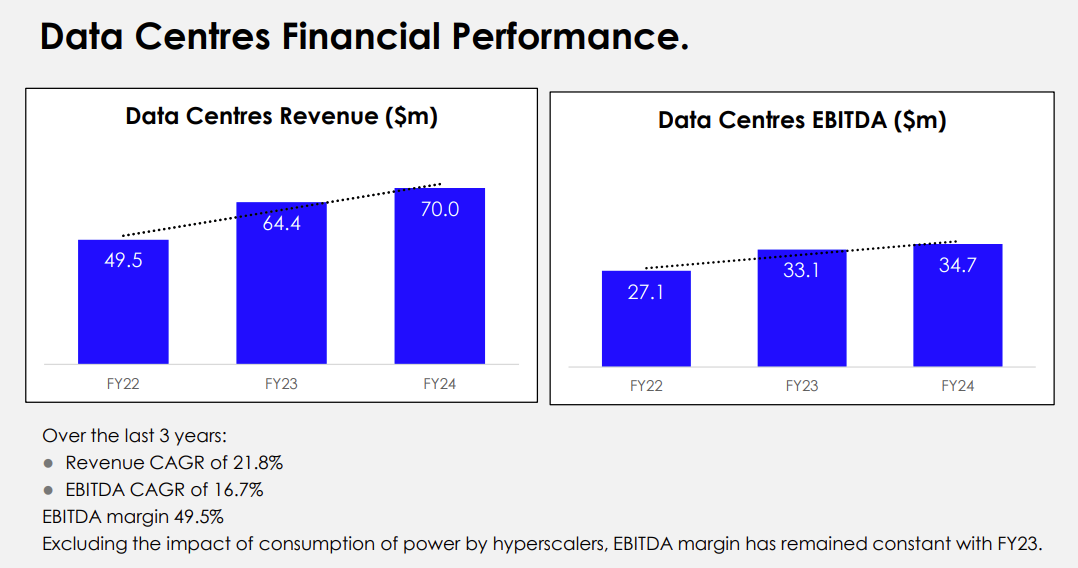

Main thesis for MAQ is the continued growth in its data centre segment which is the segment with the highest margins. MAQ currently has around 23MW of data centre load across 3 sites:

- IC1 (Sydney CBD) = 3MW

- IC2, IC3 east and IC3 super west (Macquarie Park) = 10MW (IC2)+ 8MW (IC3 E)

- IC4 and IC5 (Canberra) around 2MW

Future development of IC3 SW is due to start soon and when complete will bring the total capacity to around 68MW.

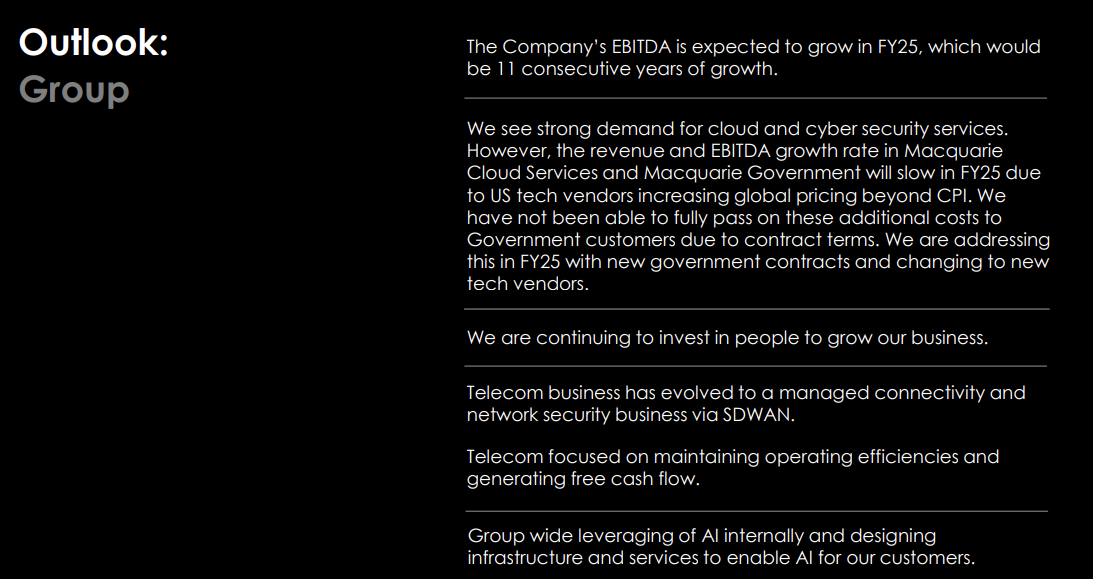

Outlook was somewhat muted considering IC3 SW has been part of plans for a while now. MAQ expect that the first phase will be online around 3Q 2026 bringing an extra 6MW of capacity. I guess the market probably also didn't like the fact that MAQ expect growth rates in the Cloud and Government segments to slow in the coming FY.

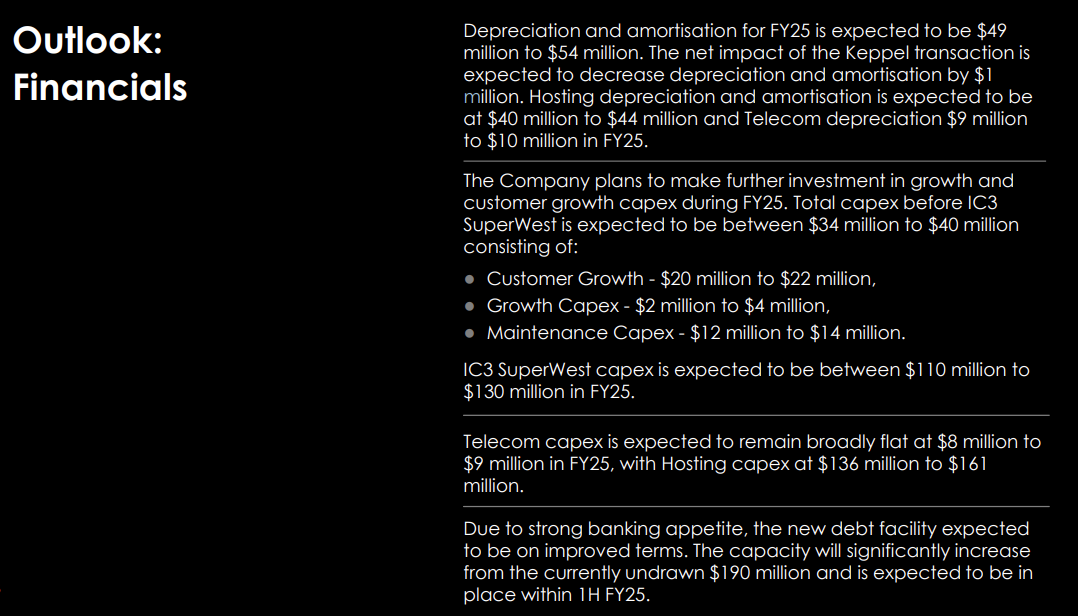

Overall capex is expected to be higher than previous years considering the need to spend to build IC3 SW. Currently MAQ have no debt but there is a loan facility of 190m which I do expect them to tap into otherwise they'll need to do another raise in the next year.

With D&A expected to be slightly lower than FY24, and EBITDA is continue to increase, I expect that NPAT may gain slightly or may be flat based on how much interest costs will be.

Considering we are only just entering the growth phase for MAQ, I will give them some leeway in terms of their financial metrics as I see this being a much bigger business in 5-10 years time once their new data centres are all up and running however it does make this business quite hard to value at the current stage.

A thesis breaker would involve further delays in the development of IC3 SW or a complete blow out in costs involved to build out the centre. So far, apart from delays, it seems that management have fairly good capital management and I trust that this should continue into the future.

Disc: Held IRL and on Strawman.