- Release Date: 28/08/24 19:07

Key Points

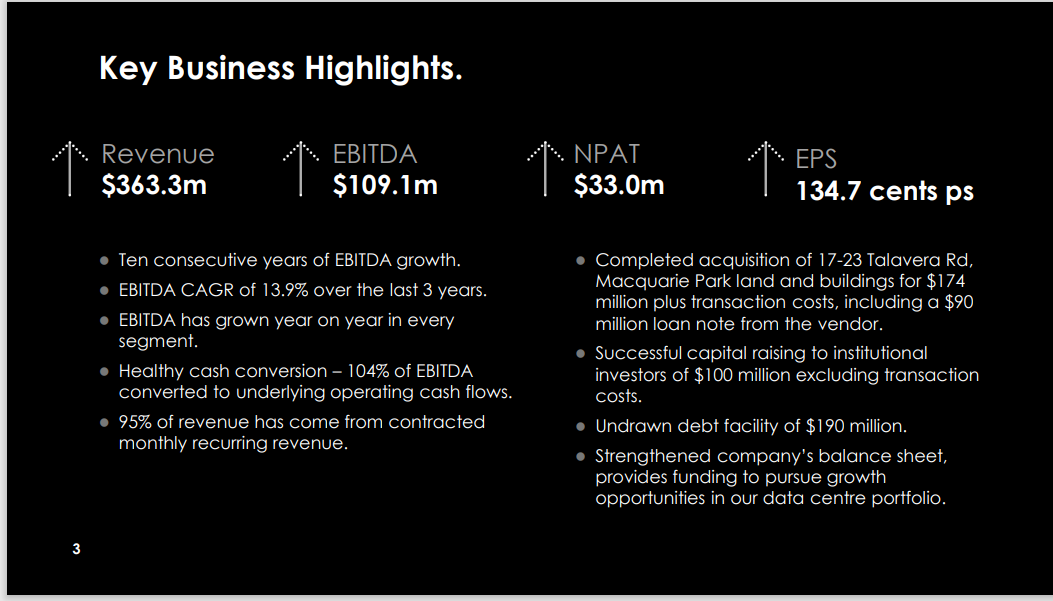

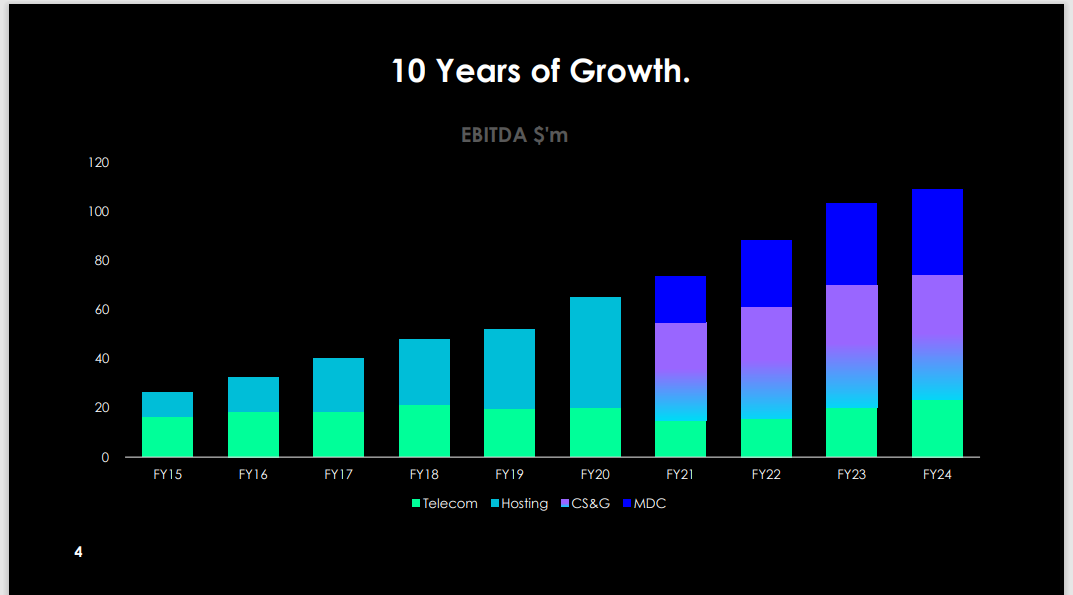

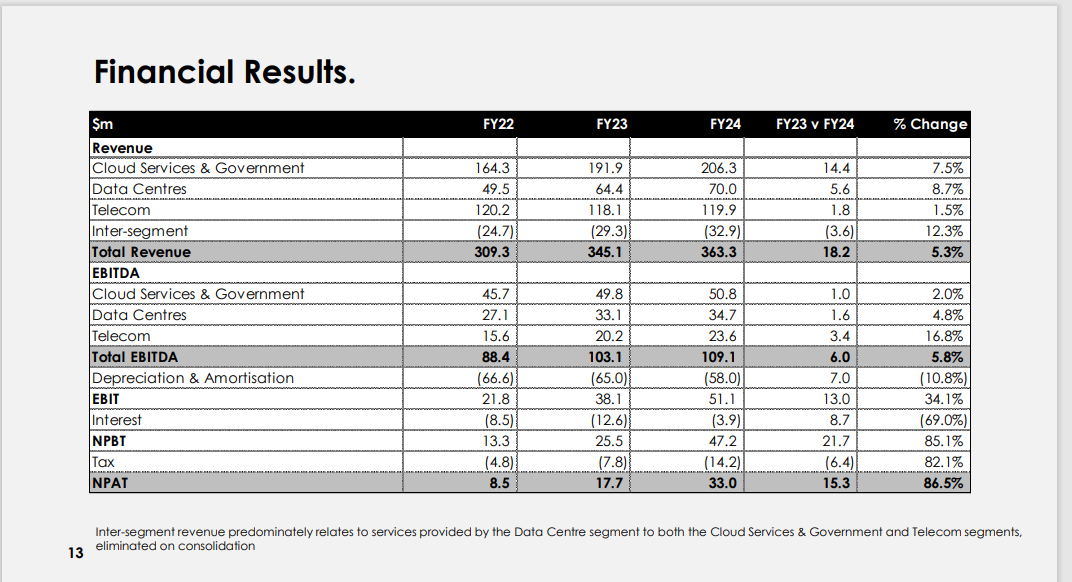

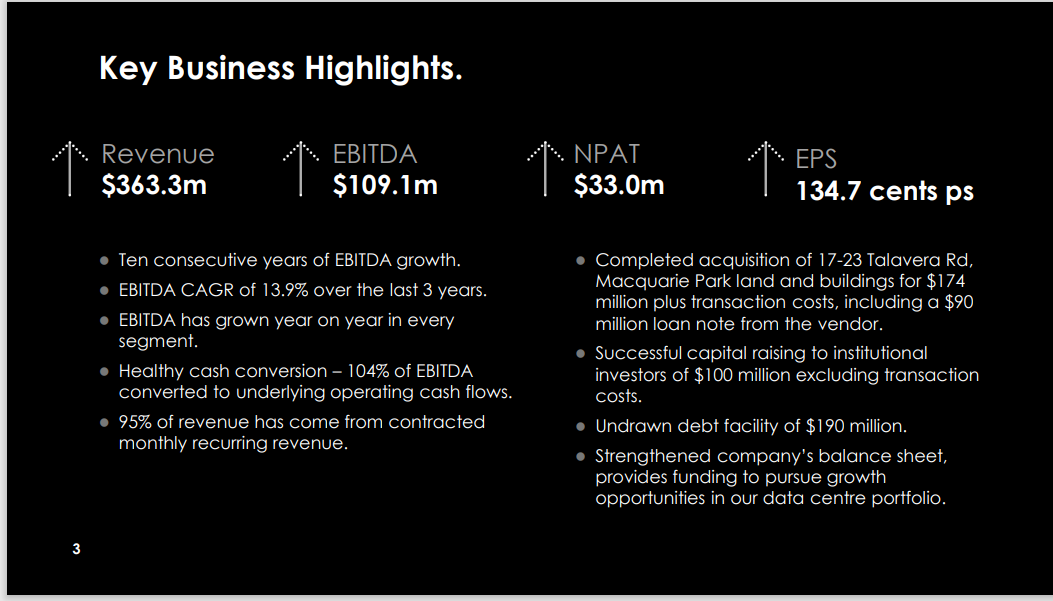

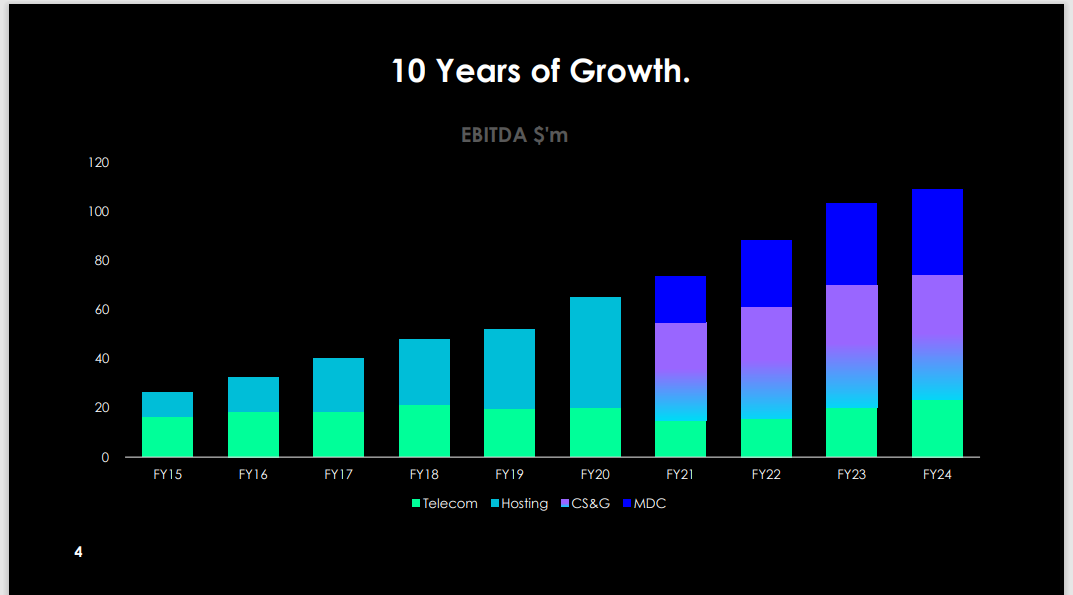

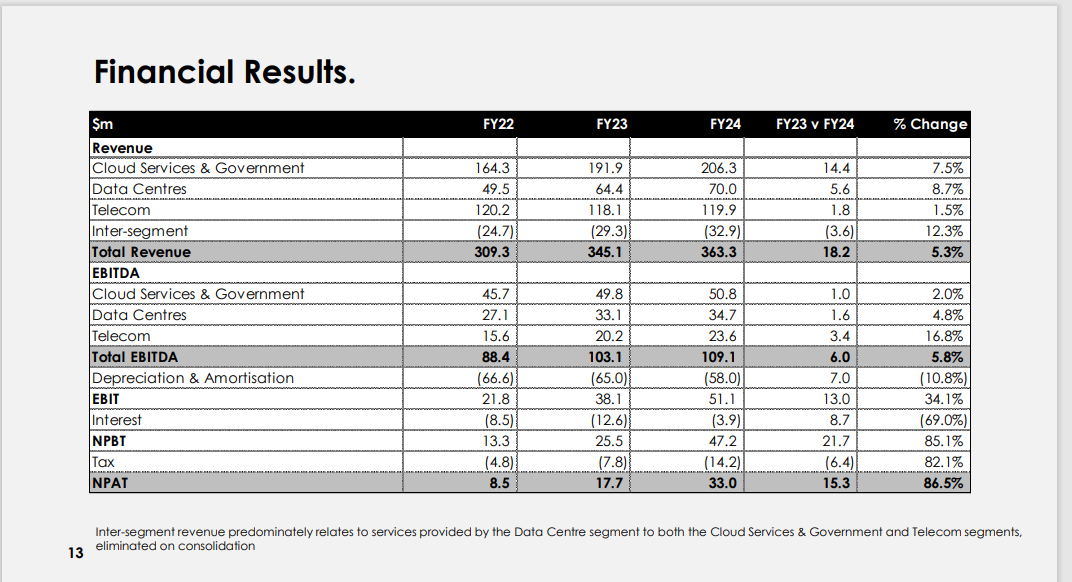

• Ten consecutive years of EBITDA growth. • Group Earnings before interest, tax, depreciation, and amortisation (EBITDA) of $109.1 million, an increase of 13.9% over the last 3 years.

• Conversion of EBITDA to operating cash flows generated total operating cash flows of $117.8 million during the year. Strong 103.8% cash conversion of EBITDA into operating cash flows, after excluding tax received and interest.

• Completed acquisition of 17-23 Talavera Rd, Macquarie Park for $174 million plus transaction costs, including a $90 million loan note from the vendor.

• Successful institutional investor capital raising of $100 million to support acquisition of 17-23 Talavera Rd, Macquarie Park.

• Capital expenditure was $51.1 million before acquisition of Macquarie Park driven by Growth Capex of $24.0 million,

Customer Related Capex of $18.5 million and Maintenance Capex of $8.6 million. Chief Executive David Tudehope said, “The acquisition of the Macquarie Park Data Centre Campus land, along with the $100 million equity raise, has positioned us for the growth of our digital infrastructure platform for the years ahead.”

CommSec | Quotes & Research