Note: This is the same post as my $NXT Straw. I just also wanted it to appear on my #MAQ history. So please move along, if you've already seen the $NXT straw, as there is nothing new to see here.

$NXT reported results yesterday that were broadly well-received by the market. Expansions, site acquisitions for new data centres, and expectations of material new contracts supported this long term growth story. Analysts reactions are broadly positive, with no major moves to SP targets based on the updates so far. (Although GS tweaked down their 12m TP from $13.60 to $13.30)

I've had exposure to the data-centre theme IRL for several years ($NXT, $MP1) and continue to see it as a long term growth theme.

However, I have recently switched my RL position from $NXT to $MAQ, and I'll briefly explain here.

$NXT is a more agressive growth play, with 3-year revenue CAGR to end FY22 of 18% vs. 8% for $MAQ, and a 3-yr EBITDA CAGR of 26% vs, 19% at $MAQ. However, this is at the cost of significant debt, with long-term borrowings now reaching $1.26bn and interest for the last 6 months now up to $62m (annualised).

On a comparative basis $NXT is spending 32% of EBITDA on interest, compared with a more conservative 12% at $MAQ.

Furthermore, $NXT have recently signalled an intention to expand internationally, although we are yet to see what this means in practice. This further increases the risk profile.

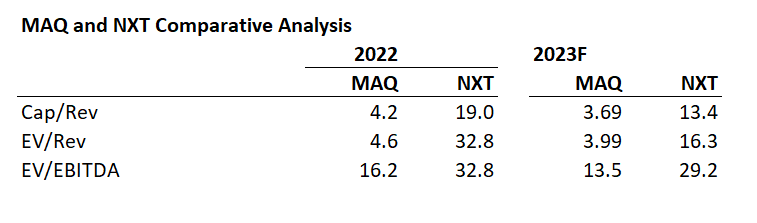

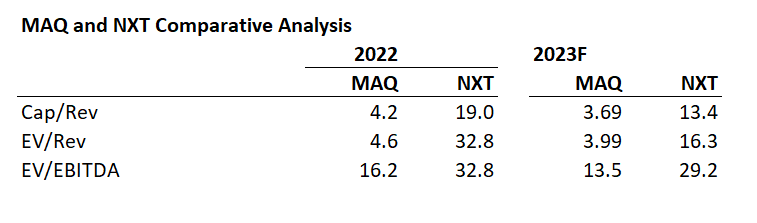

Looking at valuation multiples, $MAQ is looking favourable, and I have initiated my RL position recently at $55.50 (2.75%). (I will follow today in SM, because strictly speaking these companies are "yet to prove themselves", which is my criterion for holding in SM.)

Table 1: Comparative Valuation Multiples

Source: www.marketscreener.com; Company Accounts

Overall, with interest rates still rising (and the real chance that peak forecasts will go up further) and with tech companies reducing investment in new storage, this sector may move from a focus on expansion to a greater focus on utilisation and profitability, with consequence implications for pricing.

Overall, while I like both $NXT and $MAQ, I consider that $MAQ is more defensively positioned given these risks. I have been watching it for several years, and with the SP below $60 I feel now is the time to switch horses.

$MAQ brings some other differences to $NXT as follows:

- It is founder-led, managed and majority owned

- The limited free-float means that it is not as easily accessible to institutions; however, liquidity is fine for a retail investor

- Its capital structure is different with a higher proportion of capital leases vs. owning real estate.

I don't often switch horses within a sector and, while I think BOTH companies will generate long-term shareholder value, I now prefer the risk-reward profile of $MAQ. So, out with $NXT and in with $MAQ.

Disc: $NXT - not held; $MAQ - held IRL (and later today on SM)

P.S. For those who follow Gaurav Sodhi, you'll recognise I have adopted his rationale. I have been aware of his perspective for well over a year, and on this occasion my analysis aligns with that story. You can look it up by watching back issues on "The Call" - just search for $NXT and $MAQ and pick the days when he the "talking head".