In addition to @Bear77 updates. Going to put this here so it is easier to read and discuss

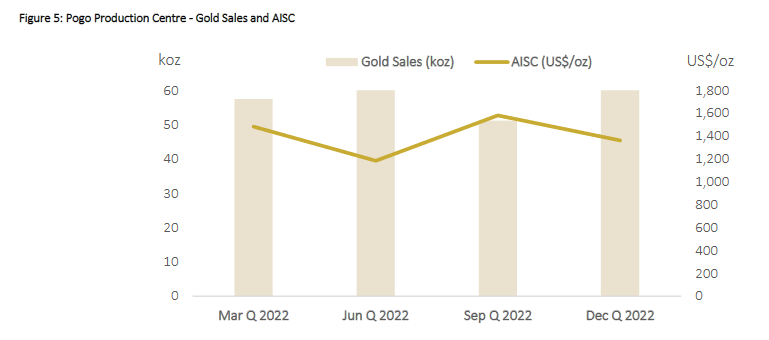

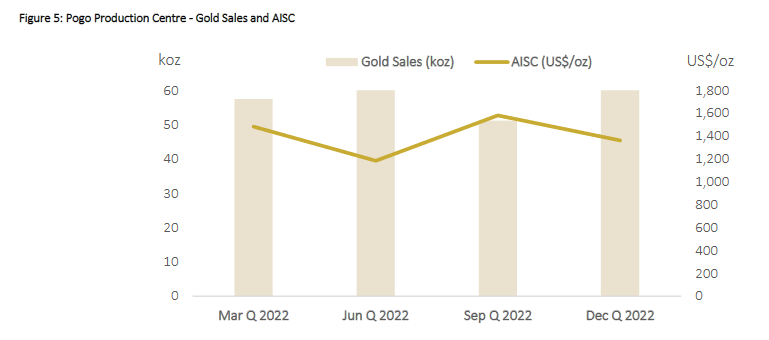

Pogo: Jury is still out on AISC and production guidance, but heading in the right direction. AISC guidance US$1,300 - 1,400 US/oz (1,857 - 2,000 AUD/oz). FY23 Prod guidance 240-260koz

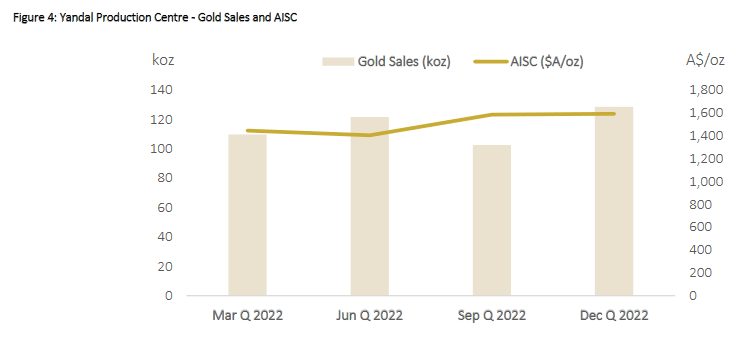

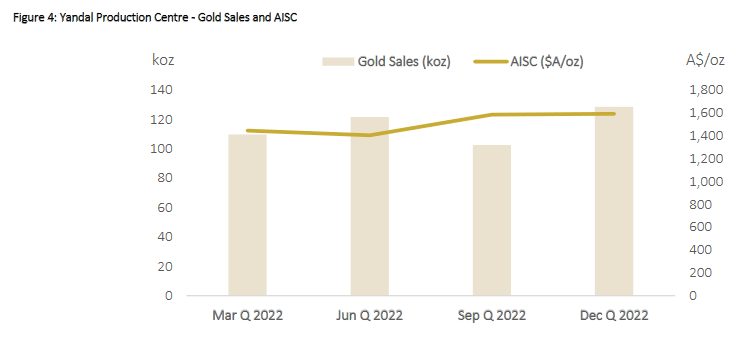

Yandal: AISC slightly up. Guidance 1,525 - 1,625 AUD/oz. FY23 Prod guidance 480 - 520

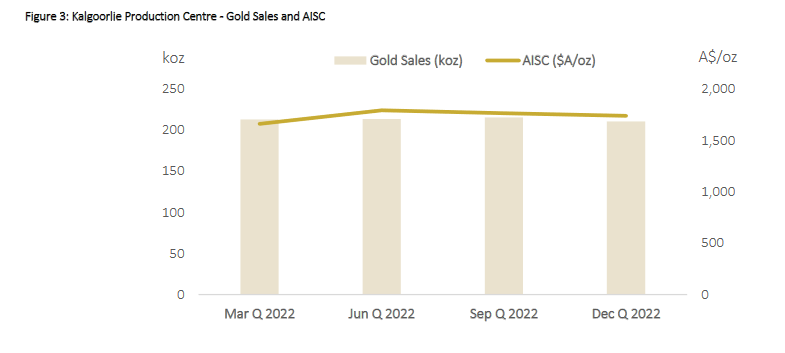

Kalgoorlie: AISC pretty much flat. Guidance 1,560 - 1,660 AUD/oz. FY23 Prod guidance 820 – 870

Kalgoorlie: AISC pretty much flat. Guidance 1,560 - 1,660 AUD/oz. FY23 Prod guidance 820 – 870

Overall performing as expected. Only shining light is KCGM (Kalgoorlie). Pogo still a bit of a concern. Yandal might just scrape through for FY23.

Enough of a hold for me. I did contemplate selling out at one stage for maybe one of the Strawman "favourites" (ie: AD8, CGS etc...) but seems gold has been trending up. Will ride out for now until I find something else.

Will be interesting to do a DCF valuation in the same way I do Capricorn Metals. I also noticed NST trades at a higher multiple than Capricorn (CMM) although Karlawinda reserves are 13 years.

[held]

Kalgoorlie: AISC pretty much flat. Guidance 1,560 - 1,660 AUD/oz. FY23 Prod guidance 820 – 870

Kalgoorlie: AISC pretty much flat. Guidance 1,560 - 1,660 AUD/oz. FY23 Prod guidance 820 – 870